UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-32929

POLYMET MINING CORP.

(Translation of registrant's name into English)

444 Cedar Street, Suite 2060,

St. Paul, MN 55101

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ X ] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

EXPLANATORY NOTE

This report on Form 6-K and attached exhibit are incorporated by reference into Registration Statement No. 333-192208 and this report on Form 6-K shall be deemed a part of such registration statement from the date on which this report on Form 6-K is filed, to the extent not superseded by documents or reports subsequently filed or furnished by PolyMet Mining Corp. under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

PolyMet Mining Corp. |

| |

(Registrant) |

| |

|

|

| Date: November 1, 2023 |

By: |

/s/ Jonathan Cherry |

| |

|

Jonathan Cherry |

| |

Title: |

Chairman, President and CEO |

TSX: POM, NYSE American: PLM

PolyMet Shareholders Approve Plan of Arrangement with Glencore

St. Paul, Minn., November 1, 2023 - PolyMet Mining Corp. ("PolyMet" or the "Company") (TSX: POM; NYSE American: PLM) announces that shareholders of PolyMet approved the previously announced plan of arrangement (the "Arrangement") with Glencore AG ("Glencore") at a special meeting (the "Meeting") of PolyMet shareholders ("Shareholders") held earlier today.

At the Meeting, Shareholders voted to approve the acquisition by Glencore of all of the issued and outstanding common shares of the Company ("Common Shares") that Glencore does not currently own (the "Minority Shares") for US$2.11 in cash per Minority Share (the "Consideration"). The Arrangement will be effected on November 7, 2023, subject to PolyMet obtaining a final order ("Final Order") from the British Columbia Supreme Court approving the Arrangement, and the satisfaction or waiver of other customary closing conditions.

Meeting Results

A total of 173,334,881 Common Shares (representing 89.13% of the issued and outstanding Common Shares), including a total of 13,528,107 Minority Shares (representing 39.03% of the issued and outstanding Minority Shares), were present in person, virtually or by proxy at the Meeting. The percentage of the votes that were cast in favor of the arrangement are summarized as follows:

|

|

Votes For

|

Votes Against

|

Votes Abstained

|

|

Common Shares

|

#

|

%

|

#

|

%

|

#

|

%

|

|

Total Common Shares Voted

|

170,886,121

|

98.58%

|

2,369,493

|

1.36%

|

79,267

|

0.04%

|

|

Minority Shares Voted(1)

|

11,079,347 (1)

|

81.89%

|

2,369,493

|

17.51%

|

79,267

|

0.58%

|

(1) Excludes an aggregate of 159,806,774 Common Shares voted by Glencore and other persons required to be excluded pursuant to Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions.

Status of Closing Conditions

PolyMet is scheduled to seek the Final Order from the British Columbia Supreme Court on November 3, 2023.

Completion of the Arrangement is subject to the satisfaction or waiver of other closing conditions, including the receipt of the Final Order. Assuming that the remaining conditions to closing are satisfied, it is expected that the Arrangement will be effected on November 7, 2023. On completion of the Arrangement, it is anticipated that the Common Shares will be delisted from the Toronto Stock Exchange and the NYSE American.

Enclosed with the management proxy circular of PolyMet dated September 28, 2023 and sent to the shareholders of PolyMet in connection with the Arrangement was a letter of transmittal explaining how registered shareholders of PolyMet can submit their Common Shares in order to receive the Consideration. Shareholders who have questions or require assistance with submitting their Common Shares may direct their questions to Computershare Investor Services Inc., by telephone at 1-800-564-6253 (toll free in Canada and the United States) or 514-982-7555 (international direct dial) or by email at corporateactions@computershare.com.

