TIDMBOIL

RNS Number : 2101P

Baron Oil PLC

24 May 2018

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

24 May 2018

Baron Oil Plc

("Baron Oil" or "the Company")

Final Results for the Year Ended 31 December 2017

Baron Oil (AIM: BOIL), the oil and gas company with a strategy

of exploring near-term drilling opportunities in established

producing areas, is pleased to announce its audited financial

results for the year ended 31 December 2017.

Key Points:

-- Net loss before taxation of GBP2,058,000 (2016: loss of

GBP175,000) with an attributable after-tax loss to equity

shareholders of GBP1,539,000 (2016: loss of GBP32,000)

-- End of year free cash balance of GBP3,873,000 (US$5,225,000);

(2016: GBP2,158,000 (US$2,662,000))

-- Increase in cash reserves arises from release of guarantee in

Peru of GBP2,674,000 offset by an operational cash outflow of

GBP959,000

-- Administration costs reduced 27% to GBP510,000 (2016:

GBP700,000) excluding exchange rate movement which gave rise to an

exchange loss of GBP508,000 (2016: gain of GBP1,131,000)

-- Relinquishment of Peru block Z-34 and recovery of the US$3.6

million guarantee during the year enabled the Company to execute a

change in strategic direction

-- Post year-end farmin to Colter and Wick prospects in UK

Offshore will see a well drilled on each in 2018

-- Farmout efforts continue for the El Barco prospect in Peru block XXI

-- Host Government delays continue to hamper progress on the SE Asia initiative

-- Bill Colvin resigned as Chairman in February 2018 and Andy

Yeo was appointed as a non-executive director in May 2018.

Commenting on the results, Malcolm Butler, Chairman & CEO,

said:

"During 2017 we were finally able to extract the Company from

the problems created by our partnership with Union Oil & Gas

Group in Peru. The fact that we were able to relinquish block Z-34

and reclaim the entire amount of the US$3.6 million guarantee bond

made for a very satisfactory end to the year. That put us in a

position to execute a change in direction of the Company and take

interests in the Colter and Wick prospects in the UK Offshore, both

close to existing oilfields and capable of rapid development if

successful. A well is planned on each of these prospects in 2018

and success on either would provide shareholders with a meaningful

uplift in the asset value of the Company. In the meantime, we

continue to seek a partner for Peru block XXI and hope we will be

able to drill the El Barco prospect in due course.

"The composition of the board changed after yearend. We were

very sorry to accept the resignation of Bill Colvin as Chairman but

pleased that Andy Yeo has now joined as an independent

non-executive director.

"The Company remains fully funded for its current planned

activities in 2018 and we look forward to the commencement of an

exciting drilling programme in the UK later in the year."

For further information, please contact:

+44 (0)1892

Baron Oil Plc 838 948

Malcolm Butler, Chairman & Chief Executive

Officer

+44 (0)20 3470

SP Angel Corporate Finance LLP 0470

Nominated Adviser and Broker

Lindsay Mair, Richard Hail, Richard

Redmayne

CHAIRMAN'S STATEMENT & OPERATIONS REPORT

FINANCE AND FINANCIAL RESULTS

The net result for the year was a loss before taxation of

GBP2,058,000, which compares to a loss of GBP175,000 for the

preceding financial year, and the loss after taxation attributable

to Baron Oil shareholders was GBP1,539,000, compared to a loss of

GBP32,000 in the preceding year.

Turnover for the year was GBPnil (2016: GBPnil), there being no

sales activity since the cessation of production in July 2015 from

the Nancy-Burdine-Maxine fields ("NBM") in Colombia and the expiry

of the licence in October 2015.

