Bezant Resources PLC Mankayan Project Update (4666L)

September 13 2021 - 2:00AM

UK Regulatory

TIDMBZT

RNS Number : 4666L

Bezant Resources PLC

13 September 2021

13 September 2021

Bezant Resources Plc

("Bezant" or the "Company")

Mankayan Project Update

Bezant (AIM: BZT), the copper-gold exploration and development

company, further to its announcements on 28 April 2021 regarding

the termination of its transaction with Mining and Minerals

Industries Holding Pte Ltd. ("MMIH") in relation to the Mankayan

project ("MMIH Transaction Agreement") , has entered into a

conditional agreement with IDM Mankayan Pty Ltd ("IDM"), a company

incorporated in Australia, to take the Mankayan Project in the

Philippines forward (the "IDM Agreement").

Highlights:

IDM to acquire IDM will acquire 100% ownership of Asean Copper

Asean Copper Investments Ltd ("Asean Copper") which holds

Investments its interest in the Mankayan project through

the Asean Copper Ownership Structure defined

below and which was the subject of the previous

MMIH Transaction Agreement.

---------------------- --------------------------------------------------------

Bezant ownership Bezant will own 27.5% of IDM with the remaining

72.5% owned by es tablished investors in the

mining sector (the "Other IDM Shareholders").

---------------------- --------------------------------------------------------

Initial funding Bezant will provide A$90,000 (approximately

GBP48K) of initial funding and the Other IDM

Shareholders will provide A$210,000 (approximately

GBP 112K) ("Initial Funding").

---------------------- --------------------------------------------------------

Initial objective IDM's initial objective is to assist and support

Crescent Mining Development Corporation ("CMDC")

in its application to renew t he Mineral Production

Sharing Agreement No. 057-96-CAR (the " MPSA

") in respect of the Mankayan Project which

is due for renewal on 11 November 2021. CMDC

submitted its renewal application on 16 March

2021 to the Mines and Geosciences Bureau of

the Department of Environment and Natural Resources

of the Philippines government.

---------------------- --------------------------------------------------------

Bezant a nti-dilution Upon the renewal of the MPSA and the payment

protection of the Conditional Renewal Proceed Payment

defined below of up to A$500,000 due by IDM

to MMIH is to be funded by the Other IDM Shareholders.

Accordingly Bezant's shareholding in IDM will

be increased to 27.5% of the then issued share

capital of IDM after the payment of the Conditional

Renewal Proceed Payment.

---------------------- --------------------------------------------------------

Colin Bird, Executive Chairman of Bezant, commented:

"Bezant are pleased to be working with IDM whose financial and

technical team have strong South East Asia experience. The Mankayan

project is well placed to benefit from recent projections for the

electrical vehicle and copper markets at a time when the Philippine

government have announced that they wish to revitalise mining in

the Philippines. We share IDM's view that the Mankayan project will

be well received by the ASX market and that the proposed listing on

the ASX will enhance value for IDM shareholders "

Background information

Asean Copper holds a 40 per cent. shareholding in Crescent

Mining and Development Corporation (" CMDC "), which is

incorporated in the Philippines and is the sole holder of Mineral

Production Sharing Agreement No. 057-96-CAR (the " MPSA ") in

respect of the Mankayan Project. Asean Copper also holds a 40 per

cent. shareholding in Bezant Holdings Inc., which is incorporated

in the Philippines and holds the balancing 60 per cent. interest in

CMDC, and has a conditional option (scheduled to expire on 30 June

2022) to acquire the balancing 60 per cent. of Bezant Holdings Inc.

(together, the " Asean Copper Ownership Structure ").

The MPSA was originally issued for a standard 25 year period,

which expires on 11 November 2021, and the current exploration

period under the MPSA, which is subject to certain work programme

commitments, is scheduled to expire on 11 November 2021.

Under their separate agreements with IDM, the Company and MMIH

have agreed to the acquisition of Asean Copper by IDM and as noted

below the Conditional Renewal Proceed Payment due to MMIH upon MPSA

renewal is to be funded by the Other IDM Shareholders not by

Bezant.

The Company has previously reported a JORC 2004 resource using a

0.4% Cu cut off of 1.3 Mt of contained copper and 4.3 M oz of gold

for the Mankayan Project and it is the intention of IDM to update

this to a JORC 2012 compliant resource.

