SIFCO Industries, Inc. (NYSE Amex: SIF) today announced

financial results for its fiscal 2012 second quarter, which ended

March 31, 2012.

Second quarter

- Net sales increased 27.1% in the second

quarter of fiscal 2012 to $34.1 million, compared with $26.8

million in the comparable period in fiscal 2011.

- Net income for the second quarter of

fiscal 2012 was $1.7 million, or $0.32 per diluted share, compared

with a net income of $2.0 million, or $0.38 per diluted share for

the comparable fiscal 2011 period.

- EBITDA in the second quarter of fiscal

2012 was $4.4 million, or 13.0% of net sales, compared with $4.4

million, or 16.5% of net sales, in the comparable period in fiscal

2011.

- Adjusted EBITDA in the second quarter

of fiscal 2012 was $5.3 million, or 15.7% of net sales, compared

with $4.9 million, or 18.1% of net sales, in the comparable period

in fiscal 2011.

First six months

- Net sales increased 29.9% in the first

six months of fiscal 2012 to $62.6 million, compared with $48.2

million in the comparable period in fiscal 2011.

- Net income for the first six months of

fiscal 2012 was $2.9 million, or $0.55 per diluted share, compared

with net income of $3.2 million, or $0.60 per diluted share, for

the comparable fiscal 2011 period.

- EBITDA in the first six months of

fiscal 2012 was $7.9 million, or 12.6% of net sales, compared with

$6.9 million, or 14.3% of net sales, in the comparable period in

fiscal 2011.

- Adjusted EBITDA in the first six months

of fiscal 2012 was $9.6 million, or 15.3% of net sales, compared

with $7.7 million, or 15.9% of net sales, in the comparable period

in fiscal 2011.

The results for fiscal 2012 include the results of Quality

Aluminum Forge, which was acquired on October 28, 2011.

Non-GAAP Supplemental Information

Neither EBITDA nor Adjusted EBITDA is a measurement of financial

performance under accounting principles generally accepted in the

United States of America (“GAAP”). EBITDA and Adjusted EBITDA are

presented in this press release as supplemental disclosures to net

income and reported results. References to “EBITDA” mean earnings

before interest, taxes, depreciation and amortization, and

references to “Adjusted EBITDA” mean EBITDA plus, as applicable for

each relevant period, certain adjustments as set forth in the

reconciliations of net income to EBITDA and Adjusted EBITDA.

The Company presents EBITDA and Adjusted EBITDA because (i) it

believes they are useful indicators for evaluating operating

performance and liquidity, including the Company's ability to incur

and service debt and (ii) it uses EBITDA to evaluate prospective

acquisitions. Although the Company uses EBITDA and Adjusted EBITDA

for the reasons noted, the use of these non-GAAP financial measures

as analytical tools has limitations and, therefore, reviewers of

the Company’s financial information should not consider them in

isolation, or as a substitute for analysis of its results of

operations as reported in accordance with GAAP. Some of these

limitations are:

- Neither EBITDA nor Adjusted EBITDA

reflects the interest expense, or the cash requirements necessary

to service interest payments, on indebtedness;

- Although depreciation and amortization

are non-cash charges, the assets being depreciated and amortized

will often have to be replaced in the future, and neither EBITDA

nor Adjusted EBITDA reflects any cash requirements for such

replacements;

- The omission of the substantial

amortization expense associated with the Company’s intangible

assets further limits the usefulness of EBITDA and Adjusted

EBITDA;

- Neither EBITDA nor Adjusted EBITDA

includes the payment of taxes, which is a necessary element of

operations; and

- Adjusted EBITDA excludes the cash

expense the Company has incurred to acquire businesses.

Because of these limitations, EBITDA and Adjusted EBITDA should

not be considered as measures of discretionary cash available to

the Company to invest in the growth of its businesses. Management

compensates for these limitations by not viewing EBITDA or Adjusted

EBITDA in isolation and specifically by using other GAAP measures,

such as net income, net sales and operating profit, to measure

operating performance. Neither EBITDA nor Adjusted EBITDA is a

measurement of financial performance under GAAP, and neither should

be considered as an alternative to net income or cash flow from

operations determined in accordance with GAAP. The Company’s

calculation of EBITDA and Adjusted EBITDA may not be comparable to

the calculation of similarly titled measures reported by other

companies.