During 2017, the local staff of Inversiones Petroleras de

Colombia SAS ("Invepetrol") finalised all the steps necessary to

administer the relinquishment of the licence, the clearance of

equipment from the well site and to obtain all necessary

environmental approvals. The remaining staff left the company

before the end of the year. The Group has held a 50% interest in

Invepetrol since 2014 but consolidated the results as it held

effective management control. However, during 2017 our 50% partner,

CI International Fuels, took control of the Board and, as a result,

Invepetrol has been deconsolidated. Furthermore, steps have been

taken to place Invepetrol into liquidation. The effect of

deconsolidation is to release net liabilities previously included

in the Statement of Financial Position and to give rise to a credit

to the Income Statement of GBP831,000. While the directors believe

that the Company will not have any further liabilities from

Colombia, we retain sufficient provision in the Statement of

Financial Position against any unforeseen eventualities.

Exploration and evaluation expenditure written off included in

the Income Statement amounts to GBP109,000. This arises from

GBP90,000 in costs regarding the South East Asia Joint Study

Agreement with SundaGas, mainly relating to the period up to 31

March 2017, and residual costs of GBP19,000 on block Z-34 in Peru

(see below).

In Peru, the decision to relinquish block Z34 leads to a write

off in the Income Statement of GBP1,837,000. This reflects

primarily the write off of the US$2 million receivable from Union

Oil & Gas Group following their failure to meet their

obligation under the farm-out agreement, plus some additional

expenditure incurred locally in Peru. This should be considered in

the context of US$3.6 million being released from cash cover to

support the Z-34 guarantee to Perupetro, this amount being added to

the free cash resources of the Group as shown in the cash flow

statement.

A further effect of the write off of the Union Oil and Gas Group

receivable is a write back of the related provision for Peruvian

tax amounting to GBP519,000, this amount being credited to the

Income Statement.

Also in Peru, the Group incurred expenditure totaling GBP84,000

on our 100%-owned onshore block XXI, arising from both direct costs

and local staff and support costs. In accordance with our

accounting policy, the Group has been charging unsuccessful

exploration costs direct to the Income Statement; however, the

results of the 2015/16 2D seismic on block XXI were encouraging and

may lead to the drilling of an exploration well during 2018.

Accordingly, the Board are of the view that this phase of

exploration is ongoing and that the expenditure should remain on

the Balance Sheet as capitalised exploration and evaluation

expenditure until the results of any such well are known, the

carrying amount being GBP1,260,000.

Administration expenditure for the year was GBP510,000, down

from GBP700,000 in the preceding year, excluding the effects of

exchange rate movements. This cost saving arises from the cessation

in activities in Colombia at GBP122,000, reduced cost in Peru of

GBP49,000, with the remainder due to cost reductions in the UK.

During the year, we saw a relative weakening in the US Dollar

and, with the majority of the group's assets being denominated in

that currency, this has given rise to a loss of GBP508,000. This

compares with a gain of GBP1,131,000 in the preceding year, when

there was a major impact on the Pound Sterling following the Brexit

referendum result.

At the end of the financial year, free cash reserves of the

Group had increased to GBP3,873,000 from a level at the preceding

year end of GBP2,158,000. This increase in cash reserves arises

from the release of cash cover funds held against the guarantee in

respect of Peru block Z-34 at GBP2,674,000 (US$3,600,000), offset

by an operational cash outflow of GBP959,000.

The Group continues to pursue a conservative view of its asset

impairment policy, giving it a Balance Sheet that consists largely

of net current assets and a realistic value for its remaining

exploration assets. Given the limited cash resources, the Board

will take a prudent approach in entering into new capital

expenditures beyond those already committed to existing

ventures.

NEW EXPLORATION ACTIVITY

Following the recovery of $3.6 million from the relinquishment

of Peru block Z-34, of which details are given below, Baron has

followed a new strategy concentrating on near-term drilling

opportunities in the United Kingdom, as follows:

UNITED KINGDOM OFFSHORE LICENCE P2235 ("WICK" PROSPECT) (BARON

15%)

