TIDMMBO

RNS Number : 2609B

MobilityOne Limited

30 September 2022

30 September 2022

MobilityOne Limited

("MobilityOne", the "Company" or the "Group")

Unaudited interim results for the six months ended 30 June

2022

MobilityOne (AIM: MBO), the e-commerce infrastructure payment

solutions and platform provider, announces its unaudited interim

results for the six months ended 30 June 2022.

Highlights:

-- Revenue decreased by 13.2% to GBP113.4 million (H1 2021:

GBP130.7 million) due to lower sales for the Group's mobile phone

prepaid airtime reload and bill payment business in Malaysia;

-- Profit after tax of GBP0.34 million (H1 2021: profit after tax of GBP1.01 million);

-- Cash and cash equivalents (including fixed deposits) at 30

June 2022 of GBP4.72 million (30 June 2021: GBP4.52 million);

and

-- The Group is cautious on the outlook for the remainder of

2022, taking into consideration the current business and

operational landscape of rising inflation and interest rates as

well as higher administrative expenses notwithstanding that the

e-payments industry is expected to continue to grow in

Malaysia.

For further information, contact:

MobilityOne Limited +6 03 89963600

Dato' Hussian A. Rahman, CEO www.mobilityone.com.my

har@mobilityone.com.my

Allenby Capital Limited

(Nominated Adviser and Broker) +44 20 3328 5656

Nick Athanas / Vivek Bhardwaj

About the Group:

MobilityOne provides e-commerce infrastructure payment solutions

and platforms through its proprietary technology solutions. The

Group has developed an end-to-end e-commerce solution which

connects various service providers across several industries such

as banking, telecommunication and transportation through multiple

distribution devices including EDC terminals, mobile devices,

automated teller machines ("ATM") and internet banking. The Group's

technology platform is flexible, scalable and designed to

facilitate cash, debit card and credit card transactions from

multiple devices while controlling and monitoring the distribution

of different products and services.

For more information, refer to our website at

www.mobilityone.com.my

Chairman's statement

The Group's revenue decreased by 13.2% to GBP113.4 million (H1

2021: revenue of GBP130.7 million) i n the first six months of

2022. This was as a result of lower sales from the Group's products

and services, namely the mobile phone prepaid airtime reload and

bill payment business through the Group's banking channels (i.e.

mobile banking and internet banking) with 10 banks and third

parties' e-wallet applications. The Malaysian market accounted for

almost the Group's entire revenue for the first six months of 2022.

As a consequence of the reduction of revenue, coupled with higher

administrative expenses, the Group registered a lower profit after

tax of GBP0.34 million in the first six months of 2022 (H1 2021:

profit after tax of GBP1.01 million).

The Group's other businesses (i.e., the international remittance

services and e-money in Malaysia and e-payment solutions activities

in the Philippines and Brunei) continued to remain small in the

first six months of 2022.

As at 30 June 2022, the Group had cash and cash equivalents

(including fixed deposits) of GBP4.72 million (30 June 2021: cash

and cash equivalents of GBP4.52 million) while the secured loans

and borrowings from financial institutions increased to GBP2.89

million (30 June 2021: GBP2.06 million).

Current trading and outlook

The Group's business activities are predominately concentrated

in Malaysia. Other than the Group's core mobile phone prepaid

airtime reload and bill payment business, the Group's international

remittance and e-money businesses are expected to remain

insignificant in 2022. This is also expected to be the case for the

e-payment solutions activities in the Philippines and Brunei.

On 1 June 2022 the Company announced that its wholly-owned

subsidiary in Malaysia, MobilityOne Sdn Bhd, had received a license

from MasterCard Asia/Pacific Pte Ltd ("MasterCard") and approval

from the Central Bank of Malaysia to issue MasterCard prepaid

cards. In line with announced expectations, the Group has commenced

the issuance of MasterCard prepaid cards in Malaysia on a small

scale to complement the Group's existing e-wallet and is part of

the Group's end-to-end payment ecosystem.

However, the Central Bank of Malaysia has not yet given its

decision, the timings of which continue to remain uncertain, for

the Group to expand its money transfer business via the Society for

Worldwide Interbank Financial Telecommunication ("SWIFT") network.

