TIDMZPHR

RNS Number : 3755G

Zephyr Energy PLC

15 November 2022

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the UK Market Abuse Regulation.

With the publication of this announcement, this information is now

considered to be in the public domain.

15 November 2022

Zephyr Energy plc

("Zephyr" or the "Company")

Third Quarter 2022 results from Williston Basin portfolio;

2022 revenue forecast upgraded; and Paradox project operations

update

Zephyr Energy plc (AIM: ZPHR) (OTCQB: ZPHRF), the Rocky Mountain

oil and gas company focused on responsible resource development

from carbon-neutral operations, is pleased to provide third quarter

2022 ("Q3") results related to hydrocarbon production from its

non-operated asset portfolio in the Williston Basin, North Dakota,

U.S., and to provide an update on current operations on its project

in the Paradox Basin, Utah, U.S. (the "Paradox project").

Q3 2022 Williston Basin Highlights

-- Q3 revenues totalled US$9.6 million net to Zephyr, giving

Zephyr total revenues for the nine-months to 30 September 2022 of

US$35.5 million.

o Q3 sales volumes averaged circa 1,313 barrels of oil

equivalent per day ("boepd").

o Q3 wellhead production averaged circa 1,208 boepd net to

Zephyr, in line with management expectations and marginally

impacted by temporary shut-ins due to planned "frac-protect"

procedures on existing wells while new nearby wells were

completed.

-- Q3 operating income was US$7.9 million (after taxes, lease

operating expenses, realised hedging impacts, and gathering and

marketing fees), giving Zephyr US$29.8 million operating income for

the nine-months to 30 September 2022 .

-- Based on the strong cash flows from the Williston Basin

portfolio to date, Zephyr has upgraded its full-year 2022 revenue

forecast for the Company to a range of US$40-45 million (up from a

previously announced range of US$35-40 million) and the Company

reaffirms its 2022 full-year production forecast of 500,000 -

550,000 barrels of oil equivalent ("boe").

Paradox project operations update

-- CWC Ironhand Drilling Rig 118 is in the process of mobilising

to the State 36-2 LNW-CC well site, and the Company continues to

expect to spud the well in the second half of November 2022.

Multiple other service providers are currently on-site completing

preparations for the upcoming drilling operation.

-- Preparations to commence production testing of the previously

drilled State 16-2LN-CC are also largely complete. Pre-test

operations included a coil unit cleanout of the well's 5.5 inch

production casing (from surface to total depth), and the completion

of procedures designed to enhance the well's flow assurance. Work

to connect the surface facilities is underway, and production

testing is scheduled to commence in the second half of November

2022.

Colin Harrington, Chief Executive of Zephyr, said : "I continue

to be delighted with the strong cash flows generated from our

non-operated Williston Basin portfolio. Our goal, as we acquired

our various Williston interests, was to generate return multiples

on cash invested which could ultimately be redeployed from the

Williston into our Paradox project activity. I'm pleased to report

the Williston assets have provided exactly that, demonstrating

rapid paybacks and significant cash generation prior to settling

into a more mature production and decline phase.

"The numbers from the portfolio speak for themselves. Over the

last 18 months, Zephyr raised and deployed US$19.6 million of

equity into the Williston portfolio - and in the first three

quarters of 2022 alone, that portfolio generated over US$35 million

in revenue and US$29.8 million of operating income. While quarterly

revenues naturally fluctuate, depending on the timing of new wells

coming online and at times for frac protect operations, the overall

trend has provided stronger year-to-date cash flow performance than

that originally forecast, and significant future cash flow is

expected to continue for many years to come.

"As a direct result of the portfolio's strong performance,

during 2022 we've been able to reduce the Company's borrowings from

an already conservative US$29.9 million to US$24.8 million

(representing a 18.6% reduction in total borrowing), expand our

Paradox acreage position from 36,000 to 45,000 acres, and acquire

the pipeline and processing infrastructure across our White Sands

Unit in the Paradox Basin. In addition, our assets have generated

more than enough excess liquidity (US$18.5 million in cash and

available borrowing base) to fund the next phase of our ambitious

Paradox drilling programme.

"With interests in a further 26 Williston wells expected to come

online over the next six months, our non-op portfolio is poised to

continue to produce significant additional cash flow available for

redeployment across our portfolio.

"We are now rapidly progressing our fully-funded operations in

the Paradox, where the augmented surface infrastructure at the

State 16-2LN-CC is largely complete and the next phase of

production testing is about to commence. Combined with the high

impact drilling potential at the State 36-2 LNW-CC location, I

believe it's a hugely exciting time to be a Zephyr shareholder.

We're coming into a period of significant near-term news flow, and

I look forward to sharing additional updates as operations on the

ground progress."

Q3 Williston Basin Sales Detail

For the third quarter of 2022, the Company reports net sales of

approximately 120,821 boe. Product mix for Q3 was 74% crude oil,

14% natural gas, and 12% natural gas liquids. The table below

provides sales volumes, product mix, and average sales prices for

the quarter:

Oil: 88,883 barrels ("bbls") at an average sales price of

US$91.38/bbl

Natural Gas: 101,315 thousand cubic feet ("mcf") at an average

sales price of US$8.19 /mcf

Natural Gas Liquids: 15,052 bbls at an average sales price of US$42.65 per bbl

( Note: Third quarter production volumes and average sales

prices figures include field estimates in respect of Sep 2022

natural gas and natural gas liquids sales volumes and are subject

to future revision.)

