TIDMCHRT

RNS Number : 9843T

Cohort PLC

28 July 2022

28 July 2022

COHORT PLC

UNAUDITED PRELIMINARY RESULTS

FOR THE YEARED 30 APRIL 2022

Cohort plc today announces its unaudited results for the year

ended 30 April 2022.

Highlights include: 2022 2021 %

* Revenue GBP137.8m GBP143.3m (4)

* Adjusted operating profit(1) GBP15.5m GBP18.6m (17)

* Adjusted earnings per share(1) 31.08p 33.63p (8)

GBP11.0m GBP2.5m

* Net funds

* Order intake GBP186.4m GBP180.3m 3

* Order book (closing) GBP291.0m GBP242.4m 20

* Proposed final dividend per share 8.35p 7.60p 10

* Total dividend per share 12.20p 11.10p 10

Statutory 2022 2021 %

* Statutory profit before tax GBP10.2m GBP7.1m 44

* Basic earnings per share 22.55p 13.38p 69

-- Trading performance in line with previous guidance

-- Divisional overview:

o MASS was the largest profit contributor and improved on last

year

o Another year of growth at MCL

o Stronger result at SEA

o Strong first full year contribution from ELAC, ahead of

expectations

o As expected, weaker result at EID

o Disappointing performance at Chess, but 2022/23 has started

better

-- Net funds at GBP11m, as previously disclosed. Robust cash generation

-- Strong order intake of GBP186.4m (2021: GBP180.3m)

-- Total dividend increased by 10%

(1) Excludes exceptional items, amortisation of other intangible

assets, research and development expenditure credits and

non-trading exchange differences, including marking forward

exchange contracts to market.

Looking forward:

-- Record year end order book of GBP291.0m:

o underpins nearly GBP128m of current year revenue, representing

78% (2021: 64%) of current consensus forecast for the year

o Coverage has risen to 90% in early July 2022 following

contract wins in first two months

-- Performance for 2022/23 expected to be ahead of 2021/22

-- Expect lower (but positive) net funds at 30 April 2023 as a

result of planned capital expenditure and expansion of working

capital

Commenting on the results, Nick Prest CBE, Chairman of Cohort

plc said:

"Performance for 2021/22 was in line with our revised

expectations, with robust cash generation, and a record closing

order book with strong cover for the coming financial year.

"It is hard to predict the duration of the conflict in Ukraine

and any direct benefit to the Group's short-term trading. In the

longer term we believe a more sustained growth in defence budgets

is likely, both in NATO and in other parts of the world where

security threats remain.

"Overall, we continue to expect that our trading performance for

2022/23 will be ahead of that achieved for the year ended 30 April

2022.

"Our order book is not only growing in value, but its longevity

continues to increase. We now have orders across the Group

stretching out to 2030. We are optimistic that the Group will make

further progress in 2023/24, based on current orders for long-term

delivery and on our pipeline of opportunities."

A presentation for analysts is being hosted today 28 July 2022

at 9.15am for 9.30am online as follows:

Please join the event 5-10 minutes prior to scheduled start

time. When prompted, provide the confirmation code or event

title.

Event Title: Cohort Results

Time Zone: Dublin, Edinburgh, Lisbon, London

Start Time/Date: 09:30 Thursday July 28, 2022

Duration: 60 minutes

Confirmation Code: 1829705

WEBCAST: https://stream.brrmedia.co.uk/broadcast/62d008d30485375c36e3de8c

Conference Call Line: UK Participant (Tollfree/Freephone) 0800 279 6877

UK, Local Participant +44 (0)330 165 4012

For further information please contact:

Cohort plc 0118 909 0390

Andy Thomis, Chief Executive

Simon Walther, Finance Director

Raquel McGrath, Company Secretary

Investec Bank Plc (NOMAD and Broker) 020 7597 5970

Daniel Adams, Christopher Baird

MHP Communications 020 3128 8276

Reg Hoare, Ollie Hoare, Pete Lambie cohort@mhpc.com

NOTES TO EDITORS

Cohort plc ( www.cohortplc.com ) is the parent company of six

innovative, agile and responsive businesses based in the UK,

Germany and Portugal, providing a wide range of services and

products for domestic and export customers in defence and related

markets.

Chess Technologies, through its operating businesses Chess

Dynamics and Vision4ce, offers surveillance, tracking and

fire-control systems to the defence and security markets. A

majority stake was acquired by Cohort plc in December 2018.

www.chess-dynamics.com

EID designs and manufactures advanced communications systems for

naval and military customers. Cohort acquired a

majority stake in June 2016. www.eid.pt

ELAC SONAR supplies advanced sonar systems and underwater

communications to global customers in the naval

marketplace. Acquired by Cohort in December 2020. www.elac-sonar.de

MASS is a specialist data technology company serving the defence

and security markets, focused on electronic warfare, digital

services and training support. Acquired by Cohort in August 2006.

www.mass.co.uk

MCL designs, sources and supports advanced electronic and

surveillance technology for UK end users including the MOD and

other government agencies. MCL has been part of the Group since

July 2014. www.marlboroughcomms.com

SEA delivers and supports technology-based products for the

defence and transport markets alongside specialist research and

training services. Acquired by Cohort in October 2007.

www.sea.co.uk

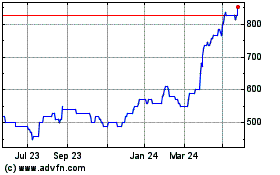

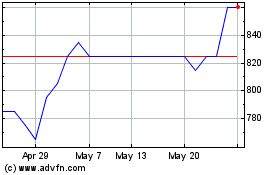

Cohort (AIM: CHRT) was admitted to London's Alternative

Investment Market in March 2006. It has headquarters in Reading,

Berkshire and employs in total over 1,000 core staff there and at

its other operating company sites across the UK, Germany and

Portugal.

Chairman's statement

"Performance in line with revised expectations, robust cash, and

a record closing order book with strong cover for the coming

financial year."

Performance

The Group's adjusted operating profit was in line with our

revised expectations at the time we announced our half-year results

on 14 December 2021, achieving an adjusted operating profit of

GBP15.5m (2021: GBP18.6m) on revenue of GBP137.8m (2021:

GBP143.3m). The reduction in performance compared to last year was

primarily the result of a disappointing performance at Chess, along

with an expected drop in profit from EID. MASS, MCL and SEA all

posted increases in profit, and we benefited from a full year

contribution from ELAC.

The Group had another strong year of order intake, winning

GBP186.4m (2021: GBP180.3m) of orders, driving us to a record

closing order book of GBP291.0m (2021: GBP242.4m). This order book

gives us a strong start to 2022/23. The Group's net funds also

finished at a higher level than we expected at the start of the

year, GBP11.0m compared with GBP2.5m.

Following strong order intake in 2020/21, SEA had an improved

year, driven by export deliveries, including a first contract with

the Royal New Zealand Navy. MCL delivered another year of growth

and, importantly, ended the year with an unusually strong order

book, providing good underpinning for 2022/23. MASS, despite

slightly lower revenue and continued challenges in its EWOS and

Training divisions from COVID-19 restrictions, delivered an

improved net margin, with better mix and flat overhead. ELAC,

having secured a large Italian sonar order early in the year,

delivered a better than expected result. In line with our

expectations, EID's performance was much weaker, having benefited

from a large export delivery in 2020/21 that was not repeated this

year. Chess's performance was disappointing. Order intake was lower

than expected, as were customer deliveries, and a small number of

problem contracts had a negative impact on margin. We have made

progress in resolving these problems, and we saw an uptick in

performance at Chess towards the end of the year.

