0001005817false00010058172025-01-312025-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of earliest event reported) | January 31, 2025 |

Tompkins Financial Corporation

| | |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| New York | 1-12709 | 16-1482357 |

(State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | | | | | | | | | | |

118 E. Seneca Street, | PO Box 460, | Ithaca | New York | 14851 |

| (Address of Principal executive offices) | (Zip Code) |

| | | | | | | | |

| Registrant’s telephone number, including area code | (607) | 273-3210 |

| | |

|

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.10 par value | TMP | NYSE American, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On January 31, 2025, Tompkins Financial Corporation, (the “Company”) issued a press release announcing its earnings for the calendar quarter ended December 31, 2024. A copy of the press release is attached to this Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information furnished under Items 2.02 and Item 9.01 of this Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2 to this Report on Form 8-K, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liabilities under the Section, nor shall it be deemed incorporated by reference in any registration statement or other filings of the Company under the Securities Act of 1933, as amended, except as shall be set forth by specific reference in such filing.

Item 8.01 Other Events

On January 30, 2024, the Company's Board of Directors declared a dividend of $0.62 per share, payable on February 21, 2025, to common shareholders of record on February 14, 2025. A copy of the press release is attached to this Report on Form 8-K as Exhibit 99.2.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | |

| (a) | Not applicable. |

| (b) | Not applicable. |

| (c) | Not applicable. |

| (d) | Exhibits. |

EXHIBIT INDEX

Exhibit No. Description

99.1 Press Release of Tompkins Financial Corporation dated January 31, 2025 99.2 Press Release of Tompkins Financial Corporation dated January 31, 2025 104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

TOMPKINS FINANCIAL CORPORATION

Date: January 31, 2025 /s/ Stephen S. Romaine

Stephen S. Romaine

President and CEO

For more information contact:

Stephen S. Romaine, President & CEO

Matthew Tomazin, Executive VP, CFO & Treasurer

Tompkins Financial Corporation (888) 503-5753

For Immediate Release

Friday, January 31, 2025

Tompkins Financial Corporation Reports Cash Dividend

ITHACA, NY - Tompkins Financial Corporation (NYSE American:TMP)

Tompkins Financial Corporation announced today that its Board of Directors approved payment of a regular quarterly cash dividend of $0.62 per share, payable on February 21, 2025, to common shareholders of record on February 14, 2025.

Tompkins Financial Corporation is a banking and financial services company serving the Central, Western, and Hudson Valley regions of New York and the Southeastern region of Pennsylvania. Headquartered in Ithaca, NY, Tompkins Financial is parent to Tompkins Community Bank and Tompkins Insurance Agencies, Inc., and offers wealth management services through Tompkins Financial Advisors. For more information on Tompkins Financial, visit www.tompkinsfinancial.com.

For more information contact:

Stephen S. Romaine, President & CEO

Matthew Tomazin, Executive VP, CFO & Treasurer

Tompkins Financial Corporation (888) 503-5753

For Immediate Release

Friday, January 31, 2025

Tompkins Financial Corporation Reports Increased Fourth Quarter Financial Results

ITHACA, NY - Tompkins Financial Corporation (NYSE American: TMP)

Tompkins Financial Corporation ("Tompkins" or the "Company") reported diluted earnings per share of $1.37 for the fourth quarter of 2024, up 5.4% and 30.5% compared to the immediate prior quarter and the fourth quarter of 2023, respectively. Net income for the fourth quarter of 2024 was $19.7 million, up $1.0 million or 5.5% compared to the third quarter of 2024, and up $4.7 million, or 31.0%, when compared to the fourth quarter of 2023.

For the year ended December 31, 2024, diluted earnings per share of $4.97 were up 653.0% compared to the year ended December 31, 2023. Net income for 2024 was $70.9 million, an increase of $61.3 million compared to 2023. The 2023 results included an after-tax loss of $52.9 million or $3.69 loss per diluted share, related to the sale of $510.5 million of available-for-sale debt securities. Earnings performance for 2024 benefited from increased net interest income, growth in fee-based businesses and lower operating expenses.

Tompkins President and CEO, Stephen Romaine, commented, "We are pleased to report increased earnings for the year and fourth quarter of 2024. Our improved results were driven by growth in revenue and lower operating expense. Revenue growth was broad and supported by strong loan growth, deposit growth, and growth in our fee-based businesses. Our fourth quarter ended the year with 9.4% annualized loan growth, 14 basis points of net interest margin expansion and improving profitability metrics. We look forward to the new year as we believe we remain well positioned to continue to drive growth through quality customer relationships."

SELECTED HIGHLIGHTS FOR THE PERIOD:

•Net interest margin for the fourth quarter of 2024 was 2.93%, improved from the immediate prior quarter of 2.79%, and 2.82% for the same period of 2023.

•Total average cost of funds of 1.88% for the fourth quarter of 2024 was down 13 basis points compared to the third quarter of 2024, as a result of funding mix and lower interest rates.

•Total fee-based services (insurance, wealth management, service charges on deposit accounts and cards) revenues for the fourth quarter of 2024 were up $1.3 million or 7.7% compared to the fourth quarter of 2023.

•Total noninterest expenses for the fourth quarter of 2024 were in line with the third quarter of 2024, and down $1.3 million or 2.6% compared to the fourth quarter of 2023.

•Total loans at December 31, 2024 were up $138.7 million, or 2.4% compared to September 30, 2024 (9.4% on an annualized basis), and up $414.0 million, or 7.4%, from December 31, 2023.

•Total deposits at December 31, 2024 were $6.5 billion, down $106.1 million, or 1.6%, from September 30, 2024, and up $72.0 million, or 1.1%, from December 31, 2023.

•Loan to deposit ratio at December 31, 2024 was 93.0%, compared to 89.4% at September 30, 2024, and 87.6% at December 31, 2023.

•Regulatory Tier 1 capital to average assets was 9.27% at December 31, 2024, up compared to 9.19% at September 30, 2024, and 9.08% at December 31, 2023.

NET INTEREST INCOME

Net interest income was $56.3 million for the fourth quarter of 2024, up $3.1 million or 5.8% compared to the third quarter of 2024, and up $3.9 million or 7.5% compared to the fourth quarter of 2023. The increase in net interest income compared to the third quarter of 2024 was due to improvement in net interest margin, which is explained further below, and an increase in average loan balances. The increase when compared to the fourth quarter of 2023 was due to increases in both average loan balances and average loan yields, and was partially offset by higher average funding costs.

