Zephyr Energy PLC Result of Broker Option (9977Z)

January 28 2022 - 5:27AM

UK Regulatory

TIDMZPHR

RNS Number : 9977Z

Zephyr Energy PLC

28 January 2022

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the UK Market Abuse Regulation.

With the publication of this announcement, this information is now

considered to be in the public domain.

28 January 2022

Zephyr Energy plc

("Zephyr" or the "Company")

Result of Broker Option

Zephyr Energy plc (AIM: ZPHR) (OTCQB: ZPHRF), the Rocky Mountain

oil and gas company focused on responsible resource development

from carbon-neutral operations, is pleased to announce the result

of the Broker Option that was announced on 26 January 2022 as part

of a fundraising (the "Fundraising").

The Broker Option is a facility to allow the Company's

Shareholders to participate in the Fundraising on the same terms to

the Placing, and which closed yesterday.

The Company's broker, Turner Pope Investments ("TPI") has

informed the Company that it intends to exercise its Broker Option

in respect of 16,000,000 new Ordinary Shares (the "Broker Option

Shares").

The Broker Option Shares will be issued at the Issue Price

(being 5p per share), resulting in gross proceeds of GBP800,000

being raised. This brings the total amount raised in the

Fundraising under the Placing and Broker Option to GBP12,800,000

(before expenses).

Similar to the Placing, one warrant to subscribe for a new

Ordinary Share at 7.5p per share will be issued for every four

Broker Option Shares (totalling 4,000,000 Investor Warrants) and in

addition, TPI will be issued with warrants to subscribe for

1,066,666 new Ordinary Shares at 7.5p per share, details of which

were announced with the Fundraising.

Admission to AIM

Application will be made for the 16,000,000 Broker Option Shares

(as well as the 173,500,000 Second Placing Shares) to be admitted

to trading on AIM and it is expected that their admission to AIM

will take place on or around 11 February 2022 ("Second Admission").

Like the Second Placing Shares, the issue of the Broker Option

Shares is conditional, inter alia, on the Resolutions being passed

at the Company's General Meeting on 10 February 2022, Second

Admission occurring and the Placing Agreement becoming

unconditional in respect of the Second Placing Shares and not being

terminated in accordance with its terms prior to Second

Admission.

Rule 17

Pursuant to AIM Rule 17, the Company sets out details of the

effect of dilution on the shareholdings of Origin Creek Energy LLC

("OCE") and Colin Harrington, CEO of Zephyr. Rick Grant, the

Chairman of Zephyr, and Colin Harrington are both shareholders and

directors of OCE, and Colin Harrington is indirectly the

controlling shareholder of OCE.

Ordinary Percentage Percentage Percentage

Shares held of current held on First held on Second

issued share Admission Admission*

capital

OCE 137,136,364 10.51 10.00 8.79

Colin Harrington

(total interest

including OCE) 138,590,300 10.62 10.11 8.88

* assuming no other shares are issued prior to Second

Admission

Total voting rights

Following Second Admission, the Company's issued share capital

will consist of 1,560,746,001 ordinary shares, with one voting

right per share. The Company does not hold any ordinary shares in

Treasury. Therefore, the total number of Ordinary Shares and voting

rights in the Company will be 1,560,746,001 from Second Admission.

This figure of 1,560,746,001 ordinary shares may be used by

Shareholders in the Company as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change in their interest in, the share capital of

the Company under the FCA's Disclosure Guidance and Transparency

Rules.

Capitalised terms used in this announcement have the same

meaning as in the Fundraising announcement of 26 January 2022,

unless otherwise specified.

Contacts:

Zephyr Energy plc Tel: +44 (0)20 7225

Colin Harrington (CEO) 4590

Chris Eadie (CFO)

Allenby Capital Limited - AIM Nominated Tel: +44 (0)20 3328

Adviser 5656

Jeremy Porter / Liz Kirchner

Turner Pope Investments - Broker Tel: +44 (0)20 3657

James Pope / Andy Thacker 0050

Flagstaff Strategic and Investor Communications

Tim Thompson / Mark Edwards / Fergus Tel: +44 (0) 20 7129

Mellon 1474

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEBPMMTMTTTBIT

(END) Dow Jones Newswires

January 28, 2022 05:27 ET (10:27 GMT)

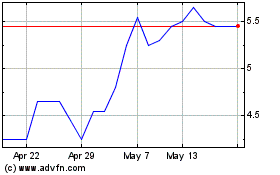

Zephyr Energy (AQSE:ZPHR.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Zephyr Energy (AQSE:ZPHR.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024