ANZ Bank CEO Expects Bolt-On Acquisitions In Asia

August 04 2009 - 12:29AM

Dow Jones News

Australia & New Zealand Group Ltd. (ANZ.AU) will continue to

target "bolt-on" acquisitions in Asia, having signed a deal to buy

some of Royal Bank of Scotland Group PLC's (RBS) banking operations

in the region for US$550 million, ANZ Chief Executive Mike Smith

said Tuesday.

Smith told Bloomberg Television in an interview that he didn't

view the RBS deal as "transformational" for Melbourne-based ANZ,

which aims to become a "super regional" lender in Asia.

ANZ built has amassed a A$4.7 billion warchest to help fund

acquisitions and bolster capital after recent share placements.

ANZ will buy RBS' commercial and retail banking operations in

Hong Kong, Singapore, Taiwan, Vietnam, Indonesia and the

Philippines, but didn't go after assets in China or India.

Smith said that the regulatory process to buy RBS' operations in

India, where the lender is applying for a banking license, would

have been onerous, and the price tag for the group's Chinese

business was too high.

RBS said earlier Tuesday it remains in talks to sell other

assets in Asia. People familiar with the situation have said

Standard Chartered PLC is interested in RBS' operations in India

and China.

-By Lyndal McFarland, Dow Jones Newswires; 61-3-9292-2093;

lyndal.mcfarland@dowjones.com

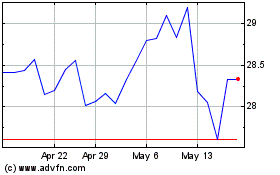

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Jul 2024 to Aug 2024

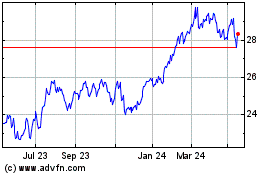

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Aug 2023 to Aug 2024