TIDMPET

RNS Number : 6721M

Petrel Resources PLC

18 September 2023

18 September 2023

Petrel Resources plc

("Petrel" or "the Company")

Unaudited Interim Statement for the six months ended 30 June

2023

Petrel Resources plc (AIM: PET) today announces unaudited

financial results for the six months ended 30(th) June 2023.

Petrel is a hydrocarbon explorer with interests in Iraq, and

Ghana.

Highlights

-- Petrel has fine-tuned its Iraqi proposals, following

feedback. We have contractors and suppliers identified but seek

improved fiscal terms to attract partners.

-- An updated Merjan oil field development proposal has been

submitted to the Ministry with a view to finalising a licence

agreement.

-- Iraqi oil output fell to 4.2 million barrels daily in July

2023, in line with OPEC+ output cut agreements. Iraqi potential is

substantially higher, while infrastructural issues are being

addressed.

-- However, despite strong energy prices, and recovered demand,

oil & gas explorers' shares remain out-of-favour in the London

market - though there is Australian interest.

-- Fiscal terms in the Middle East still reflect historical

conditions rather than current market realities. Politicians are

slow to agree contractual terms that maximise value for all

parties.

-- Ratification discussions on Tano 2A block with Ghanaian

authorities continue - though the authorities have sought to chip

away at the acreage and fiscal terms previously agreed. A new

realism seems evident.

Chairman's Statement

Europe is de-industrialising, due to policies generally hostile

to reliable fuels, but global oil & gas demand continues to

recover, as Asia recovers from lock-downs.

The withdrawal of most majors from non-core basins undermined

the farm-out market after 2014. Majors who had entered OPEC country

projects, often on uneconomic terms, now exit marginal or non-core

projects as they buy shares back and issue record dividends instead

of exploring.

Institutional reluctance to invest in exploration for reliable

fuels continues. Available funds are from private clients and

traders demanding discounts. We prefer to avoid incurring work

commitments requiring dilution at current prices. We prefer to

prepare early-stage projects to farm down when markets turn.

The world is changing: BRICS+ now have a larger GDP than the

G-7. Europe is declining, but Asia is not. The future is in the

Global South (Brazil, India, Indonesia and China, which, along with

Nigeria and Mexico). Australian brokers and investors have profited

through the liquidity of Petrel's sister company, Clontarf Energy

plc. They press Petrel Resources plc to accept Australian and Asian

participation. So far, we have avoided dilution, [but as we roll

out high-potential new projects, and the share price hopefully

rises, it may be attractive to accept funding].

Petrel has assessed various expansion projects, which failed due

diligence or did not deliver funding on satisfactory terms. These

included oil and gas, as well as in new, dynamic sectors. Proposals

are many but cash at market rates is sometimes lacking.

Petrel offers a 23-year AIM record, with potential liquidity and

capital appreciation for robust opportunities. As investors

re-focus on 'hard industries' and cash flow, we veery much consider

this is a time of opportunity.

Financing

The directors and their supporters funded working capital needs,

and are prepared to participate in any necessary, future

fundings.

The board expects to add another one or more Non-Executive

Director with the next major deal.

David Horgan

Chairman

17 September 2023

For further information please visit http://www.petrelresources.com/ or contact:

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this announcement.

In addition, market soundings (as defined in MAR) were taken in

respect of the matters contained in this announcement, with the

result that certain persons became aware of inside information (as

defined in MAR), as permitted by MAR. This inside information is

set out in this announcement. Therefore, those persons that

received inside information in a market sounding are no longer in

possession of such inside information relating to the company and

its securities.

