Regional Health Properties, Inc. (NYSE American: RHE) (NYSE

American: RHEpA) (“RHE” or the “Company”), a self-managed

healthcare real estate investment company that invests primarily in

real estate purposed for senior living and long-term care,

announced today that it has filed a registration statement on Form

S-4 (the “Registration Statement”) with the Securities and Exchange

Commission (the “SEC”) relating to its proposed offer to exchange

(the “Exchange Offer”) any and all of the outstanding shares of its

10.875% Series A Cumulative Redeemable Preferred Shares (the

“Series A Preferred Stock”) for newly issued common stock of the

Company, no par value (the “Common Stock”), and may file amendments

thereto. In exchange for each share of Series A Preferred Stock

properly tendered (and not validly withdrawn) in the Exchange Offer

and accepted by the Company, participating holders of Series A

Preferred Stock will receive 0.5 shares of Common Stock.

In connection with the Exchange Offer, the Company will also be

soliciting proxies of the holders of the Series A Preferred Stock

and holders of Common Stock to approve certain amendments to the

Company’s Amended and Restated Articles of Incorporation and

related matters (the “Proposals”). Consummation of the Exchange

Offer is conditioned on the approval of the Proposals.

Neither the Exchange Offer nor the proxy solicitation has

commenced. Holders of Series A Preferred Stock should not tender

their shares of Series A Preferred Stock until the Exchange Offer

has commenced. If the Company commences the Exchange Offer, the

Exchange Offer will be made solely by the proxy

statement/prospectus forming a part of the Registration Statement,

the related letter of transmittal and certain other related

materials, including the Company’s tender offer statement on

Schedule TO, which the Company will file with the SEC. If the

Company commences the Exchange Offer, it will file each of the

documents referenced herein with the SEC, and, when available,

investors may obtain a free copy of them from the SEC at its

website, www.sec.gov. The Company will mail the proxy

statement/prospectus and related materials to the holders of Series

A Preferred Stock and holders of Common Stock who are eligible to

participate in the Exchange Offer and entitled to vote on the

Proposals, if and after the Registration Statement is declared

effective.

The Registration Statement relating to these securities has been

filed with the SEC but has not yet become effective. These

securities may not be sold nor may offers to buy be accepted prior

to the time the Registration Statement becomes effective.

About Regional Health Properties

Regional Health Properties, Inc. (NYSE American: RHE) (NYSE

American: RHEpA) is the successor to AdCare Health Systems, Inc.,

and is a self-managed healthcare real estate investment company

that invests primarily in real estate purposed for senior living

and long-term healthcare through facility lease and sub-lease

transactions.

RHE currently owns, leases, manages for third parties and

operates, 24 facilities (12 of which are owned by RHE, eight of

which are leased by RHE, three of which are managed by RHE for

third parties and one of which is leased and operated by RHE).

Effective January 1, 2021, the Company commenced operation of one

previously subleased facility as a portfolio stabilization

measure.

For more information, visit

www.regionalhealthproperties.com.

Important Cautions Regarding Forward-Looking

Statements

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Words such as “expects,” “intends,” “believes,”

“anticipates,” “plans,” “likely,” “will,” “seeks,” “estimates” and

variations of such words and similar expressions are intended to

identify such forward-looking statements. Statements in this press

release regarding future events and developments and our future

performance, as well as management’s expectations, beliefs, plans,

estimates or projections relating to the future, are

forward-looking statements.

Forward-looking statements, by their nature, involve estimates,

projections, goals, forecasts and assumptions and are subject to

risks and uncertainties that could cause actual results to differ

materially from those projected or contemplated by our

forward-looking statements due to various factors, including, among

others: our dependence on the operating success of our operators;

the significant amount of, and our ability to service, our

indebtedness; covenants in our debt agreements that may restrict

our ability to make investments, incur additional indebtedness and

refinance indebtedness on favorable terms; the availability and

cost of capital; our ability to raise capital through equity and

debt financings or through the sale of assets; the effect of

increasing healthcare regulation and enforcement on our operators

and the dependence of our operators on reimbursement from

governmental and other third-party payors; the relatively illiquid

nature of real estate investments; the impact of litigation and

rising insurance costs on the business of our operators; the impact

on us of litigation relating to our prior operation of our

healthcare properties; the effect of our operators declaring

bankruptcy, becoming insolvent or failing to pay rent as due; the

ability of any of our operators in bankruptcy to reject unexpired

lease obligations and to impede our ability to collect unpaid rent

or interest during the pendency of a bankruptcy proceeding and

retain security deposits for the debtor’s obligations; our ability

to find replacement operators and the impact of unforeseen costs in

acquiring new properties; the impact of COVID-19 on our business

and the business of our operators, including without limitation,

the extent and duration of the COVID-19 pandemic, increased costs

experienced by our operators in connection therewith, and the

extent to which government support may be available to our

operators to offset such costs and the conditions related thereto;

