TIDMSEE

RNS Number : 1467Q

Seeing Machines Limited

16 October 2023

Seeing Machines Limited ("Seeing Machines" or the "Company")

16 October 2023

Year End Results - FY2023

Increasing global regulatory momentum targeting key transport

sectors underpins significant growth

Seeing Machines Limited (AIM: SEE, "Seeing Machines" or the

"Company"), the advanced computer vision technology company that

designs AI-powered operator monitoring systems to improve transport

safety, has published its audited financial results for the year

ended 30 June 2023 ("FY2023" or "the period").

FINANCIAL HIGHLIGHTS:

- Revenue increased by 48% to US$57.8m (2022: US$38.7m), ahead of market expectations[1]

- Non-Recurring Engineering (NRE) increased 53% to US$9.7m

(2022: US$6.4m) - a lead indicator for future royalty revenue

- Annual Recurring Revenue as at 30 June 2023 increased by 27% to US$13.6m (2022: US$10.7m)

- Total OEM revenue, including both Automotive and Aviation,

increased by 153% to US$26.6m (2022: US$10.5m)

- Automotive royalty revenues increased by 91% to US$7.6m (2022: US$3.9m)

- Aftermarket revenue increased by 10% to US$31.2m (2022: US$28.4m)

- Royalties from Guardian hardware sales of US$2.4m (2022: US$3.6m)

- Gross Profit of US$28.9m represents increase of 65% (2022: US$17.5m)

- EBITDA improved to a loss of US$9.3m (2022: loss of US$16.3m)

- Strong balance sheet, with cash[2] at 30 June 2023 of US$36.1m (2022: US$40.5m)

Paul McGlone, CEO of Seeing Machines, commented : "The global

demand for our technology has delivered strong growth in FY2023,

despite some challenges and delays. Our three business units are

now well established, and we are expecting to see continued growth

from each of them as we move closer to compliance deadlines in

Europe, where every vehicle on European roads will require

technology to mitigate risks associated with fatigue and

distraction. Seeing Machines is working directly with commercial

vehicle OEMs to increase the installation of Guardian technology as

factory-fit (After Manufacture) and with transport and logistics

operators as retrofit, our more traditional application. In

Automotive, while programs are taking longer to be awarded, we

expect there to be fewer, larger awards given the Euro NCAP and GSR

dates looming. And finally, in the growing Aviation business, we

are working with world-leading Collins Aerospace following the

announcement of our exclusive collaboration. The combination of

these factors lead to revenue expectations in FY26 of not less than

US$125m.

At end September, we can report a cash balance of US$30.8m and

expect to achieve a cash break-even run rate during FY25 from our

increasing focus on revenue growth and cost management."

OPERATIONS HIGHLIGHTS:

- Martin Ive appointed as CFO bringing significant public company experience

- Regulatory momentum continues to accelerate as compliance

dates for Europe's General Safety Regulation to enhance road safety

approach; and the US ramps up activity to incorporate safety

legislation requiring technology to reduce risks associated with

distracted and impaired driving

- The Company launched publication of quarterly Key Performance

Indicators (KPI's) to report on growth across Automotive as cars

start production and momentum in Aftermarket with Guardian

connections and hardware sales

AUTOMOTIVE:

- Seeing Machines and Magna International entered into an

exclusive, world-first collaboration to develop Driver and Occupant

Monitoring System (DMS / OMS) technology integrated into the

rear-view mirror, which included a US$65m investment in the Company

via an exclusivity arrangement payment of US$17.5m and a

convertible note of US$47.5m

- An additional program to deliver DMS / OMS for an existing

European based global OEM brings total won awards to 15 across 10

individual OEMs, carrying an initial, cumulative lifetime value of

US$321m with the majority of that revenue to be recognised over the

period to 2028

- A total of 6 OEM programs have now started production, and at

30 June 2023, Seeing Machines' technology is installed in over 1

million vehicles globally

- Over the 12-month period to 30 June 2023, cars on road

increased by 143% to 1,086,176 units (Q4 FY22: 447,225)

