TIDMAIEA

RNS Number : 0306I

Airea PLC

12 April 2022

Airea plc

Final results for the year ended 31st December 2021

Strategic Report

Neil Rylance

It is impossible to review 2021 without referring to the

untimely death of Neil Rylance in March 2022. Neil had been the CEO

of Airea plc for 13 years. Those shareholders who have supported

the company during his tenure will understand, first hand, the

impact of Neil's contribution to this Company's success. Without

his focus, tenacity, and deep understanding of the sector we would

not be the profitable business we are today.

It is easy to forget the changes that Airea has undergone, when

we see the stable, profitable business we have today. Neil led the

programme of change and, had the patience, foresight, and dogged

determination, to follow these challenges to a successful

conclusion. He did this with a Liverpudlian wit, a no-nonsense

approach and an unswerving self-belief. Neil led from the front and

was able to attract like-minded executives whom he mentored to

assist in shouldering the burden of change for the better. He has

left us with a platform for growth. He has also left a management

team who are capable of delivering on that promise. In Neil's

memory we must do so, because Neil is a man who is not easy to

forget.

The search for Neil's successor has begun.

Highlights for the year

- Recovery in revenue; however, not yet at pre-pandemic

levels.

- Continued profitability during the COVID-19 pandemic.

- Underlying gross profit margins (revenue less cost of sales)

increased year on year.

- Utilising our new equipment to enable the launch of a further

three products during the year.

- Improvement in pension funding position.

The board is pleased with the group's resilience in the face of

the challenges of the COVID-19 pandemic and its impact on all

aspects of our business. We continue to focus on improving our

operational and supply chain processes which are imperative when

facing the uncertainty regarding labour and raw material

availability and the unprecedented increases in raw material

prices.

Principal activity and strategy

The group remains focused on the design, manufacture, marketing

and distribution of floor coverings. Our approach to strategy is

uncomplicated; to develop products that sell, exploit the strength

of our combined manufacturing and distribution operation and

deliver robust cash flows to support the ongoing investment in the

business.

Overview

The group's performance during the 12 months ended 31st December

2021 has continued to be impacted by the COVID-19 pandemic and the

related lockdown restrictions. Access to our export business was

most severely impacted by the lockdown restrictions coupled with

the additional complications trading overseas following the post

Brexit transition period.

We continue to maintain our cash reserves and strong balance

sheet position to enable us manage the impact of the continued

uncertainty in the economy and the related risks on the

business.

The group increased the level of inventory on hand to help

mitigate against the supply chain tensions which continue to put a

strain on the availability of materials and the costs of obtaining

them.

Our investment in the development of our product range continues

with launches of new products into the market throughout 2021,

supported by our new equipment, which is now fully operational.

Feedback from customers has been extremely positive and the

specification of our products bodes well for our continued success.

The new product lines resulted in an increase in inventory at the

year-end due to putting new product lines into stock.

The defined benefit pension scheme deficit reduced from GBP1.8m

to an unrecognised surplus of GBP5.1m. The surplus has been

restricted from being recognised as an asset on the balance sheet

due to the group not having an unconditional right to a refund. The

group contributions to the scheme have been reduced from GBP0.4m

per year to

GBPnil (for the financial year 2022) based on the latest agreed

schedule of contributions between the group and the scheme's

trustees. There continues to be volatility in global equity markets

with the scheme's investment strategy constantly under review to

mitigate the scheme's long-term risk profile as much as

possible.

The value of our investment property increased from GBP3.7m to

GBP4.0m. The gain is highlighted separately in the income

statement.

Group results

Revenue for the year was above prior year at GBP15.9m (2020:

GBP14.6m) with home sales recovering, however the COVID-19 pandemic

continued to reduce our access to export markets and constrained

growth. Operating profit before valuation gain nevertheless

increased to GBP1.3m (2020 Restated: GBP0.7m). Underlying gross

profit margins increased year on year due to the increased level of

sales and the group also continued to benefit from furlough savings

of GBP0.3m (2020: GBP0.5m).

