Registration No. 333-264388

Filed Pursuant to Rule 433

Dated June 20, 2023

6/7/23, 10:41 AMExchange Traded Notes | MAX ETNshttps://bmonsori-www.maxetns.com1/6IntroducingMAX ETNsOering sophisticated investors access to 3X returns of an indexor strategy.View All Products

6/7/23, 10:41 AMExchange Traded Notes | MAX ETNs Amplify yourinstinctsMAX Exchange Traded Notes (ETNs) oer sophisticatedinvestors ecient, tactical leveraged exposure to market sectorsin order to manage risk and enhance returns (and may alsoenhance losses). The ETNs are designed to provide investorswith access to the returns of an index or strategy, less anyinvestor fees.LeverageSeeking leverage to enhancegains (and which will alsoamplify losses), that resets on adaily basisEcientAn ecient and convenientway to obtain a leveragedinvestment with a singleproduct

6/7/23, 10:41 AMExchange Traded Notes | MAX ETNs TacticalDaily trading tool forsophisticated investorsExposureOering exposure to varioussectors and themesView All ProductsProductsCARDCARUMAX? Auto Industry -3XInverse Leveraged ETNsView productMAX? Auto Industry 3XLeveraged ETNsView product

6/7/23, 10:41 AMExchange Traded Notes | MAX ETNs JETDJETUMAX? Airlines -3X InverseLeveraged ETNsView productMAX? Airlines 3X LeveragedETNsView productHow to buySophisticated InvestorsFinancial ProfessionalsMAX ETNs can be purchased on most trading platforms duringnormal trading hours, just like many other public securities.Simply search for the ticker symbol of the MAX product youwant to buy and follow the instructions to place an order.Alternatively, you can contact your nancial advisor or brokeraccount representative. Please note, your advisor or brokermay charge commissions or other transaction fees.Keep in mind that ETNs are complex nancial products andyou should thoroughly research and understand the risks

6/7/23, 10:41 AMExchange Traded Notes | MAX ETNs DisclosureBank of Montreal, the issuer of the ETNs, has filed a registration statement (including a pricingsupplement, product supplement, prospectus supplement and prospectus) with the SEC for theofferings to which this website relates. Before you invest, you should read those documents andthe other documents that Bank of Montreal has filed with the SEC for more complete informationabout Bank of Montreal and these offerings. These documents may be obtained without cost byvisiting EDGAR on the SEC website at www.sec.gov. Alternatively, Bank of Montreal, any agent orany dealer participating in these offerings will arrange to send the applicable pricing supplement,the product supplement, the prospectus supplement and the prospectus if so requested bycalling toll-free at 1-877-369-5412.HomeProductsResourcesAboutContact Usbefore buying them. You may also want to consider consultinga nancial advisor

6/7/23, 10:41 AMExchange Traded Notes | MAX ETNs BMO Capital Markets Corp., an affiliate of the issuer, acts as the underwriter for the offerings ofthe ETNs.

before making any investment decisions.

6/7/23, 10:43 AMAirlines Exchange Traded Notes | MAX ETNs JETDJETUMAX? Airlines-3X InverseLeveraged ETNsView productMAX? Airlines 3XLeveraged ETNsView productHow to buySophisticated InvestorsFinancial ProfessionalsMAX ETNs can be purchased on most trading platforms duringnormal trading hours, just like many other public securities.Simply search for the ticker symbol of the MAX product youwant to buy and follow the instructions to place an order.Alternatively, you can contact your nancial advisor or broker

6/2/23, 2:25 PMProducts | MAX ETNs Available ETNsCARDCARUJETDJETUMAX? Auto Industry -3XInverse Leveraged ETNsView productMAX? Auto Industry 3XLeveraged ETNsView productMAX? Airlines -3X InverseLeveraged ETNsView productMAX? Airlines 3X LeveragedETNsView productSelected Risk ConsiderationsAn investment in the ETNs involves risks. Key risks are summarized here, but we urge youto read the more detailed explanation of risks described under "Risk Factors" in Bank ofProducts

