TIDMJHD

RNS Number : 6743A

James Halstead PLC

01 October 2020

1 October 2020

JAMES HALSTEAD PLC

PRELIMINARY ANNOUNCEMENT OF AUDITED RESULTS

FOR THE YEARED 30 JUNE 2020

"It was the best of times (in the first three quarters), it was

the worst of times (in the last quarter). A creditable

performance."

Key Figures

-- Revenue at GBP238.6 million (2019: GBP253.0 million)

- down 5.7%

-- Profit before tax GBP43.9 million (2019: GBP48.3 million)

- down 9.2%

-- Earnings per 5p ordinary share of 16.5p (2019: 18.2p)

- down 9.3%

-- Final dividend per ordinary share proposed of 10.0p

(2019: 10.0p) which with the interim dividends of 4.25p

(2019: 4.0p) takes the total dividend to 14.25p (2019:

14.0p) - an increase of 1.8% and once again a record

dividend

-- Cash GBP67.4 million (2019: GBP68.7 million)

Mr Mark Halstead, Chief Executive, commenting on the results,

said :

" In a year that was on track to be our best ever, the global

pandemic challenged our teams across the world and it is pleasing

to note that we were not found wanting. We undertook many notable

projects as diverse as the renovation of Moscow subway trains and

NATO barracks in Lithuania. The year started with dealing with the

effects of a major production line breakdown through to a record

half year in terms of sales and profit followed by a final three

months of pandemic disruption. Against the backdrop I rate our

team's performance as five star."

Enquiries:

James Halstead:

Mark Halstead, Chief Executive Telephone: 0161 767 2500

Gordon Oliver, Finance Director

Hudson Sandler:

Nick Lyon Telephone: 020 7796 4133

Nick Moore

Panmure Gordon (NOMAD & Joint Broker):

Dominic Morley Telephone: 020 7886 2500

WH Ireland (Joint Broker):

Ben Thorne / Chris Hardie Telephone: 0207 220 1666

CHAIRMAN'S STATEMENT

Results

For the first time in over a generation we are not reporting

record earnings per share.

Turnover for the year at GBP238.6 million (2019: GBP253.0

million) is some 5.7% below last year with the period April through

to June 2020 showing significant decline as the global lockdown

initiatives curtailed normal business with most of our businesses

worldwide resulting in profit before tax at GBP43.9 million (2019:

GBP48.3 million), down 9.2%. Perhaps it is worth noting that

extrapolating the numbers based on performance for the first nine

months we reasonably would have expected turnover to have been

circa GBP25 million higher and profits some GBP7 million

higher.

In reporting these figures we have, as a board, considered our

approach and actions in the difficult months of the lock-downs that

were thrust upon most of our businesses and asked what we should

have done differently. In short, even with hindsight, we as a board

feel the decisions and actions were correct and that the depth and

quality of our senior teams' experience proved, once again, our

capability and resilience.

Crucially in February and March we refocused production on the

assumption of excess healthcare demand and concentrated on

maintaining output whilst altering working practices to minimise

risk to our employees.

These results are more than gratifying against the backdrop that

all our major markets faced.

Our business was awarded the title Contract Flooring

Manufacturer of the year, gratifying as the voting is by the floor

laying contractors that install our products.

The company and our strategy

James Halstead plc is a group of companies involved in the

manufacture and supply of flooring for commercial and domestic

purposes, based in Bury UK. James Halstead plc has been listed on

the London Stock Exchange for more than 70 years.

The group was established in 1914 and continues to operate out

of the original premises in Bury. In its factories in Bury and

Teesside it manufactures resilient flooring for distribution in the

UK and worldwide.

The company's strategy is to enhance the brand identity thereby

generating and enhancing goodwill and customer satisfaction with

the aim of achieving repeat business. This approach is designed to

increase revenue and consequently profitability and cash flow to

enable the continuation of dividends thereby creating shareholder

wealth. As a manufacturer our supply is in bulk to distributors

responsible for regional and local delivery. Key to the company

ethos is having dedicated sales personnel to present our product to

end users and specifiers rather than to delegate the representation

of products to stockists. Our businesses are totally flooring

focused and by far and away the majority of this flooring is

commercial.