There was an unrealised valuation gain on the investment

property of GBP0.3m (2020: GBP0.1m) giving an operating profit

after valuation gains of GBP1.6m (2020 Restated: GBP0.8m).

Other finance costs relating in the main to the defined benefit

pension scheme were GBP0.3m (2020: GBP0.4m).

After a tax charge of GBP0.2m primarily due to deferred tax on

the property plant equipment and changes in tax rate at which

deferred tax is recognised (2020: GBP0.1m) profit attributable to

shareholders of the group for the year was GBP1.0m (2020: GBP0.3m).

Earnings per share were 2.70p (2020 Restated: 0.89p).

Operating cash flows before movements in working capital and

other payables were GBP1.7m (2020 Restated: GBP1.4m). Working

capital increased by GBP0.3m (2020 Restated: GBP0.7m decrease)

following a increase in inventories, trade and other receivables

and trade and other payables. Contributions of GBP0.4m (2020:

GBP0.4m) were made to the defined benefit pension scheme in line

with the agreement reached with the trustees based on the 2017

actuarial valuation. Capital expenditure of GBP1.3m (2020 Restated:

GBP0.2m) related to the group's investment new machinery to help

with the development of new product ranges.

The group had GBP5.7m of cash on hand as at 31st December 2021

(2020: GBP6.6m). In 2020 the group borrowed GBP2.75m under the

government Coronavirus Business Interruption Loan Scheme, as of

31st December 2021 the amount outstanding was GBP2.4m (2020:

GBP2.75m). Following the six-month capital repayment holiday, the

group recommenced repayments on the existing long-term loan taken

out to acquire shares for the Employee Benefit Trust, with GBP0.8m

of the loan repaid during the year. This loan is unsecured and

repayable over three years in equal quarterly instalments with two

instalments remaining. The group has access to further liquidity of

GBP1.0m via our unutilised facility (2020:

GBP1.0m unutilised).

We continue to preserve cash to protect against unforeseen

circumstances in these difficult times. However, as an appreciation

of our shareholder support and patience, through these exacting

trading periods, we propose a total dividend of GBP0.2m or 0.4p per

share (2020: GBPnil). This proposal is subject to shareholder

approval.

Key performance indicators

As part of its internal financial control procedures the board

monitors the key financial metrics of revenue, operating profit,

gross margin, working capital (debtor and creditor days), inventory

turns and cash. These KPI's are reviewed in comparison to previous

year and the budget and analysis undertaken to establish trends and

variances. For the year ended 31st December 2021, operating profit

return on sales was 8.3% (2020: 4.8%), return on net operating

assets was 6.7% (2020: 3.8%) and working capital to sales

percentage was 57.7% (2020: 63.5%).

Principal risks and uncertainties

The board has responsibility for determining the nature and

extent of the risks it is willing to take in achieving its

strategic objectives and ensuring that risks are managed

effectively across the group. The board and the management team

meet regularly to discuss the business and the risks that it faces.

Risks are identified as being principally based on the likelihood

of occurrence and potential impact on the group. The group's

principal risks, which remain consistent with the prior year, are

identified below, together with a description of how the group

mitigates those risks.

The key operational risk facing the business continues to be the

competitive nature of the markets for the group's products. To

mitigate this risk the group seeks to improve existing products,

introduce new products and achieve high levels of customer service

and efficiency to attempt to differentiate from the

competition.

The current unrest in Ukraine presents significant uncertainty

for the upcoming financial year with an unknown impact of the

conflict, particularly on international sales performance and on

the costs and availability of raw materials and their impact on the

group's performance. However, the group is well placed to mitigate

these risks through its diversified sales base and by drawing on

the experience gained navigating similar supply chain issues during

the past 2 years when the group was able to remain open for

business.