For the year ended December 31, 2024, net interest income was $211.1 million, an increase of $1.6 million or 0.8% when compared to the year ended December 31, 2023. The increase reflects growth in average loan balances and higher yields on average earning assets, partially offset by higher average cost of funds.

Net interest margin was 2.93% for the fourth quarter of 2024, up 14 basis points when compared to the immediate prior quarter, and up 11 basis points from 2.82% for the fourth quarter of 2023. The increase in net interest margin, when compared to the most recent prior quarter, was mainly due to lower funding costs resulting from growth in average deposits and lower market rates. The increase in net interest margin when compared to the same period prior year was mainly a result of higher yields on average interest earning assets and higher average loan balances, and was partially offset by higher average funding costs.

Average loans for the quarter ended December 31, 2024 were up $100.9 million, or 1.7%, from the third quarter of 2024, and were up $445.1 million, or 8.1%, compared to the prior year period. The increase in average loans over both prior periods was mainly in the commercial real estate and commercial and industrial portfolios. The average yield on interest-earning assets for the quarter ended December 31, 2024 was 4.67%, a slight increase

from 4.66% for the quarter ended September 30, 2024, and up from 4.34% for the quarter ended December 31, 2023.

Average total deposits of $6.6 billion for the fourth quarter of 2024 were up $217.3 million, or 3.4%, compared to the third quarter of 2024, and up $91.9 million or 1.4% compared to the same period in 2023. The cost of interest-bearing deposits of 2.31% for the fourth quarter of 2024 was down 4 basis points from 2.35% for the third quarter of 2024, and up 27 basis points from 2.04% for the fourth quarter of 2023. The ratio of average noninterest bearing deposits to average total deposits for the fourth quarter of 2024 was 28.0% compared to 28.9% for the third quarter of 2024, and 29.6% for the fourth quarter of 2023. The average cost of interest-bearing liabilities for the fourth quarter of 2024 of 2.53% represents a decrease of 18 basis points over the third quarter of 2024, and an increase of 28 basis points over the same period in 2023.

NONINTEREST INCOME

Noninterest income of $20.8 million for the fourth quarter of 2024 was up $2.0 million or 10.5% compared to the same period in 2023. The increase in quarterly noninterest income when compared to the same period in 2023 was mainly due to increases in fee-based revenues, which includes insurance commissions and fees, up $698,000 or 9.0%; wealth management fees, up $456,000 or 10.3%; service charges on deposit accounts, up $81,000 or 4.6%; and card services income, up $60,000 or 2.1%. Other income was up $763,000 or 38.6% for the quarter ended December 31, 2024 compared to the same period in 2023, and included increases in gains on loan sales and derivative swap fee income.

Noninterest income of $88.1 million for the year ended December 31, 2024 was up $77.9 million or 760.5% compared to the year ended December 31, 2023. The increase in noninterest income compared to 2023 was mainly due to the $70.0 million pre-tax loss on the sale of available-for-sale debt securities in 2023 as discussed above. Also contributing to the increase for the year ended December 31, 2024 over the prior year were fee-based revenues, which includes insurance commissions and fees, up $1.7 million or 4.7%; wealth management fees, up $1.6 million or 9.1%; service charges on deposit accounts, up $375,000 or 5.4%; and card services income, up $569,000 or 5.0%. Other income was up $3.6 million for the year ended December 31, 2024 compared to 2023, and included increases in gains on loan sales, derivative swap fee income and earnings on bank-owned life insurance.

NONINTEREST EXPENSE

Noninterest expense was $50.0 million for the fourth quarter of 2024, down $1.3 million or 2.6% compared to the fourth quarter of 2023. Other operating expenses for the quarter were down $3.0 million or 20.4% from the same period prior year and included decreases in technology, down $1.1 million; marketing, down $665,000; other losses, down $364,000; and professional fees, down $242,000. Noninterest expense for the year ended December 31, 2024 was $199.6 million, a decrease of $3.7 million or 1.8% compared to the $203.3 million reported for 2023. The year-over-year decrease was mainly driven by lower other operating expenses, which were down $5.1 million or 9.1% and included decreases in technology, down $1.3 million; marketing, down $1.2 million; professional fees, down $1.0 million; retirement plan expense, down $709,000; and travel and

meeting expense, down $667,000. Partially offsetting these decreases, FDIC insurance expense was up $1.4 million or 32.5% year-over-year.

INCOME TAX EXPENSE

The provision for income tax expense for the fourth quarter of 2024 was $6.0 million for an effective rate of 23.5%, compared to a provision for tax expense of $3.1 million and an effective rate of 17.2% for the same quarter in 2023. For the year ended December 31, 2024, the provision for income tax expense was $22.0 million and the effective tax rate was 23.7% compared to tax expense of $2.5 million and an effective tax rate of 20.6% for 2023. Increased tax expense for both the quarter and year-to-date periods in 2024 was mainly a result of lower income in 2023 associated with the loss on the sale of securities described above.

In 2024, the Company's average assets exceeded the $8.0 billion threshold for receiving certain New York State tax benefits associated with the Company’s real estate investment trust (“REIT”) subsidiaries. Therefore, the Company did not recognize any tax benefit in connection with the REITs in 2024. In the fourth quarter of 2024, the Company’s bank subsidiary approved the dissolution of the REITs.

ASSET QUALITY

The allowance for credit losses represented 0.94% of total loans and leases at December 31, 2024, unchanged compared to the most recent prior quarter, and up from 0.92% reported at December 31, 2023. The year over year increase in the allowance for credit losses coverage ratio includes changes for qualitative factors relating to loan growth and asset quality, model assumptions changes, and updates to economic forecasts for unemployment and GDP. The increase in allowance for credit losses was partially offset by lower off-balance sheet reserves due to model changes related to utilization rates and a decrease in loan pipeline. The ratio of the allowance to total nonperforming loans and leases was 111.06% at December 31, 2024, compared to 88.51% at September 30, 2024, and 82.84% at December 31, 2023. The increase in the ratio compared to the same prior year period was due to the decrease in nonperforming loans and leases discussed in more detail below.

Provision for credit losses for the fourth quarter of 2024 was $1.4 million compared to $1.8 million for the same period in 2023. Provision for credit losses for the year ended December 31, 2024 was $6.6 million compared to $4.3 million for the year ended December 31, 2023. The increase in provision expense for the full year compared to 2023 was mainly driven by loan growth, an increase in net charge-offs and model assumption updates. Net charge-offs for the three months and year ended December 31, 2024 were $857,000 and $2.5 million, respectively, compared to net charge-offs of $410,000 and net recoveries of $721,000 for the same periods in 2023.