Nevertheless, the Group is currently working closely with a bank in

Malaysia on the integration process while waiting for the Central

Bank of Malaysia's approval.

On 11 October 2021, the Group entered into a joint venture cum

shareholders agreement with One M Tech Pty Ltd to explore

e-commerce and e-payment business opportunities in Australia. As

there have been no developments or progress made by the joint

venture partner, the Group has today given a notice to the joint

venture partner to terminate the agreement. While this joint

venture cum shareholders agreement was previously envisaged to not

contribute any material revenue or earnings to the Group, should a

viable new opportunity arise, the Group will reassess exploring

potential business expansion in Australia again in the future.

In order for the Group to expand its business in the UK, M-One

Tech Limited, the Company's wholly-owned subsidiary in the UK,

continues to progress its work in respect of re-submit an

application to the Financial Conduct Authority (the " FCA "), the

financial regulatory body in the UK, for authorisation as an

electronic money institution to provide e-money services in the UK

(together the "FCA Application"). While it was originally the

Group's intention to re-submit the FCA Application by September

2022, as most recently announced by the Group on 29 June 2022, the

Group now intends to re-submit the revised FCA Application

reflecting the FCA's feedback in the fourth quarter of 2022.

Notwithstanding that the e-payments industry is expected to

continue to grow in Malaysia in the long-term and that the Group

will continue to invest and enhance its research and development as

the backbone to support the business expansion and technology

advancement , t he Group is cautious on the outlook for the

remainder of 2022. This cautious view takes into consideration the

current business and operational landscape which comprises rising

inflation and interest rates as well as higher administrative

expenses. Rising administrative expenses include higher staff

costs, higher infrastructure and marketing costs as well as other

related expenses . As a result, in order to maintain or grow the

Group's business, it is the Board's view that the Group's gross

profit margin for its products and services are likely to also be

impacted. For future growth, the Group will also consider

partnerships with parties in complementary businesses to explore

new business opportunities.

Abu Bakar bin Mohd Taib (Chairman)

30 September 2022

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHS PERIODED 30 JUNE 2022

Six months Six months Financial

year

Ended Ended Ended

30 June 30 June 31 Dec 2021

2022 2021

Unaudited Unaudited Audited

CONTINUING OPERATIONS GBP GBP GBP

Revenue 113,355,113 130,710,091 255,707,270

Cost of sales (107,103,390) (123,637,568) (242,050,541)

-------------- -------------- -------------------

GROSS PROFIT 6,251,723 7,072,523 13,656,729

Other operating income 92,839 91,793 155,832

Administration expenses (5,549,417) (5,403,641) (11,256,000)

Other operating expenses (209,083) (314,042) (411,740)

Net loss on financial instruments - - (13,366)

OPERATING PROFIT 586,062 1,446,633 2,131,455

Finance costs (63,501) (58,603) (115,620)

PROFIT BEFORE TAX 522,561 1,388,030 2,015,835

Tax (184,356) (374,862) (507,582)

-------------- -------------- -------------------

PROFIT FROM CONTINUING

OPERATIONS 338,205 1,013,168 1,508,253

============== ============== ===================

Attributable to:

Owners of the parent 338,842 1,013,868 1,524,429

Non-controlling interest (637) (700) (16,176)

--------------

338,205 1,013,168 1,508,253

============== ============== ===================

EARNINGS PER SHARE

Basic earnings per share

(pence) 0.319 0.954 1.434

Diluted earnings per share

(pence) 0.301 0.882 1.341

PROFIT FOR THE PERIOD/YEAR 338,205 1,013,168 1,508,253

OTHER COMPREHENSIVE PROFIT/(LOSS)

Foreign currency translation 296,985 (30,164) (44,254)

TOTAL COMPREHENSIVE PROFIT

FOR THE PERIOD/YEAR 635,190 983,004 1,463,999

==============

Total comprehensive profit

attributable to:

Owners of the parent 636,224 962,256 1,458,754

Non-controlling interest (1,034) 20,748 5,245

635,190 983,004 1,463,999

============== ============== ===================

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2022

At At At

30 June 2022 30 June 2021 31 Dec 2021

Unaudited Unaudited Audited

GBP GBP GBP

Assets

Non-current assets

Intangible assets 421,863 598,367 433,844

Property, plant and equipment 1,180,684 991,405 950,664

Right-of-use assets 191,759 218,708 155,660

Other investment 12,144 - -

1,806,450 1,808,480 1,540,168

------------- ------------- ------------

Current assets

Inventories 3,162,123 2,485,534 3,118,571

Trade receivables 2,087,657 1,651,637 2,299,267

Other receivables 927,759 837,538 878,431

Tax recoverable 169,179 - 53,010

Fixed deposits 1,603,471 1,471,568 1,508,388

Cash and cash equivalents 3,114,703 3,050,103 3,157,136

------------- ------------- ------------

11,064,892 9,496,380 11,014,803

------------- ------------- ------------

Total Assets 12,871,342 11,304,860 12,554,971

============= ============= ============

Shareholders' equity

Equity attributable to

equity holders of the Company

Called up share capital 2,657,470 2,657,470 2,657,470

Share premium 909,472 909,472 909,472

Reverse acquisition reserve 708,951 708,951 708,951

Foreign currency translation

reserve 990,089 706,770 692,707

Accumulated profit/ (losses) 221,219 (628,184) (117,623)

------------- ------------- ------------

Shareholders' equity 5,487,201 4,354,479 4,850,977

Non-controlling interest (8,263) 8,274 (7,229)

------------- ------------- ------------

Total Equity 5,478,938 4,362,753 4,843,748

------------- ------------- ------------

Liabilities

Non-current liabilities

Loans and borrowings

- secured 225,171 226,161 217,881

Lease liabilities 74,047 76,386 83,501

Deferred tax liabilities 44,782 55,204 42,570

344,000 357,751 343,952

Current liabilities

Trade payables 947,062 1,030,890 1,195,283

Other payables 3,116,652 3,195,262 4,008,268

Amount due to directors 176,457 140,878 124,426

Loans and borrowings

- secured 2,668,243 1,830,684 1,958,841

Lease liabilities 108,810 124,358 71,988

Tax payables 31,180 262,284 8,465

7,048,404 6,584,356 7,367,271

------------- ------------- ------------

Total Liabilities 7,392,404 6,942,107 7,711,223

------------- ------------- ------------

Total Equity and Liabilities 12,871,342 11,304,860 12,554,971

============= ============= ============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTH PERIODED 30 JUNE 2022

Non-Distributable Distributable

Foreign

Reverse Currency Non-

Share Share Acquisition Translation Accumulated Controlling Total

Capital Premium Reserve Reserve Losses Total Interest Equity

GBP GBP GBP GBP GBP GBP GBP GBP

As at 1 January

2021 2,657,470 909,472 708,951 758,382 (1,642,052) 3,392,223 (12,474) 3,379,749

Foreign currency

translation - - - (51,612) - (51,612) 21,448 (30,164)

Profit for the

period - - - - 1,013,868 1,013,868 (700) 1,013,168

---------- -------- ------------ ------------ ------------ ---------- ------------ ------------

As at 30 June

2021 2,657,470 909,472 708,951 706,770 (628,184) 4,354,479 8,274 4,362,753

========== ======== ============ ============ ============ ========== ============ ============

As at 1 July 2021 2,657,470 909,472 708,951 706,770 (628,184) 4,354,479 8,274 4,362,753

Foreign currency

translation - - - (14,063) - (14,063) (27) (14,090)

Profit/(Loss) for

the period - - - - 510,561 510,561 (15,476) 495,085

---------- -------- ------------ ------------ ------------ ---------- ------------ ------------

As at 31 Dec 2021 2,657,470 909,472 708,951 692,707 (117,623) 4,850,977 (7,229) 4,843,748

========== ======== ============ ============ ============ ========== ============ ============

As at 1 January

2022 2,657,470 909,472 708,951 692,707 (117,623) 4,850,977 (7,229) 4,843,748

Foreign currency

translation - - - 297,382 - 297,382 (397) 296,985

Profit for the

period - - - - 338,842 338,842 (637) 338,205

---------- -------- ------------ ------------ ------------ ---------- ------------ ------------

As at 30 June

2022 2,657,470 909,472 708,951 990,089 221,219 5,487,201 (8,263) 5,478,938

========== ======== ============ ============ ============ ========== ============ ============

Share capital is the amount subscribed for shares at nominal

value.

