TIDMAYM

Half yearly report for the six months to 30 September 2023

Chairman's Statement and Management Report

During the reporting period significant advances were made at the company's key

asset, Parys Mountain, with the following developments:

· Submission of the Pre-Application Inquiry to the North Wales Mineral

Planning Authority and hosting an on-site hearing for over 20 statutory

consultee groups.

· Further resource update work for the Morfa Dhu zone (White Rock and Engine

Zone) with 93% of the contained resources now being in the Measured and

Indicated categories.

· Commencement of confirmatory metallurgical test work and pre-concentration

trade-off with 340kg of Morfa Dhu material sent to Grinding Solutions Limited.

Preliminary results were received subsequent to the end of the period with

overall recoveries either in-line or better than those received from previous

test work.

· Detailing the planned drilling programme for the Northern Copper Zone, the

first drilling of this high potential area since 1972. Drilling recommenced in

October 2023 and the first hole was completed on 11 December at a depth of 635

metres. Visual logging of the core suggests two zones of sulphide mineralisation

were intersected with the Northern Copper Zone interpreted to be between 351 -

540 metres and a second zone, potentially the Garth Daniel Zone, between 560 -

586 metres (all downhole depths). As expected, the interpreted Northern Copper

Zone has varying levels of sulphide accumulation. The lower zone of sulphide

accumulation between 560 - 586 metres demonstrates areas with very high levels

of chalcopyrite. A first batch of samples will be dispatched to the assay

laboratory prior to Christmas with results expected in Q1 2024.

Progress at the 49.75% owned Grängesberg iron ore project in Sweden included

ongoing discussions with potential development partners and the commencement of

planning for the environmental baseline gap analysis with a locally based

consulting group, as was recommended in the Pre-Feasibility Study Update.

Board of Directors and Management

Following the resignation of Jo Battershill and the results of the annual

general meeting held in late October 2023 the company is actively engaged in the

search for a new Chief Executive Officer and Non-Executive Chairman. We are very

pleased that Jo Battershill has agreed to remain on the board as a non-executive

director.

Financial

The group had no revenue for the period. The loss for the six months to 30

September 2023 was £604,787 (2022 comparative period £468,656) and expenditure

on the mineral properties in the period was £174,748 compared to £320,887 in the

same period in 2022. This reduction was primarily due to a cessation in Parys

Mountain drilling activity.

Net current assets as at 30 September 2023 were £711,635 compared to £86,781 as

at 31 March 2023 with the increase being due to equity private placements in May

and July 2023, which raised a total of £1.5 million to fund current operations.

Summary

We continue to firmly believe that Anglesey Mining is in a good position to

advance its two key assets at Parys Mountain and Grängesberg over the next year.

At Parys Mountain, drilling of the Northern Copper Zone is expected to generate

strong results leading to the conversion of significant areas of the resource

from the Inferred category through into the higher confidence Indicated

category. From a development study perspective, it is important that the

Northern Copper Zone is upgraded to the Indicated resource category as this will

allow the incorporation of this zone into any potential mineral reserve.

Metallurgical test work will also be required on the Northern Copper Zone to

confirm the +93% recoveries demonstrated by the original test work completed in

1969 at the Lakefield Plant in Ontario, Canada. As suggested in the initial

review of the Northern Copper Zone in 2022, we believe that the system could be

significantly larger than currently modelled, although this will require

additional drilling to test prospective areas.

At Grängesberg, we continue to explore options to advance the project. This

initially requires finalising some of the recommendations from the preliminary

feasibility study update, including baseline studies for the environmental

impact assessment and updating the mining reserve to include some improvements

to the proposed mine plan. We are also exploring a number of options to optimise

the ownership structure of Grängesberg Iron AB following our acquisition of an

additional 29.8% stake in February 2023.

Outlook

Persistent global uncertainties and difficult financial markets have resulted in

challenging conditions in which to operate. However, we continue to be

encouraged by growing investor interest in Anglesey Mining which was

demonstrated by the successful raising of £1.5 million during the reporting

period. We believe that investors are finally recognising the progress made

over the last two years after a period of relative inactivity.

Over the course of the next year, we look forward to advancing the Parys

Mountain project and to optimising the ownership and potential of the

Grängesberg iron ore project.

In closing, on behalf of the board of directors, I would like to thank our

shareholders for their ongoing support, and to confirm that I remain very

confident that the assets held by Anglesey Mining will deliver significant value

as they continue to be progressed over the next year.

