TIDMFSJ

RNS Number : 0172X

Fisher (James) & Sons plc

25 August 2020

25 August 2020

James Fisher and Sons plc

Half year results for the six months ended 30 June 2020

James Fisher and Sons plc (FSJ.L) ('James Fisher'), the leading

marine service provider, announces its unaudited results for the

six months ended 30 June 2020.

2020 2019 % change

Revenue GBP258.1m GBP286.9m (10)%

Underlying operating profit * GBP19.5m GBP24.5m (20)%

Underlying profit before tax

* GBP15.1m GBP20.9m (28)%

Underlying diluted earnings per

share * 23.6p 33.2p

Cash conversion 312% 106% (29)%

Interim dividend per share 8.0p 11.3p (29)%

Statutory operating profit GBP11.5m GBP24.5m (47)%

Statutory profit before tax GBP7.1m GBP20.9m (59)%

Statutory diluted earnings per

share 9.9p 33.6p (62)%

* excludes separately disclosed items of GBP(8.0)m (2019:

GBPnil) (note 5).

Highlights:

-- Key priority remains the safety and wellbeing of employees

and customers

-- Swift response to Covid-19 to reduce costs, optimise cash

flow and protect liquidity

-- Resilient trading performance

-- GBP30m reduction in debt

-- Interim dividend of 8.0p per share

Commenting on the results, Chief Executive Officer, Eoghan

O'Lionaird, said:

"The first half of 2020 was one of the most demanding periods

the Company has faced, and the commitment, support and engagement

of our employees in stepping up to the challenges has been

remarkable. The Group responded swiftly to both the unprecedented

headwinds presented by Covid-19 and the longer-term implications

for energy demand by taking actions to reduce costs and protect the

Group's liquidity. Whilst the second half is expected to remain

challenging and the outlook for our end markets is uncertain, we

expect trading to improve through the second half, assuming no

material deterioration in the Covid-19 situation.

James Fisher is well diversified by geographical sector and end

market. The resilience of the Group, our strong liquidity position

combined with swift actions taken to reduce costs, position James

Fisher well for any improvement in market conditions in the second

half and beyond. Whilst the financial performance in 2020 will be

lower than 2019, the Group remains well placed to deliver future

growth for its shareholders."

For further information:

Chief Executive

James Fisher and Eoghan O'Lionaird Officer

Sons plc Stuart Kilpatrick Group Finance Director 020 7614 9508

Richard Mountain

FTI Consulting Susanne Yule 0203 727 1340

----------------------------------------------- --------------

Notes:

1. James Fisher uses alternative performance measures (APMs) as

key financial indicators to assess the underlying performance of

the business. APMs are used by management as they are considered to

better reflect business performance and provide useful additional

information. APMs include underlying operating profit, underlying

profit before tax, underlying diluted earnings per share,

underlying return on capital employed and cash conversion. An

explanation of APMs is set out in note 3 in these half year

results.

2. Certain statements contained in this announcement constitute forward-looking statements. Forward-looking statements involve risks, uncertainties and other factors which may cause the actual results, performance or achievements of James Fisher to be materially different from future results, performance or achievements expressed or implied by such statements. Such risks, uncertainties and other factors include exchange rates, general economic conditions and the business environment.

Review of the six months ended 30 June 2020

Resilient performance in challenging conditions

The first half of 2020 was particularly challenging for our

employees, customers and suppliers, local communities and

shareholders as, after a stable start to the year, oil prices were

adversely impacted by over production relative to real demand which

was then quickly followed by the global lockdown due to

Covid-19.

The Group responded quickly to these challenges with our

priority being to protect our employees and, within that context,

to do all we could to continue to provide our services and goods to

customers, whilst supporting and maintaining our supply chain. The

commitment, support and engagement of our 3,000 employees during

this period has been remarkable. Since the third week of March,

approximately 70% of our office-based staff have been working from

home, made possible by our past investment in the appropriate

technology. At our operational sites we introduced enhanced safety

measures, deep cleansing and social distancing which has helped to

keep people safe, whilst maintaining good levels of efficiency and

performance.

The Group took swift actions to reduce costs, optimise cash flow

and protect liquidity. This included the deferral of all

discretionary capital expenditure, instituting a hiring freeze,

placing approximately 400 UK employees on furlough and implementing

a 20% pay deferral for approximately 800 employees across the

world. The deferred pay will be repaid to our employees during the

second half of the current year, with the exception of all Board

members, the Executive Committee and our senior leadership team,

who have agreed that their pay reduction of 20% for the second

quarter will not be reimbursed. The Group has returned to full

salaries with effect from 1 July 2020 and has ceased to take

advantage of the UK Government's furlough scheme since July.

In addition, the Group has deferred payment of cash bonuses in

relation to the 2019 financial year until July and deferred

payments of taxes where possible and defined benefit pension scheme

contributions, with the agreement of the Pension Trustees. We

announced on 26 March 2020 that the payment of the final dividend

in relation to the year ended 31 December 2019 had been suspended

as part of our response to protect the Group's liquidity going into

the Covid-19 lockdown and we have now taken the decision to cancel

this dividend.

Financial performance

Revenue in the first half of 2020 was 10% lower than the prior

year period comparator at GBP258.1m (2019: GBP286.9m). All our

divisions showed good resilience and traded profitably in each

month during the second quarter and underlying operating profit for

the first half was GBP19.5m (2019: GBP24.5m).

Underlying profit before taxation was GBP15.1m (2019: GBP20.9m)

and underlying diluted earnings per share were 23.6p (2019:

33.2p).

The strong momentum we saw in Offshore Oil through the second

half of 2019 continued into the first quarter of 2020 and although

there was a negative impact in the second quarter, this division

reported a first half underlying operating profit which was 23%

ahead of the prior period.

The combination of Covid-19 and the sharp decline in energy

prices has resulted in projects in our subsea operations in both

Renewables and Oil & Gas being deferred into the second half of

2020 and beyond. In response to these challenges, we have taken

actions, which are ongoing, to restructure our Marine Support

division. In addition, less favourable market conditions have led

us to revise assumptions of the carrying values of certain assets

across the Group which has resulted in an impairment charge. These

items are included within separately disclosed items by virtue of

their size and nature. Total separately disclosed items in the

period were GBP8.0m (2019: GBPnil) comprising restructuring in

Marine Support of GBP1.5m, impairment charges of GBP4.8m and

acquisition related charges of GBP1.7m.

Statutory operating profit for the first six months of 2020,

which is the underlying operating profit less separately disclosed

items, was GBP11.5m (2019: GBP24.5m) and statutory diluted earnings

per share were 9.9p (2019: 33.6p).

Dividends

We believe the Group has weathered the initial storm of Covid-19

and we have seen a significant improvement in the financial

headroom on our committed banking facilities. Global economies are

slowly recovering, and the price of oil has partially recovered

from the low point in April. We operate in diverse markets and have

a wide geographic spread so whilst certain parts of our business

have been seriously impacted by Covid-19, other parts of our

business have been resilient.

With this backdrop the Board has declared an interim dividend of

8.0 pence per share (2019: 11.3p), reflecting the reduction in

underlying profit before taxation in the period. The dividend will

be paid on 6 November 2020 to shareholders on the register at the

close of business on 2 October 2020.

Strategic Review

Our strategy has been to grow our business organically by

leveraging our extensive marine services skill base in areas of

specialist expertise across global markets, supplemented by

selective bolt-on acquisitions which broaden the Group's range of

specific niche services, products or geographical coverage. Our

strategic aim is to deliver long-term growth in earnings per share

and to consistently increase shareholder value. Whilst the Group

prioritises organic growth, this has been supplemented by value

enhancing acquisitions which fit into our existing divisions. James

Fisher looks to acquire businesses that have a niche product or

service offering with growth potential, a track record of

profitability, cash generation and strong management.

