TIDMPHP

RNS Number : 1725H

Primary Health Properties PLC

26 July 2023

Primary Health Properties PLC

Interim results for the six months ended 30 June 2023

Organic rental growth continuing to drive performance and

dividend fully covered at 102%

Primary Health Properties PLC ("PHP", the "Group" or the

"Company"), a leading investor in modern primary health facilities,

announces its interim results for the six months ended 30 June 2023

(the "period").

Harry Hyman , Chief Executive of PHP, commented:

"We are encouraged by the improvement in rental growth

experienced in the first half of the year and expect to deliver

over GBP4 million of extra income during 2023, another record and

continuing the trend seen in recent years. We believe PHP will be a

beneficiary of both the current inflationary environment and the

significant rise in construction costs seen in recent years both

through open market and index-linked reviews. Furthermore, with 97%

of PHP's debt either fixed or hedged for a weighted average period

of just under seven years, a strong control on costs and just one

development on site we have limited exposure to further cost

increases and development risk.

"The security and longevity of our income, near full occupancy

together with stronger rental growth are the key drivers of our

predictable cash-flows and underpin our progressive dividend policy

with 27 years of continued growth."

FINANCIAL AND OPERATIONAL HIGHLIGHTS

Income statement and financial metrics Six months to Six months

30 June 2023 to 30 June Change

2022

--------------------- ---------------

Net rental income(1) GBP75.5m GBP71.1m +6.2%

Adjusted earnings(1,2) GBP45.9m GBP44.7m +2.7%

Adjusted earnings per share(1,2) 3.4p 3.4p -

IFRS profit for the period GBP39.5m GBP107.1m

IFRS earnings per share(2) 3.0p 8.0p

Dividends

Dividend per share(5) 3.35p 3.25p +3.1%

Dividends paid(5) GBP44.8m GBP43.3m +3.5%

Dividend cover(1) 102% 103%

------------------------------------------ --------------------- --------------- --------

Balance sheet and operational metrics 30 June 31 December

2023 2022 Change

------------------------------------------ --------------------- --------------- --------

Adjusted NTA per share(1,3) 111.1p 112.6p -1.3%

IFRS NTA per share(1,3) 110.6p 110.9p -0.3%

Property portfolio

Investment portfolio valuation(4) GBP2.783bn GBP2.796bn -0.4%

Net initial yield ("NIY") (1) 4.90% 4.82%

Contracted rent roll (annualised)(1,7) GBP147.4m GBP145.3m +1.4%

Weighted average unexpired lease term 10.6 years 11.0 years

("WAULT")(1)

Occupancy 99.6% 99.7%

Rent-roll funded by government bodies(1) 89% 89%

Debt

Average cost of debt 3.2% 3.2%

Loan to value ratio ("LTV")(1) 45.6% 45.1%

Weighted average debt maturity 6.9 years 7.3 years

Total undrawn loan facilities and GBP314.4m GBP325.9m

cash(6)

------------------------------------------ --------------------- --------------- --------

1 Definitions for net rental income, Adjusted earnings, Adjusted

earnings per share, earnings per share ("EPS"), dividend cover,

loan to value ("LTV"), net tangible assets ("NTA"), rent roll, NIY,

WAULT, total adjusted NTA return and net asset value ("NAV") are

set out in the Glossary of Terms.

2 See note 7 , earnings per share, to the financial statements.

3 See note 7 , net asset value per share, to the financial

statements. Adjusted net tangible assets, EPRA net tangible assets

("NTA"), EPRA net disposal value ("NDV") and EPRA net reinstatement

value ("NRV") are considered to be alternative performance

measures. The Group has determined that adjusted net tangible

assets is the most relevant measure.

4 Percentage valuation movement during the period based on the

difference between opening and closing valuations of properties

after allowing for acquisition costs and capital expenditure.

Includes assets held for sale.

5 See note 8, dividends, to the financial statements.

(6) After deducting the remaining cost to complete contracted

acquisitions, properties under development and asset management

projects.

(7) Percentage contracted rent roll increase during the period

is based on the annualised uplift achieved from all completed rent

reviews and asset management projects.

EARNINGS AND DIVID GROWTH

-- Adjusted earnings per share unchanged at 3.4p (30 June 2022: 3.4p)

-- IFRS earnings per share decreased by 62.5% to 3.0p (30 June 2022: 8.0p)

-- Contracted annualised rent roll increased by 1.4% to GBP147.4

million (31 December 2022: GBP145.3 million)

-- Additional annualised rental income on a like-for-like basis

of GBP2.2 million or 1.5% from rent reviews and asset management

projects (H1 2022: GBP1.8 million or 1.3%; FY 2022: GBP3.3 million

or 2.4%)

-- EPRA cost ratio 10.1% (FY 2022: 9.9%), representing one of the lowest in the UK REIT sector

-- First three quarterly dividends totalling 5.025 pence per

share distributed or declared in the year-to-date, equivalent to

6.7 pence per share on an annualised basis, a 3.1% increase over

2022 (6.5 pence per share) and marking the Company's 27(th)

consecutive year of dividend growth

-- The Company intends to maintain its strategy of paying a

progressive dividend fully covered by Adjusted earnings

NET ASSET VALUE AND PORTFOLIO MANAGEMENT

-- Adjusted Net Tangible Assets ("NTA") per share decreased by

1.3% to 111.1 pence (31 December 2022: 112.6 pence)

-- Property portfolio valued at GBP2.783 billion at 30 June 2023

(31 December 2022: GBP2.796 billion) reflecting a net initial yield

of 4.90% (31 December 2022: 4.82%)

-- Revaluation deficit in the period of GBP11.9 million (30 June

2022: surplus GBP51.2 million), representing a decline of -0.4% (30

June 2022: +1.8%), comprising a GBP45 million decline driven by NIY

widening of 8bps partially offset by gains of GBP33 million arising

from rental growth and asset management projects

-- The portfolio's metrics continue to reflect the Group's

secure, long-term and predictable income stream with occupancy at

99.6% (31 December 2022: 99.7%), WAULT of 10.6 years (31 December

2022: 11.0 years) and 89% (31 December 2022: 89%) of income funded

by government bodies

-- Portfolio in Ireland comprises 20 assets, valued at GBP219

million (EUR255 million) (31 December 2022: GBP231 million / EUR261

million) and continues to be the Group's preferred area of future

investment activity with a target to grow to around 15% of the

total portfolio

-- The acquisition of Axis Technical Services Limited, an Irish

property management business, in January 2023, gives the Group a

permanent presence in Ireland and is an important strategic move as

we seek out new investment, development and asset management

opportunities

-- Pipeline of 32 asset management projects and lease regears

planned over next two years , investing GBP23.7 million, creating

additional rental income of GBP1.2 million per annum and extending

the weighted average unexpired lease term (WAULT) back to over 20

years

-- Disciplined approach to future investment focused on Ireland,

direct developments and asset management projects are our preferred

areas of future investment

FINANCIAL MANAGEMENT

-- LTV ratio 45.6% (31 December 2022: 45.1%) in the middle of

the Group's targeted range of between 40% to 50%

-- 97% (31 December 2022: 94%) of net debt fixed or hedged for a

weighted average period of just under seven years

-- Weighted average debt maturity 6.9 years (31 December 2022: 7.3 years)

-- Significant liquidity headroom with cash and collateralised

undrawn loan facilities totaling GBP314.4 million (31 December

2022: GBP325.9 million) after capital commitments

DELIVERING STRONG TOTAL RETURNS

Six months ended Six months ended Year ended

30 June 2023 30 June 2022 31 December 2022

----------------------------------- ---------------- -----------------

Adjusted NTA return 1.6% 6.3% 2.1%

Income return 2.7% 2.5% 5.0%

Capital return (0.4%) 1.8% (2.2%)

