TIDMATC

RNS Number : 2586B

All Things Considered Group PLC

30 September 2022

30 September 2022

All Things Considered Group Plc

("ATC", the "Company" or the "Group")

Interim Results for the half year ended 30 June 2022

All Things Considered Group Plc (AQSE: ATC), the independent

music company housing talent management, live booking,

livestreaming and talent services, announces its unaudited interim

results for the half year ended 30 June 2022 ("H1 2022").

Financial highlights:

-- Group consolidated revenue increased 19% to GBP6.0m (H1 2021: GBP5.0m)

-- Gross profit increased to GBP2.6m (H1 2021: loss of GBP0.9m)

-- Loss after tax of GBP0.18m (H1 2021: loss of GBP2.55m)

-- Operational cash generated of GBP3.0m (H1 2021: cash absorbed of GBP1.7m)

-- The Group retains a sufficiently healthy net cash position (after current debt) of GBP3.0 million. The net cash

position (after current and long-term debt) as at 30 June 2022 was GBP1.5m (H1 2021: debt of GBP1.8m) as a result

of the IPO in December 2021, allowing the Group to further grow the Live and Management businesses and to pursue

the Group's acquisition plans

Operational highlights:

-- Good progress with both our artists and the recruitment of new artist managers joining the ATC Group

-- ATC Live has emerged from lockdown in a strong position and expects to deliver over 6,000 shows in 2022 for its

clients

-- New client gains across our substantial artist representation businesses in Management and Live Agency which now

manage more than 70 and 400 clients respectively

-- Established "Company X" in the USA, a new joint venture brand agency with Arrival Artists, servicing our

collective client base and third parties

Post period and current trading:

-- Announced substantial developments for our livestreaming business Driift, including the acquisition of technology

and commerce platform Dreamstage, concurrent with GBP4m additional investment from Deezer into Driift to maintain

its market leading position

-- Established ATC Experience as a new division to capitalise upon the changing commercial and creative models

developing globally across the live entertainment sector

-- Strengthened the management team with the addition of Despina Tsatsas, an experienced theatre producer and

creative leader, who will head up ATC Experience

-- Excluding Driift, we expect the remaining Group businesses in aggregate to show growth in 2022 in line with, or

slightly ahead of, expectations

-- Taking a prudent view for the 2022 financial outlook for, and additional investment in, Driift (as also enlarged

by the transaction announced today), the livestreaming division is expected to report a loss this year. As Driift

is currently a significant contributor to the Group's consolidated results, the Group now expects to show a small

overall loss for the 2022 financial year

Adam Driscoll, Chief Executive Officer of ATC Group plc,

commented : "These results, covering the first six months of the

year demonstrate the resilience of our business model and market

relevance of our full-service artist offering aligned to a rapidly

changing music industry. We are pleased with the overall progress

achieved in the first half of the year, both in terms of financial

performance and operational developments, with many lead indicators

performing as expected."

"As we enter the second half, the pipeline of opportunities is

encouraging across the business divisions. Driift continues to

cement its leading position within the fast-evolving livestreaming

sector and we are delighted to continue to attract investment to

scale that business. The opportunity ahead is significant as

artists increasingly look to partner with creative agencies aligned

to their interest, and we believe we have the right model, focus

and platform to achieve significant growth"

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) No 596/2014.

For more information, please contact:

ATC Group plc Via Alma PR

Adam Driscoll, CEO

Rameses Villanueva, CFO

Canaccord Genuity +44(0)20 7523 8000

Aquis Corporate Adviser and Broker

Adam James / Patrick Dolaghan

Alma PR +44(0)20 3405 0205

Financial PR

Hilary Buchanan/ Lily Soares Smith

Notes to Editors

ATC Group is a prominent independent music company offering live

rights, live agency, production, artist management and investment

and a range of other music artist services. ATC Group is the only

independently owned company in the industry housing talent

management, live booking, livestreaming and talent services within

the same group.