We continued to see some negative impact from COVID-19 in the

first half of our financial year, particularly at MASS. This

started to alleviate in the second half and at the same time, as

some normality returned to our business activities, we saw a return

to more face-to-face business engagement, especially trade shows

and exhibitions across the world. Despite two years of challenging

business conditions the Group won over GBP365m of orders during

that period. Our order book now stretches out to 2030 and we expect

to extend that further in the coming year.

The Group's operating profit of GBP11.1m (2021: GBP7.8m) is

stated after recognising amortisation of intangible assets of

GBP6.9m (2021: GBP10.1m), exceptional income of GBP0.7m (2021:

GBP1.3m charge) and research and development expenditure credits of

GBP1.0m (2021: GBP1.0m). Profit before tax was GBP10.2m (2021:

GBP7.1m) and profit after tax was GBP8.7m (2021: GBP5.5m).

The closing net funds of GBP11.0m (2021: GBP2.5m), was better

than our expectation, due to an improved operating cash flow,

particularly at ELAC, MASS, and SEA. The cash flow also benefited

from slippage of some items of capital expenditure and the final

Chess acquisition payment into 2022/23.

International conflict

The Russian invasion of Ukraine has had a notable impact on

public and Government perceptions worldwide of the importance of an

effective defence capability. Media reporting has reflected a sense

of shock that a nascent European democracy can be the target of

state-on-state violence of an intensity not seen on the continent

since 1945. Many have had to re-learn that the stability of

democracy and maintenance of our freedoms and values requires

strong defence to deter, and if necessary, repel an aggressive

invader. It is also clearer than ever that strong defence means a

strong defence industry as well as capable armed forces. That is

something that Cohort's leadership and employees understand well,

and for many of us it is a large part of our motivation at work. We

therefore believe that an activity that generates social value as

well as business success such as the UK's defence sector, including

Cohort, is worthy of investor consideration.

Our customers' response to the situation in Ukraine had some

positive business impact in 2021/22 and we expect this to increase

in 2022/23. There is also the potential for a negative effect as

increased operational readiness makes it harder for us to provide

maintenance services, upgrades and training. On balance, we believe

that the long-term change in defence stance that has been catalysed

by these events, especially among NATO countries, will be of

benefit to the Group.

Strategic initiatives

Cohort's subsidiary, SEA, acquired the remaining 50% of its

joint venture JSK in August 2021 for a net consideration of

GBP0.4m. JSK is based in Montreal, Canada and provides SEA, and the

Group, with a local presence to provide the Royal Canadian Navy

with ongoing support to existing and new naval platforms. The

latter include the new Canadian frigate programme for which SEA is

providing certain important systems.

When we acquired Chess in December 2018, we agreed to pay

further consideration depending on the performance of the business

over the three years ended 30 April 2021. Our current best estimate

is that the additional consideration payable, including earn-out,

to take control of the whole of Chess in 2022 will now be GBP1.4m

(2021: GBP2.8m), and we expect to pay this on or before 31 October

2022.

The Group continues to review acquisition opportunities as they

arise, in line with our criteria.

Shareholder returns

Adjusted earnings per share (EPS) were 31.08 pence (2021: 33.63

pence). The adjusted EPS figure was based on profit after tax,

excluding amortisation of other intangible assets, net foreign

exchange movements and exceptional items. Basic EPS were 22.55

pence (2021: 13.38 pence). The adjusted EPS were 8% lower primarily

due to the weaker adjusted operating profit (down 17%), partly

offset by a lower tax charge of 13.5% (2021: 17.4%) and a change in

mix from which the Group's profits were derived, with the 100%

owned businesses (ELAC, MCL and SEA) performing most strongly.

The Board is recommending a final dividend of 8.35 pence per

ordinary share (2021: 7.60 pence), making a total dividend of 12.20

pence per ordinary share (2021: 11.10 pence) for the year, a 10%

increase. The dividend has been increased every year since the

Group's IPO in 2006. It will be payable on 4 October 2022 to

shareholders on the register at 26 August 2022, subject to approval

at the Annual General Meeting on 27 September 2022.

Over the medium term, the Group plans to maintain a policy of

growing its dividend each year broadly consistent with the growth

in adjusted earnings per share growth.

Our people

As always, my thanks go to all employees within the Cohort

businesses. Their hard work, skill and ability to satisfy our

customers' needs are what continue to drive the performance of our

Group.

As already highlighted, the direct impact of COVID-19 has

diminished over the year, and we have in most instances returned to

normal work and travel practices. Where appropriate we continue to

offer flexibility to our employees as to their location of work,

including hybrid working in some cases. As of June 2022, 75% of our

employees are mostly based on our or our customers' sites, which

compares with 50% at this time last year.

We have seen a return to face-to-face customer meetings and in

the last few months alone we have attended trade shows in

Australia, Europe, Asia and the United States. We could not easily

assess the direct impact of the various COVID-19 lockdowns on our

long-term business prospects but the strong order intake in the

last two years suggests this may not be as deep as we first feared.

Andy Thomis, Simon Walther and their senior executive colleagues

have continued their dedicated and skilful work which has helped

the Group to progress in the face of continuing challenging

conditions.

Governance and Board

As separately announced, Stanley Carter has decided not to stand

for re-election as a non-executive Director at Cohort's forthcoming

Annual General Meeting to be held in September 2022. Stanley has

made an immense contribution to the development and success of

Cohort since co-founding it with me in 2006, initially as Chief

Executive, then as Co-Chairman and since 2015 as a Non-executive

Director. The Board and all Cohort staff are grateful to him for

his leadership and support during different phases of the company's

development, and we look forward to continuing the relationship

with him as a major shareholder.

We formally welcomed Beatrice Nicholas onto the Board as a

Non-executive Director on 1 September 2021. Beatrice has had a long

and successful career in the defence industry and brings a wealth

of experience in engineering, project management and general

management to Cohort.

I also take this opportunity to welcome David Tuddenham as the

new Managing Director of Chess. David had worked for Chess for over

ten years in senior positions before stepping up to this role in

June 2021. David replaces Graham Beall who will lead Chess's

business development in the USA. At ELAC, we have adjusted the

senior roles, with Bernd Szukay appointed Managing Director and Ole

Schneider as Finance Director.

Outlook

The new year has started in line with our expectations and with

an encouraging outlook for Cohort, despite the challenging external

environment.

Geo-political and macro-economic trends

The recent sad events in Ukraine have impacted on a world

economy still recovering from the COVID pandemic. The invasion has

seen a higher level of focus amongst governments, particularly

European NATO members, on their defence stance. In some instances,

notably the UK and Germany, this has already led to an increase in

defence spending.

It is hard to predict the duration of the conflict in Ukraine

and its direct impact upon the Group's trading. In the longer term,

after the taboo over armed invasion of peaceful neighbours has so

clearly been broken, we expect to see a more sustained growth in

defence budgets, both in NATO but also in other parts of the world

where security threats remain.

To set against this, we expect to see economic fallout from the

war in Ukraine as well as the lingering impacts of COVID-19. These

include higher inflation and rising interest rates and therefore

pressure on governments to mitigate these effects on their

populations.

The Group is not currently facing any direct restrictions on

business activity arising from COVID-19, though we cannot rule out

some re-introduction of restrictions if a new variant should cause

severe health problems. We still face indirect fall-out in the form

of cost increases and delays to supplies. These are not currently

having any significant impact on performance, but we are seeing

delivery schedules for certain components lengthen markedly and may

see some impacts in the short term.

Encouraging outlook for Cohort

Our order intake for the year was strong and as a result of this

success, the Group has entered the new financial year with a record

order book of GBP291.0m. As we have indicated in the last few

years, our order book is not only growing in value, but its

longevity continues to increase. We now have orders across the

Group stretching out to 2030. We have good prospects in the coming

year to secure further long-term orders for our naval systems and

support work, including from the UK MOD, Portugal and in export

markets.

