TIDMJHD

RNS Number : 0377U

James Halstead PLC

31 March 2021

31 March 2021

JAMES HALSTEAD PLC

INTERIM RESULTS FOR THE HALF-YEARED 31 DECEMBER 2020

Key Figures

James Halstead plc, the AIM listed manufacturer and

international distributor of commercial floor coverings,

reports:

* Revenue at GBP130.45 million (2019: GBP130.39

million) - level

* Operating profit at GBP26.2 million (2019: GBP25.3

million) - up 3.9%

* Pre-tax profit at GBP26.0 million (2019: GBP25.2

million) - up 3.3%

* Basic earnings per ordinary share 9.8p (2019: 9.5p) -

up 3.2%

* Interim dividend declared of 4.25p

* Cash at 31 December 2020 of GBP74.4 million

The Chief Executive, Mr. Mark Halstead, commented:

"I am very pleased to report these improved figures and all

credit to our workforce for their efforts in the face of great

uncertainty and major challenge. Trading continues to be

solid".

Enquiries:

James Halstead:

Mark Halstead, Chief Executive Telephone: 0161 767 2500

Gordon Oliver, Finance Director

Hudson Sandler:

Nick Lyon Telephone: 020 7796 4133

Nick Moore

Panmure Gordon (NOMAD & Joint Broker):

Dominic Morley Telephone: 020 7886 2500

WH Ireland (Joint Broker):

Ben Thorne / Chris Hardie Telephone: 0207 220 1666

CHAIRMAN'S STATEMENT

Trading for the six months ended 31 December 2020

Our turnover of GBP130.45 million (2019: GBP130.39 million)

shows a slight increase on the comparative six months. This is a

record level for sales and, against a difficult global trading

environment, a significant achievement. The variety of projects

completed was, as ever, diverse from the Enigma Museum in Poznan,

which has been built to commemorate the great success of three

brilliant mathematicians - Marian Rejewski, Jerzy Ró ycki and

Henryk Zygalski, to the Umm Al-Qura University in Mecca and the

well known Canadian coffee retailer Second Cup in its Hemisphere

Cannabis outlets.

Profit before tax of GBP26.0 million (2019: GBP25.2 million) is

3.3% ahead of the comparative period and is another record. Our

cash inflows from operations in the period are GBP39.8 million. The

business has performed well given the breadth of interruptions to

many of our markets over the course of the six months.

In the UK our sales are 2.2% ahead of the prior comparative six

months and are testament to the efforts of our sales and

distribution teams in servicing the market. Sales across Europe

were down 1% compared to the comparative period, Australasia showed

positive growth of 2% and the rest of the world decreased 8%, the

latter being principally adversely impacted by North America and

the Middle East. Though commendable overall, it is evident that in

many markets normal business has been significantly interrupted by

the ongoing pandemic.

Gross margins were resilient but were reduced and the factories

were all affected by the operational difficulties of operating

large-scale capital equipment with significant numbers of employees

self-isolating and the associated employee safeguarding.

Overheads continue to be managed tightly and during the period

there was little activity on new product launches due to the

ongoing situation with Covid-19 and, in particular, the constraints

on site visits and meeting customers. Historically there are major

exhibitions to attend in the early part of the calendar year which

have been cancelled with resulting cost savings relating to the

usual expenditure on these events.

It is very encouraging that overall demand has been consistent

through our first half year and in many markets was significantly

higher than anticipated. Clearly normal business has been affected

in areas such as retail and hospitality but others such as

healthcare continue to be robust. We have continued our long

history of supplying flooring to healthcare projects globally from

the Mahala Hospital in Gharbia Egypt, the Kopanong Regional

Hospital in South Africa, St. Michael's Hospital in Toronto and the

Haugesund hospital in Rogaland Norway.

Earnings per Share and Dividend

Our basic earnings per share at 9.8p is above the comparative

period of 9.5p by 3.2%.

Our cash, which stands at GBP74.4 million compared with GBP64.3

million at 31 December 2019, continues to be a key strength. The

cash flow is helped by stock reduction in the period of some GBP6.5

million and whilst buoyant sales are to be welcomed, the reduction

in stock levels has been due to the difficulty of operating our

usual shift patterns as employees self-isolated. Ideally we would

have looked to have about 7-8% higher stock at the end of the

calendar year.

