TIDMCHAR

RNS Number : 3479Z

Chariot Limited

14 September 2022

14 September 2022

Chariot Limited

("Chariot", the "Company")

H1 2022 Results

Chariot (AIM: CHAR), the Africa focused transitional energy

company, today announces its unaudited interim results for the

six-month period ended 30 June 2022.

-- Significant gas discovery at the Anchois-2 well offshore Morocco

-- Material increase in gas resources within a basin scale opportunity

-- Rissana Offshore exploration licence awarded in Morocco

-- Two new renewable energy projects in development in South Africa and Zambia

-- Pre-Feasibility Study ('PFS') completed on Project Nour in

Mauritania confirming world class green hydrogen potential

-- Partnership signed with Total Eren to co-develop Project Nour

-- Oversubscribed Placing and Open Offer raised gross US$29.5m

Adonis Pouroulis, CEO of Chariot commented : "It is a pleasure

to report on our activities in the first half of 2022, as we

delivered significant progress across all areas of our business. It

has been a busy time but our focus remains on securing and

developing large-scale, scalable, first-mover positions in projects

that can diversify the energy mix, potentially reduce carbon

emissions, support greener industrial development and facilitate

access to affordable, accessible energy for all. In delivering this

strategy, we are looking to play a material role in the energy

transition whilst creating value and generating a wide range of

positive impacts for all stakeholders. As we advance our three

pillar strategy across our gas, power and hydrogen businesses, we

are building a unique position within the transitional energy space

and look forward to updating all our stakeholders on the next

phases of our journey."

Highlights during and post period

Transitional Gas: Anchois Gas Development Project

-- Successful drilling campaign completed safely and on budget in January 2022.

-- The Anchois-2 well reported a significant gas discovery, with

o 150m net pay confirmed across seven reservoirs

o confirmation of consistent and excellent quality dry gas

composition across all reservoirs, which should enable a

conventional and common development.

-- Independent assessment confirmed a significant upgrade in gas

resources - increased to 1.4 Tcf in total remaining recoverable (2C

plus 2U) at the Anchois Project.

-- Societe Generale appointed as financial advisor to lead the project financing.

-- Front end engineering design ("FEED") awarded to Schlumberger

and Subsea7 ("Subsea Integration Alliance")

-- Agreement with ONHYM to tie-in to the Maghreb-Europe Gas Pipeline ("GME")

Material Upside Potential

-- Anchois-2 drilling success directly de-risked a material

portfolio of prospects within the Lixus licence area.

-- Rissana Offshore Licence signed in February 2022 capturing

gas play extensions from the Lixus licence and prospects from our

legacy Mohammedia licence area.

-- Early assessment of areas covered by 3D seismic, estimates a

total 2U prospective resource in Rissana of over 7Tcf.

Transitional Power: Renewable Energy for Mining Projects

-- Partnership with Total Eren extended from January 2022 with

Chariot having the right to invest up to 49% into the co-developed

mining projects.

-- Two projects signed during the period and in development:

o 40MW solar PV project with Tharisa Plc to provide power to its

chrome and PGM operations in South Africa.

o Partnership with First Quantum Minerals to advance the

development of a 430 MW solar and wind power project for its copper

mining operations in Zambia - one of the largest renewable private

sector energy projects in Africa.

-- Building up a pipeline of African mining power projects and

looking to collaborate on other renewable transactions across the

continent.

Green Hydrogen - Project Nour

-- Pre-Feasibility Study ("PFS") confirmed Mauritania is

exceptionally well-placed for green hydrogen production due to its

solar and wind resources.

o Project Nour could produce some of the cheapest green hydrogen in the world.

-- 50%/50% Partnership agreement signed with Total Eren to

co-develop the project, progressing the in-depth feasibility study

and offtake options.

-- Wide ranging potential benefits for domestic, infrastructure

and energy industries within Mauritania.

-- MoU signed with the Port of Rotterdam International, a global

energy hub and Europe's largest seaport which represents a first

step towards establishing supply chains.

-- Ongoing initiatives to expand the portfolio and evaluate

further green hydrogen opportunities.

Corporate

-- Well capitalised business - further reinforced following a

successful fundraise in June 2022.

-- Cash position as at 30 June 2022 - $23.4million with no debt

with minimal licence commitments.

