TIDMHSP

RNS Number : 8207T

Hargreaves Services PLC

27 July 2022

HARGREAVES SERVICES PLC

("Hargreaves" or the "Group")

Results for the year ended 31 May 2022

Hargreaves Services plc (AIM: HSP), a diversified group

delivering key services to the industrial and property sectors,

announces its results for the year ended 31 May 2022. The Group has

delivered very strong results and developed a strong platform from

which to create, deliver and realise value for shareholders.

KEY FINANCIAL RESULTS

Year ended 31 May 2022 2021

Revenue* GBP177.9m GBP204.8m

Underlying Profit Before Tax ("UPBT")** GBP32.7m GBP21.2m

Profit from joint ventures GBP28.2m GBP17.7m

Profit Before Tax from continuing GBP34.5m GBP14.4m

operations

Basic earnings per share 113.8p 50.8p

Basic underlying EPS from continuing

operations* 103.2p 70.7p

Proposed Final Dividend 5.6p 4.5p

Proposed Additional Dividend 12.0p 12.0p

Cash and cash equivalents*** GBP13.8m GBP28.3m

Net (Debt)/Cash (including leasing (GBP4.6m) GBP16.5m

debt)

Net Assets GBP183.1m GBP144.3m

Net Assets per Share 563p 447p

* Revenue reduced following exit from coal activities in 2021,

while like-for like Services revenue increased by 18.7% to

GBP162.8m (2021: GBP137.2m)

** The basis of Underlying Profit Before Tax and basic

underlying EPS is set out in Note 7

*** Excludes GBP15m loan made to HRMS, GBP12m of which was

repaid in July

.

HIGHLIGHTS

-- UPBT improved materially to GBP32.7m (2021: GBP21.2m),

including GBP28.2m (2021: GBP17.7m) contribution from joint

ventures

o German joint venture contributed GBP27.3m (2021: GBP13.6m)

benefitting from:

-- Very strong commodity market conditions

-- DK Recycling sustainable cost reductions and operational

improvements

-- Services UPBT increased to GBP7.6m from GBP5.1m as HS2 contract progresses

-- Hargreaves Land momentum continues:

o Further sales delivered at Blindwells

o GBP50m of conditional contracts exchanged at Unity JV

o Renewable energy land portfolio records first rental

incomes

-- Balance sheet free of bank debt

-- Net assets increased by 26.9% to GBP183.1m (2021: GBP144.3m)

-- Final dividend of 5.6p (2021: 4.5p) proposed, an increase of 24.4%

-- Additional dividend of 12p (2021: 12p) proposed, funded by dividend to be received from HRMS

Commenting on the preliminary results, Chairman Roger McDowell

said: "The Board has a clear, strategic investment proposition from

which to create, deliver and realise shareholder value. These

results, which include the highest level of profit recorded in

seven years, illustrate the Group's agility in taking advantage of

market conditions whilst also delivering strong, underlying and

sustainable profits. The Board is alive to current economic issues

and our balance sheet strength will serve the Group well in a

period of challenging global economic outlook."

CEO video Q&A

Your browser does not support HTML5 video.

Analyst meeting & investor presentation

A briefing for analysts will be held via Zoom at 9.30am this

morning, Wednesday 27 July 2022. Please contact Walbrook PR on 020

7933 8780 or at hargreavesservices@walbrookpr.com for further

information.

A live presentation relating to the Company's Preliminary

Results via the Investor Meet Company platform will be given by

management on Thursday 28 July 2022 at 4:30pm GMT. Investors can

sign up to Investor Meet Company for free and add to meet

Hargreaves Services via:

https://www.investormeetcompany.com/hargreaves-services-plc/register-investor

A presentation recording on the financial results and business

outlook delivered by management will be made available on the

Company's website later today, here:

https://www.hsgplc.co.uk/investors.aspx .

Enquiries:

Hargreaves Services www.hsgplc.co.uk

Gordon Banham, Group Chief Executive Tel: 0191 373 4485

John Samuel, Group Finance Director

Walbrook PR (Financial PR & IR) Tel: 020 7933 8780 or hargreavesservices@walbrookpr.com

Paul McManus/Lianne Applegarth/ Mob: 07980 541 893/07584 391 303/

Louis-Ashe-Jepson 07747 515 393

Singer Capital Markets (Nomad and Joint Corporate Tel: 020 7496 3000

Broker)

Sandy Fraser/Justin McKeegan/Rachel Hayes

Investec (Joint Corporate Broker) Tel: 020 7597 5970

Sara Hale/David Anderson/Shalin

Bhamra

Chairman's Statement

Roger McDowell, Group Chairman

Introduction

The Group performed strongly throughout the financial year

achieving a 54.2% increase in underlying profit before tax

("UPBT")* of GBP32.7m (2021: GBP21.2m). We have seen strong growth

in both our Services business, which has been buoyed by the

commencement of the HS2 contract, and the Group's investment in the

German Joint Venture ("HRMS"). Hargreaves Land continued to

progress its major developments at Blindwells and the Unity Joint

Venture whilst also seeing the first incomes arise from its

renewable asset land portfolio which promises so much potential

future value. Profit before tax from continuing operations was

GBP34.5m (2021: GBP14.4m). Basic underlying earnings per share from

continuing operations* have increased to 103.2p compared to 70.7p

in the prior year. Basic earnings per share was 113.8p (2021:

50.8p).

On behalf of the Board, I would like to thank everyone at

Hargreaves for their hard work, dedication and passion, without

which the Group would not be what it is today. Over the last few

years the Group has undertaken a dramatic strategic transformation,

which is now creating, delivering and beginning to realise

substantially increased shareholder value.

Continuing momentum

This year the Group has built strong momentum in all three

business areas of Services, Hargreaves Land and HRMS.

The Services business has started work in earnest on the major

earthmoving project at HS2, which has led to a growth in UPBT. I am

also pleased to see the expansion of our mechanical and electrical

engineering capabilities, as demonstrated by our appointment to two

major engineering contracts on HS2 collectively worth over GBP18m.

Further environmentally positive business initiatives have been

undertaken including the remediation of over 100 acres of

previously unusable former mining land in Scotland.

Strategic progress has also been seen within Hargreaves Land.

Further sales have been completed and exchanged at Blindwells and

the wider pipeline looks strong with the conditional exchange of

contracts for the development and sale of the first logistics units

at the Unity Joint Venture near Doncaster due to complete over the

coming years. The Group's value creation from its renewable land

assets has also taken a big step forward in the year as Brockwell

Energy announced they had achieved financial close on their Energy

from Waste plant, which is under construction on our Westfield

site. The first windfarm is now under construction by BayWa AG on

our site at Dalquhandy. The creation of value from our renewable

asset land portfolio over the next few years is an exciting

prospect.