The Company has an established, long-standing client base with

over 70 artists on its management roster and over 400 acts on the

live roster. One of its livestreaming offerings, Driift, has

delivered shows with Niall Horan, Andrea Bocelli, Kylie, Johnny

Marr, The Smile and others, selling over 600,000 tickets across 190

countries since being established in June 2020.

The Group's six key divisions, grouped under two segments,

are:

-- Artist management and development

-- ATC Management - artist management

-- ATC Live - live event booking agency for artists

-- ATC Services- Promotional, agency services and technology solutions provider

-- ATC Experience - creator and distributor of artist-led digital and in-person experiences

-- Polyphonic - an artist partnerships venture

-- Live streamed events

-- Driift - a global livestreaming business, and Flymachine, a livestreaming platform

The Group is headquartered in London, with offices in Los

Angeles, New York and Copenhagen and is led by an experienced

management team who have operated across multiple music industry

sectors.

For more information see: www.atcgroupplc.com

Chief Executive's Review

Overview

The interim results to 30 June 2022 represent the first six

months of trading of the Group since being admitted to the Aquis

Growth Market in December 2021. The Board is pleased to deliver a

strong first half of double-digit revenue growth and improved

profitability, demonstrating that the Group's strategy and

positioning within the music industry is robust and delivering in

line with our vision.

Strategy

The Group has the advantages of a resilient and diversified

business model that captures income and value from multiple

verticals within the music industry. This ensures that we can

benefit from the overall growth of the market through cycles,

including the periods of significant disruption as was demonstrated

by our growth through the pandemic,

The Group's model is to provide a fully integrated service

empowering creators and artists to build optimum commercial

structures to generate increased revenues and profits.

Our substantial artist representation businesses in Management

(more than 70 clients) and Live Agency (more than 400 clients),

means that we are in business with the real revenue generators in

the industry - the artists. Building new and exciting opportunities

for artists and developing a more collaborative model enables us to

develop new revenue streams which we can benefit from and is a key

growth driver. We have been delivering upon that ambition in

2022.

Performance Review

Since we last updated on the Group's progress in our annual

report, which was published on 27(th) June, we have continued to be

encouraged by many of our lead indicators.

ATC Live

The live music industry continues to make a sustained come back

after the challenges of the Covid shutdown. At ATC Live we continue

to perform in line with our expectations, notwithstanding the fact

that the first two months of the year were challenged by continuing

Covid disruptions. Despite having experienced a record number of

cancelled or rescheduled dates in the first part of the year, ATC

Live has emerged in a strong position and expects to deliver circa

6,000 shows for its clients in 2022. This augurs well for future

periods.

ATC Management

In our management businesses we are seeing good progress with

both our artists and the recruitment of new managers joining the

ATC Group, with overall performance in line with expectations. Nick

Cave and the Bad Seeds have recently completed a hugely successful

tour across multiple territories. The Smile continue to receive

plaudits for their shows and have sold out multiple venues across

North America during Q4 2022. Amaarae is concluding a substantial

new recording deal and Jonny Marr is touring the US with The

Killers. We recently took on the management of globally recognised

artists The Hives and are building exciting plans with them for

2023 and beyond. We have recently announced that they will be the

support act for The Arctic Monkeys on their upcoming stadium tour.

In the US, Cuco and Santigold have just released their latest

albums to critical and commercial acclaim. Newer developing artists

on our roster such as underscores, The Goa Express and Izzi De-Rosa

continue to excite business partners and audiences alike.

Our composer roster within management is showing growth and

success with clients such as Isobel Waller Bridge, Ben Frost and

Brendan Angelides all delivering new projects with a range of

global partners including Apple TV and Netflix.

Over the last three months we have been delighted to welcome Dan

McEvoy, Ben Rafson, Brandon Sánchez and Jordan Alper as new

managers joining the ATC team bringing a selection of exciting

clients with substantial prospects.

