|

PROSPECTUS SUPPLEMENT

To Prospectus, dated February 13, 2019

|

|

Filed pursuant to Rule 424(b)(5)

Registration File No. 333-226905

|

PALATIN

TECHNOLOGIES, INC.

Up

to $40,000,000

Common

Stock

We have entered

into an equity distribution agreement with Canaccord Genuity LLC,

or Canaccord, as sales agent, relating to shares of our common

stock, $0.01 par value per share, offered by this prospectus

supplement and the accompanying prospectus. In accordance with the

terms of the equity distribution agreement, we may offer and sell

shares of our common stock from time to time up to an aggregate

offering price

of $40,000,000 through Canaccord.

Upon our delivery

of a placement notice and subject to the terms and conditions of

the equity distribution agreement, Canaccord may sell the common

stock by methods deemed to be an “at the market”

offering as defined in Rule 415 promulgated under the Securities

Act of 1933, as amended, or the Securities Act, including sales

made directly on the NYSE American, on any other existing trading

market for the common stock or to or through a market maker other

than on an exchange. In addition, with our prior written approval,

Canaccord may also sell the common stock by any other method

permitted by law, including in privately negotiated transactions.

Canaccord is not required to sell any specific number or dollar

amount of our common stock, but will use its commercially

reasonable efforts, as our sales agent and subject to the terms of

the equity distribution agreement, to sell the shares of common

stock offered, as instructed by us and applicable state and federal

laws, rules and regulations and the rules of the NYSE American.

There is no arrangement for funds to be received in any escrow,

trust or similar arrangement.

We will pay

Canaccord a fixed commission, or allow a discount, for its services

in acting as agent in the sale of common stock equal to 3.0% of the

gross sales price per share of all shares sold through it as agent

under the equity distribution agreement. See “Plan of

Distribution” for information relating to certain expenses of

the sales agent to be reimbursed by us.

In connection with

the sale of common stock on our behalf, Canaccord may be deemed to

be an “underwriter” within the meaning of the

Securities Act and the compensation to Canaccord will be deemed to

be underwriting commissions or discounts. We have also agreed to

provide indemnification and contribution to Canaccord with respect

to certain liabilities, including liabilities under the Securities

Act.

The net proceeds we

receive from any sales under this prospectus supplement will be the

gross proceeds from such sales less the commissions and any other

costs we may incur in offering the common stock. See “Use of

Proceeds” and “Plan of Distribution” for

additional information.

Our common stock is

traded on the NYSE American under the symbol “PTN.” On

June 18, 2019, the reported closing price of the common stock was $

1.31 per share.

Investing

in our common stock involves a high degree of risk. You should

purchase our common stock only if you can afford a complete loss of

your investment. See “Risk Factors” beginning on page

S-5 of this prospectus supplement and page 5 of the accompanying

prospectus, as well as the information under the caption

“Risk Factors” in our Annual Report on Form 10-K for

the year ended June 30, 2018 and in the other documents

incorporated by reference into this prospectus supplement and the

accompanying prospectus for a discussion of the factors you should

carefully consider before investing in our common

stock.

Neither

the U.S. Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these

securities or determined if this prospectus supplement and the

accompanying prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

Canaccord Genuity

The

date of this prospectus supplement is June 21,

2019

TABLE OF CONTENTS

|

|

|

|

Prospectus Supplement

|

|

|

Page

|

|

About

this Prospectus Supplement

|

S-i

|

|

Prospectus

Supplement Summary

|

S-1

|

|

Risk

Factors

|

S-5

|

|

Cautionary

Note Concerning Forward-Looking Statements

|

S-8

|

|

Use of

Proceeds

|

S-10

|

|

Dilution

|

S-11

|

|

Dividend

Policy

|

S-12

|

|

Material

U.S. Federal Income Tax Consequences to Non-U.S.

Holders

|

S-13

|

|

Plan of

Distribution

|

S-16

|

|

Legal

Matters

|

S-17

|

|

Experts

|

S-17

|

|

Where

You Can Find More Information

|

S-17

|

|

Incorporation

of Information by Reference

|

S-18

|

|

|

|

|

Prospectus

|

|

|

Page

|

|

Prospectus

Summary

|

1

|

|

Risk

Factors

|

5

|

|

Note

Concerning Forward-Looking Statements

|

6

|

|

Incorporation

of Information by Reference

|

8

|

|

Where

You Can Find More Information

|

9

|

|

Use of

Proceeds

|

9

|

|

Dilution

|

9

|

|

Market

Information and Related Stockholder Matters

|

9

|

|

Description

of Securities

|

10

|

|

Anti-Takeover

Effects of Provisions of Delaware Law and Our Charter

Documents

|

16

|

|

Plan of

Distribution

|

17

|

|

Legal

Matters

|

18

|

|

Experts

|

18

|

We

are responsible for the information contained and incorporated by

reference in this prospectus supplement, in any accompanying

prospectus, and in any related free writing prospectus we prepare

or authorize. You should rely only on the information contained in

this prospectus supplement, the accompanying prospectus and

information incorporated by reference herein. We have not

authorized anyone to provide you with information different from

that contained in this prospectus supplement, the accompanying

prospectus or any authorized free writing prospectus, and we take

no responsibility for any other information that others may give

you. We are offering to sell, and seeking offers to buy, common

stock only in jurisdictions where offers and sales are permitted.

The information contained in this prospectus supplement, the

accompanying prospectus and any authorized free writing prospectus

is accurate only as of the date of this prospectus supplement, the

accompanying prospectus and any such authorized free writing

prospectus, regardless of the time of delivery of this prospectus

supplement, the accompanying prospectus, any such authorized free

writing prospectus or of any sale of our common stock. Our

business, financial condition, results of operations and prospects

may have changed since those dates. You should read this prospectus

supplement, the accompanying prospectus, the documents incorporated

by reference in this prospectus supplement and any free writing

prospectus that we have authorized for use in connection with this

offering, in their entirety before making an investment decision.

You should also read and consider the information in the documents

to which we have referred you in the sections of this prospectus

supplement entitled “Where You Can Find More

Information” and “Incorporation of Documents by

Reference.”

ABOUT THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement is part of a registration statement that we

have filed with the U.S. Securities and Exchange Commission (the

“SEC”) utilizing a “shelf” registration

process. Before buying any shares of our common stock offered

hereby, we urge you to carefully read this prospectus supplement

and the accompanying prospectus, together with the information

incorporated herein and therein by reference as described under the

headings “Where You Can Find More Information” and

“Incorporation of Certain Documents by Reference.”

These documents contain important information that you should

consider when making your investment decision. Under the shelf

registration process, we are offering to sell shares of our common

stock, which we also refer herein collectively as the securities,

using this prospectus supplement and the accompanying

prospectus.