--------------------------- ------ ---------------- -----------------

Total property return(1) 2.3% 4.3% 2.8%

--------------------------- ------ ---------------- -----------------

1 The de finition for total property return is set out in the Glossary of Terms.

RESPONSIBLE BUSINESS AND ESG

-- As previously announced, Net Zero Carbon ("NZC") Framework

published with the five key steps to achieve the Group's ambitious

target of being NZC by 2030 for all of PHP's operational,

development and asset management activities

-- Ongoing construction of PHP's first NZC development in West

Sussex expected to achieve practical completion in Q1 2024

Presentation and webcast:

An in-person presentation for analysts will be held today, 26

July 2023 at 9.30am at the offices of Numis Securities: 45 Gresham

Street, London EC2V 7BF. For those who cannot attend in person, the

meeting will be accessible via live video webcast and a live

conference call facility. Following the presentation, there will be

a managed Q&A session. To access the briefing, please log on or

dial in shortly before 9.30am via the details below:

Webcast:

https://stream.brrmedia.co.uk/broadcast/648c7d6ee1ace244e084c4b0

Conference call details:

UK: +44 (0) 33 0551 0200;

USA Local: +1 786 697 3501

Password (if prompted): Quote PHP Interim Results when prompted

by the operator.

If you would like to join the briefing, please contact Buchanan

via php@buchanan.uk.com to confirm your place. A recording of the

webcast will be made available from c.12.00pm on the PHP website,

https://www.phpgroup.co.uk/

If you would like to join the briefing, please contact Buchanan

via php@buchanan.uk.com to confirm your place.

For further information contact:

Harry Hyman Richard Howell

Chief Executive Officer Chief Financial Officer

Primary Health Properties PLC Primary Health Properties PLC

T: +44 (0) 7973 344768 T: +44 (0) 7766 072272

E: harry.hyman@phpgroup.co.uk E: richard.howell@phpgroup.co.uk

David Rydell/Jamie Hooper/Hannah Ratcliff/Verity

Parker

Buchanan Communications

T: +44 (0) 20 7466 5066

E: php@buchanan.uk.com

---------------------------------------------------- -----------------------------------

EXECUTIVE REVIEW

PHP is pleased to have continued to deliver another period of

robust operational and financial performance in the first half of

2023 despite the ongoing volatility in the economic and interest

rate outlook caused by both global and domestic events. The

negative interest rate outlook has continued to weigh heavily on

the real estate sector.

The Group's strong operational resilience throughout the period

reflects the security and longevity of our income which are

important drivers of our predictable income stream and underpin our

progressive dividend policy and we are now in our 27(th) year of

continued dividend growth.

We continue to maintain our strong operational property metrics,

with a long weighted average unexpired lease term ("WAULT") of 10.6

years (31 December 2022: 11.0 years), high occupancy at 99.6% (31

December 2022: 99.7%) and 89% (31 December 2022: 89%) of our rent

being securely funded directly or indirectly by the UK and Irish

Governments. Notwithstanding the fall in values in the period the

portfolio's average lot size remains at GBP5.4 million (31 December

2022: GBP5.4 million).

We have continued to see rental growth improving with rent

reviews in the six months ended 30 June 2023 generating an extra

GBP2.2 million (six months ended 30 June 2022: GBP1.5 million) an

uplift of 9.9% over the previous passing rent equivalent to 4.4% on

annualised basis (six months ended 30 June 2022: 6.1% uplift or

3.0% annualised). Over the course of 2023 the Group continues to

anticipate that rent reviews will generate in excess of GBP4.0

million (2022: GBP3.0 million) of incremental income driven by the

impact of inflation on both index-linked and open market value

("OMV") reviews, continuing the positive trend in growth seen over

the last couple of years. It should be noted that most of the

growth on OMV rent reviews came from the period 2019 to 2021 and

therefore does not yet reflect the impact of significantly higher

construction costs experienced in the last two years.

We are encouraged by the increasingly firmer tone of rental

growth and believe PHP in the medium term will be a beneficiary of

the current inflationary environment both through open market and

index-linked reviews. In particular, the significant increases in

construction costs, together with historically suppressed levels of

open market rental growth in the sector, will be significant pull

factors to future growth especially as the NHS seeks to deliver

new, larger primary care facilities and modernise the existing

estate.

The value of the property portfolio remains broadly unchanged

and currently stands at just under GBP2.8 billion (31 December

2022: GBP2.8 billion) across 513 assets (31 December 2022: 513

assets), including 20 in Ireland, with a rent roll of GBP147.4

million (31 December 2022: GBP145.3 million). As previously

reported with PHP's full year 2022 results, the deteriorating

interest rate environment and economic outlook caused us to

reconsider our acquisition pipeline and pause investment activity

until the economic and interest rate outlook becomes clearer. Our

prudent strategy means we currently have just one development on

site and consequently very limited exposure to further build cost

inflation and development risk.

Many of our primary care facilities and occupiers will need to

deal with the backlog of procedures and demand which has built up

over the last three years and the increasing pressures being placed

on the healthcare systems in both the UK and Ireland. We continue

to maintain close relationships with our key stakeholders and GP

partners to ensure we are best placed to help the NHS and Health

Service Executive ("HSE"), Ireland's national health service

provider, particularly in primary care, evolve and deal with the

increased pressures placed on them.

Acquisition of Axis Technical Services Limited ("Axis")

In January 2023, the Group successfully completed the

acquisition of Axis, an Irish property management business, and

signed a long-term development pipeline agreement providing access

to a strong pipeline of future primary care projects in

Ireland.

Axis currently manages a portfolio of over 30 properties,

including the majority of PHP's Irish portfolio, and the

acquisition gives the Group a permanent presence on the ground,

further strengthening its position in the country and relationship

with the HSE. The acquired company also provides fit-out, property

and facilities management services to the HSE and other businesses

located across Ireland.

As part of the acquisition, PHP signed a development pipeline

agreement with Axis Health Care Assets Limited, a related company

not acquired by the Company, which gives the Group the option to

acquire its development pipeline over the next five years. Axis

Health Care Assets Limited is one of Ireland's leading developers

of primary care properties, having developed five properties over

the last five years, all of which have been acquired by PHP. Axis

Health Care Assets Limited has a pipeline of projects with an

estimated gross development value of EUR50 million with further

potential schemes beyond that.

Overview of results

PHP's Adjusted earnings increased by GBP1.2 million or 2.7% to

GBP45.9 million (30 June 2022: GBP44.7 million) in the six months

to 30 June 2023, driven by strong organic rental growth from rent

reviews and asset management projects, plus income arising from the

acquisition of Axis, partially offset by higher interest costs on

the Group's variable rate debt. Using the weighted average number

of shares in issue in the period the Adjusted earnings per share

remained unchanged at 3.4 pence (30 June 2022: 3.4 pence).

A revaluation deficit of GBP11.9 million (30 June 2022: surplus

GBP51.2 million) was generated in the period from the portfolio,

equivalent to -0.9 pence per share. The valuation deficit was

driven by net initial yield ("NIY") widening of 8 bps in the

period, equivalent to a valuation reduction of around GBP45

million, albeit this was partially offset by gains equivalent to

GBP33 million arising from rental growth and asset management

projects.

A combined gain of GBP4.8 million (30 June 2022: gain of GBP11.8

million) from the fair value movements of interest rate derivatives

and convertible bonds, the amortisation of the fair value

adjustment on the MedicX fixed rate debt at acquisition, the

amortisation of the intangible asset and write off of costs arising

on the acquisition of Axis resulted in a profit before tax as

reported under IFRS of GBP38.8 million (30 June 2022: GBP107.7

million).

