Apple's Cash Bonanza - Your Take - Real Time Insight

April 24 2013 - 10:31AM

Zacks

Apple’s fiscal 2013 second quarter results were largely in-line

with estimates, though guidance was rather tepid. But the big news

yesterday was the increase in its buyback program to $60 billion

from $10 billion and its dividend by 15%.

In all, Apple will return $100 billion to shareholders by the

end of 2015. They will access debt to fund the capital return

program.

Though Apple had $144.7 billion in cash at the end of March

2013, more than $102 billion of cash was overseas and repatriation

of those cash balances would result in tax consequences.

While many investors had been clamoring for the management to

return more cash to investors, the announcement does not appear to

have satisfied most investors.

What do you think about Apple’s capital return program?

1) Apple should have announced a

larger dividend and smaller buy-back

2) Instead of borrowing money,

Apple should have repatriated its cash balances lying offshore

3) Increase in dividend and buy-back show

that Apple is out of innovative ideas now

4) Other-please explain

APPLE INC (AAPL): Free Stock Analysis Report

NASDAQ-100 SHRS (QQQ): ETF Research Reports

SPDR-TECH SELS (XLK): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

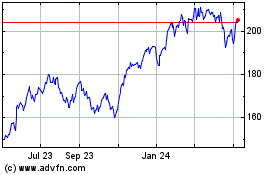

Technology Select Sector (AMEX:XLK)

Historical Stock Chart

From Apr 2024 to May 2024

Technology Select Sector (AMEX:XLK)

Historical Stock Chart

From May 2023 to May 2024