- Annual production volume increased 101% to 638,951 vehicles (FY2022: 317,491)

- Omnivision, a leading global developer of semiconductor

solutions launched its OAX4600 system-on-chip (SOC) platform with

interior sensing technology optimised with the Company's Occula(R)

Neural Processing Unit

AVIATION:

- Seeing Machines signed an exclusive licence Agreement with

Collins Aerospace generating licence revenue over three years of

US$10m, to jointly develop pioneering eye-tracking solutions for

the Aviation industry

- Collins will also pay the Company Non-Recurring Engineering

(NRE) payments to develop specific solutions, which will evolve

into potential future royalty payments as shipsets are released to

customers

- With no competition in this space, today, this world-first

collaboration brings together the companies' collective expertise

in navigation, communication, sensor technology, flight controls

and aviation system design to accelerate innovation and safety

across the industry

AFTERMARKET:

- Monitored Guardian connections increased 30% during the last

12 months to 51,975 units (Q4 FY2022: 39,892)

- Total Guardian hardware sales for FY2023 of 14,779 units, with

Q4 achieving record sales of over 10,000 units as backlog demand

met following easing of earlier supply chain constraints

- After Manufacture Segment (factory-fit) developing into a key

market for Guardian Gen 3, as European General Safety Regulation

requires all new commercial vehicles to be fitted with technology

to reduce risks of driver drowsiness in 2024, with requirements set

to expand to distraction from 2026

- Seeing Machines is working with Mobileye to jointly target

Aftermarket business globally, enhancing the Company's Guardian

solution by incorporating the Mobileye suite of external facing

Aftermarket products to alert drivers of potentially dangerous

situations

RESULTS PRESENTATIONS

Sell-side Analyst Briefing - The Company will host an in-person

briefing for analysts hosted by Paul McGlone, Chief Executive

Officer and Martin Ive, Chief Financial Officer. This will take

place at 9:00am BST on 16(th) October at the offices of Dentons

Global Advisors.

Private Investor Presentation - Paul McGlone, Chief Executive

Officer and Martin Ive, Chief Financial Officer, will provide a

live presentation and Q&A via the Investor Meet Company

platform on 16(th) October 2023 at 10:15am BST.

Enquiries:

Seeing Machines Limited +61 2 6103 4700

Paul McGlone - CEO

Sophie Nicoll - Corporate Communications

Stifel Nicolaus Europe Limited (Nominated

Adviser and Broker) +44 20 7710 7600

Alex Price

Fred Walsh

Nick Adams

Ben Burnett

Dentons Global Advisors (Media Enquiries)

James Styles

Jonathon Brill

seeingmachines@dentonsglobaladvisors.com +44 20 7664 5095

About Seeing Machines (AIM: SEE), a global company founded in

2000 and headquartered in Australia, is an industry leader in

vision-based monitoring technology that enable machines to see,

understand and assist people. Seeing Machines is revolutionizing

global transport safety. Its technology portfolio of AI algorithms,

embedded processing and optics, power products that need to deliver

reliable real-time understanding of vehicle operators. The

technology spans the critical measurement of where a driver is

looking, through to classification of their cognitive state as it

applies to accident risk. Reliable "driver state" measurement is

the end-goal of Driver Monitoring Systems (DMS) technology. Seeing

Machines develops DMS technology to drive safety for Automotive,

Commercial Fleet, Off-road and Aviation. The company has offices in

Australia, USA, Europe and Asia, and supplies technology solutions

and services to industry leaders in each market vertical.

www.seeingmachines.com

Review of Operations

The Company's total revenue for the financial year (excluding

foreign exchange gains and finance income) was US$57,771,000

compared to the 2022 revenue of US$39,000,000, representing a 48%

increase on prior year results.