* * * * *

About PolyMet

PolyMet is a mine development company holding a 50% interest in NewRange Copper Nickel LLC, a joint venture with Teck Resources. NewRange Copper Nickel holds the NorthMet and Mesaba copper, nickel, cobalt and platinum group metal (PGM) deposits, two globally significant clean energy mineral resources located in the Duluth Complex in northeast Minnesota. The Duluth Complex is one of the world's major, undeveloped copper, nickel and PGM metal mining regions. NorthMet is the first large-scale project to have received permits within the Duluth Complex; however, legal challenges contesting various aspects of NorthMet federal and state permits and decisions are ongoing. For more information: www.polymetmining.com

For further information, please contact:

Media

Bruce Richardson, Corporate Communications

Tel: +1 (651) 389-4111

M: +1 (651) 964-9729

Email: brichardson@polymetmining.com

Shareholder Communications

Laurel Hill Advisory Group

North American Toll Free: 1-877-452-7184 (or 416-304-0211 for shareholders outside North America)

Email: assistance@laurelhill.com

PolyMet Disclosures

This news release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which include all statements that do not relate solely to historical or current facts, such as statements regarding PolyMet's expectations, intentions or strategies regarding the future, including strategies or plans as they relate to the Arrangement. Forward-looking statements are frequently, but not always, identified by words such as "expects," "anticipates," "believes," "intends," "estimates," "potential," "possible," "projects," "plans," and similar expressions, or statements that events, conditions or results "will," "may," "could," or "should" occur or be achieved or their negatives or other comparable words. Forward-looking statements relate to future events or future performance and reflect management's expectations or beliefs regarding future events including, but not limited to, statements with respect to the Arrangement, including the anticipated timing of the hearing to obtain the Final Order and of the completion of the Arrangement, and other statements that are not historical facts. Because such statements are based on expectations as to future results and are not statements of fact, actual results may differ materially from those projected and are subject to a number of known and unknown risks and uncertainties, including: (i) uncertainties relating to the ability of the parties to receive in a timely manner and on satisfactory terms and the Final Order; (ii) risks relating to the ability of the parties to satisfy, in a timely manner, the other conditions to the completion of the Arrangement, and other expectations and assumptions concerning the Arrangement; (iii) risks and uncertainties relating to present and future business strategies; and (iv) local and global economic condition risks. The anticipated dates indicated may change for a number of reasons, including the inability to receive the Final Order, the necessity to extend the time limits for satisfying the other conditions to the completion of the Arrangement or the ability of the Board of Directors to consider and approve, subject to compliance by the Company of its obligations in this respect under the agreement providing for the Arrangement, a superior proposal for the Company. All such factors are difficult to predict and are beyond PolyMet's control. While the list of risks and uncertainties presented here is, and the discussion of risks and uncertainties to be presented in the information circular will be, considered representative, no such list or discussion should be considered a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, and legal liability to third parties and similar risks, any of which could have a material adverse effect on the completion of the Arrangement and/or PolyMet's consolidated financial condition and results of operations. In light of the significant uncertainties in these forward-looking statements, PolyMet cannot assure you that the forward-looking statements in this communication will prove to be accurate, and you should not regard these statements as a representation or warranty by PolyMet, its directors, officers or employees or any other person that PolyMet will achieve its objectives and plans in any specified time frame, or at all.

The forward-looking statements speak only as of the date they are made. PolyMet undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements.

Specific reference is also made to risk factors and other considerations underlying forward-looking statements discussed in the management proxy of the Company dated September 28, 2023 under the heading "Risk Factors", PolyMet's most recent Annual Report on Form 40-F for the fiscal year ended December 31, 2022, and in our other filings with Canadian securities authorities and the SEC.

The Annual Report on Form 40-F also contains the Company's mineral resource and other data as required under National Instrument 43-101.

No regulatory authority has reviewed or accepted responsibility for the adequacy or accuracy of this release.

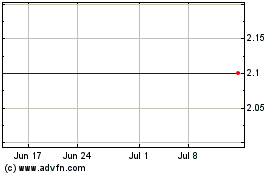

Polymet Mining (AMEX:PLM)

Historical Stock Chart

From Oct 2024 to Nov 2024

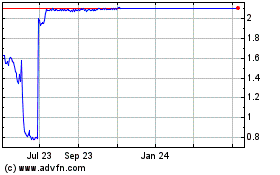

Polymet Mining (AMEX:PLM)

Historical Stock Chart

From Nov 2023 to Nov 2024