TIDMENT

RNS Number : 6319V

Entain PLC

11 August 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

11 August 2022

Entain plc

Formation of Entain CEE to drive expansion in Central and

Eastern Europe and the acquisition of SuperSport, the leading

gaming and sportsbook operator in Croatia

Entain plc (LSE: ENT), the global sports-betting, gaming and

interactive entertainment group ("Entain" or the "Group"), today

announces it has partnered with EMMA Capital ("EMMA"), a leading

investment firm based in the Czech Republic, to establish a new

venture ("Entain CEE") to drive expansion in Central and Eastern

Europe ("CEE"). Entain will own 75 % of the economic rights in

Entain CEE. Entain CEE will acquire the SuperSport Group

("SuperSport"), the leading gaming and sportsbook operator in

Croatia from EMMA (the "Acquisition").

Compelling Strategic Rationale

-- Central and Eastern Europe is a highly attractive growth

market: The c.EUR5.0bn(1) regulated CEE betting and gaming market

provides a significant opportunity for Entain and is expected to

grow at least 10% per year through 2025. The CEE market is

currently led by local operators who have often struggled to scale

or consolidate across the region, providing a compelling

opportunity for Entain with its industry leading capabilities.

-- Creation of a unique growth platform focused across CEE:

Entain is creating an exciting platform in the region, which will

be led by SuperSport's CEO, Radim Haluza, who has significant

experience across the region. The combination of Entain's global

scale, access to capital and content, EMMA's regional knowledge and

connectivity, alongside the expert local operational knowledge of

Radim and his team, makes Entain CEE uniquely positioned to unlock

the significant opportunity across the region. This bespoke

structure will allow Entain to join with further leading local

operators through Entain CEE to continue to grow this unique

platform across the region.

-- SuperSport is the Croatian market leader: SuperSport has a

leading position in the region with a 54%(2) market share in the

attractive and fully regulated Croatian market. SuperSport's online

focused sports betting and iGaming offering is underpinned by its

proprietary technology solution. SuperSport has 70% brand awareness

driven by key sponsorship agreements (such as media, marketing and

betting rights for all leagues of the Croatian Football Federation

for 2022-26), strategic partnerships and a highly active social

media presence. 85% of revenue in 2021 was online, alongside a

best-in-class retail offering with a proven omnichannel

approach.

-- Highly attractive financial profile : SuperSport has

consistently delivered strong top line financial performance, with

NGR CAGR of c.17%(3) , a sustainable EBITDA margin of c.52%(4) and

cash conversion of 90%+(5) . The Acquisition is expected to be

mid-single digit earnings accretive in its first full year of

ownership for Entain, with preliminary cost synergies of EUR5m per

year, expected to be delivered in full by 2024.

Consideration

Entain will pay the following to EMMA for 75% of the economic

rights in SuperSport:

-- EUR600m in cash at completion; and

-- A further contingent payment made to EMMA in early 2023 based

on SuperSport's EBITDA for the financial year ending 2022. This

payment is expected to be EUR90m.

EMMA will contribute their 25% stake in SuperSport to Entain CEE

at an initial implied valuation of EUR200m, with the contingent

payment implying an additional EUR30m value contributed by

EMMA.

The Acquisition is expected to value SuperSport at EUR920m which

implies a transaction multiple of 9.6x 2022 EBITDA, or 9.1x 2022

fully synergised EBITDA.(6)

EMMA is also entitled to enhanced dividends from completion to

the end of 2024, which will be linked to the performance of

SuperSport. It is expected that the consideration plus enhanced

dividends will imply a multiple of less than 10x LTM SuperSport

EBITDA at each stage.

The Acquisition will be financed through a EUR700m bridge loan

from Deutsche Bank, Lloyds, Mediobanca, NatWest, and Santander. The

Acquisition will increase Entain's pro-forma net debt to EBITDA

leverage ratio in 2022 by 0.4x. The Acquisition is expected to

complete in Q4 2022 and is conditional upon regulatory

approvals.

There is an option on EMMA's stake that can be exercised 3 years

from closing by either party, giving Entain a path to 100%

ownership.

Jette Nygaard-Anderson, Entain's CEO, commented : "We are

excited to create Entain CEE with EMMA to underpin our strategy

across the CEE region, and to be acquiring the leading betting and

gaming operator in the highly attractive, fully regulated Croatian

market. We see Croatia as an exciting, dynamic country which Entain

CEE is perfectly positioned to expand from - we are very much

looking forward to growing our business responsibly within the

country and the region. By bringing together Entain's global

expertise and EMMA's regional investment track record, we are

creating a growth platform with considerable opportunity. Expansion

across CEE is a core component of our growth strategy, and we look

forward to having Radim on board to help drive this

opportunity".