2023 2022 Variance

Product US$'000 US$'000 %

OEM 26,707 10,518 154

Aftermarket 31,064 28,482 9

-------- -------- --------

OEM revenue more than doubled compared to the previous

corresponding period in line with the early stage ramp up of

vehicle production for a number of Automotive OEM programs. Royalty

revenues, derived from installation of Seeing Machines' Driver

Monitoring System (DMS) technology, increased by 91% to

US$7,580,000 from US$3,960,000 in FY22. The growth in royalty

revenues in the OEM business has resulted in the revenue mix moving

to a greater proportion of higher margin revenue streams, which is

expected to continue as Automotive programs become the dominant

source of revenue for this business unit. In FY23, the OEM

operating segment entered into two key exclusive collaboration

arrangements which earned licensing revenue of US$11,332,000 (2022:

nil). The remainder of the revenue in the OEM segment primarily

represents NRE (Non-Recurring Engineering) revenue which is

software development activities undertaken to embed DMS

technologies into the specific OEM configuration prior to the

commencement of production. NRE revenue increased by 16% to

US$6,766,000 (2022: US$5,850,000), and is a lead indicator of

future royalty revenue.

Aftermarket hardware and installation revenue decreased by 2%

over the prior year to US$14,495,000 (2022: US$14,722,000) which

was due to limited hardware supply in the first half of the

financial year. Connected Guardian units increased to 51,975 units

in June 2023 representing 30% growth from 39,832 in June 2022. As a

result of this growth, monitoring services revenue increased by 17%

to US$11,117,000 (2022: US$9,512,000), continuing the accumulation

of recurring revenue from the Guardian connections.

Gross profit increased from US$17,508,000 in FY22 to

US$28,898,000 in FY23. Operational gross profit margin improved 5%

year on year from 45% in FY22 to 50% in FY23 primarily reflecting

increased high-margin OEM royalty and exclusivity licence

revenues.

The Company continued to invest in its core technology

development to further strengthen its competitive moat, rapidly

expand features and leverage its unique systems approach across

global OEM and Aftermarket industries. As a result, Seeing Machines

has reflected a portion of development expenditure which meets

recognition criteria as an intangible asset. During FY23, such

development expenditure amounting to US$23,685,000 (2022:

US$18,611,000) was capitalised and US$2,444,000 (2022: US$829,000)

was amortised. The remaining research and development costs have

been expensed and amount to US$11,264,000 (2022: US$11,251,000).

The total investment in research and development for the current

year amounting to US$34,949,000 (2022: US$29,862,000).

The resultant loss for the period represented a decrease of

US$3,019,000 at US$15,548,000 (2022 loss: US$18,567,000).

Net cash and cash equivalents at 30 June 2023 totalled

US$36,139,000 (2022: US$40,470,000).

On 4 October 2022, Seeing Machines received funding of

US$47,500,000 from Magna International in the form of a

non-transferable 4-year convertible note maturing in October 2026

(the "Convertible Note"). Details of the Convertible Note can be

found in Note 21 to the Financial Statements. The proceeds of the

Convertible Note are being used to meet technology demands, for

general working capital and corporate purposes, as well as to

strengthen the Company's balance sheet so that it is fully funded

to deliver on its current business plan.

Operational Highlights

Seeing Machines continues to grow across all segments, now a

well-recognised leader in the delivery of proven driver and

occupant monitoring system technology with accelerated momentum

achieved throughout FY23.

Martin Ive, CFO, was appointed to the Company in November 2022.

Martin is a highly experienced finance professional and chartered

accountant. He was previously the CFO for leading ASX-listed Altium

Limited and is responsible for overseeing the global finance

function and providing financial insights and information to guide

strategic and operational decisions.

Regulatory tailwinds have increased demand across all road

transport segments as Europe's General Safety Regulation (GSR2) is

now in effect, and Euro NCAP (New Car Assessment Program) five-star

system imminent for all cars sold across Europe, delivering a

positive global impact on DMS fitment. The USA is ramping up its

path towards a regulated requirement for driver assistance

features, including DMS, to address distraction and impairment, in

particular. Seeing Machines is working closely with rule-makers and

other bodies in the USA to inform the protocols that underpin

robust safety outcomes.

