Regional Health

Properties, Inc. (NYSE American: RHE) (NYSE

American: RHE-PA) (“RHE” or the “Company”) convened its special

meeting (the “Special Meeting”) of the holders of its 10.875%

Series A Cumulative Redeemable Preferred Shares (the “Series A

Preferred Stock”) and the holders of its common stock (the “Common

Stock”) and Series E Redeemable Preferred Shares (the “Series E

Preferred Stock”) on June 27, 2023. All of the proposals presented

at the Special Meeting were approved by the requisite votes of the

applicable shareholders of the Company, including the Preferred

Series A Charter Amendment Proposal, the Series B Preferred Stock

Proposal and the Common Charter Amendment Proposal (each as defined

herein).

As previously announced, the Company commenced

an offer to exchange (the “Exchange Offer”) any and all of its

outstanding shares of Series A Preferred Stock for newly issued

shares of the Company’s 12.5% Series B Cumulative Redeemable

Preferred Shares (the “Series B Preferred Stock”). In exchange for

each share of Series A Preferred Stock properly tendered (and not

validly withdrawn) prior to 11:59 p.m., New York City time, on June

27, 2023 (such time and date, the “Expiration Date”) and accepted

by the Company, participating holders of Series A Preferred Stock

will receive one share of Series B Preferred Stock.

The Exchange Offer expired at the Expiration

Date. All conditions to the Exchange Offer were satisfied at that

time, including:

- the approval of

the holders of at least 66 2/3% of the outstanding shares of the

Series A Preferred Stock as of the close of business on May 11,

2023 (the “Record Date”) of each of:

- the proposal

presented at the Special Meeting relating to certain amendments to

the Company’s Amended and Restated Articles of Incorporation (as

currently in effect, the “Charter”) with respect to the Series A

Preferred Stock that will significantly reduce the rights of

holders of Series A Preferred Stock (the “Series A Charter

Amendments” and, such proposal, the “Preferred Series A Charter

Amendment Proposal”), as described in the Proxy

Statement/Prospectus that is filed with the U.S. Securities and

Exchange Commission (the “SEC”); and

- the proposal

presented at the Special Meeting relating to (i) the temporary

amendment of the Charter to increase the authorized number of

shares of preferred stock to 6,000,000 shares and, following the

consummation of the Exchange Offer, the subsequent amendment of the

Charter to decrease the authorized number of shares of preferred

stock to 5,000,000 shares and (ii) the authorization, creation and

designation by the Board of Directors of the Company pursuant to

Section 14-2-602 of the Official Code of Georgia Annotated, from

the authorized but undesignated shares of preferred stock, of the

Series B Preferred Stock (the “Series B Charter Amendments” and,

such proposal, the “Series B Preferred Stock Proposal”); and

- the approval of a

majority of votes entitled to be cast by the holders of the

outstanding Common Stock and Series E Preferred Stock as of the

Record Date, less any shares of Series E Preferred Stock redeemed

prior to the Special Meeting, of the proposal presented at the

Special Meeting relating to (i) the Series A Charter Amendments and

(ii) the temporary amendment of the Charter to increase the

authorized number of shares of the Company to 61,000,000 shares,

consisting of 55,000,000 shares of common stock and 6,000,000

shares of preferred stock, and, following the consummation of the

Exchange Offer, the subsequent amendment of the Charter to decrease

the authorized number of shares of the Company to 60,000,000

shares, consisting of 55,000,000 shares of common stock and

5,000,000 shares of preferred stock (such proposal, the “Common

Charter Amendment Proposal”).

Since the Preferred Series A Charter Amendment

Proposal, the Series B Preferred Stock Proposal and the Common

Charter Amendment Proposal were approved by our shareholders, we

will amend the Charter to reflect the Series B Charter Amendments.

In addition, since the Preferred Series A Charter Amendment

Proposal and the Common Charter Amendment Proposal were approved by

our shareholders, we will amend the Charter to reflect the Series A

Charter Amendments upon the consummation of the Exchange Offer.

Continental Stock Transfer & Trust Company,

the exchange agent in connection with the Exchange Offer, has

advised the Company that, as of the Expiration Date, approximately

80% of the outstanding shares of Series A Preferred Stock had been

properly tendered (and not validly withdrawn) in the Exchange

Offer.

The Company anticipates issuing a press release

to announce the final results of the Exchange Offer. The Company

intends to accept all of the shares of Series A Preferred Stock

properly tendered (and not validly withdrawn) prior to the

Expiration Date. The closing of the Exchange Offer is expected to

occur by June 30, 2023.

About Regional Health

Properties

Regional Health Properties, Inc., a Georgia

corporation, is a self-managed healthcare real estate investment

company that invests primarily in real estate purposed for senior

living and long-term care. For more information, visit

www.regionalhealthproperties.com. Important Cautions

Regarding Forward-Looking Statements

This press release includes forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended. Words such as

“expects,” “intends,” “believes,” “anticipates,” “plans,” “likely,”

“will,” “seeks,” “estimates” and variations of such words and

similar expressions are intended to identify such forward-looking

statements. Statements in this press release regarding the

amendment of the Charter to reflect the Series A Charter Amendments

and the Series B Charter Amendments, the acceptance of the shares

of Series A Preferred Stock in the Exchange Offer and the timing of

the closing of the Exchange Offer are forward-looking

statements.