Nonperforming assets represented 0.80% of total assets at December 31, 2024, unchanged from December 31, 2023 but up slightly compared to 0.78% at September 30, 2024. At December 31, 2024, nonperforming loans and leases totaled $50.9 million, compared to $62.6 million at September 30, 2024 and $62.3 million at December 31, 2023. The decrease in nonperforming loans and leases at December 31, 2024 compared to December 31, 2023 was due to one commercial real estate loan for $14.2 million being moved from

nonperforming loans to other real estate owned. The increase in loans past due 30-89 days at December 31, 2024 compared to prior quarter end and December 31, 2023 was mainly due to the inclusion of a $17.4 million commercial real estate loan.

Special Mention and Substandard loans and leases totaled $111.1 million at December 31, 2024, compared to $126.0 million reported at September 30, 2024, and $123.1 million reported at December 31, 2023. The decrease was mainly due to the reclassification of one commercial real estate loan from nonperforming loans to other real estate owned as mentioned above.

CAPITAL POSITION

Capital ratios at December 31, 2024 remained well above the regulatory minimums for well-capitalized institutions. The ratio of total capital to risk-weighted assets was 13.07% at December 31, 2024, compared to 13.21% at September 30, 2024, and 13.36% at December 31, 2023. The decrease in the ratio is mainly a result of loan growth during the fourth quarter of 2024. The ratio of Tier 1 capital to average assets was 9.27% at December 31, 2024, compared to 9.19% at September 30, 2024, and 9.08% at December 31, 2023.

LIQUIDITY POSITION

The Company's liquidity position at December 31, 2024 was stable and consistent with the immediate prior quarter end. Liquidity is enhanced by ready access to national and regional wholesale funding sources including Federal funds purchased, repurchase agreements, brokered deposits, Federal Reserve Bank's Discount Window advances and Federal Home Loan Banks (FHLB) advances. The Company maintained ready access to liquidity of $1.3 billion, or 16.4% of total assets at December 31, 2024.

ABOUT TOMPKINS FINANCIAL CORPORATION

Tompkins Financial Corporation is a banking and financial services company serving the Central, Western, and Hudson Valley regions of New York and the Southeastern region of Pennsylvania. Headquartered in Ithaca, NY, Tompkins Financial is parent to Tompkins Community Bank and Tompkins Insurance Agencies, Inc. Tompkins Community Bank provides a full array of wealth management services under the Tompkins Financial Advisors brand, including investment management, trust and estate, financial and tax planning services. For more information on Tompkins Financial, visit www.tompkinsfinancial.com.

"Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995:

This press release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The statements contained in this press release that are not statements of historical fact may include forward-looking statements that involve a number of risks and uncertainties. Forward-looking statements may be identified by use of such words as "may", "will", "estimate", "intend", "continue", "believe", "expect", "plan", "commit", or "anticipate", as well as the negative and other variations of these terms and other similar words. Examples of forward-looking statements may include statements regarding the sufficiency of existing collateral to cover exposure related to nonperforming loans and future growth. Forward-looking statements are made based on management’s expectations and beliefs concerning future events impacting the

Company and are subject to uncertainties and factors relating to the Company’s operations and economic environment, all of which are difficult to predict and many of which are beyond the control of the Company, that could cause actual results of the Company to differ materially from those expressed and/or implied by forward-looking statements and historical performance. The following factors, in addition to those listed as Risk Factors in Item 1A in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q as filed with the Securities and Exchange Commission, are among those that could cause actual results to differ materially from the forward-looking statements and historical performance: changes in general economic, market and regulatory conditions; our ability to attract and retain deposits and other sources of liquidity; gross domestic product growth and inflation trends; the impact of the interest rate and inflationary environment on the Company's business, financial condition and results of operations; other income or cash flow anticipated from the Company's operations, investment and/or lending activities; changes in laws and regulations affecting banks, bank holding companies and/or financial holding companies, including the Dodd-Frank Act, and state and local government mandates; the impact of any change in the FDIC insurance assessment rate or the rules and regulations related to the calculation of the FDIC insurance assessment amount; increased supervisory and regulatory scrutiny of financial institutions; technological developments and changes; cybersecurity incidents and threats; the ability to continue to introduce competitive new products and services on a timely, cost-effective basis; governmental and public policy changes, including environmental regulation; reliance on large customers; the ability to access financial resources in the amounts, at the times, and on the terms required to support the Company's future businesses; and the economic impact, including potential market volatility, of national and global events, including the response to bank failures, war and geopolitical matters (including the war in Israel and surrounding regions and the war in Ukraine), widespread protests, civil unrest, political uncertainty, and pandemics or other public health crises. The Company does not undertake any obligation to update its forward-looking statements.

| | | | | | | | |

| TOMPKINS FINANCIAL CORPORATION |

| CONSOLIDATED STATEMENTS OF CONDITION |

(In thousands, except share and per share data) (Unaudited) | As of | As of |

| ASSETS | 12/31/2024 | 12/31/2023 |

| | (Audited) |

| | |

| Cash and noninterest bearing balances due from banks | $ | 53,635 | | $ | 67,212 | |

| Interest bearing balances due from banks | 80,763 | | 12,330 | |

| Cash and Cash Equivalents | 134,398 | | 79,542 | |

| | |

| Available-for-sale debt securities, at fair value (amortized cost of $1,367,123 at December 31, 2024 and $1,548,482 at December 31, 2023) | 1,231,532 | | 1,416,650 | |

| Held-to-maturity debt securities, at amortized cost (fair value of $267,295 at December 31, 2024 and $267,455 at December 31, 2023) | 312,462 | | 312,401 | |

| Equity securities, at fair value | 768 | | 787 | |

| Total loans and leases, net of unearned income and deferred costs and fees | 6,019,922 | | 5,605,935 | |

| Less: Allowance for credit losses | 56,496 | | 51,584 | |

| Net Loans and Leases | 5,963,426 | | 5,554,351 | |

| | |

| Federal Home Loan Bank and other stock | 42,255 | | 33,719 | |

| Bank premises and equipment, net | 76,626 | | 79,687 | |

| Corporate owned life insurance | 76,448 | | 67,884 | |

| Goodwill | 92,602 | | 92,602 | |

| Other intangible assets, net | 2,203 | | 2,327 | |

| Accrued interest and other assets | 176,360 | | 179,799 | |

| Total Assets | $ | 8,109,080 | | $ | 7,819,749 | |

| LIABILITIES | | |

| Deposits: | | |

| Interest bearing: | | |

| Checking, savings and money market | 3,558,946 | | 3,484,878 | |

| Time | 1,068,375 | | 998,013 | |

| Noninterest bearing | 1,844,484 | | 1,916,956 | |

| Total Deposits | 6,471,805 | | 6,399,847 | |

| | |

| Federal funds purchased and securities sold under agreements to repurchase | 37,036 | | 50,996 | |

