false

0001553788

0001553788

2023-11-09

2023-11-09

0001553788

SBEV:CommonStock0.001ParValuePerShareMember

2023-11-09

2023-11-09

0001553788

SBEV:WarrantsToPurchaseSharesOfCommonStockMember

2023-11-09

2023-11-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November

9, 2023

| SPLASH

BEVERAGE GROUP, INC. |

| (Exact Name of Registrant as Specified in Its Charter) |

| |

| Nevada |

| (State or Other Jurisdiction of Incorporation) |

| 001-40471 |

|

34-1720075 |

| (Commission File Number) |

|

(IRS Employer Identification No.) |

| |

1314 East Las Olas Blvd, Suite 221

Fort Lauderdale, Florida 33301 |

|

| (Address of Principal Executive Offices) |

| |

| (954) 745-5815 |

| (Registrant’s Telephone Number, Including Area Code) |

| |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Common Stock, $0.001 par value per share |

|

SBEV |

|

NYSE American LLC |

| Warrants to purchase shares of common stock |

|

SBEV-WT |

|

NYSE American LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

As previously announced on

October 6, 2023, Splash Beverage Group Inc., a Nevada corporation (the “Company”), entered into a securities purchase agreement

(the “Purchase Agreement”) with certain accredited investors (the “Purchasers”). Pursuant

to the Purchase Agreement, the Company sold the Purchasers: (i) senior convertible notes in the aggregate original principal amount of

$1,250,000, (the “Notes”) convertible into up to 1,470,588 shares of common stock of the Company, par value $0.001 per share

(the “Common Stock”), subject to adjustments as provided in the Notes, (ii) 625,000 shares of Common Stock (the “Commitment

Shares”) and (iii) warrants to acquire up to an aggregate of 1,250,000 additional shares of Common Stock (the “Warrants”). The

conversion price of the Notes is $0.85 per share, subject to adjustments as provided in the Notes. The Warrants are exercisable from the

date of issuance until October 3, 2028, at an exercise price of $0.85 per Warrant, subject to adjustments as provided in the Warrants.

The offering closed on October 3, 2023 (the “Closing Date”).

On

November 9, 2023, the Company and the Purchasers entered into an extension (the “Waiver Agreement”), to the registration rights

agreement (the “Registration Rights Agreement”), which was entered into in connection with the Purchase Agreement. Pursuant

to the Waiver Agreement, the Purchasers agreed to extend the Filing Deadline (as defined below) from 30 calendar days to 60 calendar days

after the Closing Date and extended the Effectiveness Deadline (as defined below) from 90 calendar days to 120 calendar days after the

Closing Date.

Prior

to the Waiver Agreement, under the Registration Rights Agreement, the Company agreed to file a registration statement to register the

Commitment Shares and shares of Common Stock underlying the Notes and Warrants within thirty (30) days after the Closing Date (the “Filing

Deadline”) and to have such registration statement effective within ninety (90) days of the Closing Date (or the second business

day after the Company is notified by the U.S. Securities and Exchange Commission that such registration statement will not be reviewed

or subject to further review) (the “Effectiveness Deadline”).

The foregoing descriptions

of the Waiver Agreement are not complete and are qualified in their entirety by reference to the full text of the form of the Waiver Agreement,

a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. |

|

Description |

| 10.1 |

|

Form of Waiver Agreement |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 13, 2023

| SPLASH BEVERAGE GROUP, INC. |

|

| |

|

| /s/ Robert Nistico |

|

| Robert Nistico |

|

| Chief Executive Officer |

|

EXHIBIT

10.1

FORM OF WAIVER AGREEMENT

This letter agreement (this “Agreement”)

is entered into as of the November 9, 2023, by and between Splash Beverage Group, Inc., a Nevada corporation (the “Company”)

and the investor signatory hereto (the “Holder”), with reference to the following facts:

A. Reference

is made to (i) that certain Securities Purchase Agreement, dated September 29, 2023 (the “Securities Purchase Agreement”),

by and among the Company, the Holder and the other investor parties thereto (the “Other Holders”), pursuant to which,

among other things, the Holder acquired certain senior convertible notes (the “Notes”), warrants (the “Warrants”),

and commitment shares (the “Commitment Shares”), and (ii) that certain Registration Rights Agreement, dated October

3, 2023 (the “Registration Rights Agreement”), by and among the Company, the Holder and the Other Holders. Capitalized

terms used but not defined herein shall have the meaning set forth in the Securities Purchase Agreement.