Livestreaming and Driift

Livestreaming came to the fore during the Covid shutdown when

the opportunity to sell concert tickets to an 'at home' audience

showed the longer-term growth prospects for this new vertical and

established the format in the minds of artists and viewers alike.

During 2022 Driift has continued to deliver fantastic shows from

the likes of Little Mix, Jack Johnson, Westlife and, in the last

few days, 5 Seconds of Summer from the Royal Albert Hall, with

approximately 25,000 tickets sold for that show.

Third party market forecasters continue to predict that

livestreaming will be a multi-billion dollar segment over the next

3 to 5 years. Driift's market leading position gives it a

substantial opportunity to be the beneficiary of that growth and

the acquisition of Dreamstage and the increased support from

Deezer, as separately announced today, makes that prospect ever

more possible. The acquisition of livestreaming platform Dreamstage

provides Driift a new array of ticketing and technology tools to

create a market leading 'end-to-end' livestreaming business. The

acquisition was delivered alongside a new investment of GBP4m from

Deezer. These combined transactions have substantially strengthened

Driift's position in its sector and are a positive development for

the Group given the wider context of the growing livestreaming

market in which we remain convinced that we can build substantial

value.

The recent investment round was consistent with our current

balance sheet valuation of our Driift equity. As we now hold 32.5%

of the combined Driift and Dreamstage business, we will report it

as an associated undertaking in future, taking our share of its

result into our group income statement.

We are taking a prudent view of Driift results for 2022,

especially given the increased cost base as we are now reporting a

share of the ongoing Dreamstage platform investment. We expect

Driift to deliver a loss in 2022 as the business continues to

invest in shows and infrastructure to secure its leading position

in the market.

Complementary offerings: ATC Experience, ATC Services and

Polyphonic

A key part of our strategy, as noted above, is to develop new

business opportunities for our own clients and for other leading

artists. Having delivered an online experience for Radiohead in

partnership with Epic Games in 2021, we are focussed on building

new audience experiences and entertainment offerings and creating

new revenue streams.

As a result, we have recently established ATC Experience as a

new division to capitalise upon the changing commercial and

creative models developing globally across the live entertainment

sector. This is a new opportunity to drive incremental revenue

growth for the Group via co-commission, co-production, investment

and partnership strategies. ATC Experience will create and

distribute artist-led digital and in-person experiences for global

audiences.

The division is headed by Despina Tsatsas, an experienced

theatre producer and creative leader, who is a great addition to

our management team. Despina was most recently the Executive

Director of the Young Vic and prior to that was the Executive

Producer at Punchdrunk Global.

In the USA we have further developed our relationship with live

agency Arrival Artists by establishing a new joint venture brand

agency, Company X, which will service our collective client base

and third parties. Led by Mara Frankel, who was previously Senior

Creative Director for Brand Partnerships at Atlantic Records, we

are confident that this new service offering will be welcomed by

our clients and will be a new source of profit contribution to the

Group.

Current Trading and FY22 outlook

In aggregate, with the exception of Driift, our Group businesses

have performed in line with expectations in the first half of 2022

and we expect that to continue for the full year.

As noted above, in order to cement its market-leading position,

the business has invested significantly into Driift in the year to

date and following the transactions announced separately today, we

will continue to see increased investment in Driift events and in

its Dreamstage platform. We feel that our investment to date has

been validated by the recent acquisition and new capital injection

and expect this to deliver long term value to shareholders.

However, Driift will report a loss this year which will be a

significant contributor to our Group results and we now expect to

show a small overall loss for the financial year. Excluding Driift,

we expect the remaining Group businesses in aggregate to show

growth in 2022 in line with, or slightly ahead of,

expectations.

The Group retains a sufficiently healthy net cash position

(after current debt ) of GBP3.0 million and net cash position

(after current and long-term debt ) of GBP1.5 million.

Chief Financial Officer's Review

Overview

During the period, despite the presence of COVID related global

lockdowns during the first quarter of 2022, the Group's results

continued to demonstrate resilience.

