TIDMCHAR

RNS Number : 0362T

Chariot Limited

20 July 2022

20 July 2022

Chariot Limited

("Chariot" or the "Company")

Material Increase in Gas Resources Offshore Morocco

Increase to 1.4 Tcf in total remaining recoverable resources (2C

plus 2U) at the Anchois Project

Range of targets de-risked in a basin-scale exploration

portfolio with multi TCF potential

Chariot Limited (AIM: CHAR), the African focused transitional

energy company, is pleased to announce the results of Independent

Assessments on its gas resources offshore Morocco, incorporating

the results of the recent successfully drilled Anchois-2 appraisal

and exploration well. The Independent Assessments have been made by

Netherland Sewell & Associates Inc. ('NSAI') on the Anchois Gas

Field and further selected exploration prospects in the Lixus

Offshore licence ('Lixus') and the adjacent Rissana Offshore

licence ('Rissana') with material resource upgrades reported across

the portfolio.

These resource upgrades underpin:

-- the Company's decision to fast-track its field development plans;

-- the associated exploration programmes to deliver further growth from the portfolio; and

-- Chariot's focus on developing a significant energy resource,

prioritising the growing demand within Morocco's domestic market,

and potentially supplying surplus gas to Europe.

Anchois Gas Field:

-- 82% increase in 1C contingent resources from 201 Bcf to 365 Bcf

-- 76% increase in 2C contingent resources from 361 Bcf to 637 Bcf

-- 49% increase in 2U prospective resources to 754 Bcf in three

undrilled targets with an improvement in the probability of

geological success, now ranging from 49 to 61 %

-- Total remaining recoverable resource at Anchois (2C plus 2U) now stands at 1.4 Tcf

Additional Lixus Prospects:

-- Updated assessments on two key undrilled prospects

(Maquereau, and Anchois West) with improvements in both prospective

resource potential and probability of geological success and the

newly identified Anguille prospect, which are all part of the same

tertiary gas play as the Anchois gas field

-- Combined, 2U prospective resources of 838 Bcf with an

estimated probability of geological success ranging from 30-52%,

with closely related additional targets in the areas surrounding

the prospects

-- The total remaining recoverable resources (2C plus 2U,

comprising audited and internal Chariot estimates) in the entire

Lixus portfolio stands at approximately 4.6 Tcf

Rissana Offshore:

-- Early assessment of the areas covered by 3D seismic, provides

a total 2U prospective resource of over 7 Tcf, combining a

high-graded prospect 'Emissole' within the lower risk Anchois

tertiary gas play and multi Tcf prospects in a higher-risk Mesozoic

play, inherited from Chariot's legacy Mohammedia Offshore licence

area.

Duncan Wallace, Technical Director of Chariot Limited,

commented:

"This independent assessment report confirms that following the

drilling of Anchois-2, we have a growing resource base from which

we can fast track our gas development towards material cashflows

and provide gas to meet Morocco's growing energy demand.

These resource upgrades across our Moroccan portfolio are a

significant step forward. As well as confirming the increased scale

of our discovery at Anchois, this independent assessment has also

corroborated the multi Tcf opportunity that sits within the basin

in our Moroccan licences and served to de-risk a number of high

potential future targets in Lixus.

We remain fully focused on bringing Anchois into production as

quickly as possible and are working hard across all aspects of the

development plan required to reach FID. We are committed to

realising the value of this gas field as well as continuing to

prove up the significant scope of our wider resource base from the

Moroccan portfolio."

Investor Presentation at the Annual General Meeting

Management will provide a detailed overview of this resource

upgrade at the AGM, which will be held on 8 September 2022.

Further information:

Chariot, through its wholly owned subsidiary, Chariot Oil &

Gas Holdings (Morocco) Limited, has a 75% interest and operatorship

of Lixus, in partnership with the Office National des Hydrocarbures

et des Mines ("ONHYM") which holds a 25% interest.

The Lixus licence covers an area of approximately 1,794km(2) ,

with water depths ranging from the coastline to 850m. The area has

been subject to earlier exploration with legacy 3D seismic data

covering approximately 1,425km(2) on-block and four exploration

wells, including the Anchois-1 gas discovery which was drilled in

2009. In Q1 2022, Chariot announced that it had successfully

drilled an appraisal and exploration well, Anchois-2 which

encountered approximately 150m of net gas pay and confirmed

excellent quality gas.

To fast track the development of the Anchois gas field Chariot

recently awarded the Front-End Engineering and Design Contract to a

consortium of world leading developers of offshore gas projects

with Societe Generale appointed to lead the debt financing.

In Q1 2022 Chariot also announced the signing of the Rissana

Offshore Licence, which surrounds the Lixus acreage, capturing

further prospectivity around the significant Anchois gas discovery

and higher risk higher-reward Mesozoic prospects originally

identified on its legacy Mohammedia Offshore Licence Area.

