Reach PLC Trading Update (4821P)

October 10 2023 - 2:00AM

UK Regulatory

TIDMRCH

RNS Number : 4821P

Reach PLC

10 October 2023

10 October 2023

Reach plc ("The Company") Q3 Trading update for the 3-month

period to 24 September 2023

Full year profit expectations unchanged

Q3 YOY % 9 Months YOY %

Digital revenue (13.7) (15.2)

--------- ---------------

Print revenue (5.8) (3.8)

--------- ---------------

* Circulation revenue (3.3) 0.4

--------- ---------------

* Advertising revenue (8.9) (15.7)

--------- ---------------

Group revenue (7.8) (6.6)

--------- ---------------

The factors affecting Q3 digital revenue are unchanged from

those outlined in our half year results. These include depressed

open market yields and the well-publicised declining digital

referral volumes, in particular from Facebook's de-prioritisation

of news. As a result over the nine-month period, year-on-year page

views declined 21%. Data driven revenue,(1) which is higher value

and more targeted, continues to be robust and now makes up a larger

part of digital revenues at 42%. (FY 2019 - 24%)

In print, circulation revenue has grown marginally over the

first 9 months of the year. This remains a resilient and

predictable revenue stream as we actively mitigate the expected

volume decline. Last September 2022 saw modest advertising activity

following the Queen's death, excluding this one-off factor the

quarter would trend in line with the 9-month movement. Brands

continue to value advertising to our substantial customer base.

Capital reduction

The Company announces that it will in due course be posting a

circular to shareholders (including notice of general meeting) in

connection with a proposed capital reduction of GBP605.4m. This is

conditional upon the approval of the Company's shareholders and by

the High Court of Justice in England and Wales. The Capital

Reduction will not involve any return of capital or payment to

shareholders but will create additional distributable

reserves.(2)

MGN Pension scheme resolution

We are pleased to report that we have now concluded the 2019

triennial valuation for the MGN scheme, and at the same time

concluded its 2022 triennial valuation. The funding valuation of

the MGN scheme at 31 December 2022 showed a deficit of GBP219.0m.

This deficit is expected to be removed via a schedule of

contributions that includes annual payments of GBP46.0m pa from

January 2023 until January 2028. The previous schedule of

contributions for the MGN scheme included payments of GBP40.9m pa

from 2023 to 2027(3) . Discussions are ongoing with the Group's

other schemes in relation to the 2022 triennial valuations and are

expected to be concluded satisfactorily by the 31 March 2024 due

date.

Outlook

We remain confident of meeting profit expectations for the full

year.(4) We do not anticipate the market backdrop to change

materially in the near term and as a result we remain focused on

the areas within our control; improving customer engagement,

diversifying revenues and driving efficiencies. Our plans to reduce

full year operating costs by 5-6% remain on track. We expect a High

Court judgement on time limitation relating to historical legal

issues in the next few months.

Jim Mullen Chief Executive

"This quarter we see continued evidence that our data driven

strategy is working, supported by our resilient print business.

Through this challenging period we have remained focused on the

controllables. We are delivering our Customer Value Strategy and

have made progress diversifying our audience. We continue to review

our cost base so that we can accelerate our digital

transformation."

Notes

Includes revenue from advertising activity which utilises data generated

(1) via registrations, audience behavioural or Mantis contextual. It

also includes other strategically driven revenues, less dependent

on audience volumes such as affiliates, partnerships and ecommerce.

This change will result in GBP605.4m cancellation of the Company's

(2) share premium account and the creation of distributable reserves

of the same amount.

Previous MGN schedule of contributions disclosed in the Half year

(3) report - 25 July 2023.

Market expectations compiled by the Company are an average of analyst

(4) published forecasts - consensus adjusted operating profit for FY23

GBP95.0m.

Enquiries

Reach communications@reachplc.com

Jim Mullen, Chief Executive Officer

Darren Fisher, Chief Financial Officer

Lorraine Clover, Group Company Secretary

Lija Kresowaty, Head of External

Communications

Jo Britten, Investor Relations Director +44 (0)7557 557447

Teneo reachplc@teneo.com

David Allchurch/Giles Kernick +44 (0)207 353 4200

About Reach

We're Reach plc, the UK's and Ireland's largest commercial news

publisher. We're home to more than 130 trusted brands, from

national titles like the Mirror, Express, Daily Record and Daily

Star, to local brands like MyLondon, BelfastLive and the Manchester

Evening News, to our recently launched U.S. titles. Every month, 48

million people come to us, via print and online, for trusted news,

entertainment and sport.

LEI: 213800GNI5XF3XOATR61

Classification: 3.1 Additional regulated information required to

be disclosed under the laws of the United

Kingdom

The information in the section of the announcement headed "MGN

Pension scheme resolution" in relation

to the conclusion of the 2019 and 2022 triennial valuations for

the MGN scheme is inside

information disclosed under article 7 of the Market Abuse

Regulation.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFSEESUEDSESS

(END) Dow Jones Newswires

October 10, 2023 02:00 ET (06:00 GMT)

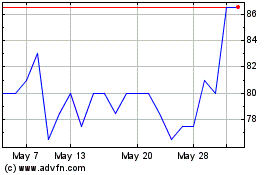

Reach (AQSE:RCH.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

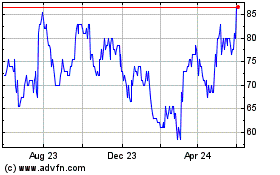

Reach (AQSE:RCH.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024