Baron announced on 19 February 2018 that it had signed an option

to farm in to UK Offshore Licence P2235 (Block 11/24b) containing

the Wick Prospect. This option was exercised on 13 March 2018, when

Baron signed a definitive Farmout Agreement with Corallian Energy

Limited, ("Corallian") under which the Company will pay 20% of the

costs of the Wick well, up to a maximum gross cost of GBP4.2

million, and 15% of other costs on the licence to earn a 15%

working interest in P2235. The Wick Prospect lies close to the

shore of NE Scotland, 5 kilometres north and updip from the Lybster

Field, which has been developed from onshore facilities. The

prospect has been defined by 3D seismic mapping by Baron and others

and a recent announcement by Upland Resources Limited stated it has

estimated in-place P50 Prospective Resources of around 250 million

barrels of oil (unrisked) in sands of Jurassic and Triassic age in

the licence area, a large part of which will be tested by the Wick

well. The Wick well will be drilled to a total depth of 1,250

metres subsea in a water depth of 38 metres. Baron announced on 15

May 2018 that Corallian had entered into a letter of intent with

Ensco UK Limited to provide a jack-up drilling rig to drill this

prospect in the third or fourth quarter of 2018, subject to

necessary

approvals and consents. The total well cost has increased, due

largely to more rigorous site survey requirements and substantially

higher fuel costs, and is currently estimated at GBP5.2 million.

Including a 15% share of back costs unrelated to the well, the

total payable by the Company is currently estimated at some

GBP1,020,000 to earn a 15% interest in the licence(1) .

UNITED KINGDOM OFFSHORE LICENCE P1918 ("COLTER" PROSPECT) AND

ONSHORE PEDLs 330 & 345 (BARON 5%)

Baron entered into a Farmout Agreement with Corallian on 5 March

2018 under which it will earn a 5% working interest in UK Offshore

Licence P1918, which contains the Colter Prospect, on which a well

is planned to be drilled this year. By participating in this well,

Baron will also earn a 5% interest in nearby onshore licences PEDL

330 and PEDL 345.

The Colter Prospect lies in Poole Bay, immediately southeast of

the Wytch Farm oilfield which has been developed from onshore

facilities. Recent re-mapping of pre-stack depth migrated 3D

seismic data by Corallian indicates that the 98/11-3 well, which

encountered oil in the Triassic Sherwood sandstone reservoir, lies

on the flank of a structure that has the potential to hold unrisked

Mean Prospective Resources of 23 million barrels of recoverable oil

equivalent. The Colter Prospect will be appraised by a well drilled

to a total depth of 1,850 metres subsea in a water depth of 16

metres. Baron announced on 15 May 2018 that Corallian had entered

into a letter of intent with Ensco UK Limited to provide a jack-up

drilling rig to drill this prospect in the third or fourth quarter

of 2018, subject to necessary approvals and consents. The total

well cost has increased, due largely to more rigorous site survey

requirements and substantially higher fuel costs, and is currently

estimated at GBP7.2 million. Under the terms of the agreement with

Corallian, subject to governmental consents, the Company would pay

6.67% of the costs related to this well, capped at a gross cost of

GBP8.0 million: costs above this cap would be funded at 5%.

Including a 5% share of back costs unrelated to the well, the total

payable by the Company is currently estimated at some GBP490,000 to

earn a 5% interest in the licence(1) .

legacy Exploration activity

PERU OFFSHORE Block Z-34 (Baron Oil 50% interest RELINQUISHED IN

DECEMBER 2017)

In November 2017, the Company elected to relinquish the contract

for block Z-34, in which it held a 50% interest through its

Peruvian subsidiary, Gold Oil Peru SAC ("GOP"). Earlier in the

year, Union Oil & Gas Group (UOGG) defaulted on its obligation

to pay GOP US$2 million when a 30% interest in Z-34 was formally

assigned to it by the Peruvian Government under a Public Deed.

Following protracted discussions, it was agreed to terminate and

unwind the 2013 Farmout Agreement with UOGG and the 30% interest

under the Joint Operating Agreement ("JOA") was returned to GOP on

10 September 2017. UOGG retained ownership of Plectrum Petroleum

Limited, which continued to hold a 50% interest in Z-34. However,

neither UOGG nor Plectrum paid cash calls due to GOP as operator

under the terms of the JOA. On 1 September 2017 both UOGG and

Plectrum were formally placed into default for non-payment of the

August cash call and, following termination of the Farmout

Agreement, Plectrum compounded its default position by not paying

cash calls for September and November.

