Filings Position Company to Meet Reporting

Obligations and Retain Listing on NYSE American

Provides Estimated Financials for Q2 2023

and Updated Outlook for the Full Year

Secures Amendment to May 2022 Credit

Agreement and Maintains Relationship with its Lending Bank

Polished.com Inc. (NYSE American: POL) (“Polished” or the

“Company”) today announced that it is filing all restated and/or

delayed financial statements for Fiscal Year 2021 and Fiscal Year

2022 and is filing its results for the first quarter of Fiscal Year

2023. As a result, the Company will be current with its financial

reporting obligations and is positioned to retain its listing

status on the NYSE American. The Company’s filings and supplemental

information can be found on its investor relations website:

https://investor.polished.com/financials/sec-filings.

The process of filing amended and delayed financial statements

was extensive because it entailed onboarding a new audit firm and

the auditing of the previously filed financial reports since the

Company’s merger and initial public offering (“IPO”) in 2021. The

audit resulted in a restatement of the Fiscal Year 2021 and first

quarter of Fiscal Year 2022 results, as well as a reevaluation of

the Company’s goodwill associated with the IPO.

Rick Bunka, Chief Executive Officer, commented:

“Since new management joined in October 2022, we have been

intensely focused on addressing the findings of the Audit

Committee’s 2022 investigation and putting Polished on stronger

footing. We have achieved the first round of milestones that

include becoming current on financial reporting obligations and

positioning the Company’s securities to preserve their listing

status. This said, we acknowledge that the unwelcomed events of the

past year were disruptive for our business, suppliers, partners,

shareholders and warrant holders. Fortunately, reaching initial

milestones and remediating past issues will allow the management

team to continue its focus on attaining greater stability,

producing profitable growth and resuming normalized communication

with the market.

Importantly, while the restated performance of the business in

Fiscal Year 2022 was extremely disappointing, our first quarter

results demonstrate that while operating on reduced volume, the

Company can deliver more normalized margins and earnings within the

constraints of a difficult consumer spending environment. We intend

to spend the rest of this fiscal year establishing a stronger

infrastructure, identifying more efficiencies and making sure we

remain a destination of choice for customers. By taking the right

steps over the duration of 2023, which is a fix-and-rebuild year,

we will be well positioned to pursue profitable growth and enhanced

value in 2024 and beyond.”

Polished also provided updates on its capital position, outlook

and strategic review.

Top Metrics – First Quarter

2023

- Net product sales for the quarter were $95.4 million, compared

to $148.7 million in the prior year period.

- Gross profit for the quarter was $21.1 million (22.2% margin),

compared to $30.8 million (20.7% margin) in the prior year

period.

- Net loss for the quarter was $2.8 million, or $0.03 per diluted

common share, compared to net income of $5.8 million, or $0.05

(restated) per diluted common share, in the prior year period.

- Adjusted EBITDA for the quarter was $1.9 million.

Top Metrics – FY 2022

- Net product sales for the year were $534.5 million, compared to

$345.7 million for the prior year.

- Gross profit for the year was $89.5 million (16.7% margin),

compared to $69.8 million (20.2% margin) for the prior year.

- Net loss for the year was $126 million, or $1.18 per diluted

common share, compared to a net loss of $7.6 million, or $0.12 per

diluted common share, in the prior year. This was largely driven by

factors that include an impairment charge of $109.1 million.

- Adjusted EBITDA for the year was $1.2 million.

Top Metrics – Amended and Restated FY

2021 Results

- Net product sales for the year ended December 31, 2021 were

$345.7 million versus previously reported net sales of $362.3

million. The reduction in revenue of $16.6 million comprised the

following: (1) an increase in the allowance for sales returns of

$7.4 million, (2) revenue of $8.1 million that should be recognized

in 2022, and (3) sales tax collections of $1.1 million improperly

recognized as revenue.

- Gross profit for the year was $69.8 million versus a previously

reported figure of $79.6 million.