In this

prospectus supplement, we provide you with specific information

about the securities that we are selling in this offering. Both

this prospectus supplement and the accompanying prospectus include

important information about us, our securities being offered and

other information you should know before investing. This prospectus

supplement also adds updates and changes information contained in

the accompanying prospectus. You should read both this prospectus

supplement and the accompanying prospectus as well as additional

information described under “Incorporation of Information by

Reference” elsewhere in this prospectus supplement and in the

accompanying prospectus before investing in our securities. To the

extent there is a conflict between the information contained in

this prospectus supplement, on the one hand, and the information

contained in any document incorporated by reference filed with the

SEC before the date of this prospectus supplement, on the other

hand, you should rely on the information in this prospectus

supplement.

We

further note that the representations, warranties and covenants

made by us in any agreement that is filed as an exhibit to any

document that is incorporated by reference in the prospectus

supplement or the accompanying prospectus were made solely for the

benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such

agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations,

warranties or covenants were accurate only as of the date when

made. Accordingly, such representations, warranties and covenants

should not be relied on as accurately representing the current

state of our affairs.

This

prospectus supplement, the accompanying prospectus and the

documents incorporated by reference herein contain market data and

industry statistics and forecasts that are based on independent

industry publications and other publicly available information.

Although we believe that these sources are reliable, we do not

guarantee the accuracy or completeness of this information and we

have not independently verified this information. Although we are

not aware of any misstatements regarding the market and industry

data presented or incorporated by reference in this prospectus,

these estimates involve risks and uncertainties and are subject to

change based on various factors, including those discussed under

the heading “Risk Factors” and any related free writing

prospectus. Accordingly, investors should not place undue reliance

on this information.

Unless

we have indicated otherwise or the context otherwise requires

references in the prospectus supplement and the accompanying

prospectus to “

Palatin

,” the “

Company

,” “

we

,” “

us

” and “

our

” or similar terms are to

Palatin Technologies, Inc. and its subsidiary.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information appearing elsewhere in

this prospectus supplement and in the accompanying prospectus and

in the documents we incorporate by reference. This summary is not

complete and does not contain all of the information you should

consider prior to investing. After you read this summary, you

should read and consider carefully the more detailed information

and financial statements and related notes that we include in

and/or incorporate by reference into this prospectus supplement and

the accompanying prospectus, especially the section entitled

“Risk Factors.” If you invest in our securities, you

are assuming a high degree of risk.

Overview

We are

a specialized biopharmaceutical company developing first-in-class

medicines based on molecules that modulate the activity of the

melanocortin and natriuretic peptide receptor systems. Our approved

product and product candidates are targeted, receptor-specific

therapeutics for the treatment of diseases with significant unmet

medical need and commercial potential. Our approved product is

Vyleesi™, the trade name for bremelanotide, a peptide

melanocortin receptor 4 (“

MC4r

”) agonist, for the treatment

of premenopausal women with acquired, generalized hypoactive sexual

desire disorder (“

HSDD

”), which is a type of female

sexual dysfunction (“

FSD

”), defined as low desire with

associated distress or interpersonal difficulty.

Vyleesi.

Vyleesi is a subcutaneous

injectable product for the treatment of HSDD in premenopausal

women. Vyleesi is a synthetic peptide analog of the naturally

occurring hormone alpha-MSH (melanocyte-stimulating hormone). In

March 2018, our exclusive North American licensee for Vyleesi, AMAG

Pharmaceuticals, Inc. (“

AMAG

”), submitted a New Drug

Application (“

NDA

”) to the U.S. Food and Drug

Administration (“

FDA

”) for Vyleesi for the

treatment of HSDD in premenopausal women, which was accepted for

filing and review by the FDA. On June 21, 2019 the FDA granted

marketing approval. We have also licensed rights to bremelanotide

to Shanghai Fosun Pharmaceutical Industrial Development Co. Ltd.

(“Fosun”) for the territories of the People’s

Republic of China, Taiwan, Hong Kong S.A.R. and Macau S.A.R.

(collectively, “

Chinese

Territories

”), and Kwangdong Pharmaceutical Co., Ltd.

(“

Kwangdong

”)

for the Republic of Korea (“

Korea

”).

The

FDA’s approval of the NDA triggers a $60 million milestone

payment to us under our North American license agreement with AMAG.

We will also receive tiered royalties on net sales ranging from

high single-digit to low double-digit percentages and up to $300

million contingent upon meeting certain annual sales milestones.

AMAG is expected to launch Vyleesi in the United States during the

third quarter of calendar year 2019.

Our

Phase 3 studies for HSDD in premenopausal women, called the

RECONNECT studies, consisted of two double-blind

placebo-controlled, randomized parallel group studies comparing the

on-demand use of 1.75 mg of Vyleesi versus placebo, in each case,

delivered via a subcutaneous auto-injector. Each trial consisted of

more than 600 patients randomized in a 1:1 ratio to either the

treatment arm or placebo with a 24-week evaluation period. In both

clinical trials, Vyleesi met the pre-specified co-primary efficacy

endpoints of improvement in desire and decrease in distress

associated with low sexual desire as measured using validated

patient-reported outcome instruments.

After

completing the studies, patients had the option to continue in an

open-label safety extension study for an additional 52 weeks.

Nearly 80% of patients who completed the randomized portion of the

study elected to remain in the open-label portion of the study. In

the Phase 3 clinical trials, the most frequent adverse events were

nausea, flushing, and headache, which were generally

mild-to-moderate in intensity and were transient.

We

retain worldwide rights for Vyleesi for HSDD and all other

indications outside North America, Korea and the Chinese

Territories. We are actively seeking potential partners for

marketing and commercialization rights for Vyleesi for HSDD outside

the licensed territories. However, we may not be able to enter into

suitable agreements with potential partners on acceptable terms, if

at all.

Melanocortin Receptor Systems.

There are

five melanocortin receptors, MC1r through MC5r. Modulation of these

receptors, through use of receptor-specific agonists, which

activate receptor function, or receptor-specific antagonists, which

block receptor function, can have significant pharmacological

effects. Our new product development activities primarily focus on

MC1r agonists, with potential to treat a number of inflammatory and

autoimmune diseases such as dry eye disease, also known as

keratoconjunctivitis sicca, uveitis, diabetic retinopathy and

inflammatory bowel disease. We believe that MC1r agonists,

including the MC1r agonist peptides we are developing, have broad

anti-inflammatory effects and appear to utilize mechanisms engaged

by the endogenous melanocortin system in regulation of the immune

system and resolution of inflammatory responses. We are also

developing peptides that are active at more than one melanocortin

receptor, and MC4r agonists, with potential utility in a number of

obesity and metabolic-related disorders, including rare disease and

orphan indications.

●

PL-8177, a

selective MC1r agonist peptide, is our lead clinical development

candidate for inflammatory bowel diseases, including ulcerative

colitis, with potential applicability for a number of other

diseases. We filed an Investigational New Drug (“

IND

”) application on PL-8177 in

late 2017 and have completed subcutaneous dosing of human subjects

in a Phase 1 single and multiple ascending dose clinical safety

study, with favorable results announced in a press release issued

November 8, 2018. We completed a clinical study with oral dosing of

PL-8177 in human subjects in the fourth quarter of calendar year

2018, with positive results announced in a press release issued

April 4, 2019. Phase 2 clinical trials with oral PL-8177 in

ulcerative colitis patients are anticipated to commence in the

fourth quarter of calendar year 2019. A phase 2 clinical trial with

systemic PL-8177 in non-infectious uveitis, an ocular indication,

is also planned to start in the fourth quarter of calendar

2019.