Revenue

Across the period, the Group's consolidated revenue posted 19%

growth (H1 2022: GBP6.0 m vs H1 2021: GBP5.0m) mainly due to the

following:

-- Artist management and development - The Services division has

earned significant gross commission from its consulting services of

approximately $ 2.2 million (c. GBP1.75 million) while other

divisions have benefited from the uptick in live performances and

management services activities during the second quarter of

2022.

-- Livestreamed events - Driift generated GBP1.85 million in

2022, a 36% decrease over an exceptional comparative period (2021:

GBP3.3 million) due to the one-off revenue stream from

'Glastonbury's Live at Worthy Farm'. In May 2021, Driift delivered

GBP1.7 million in gross revenues by livestreaming the event which

was not replicated in 2022 which contributed to the decline for

H12022. Excluding the revenue generated from Glastonbury in H12021,

revenue in this division increased by 12 % (2022: GBP1.85 million

vs 2021: GBP1.65million) as Driift continued to tap into the

consumer's demand for in-home shows via streaming during this

period.

Administrative expenses

Administrative expenses increased by 53% from GBP2.01 million in

2021 to GBP3.07 million in 2022. The increase is due mainly to the

additional overheads of the artist management and development

businesses/divisions that were acquired in 2021; new hirings in the

live and management businesses which have enabled us to grow the

artist, writer, producer and composer rosters, and group services

which resulted in an increase in salary cost; increase in

professional and consultancy fees related to the post IPO

compliance work and completed and ongoing business deals; and,

travelling expenses due to increased activities in the live and

management businesses in 2022

Conversely, Driift's overheads decreased by 11% or GBP0.05k

(2022: GBP0.42m vs 2021: GBP0.47 m).

Loss Before Tax and Non-controlling interest (NCI)

The loss before tax and non-controlling interest decreased by

90.2% (H1 2022: loss of GBP0.17 million, H12021: loss of GBP2.55

million). The loss was mainly due to losses incurred in Driift in

May 2021 arising from the Glastonbury event which was disrupted by

technical issues caused by a third-party supplier that resulted in

customer refunds and a reduction in ticket sales.

Excluding the net loss of the Glastonbury event, the net loss

before tax and NCI improved by GBP0.41 million in 2022 (H1 2022:

GBP0.172 million vs H1 2021: GBP0.213 million) due mainly to the

significant commission earned by the Services division and the

reversal of losses in the UK management business during the

period.

IPO and net cash/(debt)

The Group's net cash position (after current and long-term debt)

was GBP1.5 million which is a significant improvement over its net

debt position in 2021 of GBP1.82 million. The Group listed on the

Apex segment of the Aquis Growth Market in December 2021 and raised

a total of GBP4.1m, before costs, which improved its cash position

and allowed the Group to further grow the Live and Management

businesses by hiring new agents, and managers. It also provides

additional working capital to further develop Group businesses and

to pursue the Group's acquisition plans.

Financing costs of GBP0.077m (2021: GBP0.045m) was comprised

mainly of interest expenses on loans.

2022 2021

Current

- Cash and cash equivalents 8,398,106 1,864,823

- Funds held on behalf of clients (4,905,279) (600,099)

- Short-term borrowings (334,443) (780,604)

- Right of use liabilities (ST) (142,041) (167,090)

Net cash/(debt) after current debt 3,016,343 317,030

------------ ------------

Long term

- Long term borrowings (1,324,199) (1,823,019)

- Right of use liabilities (LT) (176,957) (318,381)

(1,501,156) (2,141,400)

------------ ------------

Net cash/(debt) 1,515,187 (1,824,370)

============ ============

Earnings per share

Basic and diluted earnings per share for the period was (1.87)

pence per share (H1 2021: (38.12) pence per share)

Going Concern

The accounts have been prepared on a going concern basis. The

Directors have a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future, based on projections for at least twelve months from the

date of approval of the interim accounts.

