Bezant Resources PLC JV Agreement with Caerus Mineral Resources PLC (9942R)

November 11 2021 - 2:00AM

UK Regulatory

TIDMBZT

RNS Number : 9942R

Bezant Resources PLC

11 November 2021

11 November 2021

Bezant Resources Plc

("Bezant" or the "Company")

Joint Venture Agreement with Caerus Mineral Resources PLC

copper gold projects in Cyprus

Bezant (AIM: BZT), the copper-gold exploration and development

company, is pleased to announce that further to its announcements

dated 2 August 2021 and 26 August 2021 it has on 10 November 2021

entered into a Joint Venture Agreement (the "Agreement") with

Caerus Mineral Resources PLC (LON:CMRS) ("Caerus") in relation to

three of Caerus's copper gold projects in Cyprus.

Highlights

Three JV Properties Joint Venture ("JV") covers the Troulli, Kokkinapetra

and Anglisides projects (as detailed in Bezant's

announcement 26 August 2021), held by Caerus

in Cyprus ("JV Properties")

------------------------ -------------------------------------------------------

Drilling has The JV begins with immediate effect with the

commenced on parties joint financial contribution being from

one property the commencement of diamond drilling at Troulli

on 16 September 2021

------------------------ -------------------------------------------------------

USD 1M exploration The Parties have committed an initial sum of

budget to be USD1.0 million towards resource development and

jointly funded to take the Project to feasibility to be funded

on a 50:50 basis

------------------------ -------------------------------------------------------

Caerus to manage Caerus will manage the exploration and resource

exploration program development phase of the program

------------------------ -------------------------------------------------------

Bezant responsibilities Bezant will be responsible for;

a) project feasibility studies, and mine development;

and

b) arranging funding and guarantees required

by third party funders for plant and infrastructure

funding to commence mining

------------------------ -------------------------------------------------------

Recovery of exploration Direct exploration expenditure committed in getting

costs to feasibility will be refunded from excess cash-flow

in the ratio 70% to Caerus and 30% to Bezant

------------------------ -------------------------------------------------------

Distribution Once direct exploration expenditure has been

post exploration refunded excess cash-flow will be shared in the

cost recovery ratio 80% to Bezant and 20% to Caerus

------------------------ -------------------------------------------------------

Option Agreement The 18 month option agreement dated 30 July 2021

remains in force between Bezant and Caerus which commenced on

1 August 2021 to allow the parties to review

Caerus extensive portfolio of copper / gold projects

in Cyprus with a view to possible joint venture

mining operations remains in force (the "Option

Agreement").

------------------------ -------------------------------------------------------

Colin Bird, Executive Chairman of Bezant, commented :

"This initial joint venture is an important milestone in our

relationship with Caerus in Cyprus. I am convinced that Cyprus in

general and these projects in particular offers extraordinary

potential for the development of new copper mines in the short and

long term.

We have already commenced exploration and assessment activities

on the concessions and are putting in place an organisation to test

and optimise all of the perimeters which go into a successful

mining project.

I look forward to working with the Caerus team on this exciting

joint venture."

Summary of the Terms of the Joint Venture Agreement ("JV" or

"Agreement")

1. Parties (a) Caerus Mineral Resources Plc (registered in

England with company number 11043077) whose registered

office is at 25 Eccleston Place, London, England,

SW1W 9NF (hereinafter referred to as "Caerus");

and

(b) Bezant Resources Plc (registered in England

with company number 02918391) whose registered

office is at Quadrant House Floor 6, 4 Thomas

More Square, London, E1W 1YW (hereinafter referred

to as "Bezant")

----------------------- -------------------------------------------------------------

2. Joint Venture The parties have selected the following three

properties projects from those covered by the Option Agreement

to be the subject of this joint venture agreement:

(a) Troulli Project comprising licences AE4662

together with a licence extension that has been

submitted to the Mines Department for approval;

(b) Kokkinapetra Project comprising licence AE4644;

and

(c) Angleside Project comprising licence AE4791

The "Joint Venture Properties"

----------------------- -------------------------------------------------------------

3. Option Agreement The Option Agreement remains in full force and

effect and other properties covered by the Option

Agreement may be added to this joint venture or

form the basis of a further joint venture agreement.

4. Funding & budgets (a) The parties have agreed to fund an exploration

programme of USD1million on the Joint Venture

Properties and each party shall subscribe USD500,000

with drawdowns being of the same amount and at

the same time.

(b) Caerus will present to the technical committee

for approval a budget for the USD1million expenditure,

with proposed drawdowns to be agreed prior to

any drawdown.

(c) Bezant will be responsible for arranging the

funding of any scoping study and/or feasibility

study to access project economics.

(d) For any project where a decision to mine has

been made or is being contemplated Bezant will

prepare a budget and a development build programme

the financing of which will be sought and managed

by Bezant.

----------------------- -------------------------------------------------------------

5. Caerus Exploration (a) On a decision to mine, the exploration expenses

Costs of Caerus on the three projects the subject of

this joint venture agreement (the "Caerus Exploration

Expenditure") will be submitted to the technical

committee and upon approval will be repaid from

future operational cash flows.