●

PL-9643, a

pan-melanocortin peptide agonist, is a preclinical development

candidate for treating ocular inflammation. We have ongoing

IND-enabling preclinical activities with PL-9643, and if results

continue to be favorable, we anticipate filing an IND

.

●

We have initiated

preclinical programs with MC4r peptides and orally active small

molecules for treatment of rare genetic metabolic and obesity

disorders, and if results are favorable, anticipate selecting a

lead clinical development candidate and completing IND-enabling

activities in calendar year 2019.

Natriuretic Peptide Receptor Systems.

The natriuretic

peptide receptor (“

NPR

”) system has numerous

cardiovascular functions, and therapeutic agents modulating this

system may be useful in treatment of cardiovascular diseases,

including reducing cardiac hypertrophy and fibrosis, heart failure,

acute asthma, other pulmonary diseases and hypertension. While the

therapeutic potential of modulating this system is well

appreciated, development of therapeutic agents has been difficult

due, in part, to the short biological half-life of native peptide

agonists. We have designed and are developing potential candidate

drugs that are selective for one or more different natriuretic

peptide receptors, including natriuretic peptide receptor-A

(“

NPR-A

”),

natriuretic peptide receptor B (“

NPR-B

”), natriuretic peptide

receptor C (“

NPR-C

”).

●

PL-3994 is an NPR-A

agonist we developed which has completed Phase 1 clinical safety

studies. It has potential utility in treatment of a number of

cardiovascular diseases, including genetic and orphan diseases

resulting from a deficiency of endogenous active NPR-A. We have

ongoing academic collaborations with several institutions with

PL-3994, and seek to enter into a development partnership by the

end of calendar year 2019.

●

PL-5028, a dual

NPR-A and NPR-C agonist we developed, is in preclinical development

for cardiovascular diseases, including reducing cardiac hypertrophy

and fibrosis. We have ongoing academic collaborations with several

institutions with PL-5028, and seek to enter into a development

partnership by the end of calendar year 2019.

The

following chart illustrates the status of our drug development

programs.

Our Strategy

Key

elements of our business strategy include:

●

Using our

technology and expertise to develop and commercialize products in

our active drug development programs;

●

Entering into

strategic alliances and partnerships with pharmaceutical companies

to facilitate the development, manufacture, marketing, sale and

distribution of product candidates that we are

developing;

●

Partially funding

our product development programs with the cash flow generated from

existing license agreements, as well as any future research,

collaboration or license agreements; and

●

Completing

development and seeking regulatory approval of certain of our other

product candidates.

At

March 31, 2019, we had an accumulated deficit of approximately $348

million. We expect to incur substantial operating losses in future

periods. We do not expect to generate significant product revenue,

sales-based milestones or royalties until we successfully complete

development and obtain marketing approval for our product

candidates. While our North American licensee, AMAG, has received

marketing approval for Vyleesi for HSDD, our other product

candidates are in their early stages and must successfully complete

clinical trials before marketing approval can be sought, which will

take a number of years to complete. In order to commercialize our

product candidates, we need to complete clinical development and to

comply with comprehensive regulatory requirements.

We

believe that our existing capital resources, together with the $60

million milestone payment due from AMAG on approval of Vyleesi and

proceeds we receive from the sale of shares of our common stock in

the “at-the-market” program (if any), will be adequate

to fund our planned operations through at least calendar year 2020.

Following this offering we will need additional funding to complete

required clinical trials for our product candidates other than

bremelanotide, and, assuming those clinical trials are successful,

as to which there can be no assurance, to complete submission of

required regulatory applications to the FDA. It is possible that we

will not achieve the progress that we expect because the actual

costs and timing of clinical development activities are difficult

to predict and are subject to substantial risks and delays.

Accordingly, we will be required to obtain further funding through

public or private equity offerings, debt financings, collaborations

and licensing arrangements or other sources. Financing may not be

available to us in the necessary timeframe, in the amounts that we

need, on terms acceptable to us, or at all. Our failure to raise

capital as and when needed would have a negative impact on our

financial condition and our ability to pursue our business

strategy.

Our cash and

cash equivalents balance as of March 31, 2019 was approximately

$19.8 million.

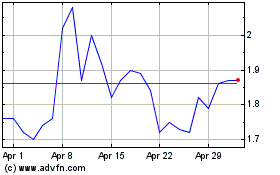

Between April 1,

2019 and June 18, 2019, a total of 12,573,643 shares of the

Company’s common stock were sold through Canaccord in an

at-the-market offering under an equity distribution agreement

entered into with Canaccord on April 20, 2018, for net proceeds of

$17,343,286.

Corporate Information

Our

corporate offices are located at 4B Cedar Brook Drive, Cedar Brook

Corporate Center, Cranbury, NJ 08512. Our telephone number is (609)

495-2200. Our internet address is www.palatin.com. The information

on our website is not incorporated by reference into this

prospectus supplement and should not be considered to be part of

this prospectus supplement. Our website address is included in this

prospectus supplement as an inactive textual reference

only.

The Offering

Issuer

Palatin

Technologies, Inc.

Securities offered

by us

Shares of our

common stock having an aggregate offering price of up to

$40,000,000.

Shares outstanding

after offering

246,090,573 shares,

assuming sale of $40,000,000 of shares of common stock at $1.31,

the closing sale price on June 18, 2019 (30,534,351

shares).

Manner of

offering

An

“at-the-market” offering that may be made from time to

time through our sales agent. See “Plan of

Distribution.”

Use of

proceeds

We intend to use

the proceeds from this offering for research and further

development of our product candidates, working capital, capital

expenditures, general and administrative expenses and other general

corporate purposes. See the section of this prospectus supplement

entitled “Use of Proceeds.”

NYSE American

symbol

“PTN”

Risk

factors

You should read the

section of this prospectus supplement entitled “Risk

Factors”, including the information incorporated by

reference, and the other information included in this prospectus

supplement for a discussion of factors that you should consider

before deciding to invest in our securities.

The

number of shares of our common stock to be outstanding after this

offering is based on 215,556,222 shares outstanding as of June 18,

2019.

Unless

otherwise indicated, all information in this prospectus supplement,

including the number of shares of our common stock to be

outstanding after this offering, excludes the

following:

●

61,335 shares of

common stock reserved as of May 31, 2019 for issuance upon any

conversion of our Series A Convertible Preferred Stock outstanding

as of June 18, 2019;

●

12,481,399 shares

of common stock issuable upon the exercise of stock options at a

weighted-average exercise price of $0.75 per share outstanding as

of June 18, 2019;

●

4,863,758 shares of

common stock issuable upon the vesting of outstanding restricted

stock units as of June 18, 2019 which vest on dates between June

11, 2019 and June 26, 2022, subject to the fulfillment of service

or performance conditions, some of which are subject to provisions

to delay delivery upon vesting;

●

3,950,125 shares of

common stock which have vested under restricted stock unit

agreements as of June 18, 2019 which are subject to provisions to

delay delivery; and

●

23,122,046 shares

of common stock issuable upon the exercise of warrants at a

weighted-exercise exercise price of $0.77 per share outstanding as

of June 18, 2019.