Share premium represents the excess of the amount subscribed for

share capital over the nominal value of the respective shares net

of share issue expenses.

The reverse acquisition reserve relates to the adjustment

required by accounting for the reverse acquisition in accordance

with IFRS 3.

The Company's assets and liabilities stated in the Statement of

Financial Position were translated into Pound Sterling (GBP) using

the closing rate as at the Statement of Financial Position date and

the income statements were translated into GBP using the average

rate for that period. All resulting exchange differences are taken

to the foreign currency translation reserve within equity.

Retained earnings represent the cumulative earnings of the Group

attributable to equity shareholders.

Non-controlling interests represent the share of ownership of

subsidiary companies outside the Group .

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTH PERIODED 30 JUNE 2022

Six months Six months Financial

year

Ended Ended ended

30 June 30 June 31 Dec 2021

2022 2021

Unaudited Unaudited Audited

GBP GBP GBP

Cash flows (used in)/from operating

activities

Cash (used in)/generated from

operations (205,386) 2,011,004 2,409,305

Interest paid (63,501) (58,630) (115,620)

Interest received 11,221 12,568 12,867

Tax paid (287,340) (242,859) (723,469)

Tax refund 5,470 - -

Net cash (used in)/generated from

operating activities (539,536) 1,722,083 1,583,083

---------- ----------- -----------

Cash flows (used in) investing

activities

Purchase of property, plant and

equipment (306,614) (1,692) (34,866)

Addition in right-of-use assets - - (5,690)

Net cash outflow for acquisition

of subsidiary company - (408,722) (376,517)

Repayment from associate company - - 221,583

Addition in non-controlling interests - - 21,310

Proceeds from disposal of property,

plant & equipment 8,370 - -

Net cash (used in) investing activities (298,244) (410,414) (174,180)

---------- ----------- -----------

Cash flows from/(used in) financing

activities

Net change of banker acceptance 607,556 (1,136,798) (1,202,597)

Repayment of lease liabilities (53,825) (71,214) (122,576)

Repayment of term loan (4,038) (6,685) (8,734)

Net cash from/(used in) financing

activities 549,693 (1,214,697) (1,333,907)

---------- ----------- -----------

(Decrease)/Increase in cash and

cash equivalents (288,087) 96,972 74,996

Effect of foreign exchange rate

changes 340,737 6,823 172,652

Cash and cash equivalents at

beginning of period/year 4,665,524 4,417,876 4,417,876

Cash and cash equivalents at

end of period/year 4,718,174 4,521,671 4,665,524

========== =========== ===========

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. Basis of preparation

The Group's interim financial statements for the six months

ended 30 June 2022 were authorised for issue by the Board of

Directors on 30 September 2022.

The interim financial statements are unaudited and have been

prepared in accordance with International Financial Reporting

Standards (IFRSs and IFRIC interpretations) issued by the International

Accounting Standards Board (IASB), as adopted by the European

Union, and with those parts of the Companies (Jersey) Law 1991

applicable to companies preparing their financial statements

under IFRS. It has been prepared in accordance with IAS 34 "Interim

Financial Reporting" and does not include all of the information

required for full annual financial statements. The financial

statements have been prepared under the historical cost convention.

Full details of the accounting policies adopted, which are consistent

with those disclosed in the Company's 2021 Annual Report, will

be included in the audited financial statements for the year

ending 31 December 2022.

2. Basis of consolidation

The consolidated statement of comprehensive income and statement

of financial position include financial statements of the Company

and its subsidiaries made up to 30 June 2022.

3. Nature of financial information

The unaudited interim financial information for the six months

ended 30 June 2022 does not constitute statutory accounts under

the meaning of Section 435 of the Companies Act 2006. The comparative

figures for the year ended 31 December 2021 are extracted from

the audited statutory financial statements. Full audited financial

statements of the Group in respect of that financial year prepared

in accordance with IFRS, which we received an unqualified audit

opinion, have been delivered to the Registrar of Companies.