The HRMS team continues to demonstrate its ability to be agile

in an ever-changing commodities market, which has allowed them to

take advantage of recent favourable pricing to deliver an excellent

profit for the year, following a very strong performance in the

prior year. Whilst the current result is pleasing, I am more

excited by the underlying and sustainable improvements made in the

steel recycling business, DK Recycling und Roheisen GmbH ("DK").

Since acquisition by HRMS in 2019, the management team has

implemented improvements to operating processes and administrative

functions which should deliver a sustainable improvement of around

EUR10m per annum compared to their pre-acquisition performance. DK

contributed approximately 43% of the HRMS result for the year.

Cash and leasing debt

The Group remains free from any bank debt and held net cash of

GBP13.8m on 31 May 2022, compared to GBP28.3m in the prior year.

This reduction is due to the decision to loan GBP15m to HRMS to

enable them to capitalise on the current trading conditions. I am

pleased to see that this funding provided to our Joint Venture has

helped to deliver substantial returns. GBP12m of this loan was

repaid in July 2022. Notwithstanding this, cash generated from

operations has been primarily invested into Hargreaves Land assets

and leased plant and equipment, principally for the HS2

contract.

The only debt held by the Group relates to specific leasing

debts for the acquisition of fixed assets. At the year end this

borrowing stood at GBP18.4m, which is an increase of GBP6.6m when

compared to 31 May 2021 due to the initial investment required to

mobilise the HS2 earthmoving contract within Services.

Dividend

The Group paid an interim dividend of 2.8p, which represented a

3.7% increase year on year. The continued strong performance of the

Group throughout the remainder of the year has enabled the Board to

announce an increase of nearly 25% to the final dividend, which is

proposed to be 5.6p (2021: 4.5p). This brings the underlying full

year dividend to 8.4p (2021: 7.2p) representing an overall increase

of 16.7%.

In addition to the final dividend of 5.6p, the Board is also

proposing an additional dividend of 12.0p per share (2021: 12.0p)

in relation to dividends to be received from previously

undistributed profits at HRMS. Combined this brings the total

dividend for the year ended 31 May 2022 to 20.4p (2021: 19.2p).

If approved at the Annual General Meeting, the final dividend of

5.6p and the additional dividend of 12.0p will be paid on 31

October 2022 to all shareholders on the register at the close of

business on 23 September 2022. The shares will become ex-dividend

on 22 September 2022.

Environmental, social and governance ("ESG")

The Group has established a cross-business working group ("ESG

Group") which is focussed on identifying the risks and

opportunities arising from climate change and other social and

governance matters. The ESG Group reports directly into the Audit

and Risk Committee and contains representatives from each aspect of

the business. I am pleased to see the high levels of engagement in

this group and the fact that the drive for sustainability is coming

from all parts of the Group.

Hargreaves has taken significant strides in the last year to

develop our Employee Assistance Programme and train our mental

health first aiders. The well-being of our employees is essential

in delivering value to all of our stakeholders. We have also

established a dedicated Corporate Social Responsibility fund for

supporting local charities and activities in which our employees

are actively involved.

Strategy and Shareholder Value

The Group remains focussed on its strategy to create, deliver

and realise value for shareholders through the three core

businesses of Services, Hargreaves Land and HRMS.

Create

The commencement of the major earthmoving contract at HS2 and

the growing mechanical and electrical capabilities of the Services

business have enabled opportunities for the Group to create value

for Shareholders. The Hargreaves Land team are creating substantial

shareholder value through the development of the renewable energy

land portfolio and HRMS continues to create value through its

ability to adapt to market conditions.

Deliver

The Services business has secured over 50 term contracts and

framework agreements and is focussed on their successful delivery.

The long term land development assets at Blindwells and Unity are

continuing to deliver returns as we are now seeing regular revenues

and profit generation. The delivery of value from the renewable

land portfolio will increase steadily over the next few years. The

transformation of the operations within DK, part of HRMS, is now

delivering recurring and more sustainable returns, enabling the

base level of profitability to be increased within HRMS.

Realise

We are increasing the underlying full year dividend by 16.7% to

8.4p in recognition of the successful delivery of the value created

within the Group. Additionally, the value within HRMS continues to

be repatriated to shareholders via the additional 12.0p annual

dividend. The Board is confident that this increase is sustainable

and fairly reflects the value that is being delivered within the

Group. Further value realisation opportunities remain in the

forefront of the Board's considerations.

Outlook

The Group now has significant momentum, which has resulted in

the highest UPBT for the Group in seven years. The Balance Sheet

remains free from bank debt and third party security and provides a

strong platform for growth allowing the Group to remain agile to

opportunities. Our net tangible assets now stand at GBP178.3m

(2021: GBP139.5m) representing 548p per share (2021: 432p).

The Board is acutely aware of the uncertainties in current

global economic outlook and has strategies in place to mitigate the

challenges of UK inflation. HRMS is also taking steps to plan for

potential threats to German energy supplies. The Board has great

confidence in the strategy and expectations for the Group's

financial performance heading into the year ending 31 May 2023.

Roger McDowell

Chairman

26 July 2022

* The basis of Underlying profit before tax and basic underlying

EPS is set out in Note 7.

Group Business Review

Gordon Banham, Group Chief Executive

CHIEF EXECUTIVE'S REVIEW

GBP'm Services Hargreaves HRMS Central Total

Land Costs

Revenue (2022) 162.8 15.1 - - 177.9

--------- ----------- ----- -------- ------

Revenue (2021) 193.0 11.8 - - 204.8

--------- ----------- ----- -------- ------

Underlying Profit/(Loss)

before Tax* (2022) 7.6 2.1 27.3 (4.3) 32.7

--------- ----------- ----- -------- ------

Underlying Profit/(loss)

before Tax* (2021) 5.1 6.3 13.6 (3.8) 21.2

--------- ----------- ----- -------- ------

Profit before tax

from continuing operations

(2022) 9.4 2.1 27.3 (4.3) 34.5

--------- ----------- ----- -------- ------

Profit before tax

from continuing operations

(2021) (1.7) 6.3 13.6 (3.8) 14.4

--------- ----------- ----- -------- ------

* The basis of Underlying Profit Before Tax is set out in Note 7

.

Services

The Services business recorded a reduction in revenue from

GBP193.0m to GBP162.8m due to the decision taken in the prior year

to cease all material coal activities, which accounted for GBP55.8m

in the year ended 31 May 2021. Like for like Services revenue has

grown from GBP137.2m to GBP162.8m, an increase of 18.7%. This

growth has predominantly come from the major earthmoving contract

on HS2, which commenced during the year.