Taking into account the partner default, the failure of an

extended effort by UOGG to farm out its interests in Z-34 and the

fact that the contract had been in Force Majeure since 2014 because

of the lack of legislation and regulations necessary to allow

drilling operations in this deep-water environment, GOP proposed

that the block be relinquished. An Operating Committee Meeting was

held in accordance with the JOA at the beginning of November 2017,

at which Plectrum could not exercise its vote because of its

default, and the unanimous decision was made to relinquish block

Z-34.

Notice of relinquishment was given to Perupetro on 9 November

2017 and the relinquishment became effective on 9 December. At this

point, GOP notified Perupetro that the terms of the Z-34 contract

allowed it to claim the release of the $3.6 million bond held as

guarantee for the work programme if the contract had been in Force

Majeure for a period exceeding one year. This was accepted by

Perupetro on 14 December 2017 and the funds were released on 19

December. Following delays over the Christmas period, the funds

were finally cleared in the Company's UK bank account on 5 January

2018.

PERU ONSHORE Block XXI (Baron Oil 100%)

The Company owns a 100% interest in the contract for block XXI

through GOP. The block lies onshore in the Sechura Desert, close to

the town of Piura, and covers a current area of 2,425 square

kilometres.

The El Barco prospect has been identified in the area to the

northeast of the 1954 Minchales-1X well and a drilling prognosis

has been prepared for a well to 1,850 metres. Mapping of the El

Barco prospect by GOP indicates that unrisked Prospective Resources

are in the range of 6.4 billion cubic feet of recoverable gas in a

low-risk shallow sand and 7.1 million barrels of recoverable oil in

a much higher risk fractured basement play. Initial estimates are

that the actual drilling of this well will cost some US$1.4 million

but additional costs of some US$500,000 are expected to be incurred

for the necessary civil engineering and environmental work involved

in building a suitable track from the Pan-American Highway across

the desert and scrub to the proposed wellsite, a distance of some

15 kms.

Farmout negotiations with interested parties continue since, as

previously stated, the directors wish to find a partner to pay at

least 50% of the costs of the El Barco well. Discussions are also

underway with qualified drilling contractors. The block XXI

contract is currently in Force Majeure, because of local opposition

to the drilling at El Barco, which adds a further potential expense

to the drilling operation. If the well is not drilled within 6

months of expiry of the current Force Majeure situation, the

contract will terminate and the Company will forfeit its guarantee

bond of US$160,000.

NORTHERN IRELAND ONSHORE LICENCE PL 1/10 licence (Baron Oil

12.5%)

No significant activity took place on this licence in 2017 and

in February 2018 Baron gave notice that it would withdraw from the

licence. This became effective in April 2018 and the Company has no

further obligations.

OPERATIONS IN COLOMBIA

During the year, the remaining staff in Colombia completed the

administration of the cessation of the NBM licence, which took

effect in October 2015. By the end of the year, all staff had left

the local operation. NBM was operated by Invepetrol in which we are

50% shareholders and in which control effectively passed to our

partner, CI International Fuels, in 2017. Proceedings to liquidate

this company are expected to commence shortly.

SE ASIA STUDY GROUP

Baron entered into a joint study agreement in September 2016

with SundaGas Pte Ltd, based in Singapore. The purpose was to give

the Company accelerated access to a range of exploration and

production activities in prospective areas of South East Asia

without the need to increase its own staff and overhead. The

agreement ran for a six-month period to 31 March 2017, during which

time the group considered a broad range of possibilities and

entered into preliminary negotiations on several potential

projects, one of which is still active. The directors had hoped

that this project would come to fruition during 2017 but a decision

by the host government continues to be delayed and it seems

unlikely that an award, if any, will be made before the fourth

quarter of 2018.