Andrew King

Interim Chairman

19 December 2023

Unaudited condensed consolidated income statement

Notes Unaudited six months ended Unaudited six months

ended

30 September 2023 30 September 2022

All

operations £ £

are

continuing

Revenue - -

Expenses (476,872) (388,972)

Equity-settled (24,572) -

employee

benefits

Investment 800 20

income

Finance costs (104,296) (79,789)

Foreign exchange 153 85

movement

Loss (604,787) (468,656)

before tax

Taxation 8 - -

Loss for 7 (604,787) (468,656)

the period

Loss per share

Basic - pence (0.2)p (0.2)p

per share

Diluted - pence . (0.2)p (0.2)p

per share

Unaudited condensed consolidated statement of comprehensive income

Loss for the period (604,787) (468,656)

Other comprehensive income

Items that may subsequently be reclassified to profit or loss:

Change in fair value of investment (155,557) (176,428)

Foreign currency translation reserve 8,021 4,967

Total comprehensive loss for the period (752,323) (640,117)

All attributable to equity holders of the company

Unaudited condensed consolidated statement of financial position

Notes 30 September 31 March 2023

2023

£

£

Assets

Non-current assets

Mineral property 9 16,346,569 16,171,821

exploration and

evaluation

Property, plant and 204,687 204,687

equipment

Investments 10 1,877,628 2,033,185

Deposit 124,586 124,586

18,553,470 18,534,279

Current assets

Other receivables 53,354 49,635

Cash and cash 941,208 247,134

equivalents

994,562 296,769

Total assets 19,548,032 18,831,048

Liabilities

Current liabilities

Trade and other (282,927) (209,988)

payables

(282,927) (209,988)

Net current assets 711,635 86,781

Non-current

liabilities

Loans (3,813,430) (4,194,721)

Long term provision (50,000) (50,000)

(3,863,430) (4,244,721)

Total (4,146,357) (4,454,709)

liabilities

Net assets 15,401,675 14,376,339

Equity

Share capital 11 9,711,764 8,463,039

Share premium 12,948,103 12,443,741

Currency translation (64,117) (72,138)

reserve

Retained losses (7,194,075) (6,458,303)

Total 15,401,675 14,376,339

shareholders'

funds

All attributable to equity holders of the company

Unaudited condensed consolidated statement of cash flows

Notes Unaudited six months ended Unaudited six months

ended

30 September 2023 30 September 2022

£ £

Operating

activities

Loss for the period (604,787) (468,656)

Adjustments for:

Investment income (800) (20)

Finance costs 104,296 79,789

Equity-settled 24,572 -

employee benefits

Shares issued in lieu 50,000 -

of salary

Foreign exchange (153) (85)

movement

(426,872) (388,972)

Movements in working

capital

(Increase) in (3,719) (18,375)

receivables

Increase/(decrease) 58,774 (131,982)

in payables

Net cash (371,817) (539,329)

used in

operating

activities

Investing

activities

Investment income 800 -

Mineral property (165,062) (355,542)

exploration and

evaluation

Net cash (164,262) (355,542)

used in

investing

activities

Financing

activities

Issue of share 1,380,000 797,951

capital

Loan repayment (150,000) (78,345)

Net cash 1,230,000 719,606

generated

from

financing

activities

Net 693,921 (175,265)

increase/(de

crease) in

cash and

cash

equivalents

Cash and 247,134 922,177

cash

equivalents

at start of

period

Foreign 153 85

exchange

movement

Cash and 941,208 746,997

cash

equivalents

at end of

period

All attributable to equity holders of the company

Unaudited condensed consolidated statement of changes in group equity

Share Share Currency Retained Total

capital premium translation losses £

£ £ reserve £

£

Equity at 1 April 8,463,039 12,443,741 (72,138) (6,458,303) 14,376,339

2023 - audited

Total

comprehensive

loss for

the period:

Loss for the - - - (604,787) (604,787)

period

Change in fair - - - (155,557) (155,557)

value of

investment

Exchange - - 8,021 - 8,021

difference on

translation

of foreign

holding

Total - - 8,021 (760,344) (752,323)

comprehensive

loss for

the period

Shares issued 1,248,725 624,362 - - 1,873,087

Share issue - (120,000) - - (120,000)

expenses

Equity at 9,711,764 12,948,103 (64,117) (7,194,075) 15,401,675

30 September 2023

- unaudited

Comparative

period

Equity at 1 April 7,991,541 11,453,789 (84,926) (5,040,074) 14,320,330

2022 - audited

Total

comprehensive

loss for

the period:

Loss for the - - - (468,656) (468,656)

period

Change in fair - - - (176,428) (176,428)

value of

investment

Exchange - - 4,967 - 4,967

difference on

translation

of foreign

holding

Total - - 4,967 (645,084) (640,117)

comprehensive

loss for

the period

Shares issued 326,050 780,020 - - 1,106,070

Share issue - (80,965) - - (80,965)

expenses

Equity at 8,317,591 12,152,844 (79,959) (5,685,158) 14,705,318

30 September 2022

- unaudited

All attributable to equity holders of the company

Notes to the accounts

1. Basis of preparation

This half-yearly financial report comprises the unaudited condensed consolidated

financial statements of the group for the six months ended 30 September 2023. It

has been prepared in accordance with the Disclosure and Transparency Rules of

the Financial Conduct Authority, the requirements of IAS 34 - Interim financial

reporting (as adopted by the UK) and using the going concern basis. The

directors are not aware of any events or circumstances which would make this

inappropriate. It does not constitute financial statements within the meaning of

section 434 of the Companies Act 2006 and does not include all of the

information and disclosures required for annual financial statements. It should

be read in conjunction with the annual report and financial statements for the

year ended 31 March 2023 which is available on request from the company or may

be viewed at www.angleseymining.co.uk/accounts.

The financial information contained in this report in respect of the year ended

31 March 2023 has been extracted from the report and financial statements for

that year which have been filed with the Registrar of Companies. The report of

the auditors on those accounts did not contain a statement under section 498(2)

or (3) of the Companies Act 2006 and was not qualified. The half-yearly results

for the current and comparative periods have not been audited or reviewed by the

company's auditor.

2. Significant accounting policies

The accounting policies applied in these unaudited condensed consolidated

financial statements are consistent with those set out in the annual report and

financial statements for the year ended 31 March 2023. There are no new

standards, amendments to standards or interpretations that are expected to have

a material impact on the group's results.

The group has not applied certain new standards, amendments and interpretations

to existing standards that have been issued but are not yet effective. They are

either not expected to have a material effect on the consolidated financial

statements or they are not currently relevant for the group.

3. Risks and uncertainties

The principal risks and uncertainties set out in the group's annual report and

financial statements for the year ended 31 March 2023 remain the same for this

half-yearly period. They can be summarised as: development risks in respect of

mineral properties, especially in respect of permitting and metal prices;

liquidity risks during development; and foreign exchange risks. More information

is to be found in the 2023 annual report - see note 1 above.

4. Statement of directors' responsibilities

The directors confirm to the best of their knowledge that:

(a) the unaudited condensed consolidated financial statements have been prepared

in accordance with the requirements of IAS 34 Interim financial reporting (as

adopted by the UK); and

(b) the interim management report includes a fair review of the information

required by the FCA's Disclosure and Transparency Rules (4.2.7 R and 4.2.8 R).

This report and financial statements were approved by the board on 19 December

2023 and authorised for issue on behalf of the board by Andrew King, interim

chairman and Jo Battershill, chief executive officer.

5. Activities

The group is engaged in mineral property development and currently has no

turnover. There are no minority interests or exceptional items.

6. Earnings per share

The loss per share is computed by dividing the loss attributable to ordinary

shareholders of £0.6 million by 406 million - the weighted average number of

ordinary shares in issue during the period. The comparative figures were a loss

to 30 September 2022 of £0.47m divided by 282 million shares. However where

there are losses the effect of outstanding share options is not dilutive.

7. Business and geographical segments

There are no trading revenues. The cost of all activities charged in the income

statement relates to exploration and evaluation of mining properties. The

group's income statement and assets and liabilities are analysed as follows by

geographical segments, which is the basis on which information is reported to

the board.

Income statement analysis

Unaudited

six

months

ended 30

September

2023

UK Sweden - Canada - investment Total

investment

£ £

£ £

Expenses (476,872) - - (476,872)

Equity settled (24,572) - - (24,572)

employee

benefits

Investment 800 - - 800

income

Finance costs (99,231) (5,065) - (104,296)

Exchange rate - 153 - 153

movements

Loss for the (599,875) (4,912) - (604,787)

period

Unaudited

six

months

ended 30

September

2022

UK Sweden - Canada - investment Total

investment

£ £

£ £

Expenses (388,972) - - (388,972)

Equity settled - - - -

employee

benefits

Investment 20 - - 20

income

Finance costs (74,356) (5,433) - (79,789)