The Group's balance sheet remains robust with a loan to value

ratio of 45.6% (31 December 2022: 45.1%), which is in the middle of

the targeted range of between 40% and 50%, and we have significant

liquidity headroom with cash and collateralised undrawn loan

facilities, after capital commitments, totalling GBP314.4 million

(31 December 2022: GBP325.9 million). The Group continues to have

significant valuation headroom across the various loan facilities

with values needing to fall by around GBP1.2 billion or 42% before

the loan to value covenants are impacted.

Dividends and total shareholder return

The Company distributed a total of 3.35p per share in the six

months to 30 June 2023, equivalent to 6.7 pence on an annualised

basis, which represents an increase of 3.1% over the dividend per

share distributed in 2022 of 6.5 pence.

A third quarterly interim dividend of 1.675 pence per share was

declared on 29 June 2023. The dividend will be paid on 18 August

2023 to shareholders who were on the register at the close of

business on 7 July 2023. The dividend will comprise a Property

Income Distribution of 1.34 pence per share and a normal dividend

of 0.335 pence. The Company intends to maintain its strategy of

paying a progressive dividend, which is paid in equal quarterly

instalments, and covered by underlying earnings in each financial

year. A further interim dividend payment is planned to be made in

November 2023, which is expected to comprise a mixture of both

Property Income Distribution and normal dividend.

The total value of dividends distributed in the period increased

by 3.5% to GBP44.8 million (30 June 2022: GBP43.3 million), which

were fully covered by Adjusted earnings. As previously reported, we

suspended the scrip dividend scheme in light of the fall in the

share price in 2022 and first half of 2023 and are continuing to

offer a dividend re-investment plan in its place.

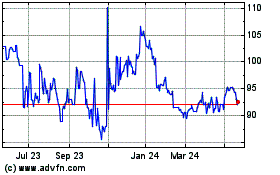

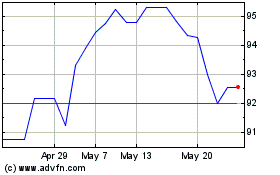

The Company's share price started the year at 110.8p per share

and closed on 30 June 2023 at 95.45p, a decrease of 13.9%.

Including dividends, those shareholders who held the Company's

shares throughout the period achieved a Total Shareholder Return of

-10.8% (30 June 2022: -7.8%). This compares to the total return

delivered by UK real estate equities (FTSE EPRA Nareit UK Index) of

-7.6% (30 June 2022: -21.2%) and the wider UK equity sector (FTSE

All-Share Index) of +2.6% (30 June 2022: -4.8%) in the period.

Environmental, Social and Governance ("ESG")

PHP has a strong commitment to responsible business. ESG matters

are at the forefront of the Board's and our various stakeholders'

considerations and the Group has committed to transitioning to net

zero carbon ("NZC"). We commenced construction of PHP's first NZC

development which is due to achieve practical completion in the

first quarter of 2024 and published, at the start of 2022, a NZC

Framework with the five key steps we are taking to achieve an

ambitious target of being NZC by 2030 for all of PHP's operational,

development and asset management activities. The NZC Framework also

sets out our ambition to help our occupiers achieve NZC by 2040,

five years ahead of the NHS's target of becoming the world's first

net zero carbon national health system by 2045 for the emissions it

can influence and ten years ahead of the UK and Irish Governments'

target of 2050. Further details on our progress in the year,

objectives for the future and approach to responsible business can

be found on pages 32 to 53 of the 2022 Annual Report and on our

website.

Board changes

As previously reported, Harry Hyman, Chief Executive Officer

("CEO"), intends to retire from his role at the Company's Annual

General Meeting ("AGM") in 2024. This intention is consistent with

the commitment made at the time of the MedicX merger, announced in

January 2019, that he manage PHP for a further five years. The

Company has now commenced the search for a new CEO which is

currently ongoing and hopes to make an announcement later in the

third quarter of the year with an appointment expected to take

effect from the 2024 AGM.

Market update and outlook

The primary care market continues to face challenges in meeting

the growing demand for healthcare services. The capacity of

existing facilities remains a significant obstacle to implementing

government policies aimed at expanding service delivery within

general practice, including social prescribing, clinical

pharmacists, physiotherapists, mental health, minor operations and

other activities. The need for additional space is driven by a

population that is growing, aging and suffering from increased

chronic illnesses, which are placing a greater burden on healthcare

systems in both the UK and Ireland. The extent of the NHS England

backlog remains a significant concern, with hospitals struggling to

meet objectives for cancer care and routine treatments. The number

of patients waiting for treatment has reached record highs,

exacerbating the need for improved and increased primary healthcare

infrastructure.

There is a growing expectation that many services in the

medium-term will progressively move from hospitals to primary care

settings, necessitating substantial investment in facilities to

accommodate these changes and alleviate the pressure on secondary

care. in the years to come. The UK government's new vision for

primary care premises, advocating the establishment of hubs or

"super hubs" is a step in this direction. The UK government's

vision is that these hubs is to promote collaboration among various

primary care staff and provide a wider range of services in a

single location. Larger GP practices with more staff and patients

are shown to produce better outcomes. This is in line with larger

purpose-built medical centres typical of PHP's portfolio.

Declining rents in real terms have made investing in the

transformation of GP facilities less appealing. Construction costs

have risen significantly over the past decade, surpassing the

growth in primary care rents, driven by material and labour costs

and increasing sustainability requirements, all of which has been

compounded by Brexit and the COVID-19 pandemic. Future developments

will now need a significant shift of between 20% to 30% in rental

values to make them economically viable and we continue to actively

engage with both the NHS, Integrated Care Boards and District

Valuer for higher rent settlements.

PHP's mission is to support the NHS, the HSE and other

healthcare providers, by being a leading investor in modern,

primary care premises. We will continue to actively engage with

government bodies, the NHS, the HSE in Ireland and other key

stakeholders to establish, enact (where we can), support and help

alleviate increased pressures and burdens currently being placed on

healthcare networks.

Primary care and property investment market update

The commercial property market continues to be impacted by

economic turbulence but primary care asset values have continued to

perform well relative to mainstream commercial property recognising

the security of their government backed income, crucial role in

providing sustainable healthcare infrastructure and more

importantly a much stronger rental growth outlook enabling

attractive reversion over the course of long leases.

The lack of recent transactions in the first half of the year

has resulted in valuers, to an extent, placing reliance on

sentiment to arrive at fair values.

We continue to see that for both the primary care and indeed the

wider commercial property markets, the high level of financial

market volatility and economic uncertainty has resulted in a

'wait-and-see' attitude amongst investors until the outlook settles

down.

Rising interest rates will undoubtedly continue to impact the

market. However, notwithstanding the significant increases and

volatility in interest rates seen in the first half of 2023 we

continue to believe further significant reductions in primary care

values are likely to be muted with a stronger rental growth outlook

offsetting the impact of any further yield expansion.

Additionally, the market for primary care assets is relatively

small with most assets tightly held by the main specialists in the

sector and consequently we anticipate most investors will likely

hold their existing assets in the current market primarily because

of:

-- Limited supplies of stock;

-- Very secure, rising income streams with an improving rental growth outlook;

-- The main specialists in the sector all having strong balance

sheets so there are unlikely to be any "forced sales"; and

-- A desire from investors to seek a "Safe Haven" with some

shifting from other property sectors.

PHP Outlook

Growth in the immediate future will continue to be focused on

increasing income from our existing portfolio and we are encouraged

by the firmer tone of rental growth experienced both in 2022 and

the first six months of 2023. As already noted, we believe the

favourable dynamics of higher inflation and increased build costs

combined with a demand for new primary care facilities and the need

to modernise the estate will continue to increase future rental

settlements.

We are currently on site with just one development and

consequently have very limited exposure to higher construction cost

pressures and supply chain delays. In our immediate development

pipeline we have just three projects with a total expected cost of

GBP15.2 million and will continue to evaluate these, together with

a wider medium term pipeline at various stages of progress, and

seek to negotiate rents with the NHS at the level required to

deliver an acceptable return.