- Net loss for the year ended December 31, 2021 was $7.6 million,

or $0.12 per diluted common share, versus reported net income of

$7.7 million, or $0.10 per diluted common share.

Update on Capital Position, Outlook and

Ongoing Review Process

- As of June 30, 2023, the Company had $8.7 million in cash and

cash equivalents and $5.6 million in restricted cash relative to

$102.8 million in debt. At this time, the Company has sufficient

cash to fund its operations and it does not anticipate the need to

raise capital to sustain operations.

- The Company has secured an amendment (the “Amended Credit

Agreement”) to its May 2022 credit agreement that revises the new

EBITDA covenant and minimum liquidity provision. The amendment

requires the Company to repay its existing term loan and any

revolving loans by August 31, 2024. To help Polished maintain

optimal flexibility and liquidity, the Company has started working

with an independent financial advisor to explore options for

replacing the loan. Additional information pertaining to the

Amended Credit Agreement can be found on a Form 10-K that will be

filed by the Company with the U.S. Securities and Exchange

Commission.

- Due to extended disruptions associated with remediating legacy

issues and the significant, unexpected decline in discretionary

spending, which has impacted the broader household appliances

market, Polished is estimating Net Sales of between $85 million and

$90 million and low-single-digit EBITDA margins for the second

quarter.

- The Company expects to generate annualized Net Sales of between

$375 million and $400 million and low-single-digit EBITDA margins

for the full year.

- These expectations are as of July 31, 2023, and remain subject

to substantial uncertainty. Results are unpredictable and may be

materially affected by various factors, such as the economy,

inflation, interest rates, regional labor markets, supply chain

constraints and other variables.

- The Board of Directors and management continue to work with

independent advisors to evaluate strategic alternatives that can

maximize value. There is no assurance that this ongoing process

will result in any transaction or sale of the Company.

Conference Call

The Company will host an investor conference call at 8:30 a.m.

ET on Friday, August 4, 2023 to review its results. The phone

number for the investor conference call is 1-844-881-0136

(toll-free) or 1-412-902-6507 (international); please ask to join

the Polished Investor Conference Call. This call and all

supplemental information can be accessed on the Company’s investor

relations site at https://investor.polished.com.

ABOUT POLISHED

Polished is raising the bar, delivering a world-class,

white-glove shopping experience for home appliances. From the best

product selections from top brands to exceptional customer service,

we are simplifying the purchasing process and empowering consumers

as we provide a polished experience, from inspiration to

installation. A product expert helps customers get inspired and

imagine the space they want, then shares fresh ideas, unbiased

recommendations and excellent deals to suit the project's budget

and style. The goal is peace of mind when it comes to new

appliances. Polished perks include its "Love-It-Or-Return-It"

30-day policy, extended warranties, the ability to arrange for

delivery and installation at your convenience and other special

offers. Learn more at www.Polished.com.

FORWARD LOOKING STATEMENTS

This press release contains "forward-looking statements" that

are subject to substantial risks and uncertainties. All statements,

other than statements of historical fact, contained in this press

release are forward-looking statements. Forward-looking statements

contained in this press release may be identified by the use of

words such as "anticipate," "believe," "contemplate," "could,"

"estimate," "expect," "intend," "seek," "may," "might," "plan,"

"potential," "predict," "project," "target," "aim," "should,"

"will", "would," or the negative of these words or other similar

expressions, although not all forward-looking statements contain

these words. Forward-looking statements are based on the Company's

current expectations and are subject to inherent uncertainties,

risks and assumptions that are difficult to predict. Further,

certain forward-looking statements are based on assumptions as to

future events that may not prove to be accurate. You should not

place undue reliance on forward-looking statements because they

involve known and unknown risks, uncertainties and other factors,

which are, in some cases, beyond the Company’s control and which

could materially affect results. Factors that may cause actual

results to differ materially from current expectations include,

among other things, those described more fully in the section

titled "Risk Factors" of the Company’s Annual Report on Form 10-K

for the year ended December 31, 2021, and Quarterly Report on Form

10-Q for the quarter ended March 31, 2022, filed with the

Securities and Exchange Commission. Forward-looking statements

contained in this announcement are made as of this date, and the

Company undertakes no duty to update such information except as

required under applicable law.