Over many years our strategy has also included a policy of

continual investment in both process improvement and in product

development to improve output efficiency and product offering.

Corporate governance and corporate social responsibility

The Board has over many years recognised its responsibility

towards good corporate governance. It is part of our character and,

I believe, contributes to our ability to deliver long-term

shareholder value. Increasingly companies are, quite rightly,

tasked with demonstrating their environmental credentials, supply

chain management with social and economic dimensions and

stewardship.

Polyflor is certified to Quality Management System ISO9001 and

ISO14001 to underline our robust environmental procedures. We are

certified to BES9001 the standard for responsible sourcing which

takes our credentials beyond our own factories to our suppliers.

Added to this is our SA8000 accreditation based on the UN

declaration of human rights that audits supplier provision of sound

workplace and standards. Our commitment to our employees continues

and this year saw one of our shop floor workers achieve the

milestone of 50 years with the business.

We continue to be active members of trade bodies that bring

standards across the industry for example the European Resilient

Flooring Manufacturing Institute ERFMI (where our Technical

Director is President). We publish, annually, a sustainability

report, although given the disruption of the recent few months it

will be a much briefer interim report.

Dividend

Profits and earnings per share have slightly decreased but we

continue un-geared. Our cash balances stand at GBP67.4 million

(2019: GBP 68.7 million), even after dividends paid in the last

year that amounted to GBP25.2 million, increased pension scheme

payments of GBP4.1m and taxation of GBP11.6 million. Our cash

reserves continue as the foundation of our strong balance sheet. I,

and the Board, believe that the work done on control of working

capital during the final quarter of the year was sterling.

It is pleasing to report that the Board proposes at this point,

and subject to the approval of the shareholders at the upcoming

AGM, to pay a final dividend. The final dividend will be 10.0p

(2019: 10.0p). This, combined with the interim dividends paid in

June and September totalling 4.25p (2019: 4.0p), makes a total of

14.25p (2019: 14.0p) for the year, an increase of 1.8%.

This is, yet again, a record level of dividend.

Acknowledgements

My thanks go to our staff in the UK and around the world whose

hard work continues to allow us to increase our business. This year

has been particularly challenging as we all faced uncertainties and

a particular mention to those who have worked hard on the

safeguards we have. I would also like to thank two of our

competitors (Altro Group plc and Amtico International Ltd) for

their assistance with PPE during the lockdown period.

Outlook

Currently, some three months into the new trading year, our

sales are on a par with the record trading of the comparative

period. Business has bounced back with refurbishment in many

sectors buoyant, but with difficulties in sectors such as

catering/hospitality.

Looking ahead there are two external factors that cloud a clear

view of the current year - the pandemic and the final exit of the

UK from the European Union. There are many reasons to believe that

a second wave of the virus will not lead to a second major lock

down - better knowledge and treatments within healthcare, greater

awareness of social distancing and greater testing capability. That

said the effects of targeted lockdowns does mean uncertainty is

ongoing and we cannot say that the worst is past.

Despite these doubts I can only be confident of continued

progress in the coming year.

Both these issues will, no doubt, have an impact on the

forthcoming financial year but, I believe, we have the experience

and ability to move forward with confidence.

Healthcare has always been an area of core competence for our

businesses and alongside the urgent demands of our NHS we have

supplied flooring to 12 modular hospitals in Argentina, 13

hospitals in Mexico and 11 hospitals in South Africa. The pandemic

tested supply chains but across the globe we have supplied from our

stock-holdings. Notwithstanding these sales our business has

suffered as building projects are delayed and it is far from

business as usual in many parts of the world.

I, and the Board, are confident of another solid year tempered

by the uncertainties that currently abound.

Anthony Wild

Chairman

CHIEF EXECUTIVE'S REVIEW

At this time last year, we thought the major challenge would be

the fast approaching implications of "Brexit", but we were tasked

with something on a different scale entirely.

We drew on a wealth of experience to protect our company, our

leading market position and our stakeholders. In most markets we,

as manufacturers, deliver bulk for wholesalers and distributors who

in turn break that bulk. Many of our distributors were closed and

thus we faced the challenge of organising and fulfilling much

smaller despatches to health providers across the UK, Europe and

the rest of the world. In this task we were successful.