In the current environment, Ireland continues to be the Group's

preferred area of future investment activity and we have ambitions

to continue to grow the portfolio there to around 15% of the total

(30 June 2023: 8%). The acquisition of Axis, in January 2023, gives

the Group a permanent presence in Ireland, an important strategic

move as we seek out new investment, development and asset

management opportunities and try to strengthen our relationship

with the HSE as the leading provider of modern primary care

infrastructure in the country.

With an improving rental growth outlook, a strong control on

costs resulting in one of the lowest EPRA cost ratio in the sector

and the vast majority of PHP's debt either fixed or hedged for a

weighted average period of just under seven years, we look forward

to the rest of 2023 with confidence.

We believe that our activities benefit not only our shareholders

but also our wider stakeholders, including occupiers, patients, the

NHS and HSE, suppliers, lenders, and the wider communities in both

the UK and Ireland.

Steven Owen Harry Hyman

Chairman Chief Executive Officer

25 July 2023

BUSINESS REVIEW

Investment and pipeline

In the first half of 2023 the Group did not acquire or dispose

of any assets because of the ongoing turmoil in the wider economy.

In the short term, we expect further investment activity will

continue to be muted and future acquisitions and developments will

only take place if accretive to earnings.

The Group currently has only one forward funded development in

legal due diligence, in Ireland for GBP12.8 million (EUR14.8

million) together with 32 asset management projects in the UK at a

cost of GBP23.7 million which will be progressed over the next two

years.

However, we continue to monitor a number of potential standing

investments, direct and forward funded developments, primarily in

Ireland - our preferred area of investment due to higher net

initial yields, larger lots sizes and cheaper cost of finance for

euro denominated debt.

Pipeline In legal due diligence Advanced pipeline

Number Cost Number Cost

--------------------------------------- ---------- -------------- -------- -------------

GBP12.8m GBP27.4m

Ireland - forward funded development 1 (EUR14.8m) 2 (EUR31.8m)

UK - direct development - - 3 GBP15.2m

UK - asset management 20 GBP16.8m 12 GBP6.9m

UK - investment - - - -

--------------------------------------- ---------- -------------- -------- -------------

Total pipeline 21 GBP29.6m 17 GBP49.5m

--------------------------------------- ---------- -------------- -------- -------------

Developments

At 30 June 2023, the Group had limited development exposure with

just one project on site at Croft Primary Care Centre, West Sussex

with GBP5.9 million of expenditure required to complete the project

which is being built to NZC standards.

The Group has currently paused an advanced direct development

pipeline across three schemes, with a total cost of GBP15.2

million, whilst negotiations with the NHS, Integrated Care Boards

and District Valuer continue to increase rental levels to make

these schemes economically viable. We are hopeful that previously

agreed rents will be increased by around 20%-30% across the three

pipeline developments.

We currently do not have any forward funded developments on-site

in Ireland.

PHP expects that all future direct developments will be

constructed to NZC standards.

Asset management

PHP's sector-leading metrics remain good and we continue to

focus on delivering the organic rental growth that can be derived

from our existing assets. This growth arises mainly from rent

reviews and asset management projects (extensions, refurbishments

and lease re-gears) which provide an important opportunity to

increase income, extend lease terms and avoid obsolescence whilst

ensuring that our properties continue to meet the communities'

healthcare needs and improve their ESG credentials.

In the first half of 2023 we have continued to see stronger

organic rental growth from our existing portfolio with income

increasing by GBP2.2 million or 1.5% (six months ended 30 June

2022: GBP1.8 million or 1.3%; year ended 31 December 2022: GBP3.3

million or 2.4%) on a like-for-like basis. The progress continues

the improving rental growth outlook seen over the last couple of

years and it should be noted that most of the increase comes from

rent reviews arising in the period 2019 to 2021, a period when

rental growth was muted and not reflecting the higher levels of

construction cost and general inflation experienced in recent

periods. We have also seen the improving rental growth outlook

reflected in the valuation of the portfolio with the independent

valuers' assessment of estimated rental values ("ERV") increasing

by 1.4% in the six months ended 30 June 2023 (six months ended 30

June 2022: 1.0%; year ended 31 December 2022: 2.2%).

Rent review performance

The Group completed 172 (six months ended 30 June 2022: 192;

year ended 31 December 2022: 318) rent reviews with a combined

rental value of GBP22.4 million (six months ended 30 June 2022:

GBP24.4 million; year ended 31 December 2022: GBP42.2 million),

adding GBP2.2 million and delivering an average uplift of 9.9%

against the previous passing rent (six months ended 30 June 2022:

GBP1.5 million / 6.1%; year ended 31 December 2022: GBP2.8 million

/ 6.7%).

In addition, a further 315 (31 December 2022: 286) open market

reviews have been agreed in principle, which will add another

GBP1.9 million (31 December 2022: GBP1.7 million) to the contracted

rent roll when concluded and represents an uplift of 4.3% (31

December 2022: 4.1%) against the previous passing rent.

69% of our rents are reviewed on an open market basis which

typically takes place every three years. The balance of the PHP

portfolio has either indexed (25%) or fixed uplift (6%) based

reviews which also provide an element of certainty to future rental

growth within the portfolio. Approximately one-third of index

linked reviews in the UK are subject to caps and collars which

typically range from 2% to 4%.

In Ireland, we concluded 13 index-based reviews, adding a

further GBP0.3 million (EUR0.4 million), an uplift of 15.3% against

the previous passing rent. In Ireland, all reviews are linked to

the Irish Consumer Price Index, upwards and downwards, with reviews

typically every five years. Leases to the HSE and other government

bodies, which comprise 75% of the income in Ireland, have increases

and decreases capped and collared at 25% over a five-year

period.

The growth from reviews completed in the period, noted above, is

summarised below:

Previous

rent Rent increase Total Annualised

(per annum) (per annum) increase increase

Number GBP million GBP million % %

---------------------- -------- -------------- --------------- ----------- ------------

UK - open market(1) 83 11.0 0.7 6.2 2.0

UK - indexed 67 8.2 1.1 14.0 8.1

UK - fixed 9 1.1 0.1 6.8 2.5

---------------------- -------- -------------- --------------- ----------- ------------

UK - total 159 20.3 1.9 9.4 4.5

Ireland - indexed 13 2.1 0.3 15.3 3.4

---------------------- -------- -------------- --------------- ----------- ------------

Total - all

reviews 172 22.4 2.2 9.9 4.4

---------------------- -------- -------------- --------------- ----------- ------------

(1) - includes 24 reviews where no uplift was achieved.

At 30 June 2023 the rent at 607 (31 December 2022: 656)

tenancies, representing GBP84.6 million (31 December 2022: GBP90.2

million) of passing rent, was under negotiation and the large

number of outstanding reviews reflects the requirement for all

awards to be agreed with the District Valuer. A great deal of

evidence to support open market reviews comes from the completion

of historical rent reviews and the rents set on delivery of new

properties into the sector. We continue to see positive momentum in

the demand, commencement and delivery for new, purpose-built

premises which are being supported by NHS initiatives to modernise

the primary care estate albeit previously agreed rental values are

having to be renegotiated to make a number of these viable in the

current economic environment.

Asset Management Projects

During the six months ended 30 June 2023, we exchanged on four

new asset management projects, four lease re-gears and one new

letting. These initiatives will increase rental income by GBP0.2

million investing GBP4.3 million and extending the leases back to

17 years. In the period, seven leases expired and the units became

vacant with the loss of GBP0.2m of income.

PHP continues to work closely with its occupiers and has a

strong pipeline of 32 similar asset management projects which are

at an advanced stage and are being progressed to further increase

rental income and extend unexpired occupational lease terms. The

asset management pipeline will require the investment of

approximately GBP23.7 million, generating an additional GBP1.2

million of rental income and extending the WAULT on those premises

back to an average of 20 years.