The appointment of Eoghan O'Lionaird as CEO on 1 October 2019

was an opportune time to revisit and retest the Group's strategy

and to create a plan for further growth in the years ahead. We had

intended to hold a capital markets day in June 2020 to update

shareholders on our strategic review but whilst considerable

progress has been made, our primary focus has been on protecting

the Group, its employees and its financial integrity and we have

deferred any announcement until next year.

Environmental, Social and Governance

The Health and Safety of our employees is always our highest

priority and new measures in response to Covid-19 were quickly

implemented throughout our Group. Regrettably, 56 James Fisher

employees have contracted the virus and one has sadly passed away.

The majority of cases in the Group have been in Brazil and many of

our team working in Mozambique were quarantined following an

outbreak at their operational base. We have sought to ensure any

affected employees receive the best medical care and support.

Our work in reviewing the Group strategy includes expanding our

focus to include our five key stakeholder groups: employees,

customers and suppliers, the local communities in which we operate,

the environment and our shareholders. With the objective of

ensuring that our strategy is intrinsically sustainable, each of

our operating companies is updating their respective strategies to

include policies, objectives and actions focused on each of these

primary stakeholders.

James Fisher continues to focus on diversity and inclusion. In

the first half of 2020, women represented 29% of our Board

membership and 29% of our Executive Committee.

Liquidity

During the first half, with the support of its bankers, the

Group increased its committed revolving credit facilities by GBP50m

to GBP300m (30 June 2019: GBP250m). Rapid actions taken to protect

the Company and improve liquidity resulted in a GBP29.9m reduction

in borrowings when compared to 31 December 2019. At 30 June 2020,

the Group had headroom against its committed revolving credit

facilities of GBP115.6m (2019: GBP83.7m). The ratio of net debt

(inclusive of bonds and guarantees) to Ebitda was 2.5 times (2019:

2.3 times) as calculated under our banking agreements, which

require a covenant of less than 3.5 times.

Outlook

The first half of 2020 was one of the most demanding periods the

Company has faced, and the commitment, support and engagement of

our employees in stepping up to the challenges has been remarkable.

The Group responded swiftly to both the unprecedented headwinds

presented by Covid-19 and the longer-term implications for energy

demand by taking actions to reduce costs and protect the Group's

liquidity. Whilst the second half is expected to remain challenging

and the outlook for our end markets is uncertain, we expect trading

to improve through the second half, assuming no material

deterioration in the Covid-19 situation.

James Fisher is well diversified by geographical sector and end

market. The resilience of the Group, our strong liquidity position

combined with swift actions taken to reduce costs position James

Fisher well for any improvement in market conditions in the second

half and beyond. Whilst the financial performance in 2020 will be

lower than 2019, the Group remains well placed to deliver future

growth to its shareholders.

Business review

Marine Support

H1 2020 H1 2019 change

Revenue (GBPm) 121.2 140.0 (13)%

Underlying operating profit (GBPm) 4.8 6.7 (28)%

Underlying operating margin 4.0% 4.8% (80)bps

Return on capital employed 4.4% 6.7% (230)bps

Revenue in Marine Support was 13% lower in the period at

GBP121.2m (2019: GBP140.0m), mainly due to lack of subsea and high

voltage projects in the Renewables sector, as projects were

cancelled or deferred.

Despite the challenges of Covid-19, good progress in the early

beach landing project in Mozambique offset a reduction of subsea

oil & gas projects in the Middle East and West Africa.

Ship-to-ship services performed strongly with revenue 20% higher

than the first half of 2019.

Given the GBP18.8m fall in revenue, underlying operating profit

was resilient, decreasing by GBP1.9m compared to the prior period

comparative as the lack of subsea projects offset excellent profit

growth in ship-to-ship services. The Group responded quickly to the

challenges within Marine Support and reduced headcount in the first

half with an associated one-off charge of GBP1.5m which will lead

to annualised savings in the future.

The businesses acquired in 2019, Martek Marine and Brazil based,

Servicos Maritimos Continental, adapted well to the Covid-19

situation and both made strong contributions to the first half.

Specialist Technical

H1 2020 H1 2019 change

Revenue (GBPm) 65.7 74.1 (11)%

Underlying operating profit (GBPm) 7.5 9.3 (19)%

Underlying operating margin 11.4% 12.6% (120)bps

Return on capital employed 13.4% 16.1% (270)bps

Revenue was 11% lower in Specialist Technical with difficulty

experienced in receiving components from the supply chain and in

progressing and completing projects in Asia Pacific as a result of

Covid-19. This adversely affected our defence and diving equipment

business, JFD, but our nuclear decommissioning business remained

resilient and posted a 3% increase in revenue in the first

half.

Underlying operating profit was GBP1.8m lower at GBP7.5m (2019:

GBP9.3m). Despite lower volumes, gross margins were one percentage

point higher on a similar cost of operations.

Whilst progress on saturation diving systems for Shanghai

Salvage was delayed by Covid-19, JFD made good progress on its

swimmer delivery vehicle order due for completion in 2021 as well

as on two submarine rescue vessel projects which commenced during

2019. JFD was awarded a three-year extension to its submarine

rescue service for NATO. This contract extension secures the safe

and continued in-service support, through maintenance and

operation, of a globally deployable submarine rescue system for the

UK MoD and the partner nations of France and Norway.

In March 2020, Fathom Systems, a leading provider of diving

communications, gas analysis and integrated diving control systems,

was acquired. Fathom further enhances JFD's ability to provide

differentiated solutions to support safe diving operations in the

most extreme environments.

We were proud of JFD's response to the UK Government's call for

rapidly manufactured ventilators to provide essential medical

equipment to the NHS. Using its world-leading breathing gas reclaim

systems, the InVicto ventilator was quickly developed, tested and

designed for minimal oxygen consumption, which could become a

scarce resource. While the UK medical authority did not take

InVicto forward, clinical trials are continuing in other

countries.

Offshore Oil

H1 2020 H1 2019 change

Revenue (GBPm) 41.3 39.6 +4%

Underlying operating profit (GBPm) 5.4 4.4 +23%

Underlying operating margin 13.1% 11.1% +200bps

Return on capital employed 8.6% 6.8% +180bps

The momentum from the second half of 2019 in Offshore Oil flowed

through into the first quarter of 2020 until the logistical issues

caused by Covid-19 in late March started to adversely impact the

division. Lower energy prices typically have a delayed impact in

Offshore Oil. Revenue in the first half was 4% higher than the

prior period and underlying operating profit was 23% higher at

GBP5.4m (2019: GBP4.4m). Underlying operating margins increased to

13.1% (2019: 11.1%).

RMSpumptools, which provides solutions to extend the life of

existing wells, experienced good demand throughout the first half

and enters the second half with a similar order book to last year.

Scantech Offshore further increased its services to the Renewables

market where it provides compressors for bubble curtains, which

reduce subsea sound and pollution during construction and protects

marine life. Fisher Offshore won good orders for its specialist

cutting tool services for oil rig decommissioning projects. This is

an area where demand is increasing, which augurs well for the

future.

Tankships

H1 2020 H1 2019 change

Revenue (GBPm) 29.9 33.2 (10)%

Underlying operating profit (GBPm) 3.6 5.9 (39)%

Underlying operating margin 12.0% 17.8% (580)bps

Return on capital employed 24.3% 40.7% (1640)bps

Revenue at Tankships was 10% lower at GBP29.9m (2019: GBP33.2m)

and underlying profit 39% lower at GBP3.6m (2019: GBP5.9m). The

business operated two fewer tankers in the first half of 2020 and

was trading in line with expectations until the end of April when

the impact of lockdown significantly reduced the transportation of

clean petroleum products and hence tanker utilisation. Despite the

Covid-19 challenges, the division traded profitably in both May and

June. Volumes improved in June and further in July as the lockdown

was gradually eased.