Forward-Looking Language

Certain statements contained in this press release are

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, such as statements

relating to financial results and plans for future business

development activities, and are thus prospective. Such

forward-looking statements are subject to risks, uncertainties and

other factors, which could cause actual results to differ

materially from future results expressed or implied by such

forward-looking statements. Potential risks and uncertainties

include, but are not limited to, economic conditions, competition

and other uncertainties detailed from time to time in the Company’s

Securities and Exchange Commission filings.

The Company’s Form 10-Q for the quarter ended March 31, 2012 can

be accessed through its website: www.sifco.com, or on the

Securities and Exchange Commission’s website: www.sec.gov.

SIFCO Industries, Inc. is engaged in the production and sale of

a variety of metalworking processes, services and products produced

primarily to the specific design requirements of its customers. The

processes and services include both conventional and precision

forging, heat-treating, coating, welding, machining and selective

plating. The products include both conventional and precision

forged components, machined forged parts and other machined metal

components, remanufactured component parts for aerospace turbine

engines, and selective plating solutions and equipment. The

Company’s operations are conducted in three business segments: (1)

Forged Components Group, (2) Turbine Components Services and Repair

Group, and (3) Applied Surface Concepts Group.

Second Quarter Ended March 31,

2012

(Amounts in thousands, except per share data)

Consolidated Condensed Statements of

Operations

Second Quarter

Six Months

Ended March

31,

Ended March

31,

2012

2011

2012

2011

Net sales $ 34,079 $ 26,804 $ 62,589 $ 48,200 Cost of goods

sold 26,601 19,878 48,646 36,299 Selling, general and

administrative expenses 4,104 3,318 8,073 6,494 Amortization of

intangible assets 662 685 1,477

742 Operating income 2,712 2,923 4,393 4,665

Interest expense, net 131 33 218 31 Foreign currency exchange loss

(gain), net 3 5 (19 ) 9 Other income, net (118 ) (117

) (235 ) (234 ) Income before income tax provision

2,696 3,002 4,429 4,859 Income tax provision 972

1,007 1,519 1,658

Net income $ 1,724

$

1,995 $ 2,910 $ 3,201 Net income per

share: Basic $ 0.32 $ 0.38 $ 0.55 $ 0.61 Diluted $ 0.32 $ 0.38 $

0.55 $ 0.60 Weighted average number of common shares (basic)

5,315 5,267 5,303 5,263 Weighted average number of common shares

(diluted) 5,336 5,313 5,326 5,302

Supplemental Information –

Reconciliation of EBITDA and Adjusted EBITDA

Second Quarter

Six Months

Ended March

31,

Ended March

31,

2012

2011

2012

2011

Net income $ 1,724 $ 1,995 $ 2,910 $ 3,201 Adjustments:

Depreciation and amortization expense 1,595 1,385 3,255 2,005

Interest expense, net 131 33 218 31 Income tax provision 972

1,007 1,519 1,658

EBITDA 4,422 4,420 7,902 6,895 Adjustments: Inventory purchase

accounting adjustments (1) 216 110 441 202 Acquisition

transaction-related expenses (2) 105 25 229 173 Equity compensation

expense (3) 329 123 567 177 LIFO provision (4) 269

183 428 225 Adjusted

EBITDA

$

5,341 $ 4,861 $ 9,567 $ 7,672

(1) Represents accounting adjustments to inventory

associated with acquisitions of businesses that were charged to

cost of sales when the inventory was sold. (2) Represents

transaction-related costs comprising legal, financial and tax due

diligence expenses; and valuation services costs that are required

to be expensed as incurred. (3) Represents the equity based

compensation expense recognized by the Company under its 2007

Long-term Incentive Plan. (4) Represents the increase in the

reserve for inventories for which cost is determined using the last

in, first out (“LIFO”) method.

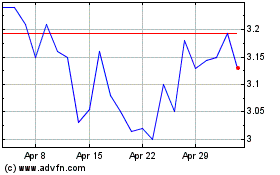

Sifco Industries (AMEX:SIF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sifco Industries (AMEX:SIF)

Historical Stock Chart

From Jul 2023 to Jul 2024