The Company will continue to invest capital in a range of

physical extensions or refurbishments through asset management

projects which help avoid obsolescence, including improving energy

efficiency, and which are key to maintaining the longevity and

security of our income through long term occupier retention,

increased rental income and extended occupational lease terms,

adding to both earnings and capital values.

Sector leading portfolio metrics

The portfolio's annualised contracted rent roll at 30 June 2023

was GBP147.4 million (31 December 2022: GBP145.3 million), an

increase of GBP2.1 million or +1.4% in the period driven entirely

by stronger organic growth from rent reviews and asset management

projects of GBP2.2 million (six months ended 30 June 2022: GBP1.8

million) offset by GBP0.1 million loss of income arising from

foreign exchange movements on our portfolio in Ireland.

The security and longevity of our income are important drivers

of our secure, long term predictable income stream and enable our

progressive dividend policy.

Security:PHP continues to benefit from secure, long term cash

flows with 89% (31 December 2022: 89%) of its rent roll funded

directly or indirectly by the NHS in the UK or HSE in Ireland. The

portfolio also benefits from an occupancy rate of 99.6% (31

December 2022: 99.7%).

Rental collections : These continue to remain robust and as at

25 July 2023 98% had been collected in both the UK and Ireland for

the first three quarters of 2023. This is in line with collection

rates experienced in both 2022 and 2021 which now stand at over 99%

for both countries. The balance of rent due for the third quarter

of 2023 is expected to be received shortly.

Longevity: The portfolio's WAULT at 30 June 2023 was 10.6 years

(31 December 2022: 11.0 years). Only GBP13.3 million or 9% of our

income expires over the next three years of which c. 70% have

agreed terms or are in advanced discussions to renew their lease.

GBP65.8 million or 45% expires in over 10 years. The table below

sets out the current lease expiry profile of our income:

Income subject to expiry GBPm %

-------------------------- ----------------------- ------------------------

< 3 years 13.3 9%

4 - 5 years 14.8 10%

5 - 10 years 53.5 36%

10 - 15 years 31.9 22%

15 - 20 years 22.6 15%

> 20 years 11.3 8%

-------------------------- ----------------------- ------------------------

Total 147.4 100%

-------------------------- ----------------------- ------------------------

Valuation and returns

During the period there were no acquisitions or disposals and as

at 30 June 2023, the Group's portfolio comprised 513 (31 December

2022: 513) assets independently valued at GBP2.783 billion (31

December 2022: GBP2.796 billion). After allowing for capital

expenditure on developments and asset management projects, the

portfolio generated a valuation deficit of GBP11.9 million or -0.4%

(Six months ended 30 June 2022: surplus of GBP51.2 million or

+1.8%).

The valuation deficit of GBP11.9 million in the period was

driven primarily by a loss arising from yield expansion of

approximately GBP45 million partially offset by gains of

approximately GBP33 million arising from an improving rental growth

outlook and asset management projects.

During the period the Group's portfolio NIY has expanded by 8

bps to 4.90% (31 December 2022: 4.82%) and the true equivalent

yield increased to 4.94% at 30 June 2023 (31 December 2022:

4.89%).

At 30 June 2023, the portfolio in Ireland comprised 20 standing

and fully let properties with no developments currently on site,

valued at GBP218.9 million or EUR254.8 million (31 December 2022:

20 assets/GBP230.9 million or EUR260.8 million). At 30 June 2023,

the portfolio in Ireland has been valued at a NIY of 5.4% (31

December 2022: 5.2%).

Despite the fall in values during the period the portfolio's

average lot size remained unchanged at GBP5.4 million (31 December

2022: GBP5.4 million) and 88% of the portfolio is valued at over

GBP3.0 million. The Group only has five assets valued at less than

GBP1.0 million.

Number of Valuation Average

properties GBP million lot size

% (GBP million)

--------------------- ------------ ------------- ----- ----------------

> GBP10m 58 886.2 32 15.3

GBP5m - GBP10m 137 928.8 34 6.8

GBP3m - GBP5m 155 615.9 22 4.0

GBP1m - GBP3m 158 344.8 12 2.2

< GBP1m (including

land GBP1.3m) 5 4.7 0 0.7

--------------------- ------------ ------------- ----- ----------------

Total(1) 513 2,780.4 100 5.4

--------------------- ------------ ------------- ----- ----------------

(1) Excludes the GBP3.0 million impact of IFRS 16 Leases with

ground rents recognised as finance leases.

The valuation deficit combined with the portfolio's growing

income, resulted in a total property return of 2.3% for the period

(six months ended 30 June 2022: +4.3%). The total property return

in the period compares with the MSCI UK Monthly Property Index of

+1.1% for the first six months of 2023 (six months ended 30 June

2022: +9.3%, year ended 31 December 2022: -10.4%).

Six months ended Six months ended Year ended

30 June 2023 30 June 2022 31 December 2022

----------------- ----------------------- ---------------------- -----------------------

Income return 2.7% 2.5% 5.0%

Capital return (0.4%) 1.8% (2.2%)

----------------- ----------------------- ---------------------- -----------------------

Total return 2.3% 4.3% 2.8%

----------------- ----------------------- ---------------------- -----------------------

FINANCIAL REVIEW

PHP's Adjusted earnings increased by GBP1.2 million or 2.7% to

GBP45.9 million in the six months to 30 June 2023, (30 June 2022:

GBP44.7 million). The increase in the period reflects the improving

organic rental growth from rent reviews and asset management

projects in both 2022 and the first half of 2023 partially offset

by increased interest costs on the Group's variable rate debt.

On 20 January 2023 the Group completed the acquisition of Axis

which contributed GBP0.5 million and is trading in line with

expectations and is forecast to generate a profit of approximately

GBP1.0 million in 2023.

Using the weighted average number of shares in issue in the

period the Adjusted earnings per share remained unchanged at 3.4p

(30 June 2022: 3.4p).

The financial results for the Group are summarised as

follows:

Six months Six months Year ended

ended ended 31 December

30 June 2023 30 June 2022 2022

GBPm GBPm GBPm

------------------------------------------------- ------ ------------- ----------------

Net rental income 75.5 71.1 141.5

Axis contribution 0.5 - -

Administrative expenses (1) (6.1) (5.5) (9.6)

------------------------------------------------- ------ ------------- ----------------

Operating profit before revaluation gain

and net financing costs 69.9 65.6 131.9

Net financing costs (24.0) (20.9) (43.2)

------------------------------------------------- ------ ------------- ----------------

Adjusted earnings 45.9 44.7 88.7

Revaluation (deficit)/surplus on property

portfolio and profit on sales (11.9) 51.2 (61.5)

Fair value gain on interest rate derivatives

and convertible bond 3.9 10.4 26.8

Amortisation of MedicX debt MtM at acquisition 1.5 1.4 2.9

Axis amortisation of intangible asset (0.4) - -

Axis acquisition costs (0.2) - -

------------------------------------------------- ------ ------------- ----------------

IFRS profit before tax 38.8 107.7 56.9

Corporation tax - 0.1 0.2

Deferred tax provision 0.7 (0.7) (0.8)

------------------------------------------------- ------ ------------- ----------------

IFRS profit after tax 39.5 107.1 56.3

------------------------------------------------- ------ ------------- ----------------

(1) Excludes amortisation of intangible asset and costs arising

on the acquisition of Axis.