RISK FACTORS

You should carefully consider the risks described below and

discussed under the section entitled “Risk Factors” in

Part I, Item 1A of our Annual Report on Form 10-K for the fiscal

year ended June 30, 2018, which are incorporated by reference in

this prospectus supplement and the accompanying prospectus in their

entirety, together with other information in this prospectus

supplement, the accompanying prospectus and the documents

incorporated by reference before deciding to invest in our

securities. These risks should be considered in conjunction with

any other information included or incorporated by reference herein,

including in conjunction with forward-looking statements made

herein. See the section of this prospectus supplement entitled

“Where You Can Find More Information.” If any of the

following risks actually occur, they could materially adversely

affect our business, financial condition, operating results or

prospects.

Risks Related to this Offering

Our stock price is volatile and may fluctuate in a way that is

disproportionate to our operating performance and we expect it to

remain volatile, which could limit investors’ ability to sell

stock at a profit.

The

volatile price of our stock makes it difficult for investors to

predict the value of their investment, to sell shares at a profit

at any given time or to plan purchases and sales in advance. A

variety of factors may affect the market price of our common stock.

These include, but are not limited to:

●

publicity regarding

actual or potential clinical results relating to products under

development by our competitors or us;

●

delay or failure in

initiating, completing or analyzing preclinical or clinical trials

or unsatisfactory designs or results of these trials;

●

interim decisions

by regulatory agencies, including the FDA, as to clinical trial

designs, acceptable safety profiles and the benefit/risk ratio of

products under development;

●

achievement or

rejection of regulatory approvals by our competitors or by

us;

●

announcements of

technological innovations or new commercial products by our

competitors or by us;

●

developments

concerning proprietary rights, including patents;

●

developments

concerning our collaborations;

●

regulatory

developments in the United States and foreign

countries;

●

economic or other

crises and other external factors;

●

period-to-period

fluctuations in our revenue and other results of

operations;

●

changes in the

structure of healthcare payment systems or other actions that

affect the effective reimbursement rates for treatment regimens

containing our products;

●

changes in

financial estimates and recommendations by securities analysts

following our business or our industry;

●

sales of our common

stock, or the perception that such sales could occur;

and

●

the other factors

described in this “Risk Factors” section and

in

the section entitled

“Risk Factors” in Part I, Item 1A of our Annual Report

on Form 10-K for the fiscal year ended June 30, 2018.

We will

not be able to control many of these factors, and we believe that

period-to-period comparisons of our financial results will not

necessarily be indicative of our future performance. If our

revenues, if any, in any particular period do not meet

expectations, we may not be able to adjust our expenditures in that

period, which could cause our operating results to suffer further.

If our operating results in any future period fall below the

expectations of securities analysts or investors, our stock price

may fall by a significant amount.

For the

12-month period ended June 30, 2018, the price of our stock has

been volatile, ranging from a high of $1.59 per share to a low of

$0.38 per share. For the eleven-month period ended May 31, 2019,

the price of our stock has been volatile, ranging from a high of

$1.74 per share to a low of $0.59 per share. In addition, the stock

market in general, and the market for biotechnology companies in

particular, has experienced extreme price and volume fluctuations

that may have been unrelated or disproportionate to the operating

performance of individual companies. These broad market and

industry factors may seriously harm the market price of our common

stock, regardless of our operating performance.

You will experience immediate and substantial dilution in the net

tangible book value per share of the common stock you

purchase.

The

offering price per share in this offering may exceed the net

tangible book value per share of our common stock outstanding prior

to this offering. Assuming that an aggregate of 30,534,351 shares

of our common stock are sold at the assumed offering price of $1.31

per share (the last reported sale price of our common stock on the

NYSE American on June 18, 2019), and after deducting commissions

and estimated aggregate offering expenses payable by us, you will

experience immediate dilution of $1.08 per share, representing the

difference between our as adjusted net tangible book value per

share as of March 31, 2019 after giving effect to this offering and

the assumed offering price. In addition, we are not restricted from

issuing additional securities in the future, including shares of

common stock, securities that are convertible into or exchangeable

for, or that represent the right to receive, common stock or

substantially similar securities. The issuance of these securities

may cause further dilution to our stockholders. The exercise of

outstanding stock options, the vesting of outstanding restricted

stock units and the delivery of shares under restricted stock unit

agreements containing provisions to delay delivery may also result

in further dilution of your investment. See the section entitled

“Dilution” on page S-11 below for a more detailed

illustration of the dilution you may incur if you participate in

this offering.

You may experience future dilution as a result of future equity

offerings.

In

order to raise additional capital, we may in the future offer

additional shares of our common stock or other securities

convertible into or exchangeable for our common stock. We cannot

assure you that we will be able to sell shares or other securities

in any other offering at a price per share that is equal to or

greater than the price per share paid by investors in this

offering, and investors purchasing shares or other securities in

the future could have rights superior to existing stockholders. The

price per share at which we sell additional shares of our common

stock or other securities convertible into or exchangeable for our

common stock in future transactions may be higher or lower than the

price per share in this offering. As of June 18, 2019, an aggregate

total of approximately 29.3 million shares of common stock are

either subject to outstanding options or restricted stock unit

grants or reserved for future issuance under our equity incentive

plans. To the extent we grant additional awards under our equity

incentive plans, you could experience dilution, and, as a result,

the market price of our common stock may decline.

Resales of our common stock in the public market by our

stockholders during this offering may cause the market price of our

common stock to fall.

We may

issue common stock from time to time in connection with this

offering. The issuance from time to time of these new shares of our

common stock, or our ability to issue new shares of common stock in

this offering, could result in resales of our common stock by our

current stockholders concerned about the potential dilution of

their holdings. In turn, these resales could have the effect of

depressing the market price for our common stock.

We will have broad discretion over the use of the proceeds of this

offering and may not realize a return.

Our

management will have broad discretion over the use of our net

proceeds from this offering, and you will be relying on the

judgment of our management regarding the application of these

proceeds. Our management might not apply our net proceeds in ways

that ultimately increase the value of your investment and we might

not be able to yield a significant return, if any, on any

investment of these net proceeds. Our failure to apply these funds

effectively could have a material adverse effect on our business,

delay the development of our products and cause the price of our

common stock to decline.

Because we do not intend to declare cash dividends on our shares of

common stock in the foreseeable future, stockholders must rely on

appreciation of the value of our common stock for any return on

their investment.

We have

never declared or paid cash dividends on our common stock. We

currently anticipate that we will retain future earnings for the

development, operation and expansion of our business and do not

anticipate declaring or paying any cash dividends in the

foreseeable future. In addition, the terms of any existing or

future debt agreements may preclude us from paying dividends. As a

result, we expect that only appreciation of the price of our common

stock, if any, will provide a return to investors in this offering

for the foreseeable future.