Worthy of note were the various government funding initiatives

that were put in place across many markets. At the start of the

lockdowns we assessed liquidity and debtor risk as major issues but

these did not, by and large, transpire. The contrast with the 2008

recession was stark and it can only be said that various government

initiatives appeared to have been a success in the continuity of

liquidity. In terms of our sector, flooring, we were well aware of

the types of flooring that would be in immediate demand for the

healthcare sector, not least because of our prior experience during

the SARS-Cov-1 outbreak many years ago.

Turnover at GBP238.6 million (2019: GBP253.0 million) was 5.7%

down on the year. The UK sales at GBP78.9 million (2019: GBP88.6

million) were 10.9% below last year. Overseas sales were 2.9% below

last year. The shortfalls all came in the period April to June

2020.

Profit before tax at GBP43.9 million (2019: GBP48.3 million) was

9.2% below last year and though we traded profitably in the period

April to June 2020 the shortfall in turnover inevitably lead to a

major fall in profits.

It has been many years since we have seen profits fall, but

these were far from normal times. I am very encouraged by the

actions and efforts of our key staff during those difficult weeks

when the news seemed to get progressively worse. Our focus was to

protect our workforce and our company and to continue to supply our

global market. To date we have succeeded.

Reviewing the businesses in more detail:

Objectflor / Karndean and James Halstead France, our European

operations

Sales overall were slightly behind the prior year by 2.7% which

also had an impact on profitability. The area of slowdown can be

ascribed to the pandemic as there was a downturn in retail shop

fitting in terms of refurbishment and new store openings. The

business supplies a number of "private-label" collections to

various buying groups which are refreshed on a two/three year cycle

and, consequently, sales in these ranges reduced as the ranges

approach re-launch in the coming financial year. Our own branded

ranges however showed increases in sales. There were several

product launches in the year including Expona Simplay 19dB and

Expona Puzzle (an interlocking tile) both of which are loose lay

products (ie not requiring glue). Loose lay flooring is seen as a

growth area and we have developed over the last years a

comprehensive offering in this area. These projects included the

World Fashion Center in Amsterdam and Le Théatre des Folies

Bergère, Paris.

Alongside expansion of the vinyl ranges we have launched a range

of carpet tiles in these markets branded as Expona. This range

closely aligns with our LVT ranges and will act as both

complementary sales as well as new market segments. Our Expona

carpet tiles have been installed in the Friedrich-Ebert-Allee in

Bonn which is a very high profile office development that includes

retail space and a museum. Another example of Expona carpet are the

Mima Furniture Stores in Croatia.

Furthermore, the Saarflor (rubber sheet) range has been updated

and is being sold across the European markets. Polyflor sheet vinyl

sales continue to grow with Polyflor "Trend" fitted in many

branches of Toys "r" Us across Germany and "Palettone" installed at

Kliniken der Stadt Köln-Merheim (municipal hospitals of the City of

Cologne in the district of Merheim).

Geographically, prior to the crisis most of the markets were

showing performance ahead of the prior year, most significantly

growth was experienced in France and Eastern markets with Germany

and Austria performing well. Different markets had different levels

of lock down of which France and Austria were the most significant.

In France our route to market is generally through distribution and

these outlets tend to also sell paint and the majority remained

open and instigated "click and collect" which reduced the downside

of the lockdown to our trade. Our French business continues to

secure prestigious clients of which just one example is the Nestl é

Waters headquarters is Issy-les-Moulineaux. The central European

markets have recovered well following release of the restrictions

and in France we are seeing the start of enquiries in advance of

the 2024 Paris Olympics though it is noticeable that larger

projects in general are being delayed.

Polyflor Pacific - encompassing Australia, New Zealand and

Asia

Turnover in the region was down 4% at constant exchange rates

(7% down when foreign exchange movements are included). Profit was

however 11% ahead of last year as a result of a better mix of sales

and strong control of costs.