The order book underpins nearly GBP128m (2021: GBP100m) of

current financial year revenue, representing 78% of expected

consensus revenue for the year. Following order wins since the

start of the financial year of just over GBP20m, that cover now

stands at 90%.

Overall, we continue to expect that our trading performance for

2022/23 will be ahead of that achieved for the year ended 30 April

2022. As a result of planned capital expenditure and expansion in

working capital we expect that our net cash balance will decrease,

but that we will maintain positive net funds at the year end.

We are optimistic that the Group will make further progress in

2023/24, based on current orders for long-term delivery and on our

pipeline of opportunities.

Nick Prest CBE

Chairman

Operations Review

"The Group's profit performance for the year was in line with

our expectations at the time of our half-year results announcement

on 14 December 2021. Pleasing improvements in performance at ELAC,

MCL and SEA were offset by reduced profits at EID and, especially,

Chess. Cash performance was better than expected, resulting in a

strong positive net cash position at the year end. Order intake was

also strong, and the resulting record order book gives us a solid

base for 2022/23. We see good prospects for further significant new

orders in the year ahead."

Operating review

2022 saw another strong year for order intake, with GBP186.4m of

new work contracted compared with GBP180.3m in 2021. That resulted

in a record closing order book of GBP291.0m, an historic high for

the Group, underpinning 78% of the consensus forecast revenue for

2023. Cash flow was robust, the Group closing the year with net

funds of GBP11.0m (2021: GBP2.5m). In line with our expectations at

the time of the half-year results announcement in December 2021,

revenue was down despite a full year contribution from ELAC, and

trading profit down 17%.

We saw a welcome return to growth at SEA, with an increase in

export deliveries following order wins in 2020/21. MCL grew its

revenue and trading profit with higher deliveries of autonomous

vehicle systems to the UK MOD. Despite slightly reduced revenue,

mostly from cessation of its lower margin support to the

Metropolitan Police Service, MASS delivered a record high net

margin. As expected, EID's contribution was lower this year, with

deliveries on a large export order in 2020/21 not being repeated.

The main disappointment of the year was at Chess, where

significantly reduced revenue and profit resulted from order

slippage, delayed deliveries on key programmes and continuing cost

increases on certain legacy projects.

ELAC performed well in its first full year in the Group

(compared with its five-month contribution in 2020/21). Its revenue

and profit included a GBP1.1m contribution from the mechanism

agreed with Wärtsilä, ELAC's former owner, in respect of an export

contract that has not yet been made effective. This mechanism may

provide up to a further GBP0.5m in 2022/23. ELAC has begun to

recognise revenue on the major Italian submarine sonar contract won

last July and has continued to deliver against a pleasing level of

product, spares and repair orders.

Travel and operational restrictions arising from the COVID-19

pandemic continued in the first half of the financial year, with

international travel restrictions still in place in many regions,

and this has affected some customer contact, and with that some

order closure and pipeline building opportunities, but despite this

the Group overall has performed well in winning new business. The

Group's record closing order book of GBP291m gives us order cover

of just under GBP128m for 2022/23. Over the last two years, despite

the effects of COVID-19, the Group secured orders of over GBP365m,

materially growing and extending the duration of its order

book.

We have seen an impact on deliveries of products and services

resulting from pandemic-related customer site closures and

restrictions. This has been especially true of MASS's training

work, some of which has slipped into 2022/23. Although COVID-19

restrictions have now generally lifted, we continue to see price

increases and extended lead times for certain materials and

components, especially semiconductors. We also see upwards pressure

on salaries in certain specialist areas of expertise. We are taking

action to maintain deliveries and protect our margins through

increasing stock levels, seeking alternative sources of supply, and

ensuring that our commercial arrangements enable us to pass on

higher costs.

Towards the end of the financial year, we began to see an

increase in activity as certain of our customers responded to

Russia's invasion of Ukraine. This had minimal financial impact on

2021/22 but we anticipate some of this activity converting to

tangible orders and deliveries during 2022/23.

As we signalled in December 2021, the Group's adjusted operating

profit fell by nearly 17% to GBP15.5m (2021: GBP18.6m) on revenue

of GBP137.8m (2021: GBP143.3m), a net operating return of 11.2%

(2021: 13.0%). This was primarily a result of the disappointing

performance at Chess. The Group's statutory operating profit of

GBP11.1m (2021: GBP7.8m) reflects the amortisation of other

intangible assets, a GBP6.9m non-cash charge in 2022 (2021:

GBP10.1m charge). In this review, therefore, the focus is on the

adjusted operating profit of each business, which we consider to be

a more appropriate measure of performance year on year.

ELAC made a strong full year contribution after its initial

five-month contribution in 2020/21. Its revenue included an initial

contribution from the major Italian submarine sonar programme won

in July 2021. It also delivered specialist sonar products for

various export customers, including its widely used underwater

communication system, and spares and support for both its current

product range and legacy hydrographic products.

MASS returned to growing its trading profit despite a slight

(3%) fall in revenue. MASS continued to see some headwinds from

COVID-19 restrictions, especially in the first half of the year,

but these began to ease in the second half with a pick-up in its

various training services and support to the UK's Joint Forces

Command.

MCL delivered increased revenue and profit with provision of

autonomous land vehicles and hearing protection more than

offsetting a reduction in deliveries of systems for the UK

submarine fleet last year.

SEA saw a welcome return to growth with higher export and

support sales offsetting lower submarine activity. Transport sales

also returned to growth following a hiatus in activity during

COVID-19 restrictions in the early part of 2020/21.

As expected, EID's performance was much weaker than last year

which included a large export order of intercom systems. EID had a

stronger order intake for the year compared with 2020/21 but the

business still awaits some key orders, particularly for long term

naval programmes which are anticipated in the coming financial

year.

Chess had a poor year, delivering only a marginal trading profit

on much lower revenue compared to 2020/21. This resulted from order

intake that was lower than expected, delivery delays and cost

overruns on a small number of problem projects. Over the year we

have strengthened Chess's senior management team and made

organisational changes intended to improve performance and reduce

risk. These changes have begun to have an impact, and we have seen

an improved performance at the beginning of 2022/23.

The growth in central costs reflects the enhanced commercial,

legal and financial resources we have brought in to support

subsidiary growth, especially in export markets, together with the

increasing compliance requirements faced by the Group.

Our people

All the Group's capabilities and customer relationships

ultimately derive from our people, and the success we have enjoyed

is a result of their efforts. Their adaptability and perseverance

through the challenges of the pandemic have been exemplary. I would

like to take this opportunity to express my sincere thanks to all

employees of Cohort and its businesses as we hopefully now return

to more normal working practices.

We have made a small number of changes to the senior management

of our subsidiary businesses. David Tuddenham took over as Managing

Director of Chess in June 2021. After a period when they shared the

role, Bernd Szukay has been appointed as sole Managing Director of

ELAC with Ole Schneider taking on the role of Finance Director, the

latter including responsibility for certain operational matters.

Both retain the German legal status of Geschäftsführer.

Like many high-skill businesses, we are facing challenges in

recruiting qualified and experienced people to meet our customer

demands and our own investment strategies. As our order book has

grown, so have our employee numbers and the Group now has nearly

1,050 staff compared with just over 1,000 this time last year. We

will continue to add more resources in the coming year, especially

at Chess, ELAC and SEA.

Operating strategy

Organic growth

The Group's adjusted operating profit was in line with our

expectations at the time of the half year results in December 2021.