Cash flow and borrowings

Summary cash flow

----------------------------- -------- --------

H1 2020 H1 2019

GBPm GBPm

----------------------------- -------- --------

Underlying operating profit 19.5 24.5

Depreciation & amortisation 16.5 15.3

-----------------------------

Underlying ebitda * 36.0 39.8

Working capital 24.7 (7.1)

Pension / other 0.2 (6.7)

-----------------------------

Operating cash flow 60.9 26.0

Cash outflow on separately

disclosed (1.1) (0.6)

Interest & tax (8.8) (6.2)

Capital expenditure (12.7) (38.2)

Acquisitions (4.5) (13.6)

Dividends - (11.1)

Other (3.9) (2.1)

-----------------------------

Net inflow/(outflow) 29.9 (45.8)

net debt (IAS 17) at start

of period (203.0) (113.6)

----------------------------- -------- --------

Net debt on an IAS 17 basis reduced

by GBP29.9m to GBP173.1m (2019:

GBP159.4m) reflecting the rapid

actions taken to conserve cash and

increase liquidity. These included

suspending payment of the final

proposed dividend in relation to

2019, deferring pensions and employee

related tax liabilities and a significant

drive on collections from customers.

As a result, working capital improved

by GBP31.8m compared to 2019 and

operating cash flow by GBP34.9m

to GBP60.9m (2019: GBP26.0m). Cash

conversion, the ratio of operating

cash flow to underlying operating

profit, was 312% (2019: 106%).

Acquisition spend comprised Fathom

Systems for GBP1.2m, deferred consideration

for businesses purchased in prior

years of GBP2.7m with the balance

related to a joint venture in Norway.

Capital expenditure of GBP12.7m

(2019: GBP38.2m) reflected the spending

freeze imposed to respond to Covid-19

but with careful attention to ensure

net debt (IAS 17) at end investment for future growth was

of period (173.1) (159.4) maintained.

----------------------------- -------- --------

* Underlying earnings before interest, tax, depreciation and

amortisation

At 30 June 2020 the Group had committed revolving credit

facilities of GBP300m (2019: GBP250m) and GBP115.6m of headroom

(2019: GBP83.7m). The ratio of net debt to underlying Ebitda on an

IAS 17 basis was 1.9 times (2019: 1.7 times). Our banking

agreements are on a frozen GAAP basis and the ratio of net debt

(including bonds and guarantees) to Ebitda, was 2.5 times (2019:

2.3 times). Net borrowings including operating leases (IFRS16

basis) were GBP31.9m lower than 31 December 2019 at GBP198.5m

(2019: GBP190.5m).

Balance sheet

Working capital was GBP16.2m lower

than at 30 June 2019 and GBP23.2m

lower than at 31 December 2019. The

ratio of working capital to sales

at 30 June 2020 was 13.4% (2019:

16.1%) reflecting the improvement

in the period, but also the reduction

in revenue.

Net gearing, the ratio of net debt

30 June 30 June (IAS 17) to equity was 55 % (2019:

2020 2019 52%).

--------------------------

GBPm GBPm

-------------------------- -------- --------

Intangible assets 208.4 212.5

Other assets 218.5 183.8

Right-of-use assets 24.4 30.7

Working capital 78.6 94.8

Deferred consideration (3.3) (3.6)

Pensions (5.2) (10.7)

Tax (6.7) (8.3)

--------------------------

Capital employed 514.7 499.2

-------------------------- -------- --------

Net debt (IAS 17) 173.1 159.4

Right-of-use liabilities 25.4 31.1

Equity 316.2 308.7

--------------------------

514.7 499.2

-------------------------- -------- --------

Risks and uncertainties

Aside from Covid-19, the principal risks and uncertainties which

may have the largest impact on performance in the second half of

the year are the same as disclosed in the 2019 Annual Report and

Accounts on pages 25-27. The principal risks set out in the 2019

Annual Report and Accounts were:

-- Operational - project delivery, recruitment and retention of

key staff, health, safety and environment, contractual risk and

cyber security;

-- Strategic - operating in emerging markets; and

-- Financial - foreign currency and interest rates.

The Board considers that the principal risks and uncertainties

set out in the 2019 Annual Report and Accounts remain the same,

although there has been a slight increase in some of the

operational and financial risks, predominantly as a result of the

impact and uncertainties of the global pandemic which have been set

out above. The principal risks set out in the 2019 Annual Report

and Accounts, together with the addition of a global pandemic,

remain relevant for the second half of the financial year.

Directors' Responsibilities

We confirm that to the best of our knowledge:

(a) The condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting' as adopted

by the European Union.

(b) The interim management report includes a fair review of the

information required by:

a. DTR 4.2.7R of the 'Disclosure and Transparency Rules', being

an indication of important events that have occurred during the

first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

b. DTR 4.2.8R of the 'Disclosure and Transparency Rules', being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

the period; and any changes in the related party transactions

described in the last annual report that could do so.

Approved by the Board of Directors and signed on its behalf

by:

E P O'Lionaird S C Kilpatrick

Chief Executive Officer Group Finance Director

24 August 2020

CONDENSED CONSOLIDATED INCOME STATEMENT

for the six months ended 30 June 2020

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2020 2019 2019

Note GBPm GBPm GBPm

Revenue 4 258.1 286.9 617.1

Cost of sales (187.2) (204.9) (432.4)

----------- ----------- -------------

Gross profit 70.9 82.0 184.7

Administrative expenses (60.1) (58.7) (129.9)

Share of post tax results of joint

ventures 0.7 1.2 0.8

----------- ----------- -------------

Operating profit 4 11.5 24.5 55.6

Net finance expense 6 (4.4) (3.6) (7.8)

----------- ----------- -------------

Profit before taxation 7.1 20.9 47.8

Income tax 7 (2.0) (4.0) (11.1)

Profit for the period 5.1 16.9 36.7

=========== =========== =============

Attributable to:

Owners of the Company 5.0 17.0 36.7

Non-controlling interests 0.1 (0.1) -

5.1 16.9 36.7

=========== =========== =============

Earnings per share

pence pence pence

Basic 8 9.9 33.8 73.1

Diluted 8 9.9 33.6 72.7

Alternative performance measures 3 GBPm GBPm GBPm

Operating profit 11.5 24.5 55.6

Separately disclosed items 5 8.0 - 10.7

----------- ----------- -------------

Underlying operating profit 19.5 24.5 66.3

Net finance expense (4.4) (3.6) (7.8)

----------- ----------- -------------

Underlying profit before tax 15.1 20.9 58.5

=========== =========== =============

Underlying earnings per share

pence pence pence

Basic 8 23.6 33.4 93.2

Diluted 8 23.6 33.2 92.8

------------------------------------- ----- ----------- ----------- -------------

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 30 June 2020

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2020 2019 2019

Note GBPm GBPm GBPm

Profit for the period 5.1 16.9 36.7

Items that will not be reclassified to the

income statement

Remeasurement loss on defined benefit pension

schemes 10 (0.4) - 2.2

Tax on items that will not be reclassified 0.1 - 0.6

-------- ----------- ------------

(0.3) - 2.8

Items that may be reclassified subsequently to

the income statement

Exchange differences on foreign currency

net investments 1.8 1.2 (8.1)

Effective portion of changes in fair value

of cash flow hedges (3.6) (0.7) 2.3

Effective portion of changes in fair value of

cash flow hedges in joint ventures (0.3) (0.1) (0.1)

Net change in fair value of cash flow hedges

transferred to income statement 0.6 (0.6) (1.4)

Deferred tax on items that may be reclassified 0.7 0.3 (0.4)

-------- ----------- ------------

(0.8) 0.1 (7.7)

Total comprehensive income for the period 4.0 17.0 31.8

======== =========== ============

Attributable to:

Owners of the Company 3.9 17.1 31.8

Non-controlling interests 0.1 (0.1) -

4.0 17.0 31.8

======== =========== ============

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

at 30 June 2020

30 June 30 June 31 December

2020 2019 2019

Note GBPm GBPm GBPm

Non-current assets

Goodwill 11 182.8 184.2 185.5

Intangible assets 25.6 28.3 29.7

Property, plant and equipment 208.2 172.8 210.6

Right-of-use assets 24.4 30.7 27.1

Investment in joint ventures 8.9 9.6 8.5

Other investments 1.4 1.4 1.4

Deferred tax assets 5.6 4.0 4.5

456.9 431.0 467.3

-------- -------- ------------

Current assets

Inventories 52.3 50.2 47.9

Trade and other receivables 201.2 202.5 213.7

Cash and cash equivalents 12 20.8 17.4 18.5

274.3 270.1 280.1

-------- -------- ------------

Current liabilities

Trade and other payables (173.6) (158.8) (158.0)

Provisions for liabilities and charges (0.9) (2.1) (0.7)

Current tax (7.1) (9.8) (10.5)

Borrowings (8.2) (10.9) (11.3)

Lease liabilities (8.4) (8.9) (8.9)

(198.2) (190.5) (189.4)

-------- -------- ------------

Net current assets 76.1 79.6 90.7

Total assets less current liabilities 533.0 510.6 558.0

-------- -------- ------------

Non-current liabilities

Other payables (3.7) (0.6) (4.8)

Retirement benefit obligations 10 (5.2) (10.7) (5.8)

Cumulative preference shares (0.1) (0.1) (0.1)

Borrowings (182.8) (165.6) (207.3)

Lease liabilities (19.8) (22.4) (21.3)

Deferred tax liabilities (5.2) (2.5) (4.7)

(216.8) (201.9) (244.0)

-------- -------- ------------

Net assets 316.2 308.7 314.0

======== ======== ============

Equity

Called up share capital 12.6 12.6 12.6

Share premium 26.6 26.2 26.5

Treasury shares (0.3) - -

Other reserves (11.0) (0.9) (10.6)

Retained earnings 287.4 270.7 284.7

-------- -------- ------------

Equity attributable to owners of the

Company 315.3 308.6 313.2

Non-controlling interests 0.9 0.1 0.8

Total equity 316.2 308.7 314.0

======== ======== ============

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months ended 30 June 2020

Share Share Retained Other Treasury Shareholders' Non-controlling Total

capital premium earnings reserves shares equity interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 1 January

2020 12.6 26.5 284.7 (10.6) - 313.2 0.8 314.0

Total

comprehensive

income - - 4.2 (0.3) - 3.9 0.1 4.0

Acquisitions - - - (0.1) - (0.1) - (0.1)

Share based

payments - - 0.2 - - 0.2 - 0.2

Tax effect of

share

based payments - - (0.3) - - (0.3) - (0.3)

Purchase of

shares

by ESOT - - - - (0.9) (0.9) - (0.9)

Award of

treasury

shares - - (1.4) - 0.6 (0.8) - (0.8)

Arising on the

issue

of shares (0.0) 0.1 - - - 0.1 - 0.1

-------- -------- --------- --------- ------------ -------------- ---------------- -------

At 30 June 2020 12.6 26.6 287.4 (11.0) (0.3) 315.3 0.9 316.2

======== ======== ========= ============ ============== ================ =======

At 1 January

2019 12.6 25.9 267.8 (0.9) (0.4) 305.0 1.4 306.4

IFRIC 23 -

opening

balance

adjustments - - (2.0) - - (2.0) - (2.0)

Total

comprehensive

income - - 17.1 - - 17.1 (0.1) 17.0

Ordinary

dividends

paid - - (10.7) - - (10.7) - (10.7)

Dividends paid

to

non-controlling

interest - - - - - - (0.4) (0.4)

Acquisition of

non-controlling

interest - - - - - - (0.8) (0.8)

Share based

payments - - 0.9 - - 0.9 - 0.9

Tax effect of

share

based payments - - 0.3 - - 0.3 - 0.3

Purchase of

shares

by ESOT - - - - (2.3) (2.3) - (2.3)

Award of

treasury

shares - - (2.7) - 2.7 - - -

Arising on the

issue

of shares - 0.3 - - - 0.3 - 0.3

-------- -------- --------- --------- ------------ -------------- ---------------- -------

At 30 June 2019 12.6 26.2 270.7 (0.9) - 308.6 0.1 308.7

======== ======== ========= ========= ============ ============== ================ =======

Other reserve

movements Translation Hedging Put option

reserve reserve liability Total

Other reserves GBPm GBPm GBPm GBPm

At 1 January

2019 0.3 (1.2) - (0.9)

Other

comprehensive

income (8.1) 1.0 - (7.1)

Remeasurement of non-controlling interest

put option - - (2.6) (2.6)

------------ -------------- ---------------- -------

At 31 December

2019 (7.8) (0.2) (2.6) (10.6)

Other

comprehensive

income 1.9 (2.9) - (1.0)

Remeasurement of non-controlling interest

put option - - (0.1) (0.1)

At 30 June 2020 (5.9) (3.1) (2.7) (11.7)

============ ============== ================ =======

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

for the six months ended 30 June 2020

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2020 2019 2019

Note GBPm GBPm GBPm

Profit before tax for the period 7.1 20.9 47.8

Adjustments to reconcile profit before tax

to net cash flows

Depreciation and amortisation 23.3 21.8 43.1

Separately disclosed items (excluding amortisation) 6.5 (1.5) 7.6

Other non cash items 6.0 2.5 6.4

Increase in inventories (3.4) (4.8) (2.4)

Decrease/(increase) in trade and other receivables 14.5 (14.3) (31.1)

Decrease in trade and other payables 13.6 12.0 12.2

Defined benefit pension cash contributions

less service cost (1.2) (5.6) (8.4)

-------- ----------- ------------

Cash generated from operations 66.4 31.0 75.2

Cash outflow from separately disclosed items (1.1) (0.6) (7.5)

Income tax payments (5.2) (4.1) (9.6)

-------- ----------- ------------

Cash flow from operating activities 60.1 26.3 58.1

Investing activities

Dividends from joint venture undertakings 0.6 0.5 1.7

Proceeds from the disposal of property, plant

and equipment 0.6 1.1 2.2

Finance income 0.1 0.1 0.3

Acquisition of subsidiaries, net of cash

acquired (4.0) (11.3) (12.5)

Investment in joint ventures and other investments (0.5) (0.7) (4.7)

Acquisition of property, plant and equipment (11.8) (37.6) (88.9)

Development expenditure (1.5) (1.7) (3.5)

Cash flows used in investing activities (16.5) (49.6) (105.4)

Financing activities

Proceeds from the issue of share capital 0.1 0.3 -

Finance costs (3.7) (2.2) (5.3)

Purchase of own shares by Employee Share

Ownership Trust (0.9) (1.1) (1.1)

Notional purchase of own shares for LTIP

award (0.8) (1.2) (1.3)

Capital element of lease repayments (6.2) (5.6) (11.3)

Proceeds from borrowings 43.9 111.3 106.6

Repayment of borrowings (73.1) (68.4) (21.2)

Dividends paid - (10.7) (16.4)

Dividend paid to non-controlling interest - (0.4) (2.0)

-------- ----------- ------------

Cash flows from/(used in) financing activities (40.7) 22.0 48.0

Net increase/(decrease) in cash and cash

equivalents 2.9 (1.3) 0.7

Cash and cash equivalents at beginning of

period 18.5 18.6 18.6

Net foreign exchange differences (0.6) 0.1 (0.8)

Cash and cash equivalents at end of period 12 20.8 17.4 18.5

======== =========== ============

NOTES TO THE CONDENSED CONSOLIDATED HALF YEAR STATEMENTS

1 Basis of preparation

James Fisher and Sons Plc (the Company) is a public limited

company registered and domiciled in England and Wales and listed on

the London Stock Exchange. The condensed consolidated half year

financial statements of the Company for the six months ended 30

June 2020 comprise the Company and its subsidiaries (together

referred to as the Group) and the Group's interests in jointly

controlled entities.