Our Australian business faced a series of issues during the

course of the year including bush fires that were widespread in the

most populous states, an ongoing drought that severely impacted the

New South Wales economy, a relatively weak economy and the

significant depreciation of the Australian dollar against the US

dollar. In addition, of course, the pandemic. Furthermore, the

plant breakdown in Radcliffe affected supply of stock for some time

during the mid-part of the financial year. Sales in Australia have

fallen slightly against the prior year (3.7%) although increased

margins coming from sales mix and lower costs has resulted in

slightly higher profits. A particularly creditable result given the

list of adversities.

The Australian business has continued to operate throughout the

period and managed to continue to supply despite the various local

restrictions that were in place. As with a number of our businesses

good levels of local stock assisted in us being able to take

opportunities from competitors where they were unable to supply,

either because of issues within their supply chain or them having

closed their operations. Polyflor (UK) continued despatches to

Australia and New Zealand at normal levels in spite of the local

lockdowns in anticipation that sales would quickly return to normal

due to the majority of sales being refurbishments.

Our Australian business is strong both in the commercial and

domestic sectors, and we have found that softening in the

commercial markets has been offset by stronger domestic demand,

which is thought, partly at least, to be a factor of travel

restrictions meaning people taking fewer holidays and, instead,

investing in their own property. The team have updated the local

website and complemented this with new social media platforms

whilst revamping the sampling processes across the continent and

increasing sales representation in New South Wales and South

Australia.

The New Zealand business, under new local management from the

latter quarter of last year has shown significant growth in sales

and profit for the first three quarters of the year. The business

was closed for a seven week period during which New Zealand's

commercial activities were forced to cease. New Zealand faced the

most stringent lockdown of any market in which we operate. Some

government support was received in this period which, combined with

savings in overheads, has eased the impact on profit which came

from low sales activity. Sales ended up lower than the prior year

as a result of this, however post lockdown activity levels are

showing good recovery. Despite this, profits for the full year were

noticeably higher.

Towards the end of the year we re-secured the Kianga Ora (New

Zealand's social housing provider) contract for a period of four

years. This project takes product manufactured in our Manchester

plant.

We continue to increase our sales resource in several of the

Asian markets, including Indonesia, Malaysia and Singapore whilst

also investing in more localised stocks. A warehouse has been

established in Shanghai during the year to service the market

locally. This initiative is in its infancy. Early signs suggest

that it is having a positive impact on sales overall. Our social

media and marketing are also being developed to be more localised

in nature to facilitate a better understanding of our offering in

these markets. China continues to be an important market but with

the competitive situation there as rigorous as ever.

Polyflor & Riverside Flooring, based in UK

Turnover for the year was 7.2% below the prior year comparative

and profit was 12% down. The loss of turnover and increased cost of

working in the period of the UK lockdown is the causal factor

behind these results. Looking at the turnover in more detail the UK

turnover was down 10.9% against the prior year, sales from Polyflor

to our overseas subsidiaries were level with the prior year and

exports to third parties were 2.7% down. The closure by lockdown of

the UK and several of our major customers was the reason for the

decline. Extrapolating the period to the end of March we were

expecting about 8-10% growth.

Polyflor is the engine behind the growth of our UK and overseas

trade and there were several major product launches in the course

of the year which, I believe, underline our market leading

position. In August 2019 the Expona Design collection was

re-launched with 24 new innovative designs of heavy duty commercial

luxury vinyl tiles. These ranges have exceeded expectations for

increased sales.

I would also note that the new ranges that we brought to market

in the early months of 2019 have also proved to be very successful.

Firstly, Polysafe Quicklay, a vinyl sheet that can be installed

without adhesive (even on damp sub-floors) has been very well

received and was the floor of choice for very many of the

healthcare initiatives during the early stages of the pandemic and

indeed broadened greatly the general acceptance by the conservative

floor layers of a "glue - free" installation. In addition, Expona

EnCore Rigid loc, our commercial luxury tile that is also adhesive

free has been very successful and featured in some depth in the BBC

renovation show "Your Home Made Perfect". It is clear that quality

commercial flooring can gain market share in the domestic market,

though our focus remains in the commercial sector. Projects of note

in the year include Ibrox Stadium refurbishment, Knock Airport in

County Mayo and Glenfield Hospital in Leicester.