During Q3, a number of Zephyr's existing production wells were

temporarily shut-in due to "frac-protect" procedures while new

nearby wells were stimulated and completed. As new infill wells are

drilled, existing offset wells are temporarily shut in to optimise

the nearby completion and mitigate offset well production losses.

Offset wells are then re-instated for production when the new

infill wells are started up for production.

In comparison to Q3, Q2 sales volumes of 168,880 boe included

approximately 41,480 boe produced prior to Q2 but for which

payments were received during Q2. In the Williston Basin, cashflow

from non-operated interests in newly drilled wells may lag actual

production by up to five months. Such payments from the operator

accrue on a monthly basis and are paid in full prior to the sixth

month of production, which may result in fluctuating impacts to

quarterly sales volumes and revenues during times of significant

completion activity.

Q3 revenues totalled US$9.6 million, net to Zephyr. This

compares to quarterly revenues in the second quarter of 2022 ("Q2")

of US$14.3 million. As referred to above, Q2 revenues were

positively impacted by deferred payments for production of US$3.7

million on newly completed wells generated prior to that quarter

but paid to Zephyr in Q2.

Total revenues for the nine months to 30 September 2022 were

US$35.5 million.

Q3 operating income was US$7.9 million (after taxes, lease

operating expenses, realised hedging impacts, and gathering and

marketing fees).

Q3 Williston Basin Production Detail

Q3 wellhead production averaged circa 1,208 boepd of wet oil and

gas produced, net to Zephyr, in line with management expectations

albeit marginally impacted by temporary shut-ins due to planned

"frac-protect" procedures on existing wells while new nearby wells

were completed. At the end of Q3, 199 wells in the portfolio were

available for production, including four wells which came online

during the quarter.

An estimated 26 additional wells in which Zephyr has minority

working interests are forecast to be brought on production over the

next six months, which will help to decrease typical Williston

Basin portfolio decline rates.

Net working interests across the Williston Basin non-operated

portfolio now average 7.3% per well, equivalent to 15 gross wells,

all of which utilised horizontal drilling and modern, hydraulically

stimulated completions.

Williston Basin production outlook

As mentioned above, 26 additional producing wells from Zephyr's

existing portfolio are expected to be brought online during the

next six months, which will partially mitigate further decline

rates typical of Williston Basin production.

The Company previously announced hedges on just under half of

its forecast non-operated production for the fourth quarter of

2022, with an average hedged production price of US$94.55 for the

remainder of the 2022 calendar year.

Based on the strong cash flows to date from the Williston Basin

portfolio, Zephyr is upgrading its 2022 revenue forecast for the

Company to a range of US$40-45 million (an increase from a

previously announced range of US$35-40 million) and reaffirms its

2022 production forecast of 500,000 - 550,000 boe.

Contacts

Zephyr Energy plc Tel: +44 (0)20 7225

Colin Harrington (CEO) 4590

Chris Eadie (CFO)

Allenby Capital Limited - AIM Nominated Tel: +44 (0)20 3328

Adviser 5656

Jeremy Porter / Vivek Bhardwaj

Turner Pope Investments - Joint-Broker Tel: +44 (0)20 3657

James Pope / Andy Thacker 0050

Panmure Gordon (UK) Limited - Joint-Broker

John Prior / Hugh Rich / James Sinclair-Ford Tel: +44 (0) 20 7886

/ Harriette Johnson 2500

Celicourt Communications - PR

Mark Antelme / Felicity Winkles

Tel: +44 (0) 20 8434

2643

Dr Gregor Maxwell, BSc Hons. Geology and Petroleum Geology, PhD,

Technical Adviser to the Board of Zephyr Energy plc, who meets the

criteria of a qualified person under the AIM Note for Mining and

Oil & Gas Companies - June 2009, has reviewed and approved the

technical information contained within this announcement.

Notes to Editors

Zephyr Energy plc (AIM: ZPHR) (OTCQB: ZPHRF) is a technology-led

oil and gas company focused on responsible resource development

from carbon-neutral operations in the Rocky Mountain region of the

United States. The Company's mission is rooted in two core values:

to be responsible stewards of its investors' capital, and to be

responsible stewards of the environment in which it works.

Zephyr's flagship asset is an operated 45,000-acre leaseholding

located in the Paradox Basin, Utah, 25,000 acres of which has been

assessed by third party consultants Sproule International to hold,

net to Zephyr, 2P reserves of 2.1 million barrels of oil equivalent

("mmboe"), 2C resources of 27 mmboe and 2U resources 203 mmboe.

Following the successful initial production testing of the recently

drilled and completed State 16-2LN-CC well, Zephyr has planned a

three well drilling program - commencing in 2022 with the State

36-2 LNW-CC well - to further delineate the scale and value of the

project.

In addition to its operated assets, the Company owns working

interests in a broad portfolio of non-operated producing wells

across the Williston Basin in North Dakota and Montana.

The Williston portfolio currently consists of working-interests

in over 200 modern horizontal wells which are expected to provide

US$35-40 million of revenue, net to Zephyr, in 2022. Cash flow from

the Williston production will be used to fund the planned Paradox

Basin development. In addition, the Board will consider further

opportunistic value-accretive acquisitions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDGZMMMFDZGZZZ

(END) Dow Jones Newswires

November 15, 2022 02:00 ET (07:00 GMT)

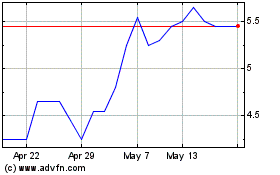

Zephyr Energy (AQSE:ZPHR.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Zephyr Energy (AQSE:ZPHR.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024