Globe Capital Limited Corporate, Board & Appointment of Corporate Advisor

November 15 2021 - 1:45PM

UK Regulatory

TIDMGCAP

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY THE COMPANY TO

CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION

(EU) NO. 596/2014, AS AMENDED ("MAR"). ON THE PUBLICATION OF THIS

ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE ("RIS"), THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

Globe Capital Limited

("Globe Capital" or the "Company")

AQSE: GCAP

Corporate Update, Board Changes & Appointment of Corporate Advisor

Particulars of the RIS

1. Corporate Update

2. Board Changes

3. Appointment of Corporate Advisor

4. Director Statement

1. Corporate Update

The Company's ordinary shares were suspended earlier this year due to

complications that arose with the issuer's Depositary Interest function

lapsing. During the subsequent months, the Board of Directors entered

commercial discussions with various parties to develop a recapitalisation and

corporate restructure strategy in order for the Company to progress,

meaningfully.

During this period the Company has entered discussions with creditors of the

Company in efforts to rationalise the Company's balance sheet and expect to

conclude these discussions in the coming weeks.

To this end, the two incoming Directors, Mr Burns Singh Tennent-Bhohi & Mr

Simon Grant-Rennick have agreed to advance the Company £100,000 under a

convertible loan note ("CLN") to accelerate the recapitalisation and

restructure (for which monies have been advanced to date as the Company

continues to be actively recapitalised and restructured). The CLN shall be

unsecured, bear no interest and mature upon the three year anniversary for

which it was issued and be convertible at a price of £0.0004, requiring the

consent of shareholders in approving amongst other resolutions the issue of

equity.

The CLN will convert into ordinary shares of the Company, immediately on

approval of the Annual General Meeting resolutions , for which posting will be

announced in the coming weeks. Upon conversion of the CLN, the holders shall be

granted 250,000,000 warrants to subscribe for new ordinary shares with a strike

price of £0.0008 and a life to expiry of 5-years from date of grant.

The newly constituted Board expect to undertake further capital raising

activities in the near future and to present the newly formed corporate

strategy at the upcoming Annual General Meeting for the Company that the

Directors intend to post in the coming weeks.

1. Board Changes

The Board would like to welcome the appointments of, Mr Burns Singh

Tennent-Bhohi (Executive Director) & Mr Simon Grant-Rennick (Executive

Chairman) both of whom have led this recapitalisation and restructure with the

Board of Globe.

In conjunction with their appointments Mr Darren Edmonston will become a

Non-Executive Director and Mr David Barnett will retire his role from the Board

of Directors effective immediately.

The Board would like to extend their well wishes to David and thank him for his

services.

Burns Singh Tennent-Bhohi (Executive Director)

Burns Singh Tennent-Bhohi is the founder & CEO of The Glenpani Group, an

international private venture capital business based in London/UK. Glenpani's

principal focus is the evaluation and augmentation of distressed-asset

opportunities and private-transaction/investment origination. Glenpani Group

cornerstone-invest, originate transactions and provide corporate consultancy to

international companies both private and public including; AQSE, AIM, TSX-V,

CSE & ASX.

Burns assumes a number of directorships of both private and public companies

and his current appointments in public interest companies include: Chairman of

Oscillate plc (AQSE: MUSH), CEO and a Director of, Evrima plc (AQSE: EVA) and

Director of Igraine plc (AQSE: KING) and have included: Forum Energy Metals

Corp. (TSX-V: FMC), in 2019 FMC executed a $30,000,000 project earn-in

agreement with Rio Tinto on its Janice Lake sedimentary copper project and a

$6,000,000 project earn-in with Orano & the CEO and a Director of IamFire plc

(AQSE: FIRE)

Active in North American capital markets, Burns is also the founder of LC, a

specialised private investment vehicle that syndicates and connects global

capital investment for private transaction origination & pre-IPO opportunities.

Glenpani Group maintains an extensive international network that includes

corporate brokers/financiers, investment bankers, merchant banks, UHNWIs,

project financiers, asset-banks and technical teams. Burns graduated from the

University of Glasgow with a degree in Economics/Social Sciences.

Current Directorships and/or Former Directorships and/or

Partnerships partnerships (within the last five

years):

Evrima plc IamFire plc

Igraine plc Forum Energy Metals Corp

Oscillate plc Residential Sales (London) Ltd

Eastport Ventures (Ontario) Inc.