Despite some good performances across the Group, overall, this

meant a lower level of revenue and profit than in 2020/21.

Nevertheless, the strong order intake achieved in 2021/22, and the

further prospects we can see in the short and medium term, provide

confidence that the group will make progress in the year ahead.

Despite the difficulties thrown up by the COVID-19 pandemic in

the first half of the year, we have had a good year for new orders,

and we ended it with a record order book. The return to some

normality in the second half of our financial year saw a welcome

return to face-to-face business shows, with members of the Group

attending defence events in the USA, Australia, Malaysia,

Philippines and across Europe. These are positive indicators for

future organic growth, and we enter 2022/23 with a record level of

order cover for external revenue expectations for the year.

Cohort currently operates as a group of six small and

medium-sized businesses, operating primarily in defence and

security markets, and with a strong emphasis on technology,

innovation and specialist expertise. Within our markets we have

sought to identify niches where prospects are attractive and where

we have some sustainable competitive advantage. Growth strategies

and opportunities vary around the Group:

-- MASS benefits from an extremely high customer reputation,

rare or unique technical capabilities and experience at building

long-lasting customer relationships. Much of its revenue derives

from long-term service contracts, and it aims gradually to add more

of these building-blocks to its revenue stream.

-- EID combines a low cost-base by international standards with

access to Portugal's extremely strong technical education system.

This has allowed it to develop high-performance low-cost defence

communications products that can win business in a highly

competitive marketplace.

-- Chess makes use of its innovative engineers, customer-focused

culture and freedom to source sensors from the best international

providers to win business against more vertically-integrated larger

competitors.

-- SEA has used its close long-term relationship with the Royal

Navy to build confidence with that important customer, which in

turn creates a strong platform for export orders. It is also

investing in new technologies where there is an opportunity to

build a strong competitive position, for instance in lightweight

towed-array sonars and, alongside Chess, trainable decoy

launchers.

-- MCL has a unique business model, combining a small but

innovative engineering team with a wide range of international

partnerships to provide highly specialised equipment and services

to the UK armed forces and security services.

-- ELAC, the newest member of the Group, has built on almost a

century of hydro-acoustic knowledge to create a new architecture

for sonar systems on a scale that only a few international

providers can match. Its systems combine world-class performance

with an ability for customers to tailor analysis techniques and

data libraries to their own specific needs.

Our businesses have continued to be active in finding new

customers, and 2022 has seen some notable successes for ELAC, MCL

and, in particular SEA. Discussions with potential customers have

opened up some major longer-term opportunities for all of our

businesses.

Being part of the Cohort Group brings material advantages to our

operating businesses. The Group's strong balance sheet gives

customers the confidence to award large or long-term contracts that

we are well able to execute technically but which might otherwise

be perceived as risky. Examples in the last year included the award

of a EUR49m order to ELAC for sonar systems for the Italian Navy's

new class of submarine and an initial development order for the

Royal New Zealand Navy at SEA.

The Group's Directors have long experience of operating in the

defence sector and have contacts and working relationships with

senior customers in the UK and internationally that would be hard

for independent smaller businesses to establish. Our six operating

businesses, while remaining operationally independent, have formed

close working relationships with each other and benefit from

sharing technical capabilities, customer relationships and market

knowledge within the bounds imposed by our various confidentiality

obligations. We will continue to work to promote the Group's

services and products in wider markets, including through business

development visits as and when government restrictions allow.

These strategies have generated long-term customer relationships

and good opportunities that give us confidence that we can continue

to win substantial new business in the year ahead. Recent examples

include a renewal of MASS's support to the Joint Forces Command out

to July 2024 and significant (GBP15m) orders for hearing protection

systems at MCL. We also expect to conclude some key long-term

supply and support orders for the Royal Navy and systems orders for

export naval customers in the coming year.

Acquisitions

Alongside our organic growth strategy, we continue to see

opportunities to accelerate our growth by making further targeted

value enhancing acquisitions. We believe that there are good

businesses in the UK and overseas that would thrive under Cohort

ownership, whether as standalone members of the Group or as

"bolt-in" acquisitions to our existing subsidiaries.

The most likely candidates for bolt-in acquisitions are

businesses with capabilities and/or customer relationships that are

closely linked to one of our existing subsidiaries. We would expect

to integrate an acquired business of this nature fully within the

relevant subsidiary. This could lead to both cost savings and

benefits from shared access to markets and technologies.

For standalone acquisitions we are looking for agile, innovative

businesses that have reached a stage of development where there

will be mutual benefit in joining Cohort. It is likely that

candidates will be operating in the defence and security markets

either in the UK or internationally, as that is where the Group can

add most value. Growth prospects, sustainable competitive

advantage, and the ability to operate as part of a publicly quoted

UK group will all be important.

We have reviewed a significant number of possible acquisitions

over the last year, in some cases leading to active discussions.

Our experienced executive team is conscious of the various

potential risks that arise from acquisitions and takes a careful

approach, with only a small proportion of the opportunities we see

being brought to fruition. When we do identify an opportunity that

we believe to be value-creating, the close involvement of our

senior team means we can be very flexible in terms of transaction

structure, and quick in decision-making. That gives us some

advantage compared to competitors who may have larger resources

available.

On 20 August 2021 SEA acquired the reminder of its joint

venture, JSK, which is based in Canada for a net consideration of

GBP0.4m. This was part of SEA's plan to develop and grow its

business in Canada, primarily to support the new Canadian Frigate

programme.

We acquired 81.84% of Chess in December 2018 for an initial

consideration of just over GBP20.0m. The acquisition includes an

earn-out clause and an option for acquiring the minority interest

(18.16%), both based on Chess's performance for the three years

ended 30 April 2021. The performance period for determining the

value of the earn-out and option ended on 30 April 2021, and we now

expect to pay GBP1.4m (2021: GBP2.8m) in total on or before 31

October 2022.

Maintain confidence

Cohort's management approach is to allow its subsidiary

businesses a significant degree of operational autonomy to develop

their potential fully. At the same time we provide light-touch but

rigorous financial and strategic controls at Group level to manage

and control risks and ensure legislative and regulatory compliance.

Our experience is that our customers prefer to work with businesses

where decision making is streamlined and focused on solving their

immediate problems. This model provides us with a degree of

competitive advantage over some larger rivals where the

decision-making process can be more extended. It is also

cost-effective as it avoids the need for additional layers of

management involved in coordination activities and for a large

headquarters team. High-calibre employees find our business model

attractive and more rewarding as it allows them to be involved in

decisions affecting the business, even at a relatively junior

level, rather than being constrained to a narrow or purely

technical role. This positions us well with customers where such

attributes are highly valued.

We have invested in our Head Office function over the last two

years, introducing commercial support to the subsidiaries,

particularly for export business. We have also invested in the

financial, legal and company secretarial functions, partly to

support the subsidiaries but also to deal with the ever-growing

tide of compliance requirements. This includes increasingly wide

and onerous external audit requirements, which is reflected in

rising audit fees, and the need for external support for

environmental reporting.

Although the degree of autonomy our subsidiary businesses enjoy

is high, and we believe that this is an effective operational

strategy, we take a practical view of the best way forward when

circumstances change. When the operational situation is such that a

merger, restructuring or even sale is necessitated, we will act and

have acted in the best interests of the wider Group and its

shareholders.

Andrew Thomis

Chief Executive

SUBSIDIARY Review

Chess

Chess Dynamics is an innovative, well-respected surveillance, tracking

and gunfire control specialist for military and commercial customers.

Chess' military customers include defence forces and prime contractors

in the UK and overseas for the naval and land sectors.