| Other borrowings | 790,247 | | 602,100 | |

| | |

| Other liabilities | 96,548 | | 96,872 | |

| Total Liabilities | $ | 7,395,636 | | $ | 7,149,815 | |

| EQUITY | | |

| Tompkins Financial Corporation shareholders' equity: | | |

| Common Stock - par value $.10 per share: Authorized 25,000,000 shares; Issued: 14,468,013 at December 31, 2024; and 14,441,830 at December 31, 2023 | 1,447 | | 1,444 | |

| Additional paid-in capital | 300,073 | | 297,183 | |

| Retained earnings | 537,157 | | 501,510 | |

| Accumulated other comprehensive loss | (118,492) | | (125,005) | |

| Treasury stock, at cost – 131,497 shares at December 31, 2024, and 132,097 shares at December 31, 2023 | (6,741) | | (6,610) | |

| Total Tompkins Financial Corporation Shareholders’ Equity | 713,444 | | 668,522 | |

| Noncontrolling interests | 0 | | 1,412 | |

| Total Equity | $ | 713,444 | | $ | 669,934 | |

| Total Liabilities and Equity | $ | 8,109,080 | | $ | 7,819,749 | |

| | |

| | | | | | | | | | | | | | | | | |

| TOMPKINS FINANCIAL CORPORATION | | |

| CONSOLIDATED STATEMENTS OF INCOME | | |

| (In thousands, except per share data) (Unaudited) | Three Months Ended | Year Ended |

| 12/31/2024 | 09/30/2024 | 12/31/2023 | 12/31/2024 | 12/31/2023 |

| INTEREST AND DIVIDEND INCOME | | | | | |

| Loans | $ | 78,911 | | $ | 77,814 | | $ | 69,035 | | $ | 301,970 | | $ | 260,434 | |

| Due from banks | 235 | | 168 | | 227 | | 741 | | 674 | |

| Available-for-sale debt securities | 8,760 | | 9,037 | | 9,717 | | 36,779 | | 29,677 | |

| Held-to-maturity debt securities | 1,222 | | 1,222 | | 1,222 | | 4,881 | | 4,876 | |

| Federal Home Loan Bank and other stock | 894 | | 888 | | 584 | | 3,203 | | 1,697 | |

| Total Interest and Dividend Income | 90,022 | | $ | 89,129 | | $ | 80,785 | | $ | 347,574 | | $ | 297,358 | |

| INTEREST EXPENSE | | | | | |

| Time certificates of deposits of $250,000 or more | 4,698 | | 4,158 | | 3,949 | | 16,914 | | 11,421 | |

| Other deposits | 22,856 | | 22,553 | | 19,526 | | 87,069 | | 59,387 | |

| | | | | |

| Federal funds purchased and securities sold under agreements to repurchase | 11 | | 11 | | 14 | | 46 | | 58 | |

| | | | | |

| Other borrowings | 6,176 | | 9,214 | | 4,937 | | 32,443 | | 16,978 | |

| Total Interest Expense | 33,741 | | 35,936 | | 28,426 | | 136,472 | | 87,844 | |

| Net Interest Income | 56,281 | | 53,193 | | 52,359 | | 211,102 | | 209,514 | |

| Less: Provision for credit loss expense | 1,411 | | 2,174 | | 1,761 | | 6,611 | | 4,339 | |

| Net Interest Income After Provision for Credit Loss Expense | 54,870 | | 51,019 | | 50,598 | | 204,491 | | 205,175 | |

| NONINTEREST INCOME | | | | | |

| Insurance commissions and fees | 8,471 | | 11,283 | | 7,773 | | 39,100 | | 37,351 | |

| Wealth management fees | 4,878 | | 4,925 | | 4,422 | | 19,589 | | 17,951 | |

| Service charges on deposit accounts | 1,854 | | 1,872 | | 1,773 | | 7,288 | | 6,913 | |

| Card services income | 2,919 | | 2,921 | | 2,859 | | 12,057 | | 11,488 | |

| Other income | 2,740 | | 2,299 | | 1,977 | | 10,061 | | 6,511 | |

| Net gain (loss) on securities transactions | (33) | | 85 | | 46 | | 32 | | (69,973) | |

| Total Noninterest Income | 20,829 | | 23,385 | | 18,850 | | 88,127 | | 10,241 | |

| NONINTEREST EXPENSE | | | | | |

| Salaries and wages | 25,870 | | 25,664 | | 23,710 | | 101,150 | | 97,370 | |

| Other employee benefits | 7,429 | | 6,276 | | 6,626 | | 26,661 | | 27,333 | |

| Net occupancy expense of premises | 2,873 | | 3,065 | | 3,544 | | 12,634 | | 13,278 | |

| Furniture and fixture expense | 1,834 | | 1,797 | | 2,425 | | 7,666 | | 8,663 | |

| Amortization of intangible assets | 90 | | 86 | | 84 | | 332 | | 334 | |

| Other operating expense | 11,870 | | 12,989 | | 14,911 | | 51,199 | | 56,314 | |

| Total Noninterest Expenses | 49,966 | | 49,877 | | 51,300 | | 199,642 | | 203,292 | |

| Income Before Income Tax Expense | 25,733 | | 24,527 | | 18,148 | | 92,976 | | 12,124 | |

| Income Tax Expense | 6,045 | | 5,858 | | 3,114 | | 22,003 | | 2,495 | |

| Net Income Attributable to Noncontrolling Interests and Tompkins Financial Corporation | 19,688 | | 18,669 | | 15,034 | | 70,973 | | 9,629 | |

| Less: Net Income Attributable to Noncontrolling Interests | 30 | | 31 | | 31 | | 123 | | 124 | |

| Net Income Attributable to Tompkins Financial Corporation | $ | 19,658 | | 18,638 | | 15,003 | | 70,850 | | 9,505 | |

| Basic Earnings Per Share | $ | 1.38 | | $ | 1.31 | | $ | 1.06 | | $ | 4.98 | | $ | 0.66 | |

| Diluted Earnings Per Share | $ | 1.37 | | $ | 1.30 | | $ | 1.05 | | $ | 4.97 | | $ | 0.66 | |

| | | | | | | | | | | | | | | | | | | | |

| Average Consolidated Statements of Condition and Net Interest Analysis (Unaudited) |

| Quarter Ended | Quarter Ended |

| December 31, 2024 | September 30, 2024 |

| Average | | | Average | | |

| Balance | | Average | Balance | | Average |

| (Dollar amounts in thousands) | (QTD) | Interest | Yield/Rate | (QTD) | Interest | Yield/Rate |

| ASSETS | | | | | | |

| Interest-earning assets | | | | | | |

| Interest-bearing balances due from banks | $ | 19,065 | | $ | 235 | | 4.90 | % | $ | 13,189 | | $ | 168 | | 5.07 | % |

