Additional Proxy Soliciting Materials (definitive) (defa14a)

April 13 2020 - 5:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for Use of the Commission Only (as

permitted by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive Proxy Statement

|

|

|

x

|

Definitive Additional Materials

|

|

|

¨

|

Soliciting Material Pursuant to §240.14a-12

|

|

TRILOGY METALS INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required.

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials:

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

SUPPLEMENT TO MANAGEMENT INFORMATION

CIRCULAR

RELATING TO 2020 ANNUAL MEETING OF SHAREHOLDERS

This supplement to the management information

circular should be read together with the management information circular (the “Circular”) of Trilogy Metals Inc. (the

“Company”), filed with the Securities and Exchange Commission on March 30, 2020 in connection with the Company’s

2020 Annual Meeting of Stockholders to be held at the Company’s corporate office located at Suite 1150, 609 Granville, Vancouver,

British Columbia Canada V7Y 1G5 on Thursday, May 28, 2020 at 9:00 a.m. (Vancouver time).

The purpose of this filing is to update information contained

in the Circular relating to the “broker non-vote” voting rules that apply to “Proposal 1 - Setting the Number

of Directors at Eight” (“Proposal One”). As further discussed below, the Circular stated that with respect to

Proposal One, a broker who has received no instructions from its clients does not have discretion to vote its clients’ uninstructed

shares on that proposal, thus resulting in a broker non-vote with respect to such uninstructed shares (such proposals being commonly

referred to as “non-routine” matters). The Company has since been advised by the New York Stock Exchange that it considers

Proposal One to be a “routine” matter and that a broker who has received no instructions from its clients will have

discretion to vote its clients’ uninstructed shares on that proposal in addition to the proposal on ratification of the selection

of our independent auditor.

Background

Broker non-votes occur with respect to

shares held in “street name” (i.e., by a broker) in cases where the broker does not receive voting instructions from

its clients and the broker does not have the authority to vote those shares. The rules of the New York Stock Exchange applicable

to brokers determine whether a broker has authority to vote on a proposal if the broker does not receive voting instructions from

its client. The broker may vote on proposals that are determined to be “routine” under these rules and may not vote

on proposals that are determined to be “non-routine” under these rules. If a proposal is determined to be routine,

a broker who has received no voting instructions from its client with respect to that proposal has discretion to vote the client’s

uninstructed shares on that proposal. If a proposal is determined to be non-routine, a broker who has received no voting instructions

from its client with respect to that proposal does not have discretion to vote the client’s uninstructed shares on that proposal.

Proposal One Vote Requirements

With respect to Proposal One, the affirmative

vote of a majority of the votes cast is required for the approval of the proposal. Abstentions will have no effect. Proposal One

is a “routine” matter and, as such, a broker will have discretion to vote on Proposal One if the broker has received

no voting instructions from its clients with respect to that proposal. However, despite the fact that Proposal One is considered

to be a routine matter allowing for discretionary voting by brokers, if you hold your shares in street name the Company still encourages

you to instruct your broker or other nominee how to vote.

Except as specifically supplemented by

the information contained herein, all information set forth in the Circular remains unchanged, and all voting requirements otherwise

remain the same. From and after the date of this supplement, all references to the “Circular” are to the Circular as

supplemented hereby.

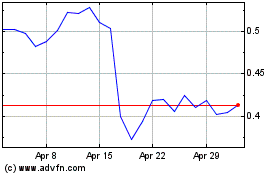

Trilogy Metals (AMEX:TMQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

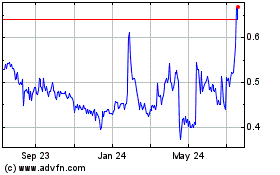

Trilogy Metals (AMEX:TMQ)

Historical Stock Chart

From Jul 2023 to Jul 2024