Based in Horsham, Plymouth and Wokingham, Chess Dynamics designs,

develops and manufactures precision stabilised and non-stabilised

multi-axis platforms, fire control directors and positioners for electro-optic,

radar, communication, security, surveillance, tracking, and targeting

systems, and a wide range of high-performance cameras and special

sensors.

The Chess portfolio includes the Vision4ce branded real time video

and image processing solutions for electro-optic systems. This covers

the supply of rugged hardware (PCs that utilise the latest Intel mobile

processors) for harsh environments on land, at sea and in the air,

along with integrated software solutions (such as GRIP View video

management software and DART video tracking software) incorporating

sophisticated image processing algorithms for object detection and

tracking.

The more complex tracking and targeting systems are integrated into

naval fire-control solutions and sophisticated vehicle-based surveillance,

targeting, tracking and force protection systems.

The company is also a major developer and world-wide supplier of counter-sUAV

(drone) protection systems including rapid deployment systems for

military and security use. It provides a complete service including

survey, installation, training, and maintenance across its entire

product range, including bespoke engineering solutions.

Chess has been supplying equipment, sub-systems and systems to defence

forces and prime contractors since 2005. Cohort acquired a majority

share in Chess in 2018. It is led by Managing Director David Tuddenham.

2022 2021

GBPm GBPm

--------------------- ------ ------

Revenue 16.9 28.6

Adjusted operating

profit 0.3 3.0

Operating cash flow (5.8) (1.0)

--------------------- ------ ------

Chess had a very poor 2021/22. Order delays, technical and

delivery delays, and continued project issues all negatively

impacted on both revenue and trading profit. It has made a better

start to 2022/23.

Chess previously operated through two distinct businesses, Chess

Dynamics and Vision4ce, both owned by Chess Technologies. During

2021/22, Vision4ce was integrated with Chess Dynamics to ensure

that the process improvements at Chess were replicated there, and

that the full resources of the business, including its software

arm, could be focused on the highest priority tasks.

Chess's revenue is dominated by export customers. Deliveries

during 2021/22 for some major contracts that were secured in the

previous few years saw delays due to technical issues, including in

one instance a customer requested deferral whilst a technical

upgrade was developed and tested. Chess also suffered margin

deterioration from continuing issues on legacy projects. We have

made significant progress on these, and we expect them to be fully

resolved in the coming year.

Chess and its customer reached a mutual agreement to terminate

one contract in 2021/22. Approximately GBP6m of revenue had been

recognised previously on the project and this was reversed in

2021/22. The profit impact in 2021/22 was minimal and the system

has been subsequently sold to a new customer in 2022/23.

Despite the dip in performance in 2021/22, Chess has continued

to demonstrate what a good strategic fit it is for the Group. It is

a leading supplier within its market and has a strong ethos of

innovation and responsiveness. For instance, it is working closely

with SEA on developing a new generation of decoy launcher.

Chess's operations were only marginally impacted by the COVID-19

pandemic and lockdown with a few in-country activities being

postponed. However, its business winning methods rely significantly

on demonstrating its product, often at trade shows and exhibitions

which Chess was unable to do during the various COVID-19

restrictions. In the last few months, as restrictions have eased,

Chess has been able to renew its activities including demonstrating

new products to the US Navy.

Chess's rapid evolution over the last few years has caused it

some growing pains, especially in project control and delivery.

This, along with an increase in working capital, has resulted in a

weak cash performance this year. Cohort has been working with

Chess's management to strengthen its processes to ensure it can

successfully grow whilst still maintaining its agility and

innovative approach. This work continues to focus on improving its

project delivery, its commercial approach and ultimately its cash

performance, with the aim of ensuring it will be fully able to

deliver on its order winning success over the last two years.

We made changes to the senior management and organisation of

Chess in 2021/22 following the appointment of David Tuddenham as

Managing Director last June. These have led in turn to improvements

in processes and controls, which have begun to show a tangible

positive impact. Most of Chess's problem projects are now either

fully resolved or on a clear path to improvement.

Chess's order book at April 2022 of nearly GBP41m provides cover

for GBP22m of 2022/23 revenue and our expectation is that Chess

should return to growth in the coming year.

SUBSIDIARY REVIEW

EID

EID is a Portuguese high-tech company with over 35 years' experience

and deep know-how in the increasingly critical fields of tactical

and naval C3 (command, control and communications). The company's

focus is the design, manufacture, delivery and support of advanced

high-performance C3 equipment for the global defence and security

markets. Its customers are primarily national naval and military forces

in Portugal and overseas.

EID changed its operational structure in May 2021, creating single

engineering and business development teams to enable a more coordinated

focus on product development and to addressing its markets. These

changes have already seen progress in developing both its next generation

naval communication system and a new soldier system, the latter resulting

in the award of a major contract by the Portuguese Army during 2021/22.

The Royal Navy is amongst the customers for its naval communications

systems and its products equip over 145 vessels worldwide including

the navies of Portugal, the Netherlands, Spain and Belgium and many

non-NATO export customers. Its tactical communications products are

used extensively in a variety of personal and vehicular applications

for armies worldwide.

EID operates from an engineering and production facility near Lisbon

and is led by its Managing Director, Frederico Lemos. EID is 80% owned

by Cohort, with the remaining 20% of its shares held by the Portuguese

Government though its defence investment arm, idD, and innovation

agency IAPMEI. EID joined the Group in 2016.

2022 2021

GBPm GBPm

--------------------- ------ ------

Revenue 8.2 20.9

Adjusted operating

profit 0.9 4.8

Operating cash flow 1.7 5.4

--------------------- ------ ------

As expected, EID's revenue and profit were lower than in

2020/21, which saw the completion of a large export contract.

EID's reliance on some significant export orders does bring a

risk of year-to-year fluctuations in performance. In 2021/22 nearly

50% of EID's revenue was from its domestic customer, the Portuguese

MOD. We expect this situation to continue into 2022/23 with key

orders for the Portuguese Army and Navy being important to EID's

trading performance over the next few years. One significant Army

order, on which delivery has already begun, was secured in 2021/22.

We expect to see a key naval order in 2023. EID is also actively

working with both ELAC and SEA to promote their respective products

and solutions for the Portuguese Navy, using EID as a local

integrator and support partner.

EID had a solid cash performance for the year. Some significant

deliveries were made late in the year and the receipts from these

will be received in early 2022/23. EID is increasing its stock

holding to enable it more readily to meet customer needs.

EID's closing order book of GBP23m underpins over GBP11m of

revenue for 2022/23, already greater than that achieved in 2021/22.

At over 70% of revenue expectation for the year this order cover is

much greater than at the same time last year, when it was below

50%.

SUBSIDIARY REVIEW

ELAC

ELAC serves global customers in the naval marketplace. Working with

navies, system integrators and shipyards, ELAC supplies mission critical

hydro-acoustic naval sensors for underwater surveillance, object avoidance

and ranging. These include complete submarine and surface ship sonar

suites, submarine rescue sonars, digital underwater communications

and echo-sounders for manned and unmanned platforms. The company specialises

in developing innovative hydro-acoustics, working in partnership with

customers to meet their specific needs, offering flexibility through

open architectures.

The market-leading digital underwater communication system UT3000

and the open-architecture based KaleidoScope system, developed and

successfully delivered throughout the past 20 years, have laid the

foundations for the current second-generation, open sonar processing

platform and fully digitised hydrophones.

The company was founded in 1926 and is located in Kiel, Germany, where

it benefits from being close to the German Navy and NATO Centre of

Excellence for Confined and Shallow Waters. With several global players

in naval shipbuilding, the naval systems industry and the University

of Kiel nearby, ELAC has access to excellent resources and networks.