Updated independent assessment for Lixus Offshore licence based on Anchois-2 drilling results

----------------------------------------------------------------------------------------------------------------------

Field / Prospect Contingent Gas Resources* (Bcf) Probability of Geological Success (Pg)

---------------------------------------

Prospective Gas Resources (Bcf)

---------------------------------------

1C* / 1U 2C* / 2U 3C* / 3U

---------- ---------------------------------------

Anchois Field

Anchois Field Contingent* 365 637 907 N/A

---------------------------------------

(201) (361) (550) N/A

--------------------------------------- ----------- ---------- ----------- ---------------------------------------

Anchois Field Prospective 377 754 1123 49-61%**

---------------------------------------

(384)(+) (690)(+) (1013)(+) (37-64%)**

--------------------------------------- ---------------------------------------

Anchois Field - Total Remaining

Recoverable Resource 742 1391 2030

---------------------------------------

(585) (1051) (1563)

--------------------------------------- ---------- ----------- ---------------------------------------

Other Lixus Prospects

----------------------------------------------------------------------------------------------------------------------

Anchois West 68 241 499 52%

---------------------------------------

(45) (89) (134) (35%)

--------------------------------------- ----------- ---------- ----------- ---------------------------------------

Maquereau (Central) 108 428 886 30%

---------------------------------------

(73) (267) (559) (25%)

--------------------------------------- ----------- ---------- ----------- ---------------------------------------

Anguille 71 169 290 34%

--------------------------------------- ----------- ---------- ----------- ---------------------------------------

Not previously evaluated

--------------------------------------- -----------------------------------------------------------------------------

Independent assessment for Rissana Offshore licence

----------------------------------------------------------------------------------------------------------------------

Prospect Prospective Gas resources (Bcf) Probability of Geological Success (Pg)

1U 2U 3U

Emissole 75 171 332 22%

Arnoux(++) 356 1023 1944 22%

Beluga/Beluga Deep(++) 996 2250 4370 20%

Cachalot/Cachalot North(++) 1084 2405 4377 18-20%**

Dauphin(++) 586 1463 2906 18%

----------- ---------- ----------- ---------------------------------------

Total Rissana Prospective 3097 7312 13929

----------- ---------- ----------- ---------------------------------------

( ) Previous independent assessment of resources and probability of geologic success

* Contingent Gas Resource estimates

** Geologic risk assessment values composed of multiple targets with differing risks

(+) Pre-Anchois-2 assessments of prospective resources also included the C sands and M sands

reservoirs in the Anchois Deep prospect which were successfully drilled in Anchois-2. The

previous assessment estimated the total 2U prospective resource for the three targets yet

to be drilled to be 505 Bcf with a Pg of 37-46%, compared with the updated assessment of 754

Bcf and Pg of 49-61%.

(++) Prospects originally identified during Chariot's work on the Mohammedia Offshore licence

area, which are now part of the Rissana licence area and considered as gas prospective.

Resources have been reported as Wet Gas resources, with no separate accounting for contained

liquids. It should be recognized that this is a resources assessment definition and not a

phase behaviour definition (Anchois gas is regarded as a dry gas in terms of composition).

The estimates in this report have been prepared in accordance

with the definitions and guidelines set forth in the 2018 Petroleum

Resources Management System (PRMS) approved by the Society of

Petroleum Engineers.

Glossary

Contingent Those quantities of petroleum that are estimated,

Resources as of a given date, to be potentially recoverable

from known accumulations by application of development

projects, but which are not currently considered

to be commercially recoverable owing to one or more

contingencies

Prospective Those quantities of petroleum that are estimated,

Resources as of a given date, to be potentially recoverable

from undiscovered accumulations

Total Remaining The total resource estimates including both contingent

Recoverable and prospective resources (as above); resource estimates

Resources aggregated with understanding that contingent vs

prospective resources hold different technical and

commercial risks

1C Low estimate scenario of contingent resources

1U Low estimate scenario of prospective resources

2C Best estimate scenario of contingent resources

2U Best estimate scenario of prospective resources

3C High estimate scenario of contingent resources

3U High estimate scenario of prospective resources

Qualified Person Review

This release has been reviewed by Duncan Wallace, Technical

Director of Chariot, who is a petroleum geologist with over 20

years' experience in petroleum exploration, MSc in Petroleum

Geology from Imperial College, a Fellow of the Geological Society

and a member of the Petroleum Exploration Society of Great Britain.

Mr Wallace has consented to the inclusion of the technical

information in this release in the form and context in which it

appears.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014, as retained in the UK

pursuant to S3 of the European Union (Withdrawal) Act 2018.

Enquiries

Chariot Limited

Adonis Pouroulis, Acting CEO +44 (0)20 7318

Julian Maurice-Williams, CFO 0450

+44 (0)20 7397

Cenkos Securities Plc (Nomad and Joint Broker) 8900

Derrick Lee, Adam Rae (Corporate Finance)

Peel Hunt LLP (Joint Broker) +44 (0) 20 7894

Richard Crichton, David McKeown 7000

Celicourt Communications (Financial PR) +44 (0)20 8434

Mark Antelme, Jimmy Lea 2754

NOTES FOR EDITORS:

About Chariot

Chariot is an African focussed transitional energy group with

two business streams, Transitional Gas and Transitional Power.

Chariot Transitional Gas is focussed on a high value, low risk

gas development project offshore Morocco with strong ESG

credentials in a fast-growing emerging economy with a clear route

to early monetisation, delivery of free cashflow and material

exploration upside. Chariot Transitional Power, looking to

transform the energy market for mining operations in Africa,

providing a giant largely untapped market with cleaner,

sustainable, and more reliable power. Chariot is also partnering

with the Government of Mauritania on the potential development of a

10GW green hydrogen project, Project Nour.

The ordinary shares of Chariot Limited are admitted to trading

on the AIM under the symbol 'CHAR'.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRQKLFFLDLXBBB

(END) Dow Jones Newswires

July 20, 2022 02:00 ET (06:00 GMT)

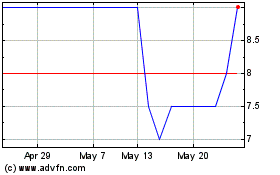

Chariot (AQSE:CHAR.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

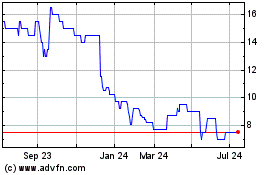

Chariot (AQSE:CHAR.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024