Enquiries:

Chariot Limited

Adonis Pouroulis, CEO +44 (0)20 7318

Julian Maurice-Williams, CFO 0450

+44 (0)20 7397

8900

Cenkos Securities Plc (Nomad and Joint Broker)

Derrick Lee, Adam Rae

Peel Hunt LLP (Joint Broker) +44 (0) 20 7894

Richard Crichton, David McKeown 7000

Celicourt Communications (Financial PR) +44 (0)20 8434

Mark Antelme, Jimmy Lea 2754

Chariot Limited

Chief Executive's Review

Climate change and the tumultuous events that have unfolded in

Eastern Europe this year have reinforced the reality that energy

security and sustainability remain at the forefront of global

agendas and we are fully focused on developing and delivering on

our transitional energy projects, all of which have the potential

to play a material role within this context. I am delighted to

report on our progress over the first half of 2022, as we have

significantly increased our natural gas resources and are moving

towards FID at the Anchois Gas Project offshore Morocco. In

addition, over this period we added two major projects to our

renewable power pipeline in Southern Africa and delivered on our

objective of securing a world class partner in Total Eren to

co-develop our large-scale green hydrogen asset in Mauritania.

Transitional Gas

The Anchois Development Project

Our successful drilling campaign and significant gas discovery

at the Anchois gas field offshore Morocco has been well documented

since the beginning of this year, the results from which exceeded

expectations, confirmed the consistency and quality of the gas and

reported an upgrade to net pay estimates as well as a material

increase in gas resources. We were pleased to have our in-house

analysis corroborated by Netherland Sewell & Associates Inc

which confirmed upgrades to the 2C and 2U resources as well as the

basin scale opportunity that sits within our acreage providing

further material upside to both Anchois and Lixus.

We are now developing a significant project which has 1.4 Tcf in

2C plus 2U total recoverable resources at Anchois and our team is

fully focused on the FEED elements of the development plan, working

alongside Schlumberger and Subsea 7 who we appointed in June. With

Societe Generale leading the project financing, a Tie-In agreement

signed with OHNYM post-period end providing access to the major

Maghreb Europe Gas pipeline, ongoing offtake and strategic

partnering discussions and our Environmental and Social Impact

Assessment underway, we are looking to reach FID as soon as

possible to start generating material cash flows thereafter.

Material Upside Potential

The exploration and appraisal drilling also served to derisk a

range of targets, both in the Lixus licence where Anchois is

located and also in surrounding acreage in the Rissana licence

which we signed in February 2022. Early assessment of the areas in

Rissana covered by 3D seismic, provides a total 2U prospective

resource of over 7 Tcf, combining a high-graded prospect 'Emissole'

within the lower risk Anchois Tertiary gas play and multi Tcf

prospects in a higher-risk Mesozoic play, inherited from Chariot's

legacy Mohammedia Offshore licence area.

We are committed to developing and realising the value of this

gas field and moving it into production to help meet the growing

demand within Morocco's domestic market as well as potentially

supplying surplus gas to Europe.

Transitional Power

Providing Renewable Power in Africa

Our Transitional Power business is focused on providing

innovative energy solutions for mining and industrial offtakers

across the African continent in order to reduce costs, improve ESG

performance, and deliver reliable and low-risk energy supplies.

Working alongside Total Eren our team has continued to leverage

their expertise and network securing two substantial new projects

within the first half of the year with a 40MW solar plant now in

development at Tharisa's PGM and chrome mine in South Africa, and a

430 MW solar and wind partnership underway at First Quantum's

Kansanshi copper gold mine in Zambia. Both projects are flagship

initiatives within these countries and will follow a similar

development path to that of IAMGold's exemplary operational 15GW

solar project at the Essakane gold mine in Burkina Faso, our first

renewable project in which we hold a 10% stake.

The power demand of the mining sector offers huge scale and

growth potential but we are also looking at other opportunities

that stem from wider energy needs and scarcity of resources in some

regions across Africa. We have the team and the flexibility to

access and evaluate a range of options and we will consider all

those that would be value accretive and fit within our Transitional

Power remit and strategy. Considering that our Power business is

only just over a year old, we have grown rapidly over this last

period and we are just beginning the journey. There are huge

opportunities in which Chariot can play a leading role in Africa's

energy transition.