4. Functional and presentation currency

(i) Functional and presentation currency

Items included in the financial statements of each of the Group's

entities are measured using the currency of the primary economic

environment in which the entity operates (the functional currency).

The functional currency of the Group is Ringgit Malaysia (RM).

The consolidated financial statements are presented in Pound

Sterling (GBP), which is the Company's presentational currency

as this is the currency used in the country in which the entity

is listed.

Assets and liabilities are translated into Pound Sterling (GBP)

at foreign exchange rates ruling at the Statement of Financial

Position date. Results and cash flows are translated into Pound

Sterling (GBP) using average rates of exchange for the period.

(ii) Transactions and balances

Foreign currency transactions are translated into the functional

currency using exchange rates prevailing at the dates of the

transactions. Foreign exchange gains and losses resulting from

the settlement of such transactions and from the translation

at year/period-end exchange rates of monetary assets and liabilities

denominated in foreign currencies are recognised in the statement

of comprehensive income.

The financial information set out below has been translated

at the following rates:

Exchange rate (RM: GBP)

At Statement Average for

of Financial year/

Position date Period

Period ended 30 June

2022 5.35 5.54

Period ended 30 June

2021 5.74 5.69

Year ended 31 December

2021 5.63 5.70

5. Segmental analysis

The Group has three operating segments as follows:

(a) Telecommunication services and electronic commerce solutions;

(b) Hardware; and

(c) Remittance services

No segmental analysis of assets and capital expenditure are

presented as they are mostly unallocated items which comprise

corporate assets and liabilities. No geographical segment information

is presented as more than 95% of the Group's revenue was generated

in Malaysia.

Telecommunication

services and Remittance

Group electronic Hardware services Elimination Total

commerce

solutions

6 months ended 30 GBP GBP GBP GBP GBP

June 2022

==================== ================== ========== =========== ============ ============

Segment revenue:

Sales to external

customers 112,494,543 959,051 56,692 (155,173) 113,355,113

-------------------- ------------------ ---------- ----------- ------------ ------------

112,494,543 959,051 56,692 (155,173) 113,355,113

-------------------- ------------------ ---------- ----------- ------------ ------------

Profit before tax 522,561 - - - 522,561

Tax (184,356) - - (184,356)

-------------------- ------------------ ---------- ----------- ------------ ------------

Profit for the

period 338,205 - - - 338,205

-------------------- ------------------ ---------- ----------- ------------ ------------

Non-cash

expenses/(income)*

Depreciation of

property, plant

and equipment 132,115 - - - 132,115

Amortisation of

intangible assets 33,384 - - - 33,384

Amortisation of

right-of-use

assets 43,584 - - - 43,584

209,083 - - - 209,083

-------------------- ------------------ ---------- ----------- ------------ ------------

Group

6 months ended 30

June 2021

==================== ================== ========== =========== ============ ============

Segment revenue:

Sales to external

customers 129,559,457 1,297,991 - (147,357) 130,710,091

-------------------- ------------------ ---------- ----------- ------------ ------------

129,559,457 1,297,991 - (147,357) 130,710,091

-------------------- ------------------ ---------- ----------- ------------ ------------

Profit before tax 1,388,030 - - - 1,388,030

Tax (374,862) - - - (374,862)

-------------------- ------------------ ---------- ----------- ------------ ------------

Profit for the

period 1,013,168 - - - 1,013,168

-------------------- ------------------ ---------- ----------- ------------ ------------

Non-cash

expenses/(income)*

Depreciation of

property, plant

and equipment 109,577 - - - 109,577

Amortisation of

intangible assets 32,488 - - - 32,488

Amortisation of

right-of-use

assets 60,111 - - - 60,111

-------------------- ------------------ ---------- ----------- ------------ ------------

202,176 - - - 202,176

-------------------- ------------------ ---------- ----------- ------------ ------------

Group

Financial year

ended 31 Dec 2021

-------------------- ------------------ ---------- ----------- ------------ ------------

Segment revenue:

Sales to external

customers 252,841,803 3,248,248 - (382,781) 255,707,270

-------------------- ------------------ ---------- ----------- ------------ ------------

252,841,803 3,248,248 - (382,781) 255,707,270

-------------------- ------------------ ---------- ----------- ------------ ------------