6/2/23, 2:25 PMProducts | MAX ETNs Montreal's pricing supplement for the applicable securities. Capitalized terms used butnot dened herein have the meanings set forth in such pricing supplement.You may lose some or all of your principal ? The ETNs do not guarantee any return onyour initial investment. The ETNs are leveraged notes, which means they are exposed tothree times the risk of any increase or decrease in the level of the Index, compoundeddaily. Due to leverage, the ETNs are very sensitive to changes in the level of the Index andthe path of such changes. Because the Daily Investor Fee and the Daily Financing Charge(or any negative Daily Interest, in the case of inverse leveraged ETNs) reduce your nalpayment, the level of the Index, measured as a component of the closing Indicative NoteValue during the Final Measurement Period or Call Measurement Period, or on aRedemption Measurement Date, will need to increase (or decrease, as applicable) by anamount at least equal to the percentage of the principal amount represented by the DailyInvestor Fee, the Daily Financing Charge (or any negative Daily Interest, in the case ofinverse leveraged ETNs) and any Redemption Fee Amount in order for you to receive anaggregate amount at maturity, upon a call or redemption, or if you sell your ETNs, that isequal to at least the principal amount. You may lose some or all of your investment atmaturity or call, or upon early redemption.Credit of issuer ? The ETNs are senior unsecured debt obligations of the issuer, Bank ofMontreal, and are not, either directly or indirectly, an obligation of any third party. Anypayment to be made on the ETNs, including any payment at maturity, call or upon earlyredemption, depends on the ability of Bank of Montreal to satisfy its obligations as theycome due. As a result, the actual and perceived creditworthiness of Bank of Montreal willaect the market value, if any, of the ETNs prior to maturity, call or early redemption. Inaddition, in the event Bank of Montreal defaults on its obligations, you may not receiveany amounts owed to you under the terms of the ETNs.Correlation and compounding risk ? A number of factors may aect the ETNs' ability toachieve a high degree of correlation with the performance of the Index, and the ETNs arenot expected to achieve a high degree of correlation with the performance of the Indexover periods longer than one day. The leverage is reset daily, the return on the ETNs ispath dependent and you will be exposed to compounding of daily returns. As a result,the performance of the ETNs for periods greater than one Index Business Day may beeither greater than or less than three times the Index performance, before accountingfor the Daily Investor Fee, the Daily Financing Charge (or any negative Daily Interest, inthe case of inverse leveraged ETNs) and any Redemption Fee Amount.

6/2/23, 2:25 PMProducts | MAX ETNs Path dependence ? The return on the ETNs will be highly path dependent. Accordingly,even if the level of the Index increases or decreases over the term of the ETNs, or overthe term which you hold the ETNs, the value of the ETNs will increase or decrease notonly based on any change in the level of the Index over a given time period, but alsobased on the volatility of the Index over that time period. The value of the ETNs willdepend not only upon the level of the Index at maturity, upon call or upon earlyredemption, but also on the performance of the Index over each day that you hold theETNs. It is possible that you will suer signicant losses in the ETNs, even if the long-termperformance of the Index is positive (or negative, in the case of inverse leveraged ETNs).Accordingly, the returns on the ETNs may not correlate with returns on the Index overperiods of longer than one day.Long holding period risk ? The ETNs are intended to be daily trading tools forsophisticated investors and are designed to reect a leveraged long or inverse exposureto the performance of the Index, as applicable, on a daily basis; however, their returnsover dierent periods of time can, and most likely will, dier signicantly from threetimes the return on a direct long or inverse investment in the Index, as applicable. TheETNs are very sensitive to changes in the level of the Index, and returns on the ETNs maybe negatively aected in complex ways by volatility of the Index on a daily or intradaybasis. Accordingly, the ETNs should be purchased only by knowledgeable investors whounderstand the potential consequences of investing in the Index and of seeking dailycompounding leveraged long or inverse investment results, as applicable. Investorsshould actively and frequently monitor their investments in the ETNs, even intra-day. It ispossible that you will suer signicant losses in the ETNs even if the long-termperformance of the Index is positive or negative, as applicable (before taking into accountthe negative eect of the Daily Investor Fee and the Daily Financing Charge (or negativeDaily Interest, in the case of inverse leveraged ETNs), and the Redemption Fee Amount, ifapplicable).Potential total loss of value ? If the closing Indicative Note Value of the ETNs is equal toor less than $0 on any Exchange Business Day, then the Indicative Note Value on allfuture Exchange Business Days will be $0. If the Intraday Indicative Value of the ETNs isequal to or less than $0 at any time on any Index Business Day, then both the IntradayIndicative Value of the ETNs and the closing Indicative Note Value on that ExchangeBusiness Day, and on all future Exchange Business Days, will be $0. If the Indicative NoteValue is $0, the Cash Settlement Amount will be $0.