Statement of compliance

The condensed consolidated financial statements have been

prepared in accordance with International Financial Reporting

Standard (IFRS) IAS 34 "Interim Financial Reporting" as adopted by

the European Union (EU). As required by the Disclosure and

Transparency Rules of the Financial Services Authority, the

condensed consolidated set of financial statements has been

prepared applying the accounting policies and presentation that

were applied in the preparation of the Group's published

consolidated financial statements for the year ended 31 December

2019 with the exceptions described below. They do not include all

of the information required for full annual financial statements

and should be read in conjunction with the consolidated financial

statements of the Group for the year ended 31 December 2019.

The comparative figures for the financial year ended 31 December

2019 are not the Group's statutory accounts for that financial

year. Those accounts which were prepared under International

Financial Reporting Standards (IFRS) as adopted by the EU (adopted

IFRS), have been reported on by the Group's auditors and delivered

to the Registrar of Companies. The report of the auditors was (i)

unqualified, (ii) did not include a reference to any matters to

which the auditors drew attention by way of emphasis without

qualifying their report and (iii) did not contain a statement under

section 498 (2) or (3) of the Companies Act 2006.

The consolidated financial statements of the Group for the year

ended 31 December 2019 are available upon request from the

Company's registered office at Fisher House, PO Box 4,

Barrow-in-Furness, Cumbria LA14 1HR or at www.james-fisher.co.uk

.

The half year financial information is presented in Sterling and

all values are rounded to the nearest million pounds (GBPm) except

where otherwise indicated.

Going concern

The Directors have, at the time of approving these Condensed

Consolidated Interim Financial Statements, a reasonable expectation

that the Group has adequate resources to continue in operational

existence for at least 12 months from this reporting date.

In light of the Covid-19 global pandemic experienced in 2020 and

subsequent uncertainty, the Group has undertaken a detailed

viability review and taken appropriate mitigating actions to

protect the business and liquidity. Operations have been impacted

by travel restrictions, supply chain logistics and actions to

protect employees to ensure safe working conditions. The Group's

quick response to Covid-19 has mitigated the impact on financial

performance, however the potential impact of a second wave or a

post pandemic recession gives ongoing risk to future financial

performance.

The Group had GBP115.6m of undrawn committed facilities at 30

June 2020 (2019: GBP83.7m) and increased committed facilities by

GBP50m in the period to GBP300m (30 June 2019: GBP250m). No

revolving credit facilities are due for renewal within the next

twelve months. In addition, on 21 July 2020, the Group was

confirmed as an eligible issuer under the Bank of England's Covid

Corporate Financing Facility (CCFF), under which the Group can draw

up to GBP60m. The Group has not needed to draw on this CCFF

facility and assumes that this facility continues to remain

undrawn.

For the interim going concern review, the base case forecast

reflected financial performance in the six months ended 30 June

2020 and the associated impacts of Covid-19. A number of scenarios

were calculated compared to the base case forecast of profit and

cash flow to assess headroom against facilities for the next 30

months. Against negative scenarios, mitigating actions were applied

and in the severe but plausible downside, which reduced operating

profit by GBP10m in 2020 and by GBP20m in 2021 and 2022, adjusted

projections showed no breach of covenants. Additional sensitivities

which reduced cash receipts by GBP10m in 2020, GBP20m in 2021 and

GBP10m in 2022 and delayed project delivery deferring debtor

allocation by GBP3m in 2020 and by GBP6m in 2021 and 2022 were also

run separately in combination with the severe but plausible

downside and adjusted projections showed no breach of

covenants.

Taking into account the level of cash and available facilities

outlined above, the Directors consider that the Group has

sufficient funds to allow it to meet its liabilities as they fall

due for at least 12 months from the date of approval of the

financial statements, having undertaken a rigorous assessment of

financial forecasts and therefore continue to adopt the going

concern basis of accounting in preparing these Condensed

Consolidated Interim Financial Statements.

Adoption of standards

IAS 20 Accounting for Government Grants and Disclosure of

Government Assistance

During the period, some employees across the Group were placed

on furlough under the Coronavirus Jobs Retention Scheme. Furlough

income of GBP1.9m in relation to a maximum of 400 employees has

been recognised in the six months ended 30 June 2020 and as such

the Group has adopted IAS 20 in accounting for this government

income. The grant has been recognised as income and matched with

the associated payroll costs over the same period. The

corresponding asset is shown within trade and other receivables on

the balance sheet, to the extent that claimed amounts remain

outstanding at 30 June 2020.

Significant accounting policies

The accounting policies applied by the Group in these condensed

consolidated financial statements are the same as those applied by

the Group in its consolidated financial statements as at and for

the year ended 31 December 2019.

2 Accounting estimates and judgements

The preparation of half year financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those applied to the consolidated

financial statements as at and for the year ended 31 December

2019.

3 Alternative performance measures

The Group presents a number of alternative (non-Generally

Accepted Accounting Practice (non-GAAP)) performance measures which

are not defined within IFRS. These measures are presented to assist

investors in gaining a clear and balanced view of the underlying

operational performance of the Group and, are consistent year on

year and with how business performance is measured internally. The

adjustments are separately disclosed (note 5) and are usually items

that are significant in size or non-recurring in nature. The

following non-GAAP measures are referred to in the half year

results.

3.1 Underlying operating profit and underlying profit before taxation

Underlying operating profit is defined as operating profit

before acquisition related income and expense (amortisation or

impairment of acquired intangible assets, acquisition expenses,

adjustments to contingent consideration), the costs of a material

restructuring, litigation, or asset impairment and the profit or

loss relating to the sale of businesses. As acquisition related

income and expense fluctuates with activity and to provide a better

comparison to businesses that are not acquisitive, the Directors

consider that these items should be separately disclosed to give a

better understanding of operating performance. Underlying profit

before taxation is defined as underlying operating profit less net

finance expense.

3.2 Underlying earnings per share

Underlying earnings per share is calculated as the total of

underlying profit before tax, less income tax, but excluding the

tax impact on separately disclosed items included in the

calculation of underlying profit less profit attributable to

non-controlling interests, divided by the weighted average number

of ordinary shares in issue during the year. Underlying earnings

per share is set out in note 8.

3.3 Capital employed and Return on Capital Employed (ROCE)

Capital employed is defined as net assets less cash and

short-term deposits and after adding back borrowings. Average

capital employed is adjusted for the timing of businesses acquired,

right-of-use assets, and after adding back cumulative amortisation

of acquired intangible assets. Segmental ROCE is defined as the

underlying operating profit, divided by average capital employed.

The key performance indicator, Group post-tax ROCE, is defined as

underlying operating profit, less notional tax, calculated by

multiplying the effective tax rate by the underlying operating

profit, divided by average capital employed.

2020 2019 2019

Six months ended Six months Year ended

30 June ended 30 June 31 December

GBPm GBPm GBPm

Net assets 316.2 308.7 314.0

Less right-of-use

assets (24.4) (30.7) (27.1)

----------------- --------------- -------------

291.8 278.0 286.9

Less cash and short-term deposits (13.3) (17.4) (18.5)

Plus borrowings and lease

liabilities 211.7 207.8 248.8

Capital employed 490.2 468.4 517.2

----------------- --------------- -------------

Underlying operating

profit 19.5 24.5 66.3

Notional tax at the effective

tax rate (4.1) (4.9) (13.1)

----------------- --------------- -------------

15.4 19.6 53.2

Average capital employed 471.9 449.3 471.1

Return on average capital

employed 6.6% 8.7% 11.3%

----------------- --------------- -------------

3.4 Cash conversion

Cash conversion is defined as the ratio of operating cash flow

to underlying operating profit. Operating cash flow comprises:

2020 2019 2019

Six months Six months Year ended

ended 30 June ended 30 June 31 December

GBPm GBPm GBPm

Cash generated from operations 66.4 31.0 75.2

Dividends from joint venture

undertakings 0.6 0.5 1.7

Capital element of lease

repayments (6.2) (5.6) (11.3)

less capital element of finance

lease repayments 0.1 0.1 0.2

--------------- --------------- -------------

Operating cash flow 60.9 26.0 65.8

Underlying operating

profit 19.5 24.5 66.3

Cash conversion 312% 106% 99%

3.5 Underlying earnings before interest, tax, depreciation and amortisation (Ebitda)

Underlying Ebitda is defined as the underlying operating profit

before interest, tax, depreciation and amortisation.