Securities1 | | | | | | |

| U.S. Government securities | 1,619,973 | | 9,471 | | 2.33 | % | 1,664,611 | | 9,740 | | 2.33 | % |

| | | | | | |

State and municipal2 | 86,481 | | 557 | | 2.56 | % | 87,799 | | 560 | | 2.54 | % |

| Other securities | 3,287 | | 55 | | 6.66 | % | 3,282 | | 60 | | 7.27 | % |

| Total securities | 1,709,741 | | 10,083 | | 2.35 | % | 1,755,692 | | 10,360 | | 2.35 | % |

| FHLBNY and FRB stock | 30,665 | | 894 | | 11.60 | % | 38,534 | | 888 | | 9.17 | % |

Total loans and leases, net of unearned income2,3 | 5,931,771 | | 79,126 | | 5.31 | % | 5,830,899 | | 78,040 | | 5.32 | % |

| Total interest-earning assets | 7,691,242 | | 90,338 | | 4.67 | % | 7,638,314 | | 89,456 | | 4.66 | % |

| Other assets | 282,490 | | | | 276,610 | | | |

| Total assets | $ | 7,973,732 | | | | $ | 7,914,924 | | | |

| LIABILITIES & EQUITY | | | | | | |

| Deposits | | | | | | |

| Interest-bearing deposits | | | | | | |

| Interest bearing checking, savings, & money market | $ | 3,661,006 | | $ | 17,223 | | 1.87 | % | $ | 3,509,116 | | $ | 16,635 | | 1.89 | % |

| Time deposits | 1,076,300 | | 10,331 | | 3.82 | % | 1,016,949 | | 10,076 | | 3.94 | % |

| Total interest-bearing deposits | 4,737,306 | | 27,554 | | 2.31 | % | 4,526,065 | | 26,711 | | 2.35 | % |

| Federal funds purchased & securities sold under agreements to repurchase | 39,519 | | 11 | | 0.11 | % | 42,449 | | 11 | | 0.10 | % |

| Other borrowings | 534,219 | | 6,176 | | 4.60 | % | 709,474 | | 9,214 | | 5.17 | % |

| | | | | | |

| Total interest-bearing liabilities | 5,311,044 | | 33,741 | | 2.53 | % | 5,277,988 | | 35,936 | | 2.71 | % |

| Noninterest bearing deposits | 1,844,772 | | | | 1,838,725 | | | |

| Accrued expenses and other liabilities | 101,370 | | | | 101,679 | | | |

| Total liabilities | 7,257,186 | | | | 7,218,392 | | | |

| Tompkins Financial Corporation Shareholders’ equity | 715,299 | | | | 695,057 | | | |

| Noncontrolling interest | 1,247 | | | | 1,475 | | | |

| Total equity | 716,546 | | | | 696,532 | | | |

| | | | | | |

| Total liabilities and equity | $ | 7,973,732 | | | | $ | 7,914,924 | | | |

| Interest rate spread | | | 2.15 | % | | | 1.95 | % |

| Net interest income (TE)/margin on earning assets | | 56,597 | | 2.93 | % | | 53,520 | | 2.79 | % |

| | | | | | |

| Tax Equivalent Adjustment | | (316) | | | | (327) | | |

| Net interest income | | $ | 56,281 | | | | $ | 53,193 | | |

| | | | | | | | | | | | | | | | | | | | |

| Average Consolidated Statements of Condition and Net Interest Analysis (Unaudited) |

| Quarter Ended | Quarter Ended |

| December 31, 2024 | December 31, 2023 |

| Average | | | Average | | |

| Balance | | Average | Balance | | Average |

| (Dollar amounts in thousands) | (QTD) | Interest | Yield/Rate | (QTD) | Interest | Yield/Rate |

| ASSETS | | | | | | |

| Interest-earning assets | | | | | | |

| Interest-bearing balances due from banks | $ | 19,065 | | $ | 235 | | 4.90 | % | $ | 14,351 | | $ | 227 | | 6.28 | % |

Securities1 | | | | | | |

| U.S. Government securities | 1,619,973 | | 9,471 | | 2.33 | % | 1,789,043 | | 10,411 | | 2.31 | % |

| | | | | | |

State and municipal2 | 86,481 | | 557 | | 2.56 | % | 90,070 | | 574 | | 2.53 | % |

| Other securities | 3,287 | | 55 | | 6.66 | % | 3,242 | | 60 | | 7.37 | % |

| Total securities | 1,709,741 | | 10,083 | | 2.35 | % | 1,882,355 | | 11,045 | | 2.33 | % |

| FHLBNY and FRB stock | 30,665 | | 894 | | 11.60 | % | 24,555 | | 584 | | 9.44 | % |

Total loans and leases, net of unearned income2,3 | 5,931,771 | | 79,126 | | 5.31 | % | 5,486,715 | | 69,197 | | 5.00 | % |

| Total interest-earning assets | 7,691,242 | | 90,338 | | 4.67 | % | 7,407,976 | | 81,053 | | 4.34 | % |

| Other assets | 282,490 | | | | 259,006 | | | |

| Total assets | $ | 7,973,732 | | | | $ | 7,666,982 | | | |

| LIABILITIES & EQUITY | | | | | | |

| Deposits | | | | | | |

| Interest-bearing deposits | | | | | | |

| Interest bearing checking, savings, & money market | $ | 3,661,006 | | $ | 17,223 | | 1.87 | % | $ | 3,643,919 | | $ | 14,915 | | 1.62 | % |

| Time deposits | 1,076,300 | | 10,331 | | 3.82 | % | 925,790 | | 8,560 | | 3.67 | % |

| Total interest-bearing deposits | 4,737,306 | | 27,554 | | 2.31 | % | 4,569,709 | | 23,475 | | 2.04 | % |

| Federal funds purchased & securities sold under agreements to repurchase | 39,519 | | 11 | | 0.11 | % | 51,903 | | 14 | | 0.10 | % |

| Other borrowings | 534,219 | | 6,176 | | 4.60 | % | 398,932 | | 4,937 | | 4.91 | % |