Adjusted earnings increased by GBP1.2 million or 2.7% in the six

months to June 2023 to GBP45.9m (30 June 2022: GBP44.7m) and the

movement can be summarised as follows:

GBPm

-------------------------------- -------

Six months ended 30 June 2022 44.7

Net rental income 4.4

Axis contribution 0.5

Administrative expenses (0.6)

Net financing costs (3.1)

--------------------------------- -------

Six months ended 30 June 2023 45.9

--------------------------------- -------

Net rental income received in the six months to 30 June 2023

increased by 6.2% or GBP4.4 million to GBP75.5 million (30 June

2022: GBP71.7 million) reflecting GBP3.4 million of additional

income from completed rent reviews and asset management projects,

GBP0.8 million from the impact of acquisitions, disposals and

developments completed 2022 and a GBP0.2 million reduction in

non-recoverable property costs.

Notwithstanding the acquisition of Axis at the start of the year

administration expenses continue to be tightly controlled and the

Group's EPRA cost ratio remains one of the lowest in the sector at

10.1% (30 June 2022: 10.5%). The GBP0.6 million increase in

administration costs in the period is due to GBP0.4 million

increase in staff costs from annual pay increases and provision for

performance-related pay together with an additional GBP0.2 million

arising from the acquisition of Axis and cost of the team now based

in Ireland.

EPRA cost ratio Six months Six months ended Year ended

ended 30 June 2022 31 December

30 June 2023 2022

GBPm GBPm GBPm

--------------------------------------- ------------- ---------------- ------------

Gross rent less ground rent and

service charge income 78.2 73.5 147.0

--------------------------------------- ------------- ---------------- ------------

Direct property expense 7.9 5.7 12.6

Less: service charge and recoverable

costs (5.7) (3.2) (7.0)

--------------------------------------- ------------- ---------------- ------------

Non-recoverable property costs 2.2 2.5 5.6

Administrative expenses 6.1 5.5 9.6

Less: ground rent (0.1) (0.1) (0.2)

Less: other operating income (0.3) (0.2) (0.4)

--------------------------------------- ------------- ---------------- ------------

EPRA costs (including direct vacancy

costs) 7.9 7.7 14.6

--------------------------------------- ------------- ---------------- ------------

EPRA cost ratio 10.1% 10.5% 9.9%

--------------------------------------- ------------- ---------------- ------------

Total expense ratio - administrative

expenses as a

percentage of gross asset value

(annualised) 0.4% 0.4% 0.3%

--------------------------------------- ------------- ---------------- ------------

Net finance costs in the period increased by GBP3.1 million to

GBP24.0 million (30 June 2022: GBP20.9 million) because of a

GBP14.4 million increase in the Group's net debt since June 2022,

the impact of increased in interest rates on the Group's unhedged

debt and the loss of interest receivable on forward funded

developments which completed in 2022, now income producing and

accounted for as rent.

Shareholder value

The Adjusted Net Tangible Assets (NTA), per share decreased by

1.5 pence or 1.3% to 111.1 pence (31 December 2022: 112.6 pence per

share) during the period with the revaluation deficit of GBP11.9

million or 0.9 pence per share and cost of the Axis acquisition of

GBP7.3 million (EUR8.2 million) or 0.5 pence per share being the

main reason for the decrease.

The adjusted NTA return per share, including dividends

distributed, in the six months ended 30 June 2023 was 1.9 pence or

1.6% (30 June 2022: 7.3 pence or 6.3 %).

The table below sets out the movements in the Adjusted NTA and

EPRA Net Disposal Value (NDV) per share over the period under

review.

Adjusted Net Tangible Asset 30 June 2023 30 June 2022 31 December

(NTA) per share pence per share pence per share 2022 pence per

share

----------------------------------------- ------------------------ ----------------------- ------------------

Opening Adjusted NTA per share 112.6 116.7 116.7

Adjusted earnings for the period 3.4 3.4 6.6

Dividends paid (3.4) (3.2) (6.5)

Revaluation of property portfolio

and profit on sales (0.9) 3.8 (4.6)

Amortisation of intangible assets (0.5) - -

Net impact of Interest rate derivatives (0.1) - -

Foreign exchange movements - - 0.3

Shares issued - 0.1 0.1

Closing Adjusted NTA per share 111.1 120.8 112.6

Fixed rate debt and swap mark-to-market

value 12.6 3.2 8.7

Convertible bond fair value

adjustment 0.4 (0.7) 2.1

Deferred tax 0.1 (0.4) (0.1)

Intangible assets 0.5 - -

----------------------------------------- ------------------------ ----------------------- ------------------

Closing EPRA NDV per share 124.7 122.9 123.3

----------------------------------------- ------------------------ ----------------------- ------------------

Financing

The Group's balance sheet and financing position remains strong

with cash and committed undrawn facilities totalling GBP314.4

million (31 December 2022: GBP325.9 million) after contracted

capital commitments of GBP16.6 million (31 December 2022: GBP19.8

million).

At 30 June 2023, total available loan facilities were GBP1,600.8

million (31 December 2022: GBP1,607.0 million) of which GBP1,272.2

million (31 December 2022: GBP1,290.4 million) had been drawn. Cash

balances of GBP2.4 million (31 December 2022: GBP29.1 million)

resulted in Group net debt of GBP1,269.8 million (31 December 2022:

GBP1,261.3 million). Contracted capital commitments at the balance

sheet date totalled GBP16.6 million (31 December 2022: GBP19.8

million) and comprise development expenditure of GBP5.9 million,

asset management projects of GBP8.6 million and deferred

consideration on the acquisition of Axis of GBP2.1 million.

The Group's key debt metrics are summarised in the table

below:

Debt metrics 30 June 2023 31 December

2022

-------------------------------------------------- ------------ -----------

Average cost of debt - drawn 3.2% 3.2%

Average cost of debt - fully drawn 3.8% 3.5%

Loan to value 45.6% 45.1%

Loan to value - excluding convertible bond 40.2% 39.7%

Total net debt fixed or hedged 96.7% 93.7%

Net rental income to net interest cover 3.1 times 3.3 times

Net debt / EBITDA (annualised) 9.1 times 9.6 times

Weighted average debt maturity - drawn 6.9 years 7.3 years

facilities

Weighted average debt maturity - all facilities 5.9 years 6.4 years

Total drawn secured debt GBP1,122.2m GBP1,140.4m

Total drawn unsecured debt GBP150.0m GBP150.0m

Total undrawn facilities and cash available GBP314.4m GBP325.9m

to the Group(1)

Unfettered assets GBP80.7m GBP86.7m

-------------------------------------------------- ------------ -----------

(1) After deducting capital commitments.

Average cost of debt

Notwithstanding the recent and rapid increases in 3-month SONIA

interest rates since the start of the year which is used to

calculate interest on the unhedged element the Group's revolving

credit facilities we have managed to keep the average cost of debt

unchanged at 3.2% (31 December 2022: 3.2%).

Interest rate exposure

The analysis of the Group's exposure to interest rate risk in

its debt portfolio as at 30 June 2023 is as follows:

Facilities Drawn

GBP million % GBP million %

------------------------------------- ---------------------------- ------ ----------------------- -------

Fixed rate debt 1,075.8 67.2 1,075.8 84.5

Hedged by fixed rate interest rate

swaps 100.0 6.2 100.0 7.9

Hedged by fixed to floating rate

interest rate swaps (200.0) (12.5) (200.0) (15.7)

------------------------------------- ---------------------------- ------ ----------------------- -------

Total fixed rate debt 975.8 60.9 975.8 76.7

Hedged by interest rate caps 251.6 15.7 251.6 19.8

Floating rate debt - unhedged 373.4 23.4 44.8 3.5

------------------------------------- ---------------------------- ------ ----------------------- -------

Total 1,600.8 100.0 1,272.2 100.0

------------------------------------- ---------------------------- ------ ----------------------- -------

Interest rate swap contracts

On 18 April 2023, the Group converted EUR60.0 million (GBP51.6

million) of sterling equivalent denominated debt into euros across

its various revolving credit facilities to cover a small unhedged

euro denominated balance sheet exposure which had arisen primarily

because of historic valuation gains and retained earnings arising

on our portfolio in Ireland. As part of the transaction the Group

took advantage of cheaper euro denominated interest rates and

purchased 2.0% caps on EUR60 million nominal value for a period of

2.5 years for an all-in premium of GBP1.9 million (EUR2.2 million).