The business unit delivered a UPBT of GBP7.6m, representing a

growth of nearly 50% over the prior year. Whilst much of this

improvement is delivered by the HS2 contract, operating margins

have also improved across the business unit from 2.6% to 4.7%,

reflecting the move away from the low margin coal activities.

In my previous report, I highlighted two specific contracts,

which were on the horizon and I would like to provide an update on

both of them.

HS2

I am pleased to report that the major earthmoving contract with

the EKFB Consortium on HS2 has begun well. We now have over 350

people working on the project, with almost 300 items of plant being

put to work. In addition to the earthmoving activities, we have

also developed a solution to reduce the carbon emissions on the

project through the installation of an overland conveyor system to

remove excess material from site, which will eliminate over 78,000

lorry movements amounting to over 700,000 miles. This will not only

reduce the carbon emissions through less miles driven, but also

reduce the noise pollution for local residents.

Hemerdon

Following the listing of Tungsten West plc ("TW") on AIM in

October 2021, we received the first of eight annual payments of

GBP1m relating to maintaining our capability at site. TW announced

in April 2022 that it intended to pause their development plan for

the site and evaluate alternative approaches. A further

announcement was made by TW on 19 July 2022 which indicates that TW

plans to commence production in the first half of calendar year

2023. TW states that it has to put further funding in place to

achieve this. Whilst this news does mean that any growth that was

expected to come from the commencement of mining activities may be

delayed, the Group remains in a strong contractual position with

security over the mineral rights. The Group remains in close

contact with TW.

Profitability within Services has remained weighted to the

second half of the year, however, in the coming year this is likely

to level out as the works undertaken on HS2 provide greater

profitability in the summer months, reducing the seasonality.

With over 50 framework and term contracts in place and

approximately 75% of next year's revenue secured, the Services

business has resilience to the current inflationary pressures. Most

term contracts include a form of price escalation, particularly in

relation to fuel increases for our logistics operations. The main

HS2 contract is a defined cost plus fee arrangement so that

increases in defined costs will be recovered. With inflation in the

UK rising to over 7% in the second half of the last financial year,

the business has seen the benefit of these clauses in the contracts

in mitigating the impact of such risks.

Our mechanical, electrical and civils capabilities were enhanced

on 7 July 2022 by the acquisition for GBP750,000 in cash of SBU

Limited and its subsidiary S&B Utilities Limited ("SBU"). SBU

has long standing framework contracts with Yorkshire Water and

Severn Trent Services together with a very recent appointment with

Northumbrian Water. The business, which has annual revenue of

around GBP4m and over 40 employees, will strengthen our business

offering in the utilities sector.

Hargreaves Land

Hargreaves Land recorded revenue of GBP15.1m (2021: GBP11.8m)

and a Profit before tax of GBP2.1m (2021: GBP6.3m) for the year.

This reduction of GBP4.2m in profitability is due to the timing of

sales at the Unity Joint Venture, near Doncaster. In April 2021,

the Unity Joint Venture completed a material sale to a national

retailer, which was several months ahead of the original plan. This

sale pulled forward GBP4.1m of profit into the year ended 31 May

2021, which has led to the reduction recorded in 2022.

Further progress has been made at Unity, with the exchange of

contracts announced in February 2022 for the conditional sale of a

total of 29 acres to Aver Property and the development of two

logistics units for GBP50m consideration. Completion is expected to

occur over the next 24 months. The Unity Joint Venture is

independently funded from Hargreaves.

During the year, the business has completed a further sale at

Blindwells. A 12.9 acre plot was sold to Persimmon in January 2022

for a total consideration of GBP9.6m, which is payable in three

annual instalments. In February, the Group announced the exchange

of contracts with Ogilvie Homes for the sale of a 4.6 acre plot,

which is expected to complete in the next financial year. This

demonstrates continuing progress within the Blindwells development,

which welcomed its first residents in the financial year. The site

remains a long term, regular annual profit stream for Hargreaves

Land, with approximately 120 acres still remaining to be sold

within Phase 1. The first phase is expected to be developed out by

2031 with Phase 2, known as Greater Blindwells, comprising

approximately 1,000 acres progressing through the local plan

process with a planning allocation for up to 8,000 homes expected

to be secured before 2030.The Group has an effective 25% share of

the land in this second phase.

An exciting development within Hargreaves Land has been the

increasing momentum behind the Group's renewable energy land

assets. The Group's former subsidiary, Brockwell Energy Limited,

achieved financial close on their Energy from Waste plant at

Westfield, Fife, which provided an immediate GBP2m of deferred

consideration from the original sale of the business. Additionally,

Brockwell entered into a 35-year minimum term index linked lease,

which will deliver annual rental income of GBP0.4m following the

construction of the plant which is expected to take about three

years.

This marks the first significant income relating to the Group's

renewable energy land portfolio, which in addition to Westfield

includes options over land with wind farm developers needed to

produce 580 MWs of power on various long-term agreements, which are

expected to begin delivering value over the next 24 months. This

represents more than 2% of the UK's total installed wind power

capacity in 2021*. This is a particularly exciting area for

Hargreaves Land and represents an opportunity to create substantial

value for the Group.

Hargreaves Land acts solely as a landlord in this area and does

not undertake any construction work or ownership of the energy

generating assets themselves.

HRMS

HRMS contributed GBP27.3m (2021: GBP13.6m) to the Group's Profit

before Tax. This represents an increase of 110% and demonstrates

the continuing strong performance that was seen from HRMS in the

second half of the previous year.

The traditional trading business has seen a substantial increase

in volumes of minerals traded, which has accompanied the increase

in commodity prices seen over the past 18 months. The trading team

at HRMS have always been skilled at maximising opportunities whilst

minimising the risk profile taken. This has been highlighted in the

current year's result.

The performance by the trading team has been complemented by the

significant turn around in the profitability of the steel waste

recycling business, DK. Prior to acquisition by HRMS in December

2019, this business was loss making. Since then, the management

team has introduced a number of measures which have led to an

approximate EUR10m of sustainable improvement in profitability. In

addition to this sustainable improvement, DK has also benefited

from high commodity prices, in particular zinc and pig iron, which

have augmented the result.

The third aspect of HRMS is the Carbon Pulverisation Plant. The

plant is fully operational and producing 100kt of pulverised

product per annum, which represents around 25% of the plant's full

capacity. The facility delivered a break even result in the year,

which is in line with the prior year result. It is not expected to

move into profitability until the year ending 31 May 2024 whilst

economic uncertainties persist in German industrial markets as a

result of the war in Ukraine.

