Polished.com Announces Results for Second Quarter of 2023

August 14 2023 - 4:05PM

Business Wire

Reaffirms Previously Stated Guidance for FY

2023

Polished.com Inc. (NYSE American: POL) (“Polished” or the

“Company”) today reported financial results for the three months

ended June 30, 2023. The Company’s 10-Q and additional information

can be found on its investor relations website:

https://investor.polished.com/financials/sec-filings.

Top Metrics – Second Quarter of

2023

- Net product sales for the second quarter were $87.8 million,

compared to $138.5 million in the prior year period.

- Gross profit for the quarter was $19.6 million (22.3% margin),

compared to $23.0 million (16.6% margin) in the prior year

period.

- Net income for the quarter was $1.0 million, or $0.01 per

diluted common share, compared to a net loss of $4.3 million, or

$0.04 per diluted common share, in the prior year period.

- Adjusted EBITDA for the quarter was $1.6 million (1.8%

margin).

Rick Bunka, Chief Executive Officer, commented:

“The second quarter results are consistent with the estimated

range previously provided for both Net Sales and EBITDA. The

decline in sales observed during the first half of the year was

driven by a pullback in sales in the luxury appliance category and

declines across the balance of mass appliance categories. The

Polished team remains focused on stabilizing the business and

building a foundation for future growth. The Company’s first and

second quarter results demonstrate that we can deliver more

normalized margins and positive EBITDA on reduced volume. We intend

to build on this momentum as our fix-and-rebuild year continues and

a foundation is laid for stronger profitability and sustainable

cash flow generation in 2024.”

Guidance

Management reaffirms previously stated guidance of Net Sales

between $375 million and $400 million for 2023 and low-single-digit

EBITDA margins for 2023.

These expectations are made as of August 14, 2023, and remain

subject to substantial uncertainty. Results are unpredictable and

may be materially affected by various factors, such as the economy,

inflation, interest rates, regional labor markets, supply chain

constraints and other variables.

Conference Call

The Company will host an investor conference call at 8:30 a.m.

ET on Tuesday, August 15, 2023 to review its results. The phone

number for the investor conference call is 1-844-881-0136

(toll-free) or 1-412-902-6507 (international); please ask to join

the Polished Second Quarter Earnings Call. This call and all

supplemental information can be accessed on the Company’s investor

relations site at https://investor.polished.com.

ABOUT POLISHED Polished is raising the bar,

delivering a world-class, white-glove shopping experience for home

appliances. From the best product selections from top brands to

exceptional customer service, we are simplifying the purchasing

process and empowering consumers as we provide a polished

experience, from inspiration to installation. A product expert

helps customers get inspired and imagine the space they want, then

shares fresh ideas, unbiased recommendations and excellent deals to

suit the project's budget and style. The goal is peace of mind when

it comes to new appliances. Polished perks include its

"Love-It-Or-Return-It" 30-day policy, extended warranties, the

ability to arrange for delivery and installation at your

convenience and other special offers. Learn more at

www.Polished.com.

FORWARD LOOKING STATEMENTS This press release

contains "forward-looking statements" that are subject to

substantial risks and uncertainties. All statements, other than

statements of historical fact, contained in this press release are

forward-looking statements. Forward-looking statements contained in

this press release may be identified by the use of words such as

"anticipate," "believe," "contemplate," "could," "estimate,"

"expect," "intend," "seek," "may," "might," "plan," "potential,"

"predict," "project," "target," "aim," "should," "will", "would,"

or the negative of these words or other similar expressions,

although not all forward-looking statements contain these words.

Forward-looking statements are based on the Company's current

expectations and are subject to inherent uncertainties, risks and

assumptions that are difficult to predict. Further, certain

forward-looking statements are based on assumptions as to future

events that may not prove to be accurate. You should not place

undue reliance on forward-looking statements because they involve

known and unknown risks, uncertainties and other factors, which

are, in some cases, beyond the Company’s control and which could

materially affect results. Factors that may cause actual results to

differ materially from current expectations include, among other

things, those described more fully in the section titled "Risk

Factors" of the Company’s Annual Report on Form 10-K for the year

ended December 31, 2022, and Quarterly Report on Form 10-Q for the

quarter ended June 30, 2023, filed with the Securities and Exchange

Commission. Forward-looking statements contained in this

announcement are made as of this date, and the Company undertakes

no duty to update such information except as required under

applicable law.

NON-GAAP FINANCIAL MEASURES The Company's audited

consolidated financial statements and unaudited condensed

consolidated financial statements are prepared in accordance with

accounting principles generally accepted in the United States

("GAAP"). The Company also provides financial information in this

release that was not prepared in accordance with GAAP and should

not be considered as an alternative to the information prepared in

accordance with GAAP. The Company believes the non-GAAP financial

measures presented in this press release will help investors

understand the financial condition and operating results of the

Company and assess the Company’s future prospects. The Company

believes these non-GAAP financial measures, each of which is

discussed in greater detail below, are important supplemental

measures because they exclude unusual or non-recurring items as

well as non-cash items that are unrelated to or may not be

indicative of our ongoing operating results. Further, when read in

conjunction with GAAP results, these non-GAAP financial measures

provide a baseline for analyzing trends in our underlying

businesses and can be used by management as a tool to help make

financial, operational and planning decisions. Finally, these

measures are often used by analysts and other interested parties to

evaluate companies in our industry by providing more comparable

measures that are less affected by factors such as capital

structure.

The Company recognizes that these non-GAAP financial measures

have limitations, including that they may be calculated differently

by other companies or may be used under different circumstances or

for different purposes, thereby affecting their comparability from

company to company. In order to compensate for these and the other

limitations discussed below, management does not consider these

measures in isolation from or as alternatives to the comparable

financial measures determined in accordance with GAAP. Readers

should review the reconciliations below and should not rely on any

single financial measure to evaluate our business.

The non-GAAP financial measure used in this press release is

adjusted EBITDA. The Company defines adjusted EBITDA as net income

before income taxes, depreciation and amortization, financing

costs, interest expense, sales tax accrual and one-time

non-operational events. Adjusted EBITDA is not calculated in

accordance with GAAP and should not be considered an alternative to

any financial measure that was calculated under GAAP. Adjusted

EBITDA is used to facilitate a comparison of the ordinary, ongoing

and customary course of the operations of the combined company on a

consistent basis from period to period and provide an additional

understanding of factors and trends affecting the business of the

Company. Adjusted EBITDA may not be comparable to similarly titled

non-GAAP measures used by other companies as other companies may

have calculated the measures differently.

The reconciliation of adjusted EBITDA to net income for the

Company is provided below (in thousands):

Three Months Ended

June 30, 2023

Six Months Ended

June 30, 2023

Net income

$

1,004

$

(1,757

)

Income taxes

328

432

Interest expense

1,053

2,935

Depreciation and

amortization

1,068

2,138

EBITDA

3,453

3,748

Management fee

62

125

Change in fair value of

derivative

(1,899

)

(574

)

ADJUSTED EBITDA

$

1,616

$

3,299

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230814607764/en/

Investor Relations ir@polished.com

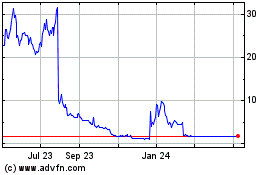

Polished (AMEX:POL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Polished (AMEX:POL)

Historical Stock Chart

From Jan 2024 to Jan 2025