Tellurian Announces Public Offering of Senior Secured Notes

August 29 2022 - 7:32AM

Business Wire

Tellurian Inc. (Tellurian or the Company) (NYSE American: TELL)

today announced that it intends to offer and sell units consisting

of 11.25% senior secured notes due 2027 ($1,000 principal amount

per note) and warrants to purchase shares of Tellurian common stock

in an underwritten public offering. There can be no assurance as to

whether or when the offering may be completed, or as to the size or

terms of the offering. The Company intends to use the net proceeds

from the offering by contributing them to the Driftwood Project

entities to support the construction of the Driftwood Project.

B. Riley Securities, Inc. is acting as sole bookrunning manager

for the offering.

The offering is being made pursuant to an effective shelf

registration statement of the Company previously filed with the

Securities and Exchange Commission (the SEC). The offering may be

made only by means of a prospectus supplement and the accompanying

prospectus. Copies of the preliminary prospectus supplement for the

offering and the accompanying prospectus may be obtained by sending

a request to B. Riley Securities, Inc., Attention: Prospectus

Department, 1300 North 17th Street, Suite 1300, Arlington, Virginia

22209; Telephone: (703) 312-9580, or by emailing

prospectuses@brileyfin.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities, in any state or jurisdiction in which such offer,

solicitation or sale of these securities would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Tellurian Inc.

Tellurian is developing a portfolio of natural gas production,

LNG marketing and trading, and infrastructure that includes an ~

27.6 mtpa LNG export facility and an associated pipeline. Tellurian

is based in Houston, Texas, and its common stock is listed on the

NYSE American under the symbol “TELL.”

CAUTIONARY INFORMATION ABOUT FORWARD-LOOKING

STATEMENTS

Statements in this press release related to the Company’s public

offering of units and all other statements other than statements of

historical fact are forward-looking statements that are made

pursuant to the Safe Harbor Provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements are

subject to a number of risks and uncertainties that may cause

actual results to differ materially from the forward-looking

statements. Tellurian urges you to carefully review and consider

the cautionary statements made in this press release, the

registration statement, the “Risk Factors” section of the

preliminary prospectus supplement for the offering and of the

Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2021, and other filings with the SEC for further

information on risks and uncertainties that could affect the

Company’s business, financial condition and results of operations.

The Company cautions you not to place undue reliance on

forward-looking statements, which speak only as of the date made.

Tellurian undertakes no obligation to update any forward-looking

statements in order to reflect any event or circumstance occurring

after the date of this press release or currently unknown facts or

conditions or the occurrence of unanticipated events. All

forward-looking statements are qualified in their entirety by this

cautionary statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220828005037/en/

Media: Joi Lecznar EVP Public and Government Affairs

Phone +1.832.962.4044 joi.lecznar@tellurianinc.com

Investors: Matt Phillips Vice President, Investor

Relations Phone +1.832.320.9331

matthew.phillips@tellurianinc.com

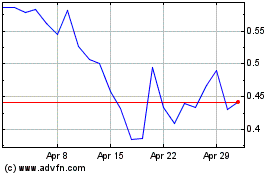

Tellurian (AMEX:TELL)

Historical Stock Chart

From Oct 2024 to Nov 2024

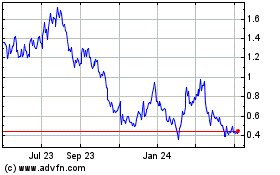

Tellurian (AMEX:TELL)

Historical Stock Chart

From Nov 2023 to Nov 2024