2020 2019 2019

Six months

ended 30 Six months Year ended

June ended 30 June 31 December

GBPm GBPm GBPm

Underlying operating

profit 19.5 24.5 66.3

Depreciation and

amortisation 23.3 21.8 43.1

Less: Deprecation on right-of-use

assets (5.3) (5.0) (10.1)

Amortisation of acquired intangibles

(note 5) (1.5) (1.5) (3.1)

----------- --------------- -------------

Underlying depreciation and

amortisation 16.5 15.3 29.9

----------- --------------- -------------

Underlying

Ebitda 36.0 39.8 96.2

----------- --------------- -------------

3.6 Underlying dividend cover

Underlying dividend cover is the ratio of the underlying diluted

earnings per share to the dividend per share.

pence pence pence

Underlying earnings per

share 23.6 33.2 92.8

Dividends per share 8.0 11.3 34.7

Underlying dividend cover

(times) 3.0 2.9 2.7

3.7 Organic

Organic growth represents the performance for the current year

in sterling compared to the prior year, adjusted for current and

prior year acquisitions and for a constant currency. The constant

currency adjustment takes the non-sterling results for the prior

year and re-translates them at the average exchange rate for the

current year.

3.8 Leases

IFRS 16 'Leases' became effective from 1 January 2019. The

financial impact of IFRS 16 compared to accounting under the

previous leasing standard IAS 17 is excluded under frozen GAAP

arrangements set out in our banking agreements and is summarised

below:

2020 2019 2019

Six months Six months

ended 30 ended 30 Year ended

June June 31 December

GBPm GBPm GBPm

Operating lease charges 6.1 5.5 11.1

Depreciation on right-of-use

assets (5.3) (5.0) (10.1)

----------- ----------- -------------

Increase in operating profit 0.8 0.5 1.0

Right-of-use interest (0.8) (0.9) (1.7)

----------- ----------- -------------

Decrease in profit before

tax - (0.4) (0.7)

=========== =========== =============

4 Segmental information

Management has determined that the Group has four operating

segments reviewed by the Board; Marine Support, Specialist

Technical, Offshore Oil and Tankships. Their principal activities

are set out in the Strategic Report within the consolidated

financial statements of the Group for the year ended 31 December

2019.

The Board assesses the performance of the segments based on

underlying operating profit. The Board believes that such

information is the most relevant in evaluating the results of

certain segments relative to other entities which operate within

these industries. Inter-segmental sales are made using prices

determined on an arms-length basis. Sector assets exclude cash,

short-term deposits and corporate assets that cannot reasonably be

allocated to operating segments. Sector liabilities exclude

borrowings, retirement benefit obligations and corporate

liabilities that cannot reasonably be allocated to operating

segments.

Six months ended 30 June 2020

Marine Specialist Offshore

Support Technical Oil Tankships Corporate Total

GBPm GBPm GBPm GBPm GBPm GBPm

Revenue

Segmental revenue reported

- point in time 104.7 18.7 41.5 - - 164.9

- over time 16.6 47.5 - 29.9 - 94.0

Inter-segmental sales (0.1) (0.5) (0.2) - - (0.8)

121.2 65.7 41.3 29.9 - 258.1

======== =========== ========= ========== ========== ========

Underlying operating

profit 4.8 7.5 5.4 3.6 (1.8) 19.5

Acquisition costs (0.1) (0.1) - - - (0.2)

Amortisation of acquired

intangibles (1.0) (0.1) (0.4) - - (1.5)

Impairment charge (1.7) (0.9) (2.2) - - (4.8)

Restructuring costs (1.5) - - - - (1.5)

-------- ----------- --------- ---------- ---------- --------

Operating profit 0.5 6.4 2.8 3.6 (1.8) 11.5

Net finance expense (4.4)

--------

Profit before tax 7.1

Income tax (2.0)

Profit for the period 5.1

========

Assets & liabilities

Segmental assets 320.7 163.5 153.4 58.6 18.6 714.8

Investment in joint

ventures 3.5 3.0 2.4 - - 8.9

-------- ----------- --------- ---------- ---------- --------

Total assets 324.2 166.5 155.8 58.6 18.6 723.7

Segmental liabilities (101.5) (55.6) (30.4) (28.8) (191.2) (407.5)

222.7 110.9 125.4 29.8 (172.6) 316.2

======== =========== ========= ========== ========== ========

Other segmental information

Capital expenditure 4.9 1.3 3.2 2.4 - 11.8

Depreciation and amortisation 8.0 3.3 6.5 5.3 0.2 23.3

======== =========== ========= ========== ========== ========

Six months ended 30 June 2019

Marine Specialist Offshore

Support Technical Oil Tankships Corporate Total

GBPm GBPm GBPm GBPm GBPm GBPm

Revenue

Segmental revenue reported

- point in time 139.5 23.3 41.4 - - 204.2

- over time 0.5 51.7 - 33.2 - 85.4

Inter-segmental sales - (0.9) (1.8) - - (2.7)

140.0 74.1 39.6 33.2 - 286.9

======== =========== ========= ========== ========== ========

Underlying operating

profit reported 6.7 9.3 4.4 5.9 (1.8) 24.5

Acquisition costs (0.5) - - - - (0.5)

Amortisation of acquired

intangibles (0.9) (0.2) (0.4) - - (1.5)

Costs of material litigation (1.5) - - - - (1.5)

Adjustment to provision

for contingent consideration 3.5 - - - - 3.5

-------- ----------- --------- ---------- ---------- --------

Operating profit 7.3 9.1 4.0 5.9 (1.8) 24.5

-------- ----------- --------- ---------- ---------- --------

Net finance expense (3.6)

--------

Profit before tax 20.9

Income tax (4.0)

Profit for the period 16.9

========

Assets & liabilities

Segmental assets 290.6 159.7 163.3 55.8 22.1 691.5

Investment in joint

ventures 5.1 3.4 1.1 - - 9.6

-------- ----------- --------- ---------- ---------- --------

Total assets 295.7 163.1 164.4 55.8 22.1 701.1

Segmental liabilities (90.6) (54.7) (30.1) (27.9) (189.1) (392.4)

205.1 108.4 134.3 27.9 (167.0) 308.7

======== =========== ========= ========== ========== ========

Other segment information

Capital expenditure 29.4 1.6 5.9 1.6 - 38.5

Depreciation and amortisation 6.5 4.0 6.4 4.7 0.2 21.8

======== =========== ========= ========== ========== ========

Year ended 31 December 2019

Marine Specialist Offshore

Support Technical Oil Tankships Corporate Total

GBPm GBPm GBPm GBPm GBPm GBPm

Revenue

Segmental revenue reported

- point in time 270.6 58.8 93.4 - - 422.8

- over time 35.6 95.4 - 67.9 - 198.9

Inter-segmental sales (0.1) (1.5) (3.0) - - (4.6)

306.1 152.7 90.4 67.9 - 617.1

======== =========== ========= ========== ========== ========

Underlying operating

profit reported 25.1 18.4 13.6 12.0 (2.8) 66.3

Acquisition costs (0.5) (0.1) - - - (0.6)

Amortisation of acquired

intangibles (2.1) (0.2) (0.8) - - (3.1)

Costs of material litigation (1.5) - - - - (1.5)

Adjustment to provision

for contingent consideration 3.5 - - - - 3.5

Impairment charge (9.0) - - - - (9.0)