With regard to our cash and profitability we have decided to

declare an interim dividend of 4.25p per share payable on 4 June

2021 to those shareholders on the register at the close of business

on 7 May 2021. Last year as the first lockdown commenced we

declared a first interim dividend of 2.125p paid on 5 June 2020

followed by a second interim, also of 2.125p, paid on 10 September

2020.

Having regard to our defined benefit pension scheme which is

undergoing its triennial valuation the Company paid additional

contributions of GBP2.0 million in August 2020. The reduction in

retirement benefit obligations partly reflects these increased

company contributions but also improved return on scheme assets and

changes in demographic assumptions (including the effects of

covid-19).

Environmental, sustainability, social responsibility and

governance

Every two years we publish a full report on these topics to

document and underline the Group's commitment to ESSG. As a

manufacturer we see this as a key way of communicating our place in

and contribution to society, and the many and varied actions that

are ongoing inside the business. Whether it is the independent

review of our supply chain or the verification of our products to

the standards of indoor air quality or energy consumption we look

always for credible, independent verification rather than "green

marketing" labels. The latest report is published on our website

and will be updated later this calendar year.

Environmental and sustainable business targets continue to be a

key focus and in January 2021 our flooring ranges were re-certified

to BES6001 (responsible sourcing) once again achieving the highest

rating of "excellent". Just one example of our innovation: Even

though our PVC flooring is incredibly durable and recyclable we

have commenced the use of fossil free PVC polymers that are sourced

from renewable biomass. This bio-vinyl does not take materials from

the food chain and its manufacture has a 90% reduction in

greenhouse gases when compared to traditional fossil fuel derived

feedstock.

In terms of governance we, as a board, continue to believe in a

straight forward approach to accounting and that a prudent and

conservative attitude serves the Company and shareholders alike.

Each year has its challenges and its successes and adjusting profit

for the trials and tribulations of that year has not seemed

appropriate to this board and for a capital intensive business

adding back costs such as depreciation (by use of, for example,

EBITDA as a performance measure) is, we believe, to ignore an

important charge on profit. Our key performance measures are

turnover, profit before tax and cash generation.

Outlook

Post-Brexit trading began in January and though our exports are

duty free into Europe there was considerable early disruption.

There was confusion among freight forwarders, border control and

customers alike and there were inescapable delays. Customers, in

particular, were unprepared and confused by VAT procedures in their

jurisdictions. The situation has improved considerably but there

remain some issues such as EU sourced goods that are re-exported

and attract import duty. The tumult in international sea freight

noted in our Trading Update on 1 February 2021 has reduced but

remains challenging.

We have recently supplied flooring to the Serum Institute of

India in Pune for expansion of production of the Astra Zeneca

AZD1222 vaccine and the ongoing roll out of the UK vaccination

program offers the prospect of a high degree of normality returning

to our home market and our production process. However, we operate

in a global economy and the challenges of disruption continue in

many regions. The situation in our biggest export market, Europe,

remains under review as the Covid-19 virus continues to affect many

countries with restrictions on movement of various degrees and

duration. It remains the case that business is very far from

normal. Another example is the "lightning" lockdown in Victoria,

Australia during the Melbourne Open tournament which closed our

facility in that state.

In recent months there have been shortages of basic raw

materials that, in conjunction with employee absenteeism, have

disrupted our production. There have been increases in the cost of

materials which in themselves present challenges but availability

is more problematical. These shortages, bordering on supplier

rationing, continue but it is encouraging that production has been

and continues to be able to fulfill all confirmed orders.

Having noted these adversities, demand remains consistently

solid. Projects such as the new Macau Wholesale Market and the Van

der Valk hotels in the Netherlands are just two examples of recent

projects. We have continued confidence in the performance of our

businesses in the second half of our financial year.

Anthony Wild

Chairman

31 March 2021

Consolidated Income Statement

for the half-year ended 31 December 2020

Half-year Half-year Year

ended ended ended

31.12.20 31.12.19 30.06.20

GBP'000 GBP'000 GBP'000

Revenue 130,447 130,391 238,630

============ ============ ===========

Operating profit 26,232 25,258 44,135

Finance income 33 243 382

Finance cost (277) (351) (660)

Profit before income tax 25,988 25,150 43,857

Income tax expense (5,639) (5,389) (9,502)

Profit for the period 20,349 19,761 34,355

============ ============ ===========

Earnings per ordinary share of 5p:

-basic 9.8p 9.5p 16.5p

-diluted 9.8p 9.5p 16.5p

All amounts relate to continuing operations.