As noted in last year's report the Radcliffe factory suffered a

major breakdown in June 2019 that closed one of our four production

lines. This ceased supply from that line for some 12 weeks into the

current year and whilst the management team tried to manage stock

and the adverse effects on sales there were projects that we lost

most noticeably in export markets and in particular our Australian

subsidiary.

Riverside, the manufacturing facility at Teesside saw sales of

its product increase during the year by more than 10% and reported

an increase in profits. The Polyflor sales team in Oldham have

marketed and shipped the Riverside portfolio to an increasing

number of countries despite the UK sales being decimated by the UK

lockdown. A commendable result.

The lockdown of the UK from late March 2020 was a major focus of

efforts in the year. Our production by-and-large continued but it

was at increased cost due to the lower output and ancillary

costs.

Polyflor Nordic comprising Polyflor Norway based in Oslo and

Falck Design based in Sweden

Sales across this region are broadly comparable with those of

the prior year in what has been a difficult year in both markets.

Business continued to be soft however a few individually

significant projects were delivered. Sales mix is weighted more

towards our own product suite through the trading year, and whilst

this has the consequence of reducing margins locally it is more

beneficial to the group as a whole.

Although there were restrictions regarding the national response

to the pandemic in Norway the business remained open throughout. To

keep their economy more active, restrictions in Sweden were less

severe however some negative commercial impacts came later in the

year as the economy and refurbishment slowed. There were many

education projects in Sweden with examples being Orkerstern School,

and the Svärtingeschool . Across the Scandinavian region,

competitors had problems supplying some specifications to the

advantage of our businesses where we were able to supply from

stocks locally or from the UK. This is a trend that has continued

into the new financial year.

Polyflor Canada, based in Toronto

As has been the case every year since the business was

established, we have increased sales, with a further 6.2% added

this year compared to the last. The growth continues to come from

the territories in which we have our own dedicated sales force,

those being Ontario, British Columbia and Ottawa.

As the business supplies the healthcare sector it was able to

remain open as an essential supplier and continue to operate during

the period of restrictions in Ontario. Healthcare and education

remain key sectors for this business selling our core ranges of

products. Sales of luxury vinyl tiles have also increased

significantly over the period in what is a very competitive market.

Our product offerings are attractive given the quality of designs

and product presentation. The City of Orillia Public Library,

Trattoria Nervosa Kitchen in Toronto and Loblaw's Toronto

headquarters are examples of key projects supplied in the year.

Polyflor India, based in Mumbai

The trend of increasing growth since the inception of this

business came to an end during the year with project specifications

facing delays / funding problems and failing to materialise as

sales.

The slowdown was compounded by the effects of the pandemic that

effectively closed the business operations for a three month

period. The majority of sales are new projects and our business in

India has a far lower level of refurbishment than any other market

in which we operate. Sales have therefore retrenched significantly

in this current period and we pared back some of the operations

accordingly. Notwithstanding these issues projects completed

included Johnson & Johnson Pharma in Mumbai and Mark &

Space Telesystems, Gurgaon.

Several significant projects have been delivered post year end

in the healthcare and pharmaceutical sectors, including material

for a manufacturing plant that will be producing one of the leading

vaccines currently being trialled.

Rest of the World

The Polyflor export and marketing offices, based in Royton,

continue to support our international businesses and to directly

sell via a global network of representatives, agents and

distributors.

During the year the export team and our Pacific Asia team have

worked hard to increase our presence in the Far East. We have added

dedicated sales representatives in Malaysia, Indonesia and

Singapore working close with the long established Polyflor Hong

Kong and reporting to the regional director in Australia. A major

programme of presentations across the regions has re-invigorated

the many contactors and architects we have dealt with over the

years and presented the company and its products to a much wider

audience. With Facebook and Instagram accounts added for Malaysia,

Thailand, Vietnam Singapore, Indonesia and Tawain and the

Philippines. In addition, our corporate websites have been

re-vamped and social media sites for Wechat, Weibo and LinkedIn are

all adding to the business and feeding enquires.

Our first full year with a sales office in Bogota, Colombia has

seen good progress with projects across the region including

Argentina, Chile, Brazil and Mexico. The team have not only

increased the support to existing distributors in the region but

also brought new opportunities and contacts with projects such as

the Industrial Hospital Medical Centre in Puerto Rica.