Consolidated statement of

comprehensive

income

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

Notes GBP GBP GBP

Revenue 2 6,015,313 5,037,428 9,143,638

Cost of sales 2 (3,413,243) (5,965,860) (8,297,894)

Gross profit/(loss) 2,602,070 (928,432) 845,744

Other operating income 3 352,402 437,764 1,163,496

Administrative expenses 4 (3,068,380) (2,007,125) (5,390,877)

Provision for amounts owed by -

associates

and joint ventures - - -

Operating loss 2 (113,908) (2,498,127) (3,381,637)

Share of results of associates and

joint ventures 5 18,908 (5,524) 167,568

Finance income 7 5 4,852

Finance costs (77,365) (45,286) (96,968)

Provision against amounts owed by

participating interests - (334) (333)

Adjusted loss before tax (172,358) (2,548,932) (2,689,783)

IPO and related costs - - - (616,735)

--------------------------------------------- ------------------------ ------------ -------------

Loss before taxation (172,358) (2,548,932) (3,306,518)

Income tax expense (6,627) (1,152) (1,256)

Loss for the period (178,985) (2,550,084) (3,307,774)

Other comprehensive income:

Currency translation differences 53,813 2,790 (5,208)

Revaluation gain on unlisted investments 53,638 - 139,061

Total comprehensive income for the period (71,534) (2,547,294) (3,173,921)

Loss for the financial period is attributable

to:

- Owners of the parent company (100,825) (1,645,234) (2,353,468)

- Non-controlling interests (78,160) (904,850) (954,306)

(178,985) (2,550,084) (3,307,774)

Total comprehensive income for the period

is attributable to:

- Owners of the parent company 6,626 (1,642,444) (2,219,615)

- Non-controlling interests (78,160) (904,850) (954,306)

(71,534) (2,547,294) (3,173,921)

Earnings per share

Basic and diluted (In pence) 6 (1.87) (38.12) (34.51)

Consolidated statement of financial position

Unaudited Unaudited Audited

As at As at As at

30 June 30 June 31 December

2022 2021 2021

GBP GBP GBP

ASSETS

Non-current assets

Goodwill 1,135,403 902,187 1,135,403

Property, plant and equipment 367,268 458,635 398,506

Investments 187,336 165,844 244,604

1,690,007 1,526,666 1,778,513

Current assets

Trade receivables and other

current

assets 2,569,897 2,744,123 2,558,201

Cash and cash equivalents 8,398,106 1,864,824 5,532,272

sni

10,968,003 4,608,947 8,090,473

Total assets 12,658,010 6,135,613 9,868,986

EQUITY

Called up share capital 95,840 34,358 95,840

Share premium account 3,983,970 2,917,969 3,983,970

Merger reserve 2,883,611 - 2,883,611

Currency translation reserve 44,063 11,557 (9,750)

Retained earnings (4,933,832) (5,303,784) (4,898,864)

Equity attributable to the

shareholders

of the parent company 2,073,652 (2,339,900) 2,054,807

Non-controlling interests 117,667 (982,829) 197,649

Total equity 2,191,319 (3,322,729) 2,252,456

LIABILITIES

Non-current liabilities

Borrowings 1,324,199 1,823,019 1,676,986

Other creditors 59,058 - 53,085

Right of use lease liabilities 176,957 318,381 248,238

1,560,214 2,141,400 1,978,309

Current liabilities

Trade and other payables 8,429,994 6,369,249 5,373,866

Borrowings 334,443 780,603 124,068

Right of use lease liabilities 142,040 167,090 140,287

8,906,477 7,316,942 5,638,221

Total liabilities 10,466,691 9,458,342 7,616,530

Total equity and liabilities 12,658,010 6,135,613 9,868,986

Consolidated statement of changes in shareholders' equity

Share Share Merger Currency Retained Non-controlling Total

capital premium reserve translation earnings interests

account reserve

GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January 2022 95,840 3,983,970 2,883,611 (9,750) (4,898,864) 197,649 2,252,456

Period ended 30

June 2022:

Loss for the

period - - - - (100,825) (78,160) (178,985)

Other

comprehensive

income:

Currency

translation

differences and

revaluation

reserve

movements - - - 53,813 53,638 - 107,451

Total

comprehensive

income for the

period - - - 53,813 (47,187) (78,160) (71,534)

Other movements - - - - 12,219 (1,822) 10,397

Balance at 30

June 2022 95,840 3,983,970 2,883,611 44,063 (4,933,832) 117,667 2,191,319

Balance at 1

January 2021 32,649 2,449,703 - 8,767 (3,687,758) 10,395 (1,186,244)

Period ended 30

June 2021:

Loss for the

period - - - - (1,645,234) (904,850) (2,550,084)

Other

comprehensive

income:

Currency

translation

differences - - - 2,790 - - 2,790

Total

comprehensive

income for the

year - - - 2,790 (1,645,234) (904,850) (2,547,294)

Issue of share

capital 1,709 468,266 - - - - 469,975

Distributions - - - - - (24,959) (24,959)

Acquisition of

non-controlling

interests - - - - 29,208 (63,415) (34,207)

Balance at 30

June 2021 34,358 2,917,969 - 11,557 (5,303,784) (982,829) (3,322,729)

Share Share Merger Currency Retained Non-controlling Total

capital premium reserve translation earnings interests

account reserve

GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January 2021 32,649 2,449,703 - (4,542) (3,442,423) 10,395 (954,218)

Year ended 31

December 2021:

Loss for the

period - - - - (2,353,468) (954,306) (3,307,774)

Other

comprehensive

income:

Revaluation gain * 139,061 - 139,061

on unlisted

investments

Currency

translation

differences - - - (5,208) - - (5,208)

Total

comprehensive

income for the

year - - - (5,208) (2,214,407) (954,306) (3,173,921)

Issue of share

capital of

previous parent 1,709 399,550 - - - - 401,259

Issue of share

capital 95,840 3,983,970 - - - - 4,079,810

Merger reserve (34,358) (2,849,253) 2,883,611 - - - -

Acquisition of

non-controlling

interests

and related

adjustments - - - - 757,966 1,141,560 1,899,526

Balance at 31

December 2021 95,840 3,983,970 2,883,611 (9,750) (4,898,864) 197,649 2,252,456

Consolidated statement of cash flows

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

GBP GBP GBP

Cash flows from operating activities

Loss for the period after tax (178,985) (2,550,084) (3,307,774)

Adjustments for:

Taxation charged 6,626 1,152 1,256

Finance costs 77,365 45,286 96,968

Finance income (7) (5) (4,852)

Gain on disposal of property, plant

and equipment - - -

Depreciation of property, plant and

equipment 65,247 66,597 133,023

Share of results of associates and joint

ventures (18,908) (15,146) (167,568)

Provision against investment in associates

and joint ventures - - 333

Movements in working capital:

Increase in trade receivable and other

current assets 45,988 (1,497,717) (572,660)

Increase in trade and other payables 2,999,364 2,258,245 1,136,345

Cash (absorbed by)/generated from

operations 2,996,690 (1,691,672) (2,684,929)

Interest paid (77,365) (45,286) (96,968)

Tax paid (57,471) (1,152) (1,256)

Net cash (outflow)/inflow from

operating activities 2,861,854 (1,738,110) (2,783,153)

Investing activities

Net additions to property, plant and

equipment (32,083) (15,469) (20,984)

Investment in unlisted shares - - (53,085)

Purchase of subsidiaries (net of

cash acquired) - 738,307 274,700

Net amount withdrawn/(injected)

in associates and joint ventures 97,806 24,885 -

Interest received 7 5 4,852

Net cash generated from investing

activities 65,730 747,728 205,483

Financing activities

Proceeds from issue of shares - 469,975 4,011,094

Proceeds from issue of shares in

previous parent - - 300,025

Proceeds from borrowings - 500,000 500,000

Repayment of borrowings (171,733) (254,156) (735,800)