6/2/23, 2:25 PMProducts | MAX ETNs Leverage risk ? The ETNs are three times leveraged and, as a result, the ETNs willbenet, or result in losses, on a leveraged basis, based on the daily performance of theIndex. However, the leverage of the ETNs may be greater or less the amount set forth inthe name of the ETN during any given Index Business Day. Volatility of the Index levelmay have a signicant negative eect on the value of the ETNs.The applicable Index may have a limited performance history ? The Index to whichyour ETNs are linked may be of recent origin, and have only limited historicalinformation. Accordingly, your investment in the ETNs may involve a greater risk thaninvesting in securities linked to one or more indices with a more established record ofperformance.The applicable Index may be concentrated in a specic sector ? The Index to whichyour ETNs are linked may be concentrated in only one, or a limited number of, sectors. Asa result, an investment in the ETNs may not benet from the diversication that couldresult from an investment linked to multiple economic sectors.We may replace the applicable Index with a dierent Index ? We may substitute adierent index for the Index to which your ETNs are linked. The performance of any newindex to which your ETNs are linked may perform dierently than the original Index overthe remaining term of the ETNs. Any such replacement index may have risks that aredierent from, or additional to, the Index. Accordingly, if we exercise this right, thepayments on the ETNs may be adversely aected.A trading market for the ETNs may not develop ? The ETNs are listed on the NYSEArca under the appliable trading symbol. However, a trading market for the ETNs maynot develop. We are not required to maintain any listing of the ETNs on the NYSE Arca orany other exchange.The Intraday Indicative Value is not the same as the trading price of the ETNs in thesecondary market ? The Intraday Indicative Value of the ETNs will be calculated andpublished every 15 seconds on each Exchange Business Day during normal trading hourson Bloomberg, so long as no Market Disruption Event has occurred or is continuing. Thetrading price of the ETNs at any time is the price at which you may be able to sell yourETNs in the secondary market at such time, if one exists. The trading price of the ETNs atany time may vary signicantly from the Intraday Indicative Value of the ETNs at suchtime.

