Will Google Glass Make You A Buyer of GOOG Stock? - Real Time Insight

May 09 2013 - 10:30AM

Zacks

Even though most of big tech has had a rocky year, shares of

Google (GOOG) have been powering ahead. The search

giant is now above $870/share, marking a nearly 40% gain over the

past 12 month period.

This is in stark contrast to many other names in the technology

world, such as Apple (AAPL),

Microsoft (MSFT) or even the

broad technology sector (XLK) in the same time

frame, as all of these options have paled in comparison to Google’s

return as of late. Thanks to this, many are now looking to GOOG as

the leader of the technology world and the best hope for growth

among the tech giants.

However, it is worth noting that GOOG could be facing some

headwinds in the near future. Some analysts are worried that search

revenue could be in trouble—as more consumers just buy on

Amazon (AMZN) instead of searching for a product

on Google—and that other avenues haven’t really paid off yet for

the company.

After all, the company is trading at a somewhat lofty forward PE

of 22, which seems a bit high for a nearly $300 billion company

that already has a stranglehold on its only real market. Analysts

are also mixed on the prospects in the near term, as the stock has

a Zacks Rank #3 (Hold) with EPS growth of just 2% predicted for

this quarter.

Change on the horizon?

Clearly if GOOG is going to continue to surge it will need to

find new ways to grow beyond desktop search and android phone

adoption. One such way that many are banking on is via Google

Glass.

Google glass is basically a wearable computing device that one

utilizes like glasses. It will run on an android operating system

and allow users to access a number of Google applications, take

videos and pictures, and run third-party apps as well.

Although the product is still in development, many analysts and

journalists have already developed strong opinions about the

product, its likely sales figures, and the widespread adoption of

the device.

On the high side, some are terming Glass as a gamechanging

product that could sell as many as 6.6 million units a year in

2016. Meanwhile, others are much less optimistic, declaring that

‘nobody likes Google Glass’ and that the sales estimates will fall

well short of estimates.

Bottom Line

Personally, I am more apt to believe in the high side estimates

and that Google Glass will be a key part of many consumers’

technology lives, and a major part of Google’s growth going

forward. The possible uses for the product are limitless, with

potential applications in industries like the military,

health care, and education just to name a few.

Still, many remain deeply skeptical of the product, predicting

that its adoption will be slowed by people not wanting to look

‘stupid’ wearing them (kind of like how some view those who use

Bluetooth headsets). Or that Glass will basically be a ‘Segway’

redux; a technological innovation billed as the next big thing that

only has found its way into niche markets.

But what do you think? Is Google Glass going to be a

transformative product and a key aspect of GOOG’s lineup, or a

Segway-like flop?

And, does this product change how you feel about Google’s stock

going forward?

Let us know in the comments below!

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

APPLE INC (AAPL): Free Stock Analysis Report

AMAZON.COM INC (AMZN): Free Stock Analysis Report

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

SPDR-TECH SELS (XLK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

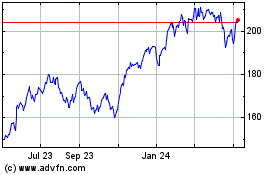

Technology Select Sector (AMEX:XLK)

Historical Stock Chart

From Apr 2024 to May 2024

Technology Select Sector (AMEX:XLK)

Historical Stock Chart

From May 2023 to May 2024