Lift Global Ventures PLC Proposed Acquisition of Miriad Limited (1707V)

August 08 2022 - 2:00AM

UK Regulatory

TIDMLFT

RNS Number : 1707V

Lift Global Ventures PLC

08 August 2022

8 August 2022

Lift Global Ventures Plc

("Lift" or the "Company")

Proposed Acquisition of Miriad Limited

Posting of Circular and Notice of General Meeting

Lift Global Ventures Plc (AQSE:LFT), an enterprise company

formed to identify investment and acquisition opportunities within

the financial media and related technology industries, is pleased

to announce that it has entered into a share purchase agreement to

conditionally acquire the entire issued share capital of Miriad

Limited ("Miriad"), a financial PR and IR consulting company run by

well-known stock market commentator and current Director, Zak Mir

(the "Acquisition"). The Company has posted, or otherwise made

available, a circular to shareholders (containing a notice

convening a General Meeting to be held at 10 a.m. on 5 September

2022 (the General Meeting)) in connection with the proposed

acquisition of Miriad, which will constitute a substantial property

transaction ("SPT").

Background to and Reasons for the Acquisition

Miriad provides a bespoke, personalised service to small/mid-cap

entities in the UK and access to Zak's deep market insights, vast

industry connections and significant social media following.

For the year ended 30 June 2022, Miriad reported revenue of

GBP340,684 and an operating profit of GBP265,098. However, based on

the annualised amount of current client retainers, current revenue

can be measured slightly higher at GBP420,000 (spread across 26

companies).

The Acquisition will help to achieve the Directors' goal of

covering Lift's fixed costs and providing, not just stability

during a time of market turmoil, but an ideal platform from which

to launch into the next phase of the Company's growth strategy.

Following the Acquisition, Lift will seek to build on and

strengthen Miriad's client base by offering clients the opportunity

to work with a listed company at the epicentre of the small/mid-cap

arena.

Lift will also continue to seek complimentary acquisitions and

other business growth opportunities which echo the Company's

strategy and broaden its hold in its field of expertise.

Terms of the Acquisition

The parties have entered into a share purchase agreement for the

proposed acquisition of Miriad. The transaction remains conditional

upon the satisfaction of certain conditions, including, inter alia,

the approval of the resolutions tabled at the general meeting.

The consideration for the transaction is GBP366,667, which is to

be satisfied by: (a) a cash payment of GBP200,000; and (b) the

issue and allotment of 4,166,666 ordinary shares in the Company (at

an issue price of GBP0.04 per share) (the "Consideration

Shares").

The Consideration Shares issued to the shareholders of Miriad,

being Mr Mir and his spouse (the "Sellers"), will be subject to a

lock-in restriction on disposals for a period of 12 months from

completion of the Acquisition ("Lock-in"). The Lock-in restriction

is subject to normal customary exceptions.

The agreement has been based upon standard arms' length terms,

and the Sellers have provided customary warranties in favour of the

Company.

Related Party Transaction

Zak Mir is a director and a shareholder of the Company, and a

significant shareholder and sole director of Miriad. The proposed

transaction will therefore constitute a related party transaction

for the purposes of Rule 4.6 of the AQSE Rules for Companies

("Related Party Transaction").

Paul Gazzard and Tim Daniel are considered independent for the

purposes of considering and approving the terms of the transaction

on behalf of the Board (the "Independent Directors"). The

Independent Directors have considered the terms of the Acquisition

and believe the transaction to be in the best interests of

Shareholders, as a whole.

Notice of General Meeting

The transaction will constitute a SPT which will require the

approval of Shareholders at the General Meeting and the transaction

is conditional upon such approvals. Subject to the resolutions

being passed at the General Meeting, the Company expects to release

an announcement thereafter to confirm that the Acquisition has been

completed and that Miriad Limited has become a wholly owned

subsidiary of the Company.

Enquiries:

Lift Global Ventures Plc

Zak Mir, CEO

Tim Daniel, Executive Director +44 (0)203 745 1865

--------------------

Optiva Securities (AQSE Corporate

Adviser and Broker)

--------------------

Christian Dennis

Daniel Ingram +44 (0)203 411 1881

--------------------

For more information please visit: www.liftgv.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXUPUAGRUPPPUM

(END) Dow Jones Newswires

August 08, 2022 02:00 ET (06:00 GMT)

Lift Global Ventures (AQSE:LFT)

Historical Stock Chart

From Feb 2025 to Mar 2025

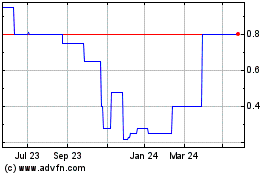

Lift Global Ventures (AQSE:LFT)

Historical Stock Chart

From Mar 2024 to Mar 2025