TIDMBMN

RNS Number : 9564R

Bushveld Minerals Limited

01 November 2019

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

1 November 2019

Bushveld Minerals Limited

("Bushveld Minerals" or the "Company")

Support for redT - Avalon Merger and Potential Strategic

Interest in Resulting Entity

Bushveld Minerals Limited (AIM: BMN), the AIM quoted, integrated

primary vanadium producer, with ownership of high grade vanadium

assets in South Africa ("Bushveld"), is pleased to announce that it

has agreed to support the merger of Avalon Battery Corporation

("Avalon") and redT energy plc ("'redT") (the "Merger") with

interim funding of US$5 million which will give Bushveld the

opportunity to acquire a strategic interest in the merged energy

storage company.

In July 2019, AIM-quoted energy storage provider redT and

Avalon, a North American-based vanadium redox flow battery ("VRFB")

manufacturer, announced their plans to merge. The resulting

business will be a leading player in the growing energy storage

market. Traded on AIM in London, the merged entity will have a

global sales footprint, a robust near-term project pipeline,

operations in North America, Europe and Asia, market-leading

technology, and a strong management team.

The Merger remains subject inter alia to further due diligence

by each party, definitive legal agreements being reached, and a

total of at least US$30 million of new funds being raised by redT

and Avalon to support the merged business (the "Fundraising"). The

Fundraising and the Merger will be subject to the redT's and

Avalon's shareholders' approval respectively.

Bushveld has agreed to provide a convertible loan of up to US$5

million to Avalon (the "Interim Funding"), half of which will be

loaned by Avalon to redT, to support the companies through the due

diligence process, finalisation of the Merger negotiation and

completion of the Fundraising. These funds also allow both

companies to continue delivering on their current project

pipelines.

The investment is in line with the Company's strategy of

building a leading downstream vanadium-based energy storage

platform, by:

-- Increasing Bushveld's exposure to the massive potential of

the stationary energy storage market, for the first time directly

with a manufacturer of the VRFB technology;

-- Partnering with selective VRFB companies with attractive

upside potential, including the establishment of a VRFB Investment

Platform; and

-- Demonstrating upstream support from the vanadium industry for

the development of the VRFB sector and encouraging additional

investment into the combined company.

Rationale of the specific transaction:

The Interim Funding creates an investment in a prominent

VRFB/energy storage entity with the potential to become a leading,

global battery energy storage systems supplier. This includes:

-- Real, near-term deployment opportunities with major buyers

that offer robust follow-on sales opportunities.

-- A global sales reach that is oriented on North America,

Europe and Asia, covering VRFB sales and infrastructure

projects.

-- An experienced management team that combines decades of VRFB development experience with industry-specific understanding of customer storage requirements.

-- A burgeoning project pipeline that will allow the merged

entity to achieve the economies of scale essential for

cost-competitiveness quicker; to increase investor confidence; and

to raise the bankability of its products and projects.

-- Operating synergies between the two companies in research and

development, sales and deployment and manufacturing.

-- The option to participate with a follow on investment into the merged entity.

-- The closer relationship with redT and Avalon's experienced

management will allow Bushveld to implement new supply models for

vanadium and electrolyte.

-- Diversification of Bushveld's customer and revenue base.

-- Preferential vanadium supply rights support Bushveld's

mining, processing and chemicals activities in a sector that may

require up to 50,000mtV based on market forecasts.

-- This transaction further hedges Bushveld's position against

future volatility in vanadium market prices.

Transaction Terms

The terms of the Interim Funding include provisions that, on

successful completion of the Merger, the loan will convert into

shares in the merged entity. Bushveld also has the right, but not

the obligation, to invest a further into the merged entity on the

same terms as other investors, at a maximum price of 1.65p per

ordinary share.