Green Hydrogen - an essential part of the future energy mix

We are delighted to have partnered with Total Eren in Mauritania

to co-develop Project Nour, which with the potential to install

10GW of electrolyser capacity, could become one of the most

significant green hydrogen projects in Africa. We share a similar

vision for green hydrogen seeing it as a key component in

diversifying the energy mix and a vital energy source of the future

and our teams have complementary skillsets that we bring to this

project. The partnership will be a 50%/50% split, and we will be

working together to progress the in-depth feasibility study and

offtake options. Chariot will continue to co-lead on project

development and permitting, local content, and stakeholder

engagement and the project will undoubtedly benefit from Total

Eren's range of expertise and engineering knowledge. As confirmed

by the PFS, this could become one of the most competitive green

hydrogen projects in the world due to the abundance of natural

resources and could bring a range of sustainable economic benefits

to Mauritania including greener industry opportunities and

provision of clean power to the national grid. It could also

potentially result in the country becoming one of the world's main

producers and exporters of green hydrogen, providing a

cost-effective, transportable energy solution to replace CO(2)

emitting fuels for exportation to the European market.

We are very pleased to have secured a first mover advantage and

are keen to expand our footprint within this fast moving and

critical sector. We will continue to evaluate opportunities in this

space and look forward to collaborating on new ventures with Total

Eren in the future.

Financial Review

The Group remains debt free and had a cash balance of US$23.4

million at 30 June 2022 (US$19.4 million at 31 December 2021)

following the equity fundraising completed in June 2022 which

raised gross proceeds of US$29.5 million.

Hydrogen and other business development costs of $1.5m (30 June

2021: $nil) comprise non-administrative expenses incurred in the

development of Transitional Power and Hydrogen projects following

the acquisitions made in June 2021.

Other administrative expenses of US$5.0 million (30 June 2021:

US$1.7 million) are higher than the prior period driven by one-off

new venture and employment costs and the inclusion of

administration costs from the Transitional Power acquisitions.

Finance expenses of US$0.4 million (30 June 2021: US$0.3

million) reflect foreign exchange losses on the holding of cash

balances in Sterling to meet administrative and capital

expenditures, in addition to the unwinding of the discount on the

lease liability under IFRS 16.

Share-based payments charges of US$0.9 million (30 June 2021:

US$0.2 million) are higher than the prior period due to the

granting of share awards to employees across the group, including

employees joining the group as part of the Transitional Power

acquisition.

Outlook

Looking forward, we are enthused with both the evolution and

revolution taking place within our business, especially when I look

at the projects we offer and what the future might hold for the

Company. We are excited about the path forward with our gas

development project at Anchois, fast tracking all workstreams to

reach FID and deliver a valuable resource to energy hungry

customers. Within our Transitional Power business, we will continue

to develop our mining project pipeline across the continent as well

as potentially broadening our portfolio and with Green Hydrogen we

look forward to further unlocking the scale of this nascent but

important commodity. Our business has three pillars, gas, power and

hydrogen, which offer a range of significant, scalable resources

underpinned by expanding markets and fundamental objectives of

looking to create value and deliver positive change. As a

management team, we remain closely aligned with our shareholder

base and we look forward to providing further updates on our

continued progress and development over the coming months.

A Pouroulis

Chief Executive Officer

14 September 2022

Chariot Limited

Consolidated statement of comprehensive income for the six

months ended 30 June 2022

Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

US$000 US$000 US$000

Notes Unaudited Unaudited Audited

Share based payments (938) (26) (760)

Hydrogen and other business development

costs (1,463) (1,139)

Other administrative expenses (4,970) (1,655) (4,549)

----------------------------------------------------- ------------------ ---------------- -----------------

Total operating expenses (7,371) (1,681) (6,448)

----------------------------------------------------- ------------------ ---------------- -----------------

Loss from operations (7,371) (1,681) (6,488)

Finance expense (390) (329) (512)

----------------------------------------------------- ------------------ ---------------- -----------------

Loss for the period before

and after taxation (7,761) (2,010) (6,960)

Loss for the period and total

comprehensive loss for the

period attributable to equity

owners of the parent (7,761) (2,010) (6,960)

----------------------------------------------------- ------------------ ---------------- -----------------

Loss per ordinary share attributable 3 US$(0.01) US$(0.01) US$(0.01)

to the equity holders of the

parent - basic and diluted

---------------------------------------- ----------- ------------------ ---------------- -----------------