Investing in our common stock may involve a high degree of

risk.

The

investments that we make in accordance with our investment

objectives may result in a high amount of risk, resulting in a

complete loss of principal, when compared to alternative investment

options. Our investments may be highly speculative and aggressive,

and therefore an investment in our common stock may not be suitable

for someone with lower risk tolerance.

It is not possible to predict the aggregate proceeds resulting from

sales made under the equity distribution agreement.

Subject

to certain limitations in the equity distribution agreement and

compliance with applicable law, we have the discretion to deliver a

placement notice to Canaccord at any time throughout the term of

the equity distribution agreement. The number of shares that are

sold through Canaccord after delivering a placement notice will

fluctuate based on a number of factors, including the market price

of our common stock during the sales period, the limits we set with

Canaccord in any applicable placement notice, and the demand for

our common stock during the sales period. Because the price per

share of each share sold will fluctuate during the sales period, it

is not currently possible to predict the aggregate proceeds to be

raised in connection with those sales.

The common

stock offered hereby will be sold in “at the market

offerings,” and investors who buy shares at different times

will likely pay different prices.

Investors

who purchase shares in this offering at different times will likely

pay different prices, and so may experience different levels of

dilution and different outcomes in their investment results. We

will have discretion, subject to market demand, to vary the timing,

prices, and number of shares sold in this offering. In addition,

subject to the final determination by our board of directors, there

is no minimum or maximum sales price for shares to be sold in this

offering. Investors may experience a decline in the value of the

shares they purchase in this offering as a result of sales made at

prices lower than the prices they paid.

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING

STATEMENTS

This

prospectus supplement and the accompanying prospectus, including

the information that we incorporate by reference, contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995 that involve substantial

risks and uncertainties. All statements other than statements of

historical facts contained in this prospectus, including statements

regarding our future financial condition, business strategy and

plans and objectives of management for future operations, are

forward-looking statements. In some cases, you can identify

forward-looking statements by terminology such as

“believe,” “will,” “may,”

“estimate,” “continue,”

“anticipate,” “intend,”

“should,” “plan,” “expect,”

“predict,” “could,”

“potentially” or the negative of these terms or other

similar expressions. We have based these forward-looking statements

largely on our current expectations and projections about future

events and financial trends that we believe may affect our

financial condition, results of operations, business strategy and

financial needs. These forward-looking statements include, but are

not limited to, statements concerning the following:

●

estimates of our

expenses, future revenue and capital requirements;

●

our ability to

achieve and maintain profitability;

●

our ability to

obtain additional financing on terms acceptable to us, or at

all;

●

our ability to

advance product candidates into, and successfully complete,

clinical trials;

●

the initiation,

timing, progress and results of future preclinical studies and

clinical trials, and our research and development

programs;

●

the timing or

likelihood of regulatory filings and approvals;

●

our expectations

regarding market acceptance and sales of Vyleesi™ (the trade

name for bremelanotide) for the treatment of premenopausal women

with hypoactive sexual desire disorder (“

HSDD

”), which is a type of female

sexual dysfunction (“FSD”);

●

our expectation

regarding the timing of our regulatory submissions for approval of

Vyleesi for HSDD in certain other jurisdictions outside the United

States;

●

our expectation

regarding performance of our exclusive licensees of Vyleesi,

including;

o

AMAG

Pharmaceuticals, Inc. (“

AMAG

”) for North

America,

o

Shanghai Fosun

Pharmaceutical Industrial Development Co. Ltd. (“

Fosun

”), a subsidiary of Shanghai

Fosun Pharmaceutical (Group) Co., Ltd., for the territories of the

People’s Republic of China, Taiwan, Hong Kong S.A.R. and

Macau S.A.R. (collectively, the “

Chinese Territories

”),

and

o

Kwangdong

Pharmaceutical Co., Ltd. (“

Kwangdong

”) for the Republic of

Korea (“

Korea

”);

●

the potential for

commercialization of Vyleesi for HSDD in North America by AMAG and

other product candidates, if approved, by us;

●

our expectations

regarding the potential market size and market acceptance for

Vyleesi for HSDD and our other product candidates, if approved for

commercial use;

●

our ability to

compete with other products and technologies similar to our product

candidates;

●

the ability of our

third-party collaborators to timely carry out their duties under

their agreements with us;

●

the ability of our

contract manufacturers to perform their manufacturing activities

for us in compliance with applicable regulations;

●

our ability to

recognize the potential value of our licensing arrangements with

third parties;

●

the potential to

achieve revenues from the sale of our product

candidates;

●

our ability to

obtain adequate reimbursement from Medicare, Medicaid, private

insurers and other healthcare payers;

●

our ability to

maintain product liability insurance at a reasonable cost or in

sufficient amounts, if at all;

●

the performance of

our management team, senior staff professionals, and third-party

contractors and consultants;

●

the retention of

key management, employees and third-party contractors;

●

the scope of

protection we are able to establish and maintain for intellectual

property rights covering our product candidates and technology in

the United States and throughout the world;

●

our compliance with

federal and state laws and regulations;

●

the timing and

costs associated with obtaining regulatory approval for our product

candidates;

●

the impact of

fluctuations in foreign exchange rates;

●

the impact of

legislative or regulatory healthcare reforms in the United

States;

●

our ability to

adapt to changes in global economic conditions as well as competing

products and technologies; and

●

our ability to

remain listed on the NYSE American stock exchange.

These

forward-looking statements are subject to a number of risks,

uncertainties and assumptions described under the section titled

“Risk Factors” and elsewhere in this prospectus

supplement, the accompanying base prospectus, and in the reports

with file with the SEC. We also operate in a very competitive and

rapidly changing environment. New risks emerge from time to time

and it is not possible for our management to predict all risks, nor

can we assess the impact of all factors on our business or the

extent to which any factor, or combination of factors, may cause

actual results to differ materially from those contained in, or

implied by, any forward-looking statements. In light of these

risks, uncertainties and assumptions, the forward-looking events

and circumstances described in this prospectus may not occur and

actual results could differ materially and adversely from those

anticipated or implied in the forward-looking statements contained

or incorporated by reference in this prospectus.

You

should not rely upon forward-looking statements as predictions of

future events. Although we believe that the expectations reflected

in the forward-looking statements are reasonable, we cannot

guarantee that the future results, levels of activity, performance,

events, circumstances or achievements reflected in the

forward-looking statements will ever be achieved or occur. Except

as required by law, we undertake no obligation to update any

forward-looking statements for any reason after the date of this

prospectus to conform these statements to actual results or to

changes in our expectations.

You

should read this prospectus, together with the information

incorporated herein by reference as described under the section

entitled “Incorporation of Information by Reference,”

and the documents that we reference in this prospectus and have

filed with the SEC as exhibits to the registration statement on

Form S-3, of which this prospectus is a part, with the

understanding that our actual future results, levels of activity,

performance and achievements may be materially different from what

we expect. We qualify all of our forward-looking statements by

these cautionary statements.