Exchange rate - 85 - 85

movements

Loss for the (463,308) (5,348) - (468,656)

period

Assets and liabilities

` Unaudited

30

September

2023

UK Sweden investment Canada investment Total

£ £ £

£

Non current 16,675,842 633,170 1,244,458 18,553,470

assets

Current 993,244 1,318 - 994,562

assets

Liabilities (3,821,291) (325,066) - (4,146,357)

Net 13,847,795 309,422 1,244,458 15,401,675

assets/(liabil

ities)

Audited 31

March 2023

UK Sweden investment Canada investment Total

£ £ £

£

Non current 16,501,094 633,170 1,400,015 18,534,279

assets

Current 295,560 1,209 - 296,769

assets

Liabilities (4,122,208) (332,501) - (4,454,709)

Net 12,674,446 301,878 1,400,015 14,376,339

assets/(liabil

ities)

8. Deferred tax

There is an unrecognised deferred tax asset of £1.6 million (31 March 2023 -

£1.6m) which, in view of the group's results, is not considered to be

recoverable in the short term. There are also capital allowances, including

mineral extraction allowances, exceeding £13.7 million (unchanged from 31 March

2023) unclaimed and available. No deferred tax asset is recognised in the

condensed financial statements.

9. Mineral property exploration and evaluation costs

Mineral property exploration and evaluation costs incurred by the group are

carried in the unaudited condensed consolidated financial statements at cost,

less an impairment provision if appropriate. The recovery of these costs is

dependent upon the successful development and operation of the Parys Mountain

project which is itself conditional on finance being available to fund such

development. During the period expenditure of £174,748 was incurred (six months

to 30 September 2022 - £320,887). There have been no indicators of impairment

during the period.

10. Investments

Labrador Grangesberg Total

£ £ £

At 1 April 2022 1,914,185 110,157 2,024,342

Net change during the period (514,170) 523,013 8,843

At 31 March 2023 1,400,015 633,170 2,033,185

Net change during the period (155,557) - (155,557)

At 30 September 2023 1,244,458 633,170 1,877,628

Labrador - Canada

The group has an investment in Labrador Iron Mines Holdings Limited, (LIM) a

Canadian company which is carried at fair value through other comprehensive

income. The group's holding of 19,289,100 shares in LIM (12% of LIM's total

issued shares) is valued at the closing price traded on the OTC Markets in the

United States. In the directors' assessment this market is sufficiently active

to give the best measure of fair value, which on 30 September 2023 was 10 US

cents per share. As at the 13 December 2023 the share price was 5.5 US cents per

share.

Grängesberg - Sweden

The group has, through its Swedish subsidiary Angmag AB, a 49.75% ownership

interest in Grängesberg Iron AB an unquoted Swedish company (GIAB) which holds

rights over the Grängesberg iron ore deposits.

Under a shareholders' agreement, Angmag has a reciprocal right of first refusal

over the remaining 50.25% of the equity of GIAB, together with management

direction of the activities of GIAB subject to certain restrictions. The

shareholders' agreement has an initial term of 10 years from 28 May 2014,

extendable on a year-to-year basis, unless terminated on one year's notice.

The directors assessed the fair value of the investment in Grängesberg under

IFRS 9 and consider the investment's value at 30 September 2023 to be £633,170.

11. Share capital

Deferred shares of 4p Total

Ordinary

shares of

1p

Issued and Nominal Number Nominal Number Nominal

fully paid value £ value £ value £

At 1 April 2,480,708 248,070,732 5,510,833 137,770,835 7,991,541

2022

Issued in 471,498 47,149,816 - - 471,498

the period

At 31 2,952,206 295,220,548 5,510,833 137,770,835 8,463,039

March 2023

Issued in 1,248,725 124,872,469 - - 1,248,725

the period

At 30 4,200,931 420,093,017 5,510,833 137,770,835 9,711,764

September

2023

The deferred shares are non-voting, have no entitlement to dividends and have

negligible rights to return of capital on a winding up.

On 16 May 2023 a placing of 66,666,659 new ordinary shares was made at 1.5 pence

per share to several institutions and two of the directors, to raise a total of

£1,000,000. At the same time Juno converted part of its loan, at the issue

price, into 14,589,149 new ordinary shares and a bonus payment of £50,000 was

made in shares, again at the same price.

On 31 July 2023 a placing of 33,333,329 new ordinary shares was made at 1.5

pence per share to several institutions, to raise a total of £500,000. At the

same time Juno converted part of its loan, at the issue price, into 6,950,000

new ordinary shares.