6/2/23, 2:25 PMProducts | MAX ETNs Paying a premium purchase price over the Intraday Indicative Value of the ETNscould lead to signicant losses in the event one sells such ETNs at a time whensuch premium is no longer present in the market place or the ETNs are called ?Paying a premium purchase price over the Intraday Indicative Value of the ETNs couldlead to signicant losses in the event one sells the ETNs at a time when such premium isno longer present in the market place or if the ETNs are called, in which case investorswill receive a cash payment in an amount based on the arithmetic mean of the closingIndicative Note Value of the ETNs during the Call Measurement Period. Before trading inthe secondary market, you should compare the Intraday Indicative Value with the then-prevailing trading price of the ETNs.Call right ? We may elect to redeem all or a portion of the outstanding ETNs at any time.If we exercise our Call Right, the Call Settlement Amount may be less than the principalamount of your ETNs. Any exercise by us of our Call Right could present a conictbetween your interest in the ETNs and our interests in determining whether to call theETNs.Minimum redemption amount ? You must elect to redeem at least the number of ETNsspecied in the applicable pricing supplement for us to repurchase your ETNs, unless wedetermine otherwise or your broker or other nancial intermediary bundles your ETNsfor redemption with those of other investors to reach this minimum requirement, andthere can be no assurance that they can or will do so. Therefore, your ability to electredemption of the ETNs may be limited.Your redemption election is irrevocable ? You will not be able to rescind your electionto redeem your ETNs after your redemption notice is received by us. Accordingly, you willbe exposed to market risk if the level of the Index decreases after we receive your oerand the Redemption Amount is determined on the Redemption Measurement Date. Youwill not know the Redemption Amount at the time that you submit your irrevocableredemption notice.No interest payments or ownership rights ? The ETNs do not pay any interest. You willnot have any ownership rights in the Index constituents, nor will you have any right toreceive dividends or other distributions paid to holders of the Index constituents, exceptas may be reected in the level fo the applicable Index.Potential conicts ? We and our aliates play a variety of roles in connection with theissuance of the ETNs, including acting as an agent of the issuer for the oering of the

6/2/23, 2:25 PMProducts | MAX ETNs ETNs, making certain calculations and determinations that may aect the value of theETNs and hedging our obligations under the ETNs. Any prot in connection with suchhedging activities will be in addition to any other compensation that we and our aliatesreceive for the sale of the ETNs, which creates an additional incentive to sell the ETNs toyou. In performing these activities, our economic interests and those of our aliates arepotentially adverse to your interests as an investor in the ETNs.Uncertain tax treatment ? Signicant aspects of the tax treatment of the ETNs areuncertain. You should consult your own tax advisor about your own tax situation.Bank of Montreal and its aliates do not provide tax advice, and nothing containedherein should be construed as tax advice. Please be advised that any discussion of U.S.tax matters contained herein (including any attachments): (i) is not intended or written tobe used, and cannot be used, by you for the purposes of avoiding U.S. tax-relatedpenalties, and (ii) was written to support the promotion of marketing of the transactionsor other matters addressed herein. Accordingly, you should seek advice based on yourparticular circumstances from your independent tax advisor.How to buyRead moreSophisticated InvestorsFinancial ProfessionalsMAX ETNs can be purchased on most trading platforms duringnormal trading hours, just like many other public securities.Simply search for the ticker symbol of the MAX product you

DisclosureBank of Montreal, the issuer of the ETNs, has filed a registration statement (including a pricingsupplement, product supplement, prospectus supplement and prospectus) with the SEC for theofferings to which this website relates. Before you invest, you should read those documents andthe other documents that Bank of Montreal has filed with the SEC for more complete informationabout Bank of Montreal and these offerings. These documents may be obtained without cost byHomeProductsResourcesAboutContact Uswant to buy and follow the instructions to place an order.Alternatively, you can contact your nancial advisor or brokeraccount representative. Please note, your advisor or brokermay charge commission or other transaction fees.Keep in mind that ETNs are complex nancial products andyou should thoroughly research and understand the risksbefore buying them. You may also want to consider consultinga nancial advisor before making any investment decisions.

6/2/23, 2:25 PMProducts | MAX ETNs visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Bank of Montreal, any agent orany dealer participating in these offerings will arrange to send the applicable pricing supplement,the product supplement, the prospectus supplement and the prospectus if so requested bycalling toll-free at 1-877-369-5412.BMO Capital Markets Corp., an affiliate of the issuer, acts as the underwriter for the offerings ofthe ETNs.

