Fisher (James) & Sons plc Disposal of three businesses (0783K)

December 19 2022 - 2:00AM

UK Regulatory

TIDMFSJ

RNS Number : 0783K

Fisher (James) & Sons plc

19 December 2022

This announcement contains inside information

19 December 2022

James Fisher and Sons plc

Disposal of three businesses

James Fisher and Sons plc (FSJ.L) ('James Fisher', the 'Group'),

the leading marine service provider, announces the sale of three

businesses, in two separate transactions.

Sale of Mimic and Strainstall

Mimic and the UK operations of Strainstall have been sold to the

BES Group for an initial cash consideration of GBP13.6m. In

addition, up to GBP3.9m of further cash consideration may be

payable in Q1 2023 based on performance in the last quarter of

2022.

Both Mimic and Strainstall each hold leading positions in their

respective markets, but the Board has concluded that they will be

better able to continue their development outside of James Fisher,

in line with the Group's previously stated strategy to rationalise

and focus the Group's portfolio. The proceeds will be applied to

reducing the Group's net borrowings.

The results of the combined businesses are reported within the

Marine Support division. In the year ended 31 December 2021, they

generated combined revenue of GBP8.7m and profit before tax of

GBP0.8m. At 30 June 2022, the gross assets of the businesses were

approximately GBP7.4m. Existing management and staff will

transition with the businesses to the new owners.

Sale of Prolec

In addition, James Fisher has completed the sale of Prolec to

Kinshofer Gmbh, part of Lifco AB. In the year ended 31 December

2021, Prolec contributed revenues of GBP4m to the Marine Support

division. Existing management and staff will transition with the

businesses to the new owners. The disposal further demonstrates the

Board's commitment to a strategy of rationalising the Group.

Commenting on the disposals, James Fisher's Chief Executive

Officer, Jean Vernet, said:

"The sale of Prolec, Mimic and the UK operations of Strainstall

represent a clear demonstration of our strategy to rationalise and

focus the portfolio, as well as strengthening our financial

position. We believe the transactions represent good value for

James Fisher's shareholders and in BES and Lifco, we have found

buyers of quality. We wish them and the staff at each of the

businesses continued success and thank them for their hard work and

dedication to James Fisher over many years."

For further information:

Chief Executive

Officer

James Fisher and Jean Vernet Chief Financial

Sons plc Duncan Kennedy Officer 01229 615400

Richard Mountain

FTI Consulting Susanne Yule 0203 727 1340

-------------------------------------- --------------

The person responsible for making this announcement on behalf of

the Company is Duncan Kennedy, Chief Financial Officer, James

Fisher and Sons plc.

LEI: 213800J975E5OYR6S216

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISBKFBPKBDBCBD

(END) Dow Jones Newswires

December 19, 2022 02:00 ET (07:00 GMT)

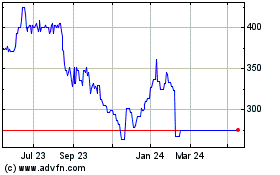

Fisher James And Sons (AQSE:FSJ.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Fisher James And Sons (AQSE:FSJ.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025