HRMS mitigates against its exposure to commodity prices by both

hedging forward sales positions and by ensuring that it does not

enter into open trading positions so that purchases of commodities

are back to back with secured sales. DK is considering the

installation of a liquid gas tank to provide resilience in the

event of a gas supply shortage although only small quantities of

gas are used in the production process.

Summary

This year has been one of real momentum, particularly within

Services and Hargreaves Land, whilst HRMS continues to demonstrate

its ability to capitalise on market opportunities.

I am particularly pleased with the resilience of the Services

business, given the challenges faced by many businesses regarding

cost inflation and supply chain difficulties. Hargreaves Land

continues to deliver long term and recurring profits from the two

flagship projects at Blindwells and Unity, whilst developing an

exciting pipeline of opportunities, not least of which is the

renewable energy land portfolio. Finally, the sustainable

improvements made at DK have highlighted the ability of the

management team to identify and take advantage of opportunities,

which can deliver substantial value.

Hargreaves has undertaken significant changes over recent years

and I believe we have navigated the challenges which have arisen

well. The business has a strong, debt-free balance sheet and I look

to the future with optimism.

Gordon Banham

Group Chief Executive

26 July 2022

*Source:

https://www.statista.com/statistics/421861/wind-power-capacity-in-the-united-kingdom

Consolidated Statement of Profit and Loss

and Other Comprehensive Income

for the year ended 31 May 2022

2022 2021

Continuing operations Note GBP000 GBP000

-------------------------------------------------------- ---- --------- ---------

Revenue 2 177,908 204,796

Cost of sales (148,458) (181,453)

-------------------------------------------------------- ---- --------- ---------

Gross profit 29,450 23,343

Other operating income 1,298 3,821

Administrative expenses (24,520) (29,234)

-------------------------------------------------------- ---- --------- ---------

Operating profit/(loss) 6,228 (2,070)

Analysed as:

Operating profit (before exceptional items and

impairment charges) 4,474 4,751

Exceptional items 3 1,754 (2,186)

Impairment of intangible assets - (4,635)

-------------------------------------------------------- ---- --------- ---------

Operating profit/(loss) 6,228 (2,070)

-------------------------------------------------------- ---- --------- ---------

Finance income 823 646

Finance expenses (770) (1,882)

Share of profit in joint ventures (net of tax) 28,200 17,680

-------------------------------------------------------- ---- --------- ---------

Profit before tax 34,481 14,374

Taxation 4 347 2,032

-------------------------------------------------------- ---- --------- ---------

Profit for the year from continuing operations 34,828 16,406

Discontinued operations

Profit for the year from discontinued operations 5 2,000 -

-------------------------------------------------------- ---- --------- ---------

Profit for the year 36,828 16,406

-------------------------------------------------------- ---- --------- ---------

Other comprehensive income/expense

Items that will not be reclassified to profit

or loss

Gain in defined benefit pension schemes 5,955 1,956

Tax recognised on items that will not be reclassified

to profit or loss (1,488) (319)

Items that are or may be reclassified subsequently

to profit or loss

Foreign exchange translation differences 313 (1,806)

Effective portion of changes in fair value of

cash flow hedges 41 136

Tax recognised on items that are or may be reclassified

subsequently to profit or loss (8) (25)

Share of other comprehensive income of joint

ventures, (net of tax) 3,070 -

-------------------------------------------------------- ---- --------- ---------

Other comprehensive income/(expense) for the

year, net of tax 7,883 (58)

-------------------------------------------------------- ---- --------- ---------

Total comprehensive income for the year 44,711 16,348

-------------------------------------------------------- ---- --------- ---------

2022 2021

Note GBP000 GBP000

------------------------------------------------------ ---- ------- -------

Profit/(loss) attributable to:

Equity holders of the Company 37,040 16,426

Non-controlling interest (212) (20)

------------------------------------------------------ ---- ------- -------

Profit for the year 36,828 16,406

------------------------------------------------------ ---- ------- -------

Total comprehensive income attributable to:

Equity holders of the Company 44,923 16,368

Non-controlling interest (212) (20)

------------------------------------------------------ ---- ------- -------

Total comprehensive income for the year 44,711 16,348

------------------------------------------------------ ---- ------- -------

Basic earnings per share (pence) 6 113.80 50.84

Diluted earnings per share (pence) 6 110.44 49.38

Continuing basic earnings per share (pence) 6 107.62 50.84

Diluted continuing basic earnings per share (pence) 6 104.44 49.38

Non-GAAP Measures

------------------------------------------------------ ---- ------- -------

Basic underlying earnings per share from continuing

operations (pence)* 6 103.23 70.66

Diluted underlying earnings per share from continuing

operations (pence)* 6 100.18 68.64

------------------------------------------------------ ---- ------- -------

* See Alternative Performance Measures in Note 7

Group Balance Sheet

at 31 May 2022

Restated*

2022 2021

GBP000 GBP000

-------------------------------------------- -------- ---------

Non-current assets

Property, plant and equipment 9,938 13,806

Right-of-use assets 22,062 13,776

Investment property 8,298 7,607

Intangible assets including goodwill 4,824 4,824

Investments in joint ventures 58,383 31,187

Deferred tax assets 11,063 10,084

Trade receivables 4,224 _-

Retirement benefit surplus 10,382 2,911

-------------------------------------------- -------- ---------

129,174 84,195

-------------------------------------------- -------- ---------

Current assets

Other financial assets - 2

Inventories 30,476 27,168

Trade and other receivables 88,574 78,260

Income tax asset - 59

Contract assets 6,752 1,720

Cash and cash equivalents 13,773 28,303

-------------------------------------------- -------- ---------

139,575 135,512

-------------------------------------------- -------- ---------

Total assets 268,749 219,707

-------------------------------------------- -------- ---------

Non-current liabilities

Other interest-bearing loans and borrowings (11,045) (8,586)

Retirement benefit obligations (2,703) (2,867)

Provisions* (2,344) (3,087)

Deferred tax liabilities (1,920) -

(18,012) (14,540)

-------------------------------------------- -------- ---------

Current liabilities

Other interest-bearing loans and borrowings (7,326) (3,179)

Trade and other payables* (50,727) (49,611)

Provisions* (9,440) (8,038)

Income tax liability (108) -

Other financial liabilities - (43)

-------------------------------------------- -------- ---------

(67,601) (60,871)

-------------------------------------------- -------- ---------

Total liabilities (85,613) (75,411)