NON-GAAP FINANCIAL MEASURES

The Company's audited consolidated financial statements and

unaudited condensed consolidated financial statements are prepared

in accordance with accounting principles generally accepted in the

United States ("GAAP"). The Company also provides financial

information in this release that was not prepared in accordance

with GAAP and should not be considered as an alternative to the

information prepared in accordance with GAAP. The Company believes

the non-GAAP financial measures presented in this press release

will help investors understand the financial condition and

operating results of the Company and assess the Company’s future

prospects. The Company believes these non-GAAP financial measures,

each of which is discussed in greater detail below, are important

supplemental measures because they exclude unusual or non-recurring

items as well as non-cash items that are unrelated to or may not be

indicative of our ongoing operating results. Further, when read in

conjunction with GAAP results, these non-GAAP financial measures

provide a baseline for analyzing trends in our underlying

businesses and can be used by management as a tool to help make

financial, operational and planning decisions. Finally, these

measures are often used by analysts and other interested parties to

evaluate companies in our industry by providing more comparable

measures that are less affected by factors such as capital

structure.

The Company recognizes that these non-GAAP financial measures

have limitations, including that they may be calculated differently

by other companies or may be used under different circumstances or

for different purposes, thereby affecting their comparability from

company to company. In order to compensate for these and the other

limitations discussed below, management does not consider these

measures in isolation from or as alternatives to the comparable

financial measures determined in accordance with GAAP. Readers

should review the reconciliations below and should not rely on any

single financial measure to evaluate our business.

The non-GAAP financial measure used in this press release is

adjusted EBITDA. The Company defines adjusted EBITDA as net income

before income taxes, depreciation and amortization, financing

costs, interest expense, sales tax accrual and one-time

non-operational events. Adjusted EBITDA is not calculated in

accordance with GAAP and should not be considered an alternative to

any financial measure that was calculated under GAAP. Adjusted

EBITDA is used to facilitate a comparison of the ordinary, ongoing

and customary course of the operations of the combined company on a

consistent basis from period to period and provide an additional

understanding of factors and trends affecting the business of the

Company. Adjusted EBITDA may not be comparable to similarly titled

non-GAAP measures used by other companies as other companies may

have calculated the measures differently.

The reconciliation of adjusted EBITDA to net income for the

Company is provided below (in thousands):

Q1 2023:

Three Months Ended

March 31, 2023

Net loss for three months ended March 31,

2023

$

(2,761

)

Depreciation and amortization

1,070

Interest expense

1,882

Income tax expense

104

EBITDA

295

Adjustments

Loss on change in fair value of derivative

contract

1,325

Management fee

63

Stock compensation expense

188

ADJUSTED EBITDA

$

1,871

FY 2022:

Year-Ended

December 31, 2022

Net loss for year

$

(125,965

)

Depreciation and amortization

11,456

Interest expense

3,421

Income tax benefit

(8,409

)

EBITDA

(119,497

)

Adjustments

Impairment of goodwill and intangible

assets

109,140

Loss on settlement of debt

3,240

Estimated penalty and interest for late

filing sales tax

2,123

Negotiated settlement of fees related to

Appliances Connection Acquisition

1,750

Specific inventory reserves

1,100

Allowance for doubtful accounts

900

Severance payments

613

Sales tax audit findings

400

Fee to re-audit 2021

465

Delaware 405 lawsuit

475

Miscellaneous other items

516

ADJUSTED EBITDA

$

1,225

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230731335825/en/

Investor Relations ir@polished.com

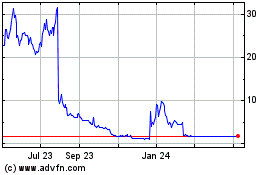

Polished (AMEX:POL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Polished (AMEX:POL)

Historical Stock Chart

From Feb 2024 to Feb 2025