Key terms of the Interim Funding include:

-- Loan for six months structured as a draw-down facility;

-- Interest of 12 per cent annum on the amount drawn;

-- Commitment fee of 20 per cent of the loan amount;

-- Interest and commitment fees will roll up and convert into

ordinary shares on completion of the Merger;

-- A right of first refusal to supply vanadium, vanadium

electrolyte and vanadium as a rental to the merged entity for two

years and thereafter subject inter alia to Bushveld continuing to

beneficially own at least 5 per cent of the merged entity; and

-- Conversion of the loan directly into Avalon shares should the

Merger not complete. Terms for the conversion mirror those for the

merged entity, including a significant minority equity position,

right of first refusal on vanadium supply, option but not

obligation to participate in future funding rounds and the ability

to nominate a director to the Board.

Subject to Bushveld continuing to beneficially own at least 5

per cent of the ordinary shares of the merged entity for one year

from completion of the Merger and the Fundraising, it will have the

right to nominate a member of the board of the merged entity.

Bushveld will retain that right after one year provided it

beneficially owns at least 10 per cent of the merged entity. In

addition, for so long as Bushveld beneficially owns at least 20 per

cent of the merged entity it shall have a right to nominate two

members of the board of the merged entity

The Merger constitutes a reverse takeover under Rule 14 of the

AIM Rules for Companies and accordingly, trading on AIM of redT's

shares is currently suspended. The Merger is expected to complete,

and the trading of shares of the merged entity on AIM expected to

resume, during the first quarter of 2020.

Fortune Mojapelo, CEO of Bushveld Minerals Limited,

commented:

"This is a major leap forward in the development of our

downstream energy business at an attractive price and prudent entry

level. It also demonstrates our conviction in the VRFB technology's

potential and our ability to meet the vanadium supply needs of the

energy storage industry. The energy storage market presents a very

large commercial opportunity, potentially exceeding $300 billion by

2030, with the combined redT-Avalon well placed to capitalise on

this opportunity."

"This transaction deepens our downstream integration in the

vanadium value chain by giving Bushveld Energy direct exposure to

the VRFB technology for the first time. It also exemplifies the

kind of partnerships we continue to establish within the sector,

covering supply, deployment and investment through Bushveld

Energy."

Neil O'Brien, Executive Chairman of redT Energy, commented:

"The market for storage assets to support renewable energy

targets is developing rapidly and the combination of redT and

Avalon will be a leading player in this market. The combination of

strengths across both companies in people, technology, and market

opportunity gives me confidence in the success of the merged

entity. We are looking forward to working with Bushveld as a

partner and strategic investor once we have completed the

merger."

Larry Zulch, CEO of Avalon Battery, commented:

"A commitment to renewable energy is increasingly a commitment

to large-scale energy storage. This storage must be dependable,

safe and economical, all characteristics of VRFBs that will be

highlighted as Avalon and redT combine to create the world's

preeminent flow battery company. Bushveld has been a steadfast

supporter of the VRFB industry and each of our companies

individually. We're thrilled to have their support and look forward

to our continued engagement with them through the merger and

beyond."

Enquiries: info@bushveldminerals.com

Bushveld Minerals +27 (0) 11 268 6555

Fortune Mojapelo, Chief Executive

Officer

Chika Edeh, Head of Investor

Relations

SP Angel Corporate Finance

LLP Nominated Adviser & Broker +44 (0) 20 3470 0470

Richard Morrison / Stephen

Wong

Abigail Wayne / Richard Parlons

Peel Hunt LLP Joint Broker +44 (0) 20 7418 8900

Ross Allister / James Bavister

BMO Capital Markets Limited Joint Broker +44 (0) 20 7236 1010

Jeffrey Couch / Tom Rider

Michael Rechsteiner / Neil

Elliot

Tavistock Financial PR +44 (0) 20 7920 3150

Charles Vivian / Gareth Tredway

Brunswick Financial PR (South Africa) +27 (0) 11 502 7300

Miyelani Shikwambana

ABOUT BUSHVELD MINERALS LIMITED

Bushveld Minerals is a low-cost, integrated, primary vanadium

producer, with ownership of high-grade vanadium assets.

The Company's flagship vanadium platform includes a 74 per cent

controlling interest in Bushveld Vametco Alloys (Pty) Ltd, a

primary vanadium mining and processing company; the Mokopane

Vanadium Project and the Brits Vanadium Project.