12. Financial instruments

Group Financial Financial

assets assets

classified at measured

fair value at

through other amortised

comprehensive cost

income

30 September 31 March 2023 30 31 March

2023 September 2023

2023

£ £ £ £

Financial

assets

Investments 1,877,628 2,033,185 - -

Deposit - - 124,586 124,586

Other - - 53,354 49,635

receivables

Cash and - - 941,208 247,134

cash

equivalents

1,877,628 2,033,185 1,119,148 421,355

Financial

liabilities

measured at

amortised

cost

30 September 31 March 2023

2023

£ £

Trade (141,485) (94,796)

payables

Other (141,442) (115,192)

payables

Loans (3,813,430) (4,194,721)

(4,096,357) (4,404,709)

13. Events after the reporting period

At the AGM held on 27 October 2023 the chairman, John Kearney, was not re

-elected to the board and consequently ceased to be chairman and a director from

that date. Non-executive director Andrew King was appointed Interim Chairman in

his place.

Danesh Varma resigned as financial director on 14 November 2023.

14. Related party transactions

Juno Limited

Juno Limited (Juno) which is registered in Bermuda held approximately 20% of the

company's issued ordinary share capital during the period. The group has an

Investor Agreement with Juno under which Juno agreed to participate in any

future equity financing, at the same price per share and on the same terms as

other arm's-length participants, to maintain its percentage, with the

subscription price to be satisfied by the conversion and consequent reduction of

debt and the company agreed to pay Juno in cash ten percent of the net proceeds

of such equity financing in further reduction of the debt. In addition, Juno has

certain nomination and reporting rights, including the right to nominate two

directors to the board, so long as Juno holds at least 20% of the company's

outstanding shares and one director so long as Juno holds at least 10% of the

company's outstanding shares. The family interests of Danesh Varma have a

significant shareholding in Juno.

Following the share issues of May and July 2023, 21,539,148 shares and

10,769,573 warrants over shares were issued to Juno and the consequently debt

due to Juno was reduced by £323,087. In addition, cash repayments of £150,000

were made in the period. All this was in conformity with the Investor Agreement.

Since the period end the company has been notified that Juno has sold 100% of

its shareholding in the company.

Grangesberg

John Kearney and Danesh Varma, as nominees of the company, are directors of

Grangesberg Iron AB. Danesh Varma has been associated with the Grängesberg

project since 2007 when he became a director of Mikula Mining Limited, a company

subsequently renamed Eurang Limited, previously involved in the Grängesberg

project. He did not take part in the decision to enter into the Grängesberg

project when this was approved by the board in 2014. The group has a liability

to Eurang Limited, amounting to £325,066 as at 30 September 2023.

There are no other contracts of significance in which any director has or had

during the year a material interest.

Anglesey Mining plc

Directors

Andrew KingInterim chairman

Jo BattershillChief executive

Namrata Verma Non executive

Registered office address - Parys Mountain, Amlwch, Anglesey, LL68 9RE

Phone 01407 831275 Email mail@angleseymining.co.uk

London office Suite S1, The Old Church, 89B Quicks Road, Wimbledon, London

SW19 1EX

RegistrarsLink Group, 29 Wellington Street, Leeds, LS1 4DL

Share dealing phone 0371 664 0445 Helpline phone 0371 664 0300

Company registered number 01849957

Web sitewww.angleseymining.co.uk

Shares listed AIM - AYM

For further information, please contact:

Anglesey Mining plc

Jo Battershill, Chief Executive - Tel: +44 (0)7540 366000

Davy

Nominated Adviser & Joint Corporate Broker

Brian Garrahy / Daragh O'Reilly - Tel: +353 1 679 6363

WH Ireland

Joint Corporate Broker

Katy Mitchell / Harry Ansell - Tel: +44 (0) 207 220 1666

LEI: 213800X8BO8EK2B4HQ71

This information was brought to you by Cision http://news.cision.com

The following files are available for download:

https://mb.cision.com/Main/22377/3896177/2503553.pdf Anglesey Interim report 2023

(END) Dow Jones Newswires

December 19, 2023 07:02 ET (12:02 GMT)

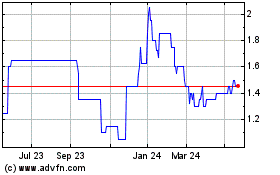

Anglesey Mining (AQSE:AYM.GB)

Historical Stock Chart

From Feb 2025 to Mar 2025

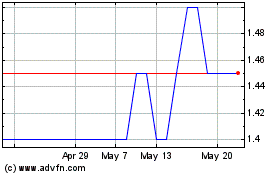

Anglesey Mining (AQSE:AYM.GB)

Historical Stock Chart

From Mar 2024 to Mar 2025