The introduction of quarterly Key Performance Indicators (KPIs)

during the period has enabled the Company to demonstrate ongoing

momentum as well as year on year growth for the Automotive and

Aftermarket businesses. In Automotive, revenue has transitioned

from low margin NRE to high margin royalty revenue as cars start

production across a range of programs. Seeing Machines now has more

than 1 million cars on the road (1,086,176) installed with DMS

technology. This number is projected to grow substantially for the

foreseeable future based on current programs and will further

expand as more programs are awarded, currently under Request for

Quote (RFQ). The value of current won business, based on initial

minimum volumes stands at US$321m with the majority of that revenue

to be recognised over the period to 2028.

A highlight during the period was the agreement between Seeing

Machines Limited and Magna to exclusively co-market DMS/OMS

integrated into the rear-view mirror. This location is predicted to

experience the biggest growth across all markets and represents a

big step-change for the Company. Working with one of the world's

largest automotive tier-one suppliers, with a focus on mirrors,

will enable Seeing Machines to increase market share as OEMs work

hard to meet regulatory requirements, deliver a reliable driver and

occupant monitoring solution and respond to the integration

challenge inside the cabin.

In Aftermarket, Guardian connections have increased by 30% over

the year to almost 52,000 global installations, contributing to

expanding Annual Recurring Revenue (ARR) performance. With a

historically low churn rate across this business, ARR is a very

important contributor to overall Company revenue. Regulation,

specifically in Europe with the GSR, is positively impacting the

potential for increased Guardian connections and there has been

good momentum in Europe with commercial vehicle manufacturers

seeking to 'factory-fit' the technology in order to sell compliant

vehicles across the continent, and globally. Seeing Machines is

engaged with these customers and this additional segment ("After

Manufacture") is now a key focus for the Company. The regulatory

momentum has also seen increased interest in large multinational

organisations and Seeing Machines will refocus on the USA as it

launches its third generation Guardian technology early in

2024.

Seeing Machines signed an exclusive licence with Collins

Aerospace, a Raytheon Technologies business, to jointly develop

pioneering eye-tracking solutions for the global Aviation industry.

Collins Aerospace is the world's largest Tier 1 Avionics company

and has been working successfully with Seeing Machines for some

years. Building on this history, the collaboration will enable the

two companies to access the significant opportunity across aircraft

and simulators of over US$700 million in the next 20 years, and to

develop revolutionary fatigue management technology solutions to

increase safety across this sector. The exclusivity will see

Collins pay Seeing Machines US$10 million over three years as well

as NRE payments that will cover development of solutions, evolving

into potential future royalty payments as shipsets are released to

customers.

Seeing Machines exists to get people home safely and now boasts

three revenue generating business units that are contributing to

that mission every day.

Significant changes in the state

of affairs

During the financial year there was no significant change in the

state of affairs of the Company other than those referred to

elsewhere in this report and in the financial statements or notes

thereto.