Further details of the IDM Agreement entered into on 10

September 2021

P arties B ezant Resources PLC and IDM Mankayan Pty

Ltd

----------------------- ------------------------------------------------------------

Acquisition of Bezant will assign its 20% shareholding in

interest in Asean Asean Copper to IDM. IDM will acquire the

Copper 80% shareholding in Asean Copper owned by

MMJV Pte. Ltd. ("MMJV"), a wholly-owned subsidiary

of MMIH by paying the Conditional Renewal

Proceed Payment defined below under the terms

of a share sa le agreement entered into between

IDM and MMIH on 6 September 2021 (the " IDM

- MMIH Agreement ")

----------------------- ------------------------------------------------------------

Initial IDM Funding Is the amount of A$300,000 ( approximately

GBP160K) of which A$90,000 (approximately

GBP48K) is to be provided by Bezant of with

the Other IDM Shareholders to provide A$210,000

(approximately GBP 112K) (the "IDM Funding

Commitment")

----------------------- ------------------------------------------------------------

Conditions Precedent The IDM Agreement is conditional upon the

following conditions being met, not applicable

or waived within 21 days of the date of the

IDM Agreement;

1. IDM completing due diligence enquiries

in relation to the Mankayan Project and related

companies to its satisfaction;

2. the IDM Funding Commitment having been

paid;

3. Bezant obtaining all, if any, applicable

regulatory approvals under the AIM Rules;

and

4. Completion occurring under the IDM-MMIH

Agreement.

----------------------- ------------------------------------------------------------

Conditional Renewal Conditional upon renewal of the MPSA an amount

Proceed Payment of up to A$500,000 (approx. GBP267K) will

be due to be paid to MMIH in two equal instalments

7 days and 3 months after the renewal of

the MPSA which is to be funded by the Other

IDM Shareholders rather than Bezant (the

"Renewal Proceed Payment"). Under the terms

of the IDM-MMIH Agreement the Renewal Proceed

Payment will be reduced by:

1. the Renewal Expenditure Excess being the

amount in excess of $200,000 incurred to

renew the MPSA;

2. the Creditors Payment Excess being payments

to c ertain creditors in excess of $100,000;

and

3. outstanding fees due to a consultant.

----------------------- ------------------------------------------------------------

Bezant anti-dilution Upon the renewal of the MPSA and the payment

of the Renewal Proceed Payment MMIH Bezant's

shareholding in IDM will be increased to

27.5% of the then issued share capital of

IDM.

----------------------- ------------------------------------------------------------

P roposed Transaction It is intended that IDM will be acquired

by IDM International Limited (ACN 108029198)

which used to be listed on the Australian

Stock Exchange ("ASX") and which has a current

cash balance of approximately A$200,000 and

no other assets with a. view to IDM International

Limited applying to relist on the ASX with

its interest in the Mankayan Project as its

only asset.

----------------------- ------------------------------------------------------------

Deferred Consideration Under the IDM-MMIH agreement MMJV shall be

issued IDM Shares, calculated using the volume

weighted average market price in Australian

dollars for each IDM Share or, if the IDM

Shares are not listed at the time, by a valuation

by an independent valuer agreed by IDM and

MMJV, as follows:

Tranche 1 - _AUD2,000,000 on completion of

a pre-feasibility study by IDM in relation

to the Mankayan Project showing a net present

value of the Mankayan Project 100% greater

than capital expenditure; and

Tranche 2 - AUD2,000,000 on completion of

the earlier of a trade sale or a decision

to mine in respect of the Mankayan Project.

----------------------- ------------------------------------------------------------

Further information on IDM Mankayan

IDM Mankayan Pty Ltd was incorporated in Australia on 6 August

2021 (ACN 652 618 758) as a special purpose vehicle to enter into

the IDM Agreement and the IDM-MMIH Agreement . For the period from

incorporation to 31 August 2021 IDM Mankayan Pty Ltd made an

unaudited loss of A$ NIL and as at that date had net liabilities of

A$ Nil.

For further information, please contact:

Bezant Resources Plc

Colin Bird

Executive Chairman +44 (0)20 7581 4477

Beaumont Cornish (Nominated Adviser)

Roland Cornish +44 (0) 20 7628 3396

Novum Securities Limited (Broker)

Jon Belliss +44 (0) 20 7399 9400

or visit http://www.bezantresources.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGRFLFEEADIILIL

(END) Dow Jones Newswires

September 13, 2021 02:00 ET (06:00 GMT)

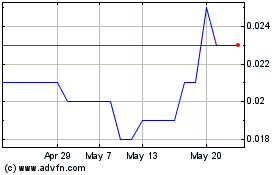

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

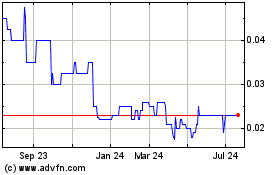

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024