Amended Statement of Beneficial Ownership (sc 13d/a)

February 09 2023 - 5:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 8)*

TELLURIAN INC.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

87968A104

(CUSIP Number)

Charif Souki

Tellurian Inc.

1201 Louisiana Street, Suite 3100

Houston, TX 77002

(832) 962-4000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

February 7, 2023

(Date of Event Which Requires Filing of This

Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f)

or 240.13d-1(g), check the following box. ¨

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 87968A104 |

Schedule 13D |

Page 2 of 5 |

| |

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS:

Charif Souki |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS):

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY: |

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS):

Not applicable |

| 5 |

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e):

¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION:

United States of America |

| |

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

P ERSON

WITH: |

|

7 |

|

SOLE VOTING POWER:

6,992,972 |

| |

8 |

|

SHARED VOTING POWER:

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER:

6,992,972 |

| |

10 |

|

SHARED DISPOSITIVE POWER:

0 |

| |

|

|

|

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

6,992,972 |

| 12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE

INSTRUCTIONS):

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

1.2%1 |

| 14 |

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS):

IN |

1 This percent of class figure is based upon 584,567,568

common shares outstanding as of December 23, 2022 (according to the prospectus supplement filed with the SEC on December 30, 2022).

| CUSIP No. 87968A104 |

Schedule 13D |

Page 3 of 5 |

Introductory Note

This Amendment No. 8 to Schedule 13D (the “Eighth Amended Schedule

13D”), filed by Charif Souki, (“Mr. Souki” or the “Reporting Person”), amends and supplements the Schedule

13D originally filed by Mr. Souki on February 21, 2017, as amended by Amendment No. 1 to Schedule 13D filed on behalf of Mr. Souki, the

Souki Family 2016 Trust (the “Trust”) and Brooke Peterson on March 20, 2017, Amendment No. 2 to Schedule 13D filed on behalf

of Mr. Souki, the Trust and Mr. Peterson on June 9, 2017, Amendment No. 3 to Schedule 13D filed on behalf of Mr. Souki, the Trust and

Mr. Peterson on October 30, 2017, Amendment No. 4 to Schedule 13D filed on behalf of Mr. Souki, the Trust and Mr. Peterson on March 13,

2018, Amendment No. 5 to Schedule 13D filed on behalf of Mr. Souki, the Trust and Mr. Peterson on April 16, 2019, Amendment No. 6 to Schedule

13D filed on behalf of Mr. Souki, the Trust and Mr. Peterson on July 22, 2019 (the “Sixth Amended Schedule 13D”), and Amendment

No. 7 to Schedule 13D filed on behalf of Mr. Souki, the Trust and Mr. Peterson on March 5, 2020 (the “Seventh Amendment”).2

Mr. Souki is filing this Eighth Amended Schedule 13D to report that Wilmington Trust, National Association (“Wilmington”)

exercised its right to become substituted as the shareholder of 25,000,000 shares of common stock, $0.01 par value per share (“Common

Stock”), of Tellurian Inc., a Delaware corporation (the “Issuer”), previously held in an account of Mr. Souki, all as

described further below in Item 6.

| Item 5. |

Interest in Securities of the Issuer. |

| |

(a) |

Shares owned by Mr. Souki: |

| |

|

|

| |

(i) |

Amount beneficially owned: 6,992,972 |

| |

|

|

|

|

| |

(ii) |

Percent of class: 1.2% |

| |

(b) |

Number of shares as to which Mr. Souki has: |

| |

(i) |

Sole power to vote or direct to vote: 6,992,972 |

| |

(ii) |

Shared power to vote or direct to vote: 0 |

| |

(iii) |

Sole power to dispose or to direct the disposition of: 6,992,972 |

| |

(iv) |

Shared power to dispose or to direct the disposition of: 0 |

2 As disclosed in the Seventh Amended Schedule 13D, on

March 4, 2020, Mr. Souki resigned as Trustee of the Trust and, as a result, ceased to beneficially own the shares held by the Trust.

| CUSIP No. 87968A104 |

Schedule 13D |

Page 4 of 5 |

| |

(c) |

Besides Wilmington becoming the

substituted shareholder of 25,000,000 shares of Common Stock reported in the introductory paragraph above and Item 6 below, the

Reporting Person has not entered into any transactions with respect to the Common Stock during the past 60 days except as set forth in the table below. |

| |

Date |

|

Reporting Person |

|

Person(s) Effecting Transactions |

Type |

|

Shares |

|

Price |

| |

|

|

|

|

|

|

|

|

|

|

| |

2/8/2023 |

|

Charif Souki |

|

Wilmington and/or lenders |

Sale |

|

1,793,194 |

|

$1.92(a) |

| (a) The price reported is a weighted average price. These shares were sold in multiple transactions

at prices ranging from $1.89 to $2.05, inclusive. The Reporting Person undertakes to provide to Tellurian Inc., any security holder

of Tellurian, or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of shares

sold at each separate price within the range set forth in footnote to Item 5(c) of this Eighth Amended Schedule 13D. |

| |

(d) |

Except for Wilmington, as pledgee, and the lenders under the Loan Agreement (defined below), no other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the shares being reported on this Eighth Amended Schedule 13D. |

| |

(e) |

Not applicable. |

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to the Securities of the Issuer. |

As previously disclosed in the Seventh Amended Schedule 13D, Mr. Souki

pledged 25,000,000 shares of Common Stock (“Pledged Shares”) as part of a collateral package to secure a loan for certain

real estate investments. The loan agreement, dated April 27, 2017, was entered into by Mr. Souki, as borrower, Wilmington, as administrative

agent, and various lenders (the “Loan Agreement”). On February 7, 2023, pursuant to the Loan Agreement and other loan documents,

Wilmington exercised its right as administrative agent to become a substituted shareholder with respect to the Pledged Shares transferred

into its account. Under one of the loan documents, Wilmington may dispose of the Pledged Shares at the time and in such manner that it

determines in its sole and absolute discretion, provided that Wilmington and the lenders agree to use their commercially reasonable efforts

to avoid any material disruption of the issuer’s stock price during the sale process. Starting on February 8, 2023, Wilmington and/or

the lenders have sold certain of the Pledged Shares and it is the Reporting Person’s understanding that they intend to continue

selling the Pledged Shares and applying the proceeds of such sales, net of fees and expenses, against amounts owed under the Loan Agreement.

| CUSIP No. 87968A104 |

Schedule 13D |

Page 5 of 5 |

Signatures

After reasonable inquiry and to the best knowledge and belief of the

undersigned, such person certifies that the information set forth in this Statement with respect to such person is true, complete and

correct.

| Date: February 9, 2023 |

Signature: |

/s/ Charif Souki |

| |

Name: |

Charif Souki |

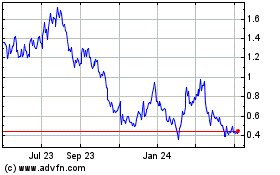

Tellurian (AMEX:TELL)

Historical Stock Chart

From Aug 2024 to Sep 2024

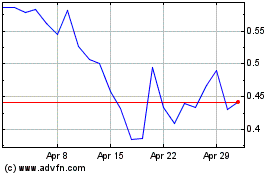

Tellurian (AMEX:TELL)

Historical Stock Chart

From Sep 2023 to Sep 2024