(b) In calculating the Caerus Exploration Expenditure;

a. the commencement date will be 16 September

2021 the date at which the diamond drilling programme

initially commenced; and

b. Caerus will include all direct cost in Cyprus,

but not any corporate cost outside Cyprus

(c) The Caerus Exploration Expenditure will be

refunded from excess operating cash flow from

the month after commercial production is achieved

- being 75% of the plant's nameplate capacity

("Commercial Production") ("Excess Cash")

(d) Where both parties have agreed to proceed

with the mine development project then Caerus

will be entitled to receive 70% of the Excess

Cash and Bezant 30% of Excess Cash until Caerus

has been fully repaid the Caerus Exploration Expenditure.

Once the Caerus Exploration Expenditure has been

fully repaid 80% of Excess Cash shall be paid

to Bezant and 20% of Excess Cash to Caerus.

(e) If Caerus have made a decision not to proceed

in relation to a mine development project then

Caerus will be entitled to receive 30% of the

Excess Cash and Bezant 70% of Excess cash until

Caerus has been fully repaid the Caerus Exploration

Expenditure. Once the Caerus Exploration Expenditure

has been fully repaid 90% of Excess Cash shall

be paid to Bezant and 10% of Excess Cash to Caerus.

----------------------- -------------------------------------------------------------

6. Technical Committee (a) A technical committee will be formed, consisting

of two members from Caerus and two members from

Bezant.

(b) During the exploration phase the Chairman

will be a Caerus nominee, who shall not have the

casting vote.

(c) On a decision to mine by the technical committee,

then the Chair of the technical committee shall

change to a Bezant nominee and Bezant will have

management of the project from that stage.

----------------------- -------------------------------------------------------------

7. Exploration (a) The exploration programme shall be designed

Program to pursue the spirit and intent of the Option

Agreement, which is to identify a minimum of 40,000

tonnes of contained copper for development to

produce a minimum of 5,000 tonnes per annum, for

a minimum period of 8 years.

(b) Caerus are to be responsible for managing

the exploration program approved by the Technical

Committee.

8. Feasibility Bezant will based on exploration results present

study to the technical committee a feasibility study,

which defines the key financial and operating

parameters of any proposed mining operation.

----------------------- -------------------------------------------------------------

9. Environmental Both the parties will jointly be responsible for

issues environmental and social responsibilities attached

to any future mining project, with Caerus in particular

being responsible for all governmental and municipal

relationships in Cyprus.

----------------------- -------------------------------------------------------------

10. Mining phase Once a decision to mine has been made the mining

will be conducted under the appropriate mining

and industrial laws of Cyprus, Bezant will be

appointed the operator, and Caerus will retain

legal ownership rights of the Projects on behalf

of the Joint Venture so the Joint Venture can

conduct mining operations.

----------------------- -------------------------------------------------------------

11. Security for (a) Caerus agree to provide the necessary property

External funding security guarantees and security and Bezant agrees

to provide the plant and associated infrastructure

security guarantees, required by any third-party

lender.

(b) Before entering into any third-party finance

agreements, Bezant and Caerus will agree the terms

and any security to be provided.

12. Caerus agreement In the event that any plant to be constructed

with Jubilee falls within the Option Agreement between Caerus

and Jubilee Metals Group Plc (the "Existing Jubilee

Option Agreement") , then both Caerus and Bezant

will subordinate there interests under this joint

venture agreement to the 15% free participation

under the Existing Jubilee Option Agreement. Both

parties acknowledge that under the Existing Jubilee

Agreement Jubilee has the first right of funding

and the joint venture will recognise this right

and Jubilee will have 30 days to match any offer

of funding from a third party.

----------------------- -------------------------------------------------------------

13. Sale to third (a) In the event that exploration drilling and

party a feasibility study identifies a project, which

could be of interest to. third party to develop

then the parties agree that any benefits derived

from sale shall be split on an equal basis with

each party recovering its sunk cost incurred from

16 September 2021 before equally dividing the

balance between the two parties.

(b) Each party agrees to come along, tag along

with the other on receipt of a third party offer,

which is deemed satisfactory to the technical

committee and to work together to enter into a

purchase and sale agreement within 15 days of

approval by the technical committee.

14. No commitment Bezant makes no representation or commitment to

to mine develop a mine and will only progress to the development

of a mine if in their opinion the in-situ or primary

material fulfil their requirements for investment.

----------------------- -------------------------------------------------------------

15. English law The agreement is subject to English Law

----------------------- -------------------------------------------------------------

For further information, please contact:

Bezant Resources Plc

Colin Bird Executive Chairman +44 (0) 20 3416 3695

Beaumont Cornish (Nominated Adviser)

Roland Cornish +44 (0) 20 7628 3396

Novum Securities Limited (Broker)

Jon Belliss +44 (0) 20 7399 9400

or visit http://www.bezantresources.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

JVEKZMMMKGGGMZM

(END) Dow Jones Newswires

November 11, 2021 02:00 ET (07:00 GMT)

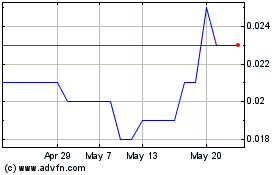

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

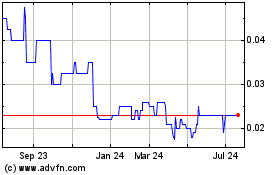

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024