Most of the group's revenue arises from trade with flooring

contractors and fit out companies. The activity levels within this

customer base are determined by consumer demand which is created

through a wide range of commercial refurbishment and new build

projects. The general level of activity in these underlying markets

has the potential to affect the demand for products supplied by the

group and is subject to seasonal variations and the economic

environment. The group mitigates these factors by closely

monitoring sales trends and taking appropriate action early, along

with strengthening the product range and developing new channels to

market, both at home and abroad, to grow demand across a wider

range of markets and help negate the impact of seasonality.

The group operates a defined benefit pension scheme. At present,

in aggregate, there is an actuarial surplus between the value of

the projected liabilities of this scheme and the assets they hold.

This actuarial surplus has been fully provided for and not

recognised due to the group not having an unconditional right to

the funds. The amount of the assets and liabilities may be

adversely affected by changes in several factors, including

investment returns, long-term interest rate and price inflation

expectations and anticipated members' longevity. Adverse changes in

the pension scheme position may require the group to recommence

cash contributions to the scheme, thereby reducing cash available

to meet the group's other operating, investing and financing

requirements. The performance and risk management of the group's

pension scheme and recovery plan are regularly reviewed by both the

group and the trustees of the scheme, taking actuarial and

investment advice as appropriate. The results of these reviews are

discussed with the board and appropriate action taken. Following

the triennial funding valuation of the group's pension scheme as at

1st July 2020, a revised deficit recovery plan was agreed. Under

the plan the company are not required to make any annual

contributions and to continue a strategy of gradual reduction in

investment risk. The next triennial funding valuation will be due

up to 1st July 2023.

Other risks

Raw material costs are a significant constituent of overall

product cost and are impacted by global commodity markets.

Significant fluctuations in raw material costs can have a material

impact on profitability. The group continuously seeks out

opportunities to develop a robust and competitive supply base,

substitute new materials, agree fixed pricing where possible,

source material with improved and shortened lead times and closely

monitors selling prices and margins adjusting when necessary.

The global nature of the group's business means it is exposed to

volatility in currency exchange rates in respect of foreign

currency denominated transactions, the most significant being the

euro. In order to protect itself against currency fluctuations the

group has taken advantage of the opportunity to naturally hedge

euro revenue with euro payments utilising foreign currency bank

accounts. No transactions of a speculative nature are undertaken.

Other risks include the availability of necessary materials,

business interruption and the duty of care to our employees,

customers and the wider public. These risks are managed through the

combination of quality assurance and health and safety procedures

and insurance cover.

Management and personnel

We continue to recognise the hard work and dedication our staff

have applied during the continued challenges of working through the

COVID-19 pandemic and uncertainty it has brought to them and their

families. We look forward to the contribution they can make going

forward in the future of the company.

Current trading and future prospects

The continued investment in our successful commercial flooring

business provides significant opportunities for profitable growth;

however, the current economic environment and the Ukrainian

conflict continue to put global raw material prices and supply

chains under pressure. The group has flexibility and can continue

to adapt to these unprecedented times and will continue to invest

in new products throughout 2022 based upon our confidence in the

prospects of the business.

MARTIN TOOGOOD RYAN THOMAS

Chairman Group Finance Director 12(th) April 2022

Enquiries:

Ryan Thomas 01924 266561

Group Finance Director

Peter Steel 020 7496 3061

Singer Capital Markets

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

The financial information set out in the announcement does not

constitute the group's statutory accounts for the 12 month period

ended 31 December 2021 or the 12 month period ended 31 December

2020. The financial information for the 12 month period ended 31

December 2020 is derived from the statutory accounts for that year

which have been delivered to the Registrar of Companies. The

auditors reported on those accounts; their report was unqualified

and did not include any statement under s498(2) or s498(3) of the

Companies Act 2006. The consolidated balance sheet at 31 December

2021, the consolidated income statement, the consolidated statement

of comprehensive income, the consolidated cash flow statement, the

consolidated statement of changes in equity and the segmental

reporting for the 12 month period then ended have been extracted

from the Group's 2021 statutory financial statements upon which the

auditor's opinion is unqualified and does not include any statement

under s498(2) or s498(3) of the Companies Act 2006.