| Total interest-bearing liabilities | 5,311,044 | | 33,741 | | 2.53 | % | 5,020,544 | | 28,426 | | 2.25 | % |

| Noninterest bearing deposits | 1,844,772 | | | | 1,920,510 | | | |

| Accrued expenses and other liabilities | 101,370 | | | | 103,648 | | | |

| Total liabilities | 7,257,186 | | | | 7,044,702 | | | |

| Tompkins Financial Corporation Shareholders’ equity | 715,299 | | | | 620,789 | | | |

| Noncontrolling interest | 1,247 | | | | 1,491 | | | |

| Total equity | 716,546 | | | | 622,280 | | | |

| | | | | | |

| Total liabilities and equity | $ | 7,973,732 | | | | $ | 7,666,982 | | | |

| Interest rate spread | | | 2.15 | % | | | 2.09 | % |

| Net interest income (TE)/margin on earning assets | | 56,597 | | 2.93 | % | | 52,627 | | 2.82 | % |

| | | | | | |

| Tax Equivalent Adjustment | | (316) | | | | (268) | | |

| Net interest income | | $ | 56,281 | | | | $ | 52,359 | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Average Consolidated Statements of Condition and Net Interest Analysis (Unaudited) |

| Year to Date Period Ended | Year to Date Period Ended |

| December 31, 2024 | December 31, 2023 |

| Average | | | Average | | |

| Balance | | Average | Balance | | Average |

| (Dollar amounts in thousands) | (YTD) | Interest | Yield/Rate | (YTD) | Interest | Yield/Rate |

| ASSETS | | | | | | |

| Interest-earning assets | | | | | | |

| Interest-bearing balances due from banks | $ | 14,052 | | $ | 741 | | 5.27 | % | $ | 13,064 | | $ | 674 | | 5.16 | % |

| Securities1 | | | | | | |

| U.S. Government securities | 1,689,411 | | 39,580 | | 2.34 | % | 1,920,678 | | 32,432 | | 1.69 | % |

| | | | | | |

State and municipal2 | 88,414 | | 2,254 | | 2.55 | % | 91,407 | | 2,338 | | 2.56 | % |

| Other securities | 3,277 | | 235 | | 7.17 | % | 3,272 | | 229 | | 6.99 | % |

| Total securities | 1,781,102 | | 42,069 | | 2.36 | % | 2,015,357 | | 35,000 | | 1.74 | % |

| FHLBNY and FRB stock | 35,369 | | 3,203 | | 9.06 | % | 22,284 | | 1,697 | | 7.63 | % |

Total loans and leases, net of unearned income2,3 | 5,768,575 | | 302,780 | | 5.25 | % | 5,357,699 | | 261,144 | | 4.87 | % |

| Total interest-earning assets | 7,599,098 | | 348,793 | | 4.59 | % | 7,408,404 | | 298,515 | | 4.03 | % |

| Other assets | 276,241 | | | | 233,268 | | | |

| Total assets | $ | 7,875,339 | | | | $ | 7,641,672 | | | |

| LIABILITIES & EQUITY | | | | | | |

| Deposits | | | | | | |

| Interest-bearing deposits | | | | | | |

| Interest bearing checking, savings, & money market | $ | 3,553,942 | | $ | 64,647 | | 1.82 | % | $ | 3,697,780 | | $ | 46,820 | | 1.27 | % |

| Time deposits | 1,017,532 | | 39,336 | | 3.87 | % | 793,709 | | 23,988 | | 3.02 | % |

| Total interest-bearing deposits | 4,571,474 | | 103,983 | | 2.27 | % | 4,491,489 | | 70,808 | | 1.58 | % |

| Federal funds purchased & securities sold under agreements to repurchase | 42,752 | | 46 | | 0.11 | % | 55,773 | | 58 | | 0.10 | % |

| Other borrowings | 638,721 | | 32,443 | | 5.08 | % | 363,530 | | 16,978 | | 4.67 | % |

| | | | | | |

| Total interest-bearing liabilities | 5,252,947 | | 136,472 | | 2.60 | % | 4,910,792 | | 87,844 | | 1.79 | % |

| Noninterest bearing deposits | 1,838,036 | | | | 1,994,861 | | | |

| Accrued expenses and other liabilities | 98,542 | | | | 101,287 | | | |

| Total liabilities | 7,189,525 | | | | 7,006,940 | | | |

| Tompkins Financial Corporation Shareholders’ equity | 684,417 | | | | 633,267 | | | |

| Noncontrolling interest | 1,397 | | | | 1,465 | | | |

| Total equity | 685,814 | | | | 634,732 | | | |

| | | | | | |

| Total liabilities and equity | $ | 7,875,339 | | | | $ | 7,641,672 | | | |

| Interest rate spread | | | 1.99 | % | | | 2.24 | % |

| Net interest income (TE)/margin on earning assets | | 212,321 | | 2.79 | % | | 210,671 | | 2.84 | % |

| | | | | | |

| Tax Equivalent Adjustment | | (1,219) | | | | (1,157) | | |

| Net interest income | | $ | 211,102 | | | | $ | 209,514 | | |

Tompkins Financial Corporation - Summary Financial Data (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| (In thousands, except per share data) | | | | | | |

| Quarter-Ended | Year-Ended |

| Period End Balance Sheet | Dec-24 | Sep-24 | Jun-24 | Mar-24 | Dec-23 | Dec-24 |

| Securities | $ | 1,544,762 | | $ | 1,622,526 | | $ | 1,630,654 | | $ | 1,679,542 | | $ | 1,729,838 | | $ | 1,544,762 | |

| Total Loans | 6,019,922 | | 5,881,261 | | 5,761,864 | | 5,640,524 | | 5,605,935 | | 6,019,922 | |

| Allowance for credit losses | 56,496 | | 55,384 | | 53,059 | | 51,704 | | 51,584 | | 56,496 | |

| Total assets | 8,109,080 | | 8,006,427 | | 7,869,522 | | 7,778,034 | | 7,819,749 | | 8,109,080 | |

| Total deposits | 6,471,805 | | 6,577,896 | | 6,285,896 | | 6,449,616 | | 6,399,847 | | 6,471,805 | |

| Federal funds purchased and securities sold under agreements to repurchase | 37,036 | | 67,506 | | 35,989 | | 43,681 | | 50,996 | | 37,036 | |

| Other borrowings | 790,247 | | 539,327 | | 773,627 | | 522,600 | | 602,100 | | 790,247 | |

| | | | | | |

| Total common equity | 713,444 | | 719,855 | | 674,630 | | 667,906 | | 668,522 | | 713,444 | |