Details of dividends paid and declared/proposed are given in

note 4.

Consolidated Balance Sheet

as at 31 December 2020

Half-year Half-year Year

ended ended ended

31.12.20 31.12.19 30.06.20

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 38,302 37,759 38,520

Right of use assets 7,799 7,103 5,872

Intangible assets 3,232 3,232 3,232

Deferred tax assets 2,568 3,179 4,334

-------------- ---------- ----------

51,901 51,273 51,958

-------------- ---------- ----------

Current assets

Inventories 61,861 67,180 68,542

Trade and other receivables 28,257 25,962 28,361

Derivative financial instruments 1,097 1,218 73

Cash and cash equivalents 74,445 64,332 67,445

-------------- ---------- ----------

165,660 158,692 164,421

-------------- ---------- ----------

Total assets 217,561 209,965 216,379

Current liabilities

Trade and other payables 54,006 50,643 47,444

Derivative financial instruments 1,791 290 883

Current income tax liabilities 1,461 740 773

Lease liabilities 3,496 2,774 2,568

-------------- ---------- ----------

60,754 54,447 51,668

-------------- ---------- ----------

Non-current liabilities

Retirement benefit obligations 13,446 19,354 23,216

Other payables 455 400 449

Lease liabilities 4,428 4,480 3,371

Preference shares 200 200 200

-------------- ---------- ----------

18,529 24,434 27,236

-------------- ---------- ----------

Total liabilities 79,283 78,881 78,904

-------------- ---------- ----------

Net assets 138,278 131,084 137,475

============== ========== ==========

Equity

Equity share capital 10,407 10,407 10,407

Equity share capital (B shares) 160 160 160

-------------- ---------- ----------

10,567 10,567 10,567

Share premium account 4,072 4,044 4,072

Capital redemption reserve 1,174 1,174 1,174

Currency translation reserve 5,688 4,338 5,601

Hedging reserve (200) 225 (37)

Retained earnings 116,977 110,736 116,098

Total equity attributable to shareholders of the parent 138,278 131,084 137,475

============== ========== ==========

Consolidated Cash Flow Statement

for the half-year ended 31 December 2020

Half-year Half-year Year

ended ended ended

31.12.20 31.12.19 30.06.20

GBP'000 GBP'000 GBP'000

Profit for the period 20,349 19,761 34,355

Income tax expense 5,639 5,389 9,502

---------- ---------- ----------------

Profit before income tax 25,988 25,150 43,857

Finance cost 277 351 660

Finance income (33) (243) (382)

Operating profit 26,232 25,258 44,135

Depreciation of property, plant & equipment 1,738 1,650 3,185

Depreciation of right of use assets 1,485 1,487 2,937

Profit on sale of plant and equipment (34) (6) (43)

Defined benefit pension scheme service cost 245 318 611

Defined benefit pension scheme employer contributions paid (3,080) (1,074) (4,138)

Change in fair value of financial instruments (654) (344) 14

Share based payments 4 7 13

Decrease in inventories 6,488 1,044 1,717

(Increase)/decrease in trade and other receivables (865) 5,685 4,388

Increase/(decrease) in trade and other payables 8,286 (5,657) (10,450)

Cash inflow from operations 39,845 28,368 42,369

Taxation paid (4,520) (7,973) (11,566)

Cash inflow from operating activities 35,325 20,395 30,803

---------- ---------- ----------------

Purchase of property, plant and equipment (1,649) (2,479) (4,215)

Proceeds from disposal of property, plant and equipment 52 32 110

---------- ---------- ----------------

Cash outflow from investing activities (1,597) (2,447) (4,105)

---------- ---------- ----------------

Interest received 33 243 382

Interest paid (15) (11) (30)

Lease interest paid (82) (110) (202)

Lease capital paid (1,424) (1,335) (2,873)

Equity dividends paid (25,237) (20,813) (25,236)

Shares issued - - 28

---------- ---------- ----------------

Cash outflow from financing activities (26,725) (22,026) (27,931)

---------- ---------- ----------------

Net increase/(decrease) in cash and cash equivalents 7,003 (4,078) (1,233)