S

For further information please visit http://www.petrelresources.com/ or contact:

Petrel Resources

David Horgan, Chairman +353 (0) 1 833 2833

John Teeling, Director

Nominated Adviser and Broker

Beaumont Cornish - Nominated Adviser

Roland Cornish

Felicity Geidt +44 (0) 020 7628 3396

Novum Securities Limited - Broker

Colin Rowbury +44 (0) 20 399 9400

BlytheRay - PR +44 (0) 207 138 3206

Megan Ray +44 (0) 207 138 3553

Said Izagaren +44(0)207 138 3208

Teneo

Luke Hogg +353 (0) 1 661 4055

Alan Tyrrell +353 (0) 1 661 4055

Petrel Resources plc

Financial Information (Unaudited)

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six Months Ended Year Ended

30 June 23 30 June 22 31 Dec 22

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

Administrative expenses (164) (140) (311)

- - -

----------------------- ----------------------- -----------------------

OPERATING LOSS (164) (140) (311)

LOSS BEFORE TAXATION (164) (140) (311)

Income tax expense - - -

----------------------- ----------------------- -----------------------

LOSS FOR THE PERIOD (164) (140) (311)

Other comprehensive income - - -

TOTAL COMPREHENSIVE PROFIT FOR THE PERIOD (164) (140) (311)

======================= ======================= =======================

LOSS PER SHARE - basic and diluted (0.09c) (0.09c) (0.19c)

======================= ======================= =======================

CONDENSED STATEMENT OF FINANCIAL POSITION 30 June 23 30 June 22 31 Dec 22

unaudited unaudited audited

ASSETS: EUR'000 EUR'000 EUR'000

NON-CURRENT ASSETS

Intangible assets 933 933 933

----------------------- ----------------------- -----------------------

933 933 933

----------------------- ----------------------- -----------------------

CURRENT ASSETS

Trade and other receivables 30 12 34

Cash and cash equivalents 51 30 166

----------------------- ----------------------- -----------------------

81 42 200

TOTAL ASSETS 1,014 975 1,133

----------------------- ----------------------- -----------------------

CURRENT LIABILITIES

Trade and other payables (935) (847) (890)

----------------------- ----------------------- -----------------------

(935) (847) (890)

----------------------- ----------------------- -----------------------

NET CURRENT LIABILITIES (854) (805) (690)

NET ASSETS 79 128 243

======================= ======================= =======================

EQUITY

Share capital 2,223 1,963 2,223

Capital conversion reserve fund 8 8 8

Capital redemption reserve 209 209 209

Share premium 21,812 21,786 21,812

Share based payment reserve 27 27 27

Retained deficit (24,200) (23,865) (24,036)

----------------------- ----------------------- -----------------------

TOTAL EQUITY 79 128 243

======================= ======================= =======================

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Capital Capital Share based

Share Share Redemption Conversion Payment Retained Total

Capital Premium Reserves Reserves Reserves Losses Equity

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

As at 1 January 2022 1,963 21,786 209 8 27 (23,725) 268

Total comprehensive income - (140) (140)

-------- -------- ----------- ----------- --------------------- --------- --------

As at 30 June 2022 1,963 21,786 209 8 27 (23,865) 128

Issue of shares 260 26 - - - - 286

Total comprehensive income - (171) (171)

-------- -------- ----------- ----------- --------------------- --------- --------

As at 31 December 2022 2,223 21,812 209 8 27 (24,036) 243

Total comprehensive income - (164) (164)

----------- ----------- ---------------------

As at 30 June 2023 2,223 21,812 209 8 27 (24,200) 79

======== ======== =========== =========== ===================== ========= ========

CONDENSED CONSOLIDATED CASH FLOW Six Months Ended Year Ended

30 June 23 30 June 22 31 Dec 22

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

CASH FLOW FROM OPERATING ACTIVITIES

Loss for the period (164) (140) (311)

Foreign exchange 1 2 3

----------- ----------- -----------

(163) (138) (308)

Movements in Working Capital 49 68 89

----------- ----------- -----------

CASH USED IN OPERATIONS (114) (70) (219)

NET CASH USED IN OPERATING ACTIVITIES (114) (70) (219)

----------- ----------- -----------

FINANCING ACTIVITIES

Shares issued - - 286

----------- ----------- -----------

NET CASH USED IN FINANCING ACTIVITIES - - 286

----------- ----------- -----------

NET (DECREASE)/INCREASE IN CASH AND CASH EQUIVALENTS (114) (70) 67

Cash and cash equivalents at beginning of the period 166 102 102

Effect of exchange rate changes on cash held in foreign currencies (1) (2) (3)

CASH AND CASH EQUIVALENT AT THE OF THE PERIOD 51 30 166

=========== =========== ===========

Notes:

1. INFORMATION

The financial information for the six months ended 30 June 2023

and the comparative amounts for the six months ended 30 June 2022

are unaudited.

The interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the European Union. The interim financial statements have been

prepared applying the accounting policies and methods of

computation used in the preparation of the published consolidated

financial statements for the year ended 31 December 2022.

The interim financial statements do not include all of the

information required for full annual financial statements and

should be read in conjunction with the audited consolidated

financial statements of the Group for the year ended 31 December

2022, which are available on the Company's website

www.petrelresources.com

The interim financial statements have not been audited or

reviewed by the auditors of the Group pursuant to the Auditing

Practices board guidance on Review of Interim Financial

Information.

2. No dividend is proposed in respect of the period.

3. GOING CONCERN

The Group incurred a loss for the period of EUR164,206 (2022:

loss of EUR310,813) and had net current liabilities of EUR854,017

(2022: EUR689,811) at the balance sheet date. These conditions as

well as those noted below, represent a material uncertainty that

may cast significant doubt on the Group and Company's ability to

continue as a going concern.

Included in current liabilities is an amount of EUR902,531

(2022: EUR857,531) owed to key management personnel in respect of

remuneration due at the balance sheet date. Key management have

confirmed that they will not seek settlement of these amounts in

cash for a period of at least one year after the date of approval

of the financial statements or until the Group has generated

sufficient funds from its operations after paying its third party

creditors.

The Group and Company had a cash balance of EUR51,098 (2022:

EUR166,309) at the balance sheet date. Additional finance may be

required to fund working capital requirements and develop existing

projects. As the Group is not revenue or cash generating it relies

on raising capital from the public market.

These conditions as well as those noted below, represent a

material uncertainty that may cast significant doubt on the Group

and Company's ability to continue as a going concern.

As in previous years the Directors have given careful

consideration to the appropriateness of the going concern basis in

the preparation of the financial statements and believe the going

concern basis is appropriate for these financial statements. The

financial statements do not include the adjustments that would

result if the Group and Company were unable to continue as a going

concern.

4. LOSS PER SHARE

Basic loss per share is computed by dividing the loss after

taxation for the year attributable to ordinary shareholders by the

weighted average number of ordinary shares in issue and ranking for

dividend during the year. Diluted earnings per share is computed by

dividing the loss after taxation for the year by the weighted

average number of ordinary shares in issue, adjusted for the effect

of all dilutive potential ordinary shares that were outstanding

during the year.

The following table sets out the computation for basic and

diluted earnings per share (EPS):

30 June 23 30 June 22 31 Dec 22

EUR EUR EUR

Loss per share - Basic and Diluted (0.09c) (0.09c) (0.19c)

============= ============= ============

Basic and diluted loss per share

The earnings and weighted average number of ordinary shares used in the calculation of basic

loss per share are as follows:

EUR'000 EUR'000 EUR'000

Loss for the period attributable to equity holders (164) (140) (311)

============= ============= ============

Denominator Number Number Number

for basic and diluted EPS 177,871,800 157,038,467 160,919,745

============= ============= ============

Basic and diluted loss per share are the same as the effect of

the outstanding share options is anti-dilutive.

5. INTANGIBLE ASSETS

30 June 23 30 June 22 31 Dec 22

Exploration and evaluation assets: EUR'000 EUR'000 EUR'000

Opening balance 933 933 933

Additions - - -

Impairment - - -

----------- ----------- ----------

Closing balance 933 933 933

=========== =========== ==========

Exploration and evaluation assets relate to expenditure incurred

in exploration in Ghana. The directors are aware that by its nature

there is an inherent uncertainty in Exploration and evaluation

assets and therefore inherent uncertainty in relation to the

carrying value of capitalized exploration and evaluation

assets.