| Total equity | 713,444 | | 721,348 | | 676,093 | | 669,338 | | 669,934 | | 713,444 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

|

| | | | | | |

| | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Average Balance Sheet | | | | | | |

| Average earning assets | $ | 7,691,242 | | $ | 7,638,314 | | $ | 7,547,689 | | $ | 7,517,705 | | $ | 7,407,976 | | $ | 7,599,098 | |

| Average assets | 7,973,732 | | 7,914,924 | | 7,810,061 | | 7,801,125 | | 7,666,982 | | 7,875,339 | |

| Average interest-bearing liabilities | 5,311,044 | | 5,277,988 | | 5,215,003 | | 5,206,836 | | 5,020,544 | | 5,252,947 | |

| Average equity | 716,546 | | 696,532 | | 662,969 | | 666,752 | | 622,280 | | 685,814 | |

| | | | | | | | | | | | | | | | | | | | |

| Share data | | | | | | |

| Weighted average shares outstanding (basic) | 14,230,297 | | 14,215,607 | | 14,214,574 | | 14,211,910 | | 14,194,503 | | 14,218,106 | |

| Weighted average shares outstanding (diluted) | 14,312,497 | | 14,283,255 | | 14,239,626 | | 14,238,357 | | 14,246,024 | | 14,268,443 | |

| Period-end shares outstanding | 14,436,363 | | 14,394,255 | | 14,395,204 | | 14,405,019 | | 14,405,920 | | 14,436,363 | |

| Common equity book value per share | $ | 49.42 | | $ | 50.01 | | $ | 46.86 | | $ | 46.37 | | $ | 46.41 | | $ | 49.42 | |

| Tangible book value per share (Non-GAAP)** | $ | 42.93 | | $ | 43.50 | | $ | 40.35 | | $ | 39.85 | | $ | 39.88 | | $ | 42.93 | |

| **See "Non-GAAP measures" below for a discussion of non-GAAP financial measures and a reconciliation of non-GAAP financial measures to the most directly comparable financial measures presented in accordance with GAAP. |

| | | | | | |

|

| | | | | | | | | | | | | | | | | | | | |

| Income Statement | | | | | | |

| Net interest income | $ | 56,281 | | $ | 53,193 | | $ | 50,953 | | $ | 50,675 | | $ | 52,359 | | $ | 211,102 | |

| Provision for credit loss expense | 1,411 | | 2,174 | | 2,172 | | 854 | | 1,761 | | 6,611 | |

| Noninterest income | 20,829 | | 23,385 | | 21,776 | | 22,137 | | 18,850 | | 88,127 | |

| Noninterest expense | 49,966 | | 49,877 | | 49,942 | | 49,857 | | 51,300 | | 199,642 | |

| Income tax expense | 6,045 | | 5,858 | | 4,902 | | 5,198 | | 3,114 | | 22,003 | |

| Net income attributable to Tompkins Financial Corporation | 19,658 | | 18,638 | | 15,682 | | 16,872 | | 15,003 | | 70,850 | |

| Noncontrolling interests | 30 | | 31 | | 31 | | 31 | | 31 | | 123 | |

Basic earnings per share4 | 1.38 | | 1.31 | | 1.10 | | 1.19 | | 1.06 | | 4.98 | |

Diluted earnings per share4 | 1.37 | | 1.30 | | 1.10 | | 1.18 | | 1.05 | | 4.97 | |

| | | | | | | | | | | | | | | | | | | | |

| Nonperforming Assets | | | | | | |

| Nonaccrual loans and leases | $ | 50,548 | | $ | 62,381 | | $ | 62,253 | | $ | 62,544 | | $ | 62,165 | | $ | 50,548 | |

| Loans and leases 90 days past due and accruing | 323 | | 193 | | 215 | | 151 | | 101 | | 323 | |

| | | | | | |

| Total nonperforming loans and leases | 50,871 | | 62,574 | | 62,468 | | 62,695 | | 62,266 | | 50,871 | |

| OREO | 14,314 | | 81 | | 80 | | 0 | | 131 | | 14,314 | |

| Total nonperforming assets | $ | 65,185 | | $ | 62,655 | | $ | 62,548 | | $ | 62,695 | | $ | 62,397 | | $ | 65,185 | |

Tompkins Financial Corporation - Summary Financial Data (Unaudited) - continued

| | | | | | | | | | | | | | | | | | | | |

| Quarter-Ended | Year-Ended |

| Delinquency - Total loan and lease portfolio | Dec-24 | Sep-24 | Jun-24 | Mar-24 | Dec-23 | Dec-24 |

| Loans and leases 30-89 days past due and | | | | | | |

| accruing | $ | 28,828 | | $ | 7,031 | | $ | 5,286 | | $ | 8,015 | | $ | 4,210 | | $ | 28,828 | |

| Loans and leases 90 days past due and accruing | 323 | | 193 | | 215 | | 151 | | 101 | | 323 | |

| Total loans and leases past due and accruing | 29,151 | | 7,224 | | 5,501 | | 8,166 | | 4,311 | | 29,151 | |

| | | | | | | | | | | | | | | | | | | | |

| Allowance for Credit Losses |

| Balance at beginning of period | $ | 55,384 | | $ | 53,059 | | $ | 51,704 | | $ | 51,584 | | $ | 49,336 | | $ | 51,584 | |

| | | | | | |

| Provision for credit losses | 1,969 | | 3,237 | | 1,864 | | 348 | | 2,658 | | $ | 7,418 | |

| Net loan and lease charge-offs (recoveries) | 857 | | 912 | | 509 | | 228 | | 410 | | $ | 2,506 | |

| Allowance for credit losses at end of period | $ | 56,496 | | $ | 55,384 | | $ | 53,059 | | $ | 51,704 | | $ | 51,584 | | $ | 56,496 | |

| | | | | | |

| Allowance for Credit Losses - Off-Balance Sheet Exposure |

| Balance at beginning of period | $ | 2,021 | | $ | 3,084 | | $ | 2,776 | | $ | 2,270 | | $ | 3,167 | | $ | 2,270 | |

| (Credit) provision for credit losses | (558) | | (1,063) | | 308 | | 506 | | (897) | | $ | (807) | |

| Allowance for credit losses at end of period | $ | 1,463 | | $ | 2,021 | | $ | 3,084 | | $ | 2,776 | | $ | 2,270 | | $ | 1,463 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Loan Classification - Total Portfolio | | | | | | |

| Special Mention | $ | 36,923 | | $ | 58,758 | | $ | 48,712 | | $ | 46,302 | | $ | 50,368 | | $ | 36,923 | |

| Substandard | 74,163 | | 67,261 | | 67,509 | | 72,412 | | 72,717 | | 74,163 | |

