Oakley Capital Investments Limited Director Dealing (5528S)

November 07 2023 - 2:00AM

UK Regulatory

TIDMOCI

RNS Number : 5528S

Oakley Capital Investments Limited

07 November 2023

7 November 2023

Oakley Capital Investments Limited

Director Dealing

Oakley Capital Investments Limited(1) (the "Company"), was

notified today of the following transactions by a Director of the

Company:

Peter Dubens, a Director of the Company, has purchased 200,000

Ordinary Shares in the Company ("Ordinary Shares") at an aggregated

price of 441 pence per share. As a result, Mr Dubens is now

interested in 19,165,200 Ordinary Shares of the Company,

representing 10.86% percent of the issued share capital.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1 Details of the person discharging managerial responsibilities/person

closely associated

a) Name Peter Dubens

---------------------------- ------------------------------------------

2 Reason for the notification

------------------------------------------------------------------------

a) Position/status Director

---------------------------- ------------------------------------------

b) Initial notification/ Initial notification

Amendment

---------------------------- ------------------------------------------

3 Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor

------------------------------------------------------------------------

a) Name Oakley Capital Investments Limited

---------------------------- ------------------------------------------

b) LEI 213800KW6MZUK12CQ815

---------------------------- ------------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type

of transaction; (iii) each date; and (iv) each

place where transactions have been conducted

------------------------------------------------------------------------

a) Description Ordinary Shares of 1p each

of the financial

instrument,

type of instrument

Identification

code BMG670131058

---------------------------- ------------------------------------------

b) Nature of Acquisition

the transaction

---------------------------- ------------------------------------------

c) Price(s) Price(s) Volume(s)

and volume(s) 435p 70,000

444p 130,000

----------

---------------------------- ------------------------------------------

Aggregated

information

* Aggregated volume

200,000

d) * Price 441p

---------------------------- ------------------------------------------

e) Date of the 3 and 6 November 2023

transactions

---------------------------- ------------------------------------------

f) Place of London Stock Exchange, Specialist Fund

the transaction Segment

---------------------------- ------------------------------------------

- ends -

For further information please contact:

Oakley Capital Limited

+44 20 7766 6900

Steven Tredget

Greenbrook Communications Limited

+44 20 7952 2000

Rob White / Michael Russell

Liberum Capital Limited (Financial Adviser & Broker)

+44 20 3100 2000

Chris Clarke / Darren Vickers / Owen Matthews

Notes:

LEI Number: 213800KW6MZUK12CQ815

(1) About Oakley Capital Investments Limited ("OCI")

OCI is a Specialist Fund Segment ("SFS") traded investment

vehicle that aims to provide shareholders with consistent long-term

capital growth in excess of the FTSE All-Share Index by providing

liquid access to private equity returns through investment in the

Oakley Funds (2) .

A video introduction to OCI is available at

https://oakleycapitalinvestments.com/videos/

The contents of the OCI website are not incorporated into, and

do not form part of, this announcement.

Oakley Capital, the Investment Adviser

Founded in 2002, Oakley Capital Limited has demonstrated the

repeated ability to source attractive growth assets at attractive

prices. To do this it relies on its sector and regional expertise,

its ability to tackle transaction complexity and its deal

generating entrepreneur network.

The Oakley Funds

Oakley Capital Private Equity L.P. and its successor funds,

Oakley Capital Private Equity II, Oakley Capital Private Equity

III, Oakley Capital IV, Oakley Capital V, Oakley Capital Origin

Fund and Oakley Capital Origin II, are unlisted lower-mid to

mid-market private equity funds that aim to provide investors with

significant long-term capital appreciation. The investment strategy

of the Funds is to focus on buy-out opportunities in industries

with the potential for growth, consolidation and performance

improvement. The Oakley family of funds also includes Oakley

PROfounders Fund III and Oakley Touring Venture Fund, which are

venture capital funds focused on investments in entrepreneur-led,

disruptive, technology led companies.

For more information on the Oakley Fund strategies in which OCI invests, please click here.

Important information

Specialist Fund Segment securities are not admitted to the

Official List of the Financial Conduct Authority. Therefore, the

Company has not been required to satisfy the eligibility criteria

for admission to listing on the Official List and is not required

to comply with the Financial Conduct Authority's Listing Rules.

The Specialist Fund Segment is intended for institutional,

professional, professionally advised and knowledgeable investors

who understand, or who have been advised of, the potential risk

from investing in companies admitted to the Specialist Fund

Segment.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHBQLLBXFLBFBK

(END) Dow Jones Newswires

November 07, 2023 02:00 ET (07:00 GMT)

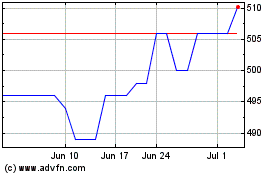

Oakley Capital Investments (AQSE:OCI.GB)

Historical Stock Chart

From Feb 2025 to Mar 2025

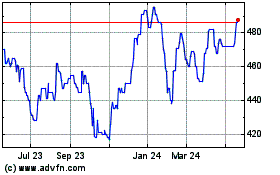

Oakley Capital Investments (AQSE:OCI.GB)

Historical Stock Chart

From Mar 2024 to Mar 2025