-------------------------------------------- -------- ---------

Net assets 183,136 144,296

-------------------------------------------- -------- ---------

2022 2021

GBP000 GBP000

---------------------------------------------------- ------- -------

Equity attributable to equity holders of the Parent

Share capital 3,314 3,314

Share premium 73,972 73,955

Other reserves 211 211

Translation reserve (1,819) (2,132)

Merger reserve 1,022 1,022

Hedging reserve 318 285

Capital redemption reserve 1,530 1,530

Share-based payment reserve 2,029 1,680

Retained earnings 102,781 64,441

------------------------------------------------------- ------- -------

183,358 144,306

Non-controlling interest (222) (10)

------------------------------------------------------- ------- -------

Total equity 183,136 144,296

------------------------------------------------------- ------- -------

*Upon review of the prior year accruals balance it was

identified that a number of items should have been classified as

provisions. As such a restatement has been undertaken during the

year. The impact is an increase in provisions of GBP3,723,000 and a

corresponding reduction in trade and other payables. There is no

impact on opening reserves.

Consolidated Statement of Changes in Equity

Share-

Capital based Total

Share Share Translation Hedging Other redemption Merger payment Retained Parent Non-controlling Total

capital premium reserve reserve reserves reserve reserve reserve earnings equity interest equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------- ------- ------- ----------- ------- -------- ---------- ------- ------- -------- ------- --------------- -------

At 1 June 2020 3,314 73,955 (326) 174 211 1,530 1,022 1,462 48,703 130,045 10 130,055

Total

comprehensive

income/(expense)

for

the year

Profit/(loss) for

the year - - - - - - - - 16,426 16,426 (20) 16,406

Other

comprehensive

income/(expense) - - (1,806) 111 - - - - 1,637 (58) - (58)

----------------- ------- ------- ----------- ------- -------- ---------- ------- ------- -------- ------- --------------- -------

Total

comprehensive

income/(expense)

for

the year - - (1,806) 111 - - - - 18,063 16,368 (20) 16,348

----------------- ------- ------- ----------- ------- -------- ---------- ------- ------- -------- ------- --------------- -------

Transactions with

owners recorded

directly

in equity

Equity-settled

share-based

payment

transactions - - - - - - - 218 - 218 - 218

Dividends paid - - - - - - - - (2,325) (2,325) - (2,325)

----------------- ------- ------- ----------- ------- -------- ---------- ------- ------- -------- ------- --------------- -------

Total

contributions

by and

distributions

to owners - - - - - - - 218 (2,325) (2,107) - (2,107)

----------------- ------- ------- ----------- ------- -------- ---------- ------- ------- -------- ------- --------------- -------

At 31 May 2021 3,314 73,955 (2,132) 285 211 1,530 1,022 1,680 64,441 144,306 (10) 144,296

----------------- ------- ------- ----------- ------- -------- ---------- ------- ------- -------- ------- --------------- -------

Share-

Capital based Total

Share Share Translation Hedging Other redemption Merger payment Retained Parent Non-controlling Total

capital premium reserve reserve reserves reserve reserve reserve earnings equity interest equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------- ------- ------- ----------- ------- -------- ---------- ------- ------- -------- ------- --------------- -------

At 1 June 2021 3,314 73,955 (2,132) 285 211 1,530 1,022 1,680 64,441 144,306 (10) 144,296

Total

comprehensive

income/(expense)

for

the year

Profit/(loss) for

the year - - - - - - - - 37,040 37,040 (212) 36,828

Other

comprehensive

income - - 313 33 - - - - 7,537 7,883 - 7,883

----------------- ------- ------- ----------- ------- -------- ---------- ------- ------- -------- ------- --------------- -------

Total

comprehensive

income/(expense)

for

the year - - 313 33 - - - - 44,577 44,923 (212) 44,711

----------------- ------- ------- ----------- ------- -------- ---------- ------- ------- -------- ------- --------------- -------

Transactions with

owners recorded

directly

in equity

Issue of shares - 17 - - - - - - - 17 - 17

Equity-settled

share-based

payment

transactions - - - - - - - 349 - 349 - 349

Dividends paid - - - - - - - - (6,237) (6,237) - (6,237)

----------------- ------- ------- ----------- ------- -------- ---------- ------- ------- -------- ------- --------------- -------

Total

contributions

by and

distributions

to owners - 17 - - - - - 349 (6,237) (5,871) - (5,871)

----------------- ------- ------- ----------- ------- -------- ---------- ------- ------- -------- ------- --------------- -------

At 31 May 2022 3,314 73,972 (1,819) 318 211 1,530 1,022 2,029 102,781 183,358 (222) 183,136

----------------- ------- ------- ----------- ------- -------- ---------- ------- ------- -------- ------- --------------- -------

Consolidated Cash Flow Statement

Restated*

2022 2021

GBP000 GBP000

------------------------------------------------------------- -------- ---------

Cash flows from operating activities

Profit for the year from continuing operations 34,828 16,406

Adjustments for:

Depreciation and impairment of property, plant and equipment

and right-of-use assets 8,666 6,562

Impairment of goodwill and intangible assets - 4,635

Net finance (income)/expense (53) 1,236

Share of profit in joint ventures (net of tax) (28,200) (17,680)

Profit on sale of property, plant and equipment, investment

property and right-of-use assets (1,298) (3,667)

Equity-settled share-based payment expenses 349 218

Income tax (credit) (347) (2,032)

Contributions to defined benefit pension schemes (2,002) (2,039)

Translation of non-controlling interest and investments 202 -

12,145 3,639

Change in inventories (3,308) 36,841

Change in trade and other receivables (19,256) 2,012

Change in trade and other payables* 903 5,545

Change in provisions and employee benefits* 1,000 (1,489)

------------------------------------------------------------- -------- ---------

(8,516) 46,548

Interest received/(paid) 34 (1,194)

Income tax (paid) (44) (127)

------------------------------------------------------------- -------- ---------

Net cash (outflow)/inflow from operating activities (8,526) 45,227

------------------------------------------------------------- -------- ---------

Cash flows from investing activities

Proceeds from sale of property, plant and equipment 801 3,125

Proceeds from sale of investment property 1,407 5,040

Proceeds from sale of right of use assets 78 753

Acquisition of property, plant and equipment (1,479) (2,727)

Acquisition of investment property (1,070) (390)

Acquisition of right of use assets (163) -

Dividends received from joint ventures 3,917 -

Net cash inflow from investing activities in continuing

operations 3,491 5,801

------------------------------------------------------------- -------- ---------

Net cash inflow from investing activities in discontinued

operations 2,000 -

------------------------------------------------------------- -------- ---------

Net cash inflow from investing activities 5,491 5,801

------------------------------------------------------------- -------- ---------

Cash flows from financing activities

Principal elements of lease payments (5,531) (6,085)