The transaction increased the proportion of net debt that is fixed

or hedged to 97% (31 December 2022: 94%).

Accounting standards require PHP to mark its interest rate swaps

to market at each balance sheet date. During the six months to 30

June 2023 there was an increase of GBP2.1 million (30 June 2022:

GBP0.9 million) on the fair value movement of the Group's interest

rate derivatives due primarily due to the EUR60 million caps

purchased in the period for GBP1.9 million along with increases in

interest rates assumed in the forward yield curves used to value

the interest rate swaps. The mark-to-market ("MtM") asset value of

the swap portfolio is GBP9.2 million (31 December 2022: asset

GBP7.1 million).

Currency exposure

The Group owns EUR254.8 million or GBP218.9 million (31 December

2022: EUR260.8 million / GBP230.9 million) of Euro denominated

assets in Ireland as at 30 June 2023 and the value of these assets

and rental income represented 8% (31 December 2022: 8%) of the

Group's total portfolio. In order to hedge the risk associated with

exchange rates, the Group has chosen to fund its investment in

Irish assets through the use of Euro denominated debt, providing a

natural asset to liability hedge, within the overall Group loan to

value limits set by the Board. At 30 June 2023 the Group had

EUR253.1 million (31 December 2022: EUR196.0 million) of drawn euro

denominated debt.

Euro rental receipts are used to first finance Euro interest and

administrative costs and surpluses are used to fund further

portfolio expansion. Given the large Euro to Sterling fluctuations

seen in recent years and continued uncertainty in the interest rate

market the Group entered a nil-cost FX collar hedge (between

EUR1.1675 and EUR1.1022: GBP1) for a two-year period to cover the

approximate Euro denominated net annual income of EUR10 million per

annum, minimising the downside risk of the Euro gaining in value

above EUR1.1675: GBP1.

Fixed rate debt mark-to-market ("MtM")

The MtM of the Group's fixed rate debt as at 30 June 2023 was an

asset of GBP171.0 million (31 December 2022: asset GBP141.3

million) equivalent to 12.8 pence per share (31 December 2022:

asset of 10.6 pence). The movement in the period is due primarily

to the significant increases in interest rates assumed in the

forward yield curves used to value the debt in the period. The MtM

valuation is sensitive to movements in interest rates assumed in

forward yield curves.

Convertible bonds

In July 2019, the Group issued for a six-year term new unsecured

convertible bonds with a nominal value of GBP150 million and a

coupon of 2.875% per annum. Subject to certain conditions, the new

bonds will be convertible into fully paid Ordinary Shares of the

Company and the initial exchange price was set at 153.25 pence per

Ordinary Share. The exchange price will be subject to adjustment,

in accordance with the dividend protection provisions in the terms

of issue, if dividends paid per share exceed 2.8 pence per annum

and in accordance with the dividend protection provisions the

conversion price was adjusted on 6 July 2023 to 134.16 pence (31

December 2022: 137.69 pence) per Ordinary Share.

The conversion of the GBP150 million convertible bonds into new

Ordinary Shares would reduce the Group's loan to value ratio by

5.4% from 45.6% to 40.2% and result in the issue of 111.8 million

(31 December 2022: 108.9 million) new Ordinary Shares.

Alternative Performance Measures ("APMs")

PHP uses Adjusted earnings and adjusted net tangible assets

amongst other APMs to highlight the recurring performance of the

property portfolio and business. The APMs are in addition to the

statutory measures from the condensed financial statements. The

measures are defined and reconciled to amounts presented in the

financial statements within this interim statement at note 7. The

Company has used EPRA earnings and EPRA net tangible assets to

measure performance and will continue to do so. However, these APMs

have also been adjusted to remove the impact of the adjustments

arising from the MtM on fixed debt acquired on completion of the

merger with MedicX in 2019. The reasons for the Company's use of

these APMs are set out in the Glossary and 2022 Annual Report.

Related party transactions

Related party transactions are disclosed in note 16 to the

condensed financial statements.

Responsible business - continued progress

Environmental impact

We continue to make good progress on our net zero carbon

framework commitments and achieved our first milestone of net zero

operations in 2022 one year ahead of target. We are also on site

with our first NZC development at Croft Medical Centre, West Sussex

and continue to progress a pipeline of further NZC schemes.

We continue to modernise existing buildings and improve the

environmental credentials of our existing portfolio through the

asset management programme and have completed five projects in the

period, improving EPC ratings to B from C and D. A further eight

projects are currently on site and due to be completed this year

with a long pipeline of additional schemes where we continue to

evaluate options for energy efficiency, renewable energy and net

zero refurbishments. 39% of assets now have an EPC rating of A or B

(31 December 2022: 35%) and 84% at A to C (31 December 2022:

81%).

As part of establishing the wider carbon impact of the buildings

in our portfolio, we have continued to engage with tenants and

increased the visibility of their energy and carbon performance and

improved the quality of data we hold, increasing this to 62% of the

portfolio (31 December 2022: 60%; 31 December 2021: 8%).

Social Impact

As a leading provider of modern primary care premises, we aim to

create a lasting positive social impact, particularly in the health

outcomes and wellbeing for the communities into which we

invest.

As part of our Community Impact Fund, we have renewed our

partnership with UK Community Foundations to target grants for

social prescribing in the communities around our buildings. In

2023, we are working with one large community foundation in the

heart of England covering an extended area in the Midlands as well

as aiming to deliver grants directly in combination with our asset

management programme.

People

PHP recognises the importance of the welfare of our employees

who work on behalf of the Group and are critical to its success. We

have continued to support our employees' personal and professional

development, improve diversity and equal opportunities within the

team and promote the highest standard of ethics, conduct and

inclusion. At the start of the year, we launched a mentoring

programme to provide another dimension of support for personal and

professional development.

Harry Hyman Richard Howell

Chief Executive Officer Chief Financial Officer

25 July 2023

Principal risks and uncertainties Risk management overview

Effective risk management is a key element of the Board's

operational processes. Risk is inherent in any business, and the

Board has determined the Group's risk appetite, which is reviewed

on an annual basis. Group operations have been structured in order

to accept risks within the Group's overall risk appetite, and to

oversee the management of these risks to minimise exposure and

optimise the returns generated for the accepted risk. The Group

aims to operate in a low-risk environment, appropriate for its

strategic objective of generating progressive returns for

shareholders. Key elements of maintaining this low-risk approach

are:

-- investment focuses on the primary health real estate sector

which is traditionally much less cyclical than other real estate

sectors;

-- the majority of the Group's rental income is received

directly or indirectly from government bodies in the UK and

Ireland;

-- the Group benefits from long initial lease terms, largely

with upwards-only review terms, providing clear visibility of

income;

-- debt funding is procured from a range of providers,

maintaining a spread of maturities and a mix of terms, with

interest costs either fixed or hedged across the majority of debt

drawn;

-- the Board funds its operations to maintain an appropriate mix of debt and equity; and

-- the Group has a very small (GBP1.4m) exposure as a direct

developer of real estate, which means that the Group is not

materially exposed to risks that are inherent in property

development.

The structure of the Group's operations includes rigorous,

regular review of risks and how these are mitigated and managed

across all areas of the Group's activities. The Group faces a

variety of risks that have the potential to impact on its

performance, position and its longer-term viability. These include

external factors that may arise from the markets in which the Group

operates, government and fiscal policy, general economic conditions

including interest rates and inflation together with internal risks

that arise from how the Group is managed and chooses to structure

its operations.