Other local representatives working locally but reporting to

Polyflor continue to represent us in Romania, Indonesia, the Czech

Republic and Hungary. Project Livesport in Prague being just one

example. In March, we appointed an experienced Spanish sales

manager, who is already securing Polyflor specifications not only

in Spain but in other Spanish speaking countries. The

representative office in the Middle East is now underpinned with

stock warehoused in the United Arab Emirates and supporting

increased business in Dubai, Oman, Qatar and Saudi Arabia. During

the year we supplied six emergency hospitals in the UAE, three more

in Qatar and four in Jordan.

The 100,000 square metres of Polyflor Voyager XL that was

shipped to refurbish the Moscow subway trains was a notable

project. This subway is the fourth longest in the world with some

seven million daily users. In addition the supply of Palettone to

the National Hospital of Iceland in Landspitali was also of

note.

In conclusion

I, and the Board, are confident of another solid year tempered

by the uncertainties that currently abound.

In several markets there is general sentiment that the cost of

the recent months will lead to economic slowdown, business closures

and increased unemployment. That said we have seen a very sharp

return to prior levels which may, in part, be pent-up demand but

equally there is demonstrable evidence of ongoing demand where

there are buoyant sectors such as modular buildings.

Mark Halstead

Chief Executive

Audited Consolidated Income Statement

for the year ended 30 June 2020

Year Year

ended ended

30.06.20 30.06.19

GBP'000 GBP'000

Revenue 238,630 253,038

Cost of sales (138,262) (144,236)

----------------- -----------------

Gross profit 100,368 108,802

Selling and distribution costs (45,297) (49,149)

Administration expenses (10,936) (11,279)

Operating profit 44,135 48,374

Finance income 382 357

Finance cost (660) (455)

Profit before income tax 43,857 48,276

Income tax expense (9,502) (10,484)

Profit for the year attributable to equity shareholders 34,355 37,792

----------------- -----------------

Earnings per ordinary share of 5p:

-basic 16.5p 18.2p

-diluted 16.5p 18.2p

All amounts relate to continuing operations.

Audited Consolidated Balance Sheet

as at 30 June 2020

As at As at

30.06.20 30.06.19

GBP'000 GBP'000

Non-current assets

Property, plant and equipment 38,520 37,449

Right of use assets 5,872 -

Intangible assets 3,232 3,232

Deferred tax assets 4,334 3,261

---------- --------------------

51,958 43,942

---------- --------------------

Current assets

Inventories 68,542 69,921

Trade and other receivables 28,361 32,816

Derivative financial instruments 73 372

Cash and cash equivalents 67,445 68,664

---------- --------------------

164,421 171,773

---------- --------------------

Total assets 216,379 215,715

---------- --------------------

Current liabilities

Trade and other payables 47,444 58,354

Derivative financial instruments 883 684

Current income tax liabilities 773 3,419

Lease liabilities 2,568 -

51,668 62,457

---------- --------------------

Non-current liabilities

Retirement benefit obligations 23,216 19,582

Other payables 449 419

Lease liabilities 3,371 -

Preference shares 200 200

---------- --------------------

27,236 20,201

---------- --------------------

Total liabilities 78,904 82,658

---------- --------------------

Net assets 137,475 133,057

---------- --------------------

Equity

Equity share capital 10,407 10,407

Equity share capital (B shares) 160 160

---------- --------------------

10,567 10,567

Share premium account 4,072 4,044

Capital redemption reserve 1,174 1,174

Currency translation reserve 5,601 5,265

Hedging reserve (37) (21)

Retained earnings 116,098 112,028

Total equity attributable to shareholders of the parent 137,475 133,057

---------- --------------------

Audited Consolidated Cash Flow Statement

for the year ended 30 June 2020

Year Year

ended ended

30.06.20 30.06.19

GBP'000 GBP'000

Profit for the year attributable to equity shareholders 34,355 37,792

Income tax expense 9,502 10,484

---------- -------------------

Profit before income tax 43,857 48,276

Finance cost 660 455

Finance income (382) (357)