Profit before tax 2,015,835 - - - 2,015,835

Tax (507,582) - - - (507,582)

-------------------- ------------------ ---------- ----------- ------------ ------------

Profit for the

period 1,508,253 - - - 1,508,253

-------------------- ------------------ ---------- ----------- ------------ ------------

Non-cash

expenses/(income)*

Depreciation of

property, plant

and equipment 243,980 - - - 243,980

Amortisation of

intangible assets 64,864 - - - 64,864

Amortisation of

right-of-use

assets 104,169 - - - 104,169

Bad debt written

off 36,339 - - - 36,339

Inventories written

off 182 - - - 182

449,534 - - - 449,534

-------------------- ------------------ ---------- ----------- ------------ ------------

*The disclosure for non-cash expenses has not been split according

to the different segments as the cost to obtain such information

is excessive and provides very little by way of information.

6. Taxation

Taxation on the income statement for the financial period comprises

current and deferred tax. Current tax is the expected amount

of taxes payable in respect of the taxable profit for the financial

period and is measured using the tax rates that have been enacted

at the Statement of Financial Position date.

Deferred tax is recognised on the liability method for all temporary

differences between the carrying amount of an asset or liability

in the Statement of Financial Position and its tax base at the

Statement of Financial Position date. Deferred tax liabilities

are recognised for all taxable temporary differences and deferred

tax assets are recognised for all deductible temporary differences,

unused tax losses and unused tax credits to the extent that

it is probable that future taxable profit will be available

against which the deductible temporary differences, unused tax

losses and unused tax credits can be utilised. Deferred tax

is not recognised if the temporary difference arises from goodwill

or negative goodwill or from the initial recognition of an asset

or liability in a transaction which is not a business combination

and at the time of the transaction, affects neither accounting

profit nor taxable profit.

Deferred tax assets and liabilities are measured at the tax

rates that are expected to apply to the period when the asset

is realised or the liability is settled, based on the tax rates

that have been enacted or substantively enacted by the Statement

of Financial Position date. The carrying amount of a deferred

tax asset is reviewed at each Statement of Financial Position

date and is reduced to the extent that it becomes probable that

sufficient future taxable profit will be available.

Deferred tax is recognised in the income statement, except when

it arises from a transaction which is recognised directly in

equity, in which case the deferred tax is also charged or credited

directly in equity, or when it arises from a business combination

that is an acquisition, in which case the deferred tax is included

in the resulting goodwill or negative goodwill.

7. Earnings per share

The basic earnings per share is calculated by dividing the profit

in the six month period ended 30 June 2022 of GBP 338,842 (30

June 2021: profit of GBP1,013,868 and year ended 31 December

2021: profit of GBP1,524,429) attributable to owners of the

parent by the number of ordinary shares outstanding at 30 June

2022 of 106,298,780 (30 June 2021: 106,298,780 and 31 December

2021: 106,298,780).

The diluted earnings per share for the six month period ended

30 June 2022 is calculated using the number of shares adjusted

to assume the exercise of all dilutive potential ordinary shares

of 112,567,904 (ie, on 5 December 2014, the Company granted

share options of 10,600,000 shares at 2.5p to directors and

certain employees of the Group. Share options of 2,000,000 shares

had lapsed due to resignation of employees and no option has

been exercised).

8. Reconciliation of profit before tax to cash generated from operations

Six months Six months Financial

year

ended Ended ended

30 June 2022 30 June 2021 31 Dec 2021

Unaudited Unaudited Audited

GBP GBP GBP

Cash flow from operating

activities

Profit before tax 522,561 1,388,030 2,015,835

------------- ------------- ------------

Adjustments for:

Amortisation of intangible

assets 33,384 32,488 64,864

Amortisation of right-of-use

assets 43,584 60,111 104,169

Bad debt written off - - 36,339

Deposit written off - - 8,683

Depreciation of property,

plant and equipment 132,115 109,577 243,980

Gain on disposal of (8,090) - -

property, plant & equipment

Impairment loss on

goodwill - - 99,939

Interest expenses 63,501 58,630 115,620

Inventories written

off - - 182

Interest income (11,221) (12,567) (12,867)

Waiver of debts - - (99,025)