Dividends paid (6,237) (2,325)

Repayment of Group banking facilities - (32,000)

------------------------------------------------------------- -------- ---------

Net cash outflow from financing activities (11,768) (40,410)

------------------------------------------------------------- -------- ---------

Net (decrease)/increase in cash and cash equivalents (14,803) 10,618

Cash and cash equivalents at 1 June 28,303 18,499

Effect of exchange rate fluctuations on cash held 273 (814)

------------------------------------------------------------- -------- ---------

Cash and cash equivalents at 31 May 13,773 28,303

------------------------------------------------------------- -------- ---------

*Upon review of the prior year accruals balance it was

identified that a number of items should have been classified as

provisions. As such a restatement has been undertaken during the

year. The impact is an increase in provisions of GBP3,723,000 and a

corresponding reduction in trade and other payables. There is no

impact on opening reserves

Notes

1 Basis of preparation and status of financial information

The financial information set out above has been prepared and

approved by the Directors in accordance with the recognition and

measurement criteria of international accounting standards in

conformity with the requirements of the Companies Act 2006.

The financial information set out above does not constitute the

Group's statutory accounts for the years ended 31 May 2022 or 31

May 2021. Statutory accounts for 2021 have been delivered to the

Registrar of Companies, and those for 2022 will be delivered in due

course. The auditor has reported on those accounts; their reports

were (i) unqualified, (ii) did not include a reference to any

matters to which the auditor drew attention by way of emphasis

without qualifying their report and (iii) did not contain a

statement under section 498 (2) or (3) of the Companies Act

2006.

The accounting policies set out below have, unless otherwise

stated, been applied consistently to all periods presented in these

consolidated financial statements.

The Group has restated the 31 May 2021 balance sheet and cash

flow statement due to a review of the prior year accruals balance

where it was identified that a number of items should have been

classified as provisions. As such a restatement has been undertaken

during the year. A third balance sheet has not been presented as

the impact of the restatement is not considered to be qualitatively

material to users of the accounts and all balances as at the

opening balance sheet day are disclosed within the relevant

notes.

Going concern

The Group's financing is not dependent on bank borrowings,

however the Group has a GBP12m invoice discounting facility which

is currently undrawn. Notwithstanding that, a rigorous review of

cash flow forecasts including testing for a range of challenging

downside sensitivities has been undertaken. These sensitivities

include testing without utilising the invoice discounting facility.

Mitigating strategies to these sensitivities considered by the

Board exclude any remedies which are not entirely within the

Group's control. As a result, and after making appropriate

enquiries including reviewing budgets and strategic plans, the

Directors have a reasonable expectation that both the Company and

the Group have adequate resources to continue in operational

existence for the foreseeable future. Accordingly, the Board

continues to adopt the going concern basis in preparing the Annual

Report and Accounts.

These results were approved by the Board of Directors on 26 July

2022.

2 Segmental Information

The following analysis by industry segment is presented in

accordance with IFRS 8 on the basis of those segments whose

operating results are regularly reviewed by the Board of Directors

(the Chief Operating Decision Maker as defined by IFRS 8) to assess

performance and make strategic decisions about allocation of

resources.

The sectors distinguished as operating segments are Services,

Hargreaves Land, Unallocated and HSEL.

-- Services: Provides materials handling, mechanical and

electrical engineering, land restoration, logistics and bulk

earthmoving into the energy, environmental, infrastructure and

industrial sectors.

-- Hargreaves Land: The development and realisation of value

from the land portfolio including rental income from investment

properties and the share of profit of the Unity joint venture.

-- Unallocated: The corporate overhead contains the central

functions that are not devolved to the individual business

units.

-- Hargreaves Services Europe ("HSEL"): The Group's share of its

German joint venture, which includes HRMS and DK.

These segments are combinations of subsidiaries and joint

ventures. They have separate management teams and provide different

products and services. The four operating segments are also

reportable segments.

The segment results, as reported to the Board of Directors, are

calculated under the principles of IFRS. Performance is measured on

the basis of underlying profit/(loss) before tax, which is

reconciled to profit/(loss) before tax in the tables below:

Hargreaves

Services Land Unallocated HSEL Total

2022 2022 2022 2022 2022

GBP000 GBP000 GBP000 GBP000 GBP000

----------------------------------- -------- ---------- ----------- ------- --------

Revenue

Total revenue 163,800 15,100 - - 178,900

Intra-segment revenue (992) - - - (992)

----------------------------------- -------- ---------- ----------- ------- --------

Revenue from external customers 162,808 15,100 - - 177,908

----------------------------------- -------- ---------- ----------- ------- --------

Operating profit/(loss) (before

exceptional items) 8,011 1,211 (4,748) - 4,474

Share of profit in joint ventures

(net of tax) - 858 - 27,342 28,200

Net finance (expense)/income (468) 58 463 - 53

Exceptional items (see Note 3) 1,754 - - - 1,754

----------------------------------- -------- ---------- ----------- ------- --------

Profit/(loss) before taxation

from continuing operations 9,297 2,127 (4,285) 27,342 34,481

Taxation (see Note 4) 3,343 (3,546) 550 - 347

----------------------------------- -------- ---------- ----------- ------- --------

Profit/(loss) after taxation 12,640 (1,419) (3,735) 27,342 34,828

----------------------------------- -------- ---------- ----------- ------- --------

Depreciation and impairment charge (8,344) (100) (222) - (8,666)

----------------------------------- -------- ---------- ----------- ------- --------

Capital expenditure (13,507) (1,165) (154) - (14,826)

----------------------------------- -------- ---------- ----------- ------- --------

Net assets/(liabilities)

Segment assets 79,155 62,505 68,706 - 210,366

Segment liabilities (70,104) (7,391) (8,118) - (85,613)

----------------------------------- -------- ---------- ----------- ------- --------

Segment net assets 9,051 55,114 60,588 - 124,753

Joint ventures - 4,836 - 53,547 58,383

----------------------------------- -------- ---------- ----------- ------- --------

Total net assets 9,051 59,950 60,588 53,547 183,136

----------------------------------- -------- ---------- ----------- ------- --------

Unallocated net assets of GBP60.6m include cash and cash

equivalents of GBP13.8m, deferred tax asset of GBP11.1m, amounts

due from Jointly Controlled Entities of GBP29.3m, a net pension

asset of GBP7.7m, deferred tax liability of GBP1.9m and other

corporate items (GBP0.6m asset).