ELAC is led by Bernd Szukay and joined the Cohort Group in December

2020.

2022 2021 (five

GBPm months)

GBPm

--------------------- ------ -----------

Revenue 21.5 8.3

Adjusted operating

profit 3.8 1.2

Operating cash flow 6.6 0.4

--------------------- ------ -----------

ELAC's full year contribution was stronger than the annualised

2020/21 equivalent. Much of this growth was due to the Italian

sonar contract.

In early July 2021, ELAC secured a contract for over GBP42m to

provide sonar systems for two new U212 Near Future Submarines being

supplied by Fincantieri for the Italian Navy. The contract also

includes delivery of a special test and crew training system and

associated technical services. This is expected to create a

capability for the Italian Navy that is unmatched on a submarine of

this class.

The contract stretches out to 2030 with the customer having the

option for a further two submarines to be supplied with the same

system. This project, which is the largest technical delivery

contract the Group has ever won, has been overseen by a Programme

Advisory Committee set up by Cohort and whose members have

extensive knowledge and experience of operating, developing, and

delivering submarine systems.

We continue to closely review the project and how it is

monitored going forward.

In addition to the significant contribution of this project to

ELAC's 2021/22 performance, it also saw a number of good orders for

its market leading underwater communication systems, both new,

upgrades and spares. ELAC also had a good contribution from higher

margin spares, repairs and legacy hydrographic equipment. ELAC

continues to add key resources, both people and capital to enable

it to deliver its order book and secure further important naval

sonar programmes with other navies.

As for 2021/22, ELAC has nearly 90% coverage of its 2022/23

revenue expectations.

At the time of the acquisition ELAC had agreed in principle to

supply another customer with submarine sonar systems, but this has

not yet resulted in a finalised contract. A mechanism was agreed

with the seller to alleviate some of the operational costs the

business would have to bear if this opportunity was delayed or not

secured. The cost recovery is payable over two years, with a

maximum value of GBP2.1m if the opportunity is not secured by 1

December 2022. The current year trading performance of ELAC

includes GBP1.1m in respect of this mechanism, which will

contribute up to a further GBP0.5m in 2022/23.

In the coming few years, ELAC will invest in a new facility in

the Kiel area to further enhance its offering. Its current facility

is now old and is planned to be redeveloped by its landlord for the

University of Kiel.

SUBSIDIARY REVIEW

MASS

MASS is a global technology company, trusted by the most secure organisations

to provide advanced, cyber hardened digital services centred around

data, information and knowledge. MASS has built its reputation through

decades in defence, providing training, electronic warfare and cyber

security services for governments to keep their confidential information

safe. It now offers its data management and protection solutions to

other sectors where data security expertise is crucial.

MASS works in partnership with customers to fit solutions to their

needs, using highly-skilled, technical experts. The company innovates

through new technology and thinking that enables swift adaptation

to the changing data environment. MASS also supports opportunities

and local initiatives for talented young people in STEM.

MASS operates through four divisions.

The EWOS (Electronic Warfare Operational Support) division includes

the THURBON(TM) Electronic Warfare (EW) database, SHEPHERD (the provision

of a system embodying THURBON(TM) to the UK MOD) and MASS's EW managed

service offerings in the UK and elsewhere.

The Digital Services division offers solutions and training to wider

government, including security customers. This division also delivers

secure network design, delivery and support and information assurance

services to commercial, defence and educational customers.

The Strategic Systems division provides certain managed service and

niche technical offerings to the UK MOD.

The Training Support division provides training simulation and support

to the UK's Joint Warfare Centre as well as similar high-level command

training to other UK and overseas customers.

Established in 1983, MASS joined the Cohort Group in 2006. The company

is based in Cambridgeshire and it also operates an Electronic Warfare

Training Academy in Lincolnshire. MASS is led by Managing Director

Chris Stanley.

2022 2021

GBPm GBPm

--------------------- ------ ------

Revenue 38.5 39.5

Adjusted operating

profit 9.1 8.7

Operating cash flow 9.9 4.6

--------------------- ------ ------

MASS had a stronger year despite a small fall in its revenue.

The mix of work and flat overheads improved its trading profit.

MASS continued to see the impact of COVID-19 restrictions,

particularly in the first half of the financial year on its EWOS

training provision. The same issues impacted exercise work at the

Joint Forces Command. The nature of MASS's work reflects its

long-term investment in defence capability and threat analysis.

Short term changes in operational circumstances can delay MASS's

delivery, even when under contract, as we have seen recently with

Joint Forces Command support. We now expect that to return a normal

level of activity in 2022/23.

The EWOS (Electronic Warfare Operational Support) business,

which is mostly export, saw a further reduction in training and

overseas support activity, some slipping into 2023. Digital

Services activity was up slightly but the mix drove a stronger

trading profit. In the other parts of the business, especially its

technical support to key parts of UK defence, MASS was able to

increase its activity as COVID restrictions eased.

MASS's net margin increased again to 23.7% (2021: 22.1%). This

was due to improved mix, especially in Digital Services, cost

savings in delivering some of its long-term work and flat

overheads. Together these offset the lower revenue and margin in

the EWOS division.

MASS's operating cash flow this year was very strong, catching

up on some delayed receipts in 2020/21. We do not expect such a

strong cash flow in 2022/23.

MASS continues to demonstrate its strength in its core markets

of EWOS and niche technical support to key government capabilities.

Its order book of nearly GBP73m gives good visibility beyond 2023

although its coverage for 2022/23 of 60% is slightly lower than we

have seen in recent years.

SUBSIDIARY REVIEW

MCL

Marlborough Communications Limited (MCL) is a leading supplier of

advanced electronic communications, information systems and signals

intelligence technology to the defence and security sectors.

MCL utilises an ever-expanding international network of specialist

technology providers, combined with its own bespoke design, engineering

and integration skills, to deliver and support a diverse portfolio

of C4 and ISTAR capabilities that transform the effectiveness of its

customers' operations.

The company's specialist C4IS portfolio includes a full suite of hearing

protection equipment for vehicle mounted and dis-mounted operations,

communication ancillaries including Antennas, while its ISTAR capabilities

include signals intelligence, electronic warfare and UAV and UGV technologies.

The company supplies customers including the UK MOD, other UK Government

departments and defence prime contractors. With an expanding, expert

workforce of nearly 40 employees, MCL is adept at identifying the

latest technologies and capabilities to suit the unique demands of

each customer it works with.

Founded in 1980 and based in Surrey, MCL has been part of the Cohort

Group since 2014 and is led by Managing Director Shane Knight.

2022 2021

GBPm GBPm

--------------------- ------ ------

Revenue 21.7 18.0

Adjusted operating

profit 2.2 2.1

Operating cash flow 0.6 4.3

--------------------- ------ ------

MCL grew in 2021/22 with revenue and adjusted operating profit

up by 21% and 5% respectively. MCL had a very strong year of order

intake, including over GBP15m of hearing protection orders.

MCL's deliveries in 2021/22 included the autonomous ground

vehicles ordered in 2020/21, as well as hearing protection systems

for the army offsetting lower systems deliveries for Royal Navy

submarines, the latter now entering a period of long-term

support.

When we acquired MCL, back in July 2014, one of the primary

objectives was to support it in building an order book and business

with greater longevity and visibility. This year saw the order book

increase from GBP12.4m (April 2021) to GBP22.5m (April 2022) which

underpins 80% of its revenue expectations for the coming year. The

visibility of MCL's revenue still remains, on average, in the three

to six-month range, MCL does see some substantial opportunities in

long-term UK naval support programmes, particularly on the new

planned frigates for the Royal Navy. Success in these would enable

MCL to improve its revenue visibility significantly.