Proceeds from non-controlling interest

additional investment ((Driift) - - 2,000,000

Payment of lease liabilities (69,527) (39,919) (136,865)

Distributions to non-controlling

interest - (24,959) -

Net cash generated from financing

activities (241,260) 650,941 5,938,454

Net (decrease)/increase in cash and

cash equivalents 2,686,324 (339,441) 3,360,784

Cash and cash equivalents at beginning

of period 5,532,272 2,200,821 2,178,505

Effect of foreign exchange rates 179,510 3,444 (7,017)

Cash and cash equivalents at end

of period 8,398,106 1,864,824 5,532,272

Notes to the interim

financial statements

1 Basis of preparation

The results for the six months ended 30 June 2022 and 30 June

2021 are unaudited. This interim report, which has neither been

audited nor reviewed by independent auditors, was approved by

the board of directors on 29 September 2022.

The results for the six months ended 30 June 2021 are extracted

from the Growth Prospectus ('Prospectus') dated 14 December 2021

and include the results of ATC Artist Management Inc (previously

Courtyard Production Inc) for the whole of the six months as

it was under common control for that period. As required under

IFRS 3 business combinations, the results for the year ended

31 December 2021, extracted from the annual report and accounts,

include the results of the business from the date of acquisition,

19 February 2021.

The consolidated Group financial statements represent the

consolidated

results of All Things Considered Group plc and its subsidiaries,

(together referred to as the "Group"). The consolidated interim

financial information has been prepared in accordance with

International

Financial Reporting Standards, International Accounting Standards

and Interpretations (collectively IFRSs), as adopted by the United

Kingdom.

The accounting policies applied by the Group are the same as

those applied by the Group in its financial statements for the

year ended 31 December 2021. The independent auditors' report

was unqualified, did not draw attention to any matters by way

of emphasis, and did not contain a statement under 498(2) or

498(3) of the Companies Act 2006.

2 Segmental analysis

Unaudited six months

ended 30 June Artist management Live streamed

2022 and development events Total

GBP GBP GBP

4,168,342

4,168,341.73

Revenue 6,015,313.08 1,846,971 6,015,313

Cost of sales (1,491,095) (1,922,148) (3,413,243)

Gross profit/(loss) 2,677,247 (75,177) 2,602,070

Other operating

income 81,074 271,328 352,402

Administrative

expenses (2,646,790) (421,590) (3,068,380)

Provision for

amounts owed by

associates

and joint ventures - - -

-

Operating profit/ (

loss) 111,531 (225,439) (113,908)

Share of results of

associates and

joint ventures 18,908 - 18,908

Finance income 7 - 7

Finance costs (77,234) (131) (77,365)

Profit/ (loss)

before taxation 53,212 (225,570) (172,358)

Income tax expense (6,627) - (6,627)

Profit/ (loss) for

the period 46,585 (225,570) (178,985)

2 Segmental analysis

Unaudited six months ended 30 June Artist

2021 management Live streamed

and development events Total

GBP GBP GBP

Revenue 1,728,218 3,309,210 5,037,428

Cost of sales (1,064,867) (4,900,993) (5,965,860)

Gross profit/(loss) 663,351 (1,591,783) (928,432)

Other operating income 437,764 - 437,764

Administrative expenses (1,535,885) (471,240) (2,007,125)

Provision for amounts owed by associates

and joint ventures (334) - (334)

Operating loss (435,104) (2,063,023) (2,498,127)

Share of results of associates and joint

ventures (5,524) - (5,524)

Finance income 5 - 5

Finance costs (45,286) - (45,286)

Loss before taxation (485,909) (2,063,023) (2,548,932)

Income tax expense (1,152) - (1,152)

Loss for the period (487,061) (2,063,023) (2,550,084)

Audited year ended 31 December 2021 Artist

management Live streamed

and development events Total

GBP GBP GBP

Revenue 4,501,426 4,642,212 9,143,638

Cost of sales (2,088,401) (6,209,493) (8,297,894)

