UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

PLANET GREEN

HOLDINGS CORP.

(Name of Issuer)

Common Stock,

Par Value $0.001 Per Share

(Title of Class of Securities)

72703U102

(CUSIP Number)

Floor 18, Donghou Tower

Aiguo Road, Luohu District

Shenzhen, China

+86 13632863833

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

June 29, 2023

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box ☐

Note: Schedules filed in paper format shall include

a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

| * | The remainder of this cover page shall be filled out for

a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

SCHEDULE 13D

| 1 |

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

| Xiangtian (Shenzhen) Aerodynamic Electricity Ltd. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY |

| |

| 4 |

SOURCE OF FUNDS (See Instructions) |

| OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) ☐ |

| |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION |

| People’s Republic of China |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER |

| 6,000,000 |

| 8 |

SHARED VOTING POWER |

| 0 |

| 9 |

SOLE DISPOSITIVE POWER |

| 6,000,000 |

| 10 |

SHARED DISPOSITIVE POWER |

| 0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| 6,000,000 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) ☐ |

| |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| 8.3% |

| 14 |

TYPE OF REPORTING PERSON (See Instructions) |

| CO |

This Amendment No. 1

to Schedule 13D (“Amendment No. 1”) amends and supplements the information set forth in the Schedule 13D filed by Xiangtian

(Shenzhen) Aerodynamic Electricity Ltd. (the “Reporting Person”) with the Securities and Exchange Commission (the “SEC”)

on June 21, 2023 (together with this Amendment No. 1, the “Schedule 13D”). All capitalized terms not otherwise defined herein

have the meanings ascribed to such terms in the initial Schedule 13D. Except as specifically provided herein, this Amendment No. 1 does

not modify any of the previous information reported in the initial Schedule 13D.

Item 3. Source and Amount of Funds or Other

Considerations

On July 20, 2022, pursuant

to the terms of a share exchange agreement (the “SEA”), a subsidiary of the Issuer acquired 30% of the outstanding equity

interests of Xianning Xiangtian Energy Holdings Group Co., Ltd. (Xianning Xiangtian), in exchange for the issuance of a total of 12,000,000

shares of Common Stock to the former beneficiary shareholder of Xianning Xiangtian. As the former beneficiary shareholder of Xianning

Xiangtian and in exchange for its 30% of the outstanding equity interests of Xianning Xiangtian, the Reporting Person received 12,000,000

shares of Common Stock.

On June 29, 2023, pursuant

to the terms of a share transfer agreement (the “STA”), the Reporting Person completed the sale of 6,000,000 shares of Common

Stock at a price of $0.4564 per share.

Item 4. Purpose of Transaction

The response to Item 3 of this

Schedule 13D is incorporated by reference herein.

The acquisition of securities

set forth in this statement, pursuant to the SEA, was to consummate the Issuer’s acquisition of 40% equity interest of Xianning

Xiangtian.

On June 29, 2023, the Reporting

Person completed the sale of an aggregate of 6,000,000 shares of Common Stock.

Except as otherwise described

above, there are no other current plans or proposals which the reporting persons may have which relate to or would result in:

(a) The acquisition by any

person of additional securities of the issuer, or the disposition of securities of the issuer;

(b) An extraordinary corporate

transaction, such as a merger, reorganization or liquidation, involving the issuer or any of its subsidiaries;

(c) A sale or transfer of a

material amount of assets of the issuer or any of its subsidiaries;

(d) Any change in the present

board of directors or management of the issuer, including any plans or proposals to change the number or term of directors or to fill

any existing vacancies on the board;

(e) Any material change in

the present capitalization or dividend policy of the issuer;

(f) Any other material change

in the issuer’s business or corporate structure including but not limited to, if the issuer is a registered closed-end investment

company, any plans or proposals to make any changes in its investment policy for which a vote is required by section 13 of the Investment

Company Act of 1940;

(g) Changes in the issuer’s

charter, bylaws or instruments corresponding thereto or other actions which may impede the acquisition of control of the issuer by any

person;

(h) Causing a class of securities

of the issuer to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation

system of a registered national securities association;

(i) A class of equity securities

of the issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Act; or

(j) Any action similar to any

of those enumerated above.

Item 5. Interest in Securities of the Issuer

(a) The aggregate percentage

of shares of Common Stock reported owned by the Reporting Person is based upon the total 72,081,930 shares of Common Stock outstanding

as of June 29, 2023.

(b) The Reporting Person has

sole beneficial ownership of an aggregate of 6,000,000 shares of Common Stock, or approximately 8.3% of the outstanding shares of Common

Stock. The Reporting Person has the sole power to vote, direct the vote, dispose or direct the disposal of these 6,000,000 shares of Common

Stock.

(c) Other than the transactions

described Item 3 above, the Reporting Persons have not been involved in any transactions involving the securities of the Issuer in the

last 60 days.

(d) No other persons are known

that have the right to receive or the power to direct the receipt of dividends from, or the proceeds of sale of, such securities.

(e) Not Applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer

Except as otherwise indicated

above, there are no contracts, arrangements, understandings or relationships (legal or otherwise) between the Reporting Person and any

other person with respect to any securities of the Issuer, including but not limited to, transfer or voting of any of the securities,

finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits or loss, or

the giving or withholding of proxies.

SIGNATURE

After reasonable inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated: June 30, 2023 |

/s/ Xuelian Zhang |

| |

Xuelian Zhang |

5

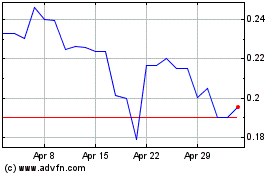

Planet Green (AMEX:PLAG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Planet Green (AMEX:PLAG)

Historical Stock Chart

From Nov 2023 to Nov 2024