Conclusions

Although the directors were forced to spend a great deal of time

during the year in difficult negotiations with our recalcitrant

partners in Peru block Z-34, the final outcome at year-end was a

satisfactory one. It had become clear that it would be impossible

to drill the block in the timeframe of the contract for

administrative, technical and financial reasons and the block was

relinquished in a way that enabled the Company to recover the

entire guarantee bond. The additional US$3.6 million of free cash

has enabled the Company to be re-positioned and, after due

consideration, the board has decided that near-term drilling

activities in areas where discoveries can easily and profitably be

developed represent the best way forward. Each of the Wick and

Colter prospects offers an excellent opportunity to drill a

relatively low-risk well this year with significant potential and

provides the possibility of early, low cost development. Success in

either of these wells would provide shareholders with a meaningful

uplift in the asset value of the Company.

The Company remains debt-free and is fully funded for its

currently planned activities in 2018.

I would like to pay a personal tribute to Bill Colvin, who

resigned as Chairman in February 2018. Bill took over the reins

under very difficult circumstances in January 2015 and guided the

Company through the difficult period when our partners in block

Z-34 prevented us from moving forward with activities on the block,

refused to honour their obligations under the Farmout Agreement and

defaulted on their payment obligations under the JOA. It was good

that he was able to savour the success of regaining the guarantee

bond and participate in the re-positioning of the Company. We wish

him every success in his other ventures.

I would also like to welcome Andrew Yeo as an independent

non-executive director. His experience in the City and in the oil

industry will be of great value to the board and he has been

appointed to chair the audit and remuneration committees.

Malcolm Butler

Chairman and Chief Executive

23 May 2018

_________________________________

(1) Under pre-existing agreements between Corallian and

InfraStrata plc, Baron is obligated to pay to InfraStrata plc on a

monthly basis an

amount equivalent to 1% of the pre-tax net profits generated to

Baron from the sales of oil and gas from licences P1918 and P2235,

taking into account, in each case, cumulative costs and expenses of

exploration, appraisal, development and production.

CONSOLIDATED INCOME STATEMENT FOR THE YEARED

31 DECEMBER 2017

Notes 2017 2016

GBP'000 GBP'000

Revenue - -

Cost of sales - -

Gross profit - -

Exploration and evaluation

expenditure (109) (739)

Intangible assets

written off (1,837) -

Intangible asset

impairment 11 - (370)

Property, plant and equipment

impairment and depreciation 10 - 95

Goodwill impairment 12 - (81)

Receivables and inventory

impairment 3 43 73

Disposal of Colombian

subsidiary 831 -

Disposal of Colombia branch

operations - 31

Administration expenses (510) (700)

(Loss)/profit on

exchange (508) 1,131

Other operating

Income 4 21 319

Operating loss 3 (2,069) (241)

Finance cost 6 (8) (35)

Finance income 6 19 101

Loss on ordinary

activities

before taxation (2,058) (175)

Income tax credit/(expense) 7 519 (113)

Loss on ordinary

activities

after taxation (1,539) (288)

Dividends - -

Loss for the year (1,539) (288)

------------------------------------ ------ ----------------------------- ------------------------------------

Loss on ordinary

activities

after taxation is attributable

to:

Equity shareholders (1,539) (32)

Non-controlling

interests 0 (256)

(1,539) (288)

---------------------------------- ------ ----------------------------- ------------------------------------

Earnings per ordinary

share - continuing 9

Basic (0.112p) (0.002p)

Diluted (0.112p) (0.002p)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AT 31 DECEMBER 2017

Notes 2017 2016

GBP'000 GBP'000

Assets

Non current assets

Property plant and equipment

--- oil and gas

assets 10 - 3

--- others 10 - -

Intangibles 11 1,260 1,325

Goodwill 12 - -

1,260 1,328

----------------------------------- --------- --------------------------- -----------------------------

Current assets

Trade and other

receivables 14 18 2,070

Cash and cash equivalents 15 3,992 5,231

4,010 7,301

----------------------------------- --------- --------------------------- -----------------------------

Total assets 5,270 8,629

------------------------------------- --------- --------------------------- -----------------------------

Equity and liabilities

Capital and reserves attributable

to owners of the parent

Share capital 17 344 344

Share premium account 18 30,237 30,237

Share option reserve 18 122 81

Foreign exchange

translation reserve 18 1,723 1,688

Retained earnings 18 (28,163) (26,624)