Gross profit/(loss) 2,413,025 (1,567,281) 845,744

Other operating income 617,517 545,979 1,163,496

Administrative expenses (4,268,933) (1,121,944) (5,390,877)

Operating loss (516,352) (2,143,245) (3,381,636)

Share of results of associates and joint

ventures 167,568 - 167,568

Finance income 4,852 - 4,852

Finance costs (96,968) - (96,968)

Provision against amounts owed by participating

interests (333) - (333)

Loss before taxation (1,163,273) (2,143,245) (3,306,518)

Income tax expense (1,256) - (1,256)

Loss for the period (1,164,529) (2,143,245) (3,307,774)

3 Other operating income

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

GBP GBP GBP

Government grants received 77,944 420,482 523,896

Film tax relief credit 271,328 - 545,979

Sundry income 3,130 17,282 93,621

352,402 437,764 1,163,496

4 Administrative expenses

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

GBP GBP GBP

Staff costs 1,835,057 903,158 2,364,472

Rent, rates and service costs 193,572 142,428 367,960

IPO and related costs - - 616,735

Legal and professional fees 102,386 216,761 642,641

Consultancy fees 289,131 317,716 580,895

Depreciation of property, plant and

equipment 65,247 66,597 133,023

Exchange (gain) losses (82,109) 5,191 61,406

Profit or loss on sale of tangible

assets - (19,694)

Travelling and entertainment expenses 228,666 16,832 120,476

Other expenses 436,430 338,442 522,963

3,068,380 2,007,125 5,390,877

5 Share of results of associates and joint ventures

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2022 2021 2021

GBP GBP GBP

ATC 4 LLP 4,791 29,626 154,439

ATC 7 LLP 5,169 31 630

ATC 9 LLP 8,948 1,751 28,251

One Eskimo LLP - - 510

Frank Carter & The Rattlesnakes LLP - (20,670) -

Your Army LLC - (16,262) (16,262)

18,908 (5,524) 167,568

6.

Earnings

per

share

Unaudited Unaudited Audited

Six months Six months Year ended

30 June 2022 30 June 31 December

2021 2021

Basic and diluted earnings/(loss) (1.87) pence (38.12) (34.51)

per share pence pence

Basic and diluted number of

shares in issue 9,584,020 6,690,314 9,584,020

Basic earnings per share is calculated by dividing the profit/loss

after tax attributable to the equity holders of All Things Considered

group plc by the numbers of shares in issue after the allotment

of ordinary shares on 14 December 2021. The same number of shares

is used for the corresponding period in order to provide a meaningful

comparison.

Events after the reporting date

7.

On 29 September 2022, subsidiary undertaking Driift

Holdings

Limited entered into a transaction whereby it

acquired, in a

share for share exchange, the shares and business

of Dreamstage

Inc. and, at the same time, Deezer SA (which was an

existing

shareholder of Dreamstage) invested GBP4m into the

combined business

of Driift and Dreamstage to fund its future growth.

The transaction

results in the Group's undiluted shareholdings in

Driift reducing

to 32.5% from 52%. As a result, from 30 September

2022, Driift

will no longer be a subsidiary undertaking but will

be accounted

for as an associated undertaking.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXFKLLLLKLBBBF

(END) Dow Jones Newswires

September 30, 2022 02:01 ET (06:01 GMT)

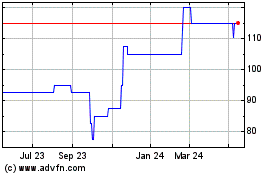

All Things Considered (AQSE:ATC)

Historical Stock Chart

From Nov 2024 to Dec 2024

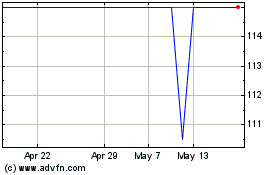

All Things Considered (AQSE:ATC)

Historical Stock Chart

From Dec 2023 to Dec 2024