Lincoln Road Ltd

Capital Homes (London) Ltd

Glenpani Group Limited

Glenpani Capital Limited

GPC 101 Ltd

GPC 102 Ltd

VNS Global Ltd

Botsjuana Ltd

Glenpani Capital Group Ltd

DiscovOre Limited

Loncad Limited

Tomas Capital Limited

DVYH196 Ltd

Loncad Holdings Ltd

H2Gogo Industries Limited

Except as set out above, there is no further information regarding Burns Singh

Tennent-Bhohi, that is required to be disclosed pursuant to Rule 4.9 of the

AQSE Growth Market Access Rulebook.

Simon Grant-Rennick (Executive Chairman)

Simon graduated from the Camborne School of Mines (Bsc Mining Engineering

[hons], ACSM) and has been actively involved in the mining and metal trading

industry for over 30-years. During this time Simon has served Board &

Management roles for both private and public (LSE, ASX, AQSE) entities

globally.

Simon has extensive experiences in the industrial and non-ferrous metal

industry which includes a successfully operating Falconbridge Internationals

non-ferrous trading arm.

Simon maintains a number of Board & Management Roles across industries

including; agriculture, property, technology & the mining sector, including;

All Active Asset Capital Ltd (AIM: AAA), U.K. Spac plc (AIM: SPC), Evrima plc

(AQSE: EVA) and was most recently the Executive Chairman of Quetzal Capital plc

(AQSE: QTZ).

Simon Richard de Clanay Grant-Rennick, aged 63, has held the following current

and former Directorships in the past 5-years:

Current Directorships and/or Former Directorships and/or

Partnerships partnerships (within the last five

years):

African Tree Nuts Limited Barnardo Capital Limited

ASP Corp Ltd Force Commodities Ltd

Elk Investments Limited Glyncastle Resource Limited

Evrima plc Glyncastle plc

Gunmakers Hall Limited Jacoma Estates Limited

IMFH Limited Kardav Limited

IM Performance Minerals Ltd QX Resources Limited

Langleycourt Properties Limited Quetzal Capital plc

Selection Mines Limited

All Active Asset Capital Limited

U.K. SPAC plc

Mr Grant-Rennick was a director of Glyncastle plc (previously Unity Power plc)

and two of its subsidiaries, Glyncastle Mining Limited (previously Horizon

Mining Limited) and Glyncastle Resource Limited (previously Unity Mine

Limited), when these three companies went into administration on 30 October

2013. Statements of affairs for each of these companies dated 13 December 2013

stated an aggregate estimated deficiency as regards creditors of £172,966,671.

A Receiver was appointed to Glyncastle plc on 23 May 2018 and Mr Grant-Rennick

ceased to be a director of this company on 27 January 2020. Glyncastle Mining

Limited and Glyncastle Resource Limited both entered into Company Voluntary

Arrangements on 7 October 2016 and Mr Grant-Rennick ceased to be a director of

both companies on 24 January 2018.

Mr Grant-Rennick was a director of Oakland Investments (UK) Limited from 30

January 1995 until 8 August 1995. This company entered into voluntary creditors

liquidation on 14 November 1995.

Except as set out above, there is no further information regarding Simon

Richard de Clanay Grant-Rennick, that is required to be disclosed pursuant to

Rule 4.9 of the AQSE Growth Market Access Rulebook.

1. Appointment of Corporate Advisor

The Company is pleased to announce that Peterhouse Capital Limited has been

appointed as the Company's AQSE Growth Market Corporate Advisor and Corporate

Broker with immediate effect. The Company wishes to thank First Sentinel for

their many years of service to the Company.

1. Director Statement, Darren Edmonston

"I would like to take this opportunity to thank all members of the Globe team

and the AQSE Growth Market Exchange in getting the Company to a point where it

has a new direction, the introduction of fresh capital investment and the

appointment of two Directors that have been pivotal in driving this change at

the Company. I am excited to progress this Company and look forward to

providing our shareholders with further updates.

I would like to also take this opportunity to thank retiring Director, David

Barnett for his services to the Company and wish him well with his future

endeavours."

The Directors of the Company, who have issued this RIS announcement after due

and careful enquiry, accept responsibility for its content.

For further information

COMPANY:

Globe Capital Limited

Darren Edmonston

+1-855-280-6793

CORPORATE ADVISER:

Peterhouse Capital Limited

Guy Miller / Mark Anwyl

Tel: +44 (0) 207 469 0930

END

(END) Dow Jones Newswires

November 15, 2021 13:45 ET (18:45 GMT)

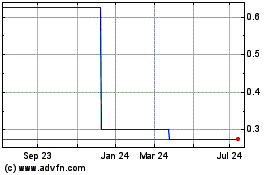

Globe Capital (AQSE:GCAP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Globe Capital (AQSE:GCAP)

Historical Stock Chart

From Jan 2024 to Jan 2025