Pavel Horák, EMMA's Chief Investment Officer, commented: "EMMA

is very happy to be partnering with the leading global betting,

gaming and interactive entertainment business to unlock the

opportunity posed by the CEE betting and gaming market. We see the

Entain CEE structure as a clear opportunity for creating value for

shareholders, and we look forward to working closely and

collaboratively with Entain".

Radim Haluza, SuperSport's CEO commented: "I am looking forward

to joining with Entain and further building on the significant

opportunity presented in this region. The prospect of leading

Entain CEE to drive expansion in fully regulated markets is an

exciting opportunity, and EMMA's investment expertise combined with

Entain's world-class platform will give us the competitive edge in

delivering on the CEE opportunity".

Th e Acquisition constitutes a Class 2 transaction for the

purposes of the UK Listing Rules. (7)

Notes

(1) Market size estimates via local intelligence / internal

sources - regulated markets only

(2) In H1 2021 by GGR

(3) For the period 2016-2021

(4) Average of EBITDA margins 2017-2021, adjusted for Entain

accounting

(5) For the period 2019-2021

(6) Includes run-rate cost synergies of EUR5m

(7) For the purposes of LR 10.4.1 R (Notification of Class 2

transactions), the gross assets and profits of EMMA Gamma Adriatic

d.o.o. (a.k.a. "SuperSport") wer e GBP256.5m and GBP65.0m

respectively based on 2021 audited accounts

Contact details

Entain plc

Investor Relations - Entain plc investors@Entaingroup.com

David Lloyd-Seed, Chief IR & Communications Officer david.lloyd-seed@Entaingroup.com

Davina Hobbs, Head of Investor Relations davina.hobbs@Entaingroup.com.com

Callum Sims, IR Manager callum.sims@Entaingroup.com.com

Media - Entain plc media@Entaingroup.com.com

Lisa Attenborough, Head of Corporate Communications lisa.attenborough@Entaingroup.com.com

Morgan Stanley (Sole Financial Adviser)

Laurence Hopkins

Tom Perry

Richard Brown

Tel: +44 (0) 20 7425 8000

Media - Powerscourt

Rob Greening / Nick Hayns / Sam Austrums

Tel: +44 (0) 20 7250 1446

Entain@powerscourt-group.com

LEI: 213800GNI3K45LQR8L28

About Entain plc

Entain plc (LSE: ENT) is a FTSE100 company and a leading global

sports-betting, gaming and interactive entertainment group,

operating both online and in the retail sector. The Group owns a

comprehensive portfolio of established brands; Sports Brands

include bwin, Coral, Crystalbet, Eurobet, Ladbrokes, Neds,

Sportingbet and Sports Interaction; Gaming Brands include

CasinoClub, Foxy Bingo, Gala, GiocoDigitale, Ninja Casino, Optibet,

Partypoker and PartyCasino. The Group operates a proprietary

platform across core product verticals and in addition to its B2C

operations provides services to a number of third-party customers

on a B2B basis.

The Group has a 50/50 joint venture, BetMGM, a leader in sports

betting and iGaming in the US. Entain provides the technology and

capabilities which power BetMGM as well as exclusive games and

products, specially developed at its in-house gaming studios. The

Group is tax resident in the UK with operations in over 30

regulated or regulating territories. Entain is a leader in ESG, a

member of FTSE4Good, the DJSI and is AA rated by MSCI. The Group

has set a science-based target, committing to be carbon net zero by

2035 and through the Entain Foundation supports a variety of

initiatives, focusing on safer gambling, grassroots sport,

diversity in technology and community projects.

For more information see the Group's website:

www.entaingroup.com

About SuperSport

SuperSport has a leading position in the region with a 54%(4)

market share in an attractive, fully regulated Croatian market.

SuperSport's online focused sports betting and iGaming offering is

underpinned by a brand which is synonymous with betting in Croatia.

SuperSport operates across three segments covering betting

services, a proprietary online casino platform, and operating slot

machines in betting shops via its subsidiary Puni Broj d.o.o ("Puni

Broj"). SuperSport also has its own in-house technology studio,

Minus5 d.o.o ("Minus5"). SuperSport has delivered sustainable

EBITDA margin of c.52% (6) (FY17-21) and cash conversion of 90%+

(FY19-21). The business has an experienced management team who has

successfully grown the business and transformed it into a

fast-growing online operator over the last 6 years. SuperSport is

led by Radim Haluza, CEO, who has significant experience in gaming

across CEE, having previously served as CEO of Fortuna

Entertainment Group in the region.