During 2018 the Group resolved the outstanding issues with the

Ghana National Petroleum Company (GNPC) regarding a contract for

the development of the Tano 2A Block. The Group has signed a

Petroleum Agreement in relation to the block and this agreement

awaits ratification by the Ghanaian government.

Relating to the remaining exploration and evaluation assets at

the financial year end, the directors believe there were no facts

or circumstances indicating that the carrying value of the

intangible assets may exceed their recoverable amount and thus no

impairment review was deemed necessary by the directors. The

realisation of these intangible assets is dependent on the

successful discovery and development of economic reserves and is

subject to a number of significant potential risks, as set out

below:

-- Licence obligations;

-- Exchange rate risks;

-- Uncertainty over development and operational costs;

-- Political and legal risks, including arrangements with

Governments for licences, profit sharing and taxation;

-- Foreign investment risks including increases in taxes,

royalties and renegotiation of contracts;

-- Financial risk management;

-- Going concern and

-- Ability to raise finance.

Regional Analysis 30 Jun 23 30 Jun 22 31 Dec 22

EUR'000 EUR'000 EUR'000

Ghana 933 933 933

========== ========== ==========

6. SHARE CAPITAL

2023 2022

EUR'000 EUR'000

Authorised:

800,000,000 ordinary shares of EUR0.0125 10,000 10,000

======== ========

Ordinary Shares -nominal value of EUR0.0125

Allotted, called-up and fully paid

Number Share Capital Share Premium

EUR'000 EUR'000

At 1 January 2022 157,038,467 1,963 21,786

Share issue - - -

------------ ----------------- --------------

At 30 June 2022 157,038,467 1,963 21,786

Share issue 20,833,333 260 26

------------ ----------------- --------------

At 31 December 2022 177,871,800 2,223 21,812

Share issue - - -

------------ ----------------- --------------

At 30 June 2023 177,871,800 2,223 21,812

============ ================= ==============

Movements in issued share capital

There was no movement in the issued share capital of the company

in the current period.

7. OTHER RESERVES

Capital Redemption Reserve Capital Conversion Reserve

EUR'000 Fund Share Based Payment Reserve

EUR'000 EUR'000

Balance at 1 January 2022 209 8 27

Movement during the year - - -

--------------------------- ---------------------------- ----------------------------

Balance at 30 June 2022 and

31 December 2022 209 8 27

Movement during the year - - -

--------------------------- ---------------------------- ----------------------------

Balance at 30 June 2023 209 8 7

=========================== ============================ ============================

Capital redemption reserve

The Capital redemption reserve reflects nominal value of shares

cancelled by the Company.

Capital conversion reserve fund

The ordinary shares of the company were re-nominalised from

EUR0.0126774 each to EUR0.0125 each in 2001 and the amount by which

the issued share capital of the company was reduced was transferred

to the capital conversion reserve fund.

Share Based Payment Reserve

The share-based payment reserve arises on the grant of share

options under the share option plan. Share options expired are

reallocated from the share-based payment reserve to retained

deficit at their grant date fair value.

8. RETAINED DEFICIT

Retained Deficit

EUR'000

At 1 January 2022 (23,725)

Profit/)Loss) for the period (140)

-----------------

At 30 June 2022 (23,865)

Profit/(Loss) for the period (171)

-----------------

At 31 December 2022 (24,036)

Profit/(Loss) for the period (164)

-----------------

At 30 June 2023 (24,200)

=================

Retained deficit

Retained deficit comprises of losses incurred in the current and

prior years.

9. POST BALANCE SHEET EVENTS

There are no material post balance sheets events affecting the

Group.

10. The Interim Report for the six months to 30(th) June 2023

was approved by the Directors on 17 September 2023.

11. The Interim Report will be available on the Company's

website at www.petrelresources.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPURWBUPWGQA

(END) Dow Jones Newswires

September 18, 2023 02:00 ET (06:00 GMT)

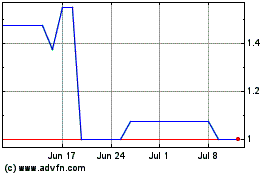

Petrel Resources (AQSE:PET.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Petrel Resources (AQSE:PET.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025