Bushveld's vision is to become a significant, low-cost,

integrated primary vanadium producer through owning high-grade

assets. This incorporates development and promotion of the role of

vanadium in the growing global energy storage market through

Bushveld Energy, the Company's energy storage project developer and

component manufacturer. Whilst the demand for vanadium remains

largely anchored in the steel industry, Bushveld Minerals believes

there is strong potential for an imminent and significant global

vanadium demand surge from the fast-growing energy storage market,

particularly through the use and adoption of Vanadium Redox Flow

Batteries.

While the Company's focus is on vanadium operations and the

development and promotion of VRFBs, it has additional investments

in coal, power and tin.

The Company's approach to project development recognises that,

whilst attractive project economics are imperative, they may be

insufficient to secure capital to bring them to account. A clear

path to production within a visible timeframe, low capital

expenditure requirements and scalability are important factors in

ensuring a positive return on investment. This philosophy is core

to the Company's strategy in developing projects.

Detailed information on the Company and progress to date can be

accessed on the website www.bushveldminerals.com.

About Bushveld Energy Limited

Bushveld Energy is a leading energy storage solutions provider,

focusing on the African market. Bushveld Energy recognises that

electricity in Africa intersects paramount potential for social

transformation with an immense commercial opportunity.

Launched in 2016, Bushveld Energy is focused on developing and

promoting the role of vanadium in the growing global energy storage

market through application in vanadium redox flow batteries. Its

near term strategy is to deploy several VRFB systems as part of its

longer term vision to become a significant electricity storage

provider in Africa by 2020, meeting the demand for utility scale

energy storage in Africa by leveraging South Africa-mined and

beneficiated vanadium.

http://www.bushveldenergy.com

About redT energy

redT energy plc are experts in energy storage, specialising in

the design, manufacture, installation and operation of energy

storage infrastructure which creates revenue alongside reliable,

low-cost renewable generation for businesses, industry and

electricity distribution networks. Using patented vanadium redox

flow technology to store energy in liquid, redT's own energy

storage machines can be run continually with no degradation:

charging and discharging for over 25 years, matching the lifespan

of renewable assets in on-grid, off-grid and weak-grid

settings.

redT's energy storage solutions, developed over the past 15

years, address today's changing energy market by providing a

flexible platform for time shifting surplus renewable power,

securing electricity supplies and earning revenue through grid

services. The company has customers in the UK, Europe, sub-Saharan

Africa, Australia and Asia Pacific. For more information, visit

www.redTenergy.com

About Avalon Battery

Avalon Battery was founded on the principle that productized

vanadium-based flow batteries will revolutionize energy projects

and play a critical role in a renewable energy future. With

operations in Fremont, California, USA and Vancouver, Canada, and a

low-cost manufacturing presence in Suzhou, China, Avalon produces

dependable, safe, and economical energy storage systems.

Avalon believes the foundations of its product excellence are

its technology and engineering team. Since 2005, its team has been

one of the global leaders in design, production and deployment of

vanadium flow batteries(1) ; the team now counts over 140 years'

experience in vanadium flow battery development, has been involved

in the deployment of over 15MWh of vanadium flow batteries since

2005, and has invented over 50 related independent patents.

www.avalonbattery.com

(1) Based on searches of the US DOE Global Storage Database for

electro-chemical, vanadium flow batteries understood to be in

operation as at 29 October 2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCCKDDDCBDKPDK

(END) Dow Jones Newswires

November 01, 2019 05:45 ET (09:45 GMT)

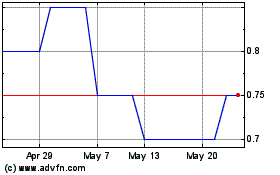

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

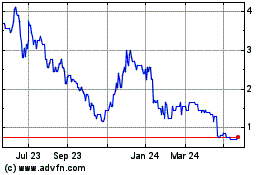

Bushveld Minerals (AQSE:BMN.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024