Seeing Machines Limited

Consolidated statement of financial position

As at 30 June 2023

Consolidated entity

At

30 June 30 June 1 July

2023 2022 2021

Notes US$'000 US$'000 US$'000

Assets

Current assets

Cash and cash equivalents 10 36,139 40,470 35,541

Trade and other receivables 11 27,039 18,588 14,887

Contract assets 12 6,513 3,433 1,613

Inventories 13 11,191 933 1,970

Other financial assets 17 312 325 354

Other current assets 14 1,116 2,244 2,465

-------- -------- --------

Total current assets 82,310 65,993 56,830

-------- -------- --------

Non-current assets

Property, plant and equipment 15 3,861 3,033 2,520

Right-of-use assets 26 1,853 2,376 7,154

Intangible assets 16 45,064 23,609 3,189

-------- -------- --------

Total non-current assets 50,778 29,018 12,863

-------- -------- --------

Total assets 133,088 95,011 69,693

-------- -------- --------

Liabilities

Current liabilities

Trade and other payables 18 11,646 11,290 6,629

Contract liabilities 20 4,634 2,495 579

Lease liabilities 26 708 653 688

Provisions 19 4,414 3,512 3,669

-------- -------- --------

Total current liabilities 21,402 17,950 11,565

-------- -------- --------

Non-current liabilities

Borrowings 21 40,322 - -

Lease liabilities 26 2,195 3,000 3,954

Deferred tax liabilities 7 2,464 - -

Provisions 19 174 245 144

-------- -------- --------

Total non-current liabilities 45,155 3,245 4,098

-------- -------- --------

Total liabilities 66,557 21,195 15,663

-------- -------- --------

Net assets 66,531 73,816 54,030

-------- -------- --------

Seeing Machines Limited

Consolidated statement of financial position

As at 30 June 2023

(continued)

Consolidated entity

At

30 June 30 June 1 July

2023 2022 2021

Notes US$'000 US$'000 US$'000

Equity

Contributed equity 22 240,948 240,948 201,093

Other equity 23 5,749 - -

Accumulated losses 24 (185,520) (169,972) (151,405)

Other reserves 24 5,354 2,840 4,342

--------- --------- ---------

Total equity attributable to owners

of Seeing Machines Limited 66,531 73,816 54,030

--------- --------- ---------

Seeing Machines Limited

Consolidated statement of comprehensive income

For the year ended 30 June 2023

Consolidated entity

Year ended

30 June 30 June

2023 2022

Notes US$'000 US$'000

Sale of goods 14,596 15,911

Services revenue 21,489 15,491

Royalty and licence fees 21,686 7,598

---------- ---------

Revenue 4 57,771 39,000

Cost of sales (28,873) (21,492)

---------- ---------

Gross profit 28,898 17,508

Net foreign exchange gains 5 916 1,022

Other income 5 31 77

Expenses 6

Research and development expenses (11,264) (11,251)

Customer suport and marketing expenses (6,477) (6,525)

Operations expenses (12,865) (8,161)

General and administration expenses (12,938) (11,167)

---------- ---------

Operating loss (13,699) (18,497)

---------- ---------

Finance income 691 282

Finance costs (2,571) (328)

---------- ---------

Finance costs - net (1,880) (46)

---------- ---------

Loss before income tax (15,579) (18,543)

Income tax (expense)/benefit 7 31 (24)

---------- ---------

Loss for the period (15,548) (18,567)

---------- ---------

Loss is attributable to:

Equity holders of Seeing Machines Limited (15,548) (18,567)

---------- ---------

Seeing Machines Limited

Consolidated statement of comprehensive income

For the year ended 30 June 2023

(continued)

Consolidated entity

Year ended

30 June 30 June

2023 2022

Notes US$'000 US$'000

Loss for the period (15,548) (18,567)

Other comprehensive income/(loss)

Items that may be reclassified to profit

or loss

Exchange differences on translation of foreign

operations 24 310 (5,137)

---------- ---------

Other comprehensive income/(loss) for the

period, net of tax 310 (5,137)

---------- ---------

Total comprehensive income/(loss) for the

period (15,238) (23,704)

---------- ---------

Total comprehensive income/(loss) for the

period is attributable to:

Owners of Seeing Machines Limited (15,238) (23,704)

---------- ---------

Cents Cents

Loss per share for profit attributable to

the ordinary equity holders of the Company:

Basic loss per share 9(0.004) (0.004)

Diluted loss per share 9(0.004) (0.004)

Seeing Machines Limited

Consolidated statement of changes in equity

For the year ended 30 June 2023

Employee

Foreign Equity

Currency Benefits

Contributed Other Accumulated Translation & Other Total

Equity equity Losses Reserve Reserve equity

Consolidated entity Notes US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Balance at 1 July 2021 201,093 - (151,405) (8,991) 13,333 54,030

----------- -------- ----------- ------------ --------- --------

Loss for the period - - (18,567) - - (18,567)