All

forward-looking statements attributable to us, or to persons acting

on our behalf, are expressly qualified in their entirety by these

cautionary statements.

USE OF PROCEEDS

The

proceeds from this offering may vary if we choose to raise less

than, or are unable to raise up to, the maximum $40,000,000 in

gross offering proceeds permitted by this prospectus supplement.

The number of shares that we offer and the offering price per share

also may vary.

We will

retain broad discretion over the use of the net proceeds from the

sale of the securities offered hereby. We currently intend to use

the net proceeds from the sale of the securities offered hereby for

research and further development of our product candidates and for

general corporate purposes, capital expenditures, working capital

and general and administrative expenses. We may also use a portion

of the net proceeds to acquire or invest in businesses, products

and technologies that are complementary to our own, although we

have no current plans, commitments or agreements with respect to

any acquisitions as of the date of this prospectus

supplement.

We have

not determined the amounts we plan to spend on any of the areas

listed above or the timing of these expenditures. As a result, our

management will have broad discretion to allocate the net proceeds

from this offering. Pending application of the net proceeds as

described above, we intend to invest the net proceeds of the

offering in short-term, investment-grade, interest-bearing

securities.

DILUTION

If

you invest in our common stock, your ownership interest will be

diluted immediately to the extent of the difference between the

offering price per share of our common stock and the as adjusted

net tangible book value per share of our common stock after this

offering.

As of

March 31, 2019, our net tangible book value was approximately $16.1

million, or $0.08 per share of common stock. Such net tangible book

value per share represents the amount of our total tangible assets

less total liabilities, divided by the number of shares of common

stock outstanding on March 31, 2019.

After

giving effect to the sale of 30,534,351 shares of common stock in

this offering at an assumed public offering price of $1.31 per

share (which was the last reported sale price on June 18, 2019),

after deducting estimated offering expenses and after deducting

estimated sales agent discounts payable by us, our pro forma net

tangible book value as of March 31, 2019 would have been

approximately $54.7 million, or $0.23 per share of common stock.

This would represent an immediate increase in pro forma net

tangible book value of $0.15 per share to existing stockholders and

an immediate dilution of $1.08 per share to new investors

purchasing shares of common stock in this offering, assuming

30,534,351 shares are sold at the assumed public offering price of

$1.31 per share.

The

following table illustrates this dilution on a per share

basis:

|

Assumed public

offering price per share

|

|

$

1.31

|

|

Historical net book

value per share as of March 31, 2019

|

$

0.08

|

|

|

As adjusted

increase in net book value per share attributable to new investors

in this offering

|

$

0.15

|

|

|

As adjusted net

book value per share of our common stock after this

offering

|

|

$

0.23

|

|

Dilution of as

adjusted net book value per share to new investors

|

|

$

1.08

|

The

foregoing table is based on 203,063,429 shares of our common stock

outstanding as of March 31, 2019 and assumes the conversion of all

then convertible preferred stock and excludes:

●

12,481,399

shares issuable on the exercise of stock options, at exercise

prices ranging from $0.37 to $2.80 per share;

●

4,872,333 shares

issuable under restricted stock units which vest on dates between

June 11, 2019 and June 26, 2022, subject to the fulfillment of

service or performance conditions;

●

3,952,875 shares of

common stock which have vested under restricted stock unit

agreements, but are subject to provisions to delay delivery;

and

●

23,404,046 shares

issuable on the exercise of warrants at exercise prices ranging

from $0.70 to $0.91 per share.

To the

extent that options or warrants are exercised, you will experience

further dilution. In addition, we may choose to raise additional

capital due to market conditions or strategic considerations even

if we believe we have sufficient funds for our current or future

operating plans. To the extent that additional capital is raised

through the sale of equity or convertible debt securities, the

issuance of these securities may result in further dilution to our

stockholders.

DIVIDEND POLICY

We have

not paid cash dividends on our common stock and do not anticipate

paying dividends in the foreseeable future. Our outstanding Series

A Preferred Stock, consisting of 4,030 shares on June 18, 2019,

provides that we may not pay a dividend or make any distribution to

holders of any class of stock unless we first pay a special

dividend or distribution of $100 per share to the holders of the

Series A Preferred Stock. Our board of directors currently intends

to retain any future earnings for reinvestment in our growing

business. Any future determination to pay dividends will also be at

the discretion of our board of directors and will be dependent upon

our results of operations and cash flows, our financial position

and capital requirements, general business conditions, legal, tax,

regulatory and any contractual restrictions on the payment of

dividends, and any other factors our board of directors deems

relevant. We currently intend to retain all available funds and any

future earnings to fund the development and expansion of our

business, and we do not anticipate paying any cash dividends in the

foreseeable future.

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S.

HOLDERS

The

following discussion describes the material U.S. federal income tax

consequences of the acquisition, ownership and disposition of our

common stock acquired in this offering by Non-U.S. Holders (as

defined below). This discussion does not address all aspects of

U.S. federal income taxes, does not discuss the potential

application of the Medicare Contribution tax, and does not deal

with state, local or non-U.S. tax consequences that may be relevant

to Non-U.S. Holders in light of their particular circumstances, nor

does it address U.S. federal tax consequences other than income

taxes (except to the limited extent set forth below). Rules

different from those described below may apply to certain Non-U.S.

Holders that are subject to special treatment under the Internal

Revenue Code of 1986, as amended, or the Code, such as financial

institutions, insurance companies, tax-exempt organizations,

“foreign governments,” international organizations,

broker-dealers and traders in securities, U.S. expatriates,

“controlled foreign corporations,” “passive

foreign investment companies,” corporations that accumulate

earnings to avoid U.S. federal income tax, persons that hold our

common stock as part of a “straddle,” “conversion

transaction,” or other risk reduction strategy, partnerships

and other pass-through entities, and investors in such pass-through

entities or entities that are treated as disregarded entities for

U.S. federal income tax purposes (regardless of their places of

organization or formation). Such Non-U.S. Holders are urged to

consult their tax advisors to determine the U.S. federal, state,

local and other tax consequences that may be relevant to them.

Furthermore, the discussion below is based upon the provisions of

the Code, and U.S. Treasury Regulations, rulings and judicial

decisions thereunder as of the date hereof, and such authorities

may be repealed, revoked or modified, perhaps retroactively, so as

to result in U.S. federal income tax consequences different from

those discussed below. We have not requested a ruling from the

Internal Revenue Service, or IRS, with respect to the statements

made and the conclusions reached in the following summary. This

discussion assumes that the Non-U.S. Holder holds our common stock

as a “capital asset” within the meaning of Section 1221

of the Code (generally, property held for investment).

The

following discussion is for general information only and is not tax

advice for Non-U.S. Holders under their particular circumstances.

Persons considering the purchase of our common stock pursuant to

this offering should consult their tax advisors concerning the U.S.

federal income tax consequences of acquiring, owning and disposing

of our common stock in light of their particular situations as well

as any consequences arising under the laws of any other taxing

jurisdiction, including any state, local and non-U.S. tax

consequences and any U.S. federal non-income tax

consequences.

