UPDATE: RBS Close To Sale Of Taiwan Assets To ANZ-Sources

July 30 2009 - 7:57AM

Dow Jones News

Royal Bank of Scotland PLC (RBS) will announce the sale of its

Taiwan banking assets to Australia and New Zealand Banking Group

Ltd. (ANZ.AU) as early as next week, people familiar with the

situation said Thursday.

One of them said Taiwan would be the first of several Asian

retail and commercial banking assets that RBS will be selling.

RBS's Taiwan investment banking operations will also be included in

this sale, the person said.

The people didn't disclose the price of the acquisition.

The Taiwan sale comes after other people familiar with the

situation said RBS was in advanced talks with ANZ over the sale of

its operations in Taiwan, Hong Kong, Singapore, Indonesia and

Vietnam.

Apart from those Asian markets, RBS is also selling its retail

and commercial operations in India, Pakistan, China, Malaysia,

Vietnam, and the Philippines. It has also said it would close down

its New Zealand operations.

ANZ's Melbourne-based spokesman Paul Edwards declined to comment

on the Taiwan sale but said "discussions (with RBS) are progressing

well."

RBS's Hong Kong based spokeswoman Yukmin Hui said the sale

process of the Asian retail and commercial assets is "well

advanced," but wouldn't comment on individual elements of the deal

due to regulatory and confidentiality constraints.

"RBS will continue to retain its presence in 11 markets in Asia,

including its securities business in Taiwan," she added. She didn't

elaborate on what the securities business entailed.

RBS said earlier in the year that it planned to sell its retail

and commercial businesses in the region, as part of efforts to

dispose of noncore businesses it said were "thinly spread" and had

yet to achieve "significant scale." But it left the door open to

selling other noncore operations in the region as well.

The troubled lender's sale of Asian assets has attracted the

attention of not just the primarily Australia-focused ANZ, but also

Standard Chartered PLC (STAN.LN), which has a wide franchise in the

region, other people familiar with the situation said earlier.

Initially, HSBC Holdings PLC (HBC), like Standard Chartered a

U.K.-listed bank with a formidable Asian franchise, was reported to

be interested in RBS's Asian assets. But earlier in the month, a

person familiar with the deal said that HSBC hadn't submitted a bid

for the assets.

RBS, which is 70%-owned by the U.K. government, employs 11,500

people in its Asian retail and commercial banking operations. Those

businesses recorded an operating profit of GBP127 million in 2008 -

just 1.8% of the contributions from the bank's global retail and

commercial franchise.

-By Amy Or, Dow Jones Newswires; 852-2832 2335;

amy.or@dowjones.com

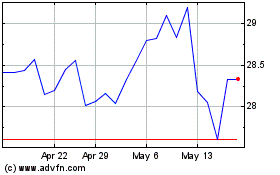

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Jul 2024 to Aug 2024

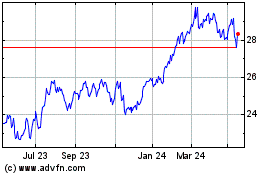

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Aug 2023 to Aug 2024