---------- -------------------

Operating profit 44,135 48,374

Depreciation of property, plant and equipment 3,185 3,105

Depreciation of right of use assets 2,937 -

(Profit)/loss on sale of plant and equipment (43) 16

Defined benefit pension scheme service cost 611 564

Defined benefit pension scheme employer contributions paid (4,138) (1,780)

Change in fair value of financial instruments 14 281

Share based payments 13 11

Decrease in inventories 1,717 1,449

Decrease/(increase) in trade and other receivables 4,388 (621)

(Decrease)/increase in trade and other payables (10,450) 9,033

Cash inflow from operations 42,369 60,432

Taxation paid (11,566) (10,487)

Cash inflow from operating activities 30,803 49,945

---------- -------------------

Purchase of property, plant and equipment (4,215) (4,263)

Proceeds from disposal of property, plant and equipment 110 107

---------- -------------------

Cash outflow from investing activities (4,105) (4,156)

---------- -------------------

Interest received 382 357

Interest paid (30) (33)

Lease interest paid (202) -

Lease capital paid (2,873) -

Equity dividends paid (25,236) (28,405)

Shares issued 28 247

---------- -------------------

Cash outflow from financing activities (27,931) (27,834)

---------- -------------------

Net (decrease)/increase in cash and cash equivalents (1,233) 17,955

---------- -------------------

Effect of exchange differences 14 30

Cash and cash equivalents at start of period 68,664 50,679

Cash and cash equivalents at end of period 67,445 68,664

========== ===================

Audited Consolidated Statement of Comprehensive Income

for the year ended 30 June 2020

Year Year

ended ended

30.06.20 30.06.19

GBP'000 GBP'000

Profit for the year 34,355 37,792

----------- -----------

Other comprehensive income net of tax:

Items that will not be reclassified subsequently to the income statement:

Remeasurement of the net defined benefit liability (5,062) (4,546)

----------- -----------

(5,062) (4,546)

----------- -----------

Items that could be reclassified subsequently to the income statement:

Foreign currency translation differences 336 (170)

Fair value movements on hedging instruments (16) (689)

----------- -----------

320 (859)

----------- -----------

Other comprehensive income for the year (4,742) (5,405)

Total comprehensive income for the year 29,613 32,387

=========== ===========

Attributable to equity holders of the

Company 29,613 32,387

=========== ===========

Items in the statement above are disclosed net of tax.

NOTES

1. The final dividend of 10.0p per ordinary share will be paid, subject to the approval of the

shareholders, on 11 December 2020 to shareholders on the register as at 20 November 2020.

The annual report and accounts will be posted to shareholders on 16 October 2020.

2. The financial information in this statement does not represent the statutory accounts of the

Group. Statutory accounts for the year ended 30 June 2019 have been delivered to the Registrar

of Companies, carrying an unqualified audit report and no statement under section 498 (2)

or (3) of the Companies Act 2006.

3. Statutory accounts for the year ended 30 June 2020 have not yet been delivered to the Registrar

of Companies. They will carry an unqualified audit report and no statement under section 498

(2) or (3) of the Companies Act 2006.

4. Earnings per ordinary share

2019 2019

GBP'000 GBP'000

Profit for the year attributable to equity shareholders 34,355 37,792

-------------- --------------

Weighted average number of shares in issue 208,135,698 208,071,633

-------------- --------------

Dilution effect of outstanding share options 148,358 70,667

Diluted weighted average number of shares 208,284,056 208,142,300

-------------- --------------

Basic earnings per ordinary share 16.5p 18.2p

Diluted earnings per ordinary share 16.5p 18.2p

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR ZZGFLVGVGGZM

(END) Dow Jones Newswires

October 01, 2020 02:00 ET (06:00 GMT)

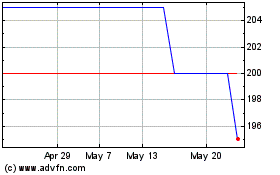

James Halstead (AQSE:JHD.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

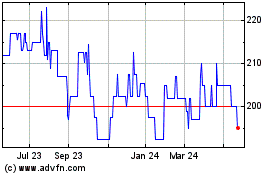

James Halstead (AQSE:JHD.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024