For the

purposes of this discussion, a “Non-U.S. Holder” is,

for U.S. federal income tax purposes, a beneficial owner of common

stock that is not a U.S. Holder. A “U.S. Holder” means

a beneficial owner of our common stock that is for U.S. federal

income tax purposes (a) an individual who is a citizen or resident

of the United States, (b) a corporation or other entity treated as

a corporation created or organized in or under the laws of the

United States, any state thereof or the District of Columbia, (c)

an estate the income of which is subject to U.S. federal income

taxation regardless of its source or (d) a trust if it (1) is

subject to the primary supervision of a court within the United

States and one or more U.S. persons have the authority to control

all substantial decisions of the trust or (2) has a valid election

in effect under applicable U.S. Treasury Regulations to be treated

as a U.S. person. Also, partnerships, or other entities that are

treated as partnerships for U.S. federal income tax purposes

(regardless of their place of organization or formation) and

entities that are treated as disregarded entities for U.S. federal

income tax purposes (regardless of their place of organization or

formation) are not addressed by this discussion and are, therefore,

not considered to be Non-U.S. Holders for the purposes of this

discussion.

Distributions

Distributions, if

any, made on our common stock to a Non-U.S. Holder of our common

stock generally will constitute dividends for U.S. tax purposes to

the extent made out of our current or accumulated earnings and

profits (as determined under U.S. federal income tax principles)

and will be subject to withholding tax at a 30% rate or such lower

rate as may be specified by an applicable income tax treaty. To

obtain a reduced rate of withholding under a treaty, a Non-U.S.

Holder generally will be required to provide us with a properly

executed IRS Form W-8BEN, W-8BEN-E or other appropriate form,

certifying the Non-U.S. Holder’s entitlement to benefits

under that treaty. In the case of a Non-U.S. Holder that is an

entity, U.S. Treasury Regulations and the relevant tax treaty

provide rules to determine whether, for purposes of determining the

applicability of a tax treaty, dividends will be treated as paid to

the entity or to those holding an interest in that entity. If a

Non-U.S. Holder holds stock through a financial institution or

other agent acting on the holder’s behalf, the holder will be

required to provide appropriate documentation to such agent. The

holder’s agent may then be required to provide certification

to us or our paying agent, either directly or through other

intermediaries. If you are eligible for a reduced rate of U.S.

federal withholding tax under an income tax treaty, you should

consult with your tax advisor to determine if you are able to

obtain a refund or credit of any excess amounts withheld by timely

filing an appropriate claim for a refund with the IRS.

Withholding tax is

generally not imposed on dividends paid to a Non-U.S. Holder that

are effectively connected with the Non-U.S. Holder’s conduct

of a trade or business within the United States (and, if required

by an applicable income tax treaty, are attributable to a permanent

establishment that such holder maintains in the United States) if a

properly executed IRS Form W-8ECI, stating that the dividends are

so connected, is furnished to us (or, if stock is held through a

financial institution or other agent, to such agent). In general,

such effectively connected dividends will be subject to U.S.

federal income tax, on a net income basis at the regular graduated

rates, unless a specific treaty exemption applies. A Non-U.S.

Holder that is a corporation for U.S. federal income tax purposes

that receives effectively connected dividends may also be subject

to an additional “branch profits tax,” which is

imposed, under certain circumstances, at a rate of 30% (or such

lower rate as may be specified by an applicable treaty) on the

corporate Non-U.S. Holder’s effectively connected earnings

and profits, subject to certain adjustments.

To the

extent distributions on our common stock, if any, exceed our

current and accumulated earnings and profits, they will first

reduce your adjusted basis in our common stock as a non-taxable

return of capital, but not below zero, and then any excess will be

treated as gain and taxed in the same manner as gain realized from

a sale or other disposition of common stock as described in the

next section.

Distributions on

our common stock will also be subject to the rules discussed below

relating to backup withholding and foreign accounts.

Gain on Disposition of Our Common Stock

Subject

to the discussion below regarding backup withholding and foreign

accounts, a Non-U.S. Holder generally will not be subject to U.S.

federal income tax with respect to gain realized on a sale or other

disposition of our common stock unless (a) the gain is effectively

connected with a trade or business of such holder in the United

States (and, if required by an applicable income tax treaty, is

attributable to a permanent establishment that such holder

maintains in the United States), (b) the Non-U.S. Holder is a

nonresident alien individual and is present in the United States

for 183 or more days in the taxable year of the disposition and

certain other conditions are met, or (c) we are or have been a

“United States real property holding corporation”

within the meaning of Code Section 897(c)(2) at any time within the

shorter of the five-year period preceding such disposition or such

holder’s holding period.

If you

are a Non-U.S. Holder described in (a) above, you will be required

to pay tax on the net gain derived from the sale at regular

graduated U.S. federal income tax rates, unless a specific treaty

exemption applies, and corporate Non-U.S. Holders described in (a)

above may be subject to the additional branch profits tax at a 30%

rate or such lower rate as may be specified by an applicable income

tax treaty. If you are an individual Non-U.S. Holder described in

(b) above, you will be required to pay a flat 30% tax on the gain

derived from the sale, which gain may be offset by U.S. source

capital losses (even though you are not considered a resident of

the United States). With respect to (c) above, in general, we would

be a United States real property holding corporation if interests

in U.S. real estate constituted (by fair market value) at least

half of our total worldwide real property interests plus business

assets. We believe that we are not, and do not anticipate becoming,

a United States real property holding corporation; however, there

can be no assurance that we will not become a U.S. real property

holding corporation in the future. Even if we are treated as a U.S.

real property holding corporation, such treatment will not cause

gain realized by a Non-U.S. Holder on a disposition of our common

stock to be subject to U.S. federal income tax so long as (1) the

Non-U.S. Holder owned, directly, indirectly and constructively, no

more than five percent of our common stock at all times within the

shorter of (i) the five-year period preceding the disposition or

(ii) the holder’s holding period and (2) our common stock is

regularly traded on an established securities market. There can be

no assurance that our common stock will continue to qualify as

regularly traded on an established securities market.

Information Reporting Requirements and Backup

Withholding

Generally, we or

certain financial middlemen must report information to the IRS with

respect to any dividends we pay on our common stock including the

amount of any such dividends, the name and address of the

recipient, and the amount, if any, of tax withheld. A similar

report is sent to the holder to whom any such dividends are paid.

Pursuant to tax treaties or certain other agreements, the IRS may

make its reports available to tax authorities in the

recipient’s country of residence.

Dividends paid by

us (or certain financial middlemen) to a Non-U.S. Holder may also

be subject to U.S. backup withholding. U.S. backup withholding

generally will not apply to a Non-U.S. Holder who provides a

properly executed appropriate IRS Form W-8 or otherwise establishes

an exemption.

Under

current U.S. federal income tax law, U.S. information reporting and

backup withholding requirements generally will apply to the

proceeds of a disposition of our common stock effected by or

through a U.S. office of any broker, U.S. or non-U.S., unless the

holder provides a properly executed IRS Form W-8BEN or IRS Form

W-8BEN-E, as applicable, or otherwise establishes an exemption.