-------- ----------- --------- ---------- ---------- --------

Operating profit 15.5 18.1 12.8 12.0 (2.8) 55.6

Net finance expense (7.8)

--------

Profit before tax 47.8

Income tax (11.1)

Profit for the year 36.7

========

Assets & liabilities

Segmental assets 325.8 166.1 164.2 60.7 22.1 738.9

Investment in joint

ventures 3.6 3.0 1.9 - - 8.5

-------- ----------- --------- ---------- ---------- --------

Total assets 329.4 169.1 166.1 60.7 22.1 747.4

Segmental liabilities (99.5) (53.1) (29.8) (28.9) (222.1) (433.4)

229.9 116.0 136.3 31.8 (200.0) 314.0

======== =========== ========= ========== ========== ========

Other segment information

Capital expenditure 66.1 4.5 11.9 12.8 - 95.3

Depreciation and amortisation 13.0 7.0 13.0 9.7 0.4 43.1

======== =========== ========= ========== ========== ========

5 Separately disclosed items

Certain items are disclosed separately in the financial

statements to provide a clear understanding of the underlying

financial performance of the Group, referred to in note 3. They are

items that are non-recurring and significant by virtue of their

size and include acquisition related income or changes, costs of

material litigation, restructure or material improvement.

Separately disclosed items comprise:

2020 2019 2019

Six months

Six months ended ended Year ended

30 June 30 June 31 December

GBPm GBPm GBPm

Acquisition related income and (expense):

Costs incurred on acquiring businesses (0.2) (0.5) (0.6)

Amortisation of acquired intangibles (1.5) (1.5) (3.1)

Adjustment to provision for contingent

consideration - 3.5 3.5

(1.7) 1.5 (0.2)

Material restructure of Marine Support (1.5) - -

Material litigation - (1.5) (1.5)

Impairment charge (4.8) - (9.0)

-------- ----------- ------------

Separately disclosed items before

taxation (8.0) - (10.7)

Taxation 1.1 - 0.5

-------- ----------- ------------

Separately disclosed items after

taxation (6.9) - (10.2)

======== =========== ============

Due to the impact of Covid-19 combined with a sharp fall in

energy prices, project work within Marine Support has sharply

declined or has been deferred and the Group commenced a material

restructure of the division. In the first half, a charge of GBP1.5m

(2019: GBPnil) was recognised.

The Group has taken an impairment charge of GBP4.8m in relation

to certain tangible and intangible assets within Marine Support,

Offshore Oil and Specialist Technical reflecting a reduction in

medium term opportunities for these assets to generate acceptable

cash flow returns based on latest forecasts.

Acquisition related income and charges benefitted from a release

in contingent consideration in 2019 which was not repeated and

primarily comprises amortisation on acquired intangibles.

6 Net finance expense

2020 2019 2019

Six months

Six months ended ended Year ended

30 June 30 June 31 December

GBPm GBPm GBPm

Finance income:

Interest receivable on short-term

deposits 0.1 0.1 0.3

Finance expense:

Bank loans and overdrafts (3.4) (2.5) (5.8)

Net interest on pension obligations (0.2) (0.2) (0.3)

Unwind of discount on right-of-use

lease liability (0.8) (0.9) (1.7)

Unwind of discount on contingent

consideration (0.1) (0.1) (0.3)

-------- ----------- ------------

(4.5) (3.7) (8.1)

Net finance expense (4.4) (3.6) (7.8)

======== =========== ============

7 Taxation

The Group's effective rate on profit before income tax was 28.2%

(30 June 2019: 18.9%, 31 December 2019: 23.2%). The effective

income tax rate on underlying profit before income tax, based on an

estimated rate for the year ending 31 December 2020, was 20.7% (30

June 2019: 20.0%, 31 December 2019: 19.8%). This is based on the

estimated effective tax rate for the year to 31 December 2020. Of

the total tax charge, GBP2.0m relates to overseas businesses (30

June 2019: GBP2.5m). Taxation on profit has been estimated based on

rates of taxation applied to the profits forecast for the full

year.

8 Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the year, after

excluding 9,227 (June 2019: 510, December 2019: 510) ordinary

shares held by the James Fisher and Sons plc Employee Share

Ownership Trust (ESOT), as treasury shares. Diluted earnings per

share are calculated by dividing the net profit attributable to

ordinary equity holders of the Company by the weighted average

number of ordinary shares that would be issued on conversion of all

the dilutive potential ordinary shares into ordinary shares.

At 30 June 2020, 139,506 options (June 2019: nil, December 2019:

44,809) were excluded from the diluted weighted average number of

ordinary shares calculation as their effect would be anti-dilutive.

The average market value of the Company's shares for purposes of

calculating the dilutive effect of share options was based on

quoted market prices for the period during which the options were

outstanding.

Weighted average number of shares

31 December

30 June 2020 30 June 2019 2019

Number of Number of Number of

shares shares shares

For basic earnings per ordinary share 50,332,654 50,248,652 50,282,962

Exercise of share options and LTIPs 107,576 298,511 240,597

For diluted earnings per ordinary

share 50,440,230 50,547,163 50,523,559

=========== ============= ============

Underlying earnings per share

To provide a better understanding of the underlying performance

of the Group, underlying earnings per share on continuing

activities is reported as an alternative performance measure (note

3).

2020 2019 2019

Six months

Six months ended ended Year ended

30 June 30 June 31 December

GBPm GBPm GBPm

Profit attributable to owners

of the Company 5.0 17.0 36.7

Separately disclosed items 8.0 - 10.7

Tax on separately disclosed

items (1.1) (0.2) (0.5)

Underlying profit attributable

to owners of the Company 11.9 16.8 46.9

================= =========== ============

Earnings per share pence pence pence

Basic earnings per share 9.9 33.8 73.1

Diluted earnings per share 9.9 33.6 72.7

Underlying basic earnings

per share 23.6 33.4 93.2

Underlying diluted earnings

per share 23.6 33.2 92.8

9 Interim dividend

The proposed interim dividend of 8.0p (2019: 11.3p) per 25p

ordinary share is payable on 6 November 2020 to those shareholders

on the register of the Company at the close of business on 2

October 2020.

10 Retirement benefit obligations

Movements during the period in the Group's defined benefit

pension schemes are set out below:

2020 2019 2019

Six months

Six months ended ended Year ended

30 June 30 June 31 December

GBPm GBPm GBPm

Net obligation as at 1 January (5.8) (16.1) (16.1)

Expense recognised in the income

statement (0.2) (0.2) (0.5)

Contributions paid to scheme 1.2 5.6 8.6

Remeasurement gains and losses (0.4) - 2.2

At period end (5.2) (10.7) (5.8)

================= =========== ============

The Group's net liabilities in respect of its pension schemes were as

follows:

2020 2019 2019

Six months

Six months ended ended Year ended

30 June 30 June 31 December

GBPm GBPm GBPm

Shore Staff (0.3) (4.0) (0.4)

Merchant Navy Officers Pension Fund (3.2) (4.2) (3.4)

Merchant Navy Ratings Pension Fund (1.7) (2.5) (2.0)

(5.2) (10.7) (5.8)

================= =========== ============

The principal assumptions in respect of these liabilities are

disclosed in the December 2019 Annual Report. The Group has not

obtained an interim valuation for the period ended 30 June 2020. In

the first half of 2020, the Group paid contributions to defined

benefit schemes of GBP0.3m (2019: GBP5.6m).

11 Goodwill

2020 2019 2019

Six months

Six months ended ended Year ended

30 June 30 June 31 December

GBPm GBPm GBPm

At 1 January 185.5 171.4 171.4

Acquisitions - 12.1 15.6

Transfers - - 0.7

Exchange differences (2.7) 0.7 (2.2)

At period end 182.8 184.2 185.5

================= =========== ============

At the half year, the results of the impairment tests carried

out in respect of the year ended 31 December 2019, were revisited

in light of the current impact of Covid-19 on the Group's

performance.