B. The

Company currently desires to obtain a waiver, in part, effective as of the date hereof, of the Company’s obligations under Section

2(a) of the Registration Rights Agreement to file a Registration Statement registering the resale of the Registrable Securities (as defined

in the Registration Rights Agreement) such that (x) the Filing Deadline (as defined in the Registration Rights Agreement) shall be extended

from 30 calendar days to 60 calendar days after the Closing Date and (y) the Effectiveness Deadline (as defined in the Registration Rights

Agreement) shall be extended from 90 calendar days to 120 calendar days after the Closing Date (the “Waiver”).

NOW, THEREFORE, in consideration

of the foregoing premises and the mutual covenants hereinafter contained, the Company and the Holder agree as follows:

1. Waiver.

The Holder hereby agrees to the Waiver in its capacity as a holder of one or more Notes, Warrants and Commitment Shares and, upon the

Company’s receipt of waivers from the Required Holders (as defined in the Registration Rights Agreement) (the “Waiver Date”),

the Waiver shall be effective as of the date hereof.

2. Limitation

of Waiver. The Waiver set forth in this Agreement constitutes a one-time waiver and is limited to the matters expressly waived

herein and should not be construed as an indication that the Holder would be willing to agree to any future modifications to, consent

of, or waiver of any of the terms of any other agreement, instrument or security or any modifications to, consents of, or waiver of any

default that may exist or occur thereunder.

3. Ratifications.

Except as otherwise expressly provided herein, each of the Transaction Documents is, and shall continue to be, in full force and effect

and is hereby ratified and confirmed in all respects.

4. Disclosure

of Transaction. The Company shall, on or before 8:30 a.m., New York City Time, on or prior to the second business day after the

date of this Agreement, file a Current Report on Form 8-K describing the terms of the transactions contemplated hereby in the form required

by the 1934 Act and attaching the form of this Agreement as an exhibit to such filing (including all attachments, the “8-K Filing”).

From and after the filing of the 8-K Filing, the Company shall have disclosed all material, non-public information (if any) provided up

to such time to the Holder by the Company or any of its Subsidiaries or any of their respective officers, directors, employees or agents.

In addition, effective upon the filing of the 8-K Filing, the Company acknowledges and agrees that any and all confidentiality or similar

obligations under any agreement with respect to the transactions contemplated hereby or as otherwise disclosed in the 8-K Filing, whether

written or oral, between the Company,

any of its Subsidiaries or any of their respective officers, directors, affiliates, employees or

agents, on the one hand, and any of the Holder or any of their affiliates, on the other hand, shall terminate. Neither the Company, its

Subsidiaries nor the Holder shall issue any press releases or any other public statements with respect to the transactions contemplated

hereby; provided, however, the Company shall be entitled, without the prior approval of the Holder, to make

a press release or other public disclosure with respect to such transactions (i) in substantial conformity with the 8-K Filing and contemporaneously

therewith or (ii) as is required by applicable law and regulations (provided that in the case of clause (i) the Holder shall be consulted

by the Company in connection with any such press release or other public disclosure prior to its release). Without the prior written consent

of the Holder (which may be granted or withheld in the Holder’s sole discretion), except as required by applicable law, the Company

shall not (and shall cause each of its Subsidiaries and affiliates to not) disclose the name of the Holder in any filing, announcement,

release or otherwise. Notwithstanding anything contained in this Agreement to the contrary and without implication that the contrary would

otherwise be true, the Company expressly acknowledges and agrees that the Holder shall not have (unless expressly agreed to the Holder

after the date hereof in a written definitive and binding agreement executed by the Company and the Holder (it being understood and agreed

that no Other Holder may bind the Holder with respect thereto)), any duty of confidentiality with respect to, or a duty not to trade on

the basis of, any material, non-public information regarding the Company or any of its Subsidiaries.

5. Fees.

The Company shall promptly reimburse Kelley Drye & Warren, LLP (counsel to the Required Holder), on demand, for all reasonable, documented

costs and expenses incurred by it in connection with preparing and delivering this Agreement (including, without limitation, all reasonable,

documented legal fees and disbursements in connection therewith, and due diligence in connection with the transactions contemplated thereby)

in an aggregate amount not to exceed $2,500. Each party to this Agreement shall bear its own expenses in connection with the structuring,

documentation, negotiation and closing of the transactions contemplated hereby, except as provided in the previous sentence and except

that the Company shall be responsible for the payment of any placement agent’s fees, financial advisory fees, transfer agent fees,

Depository Trust Company fees relating to or arising out of the transactions contemplated hereby.