Hargreaves

Services Land Unallocated HSEL Total

2021 2021 2021 2021 2021

GBP000 GBP000 GBP000 GBP000 GBP000

----------------------------------- -------- ---------- ----------- ------- --------

Revenue

Total revenue 194,600 11,800 - - 206,400

Intra-segment revenue (1,604) - - - (1,604)

----------------------------------- -------- ---------- ----------- ------- --------

Revenue from external customers 192,996 11,800 - - 204,796

----------------------------------- -------- ---------- ----------- ------- --------

Operating profit/(loss) (before

exceptional items and impairment) 6,691 2,530 (4,470) - 4,751

Share of profit in joint ventures

(net of tax) - 4,069 - 13,611 17,680

Net finance (expense)/income (1,614) (338) 716 - (1,236)

Impairment of intangibles (4,635) - - - (4,635)

Exceptional items (see Note 3) (2,186) - - - (2,186)

----------------------------------- -------- ---------- ----------- ------- --------

Profit/(loss) before taxation

from continuing operations (1,744) 6,261 (3,754) 13,611 14,374

Taxation (see Note 4) 591 (114) 1,555 - 2,032

----------------------------------- -------- ---------- ----------- ------- --------

Profit/(loss) after taxation (1,153) 6,147 (2,199) 13,611 16,406

----------------------------------- -------- ---------- ----------- ------- --------

Depreciation charge (6,135) (103) (323) - (6,561)

----------------------------------- -------- ---------- ----------- ------- --------

Capital expenditure* (5,011) (1,215) (216) - (6,442)

----------------------------------- -------- ---------- ----------- ------- --------

Net assets/(liabilities)

Segment assets 77,900 55,820 54,800 - 188,520

Segment liabilities (60,078) (6,990) (8,343) - (75,411)

----------------------------------- -------- ---------- ----------- ------- --------

Segment net assets 17,822 48,830 46,457 - 113,109

Joint ventures - 4,051 - 27,136 31,187

----------------------------------- -------- ---------- ----------- ------- --------

Total net assets 17,822 52,881 46,457 27,136 144,296

----------------------------------- -------- ---------- ----------- ------- --------

* Upon review of the prior year segmental capital expenditure

disclosure it was identified that this note only included capital

expenditure relating to property, plant, and equipment. As such a

restatement has been undertaken during the year to show total

capital expenditure of property, plant, and equipment, right of use

assets and investment properties. There is no other impact on the

financial statements.

Unallocated net assets of GBP46.5m include cash and cash

equivalents of GBP28.3m, deferred tax asset of GBP10.1m, amounts

due from Jointly Controlled Entities of GBP14.5m, VAT liability of

GBP3.8m and other corporate items (GBP2.6m liability).

3 Exceptional Items

The Group incurred one exceptional item in each year as

follows:

2022 2021

GBP000 GBP000

--------------------------------------------------------- ------- -------

Exceptional item in Cost of sales

Losses on legacy contracts in C.A. Blackwell (Contracts)

Limited - (2,186)

Total exceptional item in Cost of sales - (2,186)

--------------------------------------------------------- ------- -------

Exceptional item in Administrative expenses

Release of accrual relating to a liability from the

year ended 31 May 2015 1,754 -

--------------------------------------------------------- ------- -------

Total exceptional item in Administrative expenses 1,754 -

--------------------------------------------------------- ------- -------

Total 1,754 (2,186)

--------------------------------------------------------- ------- -------

In the year ending 31 May 2022, an aged accrual dating from the

year ended 31 May 2015 totalling GBP1,754,000 was released as the

potential for payment had lapsed due to time.

In the year ending 31 May 2021, further losses were recognised

on the legacy contracts within C.A. Blackwell (Contracts) Limited

resulting in costs of GBP2,186,000.

4 Taxation

Recognised in the Income Statement

2022 2021

GBP000 GBP000

--------------------------------------------------------- ------- -------

Current tax

Current year 212 57

Adjustments for prior years (4) 8

--------------------------------------------------------- ------- -------

Current tax expense 208 65

--------------------------------------------------------- ------- -------

Deferred tax

Origination and reversal of temporary timing differences 1,542 764

Impact of increase in tax rate - (2,736)

Adjustments for prior years (2,097) (125)

--------------------------------------------------------- ------- -------

Deferred tax credit (555) (2,097)

--------------------------------------------------------- ------- -------

Tax credit in Income Statement (excluding share of tax

of equity accounted investees) (347) (2,032)

--------------------------------------------------------- ------- -------

The deferred tax adjustment in respect of prior years of

GBP2,097,000 relates to losses assumed to be utilised in the

previous year, which were ultimately retained.

Recognised in Other Comprehensive Income

2022 2021

GBP000 GBP000

-------------------------------------------------------- ------- -------

Deferred tax expense

Effective portion of changes in fair value of cash flow

hedges (8) (25)

Remeasurements of defined benefit pension schemes (1,488) (319)

-------------------------------------------------------- ------- -------

(1,496) (344)

-------------------------------------------------------- ------- -------

Reconciliation of Effective Tax Rate

2022 2021

GBP000 GBP000

------------------------------------------------------- ------- -------

Profit for the year from continuing operations 34,828 16,406

Total tax credit (347) (2,032)

------------------------------------------------------- ------- -------

Profit before taxation from continuing operations 34,481 14,374

------------------------------------------------------- ------- -------

Tax using the UK corporation tax rate of 19.00% (2021:

19.00%) 6,551 2,731

Effect of tax rates in foreign jurisdictions 37 (143)

Tax effect of joint ventures (5,194) (2,586)

Previously unrecognised tax losses 136 (92)

Non-deductible expenses 407 894

Impact of change in tax rates - (2,736)

Other temporary trading differences (183) 17

Adjustment in respect of previous periods (2,101) (117)

------------------------------------------------------- ------- -------

Effective total tax credit (347) (2,032)

------------------------------------------------------- ------- -------

The UK corporation tax rate has been 19.00% for the duration of

the financial year (2021: 19.00%).

Factors That May Affect Future Current and Total Tax Charges

Following the March 2021 budget, the corporate tax rate will

increase from 19% to 25% with effect from 1 April 2023. The

deferred tax balances at 31 May 2022 and 31 May 2021 have been

calculated based on the rate substantively enacted at the balance

sheet date of 25%.

5 Discontinued Operations

All discontinued operation results are attributable to equity

holders. The Group's discontinued operations made a profit of

GBP2,000,000 (2021: GBPnil) after tax during the year.