and other factors discussed from time to time in our news releases,

public statements and documents filed by us with the SEC from time

to time, including our Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K. These

forward-looking statements and such risks, uncertainties and other

factors speak only as of the date of this press release, and we

expressly disclaim any obligation or undertaking to update or

revise any forward-looking statement contained herein, to reflect

any change in our expectations with regard thereto or any other

change in events, conditions or circumstances on which any such

statement is based, except to the extent otherwise required by

applicable law.

No Offer or Solicitation

This communication is not intended to and shall not constitute

an offer to buy or sell or the solicitation of an offer to buy or

sell any securities, or a solicitation of any vote or approval, nor

shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made, except by

means of a prospectus meeting the requirements of Section 10 of the

U.S. Securities Act of 1933, as amended.

Additional Information about the Exchange Offer and Where to

Find It

In connection with the proposed transaction, RHE filed with the

SEC a registration statement on Form S-4 on June 1, 2021, that

includes a preliminary proxy statement and that also constitutes a

preliminary prospectus. RHE intends to file other relevant

documents with the SEC regarding the proposed transaction,

including the definitive proxy statement/prospectus. The

information in the preliminary proxy statement/prospectus is not

complete and may be changed. This document is not a substitute for

the preliminary proxy statement/prospectus or registration

statement or any other document that RHE may file with the SEC. The

definitive proxy statement/prospectus (if and when available) will

be mailed to stockholders of RHE. INVESTORS AND SECURITY HOLDERS

ARE URGED TO READ THE REGISTRATION STATEMENT, THE PRELIMINARY PROXY

STATEMENT/PROSPECTUS, THE DEFINITIVE PROXY STATEMENT/PROSPECTUS IF

AND WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS THAT

MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS

TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT RHE AND THE

PROPOSED TRANSACTION. Investors and security holders are able to

obtain free copies of the registration statement, preliminary proxy

statement/prospectus and all other documents containing important

information about RHE and the proposed transaction, once such

documents are filed with the SEC, including the definitive proxy

statement/prospectus if and when it becomes available, through the

website maintained by the SEC at http://www.sec.gov. The proxy

statement/prospectus included in the Registration Statement and

additional copies of the proxy statement/prospectus will be

available for free from RHE.

Participants in the Solicitation

RHE and certain of its directors and executive officers may be

deemed to be participants in the solicitation of proxies in respect

of the proposed transaction. Information about the directors and

executive officers of RHE, including a description of their direct

or indirect interests, by security holdings or otherwise, is set

forth in RHE’s proxy statement for its 2020 Annual Meeting of

Shareholders, which was filed with the SEC on November 5, 2020, and

RHE’s Annual Report on Form 10-K for the fiscal year ended December

31, 2020, which was filed with the SEC on March 29, 2021. Investors

may obtain additional information regarding the interests of those

persons and other persons who may be deemed participants in the

proposed transaction by reading the preliminary proxy

statement/prospectus, including any amendments thereto, as well as

the definitive proxy statement/prospectus if and when it becomes

available and other relevant materials to be filed with the SEC

regarding the proposed transaction when such materials become

available. Investors should read the registration statement, the

preliminary proxy statement/prospectus, and the definitive proxy

statement/prospectus, if and when it becomes available, carefully

before making any voting or investment decisions. You may obtain

free copies of these documents from RHE using the sources indicated

above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210601006053/en/

Company Contact Benjamin A. Waites Chief Financial Officer and

Vice President Regional Health Properties, Inc. Tel (678) 368-4393

ben.waites@regionalhealthproperties.com

Investor Relations Brett Maas Managing Partner Hayden IR Tel

(646) 536-7331 brett@haydenir.com

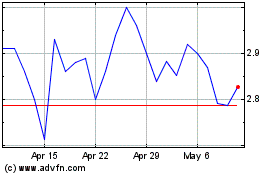

Regional Health Properties (AMEX:RHE)

Historical Stock Chart

From Oct 2024 to Nov 2024

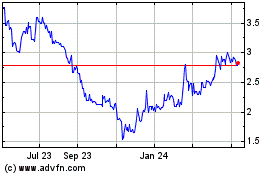

Regional Health Properties (AMEX:RHE)

Historical Stock Chart

From Nov 2023 to Nov 2024