Other comprehensive

loss - - - (5,137) - (5,137)

----------- -------- ----------- ------------ --------- --------

Total comprehensive

loss - - (18,567) (5,137) - (23,704)

----------- -------- ----------- ------------ --------- --------

Transactions with owners

in their capacity as

owners:

Shares issued 22 40,864 - - - - 40,864

Capital raising costs 22 (1,009) - - - - (1,009)

Share-based payments 28 - - - - 3,635 3,635

----------- -------- ----------- ------------ --------- --------

Balance at 30 June

2022 240,948 - (169,972) (14,128) 16,968 73,816

----------- -------- ----------- ------------ --------- --------

Balance at 1 July 2022 240,948 - (169,972) (14,128) 16,968 73,816

----------- -------- ----------- ------------ --------- --------

Loss for the year ended - - (15,548) - - (15,548)

Other comprehensive

loss - - - 310 - 310

----------- -------- ----------- ------------ --------- --------

Total comprehensive

loss - - (15,548) 310 - (15,238)

----------- -------- ----------- ------------ --------- --------

Transactions with owners

in their capacity as

owners:

Share-based payments 28 - - - - 2,204 2,204

Value of conversion

rights on convertible

notes 23 - 5,749 - - - 5,749

----------- -------- ----------- ------------ --------- --------

Balance at 30 June

2023 240,948 5,749 (185,520) (13,818) 19,172 66,531

----------- -------- ----------- ------------ --------- --------

Seeing Machines Limited

Consolidated statement of cash flows

For the year ended 30 June 2023

Consolidated entity

Year ended

30 June 30 June

2023 2022

Notes US$'000 US$'000

Cash flows from operating activities

Receipts from customers (inclusive of GST) 52,183 37,961

Payments to suppliers and employees (inclusive

of GST) (77,412) (49,543)

Interest received 691 284

Interest paid (5) -

Income taxes paid (496) (192)

---------- ---------

Net cash (outflow) from operating activities 25 (25,039) (11,490)

---------- ---------

Cash flows from investing activities

Purchase for plant and equipment (1,703) (1,344)

Payments for intangible assets (patents, licences

and trademarks) (253) (257)

Payment of intangible assets (capitalised

development costs) (23,685) (18,611)

Interest received on financial assets held

as investments 13 -

---------- ---------

Net cash (outflow) from investing activities (25,628) (20,212)

---------- ---------

Cash flows from financing activities

Proceeds from issues of new shares - 40,864

Cost of capital raising - (1,009)

Proceeds from borrowings 47,500 -

Transaction costs in borrowings (1,202) -

Principal repayment of lease liabilities (1,005) (922)

---------- ---------

Net cash inflow from financing activities 45,293 38,933

---------- ---------

Net (decrease) increase in cash and cash

equivalents (5,374) 7,231

Cash and cash equivalents at the beginning

of the financial year 40,470 35,541

Effects of exchange rate changes on cash and

cash equivalents 1,043 (2,302)

---------- ---------

Cash and cash equivalents at end of financial

year 10 36,139 40,470

---------- ---------

To read the FY2023 Annual Financial Report and access

accompanying notes to the above tables, please visit

https://www.seeingmachines.com/investors/announcements

[1] Consensus expectations for FY2023 are revenue of

US$53.9m

[2] Working capital increased due to the timing of Guardian

inventory deliveries, leading to an increased level of inventory

and receivables at 30 June 2023. Inventory levels are sufficient to

support demand for H1 FY2024 and will unwind along with receivables

in the first half of FY24.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FLFIDITLSLIV

(END) Dow Jones Newswires

October 16, 2023 02:00 ET (06:00 GMT)

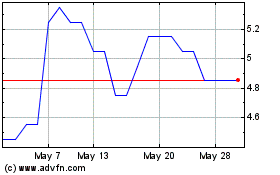

Seeing Machines (AQSE:SEE.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Seeing Machines (AQSE:SEE.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024