MCL, of all of our businesses, is very much at the forefront of

changes in operational tempo at the UK MOD. It has in the last few

months seen a significant uplift in activity from the UK MOD, and

we anticipate some of this translating to orders in the coming

financial year.

MCL moved its operations to a new site, close to its former site

in Horley in January of 2022. The new facility provides much

improved facilities for developing and trialling its products.

SUBSIDIARY REVIEW

SEA

SEA delivers systems, products and services into the defence and transport

markets alongside performing specialist research and providing services,

including training and product support.

In the maritime domain, SEA's engineering capabilities cover a wide

range of maritime combat systems requirements, including communications,

ship and fleet protection via torpedo and decoy launching systems,

and anti-submarine warfare systems, including towed-array sonar systems,

infrastructure and training. As well as providing products and services

for UK and export customers in these areas, it carries out technology

research on behalf of the UK MOD into future maritime and soldier

systems.

SEA also delivers complex data management solutions alongside automated

traffic enforcement systems to UK Government and export customers

in the transport domain, utilising its award-winning expertise in

signal processing and software engineering.

SEA manages its business through three divisions:

-- Complex Systems, based at Beckington;

-- Maritime Solutions, based at Barnstaple; and

-- Transport Management, based in Bristol.

The technology and innovation activities of the organisation are underpinned

by strong project management and dedicated production and support

teams. In the last year SEA has enhanced its senior management team

with several new recruits and has adjusted its strategy to align its

research and training activities to support its product offerings,

rather than being independent business lines.

In the final quarter of the year, SEA combined all of its engineering

capability into a single function under one director, to ensure that

the engineering resource is effectively managed and prioritised, and

that development and skill gaps are addressed.

SEA was founded in 1987 and joined the Cohort Group in 2007. SEA is

located in the UK in Somerset, Bristol and Devon and is led by Managing

Director Richard Flitton.

2022 2021

GBPm GBPm

--------------------- ------ ------

Revenue 31.0 28.0

Adjusted operating

profit 3.4 2.4

Operating cash flow 5.7 9.8

--------------------- ------ ------

After a strong order intake in 2020/21, SEA had a solid year

with revenue growing by over 10% and trading profit by over

40%.

The change in SEA's revenue over the last five years is analysed

by activity as follows:

2018 2019 2020 2021 2022

GBPm GBPm GBPm GBPm GBPm

------------------ ----- ----- ----- ----- -----

Submarine systems 7.3 4.7 2.7 4.2 2.4

Research 2.3 4.5 5.2 3.0 4.9

Export defence 7.1 8.2 1.6 2.3 4.9

Other defence

products and

support 13.2 9.6 11.7 11.1 12.1

Transport 5.3 9.2 7.6 6.4 6.7

Subsea 2.1 2.1 2.9 1.0 -

------------------ ----- ----- ----- ----- -----

SEA total revenue 37.3 38.3 31.7 28.0 31.0

------------------ ----- ----- ----- ----- -----

Submarine systems activity at SEA declined following the

cancellation of a major contract in early 2021/22. This contract

was terminated by the Australian government following a change to

its strategic stance. Its intention is move away from a

conventional (diesel) powered submarine to a nuclear-powered vessel

in alliance with the UK and USA (AUKUS). We are optimistic that,

when this programme re-launches, SEA's external communication

system, as used on the UK's nuclear submarine, will be the

preferred solution.

SEA's research activity saw growth in its naval research. SEA's

research, training and simulation activities will in future have a

greater focus on supporting its main product and service

offerings.

Export revenue at SEA was up significantly with orders won in

the final quarter of the previous financial year being delivered in

2021/22. Export revenue included development work on an order for

the Royal New Zealand Navy. This was to upgrade the external

communication system on the ANZAC class of frigates. SEA secured a

further follow-on export order from a previous customer for its

Torpedo Launch System.

Revenue from other defence products also increased, a result of

higher levels of support activity and the inclusion of revenue from

JSK, SEA's Canadian subsidiary.

SEA's transport business saw a 5% rise in revenue with a return

to pre-COVID19 activity levels. The new Clean Air Zone for Bristol

provided both order intake and revenue in year.

Over the past few years, the decline in submarine systems work

has resulted in a higher proportion of revenue being derived from

less predictable orders. For instance, SEA's transport contracts

are typically on short timeframes from win to delivery, usually a

few weeks to months. SEA has won nearly GBP100m of orders in the

last two years. This has provided SEA with improved short and

long-term visibility, including a number of export contracts for

its Torpedo Launch systems. The closing order book of over GBP75m

underpins just over GBP27m of revenue expectations for 2022/23.

SEA's position for UK submarine communication systems and key

defence systems for the Royal Navy's surface fleet provide very

good prospects for the coming and future years in securing

long-term support and delivery orders, some of which will stretch

into the early 2030s. SEA secured its first significant orders for

the new Dreadnought class of submarine in 2021/22. We also expect

follow on orders for some of its key export contracts.

SEA acquired the other half of its joint venture, JSK, which is

based in Canada. This has allowed SEA to fully control the delivery

of its Torpedo Launcher Systems to the Canadian frigate programme

and to reinvigorate its efforts to support existing Royal Canadian

Navy vessels including the Victoria Class submarines.

FINANCIAL REVIEW

Revenue analysis

The segmental breakdown of sales in 2021/22 was similar in

proportions to 2020/21. In absolute terms we saw a fall in C4ISTAR

revenue, driven by lower intercom deliveries from EID, partly

offset by higher MCL sales. The slight drop in combat systems

revenue was due to lower revenue at Chess where a project was

terminated in 2021/22, offset by higher Torpedo Launch systems

revenue at SEA to export customers. The other segment areas were in

line with last year.

The Group saw an increase in revenue with the UK MOD, although

it remains below 50% of the Group total revenue. The increase was

at MCL and MASS.

Sales to the Portuguese MOD decreased, a result of continued

delays to orders for both land and naval systems. A key land system

order for the Portuguese Army was secured in 2021/22, albeit later

than expected, and this and some delivery delays, resulted in

revenue below our expectations. Important naval orders are now

expected in 2023 and should start to deliver revenue in 2023/24.

The higher German sales reflected a full year contribution from

ELAC and some refresh programmes starting for German surface

ships.

Security sales were lower as MASS completed its contract with

the Metropolitan Police Service in July 2021.

Export defence sales were lower due completion of a large Middle

East order at EID last year. Chess saw declines in revenue as one

contract was terminated and deliveries on other contracts were

delayed into 2022/23 due to changes in customer requirements. These

were partly offset by stronger export sales at SEA following good

order intake in 2020/21. MASS's export revenue was lower as

training provision to export customers continued to be impaired by

COVID-19 restrictions, especially in the first half of the year and

these could not be made up in the second half.

The Group's defence and security business is the largest part of

our business, accounting for 92% of our revenue this year (2021:

94%). The Group's non-defence revenue was up over 30% compared to

last year, with SEA's transport business seeing a slight increase

as COVID-19 restrictions eased. MASS education revenue was higher

and ELAC saw increased deliveries of legacy commercial echosounder

spares.