Important notices

The person responsible for arranging for the release of this

announcement on behalf of Entain is Emily Carey (Company

Secretary).

Certain statements in this announcement are forward-looking

statements, including with respect to Entain's expectations,

intentions and projections regarding its future performance,

strategic initiatives, anticipated events or trends and other

matters that are not historical facts and which are, by their

nature, inherently predictive, speculative and involve risks and

uncertainty because they relate to events and depend on

circumstances that may or may not occur in the future. All

statements that address expectations or projections about the

future, including statements about operating performance, strategic

initiatives, objectives, market position, industry trends, general

economic conditions, expected expenditures, expected cost savings

and financial results are forward -- looking statements. Any

statements contained in this announcement that are not statements

of historical fact are, or may be deemed to be, forward -- looking

statements. These forward-looking statements, which may use words

such as "aim", "anticipate", "believe", "could", "intend",

"estimate", "expect", "may", "plan", "project" or words or terms of

similar meaning or the negative thereof, are not guarantees of

future performance and are subject to known and unknown risks and

uncertainties. There are a number of factors including, but not

limited to, commercial, operational, economic and financial

factors, that could cause actual results, financial condition,

performance or achievements to differ materially from those

expressed or implied by these forward-looking statements. Many of

these risks and uncertainties relate to factors that are beyond

Entain's ability to control or estimate precisely, such as changes

in taxation or fiscal policy, future market conditions, currency

fluctuations, the behaviour of other market participants, the

actions of governments or governmental regulators, or other risk

factors, such as changes in the political, social and regulatory

framework in which Entain operates or in economic or technological

trends or conditions, including inflation, recession and consumer

confidence, on a global, regional or national basis. Given those

risks and uncertainties, readers are cautioned not to place undue

reliance on forward-looking statements. Forward-looking statements

speak only as of the date of this announcement. Entain and its

affiliates, and any of its or their respective directors, officers,

partners, employees, advisers or agents (collectively,

"Representatives") expressly disclaim any obligation or undertaking

to update or revise publicly any forward-looking statements,

whether as a result of new information, future events or otherwise

unless required to do so by applicable law or regulation.

In particular, no statement in this announcement is intended to

be a profit forecast or profit estimate and no statement of a

financial metric (including estimates of EBITDA, profit before tax,

free cash flow or net debt) should be interpreted to mean that any

financial metric for the current or future financial years would

necessarily match or exceed the historical published position of

Entain and its subsidiaries. Certain statements in this

announcement may contain estimates. The estimates set out in this

announcement have been prepared based on numerous assumptions and

forecasts, some of which are outside of Entain's influence and/or

control, and is therefore inherently uncertain and there can be no

guarantee or assurance that it will be correct. The estimates have

not been audited, reviewed, verified or subject to any procedures

by Entain's auditors. Undue reliance should not be placed on them

and there can be no guarantee or assurance that they will be

correct.

This announcement is being issued by and is the sole

responsibility of Entain. No representation or warranty, express or

implied, is or will be made as to, or in relation to, and no

responsibility or liability is or will be accepted by or on behalf

of Entain (apart from the responsibilities or liabilities that may

be imposed by the Financial Services and Markets Act 2000, as

amended or the regulatory regime established thereunder) or by its

affiliates or any of its Representatives as to, or in relation to,

the accuracy, adequacy, fairness or completeness of this

announcement or any other written or oral information made

available to or publicly available to any interested party or its

advisers or any other statement made or purported to be made by or

on behalf of Entain or any of its affiliates or any of its

Representatives in connection with Entain and any responsibility

and liability whether arising in tort, contract or otherwise

therefore is expressly disclaimed.

Morgan Stanley & Co. International plc ("Morgan Stanley"),

which is authorised by the Prudential Regulation Authority and

regulated by the Financial Conduct Authority and the Prudential

Regulation Authority in the United Kingdom, is acting exclusively

as financial adviser to Entain and no one else in connection with

the Acquisition. In connection with such matters, Morgan Stanley,

its affiliates and their respective directors, officers, employees

and agents will not regard any other person as their client, nor

will they be responsible to anyone other than Entain for providing

the protections afforded to clients of Morgan Stanley nor for

providing advice in connection with the Acquisition, the contents

of this announcement or any matter referred to herein.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQPMMPTMTABBJT

(END) Dow Jones Newswires

August 11, 2022 02:00 ET (06:00 GMT)

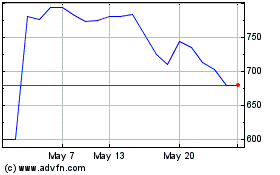

Entain (AQSE:ENT.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Entain (AQSE:ENT.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024