Forward-looking statements, by their nature,

involve estimates, projections, goals, forecasts and assumptions

and are subject to risks and uncertainties that could cause actual

results to differ materially from those projected or contemplated

by our forward-looking statements due to various factors,

including, among others: our dependence on the operating success of

our operators; the significant amount of, and our ability to

service, our indebtedness; covenants in our debt agreements that

may restrict our ability to make investments, incur additional

indebtedness and refinance indebtedness on favorable terms; the

availability and cost of capital; our ability to raise capital

through equity and debt financings or through the sale of assets;

increases in market interest rates and inflation; our ability to

meet the continued listing requirements of the NYSE American LLC

and to maintain the listing of our securities thereon; the effect

of increasing healthcare regulation and enforcement on our

operators and the dependence of our operators on reimbursement from

governmental and other third-party payors; the relatively illiquid

nature of real estate investments; the impact of litigation and

rising insurance costs on the business of our operators; the impact

on us of litigation relating to our prior operation of our

healthcare properties; the effect of our operators declaring

bankruptcy, becoming insolvent or failing to pay rent as due; the

ability of any of our operators in bankruptcy to reject unexpired

lease obligations and to impede our ability to collect unpaid rent

or interest during the pendency of a bankruptcy proceeding and

retain security deposits for the debtor’s obligations; our ability

to find replacement operators and the impact of unforeseen costs in

acquiring new properties; epidemics or pandemics, including the

COVID-19 pandemic, and the related impact on our tenants, operators

and healthcare facilities; and other factors discussed from time to

time in our news releases, public statements and documents filed by

us with the SEC from time to time, including our Annual Report on

Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K. These forward-looking statements and such risks,

uncertainties and other factors speak only as of the date of this

press release, and we expressly disclaim any obligation or

undertaking to update or revise any forward-looking statement

contained herein, to reflect any change in our expectations with

regard thereto or any other change in events, conditions or

circumstances on which any such statement is based, except to the

extent otherwise required by applicable law.

No Offer or Solicitation

This communication is not intended to and shall

not constitute an offer to buy or sell or the solicitation of an

offer to buy or sell any securities, or a solicitation of any vote

or approval, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made, except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act.

Additional Information about the

Exchange Offer and Where to Find It

In connection with the proposed Exchange Offer

(the “proposed transaction”), RHE filed with the SEC a registration

statement on Form S-4 on February 14, 2023 (as amended on April 28,

2023, May 18, 2023 and May 22, 2023) that includes a proxy

statement and that also constitutes a prospectus. The registration

statement was declared effective by the SEC on May 25, 2023 at 9:00

a.m., Eastern Time. RHE filed the definitive proxy

statement/prospectus (as supplemented or amended) in connection

with the proposed transaction with the SEC. RHE commenced mailing

the definitive proxy statement/prospectus to shareholders on or

about May 25, 2023. RHE also filed with the SEC a joint statement

on Schedule TO/13E-3 (as supplemented or amended, the “Schedule

TO/13E-3”) for the proposed transaction. RHE intends to file other

relevant documents with the SEC regarding the proposed transaction.

This document is not a substitute for the definitive proxy

statement/prospectus or registration statement or any other

document that RHE may file with the SEC. INVESTORS AND SECURITY

HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE SCHEDULE

TO/13E-3, THE DEFINITIVE PROXY STATEMENT/PROSPECTUS, AND ANY OTHER

RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY

AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY AND IN

THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT

INFORMATION ABOUT RHE AND THE PROPOSED TRANSACTION. Investors and

security holders are able to obtain free copies of the registration

statement, the Schedule TO/13E-3, the definitive proxy

statement/prospectus and all other documents containing important

information about RHE and the proposed transaction, once such

documents are filed with the SEC, including the definitive proxy

statement/prospectus, through the website maintained by the SEC at

www.sec.gov. The proxy statement/prospectus included in the

registration statement and additional copies of the proxy

statement/prospectus will be available for free from RHE.

Participants in the

Solicitation

RHE and certain of its directors and executive

officers may be deemed to be participants in the solicitation of

proxies in respect of the proposed transaction. Information about

the directors and executive officers of RHE, including a

description of their direct or indirect interests, by security

holdings or otherwise, is set forth in RHE’s proxy statement for

its 2022 Annual Meeting of Shareholders, which was filed with the

SEC on December 30, 2022, and RHE’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2022, which was filed with the

SEC on April 14, 2023. Investors may obtain additional information

regarding the interests of those persons and other persons who may

be deemed participants in the proposed transaction by reading the

definitive proxy statement/prospectus and other relevant materials

to be filed with the SEC regarding the proposed transaction when

such materials become available. Investors should read the

definitive proxy statement/prospectus carefully before making any

voting or investment decisions. You may obtain free copies of these

documents from RHE using the sources indicated above.

Company ContactBrent

MorrisonChief Executive Officer and PresidentRegional Health

Properties, Inc.Tel (678)

368-4402brent.morrison@regionalhealthproperties.com

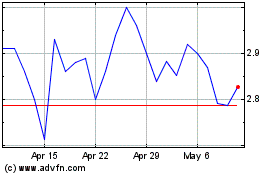

Regional Health Properties (AMEX:RHE)

Historical Stock Chart

From Oct 2024 to Nov 2024

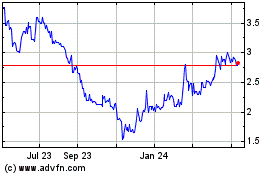

Regional Health Properties (AMEX:RHE)

Historical Stock Chart

From Nov 2023 to Nov 2024