The announcement has been agreed with the company's auditor for

release.

Consolidated Income Statement

Year ended 31 December 2021

Year ended Year ended

31 December 31 December

2021 2020

GBP'000 GBP'000

Continuing Operations

Revenue 15,865 14,554

Operating costs (14,832) (14,136)

Other operating income 280 280

Operating profit before valuation gain 1,313 698

Unrealised valuation gain 275 125

--------------------------------------------- ------------ ------------

Operating profit 1,588 823

Finance income 8 7

Finance costs (305) (376)

_______ _______

Profit before taxation 1,291 454

Taxation (249) (109)

_______ _______

Profit attributable to shareholders of the

group 1,042 345

_______ _______

Consolidated Statement of Comprehensive Income

Year ended 31 December 2021

2021 2021 2020 2020

GBP GBP GBP GBP

Profit attributable to

shareholders of the group 1,042 345

Items that will not be

classified to profit or

loss

Actuarial gain/(loss) recognised

in the pension scheme 1,599 (389)

Related deferred taxation (380) 74

Revaluation of property 166 37

Related deferred taxation (32) (4)

Total other comprehensive

income/(loss) 1,353 (282)

Total comprehensive income

attributable to shareholders

of the group 2,395 63

------ ------ ------ --------

Consolidated Balance Sheet

Year ended 31 December 2021

2021 2021 2020 2020

GBP'000 GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and

equipment 5,305 4,202

Intangible assets 55 54

Investment property 4,000 3,725

Deferred tax asset 720 920

Right-of-use-asset 972 1,086

_______ _______

11,052 9,987

Current assets

Inventories 6,150 5,622

Trade and other receivables 1,887 1,735

Cash and cash equivalents 5,688 6,555

_______ _______

13,725 13,912

_______ _______

Total assets 24,777 23,899

_______ _______

Current liabilities

Trade and other payables (3,258) (2,895)

Provisions (245) (465)

Lease liabilities (124) (243)

Loans and borrowings (935) (1,071)

_______ _______

(4,562) (4,674)

Non-current liabilities

Deferred tax (1,031) (609)

Pension deficit - (1,789)

Lease liabilities (183) (188)

Loans and borrowings (2,592) (2,641)

_______ _______

(3,806) (5,227)

_______ _______

Total liabilities (8,368) (9,901)

_______ _______

Net assets 16,409 13,998

_______ _______

Equity

Called up share capital 10,339 10,339

Share premium account 504 504

Own shares (555) (1,197)

Share based payment

reserve 157 141

Capital redemption reserve 3,617 3,617

Revaluation reserve 3,150 3,014

Retained earnings (803) (2,420)

_______ _______

Total equity 16,409 13,998

_______ _______

Consolidated Cash Flow Statement

Year ended 31 December 2021

Year ended Year ended

31 December 31 December

2021 2020

GBP'000 GBP'000

Cash flows from operating activities

Profit for the year 1,042 345

Depreciation 276 228

Depreciation of right-of-use-assets 250 270

Amortisation 30 38

Movement in provisions (220) 145

Share based payment expense 16 56

Net finance costs 297 369

Tax charge 249 109

Unrealised valuation gain (275) (125)

------------ ------------

_______ _______

_______ _______

Operating cash flows before movements in

working capital 1,665 1,435

Increase in inventories (528) (161)

(Increase)/decrease in trade and other

receivables (152) 433

Increase in trade and other payables 347 467

--------------------------------------------------- ------------ ------------

_______ _______

_______ _______

Cash generated from operations 1,332 2,174

Contributions to defined benefit pension

scheme (400) (400)

_______ _______

Net cash generated from operating activities 932 1,774

Cash flows from investing activities

Payments to acquire intangible fixed assets (31) (53)

Payments to acquire tangible fixed assets (1,236) (164)

--------------------------------------------------- ------------ ------------

_______ _______

_______ _______

Net cash used in generated from investing

activities (1,267) (217)

Cash flows from financing activities

Interest paid on lease liabilities (12) (15)