---------- ---------- ----------------

Effect of exchange differences (3) (254) 14

Cash and cash equivalents at start of period 67,445 68,664 68,664

Cash and cash equivalents at end of period 74,445 64,332 67,445

========== ========== ================

Consolidated Statement of Comprehensive Income

for the half-year ended 31 December 2020

Half-year Half-year Year

ended ended ended

31.12.20 31.12.19 30.06.20

GBP'000 GBP'000 GBP'000

Profit for the period 20,349 19,761 34,355

---------- ---------- ----------

Other comprehensive income net of tax:

Remeasurement of the net defined benefit liability 5,763 (247) (5,062)

Foreign currency translation differences 87 (927) 336

Fair value movements on hedging instruments (163) 246 (16)

Other comprehensive income for the period net of tax 5,687 (928) (4,742)

Total comprehensive income for the period 26,036 18,833 29,613

========== ========== ==========

Attributable to equity holders of the parent 26,036 18,833 29,613

------- ------- -------

Notes to the Interim Results

for the half-year ended 31 December 2020

1. Basis of preparation

The interim financial statements are unaudited and do not constitute statutory accounts as

defined within the Companies Act 2006.

The principal accounting policies applied in the preparation of the consolidated interim statements

are those set out in the annual report and accounts for the year ended 30 June 2020.

The figures for the year ended 30 June 2020 are an abridged statement of the group audited

accounts for that year. The financial statements for the year ended 30 June 2020 were audited

and have been delivered to the Registrar of Companies.

As is permitted by the AIM rules, the directors have not adopted the requirements of IAS 34

'Interim Financial Reporting' in preparing the interim financial statements. Accordingly the

interim financial statements are not in full compliance with IFRS.

2. Taxation

Income tax has been provided at the rate of 21.7% (2019: 21.4%).

3. Earnings per share

Half-year Half-year Year

ended ended ended

31.12.20 31.12.19 30.06.20

GBP'000 GBP'000 GBP'000

Profit for the period 20,349 19,761 34,355

--------------- --------------- --------------

Weighted average number of shares in issue 208,141,108 208,131,108 208,135,698

Dilution effect of outstanding share options 125,225 152,678 148,358

Diluted weighted average number shares 208,266,333 208,283,786 208,284,056

Basic earnings per 5p ordinary share 9.8p 9.5p 16.5p

Diluted earnings per 5p ordinary share 9.8p 9.5p 16.5p

4. Dividends

Half-year Half-year Year

ended ended ended

31.12.20 31.12.19 30.06.20

GBP'000 GBP'000 GBP'000

Equity dividends paid:

Final dividend for the year ended 30 June 2019 - 20,813 20,813

Interim dividend for the year ended 30 June 2020 4,423 - 4,423

Final dividend for the year ended 30 June 2020 20,814 - -

25,237 20,813 25,236

---------- ---------- ----------

Equity dividends declared/proposed after the end of the period

Interim dividend 8,846 4,423 4,423

Final dividend - - 20,814

Equity dividends per share, paid and declared/proposed are as

follows:

10.00p final dividend for the year ended 30 June 2019, paid on 6 December 2019

2.125p first interim dividend for the year ended 30 June 2020, paid on 5 June 2020

2.125p second interim dividend for the year ended 30 June 2020, paid 10 September 2020

10.00p final dividend for the year ended 30 June 2020, paid on 11 December 2020

4.25p interim dividend for the year ended 30 June 2021, payable on 4 June 2021, to those shareholders

on the register at the close of business on 7 May 2021.

6. Copies of the interim results

Copies of the interim results have been sent to shareholders who requested them. Further copies

can be obtained from the Company's registered office, Beechfield, Hollinhurst Road, Radcliffe,

Manchester, M26 1JN and on the Company's website at www.jameshalstead.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SDSEFSEFSEED

(END) Dow Jones Newswires

March 31, 2021 02:00 ET (06:00 GMT)

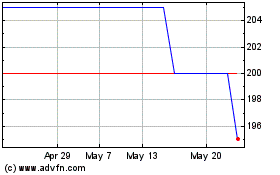

James Halstead (AQSE:JHD.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

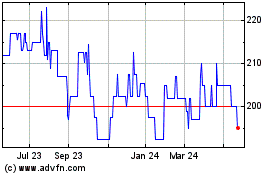

James Halstead (AQSE:JHD.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024