Chariot Limited

Consolidated statement of changes in equity for the six months

ended 30 June 2022

For the six Share Shares Total

months ended based based attributable

30 June 2022 Share Share Contributed payment to be Retained to equity

(unaudited) capital premium equity reserve issued deficit holders

reserve of the parent

US$000 US$000 US$000 US$000 US$000 US$000 US$000

------------------ ----------- ----------- --------------- ---------- ---------- ------------ -----------------

As at 1 January

2022 11,696 383,318 796 2,207 142 (359,199) 38,960

Loss and total

comprehensive

loss for the

period - - - - - (7,761) (7,761)

Issue of capital 2,541 31,892 - - - - 34,433

Issue costs - (1,618) - - - - (1,618)

Share based

payments - - - 938 - - 938

As at 30

June 2022 14,237 413,592 796 3,145 142 (366,960) 64,952

------------------ ----------- ----------- --------------- ---------- ---------- ------------ -----------------

For the six Share Total

months ended based Shares attributable

30 June 2021 Share Share Contributed payment to be Retained to equity

(unaudited) capital premium equity reserve issued deficit holders

reserve of the parent

US$000 US$000 US$000 US$000 US$000 US$000 US$000

As at 1 January

2021 6,549 359,609 796 1,447 - (352,239) 16,162

Loss and total

comprehensive

loss for the

period - - - - - (2,010) (2,010)

Issue of

capital 3,491 15,666 - - - - 19,157

Issue costs - (1,241) - - - - (1,241)

Share based

payments - - - 26 - - 26

Share based

deferred

consideration - - - - 142 - 142

----------------- ----------- ----------- --------------- ---------- ----------- ------------ -----------------

As at 30

June 2021 10,040 374,034 796 1,473 142 (354,249) 32,236

----------------- ----------- ----------- --------------- ---------- ----------- ------------ -----------------

For the Share Total

year ended based Shares attributable

31 December Share Share Contributed payment to be Retained to equity

2021 (audited) capital premium equity reserve issued deficit holders

reserve of the

parent

US$000 US$000 US$000 US$000 US$000 US$000 US$000

As at 1

January 2021 6,549 359,609 796 1,447 - (352,239) 16,162

Loss and

total

comprehensive

loss for

the year - - - - - (6,960) (6,960)

Issue of

capital 5,147 25,585 - - - - 30,732

Issue costs - (1,876) - - - - (1,876)

Share based

payments - - - 760 - - 760

Share based

deferred

consideration - - - - 142 - 142

As at 31

December

2021 11,696 383,318 796 2,207 142 (359,199) 38,960

---------------- ----------- ----------- -------------- ---------- ----------- ----------- --------------

Chariot Limited

Consolidated statement of financial position as at 30 June

2022

30 June 30 June 31 December

2022 2021 2021

US$000 US$000 US$000

Notes Unaudited Unaudited Audited

Non-current assets

Exploration and evaluation

assets 4 44,967 13,756 31,750

Investment in power projects 450 450 450

Goodwill 380 380 380

Property, plant and equipment 85 52 84

Right of use asset: office

lease 164 492 328

------------------------------------ ------- ----------- ----------- ------------

Total non-current assets 46,046 15,130 32,992

------------------------------------ ------- ----------- ----------- ------------

Current assets

Trade and other receivables 642 704 1,167

Inventory 1,306 - 1,183

Cash and cash equivalents 5 23,391 18,049 19,406

------------------------------------ ------- ----------- ----------- ------------

Total current assets 25,339 18,753 21,756

------------------------------------ ------- ----------- ----------- ------------

Total assets 71,385 33,883 54,748

------------------------------------ ------- ----------- ----------- ------------

Current liabilities

Trade and other payables 6,244 990 15,358

Lease liability: office lease 189 431 430

------------------------------------ ------- ----------- ----------- ------------

Total current liabilities 6,433 1,421 15,788

------------------------------------ ------- ----------- ----------- ------------

Non-current liabilities

Lease liability: office lease - 226 -

------------------------------------ ------- ----------- ----------- ------------

Total non-current liabilities - 226 -

------------------------------------ ------- ----------- ----------- ------------

Total liabilities 6,433 1,647 15,788

------------------------------------ ------- ----------- ----------- ------------