Ratio Analysis

| | | | | | | | | | | | | | | | | | | | |

| Credit Quality | | | | | | |

| Nonperforming loans and leases/total loans and leases | 0.85 | % | 1.06 | % | 1.08 | % | 1.11 | % | 1.11 | % | 0.85 | % |

| Nonperforming assets/total assets | 0.80 | % | 0.78 | % | 0.79 | % | 0.81 | % | 0.80 | % | 0.80 | % |

| Allowance for credit losses/total loans and leases | 0.94 | % | 0.94 | % | 0.92 | % | 0.92 | % | 0.92 | % | 0.94 | % |

| Allowance/nonperforming loans and leases | 111.06 | % | 88.51 | % | 84.94 | % | 82.47 | % | 82.84 | % | 111.06 | % |

| Net loan and lease losses (recoveries) annualized/total average loans and leases | 0.06 | % | 0.06 | % | 0.04 | % | 0.02 | % | 0.03 | % | 0.04 | % |

| | | | | | | | | | | | | | | | | | | | |

| Capital Adequacy | | | | | | |

| Tier 1 Capital (to average assets) | 9.27 | % | 9.19 | % | 9.15 | % | 9.08 | % | 9.08 | % | 9.27 | % |

| Total Capital (to risk-weighted assets) | 13.07 | % | 13.21 | % | 13.26 | % | 13.43 | % | 13.36 | % | 13.07 | % |

| | | | | | | | | | | | | | | | | | | | |

| Profitability (period-end) | | | | | | |

| Return on average assets * | 0.98 | % | 0.94 | % | 0.81 | % | 0.87 | % | 0.78 | % | 0.90 | % |

| Return on average equity * | 10.91 | % | 10.65 | % | 9.51 | % | 10.18 | % | 9.56 | % | 10.33 | % |

| Net interest margin (TE) * | 2.93 | % | 2.79 | % | 2.73 | % | 2.73 | % | 2.82 | % | 2.79 | % |

| Average yield on interest-earning assets* | 4.67 | % | 4.66 | % | 4.56 | % | 4.47 | % | 4.34 | % | 4.59 | % |

| Average cost of deposits* | 1.67 | % | 1.67 | % | 1.61 | % | 1.54 | % | 1.43 | % | 1.62 | % |

| Average cost of funds* | 1.88 | % | 2.01 | % | 1.96 | % | 1.86 | % | 1.62 | % | 1.92 | % |

| * Quarterly ratios have been annualized |

Tompkins Financial Corporation - Summary Financial Data (Unaudited) - continued

Non-GAAP Measures

This press release contains financial information determined by methods other than in accordance with U.S. generally accepted accounting principles (GAAP). Where non-GAAP disclosures are used in this press release, the comparable GAAP measure, as well as reconciliation to the comparable GAAP measure, is provided in the below tables. The Company believes the non-GAAP measures provide meaningful comparisons of our underlying operational performance and facilitate management's and investors' assessments of business and performance trends in comparison to others in the financial services industry. These non-GAAP financial measures should not be considered in isolation or as a measure of the Company's profitability or liquidity; they are in addition to, and are not a substitute for, financial measures under GAAP. The non-GAAP financial measures presented herein may be different from non-GAAP financial measures used by other companies, and may not be comparable to similarly titled measures reported by other companies. Further, the Company may utilize other measures to illustrate performance in the future. Non-GAAP financial measures have limitations since they do not reflect all of the amounts associated with the Company's results of operations as determined in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Tangible Book Value Per Share (non-GAAP) to Common Equity Book Value Per Share (GAAP) |

| Quarter-Ended | Year-Ended |

| Dec-24 | Sep-24 | Jun-24 | Mar-24 | Dec-23 | Dec-24 |

| Common equity book value per share (GAAP) | $ | 49.42 | | $ | 50.01 | | $ | 46.86 | | $ | 46.37 | | $ | 46.41 | | $ | 49.42 | |

| Total common equity | $ | 713,444 | | $ | 719,855 | | $ | 674,630 | | $ | 667,906 | | $ | 668,522 | | $ | 713,444 | |

| Less: Goodwill and intangibles | 93,670 | 93,760 | 93,847 | 93,926 | 94,003 | 93,670 | |

| Tangible common equity (Non-GAAP) | 619,774 | | 626,095 | | 580,783 | | 573,980 | | 574,519 | | 619,774 | |

| Ending shares outstanding | 14,436,363 | | 14,394,255 | | 14,395,204 | | 14,405,019 | | 14,405,920 | | 14,436,363 | |

| Tangible book value per share (Non-GAAP) | $ | 42.93 | | $ | 43.50 | | $ | 40.35 | | $ | 39.85 | | $ | 39.88 | | $ | 42.93 | |

1 Average balances and yields on available-for-sale securities are based on historical amortized cost.

2 Interest income includes the tax effects of taxable-equivalent adjustments using an effective income tax rate of 21% in 2024 and 2023 to increase tax exempt interest income to taxable-equivalent basis.

3 Nonaccrual loans are included in the average asset totals presented above. Payments received on nonaccrual loans have been recognized as disclosed in Note 1 of the Company's consolidated financial statements included in Part I of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

4 Earnings per share for the full fiscal year may not equal the sum of the quarterly earnings per share as a result of rounding of average shares.

v3.24.4

Cover Page

|

Jan. 31, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 31, 2025

|

| Entity Registrant Name |

Tompkins Financial Corp

|

| Entity Incorporation, State or Country Code |

NY

|

| Entity File Number |

1-12709

|

| Entity Tax Identification Number |

16-1482357

|

| Entity Address, Address Line One |

118 E. Seneca Street,

|

| Entity Address, Address Line Two |

PO Box 460,

|

| Entity Address, City or Town |

Ithaca

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

14851

|

| City Area Code |

(607)

|

| Local Phone Number |

273-3210

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.10 par value

|

| Trading Symbol |

TMP

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001005817

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

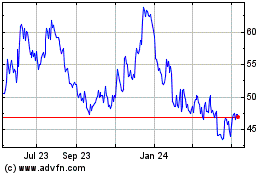

Tompkins Financial (AMEX:TMP)

Historical Stock Chart

From Jan 2025 to Feb 2025

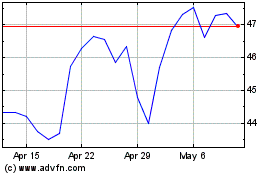

Tompkins Financial (AMEX:TMP)

Historical Stock Chart

From Feb 2024 to Feb 2025