The agricultural commodity market experienced quite the volatile

2012, thanks to the massive drought in the Midwest growing region

last summer that resulted in lower yield and steeper price

increases for grains like corn and soybean.

With a majority of agricultural land affected by drought, total

crop production was the least in several years, hampering not only

crops, but livestock as well (See: Beyond Corn: Three Commodity

ETFs Surging this Summer).

In short, the highly volatile agricultural commodity market is

largely a function of weather and thus subject to extreme

volatility. Below is what we see in store for corn, wheat, and

soybean in 2013:

Imbalance May Drive Prices, But….

The persisting drought condition in some top corn-harvesting

states will affect this year’s production and should raise prices

in early 2013. Per the USDA, retail food price inflation has

averaged 2.5%–3% each year on average for the past 20 years. But

the Department has warned of a slight increase from the historical

averages in 2013.

For the 2012/13 year, USDA forecasted total corn supplies at

around 11.8 billion bushels, 13% lower year over year and soybean

meal prices in the range of $455––$485 per short ton, up from an

estimated $394 per ton for the 2011/12 marketing year. In such a

backdrop, the global demand for grains will keep the prices firm in

the near term, but this is just one side of the coin.

Prices to Calm Down as the Year Moves

This scenario should reverse as the year progresses with easing

supply concerns and favorable weather conditions. Crops have

already seen its peak last year and could see a decline this year.

Further, anemic growth in the global economy and lingering concerns

over macro uncertainty, which might drag down overall agricultural

consumption in 2013.

There are also some external factors to regulate pricing like

the recent cancellation of a big U.S. soybean order by China, one

of the biggest importers of soybeans.

Now, industry sources are saying that China booked the soybeans

at a price well above current levels and called off the contract

watching the softening trend of prices. Soybean futures fell 2.0%

to a one-month low following the cancellation. In fact, the prices

began to simmer in September last year (See: Can the Soybean ETF

Continue its Bull Run?).

Corn and wheat prices are also trending lower with weak export

demand. The competitive scenario is also heating up.

Argentina, the second-largest corn exporter in the highest

number of years and currently enjoying relatively uninterrupted

weather conditions, remains a key exporter to world economies.

Coming to wheat, the product will likely see a supply surplus in

2013 as suggested by the report of USDA that says U.S. wheat ending

stocks for 2012/13 is anticipated to rise 50 million bushels mainly

due to a shrinkage in exports.

Higher global supplies stemming from China, Australia (see:

Australia ETF Investing 101) and Canada will pull down demand for

U.S. wheat and its prices. Relatively good harvest weather is

supporting foreign countries. Further, the recent rains in most

states could boost the supply/demand balance in favor of

production.

With this backdrop, some of the agricultural commodity ETNs

might very well be weak picks for investors in 2013. These are

Teucrium Soybean (SOYB), Teucrium

Corn (CORN), Teucrium Wheat

(WEAT), IPath DOW Jones UBS Grains Sub index (JJG)

and IPath DOW Jones UBS Grains Sub index (JJA).

But before considering selling these ETNs, let’s take a look at

each:

Ebbing Fourth Quarter 2012 Returns

While SOYB seeks to gain exposure in Soybean by investing in

futures contract of the underlying commodity, CORN invests in corn

futures contracts. Returns for both the products declined a

respective of 7.8% and 8.4% in the fourth quarter of 2012.

Most other funds are also on a downhill ride since New

Year’s Eve with a respective negative year-to-date return of 0.91%

and 1.99%. Meanwhile, WEAT has registered a sharp fall of 11.1% in

the fourth quarter while this year, it receded

3.14%.

Higher total expenses for these ETNs (including expense ratio

and bid/ask spread) also add to the woes, potentially making these

funds less attractive in the sector for play. The expense ratio for

SOYB is 2.08%, CORN is 1.49% and WEAT is 2.34% while bid-ask

spreads are average but can sometimes spike (currently they

are 0.11%, 0.06%, and 0.15%, respectively) (see Buy the Ultimate

Commodity with These Water ETFs).

Returns for one of the largest products in the agricultural

commodity space ─ JJG investing in three futures contracts on

grains ─ fell 10.6% in the fourth quarter and the uncertainty has

continued this year with modest losses.

Another high-asset ETN ─ JJA –– following the same trend which

is mainly exposed to Soybeans, corn and wheat collapsed 9.8% in the

year-end quarter with another round of losses noticed

year-to-date.

The market is abuzz with reports of short selling of corn crops

in 2013 with the purpose of repurchasing them at a lower price

afterwards. We believe, the time has come when the

agricultural commodity futures will begin to deteriorate and

chances for these products to gain is less (see Is USCI the Best

Commodity ETF?).

SOYB, CORN, JJG, JJA currently carry a Zacks #5 Rank (Strong

Sell rating) while WEAT retains a Zacks #4 Rank (short-term Sell

rating).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

TEUCRM-CORN FD (CORN): ETF Research Reports

IPATH-DJ-A AGG (JJA): ETF Research Reports

IPATH-DJ-A GRNS (JJG): ETF Research Reports

TEUCRM-SOYBEAN (SOYB): ETF Research Reports

TEUCRM-WHEAT FD (WEAT): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

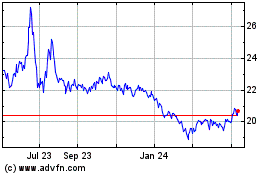

Teucrium Corn (AMEX:CORN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Teucrium Corn (AMEX:CORN)

Historical Stock Chart

From Dec 2023 to Dec 2024