Net assets 64,952 32,236 38,960

------------------------------------ ------- ----------- ----------- ------------

Capital and reserves attributable

to equity holders of the parent

Share capital 6 14,237 10,040 11,696

Share premium 413,592 374,034 383,318

Contributed equity 796 796 796

Share based payment reserve 3,145 1,473 2,207

Shares to be issued reserve 142 142 142

Retained deficit (366,960) (354,249) (359,199)

------------------------------------ ------- ----------- ----------- ------------

Total equity 64,952 32,236 38,960

------------------------------------ ------- ----------- ----------- ------------

Chariot Limited

Consolidated cash flow statement for the six months ended 30

June 2022

Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

US$000 US$000 US$000

Unaudited Unaudited Audited

-------------------------------------------- -------------- -------------- ---------------

Operating activities

Loss for the period before taxation (7,761) (2,010) (6,960)

Adjustments for:

Finance expense 390 329 512

Depreciation and amortisation 188 177 358

Share based payments 938 26 760

Net cash outflow from operating

activities before changes in working

capital (6,245) (1,478) (5,330)

Decrease / (increase) in trade and

other receivables 285 38 (116)

Increase / (decrease) in trade and

other payables 3,481 (290) 445

Increase in inventories (123) - (1,183)

Cash outflow from operating activities (2,602) (1,730) (6,184)

Net cash outflow from operating

activities (2,602) (1,730) (6,184)

-------------------------------------------- -------------- -------------- ---------------

Investing activities

Payments in respect of property,

plant and equipment (25) (22) (72)

Payments in respect of exploration

and evaluation assets (25,572) (793) (5,301)

Net cash consideration on acquisition - (21) (21)

Net cash outflow used in investing

activities (25,597) (836) (5,394)

-------------------------------------------- -------------- -------------- ---------------

Financing activities

Issue of ordinary share capital

net of fees 32,815 17,396 28,175

Payment of lease liabilities (241) (192) (419)

Finance expense on lease (10) (27) (46)

Net cash inflow from financing

activities 32,564 17,177 27,710

-------------------------------------------- -------------- -------------- ---------------

Net increase in cash and cash equivalents

in the period 4,365 14,611 16,132

Cash and cash equivalents at start

of the period 19,406 3,740 3,740

Effect of foreign exchange rate

changes on cash and cash equivalent (380) (302) (466)

Cash and cash equivalents at end

of the period 23,391 18,049 19,406

-------------------------------------------- -------------- -------------- ---------------

Chariot Limited

Notes to the interim financial statements for the six months

ended 30 June 2022

1. Accounting policies

Basis of preparation

The interim financial statements have been prepared in

accordance with UK adopted International Accounting Standards.

The interim financial information has been prepared using the

accounting policies which were applied in the Group's statutory

financial statements for the year ended 31 December 2021. The Group

has not adopted IAS 34: Interim Financial Reporting in the

preparation of the interim financial statements.

There has been no impact on the Group of any new standards,

amendments or interpretations that have become effective in the

period. The Group has not early adopted any new standards,

amendments or interpretations.

In the consolidated statement of comprehensive income Other

Administrative expenses has been split out to provide further

detail of total operating expenses. The comparative figures for 30

June 2021 and 31 December 2021 have been represented to reflect

this additional disclosure. There is no change to the total

operating expenses or loss from operations for those periods.

2. Financial reporting period

The interim financial information for the period 1 January 2022

to 30 June 2022 is unaudited. The financial statements also

incorporate the unaudited figures for the interim period 1 January

2021 to 30 June 2021 and the audited figures for the year ended 31

December 2021.

The financial information contained in this interim report does

not constitute statutory accounts as defined by sections 243-245 of

the Companies (Guernsey) Law 2008.

The figures for the year ended 31 December 2021 are not the

Group's full statutory accounts for that year. The auditors' report

on those accounts was unqualified, did not contain references to

matters to which the auditors drew attention by way of emphasis and

did not contain a statement under section 263 (3) of the Companies

(Guernsey) Law 2008.

3. Loss per share

The calculation of the basic earnings per share is based on the

loss attributable to ordinary shareholders divided by the weighted

average number of shares in issue during the period.

Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

Loss for the period US$000 (7,761) (2,010) (6,960)

------------- ------------- --------------

Weighted average number of

shares 822,031,912 391,409,534 519,854,783

------------- ------------- --------------

Loss per share, basic and US$(0.01) US$(0.01) US$(0.01)

diluted*

------------- ------------- --------------

*Inclusion of the potential ordinary shares would result in a

decrease in the loss per share and, as such, is considered to be

anti-dilutive. Consequently a separate diluted loss per share has

not been presented.

4. Exploration and evaluation assets

30 June 2022 30 June 2021 31 December 2021

US$000 US$000 US$000

-------------- -------------- ------------------

Balance brought forward 31,750 12,822 12,822

-------------- -------------- ------------------

Additions 13,217 934 18,928

-------------- -------------- ------------------

Net book value 44,967 13,756 31,750

-------------- -------------- ------------------

As at 30 June 2022 the net book value of the Moroccan geographic

area is US$45.0 million (31 December 2021: US$31.8 million).

5. Cash and cash equivalents

As at 30 June 2022 the cash balance of US$23.4 million (31

December 2021: US$19.4 million ) contains the following cash

deposits that are secured against bank guarantees given in respect

of exploration work to be carried out:

30 June 2022 30 June 2021 31 December 2021

US$000 US$000 US$000

-------------- -------------- ------------------

Moroccan licences 750 350 5,350

-------------- -------------- ------------------

750 350 5,350

-------------- -------------- ------------------

The funds are freely transferrable but alternative collateral

would need to be put in place to replace the cash security.

6. Share capital

Allotted, called up and fully paid

At At At At 31 December 31

30 June 30 June 30 June 30 June 2021 December

2022 2022 2021 2021 2021

--------------- ---------- --------------- ---------- --------------- -----------

Number US$000 Number US$000 Number US$000

--------------- ---------- --------------- ---------- --------------- -----------

Ordinary

shares

of 1p

each 958,002,421 14,237 636,077,728 10,040 759,587,023 11,696

--------------- ---------- --------------- ---------- --------------- -----------

Details of the Ordinary shares issued during the six month

period to 30 June 2022 are given in the table below:

Date Description Price No of shares

US$

1 January

2022 Opening Balance 759,587,023

--------------------------------------- ------- --------------

31 January Issue of shares at GBP0.055 relating

2022 to underwriting commitment 0.07 33,742,396

--------------------------------------- ------- --------------

Issue of shares at GBP0.055 relating

3 March 2022 to underwriting commitment 0.07 33,742,396

--------------------------------------- ------- --------------

Issue of shares at GBP0.18 in

Placing, Subscription, Open Offer

13 June 2022 and fees 0.22 130,930,606

--------------------------------------- ------- --------------

30 June 2022 958,002,421

------- --------------

The ordinary shares have a nominal value of 1p. The share

capital has been translated at the historic rate at the date of

issue, or, in the case of the LTIP, the date of grant.

Magna Capital LDA (of which Adonis Pouroulis, CEO, has a

substantial interest), underwrote the June 2021 equity fundraising

to ensure the total fundraising equated to approximately US$23

million. Accordingly, 33,742,396 new Ordinary shares were admitted

on 31 January 2022 and 33,742,396 new Ordinary shares were admitted

on 3 March 2022 and the Company received proceeds totalling US$5

million. The underwriting commitment constitutes a related party

transaction.

On 10 June 2022 the Company announced the approval by

shareholders at a General Meeting of an equity fundraising for

130,930,606 new Ordinary Shares at a price of 18 pence per share.

The new Ordinary Shares were admitted on 13 June 2022 and the

Company received gross proceeds of US$29.5m.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UOOBRURUKAAR

(END) Dow Jones Newswires

September 14, 2022 02:01 ET (06:01 GMT)

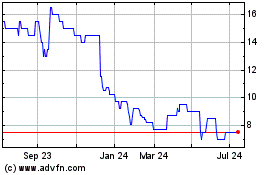

Chariot (AQSE:CHAR.GB)

Historical Stock Chart

From Jul 2024 to Aug 2024

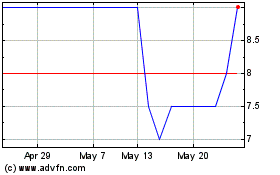

Chariot (AQSE:CHAR.GB)

Historical Stock Chart

From Aug 2023 to Aug 2024