The recoverable amount of the cash generating units (CGU's) has

been assessed based on value in use calculations using cash

projections based on 3 year plans approved by the Board which have

been adjusted based on information available to reflect the impact

of the Covid-19 outbreak and the sharp decline in energy prices

which particularly impacted projects in our Marine Support and

Offshore Oil divisions. A terminal value of cash flows beyond that

date has been calculated at a growth rate in line with management's

long-term expectations for the relevant market. The key assumptions

used in the value in use calculations include gross margin,

discount rate, inflation of overheads and payroll and growth

rates.

Sensitivity to impairment

The Directors have carried out sensitivity analysis to determine

the impact on the carrying value of goodwill of a change in

discount rate, revenue growth and terminal value growth none of

which gave rise to an impairment to goodwill of any of the

CGU's.

12 Reconciliation of net borrowings

1 January Cash Other Exchange 30 June

2020 flow non-cash movement 2020

GBPm GBPm GBPm GBPm GBPm

Cash and cash equivalents 18.5 2.9 - (0.6) 20.8

Debt due after 1 year (207.4) 26.1 (0.1) (1.5) (182.9)

Debt due within 1 year (11.3) 3.1 - - (8.2)

---------- ------ --------- --------- --------

(218.7) 29.2 (0.1) (1.5) (191.1)

Lease liabilities (30.2) 6.2 (3.8) (0.4) (28.2)

---------- ------ --------- --------- --------

Net borrowings (IFRS

16) (230.4) 38.3 (3.9) (2.5) (198.5)

---------- ------ --------- --------- --------

Right-of-use liability 27.4 (6.1) 3.7 0.4 25.4

---------- ---------

Net borrowings (IAS 17) (203.0) 32.2 (0.2) (2.1) (173.1)

========== ====== ========= ========= ========

1 January Cash Other Exchange 30 June

2019 flow non-cash movement 2019

GBPm GBPm GBPm GBPm GBPm

Cash and cash equivalents 18.6 (1.3) - 0.1 17.4

Debt due after 1 year (122.0) (43.4) (0.2) (0.1) (165.7)

Debt due within 1 year (10.0) 0.5 (1.4) - (10.9)

---------- ------- --------- --------- ------------

(132.0) (42.9) (1.6) (0.1) (176.6)

Lease liabilities (0.2) 5.6 (36.7) - (31.3)

---------- ------- --------- --------- ------------

Net borrowings (IFRS

16) (113.6) (38.6) (38.3) - (190.5)

---------- ------- --------- --------- ------------

Right-of-use liability - (5.5) 36.6 - 31.1

Net borrowings (IAS 17) (113.6) (44.1) (1.7) - (159.4)

========== ======= ========= ========= ============

1 January Cash Other Exchange 31 December

2019 flow non-cash movement 2019

GBPm GBPm GBPm GBPm GBPm

Cash and cash equivalents 18.6 0.7 - (0.8) 18.5

Debt due after 1 year (122.0) (84.1) (2.3) 1.0 (207.4)

Debt due within 1 year (10.0) (1.3) - - (11.3)

---------- ------- --------- --------- ------------

(132.0) (85.4) (2.3) 1.0 (218.7)

Lease liabilities (0.2) 11.3 (40.7) (0.6) (30.2)

---------- ------- --------- --------- ------------

Net borrowings (IFRS

16) (113.6) (73.4) (43.0) (0.4) (230.4)

---------- ------- --------- --------- ------------

Right-of-use liability - (11.1) 37.9 0.6 27.4

---------- ---------

Net borrowings (IAS 17) (113.6) (84.5) (5.1) 0.2 (203.0)

========== ======= ========= ========= ============

13 Commitments and contingencies

Capital commitments at 30 June 2020 were GBP0.9m (2019:

GBP26.5m; 31 December: GBP1.3m).

Contingent liabilities

(a) In the ordinary course of the Company's business, counter

indemnities have been given to banks in respect of custom bonds,

foreign exchange commitments and bank guarantees.

(b) A Group VAT registration is operated by the Company and

seven Group undertakings in respect of which the Company is jointly

and severally liable for all amounts due to HM Revenue &

Customs under the arrangement.

(c) A guarantee has been issued by the Group and Company to

charter parties in respect of obligations of a subsidiary, James

Fisher Everard Limited, in respect of charters relating to nine

vessels. The charters expire between 2020 and 2023.

(d) Subsidiaries of the Group have issued performance and

payment guarantees to third parties with a total value of GBP81.3m

(June 2019: GBP70.6m, December 2019: GBP73.9m).

(e) The Group is liable for further contributions in the future

to the MNOPF and MNRPF if additional actuarial deficits arise or if

other employers liable for contributions are not able to pay their

share. The Group and Company remains jointly and severally liable

for any future shortfall in recovery of the MNOPF deficit.

(f) The Group has given an unlimited guarantee to the Singapore

Navy in respect of the performance of First Response Marine Pte

Ltd, its Singapore joint venture, in relation to the provision of

submarine rescue and related activities.

(g) In the normal course of business, the Company and certain

subsidiaries have given parental and subsidiary guarantees in

support of loan and banking arrangements.

(h) The Group operates in multinational and less developed

markets which presents increased operational and financial risk in

both complying with potentially uncertain regulatory and

legislative (including in relation to tax) environments and where

local practice in those markets may be inconsistent with laws and

regulations that govern the Group. Given this risk, from time to

time concerns are raised and investigated regarding the potential

for non-compliance with the legal and regulatory framework

applicable to the Group.

In preparing the consolidated financial statements, judgements

and estimates are required to be made in respect of any matters

under active considerations at that time. This may include matters

in areas such as relevant exchange control regulations, compliance

with relevant laws and regulations, the impact of political

instability, tax legislation and overall operating environments.

Any changes impacting the assumptions underlying those estimates or

judgements may give rise to a liability. The Directors consider the

possibility of any liability arising in the future cannot currently

either be excluded or quantified and therefore no provision has

been included within the financial statements of the company and

the Group for any such matters.

(i) The Company and its subsidiaries may be parties to legal

proceedings and claims which arise in the ordinary course of

business and can be material in value. Appropriate provision has

been made in these accounts where, in the opinion of the Directors,

liabilities may materialise.

14 Related parties

There were no changes to related parties or associated

transactions disclosed in the Annual Report for the year ended 31

December 2019.

Independent review report to James Fisher and Sons plc

Conclusion

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

6 month period ended 30 June 2020 which comprises condensed

consolidated income statement, the condensed consolidated statement

of comprehensive income, the condensed consolidated balance sheet,

the condensed consolidated cash flow statement, the condensed

consolidated statement of changes in equity and the related

explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the 6 month period ended 30

June 2020 is not prepared, in all material respects, in accordance

with IAS 34 Interim Financial Reporting as adopted by the EU and

the Disclosure Guidance and Transparency Rules ("the DTR") of the

UK's Financial Conduct Authority ("the UK FCA").

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity issued by the Auditing Practices Board for use in the

UK. A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. We read the other information contained in the

half-yearly financial report and consider whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the DTR of the UK FCA.

The annual financial statements of the group are prepared in

accordance with International Financial Reporting Standards as

adopted by the EU. The directors are responsible for preparing the

condensed set of financial statements included in the half-yearly

financial report in accordance with IAS 34 as adopted by the

EU.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Mike Barradell

for and on behalf of KPMG LLP

Chartered Accountants

1 St Peters Square

Manchester

M2 3AE

24 August 2020

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR USRKRRUUWUAR

(END) Dow Jones Newswires

August 25, 2020 02:00 ET (06:00 GMT)

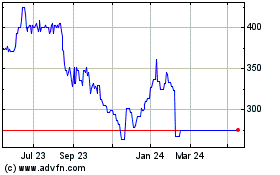

Fisher James And Sons (AQSE:FSJ.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Fisher James And Sons (AQSE:FSJ.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025