Revenue by sector and business

Chess EID ELAC MASS MCL SEA Group

----------- ---------- ---------- ---------- ---------- ---------- ----------------------

2022 2021 2022 2021 2022 2021 2022 2021 2022 2021 2022 2021 2022 2021

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm % GBPm %

----------- ---- ----- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ----- --- ----- ---

Defence and

security 16.8 28.6 8.2 20.9 20.3 8.3 35.3 37.6 21.7 18.0 24.3 20.6 126.6 92 134.0 94

Transport - - - - - - - - - - 6.7 6.4 6.7 5 6.4 4

Offshore

energy - - - - - - - - - - - 1.0 - - 1.0 1

Other

commercial 0.1 - - - 1.2 - 3.2 1.9 - - - - 4.5 3 1.9 1

----------- ---- ----- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ----- --- ----- ---

16.9 28.6 8.2 20.9 21.5 8.3 38.5 39.5 21.7 18.0 31.0 28.0 137.8 100 143.3 100

----------- ---- ----- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ----- --- ----- ---

The defence and security revenues are further broken down as

follows:

Chess EID ELAC MASS MCL SEA Group

----------- ---------- ---------- ---------- ---------- ---------- ---------------------

2022 2021 2022 2021 2022 2021 2022 2021 2021 2021 2022 2021 2022 2021

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm % GBPm %

--------------- ---- ----- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ----- ----- ---

Direct to

UK MOD 0.1 - - - - - 21.0 19.3 19.3 16.6 5.9 8.0 46.3 34 43.9 31

--------------- ---- ----- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ----- ----- ---

Indirect

to UK MOD

where the

Group acts

as a

sub-contractor

or partner 2.6 2.1 0.1 0.1 - - 4.9 4.8 0.8 0.4 10.2 8.9 18.6 13 16.3 11

--------------- ---- ----- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ----- ----- ---

Total to

UK MOD 2.7 2.1 0.1 0.1 - - 25.9 24.1 20.1 17.0 16.1 16.9 64.9 47 60.2 42

--------------- ---- ----- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ----- ----- ---

Portuguese

MOD - - 3.9 5.9 - - - - - - - - 3.9 3 5.9 4

German MOD - - - - 4.0 1.0 - - - - - - 4.0 3 1.0 1

Security 2.0 2.4 - - - - 3.1 4.5 1.6 1.0 - - 6.7 5 7.9 6

Export defence 12.1 24.1 4.2 14.9 16.3 7.3 6.3 9.0 - - 8.2 3.7 47.1 34 59.0 41

--------------- ---- ----- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ----- ----- ---

14.1 26.5 8.1 20.8 20.3 8.3 9.4 13.5 1.6 1.0 8.2 3.7 61.7 45 73.8 52

--------------- ---- ----- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ----- ----- ---

16.8 28.6 8.2 20.9 20.3 8.3 35.3 37.6 21.7 18.0 24.3 20.6 126.6 92 134.0 94

--------------- ---- ----- ---- ---- ---- ---- ---- ---- ---- ---- ---- ---- ----- ----- ---

Note: The percentages applied to the defence and security

revenue are based on the total revenue for the Group in each

year.

Defence and security revenues are categorised into market

segments as follows:

Year ended Year ended

30 April 2022 30 April 2021

---------------- ----------------

GBPm % GBPm %

----------------------------------- ---------- ---- ---------- ----

By market segment

Combat systems 19.0 14 22.0 16

C4ISTAR 75.0 54 79.0 55

Digital Services 14.0 10 14.5 10

Training and simulation 9.6 7 9.5 7

Research, advice and support 7.5 6 7.4 5

Other 1.5 1 1.6 1

----------------------------------- ---------- ---- ---------- ----

Total defence and security revenue 126.6 92 134.0 94

----------------------------------- ---------- ---- ---------- ----

The Group's total revenue, broken down by type of deliverable is

as follows:

Year ended Year ended

30 April 2022 30 April 2021

---------------- ----------------

GBPm % GBPm %

-------------- --------- ----- --------- -----

Product 82.7 60 90.7 63

Services 55.1 40 52.6 37

-------------- --------- ----- --------- -----

Total revenue 137.8 100 143.3 100

-------------- --------- ----- --------- -----

Operational outlook

Order intake and order book

Order intake Order book

-------------- ------------

2022 2021 2022 2021

GBPm GBPm GBPm GBPm

------ ------ ----- -----

Chess 15.2 57.7 40.7 42.3

EID 11.4 4.3 23.1 20.0

ELAC 57.1 7.2 56.8 21.2

MASS 34.1 25.6 72.8 77.2

MCL 31.8 21.8 22.5 12.4

SEA 36.8 63.7 75.1 69.3

------ ------ ------ ----- -----

186.4 180.3 291.0 242.4

------ ------ ------ ----- -----

The 2021 order book includes GBP23.2m of order book acquired

with ELAC in December 2020.

The increase in the Group's order book reflects the strong order

intake at ELAC and increased order intake at EID, MASS and MCL

offsetting the unwinding of some of our longer-term orders,

especially at MASS. These are typically renewed on a multi-year

cycle, and we expect a negative effect on our order book from these

contracts as deliveries take place.

The 2021/22 order intake was 135% (2021: 126%) of the Group's

revenue for that year.

The revenue on order (order cover) for the coming year is 78%

(2021: 64%) as at 30 April 2022, based on consensus external

revenue forecasts. This had risen to 90% in July.

The table below shows the expected delivery of future revenue

from the current order book. The Group's order intake and order

book are the contracted values with customers and do not include

any value attributable to frameworks or other arrangements where no

enforceable contract exists. The order intake and order book

include contractual changes to existing orders including

extensions, variations and cancellations.

Chess's order intake of GBP15.2m was mainly orders for European

land forces, including extensions to a larger order received in

2020/21. Chess's order intake is net of an order cancelled by

mutual agreement for which the equipment developed has now been

supplied to a new customer in 2022/23. Chess's order intake

included over GBP4m of spares and repairs and we have recently

invested in its logistics and support team to grow this important

revenue stream. Chess's closing order book of GBP40.7m included

GBP22.0m for delivery in 2022/23. Chess is well positioned for

further naval and land programmes which we hope will convert to

orders in the coming year. As expected, Chess's order intake was

lower than 2020/21, which was dominated by two large orders from

European customers. The actual order intake was weaker than we had

expected in the year and this in part contributed to the weaker

performance. As we saw last year, weaker margins on some projects

due to delays, customer deployment changes and technical challenges

continued. These challenging projects have mostly been closed out.

The now established new management team at Chess, and stronger

underpinning of revenue expectations for 2022/23, give us

confidence that Chess will deliver a stronger performance for the

coming year, more akin to 2020/21.

EID's order intake for this year was higher at GBP11.4m (2021:

GBP4.3m), including a long-awaited order from the Portuguese Army.

EID's order book of GBP23.1m provides GBP11.3m of underpinning for

2022/23, which is already ahead of 2021/22. As we stated last year,

the need for EID to secure orders, especially in its naval markets,

remains important for its medium to long-term order book and growth

and we expect a significant naval order for the Portuguese Navy to

be secured in 2023. The stronger start point and some good

prospects should see EID improve its performance in 2022/23 but it

will still be short of the levels achieved historically.

ELAC, as expected had a very strong order intake for 2021/22,

including over GBP40m for sonar development and delivery on two new

Italian submarines. ELAC secured orders for other navies including

the German, UK's Royal Navy and Japan. ELAC also received nearly

GBP7m of various spares and support orders, reflecting its widely

installed product base, especially for underwater communication

systems. ELAC's order book of GBP56.8m includes GBP19.9m to be

delivered in 2022/23. We expect ELAC to perform in line with

2021/22, before including the income from the agreed mechanism with

Wärtsilä, which will be lower as this mechanism concludes in

November 2022.

Delivery of the Group's order book into revenue

MASS's order intake of GBP34.1m included the exercise of an

option by the customer of over GBP11m to extend MASS's support to

the UK's Joint Forces Command out to July 2024, a service MASS has

been providing for nearly 20 years. MASS's closing order book of

GBP72.8m includes nearly GBP27m of revenue to be delivered in

2022/23. Following a good year in 2021/22, we expect MASS to only

show modest growth in the coming year. With the easing of COVID