Operating profit before

working capital changes 775,834 1,636,269 2,577,719

(Increase)/Decrease

in inventories (43,552) 1,143,696 499,324

(Increase)/Decrease

in receivables 150,139 (116,884) (848,771)

Increase in amount

due to Directors &

Shareholder - - 13,435

Amount due to/by related

company 52,030 59,310 -

Increase in payables (1,139,837) (711,387) 167,598

------------- ------------- ------------

Cash generated from

operations (205,386) 2,011,004 2,409,305

============= ============= ============

9. Contingent liabilities

In the period under review, corporate guarantees of RM27.0 million

(GBP5.04 million) (H1 2021: RM21.1 million (GBP3.68 million)

were given to a licensed bank by the Company for credit facilities

granted to a subsidiary company.

10. Significant accounting policies

The interim consolidated financial statements have been prepared

applying the same accounting policies that were applied in

the preparation of the Company's published consolidated financial

statements for the year ended 31 December 2021 except for the

adoption of new and amended reporting standards, which are

effective for periods commencing on or after 1 January 2022.

Various amendments to standards and interpretations of standards

are effective for periods commencing on or after 1 January

2022 as detailed in the 2021 Annual Report, none of which have

any impact on reported results.

Amortisation of intangible assets

Software is amortised over its estimated useful life. Management

estimated the useful life of this asset to be within 10 years.

Changes in the expected level of usage and technological development

could impact the economic useful life therefore future amortisation

could be revised.

The Group determines whether goodwill is impaired at least

on an annual basis. This requires an estimation of the value-in-use

of the cash generating units ("CGU") to which goodwill is allocated.

Estimating a value-in-use amount requires management to make

an estimation of the expected future cash flows from the CGU

and also to choose a suitable discount rate in order to calculate

the present value of those cash flows.

The research and development costs are amortised on a straight-line

basis over the life span of the developed assets. Management

estimated the useful life of these assets to be within 5 years.

Changes in the technological developments could impact the

economic useful life and the residual values of these assets,

therefore future amortisation charges could be revised.

Impairment of goodwill on consolidation

The Group's cash flow projections include estimates of sales.

However, if the projected sales do not materialise there is

a risk that the value of goodwill would be impaired.

The Directors have carried out a detailed impairment review

in respect of goodwill. The Group assesses at each reporting

date whether there is an indication that an asset may be impaired,

by considering cash flows forecasts. The cash flow projections

are based on the assumption that the Group can realise projected

sales. A prudent approach has been applied with no residual

value being factored. At the period end, based on these assumptions

there was no indication of impairment of the value of goodwill

or of development costs.

Research and development costs

All research costs are recognised in the income statement

as incurred.

Expenditure incurred on projects to develop new products is

capitalised and deferred only when the Group can demonstrate

the technical feasibility of completing the intangible asset

so that it will be available for use or sale, its intention

to complete and its ability to use or sell the asset, how

the asset will generate future economic benefits, the availability

of resources to complete the project and the ability to measure

reliably the expenditure during the development. Product development

expenditures which do not meet these criteria are expensed

when incurred.

Development costs, considered to have finite useful lives,

are stated at cost less any impairment losses and are amortised

through other operating expenses in the income statement using

the straight-line basis over the commercial lives of the underlying

products not exceeding 5 years. Impairment is assessed whenever

there is an indication of impairment and the amortisation

period and method are also reviewed at least at each Statement

of Financial Position date.

11. Dividends

The Company has not proposed or declared an interim dividend.

12. Interim report

This interim financial statement will, in accordance with Rule

26 of the AIM Rules for Companies, be available shortly on

the Company's website at www.mobilityone.com.my .

-Ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FKLLLLKLEBBZ

(END) Dow Jones Newswires

September 30, 2022 02:00 ET (06:00 GMT)

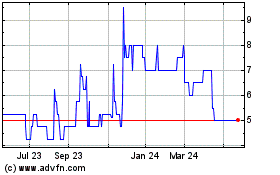

Mobilityone (AQSE:MBO.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

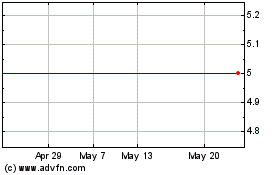

Mobilityone (AQSE:MBO.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024