Pan African Resources Plc Trading Statement for the year ended 30 June 2023

September 01 2023 - 2:00AM

UK Regulatory

TIDMPAF

Pan African Pan African Resources Funding

Resources PLC Company Limited

(Incorporated Incorporated in the Republic of

and South Africa with limited

registered in liability

England and

Wales under Registration number:

the Companies 2012/021237/06

Act 1985 with

registered Alpha code: PARI

number

3937466 on 25

February

2000)

Share code on

AIM: PAF

Share code on

JSE: PAN

ISIN:

GB0004300496

ADR ticker

code: PAFRY

("Pan

African" or

the "Company"

or the

"Group")

(Key features are reported in United States dollar (US$) and South African rand

(ZAR))

TRADING STATEMENT FOR THE YEAR ENDED 30 JUNE 2023 (CURRENT FINANCIAL YEAR)

This announcement contains inside information

In terms of paragraph 3.4(b) of the Listings Requirements of the JSE Limited, a

listed company is required to publish a trading statement as soon as it is

satisfied that a reasonable degree of certainty exists that the financial

results for the current financial year, will differ by at least 20% from those

of the year ended 30 June 2022 (previous financial year).

Pan African's presentation currency is the US$ and its functional currency is

the ZAR. Movements in the US$/ZAR exchange rate affects the Group's US$ reported

results. The average US$/ZAR exchange rate, that prevailed during the current

financial year, is used in translating the Group's ZAR financial performance

into US$.

During the current financial year, the average US$/ZAR exchange rate was

US$/ZAR:17.77 (2022: US$/ZAR:15.22), and the closing US$/ZAR exchange rate as at

30 June 2023 was US$/ZAR:18.83 (2022: US$/ZAR:16.28).

The year-on-year change in the average and closing exchange rates of 16.8% and

15.7%, respectively, must be considered when comparing period-on-period results.

The weighted average number of outstanding shares as at 30 June 2023 was

1,916,503,988 shares (2022: 1,926,065,760 shares).

Pan African advises shareholders that its headline earnings per share (HEPS) for

the current financial year are expected to be between US 2.95 cents per share

and US 3.35 cents per share, compared to US 3.93 cents per share for the

previous financial year, a decrease of between 15% and 25%. Earnings per share

(EPS) for the current financial year are expected to be between US 3.00 cents

per share and US 3.39 cents per share respectively, compared to US 3.90 cents

per share for the previous financial year, a decrease of between 13% and 23%.

The decreases in HEPS and EPS for the current financial year, relative to the

previous financial year, are largely as a result of a 16.8% depreciation in the

average US$/ZAR exchange rate, while earnings in ZAR terms remained fairly

consistent with that of the previous financial year, as a result of the

following primary factors:

· Revenue in ZAR terms decreased by 0.2% only, as the 15% decrease in gold

sold volumes previously announced was offset by a 17.5% increase in the average

ZAR gold price received during the current financial year, and

· ZAR gross profit decreased by 3.2%, and ZAR profit after tax decrease by

5.4%, compared to the previous financial year.

The financial information contained in this announcement has neither been

reviewed nor audited by the Company's auditors. The Group's results for the year

ended 30 June 2023 will be released on 13 September 2023.

The information contained within this announcement is deemed by the Company to

constitute inside information as stipulated under the Market Abuse Regulations

(EU) No. 596/2014 as it forms part of UK Domestic Law by virtue of the European

Union (Withdrawal) Act 2018. Upon the publication of this announcement via

Regulatory Information Service ('RIS'), this inside information is now

considered to be in the public domain.

Rosebank

1 September 2023

For further information on Pan African, please visit the Company's website at

www.panafricanresources.com

+-----------------------------------------------+---------------------------+

|Corporate information |

+-----------------------------------------------+---------------------------+

|Corporate office |Registered office |

| | |

|The Firs Building |2nd Floor |

| | |

|2nd Floor, Office 204 |107 Cheapside |

| | |

|Corner Cradock and Biermann Avenues |London |

| | |

|Rosebank, Johannesburg |EC2V 6DN |

| | |

|South Africa |United Kingdom |

| | |

|Office: + 27 (0) 11 243 2900 |Office: + 44 (0) 20 7796 |

| |8644 |

|info@paf.co.za | |

| |info@paf.co.za |

+-----------------------------------------------+---------------------------+

|Chief executive officer |Financial director |

| | |

|Cobus Loots |Deon Louw |

| | |

|Office: + 27 (0) 11 243 2900 |Office: + 27 (0) 11 243 |

| |2900 |

+-----------------------------------------------+---------------------------+

|Head: Investor relations |Website: |

| |www.panafricanresources.com|

|Hethen Hira | |

|Tel: + 27 (0) 11 243 2900 | |

|E-mail: hhira@paf.co.za | |

+-----------------------------------------------+---------------------------+

|Company secretary |Nominated adviser and joint|

| |broker |

|Phil Dexter/Jane Kirton | |

| |Ross Allister/David McKeown|

|St James's Corporate Services Limited | |

| |Peel Hunt LLP |

|Office: + 44 (0) 20 7796 8644 | |

| |Office: +44 (0) 20 7418 |

| |8900 |

+-----------------------------------------------+---------------------------+

|JSE sponsor |Joint broker |

| | |

|Ciska Kloppers |Thomas Rider/Nick Macann |

| | |

|Questco Corporate Advisory Proprietary Limited |BMO Capital Markets Limited|

| | |

|Office: + 27 (0) 11 011 |Office: +44 (0) 20 7236 |

|9200 (https://www.google.co.za/search?q=questco|1010 |

|&rlz=1C1EJFC_enZA816ZA818&oq=q | |

|uestco&aqs=chrome..69i57j0l5.1 | |

|159j0j4&sourceid=chrome&ie=UTF-8) | |

+-----------------------------------------------+---------------------------+

| |Joint broker |

| | |

| |Matthew Armitt/Jennifer Lee|

| | |

| |Joh. Berenberg, Gossler & |

| |Co KG (Berenberg) |

| | |

| |Office: +44 (0) 20 3207 |

| |7800 |

+-----------------------------------------------+---------------------------+

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

September 01, 2023 02:00 ET (06:00 GMT)

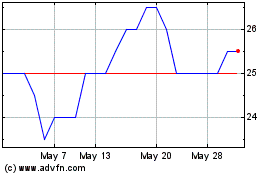

Pan African Resources (AQSE:PAF.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Pan African Resources (AQSE:PAF.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025