Capital and reserves attributable

to non-controlling interests 19 - 347

Total equity 4,263 6,073

------------------------------------- --------- --------------------------- -----------------------------

Current liabilities

Trade and other

payables 16 195 1,054

Taxes payable 16 812 1,502

1,007 2,556

----------------------------------- --------- --------------------------- -----------------------------

Total equity and

liabilities 5,270 8,629

------------------------------------- --------- --------------------------- -----------------------------

The financial statements were approved and authorised

for issue by the Board of Directors on 23 May

2018 and were signed on its behalf by:

Geoffrey

Malcolm Butler Barnes

Director Director

Company number:

5098776

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE

YEARED 31 DECEMBER 2017

Group Company Group Company

2017 2017 2016 2016

------------------- ----------------------------- ----------------------------- --------------------------- ------------------------------------

GBP'000 GBP'000 GBP'000 GBP'000

Operating

activities (680) (508) (2,326) 284

Investing

activities

Return from

investment

and servicing of

finance 19 19 101 90

Sale of Intangible

assets - - 1,784 -

Cash previously not

available

now released 2,674 2,674

Disposal of

tangible assets 82 82

Loan to subsidiary

(advanced)/repaid - (283) - (246)

Acquisition of

intangible

assets (298) (119) (492) (74)

Acquisition of

tangible

fixed assets - - (1) -

2,395 2,291 1,474 (148)

Financing

activities

Proceeds from issue

of

share capital - - - -

Net cash inflow 1,715 1,783 (852) 136

Cash and cash

equivalents

at the beginning

of the year 2,158 2,080 3,010 1,944

Cash and cash

equivalents

at the end

of the year 3,873 3,863 2,158 2,080

-------------------- ----------------------------- ----------------------------- --------------------------- ------------------------------------

Reconciliation to

Consolidated

Statement of

Financial

Position

Cash not available

for use 119 - 3,073 2,943

Cash and cash

equivalents

as shown in the

Consolidated

Statement of

Financial

Position 3,992 3,863 5,231 5,023

-------------------- ----------------------------- ----------------------------- --------------------------- ------------------------------------

CONSOLIDATED AND COMPANY STATEMENT

OF CASH FLOWS FOR THE

YEAR ENDED 31

DECEMBER

2017

Group Company Group Company

2017 2017 2016 2016

--------------------- --------------------------- ----------------------------- ----------------------------- ------------------------------------

GBP'000 GBP'000 GBP'000 GBP'000

Operating activities

Loss for the

year attributable

to controlling

interests (1,539) (1,342) (32) 47

Depreciation,

amortisation

and impairment

charges 2 - 331 61

Loss on disposal of

assets - 120 - -

Share based payments 41 41 - -

Non-cash movement

arising

on consolidation of

non-controlling

interests (347) - (257) -

Impairment of

investment - 74 - 246

Finance income

shown as an

investing

activity (19) (19) (101) (90)

Tax (benefit)/expense (519) - 113 -

Foreign exchange

translation 512 478 (1,319) (430)

Operating cash

outflows before

movements in

working capital (1,869) (648) (1,265) (166)

---------------------- --------------------------- ----------------------------- ----------------------------- ------------------------------------

(Increase)/decrease

in

receivables 2,052 148 (440) 1,178

Tax paid (4) (4) 71 (2)

Increase/(Decrease)

in

payables (859) (4) (692) (726)

Net cash (outflows)/

inflows from

operating

activities (680) (508) (2,326) 284

---------------------- --------------------------- ----------------------------- ----------------------------- ------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR FKQDDDBKDKPB

(END) Dow Jones Newswires

May 24, 2018 07:13 ET (11:13 GMT)

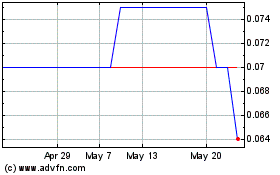

Baron Oil (AQSE:BOIL.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Baron Oil (AQSE:BOIL.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024