Reach PLC Trading Update (1835Y)

May 03 2023 - 2:00AM

UK Regulatory

TIDMRCH

RNS Number : 1835Y

Reach PLC

03 May 2023

3 May 2023

Reach plc - Trading update for the 4-month period to 23 April

2023

FY23 in line with expectations; cost actions offset continued

challenging trading

Reach plc ('the Group') is issuing a trading update for the

4-month period to 23 April 2023 ('the period'), ahead of its 2023

Annual General Meeting today.

Period

Year on year

%

Digital Revenue (14.5%)

-------------------------

Print Revenue (3.0%)

-------------------------

* circulation revenue 2.1%

-------------------------

* advertising revenue (19.2%)

-------------------------

Group Revenue (5.9%)

-------------------------

Year to date group revenue in-line

Group revenue for the period was down 5.9%, against strong

comparatives, broadly unchanged from the year to date performance

highlighted in our full year results in March, and in line with our

expectations.

Print revenue has remained strong. Volumes remain robust, with

circulation revenue benefitting from cover price increases during

FY22, with advertising slightly ahead of our expectations.

While macroeconomic conditions mean the overall market for

digital advertising is challenging, data-driven revenue continues

to outperform. Reduced demand continues to be reflected in lower

sector yields, particularly in the open market. The page view

slowdown, referred to in March, has continued, with recent changes

to the way Facebook presents news content, causing a reduction in

referred traffic across the sector.

Our investment in the US continues to progress. We currently

have almost 100 full time roles in place and expect to launch US

domain websites for both The Express and Mirror over the next few

months.

Operating cost action plan on track

As previously announced, we expect a reduction in operating

costs of between 5% and 6% during FY23 -actions to deliver this are

well advanced, with most of these savings to be realised during

H2.

Outlook

Looking forward we expect to benefit from, strategic actions to

address the decline in page views, expansion in the US and a

reduction in operating costs. In addition, H2 digital comparatives

are less demanding, mainly due to suppressed Black Friday and

Christmas trading last year. Profit expectations for FY23 remain

in-line with market consensus.(1)

Jim Mullen, Reach plc Chief Executive

"External factors continue to impact digital revenue, delivery

of the customer value strategy is driving a higher quality mix,

underpinned by the strength of print. Our focus on data, means

customers are receiving and responding more often to relevant

content and a more engaging user experience. Our scale, US

expansion, strategic delivery and strong balance sheet give us

confidence for the future."

Notes

(1) Market expectations compiled by the company are an average

of analyst published forecasts - consensus adjusted operating

profit for FY23 is GBP95.3m (range from GBP93.7m to GBP96.5m)

Enquiries

Reach communications@reachplc.com

Jim Mullen, Chief Executive Officer

Darren Fisher, Chief Financial Officer

Lija Kresowaty, Head of External Communications

Matt Sharff, Investor Relations Director +44 (0)7341 470 722

Teneo reachplc@teneo.com

Giles Kernick +44 (0)207 353 4200

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSSAFWEEDSEEI

(END) Dow Jones Newswires

May 03, 2023 02:00 ET (06:00 GMT)

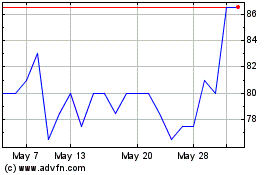

Reach (AQSE:RCH.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

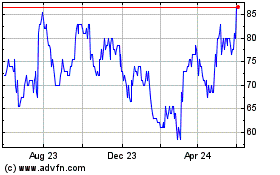

Reach (AQSE:RCH.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024