The profit from discontinued operations represents the

contingent consideration received following the disposal of

Brockwell Energy Limited ("Brockwell"). The Company disposed of the

whole of its shareholding in Brockwell on 19 October 2018 with

contingent consideration of GBP2m which was received in the year

ending 31 May 2022. There are no remaining balances relating to

this matter.

2022 2021

GBP000 GBP000

------------------------------------------------- ------- -------

Proceeds from disposal of subsidiary 2,000 -

Profit before tax of discontinued operations 2,000 -

Current tax charge - -

Profit for the year from discontinued operations 2,000 -

------------------------------------------------- ------- -------

6 Earnings per Share

The calculation of earnings per share ("EPS") is based on the

profit for the year attributable to equity holders and on the

weighted average number of shares in issue and ranking for dividend

in the year.

2022 2021

-------------------------- ------------------------ --------------------------

Earnings EPS DEPS Earnings EPS DEPS

GBP000 Pence Pence GBP000 Pence Pence

-------------------------- -------- ------ ------ -------- ------- -------

Underlying earnings per

share from continuing

operations 33,407 103.23 100.18 22,832 70.66 68.64

Exceptional items, fair

value adjustments and

impairment (net of tax) 1,421 4.39 4.26 (6,406) (19.82) (19.26)

-------------------------- -------- ------ ------ -------- ------- -------

Continuing basic earnings

per share 34,828 107.62 104.44 16,426 50.84 49.38

Discontinued operations 2,000 6.18 6.00 - - -

-------------------------- -------- ------ ------ -------- ------- -------

Basic earnings per share 36,828 113.80 110.44 16,426 50.84 49.38

-------------------------- -------- ------ ------ -------- ------- -------

Weighted average number

of shares 32,362 33,347 32,312 33,262

-------------------------- -------- ------ ------ -------- ------- -------

The calculation of weighted average number of shares includes

the effect of own shares held of 611,118 (2021: 827,150).

The calculation of diluted earnings per share ("DEPS") is based

on the profit for the year and the weighted average number of

ordinary shares in issue in the year. The potentially dilutive

effect of the share options outstanding (effect on weighted average

number of shares) is 985,056 (2021: 950,750); effect of basic

earnings per ordinary share in the current year is 3.36p (2021:

1.46p). Effect on underlying earnings per ordinary share is 3.05p

(2021: 2.02p). Effect on discontinued operations per ordinary share

for 2022 is 0.18p (2021: nil).

7 Alternative Performance Measures Glossary

This report provides alternative performance measures ("APMs"),

which are not defined or specified under the requirements of

International Financial Reporting Standards. The Board believes

that these APMs provide readers with important additional

information on the business.

Alternative Performance

Measure Definition and Purpose

-------------------------- ----------------------------------- -------------- --------------

Underlying profit before Represents the profit before tax from continuing

tax ("UPBT") operations prior to exceptional items, fair value

adjustments and impairment of intangible assets,

and, in accordance with International Accounting

Standards, including the Group's share of the post-tax

profit of its German joint venture. This measure

is consistent with how the business measures performance

and is reported to the Board.

2022 2021

GBP000 GBP000

----------------------------------- -------------- --------------

Profit before tax from continuing

operations 34,481 14,374

Exceptional items (see Note 3) (1,754) 2,186

Impairment of intangible assets

and goodwill - 4,635

Underlying Profit before Tax 32,727 21,195

------------------------------------ -------------- --------------

Basic underlying earnings Profit attributable to the equity holders of the

per share Company from continuing operations prior to exceptional

items and impairment of intangible assets after

tax divided by the weighted average number of ordinary

shares during the financial year adjusted for the

effects of any potentially dilutive options. See

Note 6.

-------------------------- --------------------------------------------------------------------

EBITDA EBITDA is defined as profit before tax from continuing

operations prior to charges for depreciation and

impairment and interest and excludes the share

of profit from jointly controlled entities and

gains and losses on the sale of fixed assets.

2022 2021

GBP'000 GBP'000

----------------------------------- --------- ---------

Profit before tax from continuing

operations 34,481 14,374

Depreciation and impairment 8,666 6,562

Impairment of goodwill - 4,635

Net finance (income)/expense (53) 1,236

Share of profit in joint ventures

(net of tax) (28,200) (17,680)

(Profit) on sale of fixed assets (1,298) (3,667)

----------------------------------- --------- ---------

EBITDA 13,596 5,460

----------------------------------- --------- ---------

-------------------------- --------------------------------------------------------------------

Net Debt/(cash) Represents the net position of the Group's cash

and loan balances including leases. Calculated

as follows:

-------------------------- --------------------------------------------------------------------

2022 2021

GBP000 GBP000

----------------------------------- -------------- --------------

Cash and cash equivalents 13,773 28,303

Non-current interest-bearing loans

and borrowings (11,045) (8,586)

Current interest bearings loans

and borrowings (7,326) (3,179)

Net (debt)/cash (4,598) 16,538

------------------------------------ ------------------------- -------------- --------------

Net Asset Value per Represents the Net Asset value of the Group divided

share by the number of shares in issue less those shares

held in treasury. Calculated as follows:

-------------------------- --------------------------------------------------------------------

2022 2021

----------------------------------- -------------- --------------

Total shares in issue 33,138,756 33,138,756

Less shares in treasury (611,118) (827,150)

------------------------------------ ------------------------- -------------- --------------

Shares for calculation 32,527,638 32,311,606

------------------------------------ ------------------------- -------------- --------------

Net Asset Value per

Balance Sheet GBP183,136,000 GBP144,296,000

------------------------------------ ------------------------- -------------- --------------

Net Asset Value per

share GBP5.63 GBP4.47

------------------------------------ ------------------------- -------------- --------------

8 Posting of Report & Accounts

The Group confirms that the annual report and accounts for the

year ended 31 May 2022 will be posted to shareholders as soon as

practicable and a copy will be made available on the Group's

website:

www.hsgplc.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR RFMATMTATBIT

(END) Dow Jones Newswires

July 27, 2022 02:00 ET (06:00 GMT)

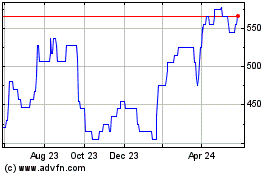

Hargreaves Services (AQSE:HSP.GB)

Historical Stock Chart

From Mar 2025 to Apr 2025

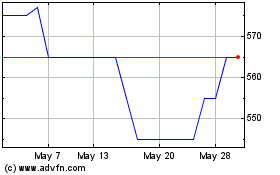

Hargreaves Services (AQSE:HSP.GB)

Historical Stock Chart

From Apr 2024 to Apr 2025