Australia's AMP Capital Shifts To 'Neutral' On Global Equities

December 21 2011 - 1:40AM

Dow Jones News

AMP Capital Investors, an Australian fund manager, has moved to

"neutral" from an "underweight" position on global equities amid

signs that Europe's sovereign debt crisis is easing, according to

one of the company's top strategists.

The company, with close to US$100 billion in assets, is buying

initially into Asian market weakness believing that most of the

risk from Europe's crisis has been priced in, said Nader Naeimi,

who heads up AMP Capital's Dynamic Asset Allocation unit in Sydney.

The firm has started by stocking up on emerging market shares,

which it says have the highest growth potential.

Asia's benchmark stock measure, the MSCI Asia Pacific Index, has

dropped close to 20% since the start of the year - making the

valuations of companies in the region attractive, according to AMP

Capital, which was "underweight" equities since about May. Stocks

worldwide have plunged this year amid investor concern that the

debt crisis could trigger a repeat of the worldwide credit crunch

and derail a fragile global economic recovery.

Strong support for a Spanish debt auction Tuesday helped boost

investor confidence that measures put in place to address the

banking and sovereign debt crisis may finally be gaining

traction.

-By Shani Raja, Dow Jones Newswires; +61-2-8272-4683;

shani.raja@dowjones.com

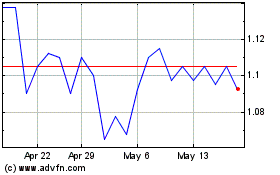

AMP (ASX:AMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

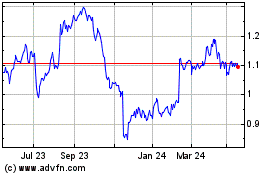

AMP (ASX:AMP)

Historical Stock Chart

From Jul 2023 to Jul 2024