Interest paid on borrowings (83) (33)

Interest received 8 7

Proceeds from loan and borrowings - 2,750

Proceeds from asset financing 934 -

Principal paid on lease liabilities (260) (344)

Repayment of loans (1,119) (324)

--------------------------------------------------- ------------ ------------

_______ _______

Net cash (used)/received in financing activities (532) 2,041

_______ _______

Net (decrease)/increase in cash and cash

equivalents (867) 3,598

Cash and cash equivalents at start of the

year 6,555 2,957

_______ _______

Cash and cash equivalents at end of the

year 5,688 6,555

_______ _______

Consolidated Statement of Changes in Equity

Year ended 31 December 2021

Share Capital

Share premium Share Share redemption Revaluation Retained Total

capital account based Option reserve reserve earnings equity

payment

reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------------------------------- ------------ --------------- ---------- --------------- --------------- ----------- ------------

At 1st January 2020 10,339 504 (1,839) 85 3,617 3,048 (1,875) 13,879

Comprehensive income for

the year

Profit for the year - - - - - - 345 345

Actuarial loss recognised

on the pension scheme - - - - - - (315) (315)

Revaluation of property

- - - - - - 33 33

---------------------------------------------------- ------------ --------------- ---------- --------------- --------------- ----------- ------------

Total comprehensive income

for the year - - - - - - 63 63

Contributions by and

distributions to owners

Share based payment - - - 56 - - - 56

Own Shares Transfer - - 642 - - - (642) -

Revaluation Reverse Transfer

- - - - - (34) 34 -

---------------------------------------------------- ------------ --------------- ---------- --------------- --------------- ----------- ------------

Total contributions by and

distributions to owners

- - 642 56 - (34) (608) 56

---------------------------------------------------- ------------ --------------- ---------- --------------- --------------- ----------- ------------

At 31st December 2020 10,339 504 (1,197) 141 3,617 3,014 (2,420) 13,998

At 1st January 2021

Comprehensive income for

the year

Profit for the year - - - - - - 1,042 1,042

Actuarial gain recognised

on the pension scheme - - - - - - 1,219 1,219

Revaluation of property

- - - - - 166 (32) 134

---------------------------------------------------- ------------ --------------- ---------- --------------- --------------- ----------- ------------

Total comprehensive income

for the year - - - - - 166 2,229 2,395

Contributions by and

distributions to owners

Share based payment - - - 16 - - - 16

Own Shares Transfer - - 642 - - - (642) -

Revaluation Reserve Transfer

- - - - - (30) 30 -

---------------------------------------------------- ------------ --------------- ---------- --------------- --------------- ----------- ------------

Total contributions by and

distributions to owners

- - 642 16 - (30) (612) 16

---------------------------------------------------- ------------ --------------- ---------- --------------- --------------- ----------- ------------

At 31st December 2021 10,339 504 (555) 157 3,617 3,150 (803) 16,409

---------------------------------------------------- ------------ --------------- ---------- --------------- --------------- ----------- ------------

In accordance with Rule 20 of the AIM Rules, Airea confirms that

the annual report and accounts for the year ended 31 December 2021

and notice of Annual General Meeting ("AGM") and related proxy form

will be available to view on the Company's website at

www.aireaplc.co.uk on 12 April 2022 and will be posted to

shareholders by 21 April 2022. The AGM will be held on 17th May

2022, at 2.00 p.m. at the Cedar Court Hotel (Huddersfield), Lindley

Moor Road, Ainley Top, Huddersfield, HD3 3RH. Further details are

set out in the notice of the AGM available within the financial

statements which can be viewed on the group's website.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR GPUGWCUPPGMG

(END) Dow Jones Newswires

April 12, 2022 02:00 ET (06:00 GMT)

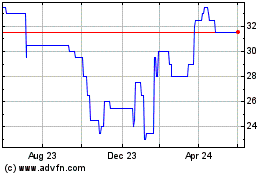

Airea (AQSE:AIEA.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Airea (AQSE:AIEA.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025