Principal risks and changes in risk factors

The Board has concluded that there should be no further

principal risks to be presented in the 2023 Interim Results

Announcement, and that the principal risks presented in the 2022

Annual Report remain relevant for this period.

Increasing risks

The Board has continued to undertake a robust assessment of

emerging and increasing risks faced by the Group.

Since the release of our 2022 full-year results, the global

economic uncertainty has continued. Within the UK, the main

challenges facing the economy are rising interest rates and

heightened inflation and the increasing risk of recession,

compounded by the impact of the ongoing war in Ukraine. The

potential adverse impact of these factors on our business includes

reduced demand for our assets impacting property values in the

investment market, the ability for us to continue to execute our

acquisition and development strategy and increased financing costs,

which could impact our rental income and earnings. The Board and

key Committees have continued to oversee the Group's response to

the impact of these challenges on our business and the wider

economic influences throughout the period.

Going concern analysis

The Group's financial review and budgetary processes are based

on an integrated model that projects performance, cash flows,

position and other key performance indicators including earnings

per share, leverage rates, net asset values per share and REIT

compliance over the review period. In addition, the forecast model

looks at the funding of the Group's activities and its compliance

with the financial covenant requirements of its debt facilities.

The model uses a number of key parameters in generating its

forecasts that reflect the Group's strategy, operating processes

and the Board's expectation of market developments in the review

period. In undertaking its financial review, these parameters have

been flexed to reflect severe, but realistic, scenarios both

individually and collectively. Sensitivities applied are derived

from the principal risks faced by the Group that could affect

solvency or liquidity and are as follows:

-- Declining attractiveness / possible obsolescence of the

Group's assets as a result of ESG initiatives or otherwise or

deteriorating economic circumstances impact investment values -

valuation parameter stress tested to provide for a one-off

10%/GBP278 million fall in the December 2023 valuation.

-- We have applied a 15% tenant default rate. In addition,

rental growth assumptions have been amended to see nil uplifts on

open market reviews.

-- Variable rate interest rates rise by an immediate 2%

effective from 1 July 2023, impacting the variable interest debt in

the portfolio.

-- Tightly controlled NHS scheme approval restricts investment

opportunity - investment quantum flexed to remove non-committed

transactions.

-- Impact on shareholder returns of all of the above occurrences

- projected dividend payments held at expected 2023 level, 6.7p per

share.

A number of specific assumptions have been made that overlay the

financial parameters used in the Group's models. It has been

assumed that the Group will be able to refinance or replace other

debt facilities that mature within the review period in advance of

their maturity and on terms similar to those at present.

Further details on going concern are set out in note 1 to the

Financial Statements.

INDEPENT REVIEW REPORT TO PRIMARY HEALTH PROPERTIES PLC

Conclusion

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2023 which comprises the Condensed Group

Statement of Comprehensive Income, the Condensed Group Balance

Sheet, the Condensed Group Statement of Changes in Equity, the

Condensed Group Cash Flow Statement and related notes 1 to 19.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2023 is not prepared, in all material respects, in accordance

with United Kingdom adopted International Accounting Standard 34

and the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

Basis for Conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410 "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" issued by the Financial Reporting Council for use in the

United Kingdom (ISRE (UK) 2410). A review of interim financial

information consists of making inquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 1, the annual financial statements of the

group will be prepared in accordance with United Kingdom adopted

international accounting standards. The condensed set of financial

statements included in this half-yearly financial report has been

prepared in accordance with United Kingdom adopted International

Accounting Standard 34, "Interim Financial Reporting".

Conclusion Relating to Going Concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

Conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This Conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410; however future events or conditions

may cause the entity to cease to continue as a going concern.

Responsibilities of the directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the Disclosure Guidance and

Transparency Rules of the United Kingdom's Financial Conduct

Authority.

In preparing the half-yearly financial report, the directors are

responsible for assessing the group's ability to continue as a

going concern, disclosing as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's Responsibilities for the review of the financial

information

In reviewing the half-yearly financial report, we are

responsible for expressing to the group a conclusion on the

condensed set of financial statements in the half-yearly financial

report. Our Conclusion, including our Conclusion Relating to Going

Concern, are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

This report is made solely to the company in accordance with

ISRE (UK) 2410. Our work has been undertaken so that we might state

to the company those matters we are required to state to it in an

independent review report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the company, for our review work, for this

report, or for the conclusions we have formed.

Deloitte LLP

Statutory Auditor

London, United Kingdom

25 July 2023

Condensed Group Statement of Comprehensive Income

For the six months ended 30 June 2023

Six months Six months Year ended

ended 30 ended 30 31 December

June June 2022

2023 2022

GBPm GBPm GBPm

Notes (unaudited) (unaudited) (audited)

------------------------------------------ ----- ------------------- -------------------- ------------------------

Rental and related income 2 83.9 76.8 154.1

Direct property expenses (7.9) (5.7) (12.6)

------------------------------------------ ----- ------------------- -------------------- ------------------------

Net rental and related income 76.0 71.1 141.5

------------------- -------------------- ------------------------

Administrative expenses (6.1) (5.5) (9.6)

Amortisation of intangible assets (0.4) - -

Axis acquisition costs (0.2) - -

------------------- -------------------- ------------------------

Total administrative expenses 3 (6.7) (5.5) (9.6)

------------------- -------------------- ------------------------

Revaluation (deficit)/ gain on property

portfolio 9 (11.9) 51.2 (64.4)

Profit on sale of land and properties - - 2.9

------------------- -------------------- ------------------------

Total revaluation (deficit)/ gain (11.9) 51.2 (61.5)

------------------- -------------------- ------------------------

Operating profit 3 57.4 116.8 70.4

Finance income 4 - 0.5 0.9

Finance costs 5 (22.5) (20.0) (41.2)

Fair value loss on derivative interest

rate swaps and

amortisation of cash flow hedging

reserve 5 (1.7) (1.4) (1.9)

Fair value gain on convertible bond 5 5.6 11.8 28.7

------------------------------------------ ----- ------------------- -------------------- ------------------------

Profit before taxation 38.8 107.7 56.9

Taxation credit/ ( charge) 6 0.7 (0.6) (0.6)

------------------------------------------ ----- ------------------- -------------------- ------------------------

Profit after taxation for the

period/year

(1) 39.5 107.1 56.3

Other comprehensive income:

Items that may be reclassified subsequently to profit and loss:

Fair value gain on interest rate

swaps treated as cash flow hedges

and amortisation of hedging reserve 1.9 2.3 4.5

Exchange (loss)/ gain on translation

of foreign balances (0.1) 1.3 3.2

------------------------------------------ ----- ------------------- -------------------- ------------------------

Other comprehensive income for the

period net of tax(1) 1.8 3.6 7.7

------------------------------------------ ----- ------------------- -------------------- ------------------------

Total comprehensive income for the

period net of tax(1) 41.3 110.7 64.0

------------------------------------------ ----- ------------------- -------------------- ------------------------

IFRS earnings per share

Basic 7 3.0p 8.0p 4.2p

Diluted 7 2.5p 6.8p 2.2p

Adjusted earnings per share(2)

Basic 7 3.4p 3.4p 6.6p

Diluted 7 3.3p 3.3p 6.4p

------------------------------------------ ----- ------------------- -------------------- ------------------------

(1) Wholly attributable to equity shareholders of Primary Health

Properties PLC

(2) See Glossary of Terms on pages 50 to 5 2.

The above relates wholly to continuing operations.

Condensed Group Balance Sheet As at 30 June 2023

30 June 30 June 31 December

2023 2022 2022

GBPm GBPm GBPm

Notes (unaudited) (unaudited) (audited)

---------------------------------- --------- ------------------ ----------- ----------------

Non-current assets

Investment properties 9 2,783.4 2,887.2 2,796.3

Derivative interest rate