Generally, U.S. information reporting and backup withholding

requirements will not apply to a payment of disposition proceeds to

a Non-U.S. Holder where the transaction is considered effected

outside the United States through a non-U.S. office of a non-U.S.

broker. Information reporting and backup withholding requirements

may, however, apply to a payment of disposition proceeds if the

broker has actual knowledge, or reason to know, that the holder is,

in fact, a U.S. person. For information reporting purposes, certain

brokers with substantial U.S. ownership or operations will

generally be treated in a manner similar to U.S.

brokers.

If

backup withholding is applied to you, you should consult with your

tax advisor to determine if you are able to obtain a tax refund or

credit with respect to the amount withheld.

Foreign Accounts

A U.S.

federal withholding tax of 30% may apply to dividends paid to a

foreign financial institution (as specifically defined by

applicable rules), including when the foreign financial institution

holds our common stock on behalf of a Non-U.S. Holder, unless such

institution enters into an agreement with the U.S. government to

withhold on certain payments and to collect and provide to the U.S.

tax authorities substantial information regarding U.S. account

holders of such institution (which includes certain equity holders

of such institution, as well as certain account holders that are

foreign entities with U.S. owners). This U.S. federal withholding

tax of 30% will also apply to dividends paid to a non-financial

foreign entity unless such entity provides the withholding agent

with either a certification that it does not have any substantial

direct or indirect U.S. owners or provides information regarding

direct and indirect U.S. owners of the entity. The withholding tax

described above will not apply if the foreign financial institution

or non-financial foreign entity otherwise qualifies for an

exemption from the rules. An intergovernmental agreement between

the United States and an applicable foreign country may modify

these requirements. While U.S. federal withholding tax of 30% would

have applied also to the gross proceeds from a sale or other

disposition of our common stock on or after January 1, 2019,

recently proposed Treasury Regulations eliminate this withholding

tax on payments of gross receipts entirely. Non-U.S. Holders

generally may rely on the proposed Treasury Regulations until final

Treasury Regulations are issued.

Under

certain circumstances, a Non-U.S. Holder might be eligible for

refunds or credits of such taxes. Holders are encouraged to consult

with their tax advisors regarding the possible implications of this

withholding tax on their investment in our common

stock.

Federal Estate Tax

An

individual who at the time of death is not a citizen or resident of

the United States and who is treated as the owner of, or has made

certain lifetime transfers of, an interest in our common stock will

be required to include the value thereof in his or her taxable

estate for U.S. federal estate tax purposes, and may be subject to

U.S. federal estate tax. Applicable estate or gift tax treaty may

alter the tax treatment described in the preceding sentence. The

definition of when an individual is a resident of the United States

for U.S. federal estate tax purposes differs from the definition

used for U.S. federal income tax purposes. Some individuals,

therefore, may be “Non-U.S. Holders” for U.S. federal

income tax purposes, but not for U.S. federal estate tax purposes,

and vice versa.

EACH

PROSPECTIVE INVESTOR SHOULD CONSULT HIS, HER OR ITS TAX ADVISOR

REGARDING THE TAX CONSEQUENCES OF PURCHASING, HOLDING AND DISPOSING

OF OUR COMMON STOCK, INCLUDING THE CONSEQUENCES OF ANY PROPOSED

CHANGE IN APPLICABLE LAW, AS WELL AS TAX CONSEQUENCES ARISING UNDER

ANY STATE, LOCAL, NON-U.S. OR U.S. FEDERAL NON-INCOME TAX

LAWS.

PLAN OF DISTRIBUTION

We have

entered into an equity distribution agreement with Canaccord under

which we may issue and sell from time to time shares of our common

stock having an aggregate gross sales price of up to $40,000,000 of

our common stock through Canaccord, acting as our sales agent for

the offer and sale of the common stock.

Sales of the

common stock, if any, will be made through ordinary brokers’

transactions at market prices by methods deemed to be an

“at-the-market” offering as defined in Rule 415

promulgated under the Securities Act, including sales made directly

on the NYSE American stock exchange, on any other existing trading

market for the common stock, or to or through a market maker other

than on an exchange. Canaccord may also sell our common stock

hereunder by any other method permitted by law, including in

privately negotiated transactions.

Upon

delivery of a placement notice, Canaccord may offer the common

stock subject to the terms and conditions of the equity

distribution agreement on a daily basis or as otherwise agreed upon

by us and Canaccord. We will designate the maximum amount of common

stock to be sold through Canaccord on a daily basis or otherwise

determine such maximum amount together with Canaccord. Subject to

the terms and conditions of the equity distribution agreement,

Canaccord will use its commercially reasonable efforts to sell on

our behalf all of the shares of common stock requested to be sold

by us. We may instruct Canaccord not to sell common stock if the

sales cannot be effected at or above the price designated by us in

any such instruction. We or Canaccord may suspend the offering of

the common stock being made through Canaccord under the equity

distribution agreement upon proper notice to the other party and

subject to other conditions.

We will

pay Canaccord commissions, in cash, for its services in acting as

agent in the sale of our common stock. The aggregate compensation

payable to Canaccord shall be equal to 3.0% of the gross sales

price per share of all shares sold through it as agent under the

equity distribution agreement. Because there is no minimum offering

amount required as a condition to close this offering, the actual

total public offering amount, commissions and proceeds to us, if

any, are not determinable at this time. In addition, we have agreed

to reimburse a portion of the expenses of Canaccord in connection

with this offering up to a maximum of $25,000. We estimate that the

total expenses of the offering payable by us, excluding commissions

payable to Canaccord under the equity distribution agreement, will

be approximately $127,500.

Settlement for

sales of common stock will occur on the second trading day

following the date on which any sales are made (or such earlier day

as is industry practice for regular-way trading), in return for

payment of the net proceeds to us. Sales of our common stock as

contemplated in this prospectus supplement will be settled through

the facilities of The Depository Trust Company or by such other

means as we and Canaccord may agree upon. There is no arrangement

for funds to be received in an escrow, trust or similar

arrangement.

Canaccord will use

its commercially reasonable efforts, consistent with its sales and

trading practices, to solicit offers to purchase the common stock

shares under the terms and subject to the conditions set forth in

the equity distribution agreement. In connection with the sales of

the common stock on our behalf, Canaccord may be deemed to be an

“underwriter” within the meaning of the Securities Act,

and the compensation to Canaccord will be deemed to be underwriting

commissions or discounts. We have also agreed in the equity

distribution agreement to provide indemnification and contribution

to Canaccord with respect to certain liabilities, including

liabilities under the Securities Act.

The

offering of our common stock pursuant to equity distribution

agreement will terminate automatically upon the sale of all shares

of our common stock subject to the equity distribution agreement or

as otherwise permitted therein. We and Canaccord may each terminate

the equity distribution agreement at any time upon ten days’

prior written notice.

Any

portion of the $40,000,000 included in this prospectus supplement

that is not previously sold or included in an active placement

notice pursuant to the equity distribution agreement is available

for sale in other offerings pursuant to the accompanying base

prospectus, and if no shares are sold under the equity distribution