6. Independent

Nature of Holder’s Obligations and Rights. The obligations of the Holder under this Agreement are several and not joint

with the obligations of any Other Holder, and the Holder shall not be responsible in any way for the performance of the obligations of

any Other Holder under any Other Agreement. Nothing contained herein or in any Other Agreement, and no action taken by the Holder pursuant

hereto, shall be deemed to constitute the Holder and Other Holders as a partnership, an association, a joint venture or any other kind

of entity, or create a presumption that the Holder and Other Holders are in any way acting in concert or as a group with respect to such

obligations or the transactions contemplated by this Agreement or any Other Agreement and the Company acknowledges that, to the best of

its knowledge, the Holder and the Other Holders are not acting in concert or as a group with respect to such obligations or the transactions

contemplated by this Agreement or any Other Agreement. The Company and the Holder confirm that the Holder has independently participated

in the negotiation of the transactions contemplated hereby with the advice of its own counsel and advisors. The Holder shall be entitled

to independently protect and enforce its rights, including, without limitation, the rights arising out of this Agreement, and it shall

not be necessary for any Other Holder to be joined as an additional party in any proceeding for such purpose.

7. Most

Favored Nations. The Company hereby represents and warrants as of the date hereof and covenants and agrees that none of the terms

offered to any Other Holder with respect to the Waiver (each an “Settlement Document”), is or will be more favorable

to such Person (other than any reimbursement of legal fees) than those of the Holder and this Agreement. If, and whenever on or after

the date hereof, the Company enters into a Settlement Document, then (i) the Company shall provide notice thereof to the Holder immediately

following the occurrence thereof and (ii) the terms and conditions of this Agreement shall be, without any further action by the Holder

or the Company, automatically amended and modified in an economically and legally equivalent manner such that the Holder shall receive

the benefit of the more favorable terms and/or conditions (as the case may be) set forth in such Settlement Document, provided that upon

written notice to the Company at any time the Holder may elect not to accept the benefit of any such amended or modified term or condition,

in which event the term or condition contained in this Agreement shall apply to the Holder as it was in effect immediately prior to such

amendment or modification as if such amendment or modification never occurred with respect to the Holder. The provisions of this Section

7 shall apply similarly and equally to each Settlement Document.

8. Miscellaneous

Provisions. Section 9 of the Securities Purchase Agreement is hereby incorporated by reference herein, mutatis mutandis.

[The remainder of the page is intentionally

left blank]

IN WITNESS WHEREOF, the

Holder and the Company have executed this Agreement as of the date set forth on the first page of this Agreement.

| |

COMPANY: |

| |

|

| |

SPLASH BEVERAGE GROUP, INC. |

| |

|

| |

By: |

|

| |

Name: |

Robert Nistico |

| |

Title: |

Chief Executive Officer |

IN WITNESS WHEREOF, Holder

and the Company have executed this Agreement as of the date set forth on the first page of this Agreement.

v3.23.3

Cover

|

Nov. 09, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity File Number |

001-40471

|

| Entity Registrant Name |

SPLASH

BEVERAGE GROUP, INC.

|

| Entity Central Index Key |

0001553788

|

| Entity Tax Identification Number |

34-1720075

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

1314 East Las Olas Blvd

|

| Entity Address, Address Line Two |

Suite 221

|

| Entity Address, City or Town |

Fort Lauderdale

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33301

|

| City Area Code |

(954)

|

| Local Phone Number |

745-5815

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, $0.001 par value per share |

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

SBEV

|

| Security Exchange Name |

NYSEAMER

|

| Warrants to purchase shares of common stock |

|

| Title of 12(b) Security |

Warrants to purchase shares of common stock

|

| Trading Symbol |

SBEV-WT

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SBEV_CommonStock0.001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SBEV_WarrantsToPurchaseSharesOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

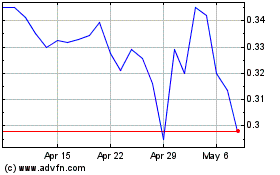

Splash Beverage (AMEX:SBEV)

Historical Stock Chart

From Oct 2024 to Nov 2024

Splash Beverage (AMEX:SBEV)

Historical Stock Chart

From Nov 2023 to Nov 2024