6/7/23, 10:43 AMAirlines Exchange Traded Notes | MAX ETN The return on the AirlinesExchanged Traded Notes islinked to a +3X times leveragedor -3X times inverse leveragedparticipation in the dailyperformance of the PrimeAirlines Index, minus theapplicable fees. The ETNs arenot "buy and hold" investmentsand should not be expected toprovide a +3x times leveraged or-3X times inverse leveragedreturn, as applicable, of theunderlying index's cumulativereturn for periods greater than aday.AirlinesExchange Traded Notes

6/7/23, 10:43 AMAirlines Exchange Traded Notes | MAX ETNs JETDJETUMAX? Airlines-3X InverseLeveraged ETNsView productMAX? Airlines 3XLeveraged ETNsView productHow to buySophisticated InvestorsFinancial ProfessionalsMAX ETNs can be purchased on most trading platforms duringnormal trading hours, just like many other public securities.Simply search for the ticker symbol of the MAX product youwant to buy and follow the instructions to place an order.Alternatively, you can contact your nancial advisor or broker

6/7/23, 10:43 AMAirlines Exchange Traded Notes | MAX ETNs DisclosureBank of Montreal, the issuer of the ETNs, has filed a registration statement (including a pricingsupplement, product supplement, prospectus supplement and prospectus) with the SEC for theofferings to which this website relates. Before you invest, you should read those documents andthe other documents that Bank of Montreal has filed with the SEC for more complete informationabout Bank of Montreal and these offerings. These documents may be obtained without cost byvisiting EDGAR on the SEC website at www.sec.gov. Alternatively, Bank of Montreal, any agent orany dealer participating in these offerings will arrange to send the applicable pricing supplement,HomeProductsResourcesAboutContact Usaccount representative. Please note, your advisor or brokermay charge commissions or other transaction fees.Keep in mind that ETNs are complex nancial products andyou should thoroughly

6/7/23, 10:43 AMAirlines Exchange Traded Notes | MAX ETNs the product supplement, the prospectus supplement and the prospectus if so requested bycalling toll-free at 1-877-369-5412.BMO Capital Markets Corp., an affiliate of the issuer, acts as the underwriter for the offerings ofthe ETNs.

research and understand the risksbefore buying them. You may also want to consider consultinga nancial advisor before making any investment decisions.

6/7/23, 11:15 AMJETU | MAX? Airlines 3X Leveraged ETNs | MAX ETNs The return on the MAX Airlines3X Leveraged ETNs is linked to a3X times leveraged participationin the daily performance of thePrime Airlines Index, minus theapplicable fees. The ETNs arenot "buy and hold" investmentsand should not be expected toprovide a 3X times leveragedreturn of the underlying index'scumulative return for periodsgreater than a day.SectorTickerJETUIntraday Indicative Value TickerJETUIVIndex TickerPJETSNTRProduct DetailsAirlinesMAX? Airlines 3X Leveraged ETNsJETU

CUSIPIssue DateMaturity Date063679492 June 20, 2023 May 28, 2043Closing Indicative Value$Market CapitalizationETNs OutstandingFact SheetProspectusDELTA AIR LINES9.42 %UNITED AIRLINES HOLDINGS INC9.14 %RAYTHEON TECHNOLOGIES CORP9.03 %GENERAL ELECTRIC CO9.01 %Daily Market DataDocumentsView PDFView PDFIndex ConstituentsWeights

6/7/23, 11:15 AMJETU | MAX? Airlines 3X Leveraged ETNs | MAX ETNs BOEING CO/THE8.98 %AMERICAN AIRLINES GROUP INC8.91 %HONEYWELL INTERNATIONAL INC8.86 %UNITED PARCEL SERVICE-CL B8.73 %FEDEX CORP8.53 %GENERAL DYNAMICS6.99 %SOUTHWEST AIRLINES CO5.92 %ALASKA AIR GROUP2.03 %JETBLUE AIRWAYS CORP1.71 %COPA HOLDINGS SA0.96 %SPIRIT AIRLINES INC0.77 %ALLEGIANT TRAVEL CO0.56 %SKYWEST INC0.46 %as of Jun 7, 2023Risk ConsiderationsKey RisksAn investment in the MAX Airlines 3X Leveraged ETNs (+3X ETNs) involves risks. Key risksare summarized here, but we urge you to read the more detailed explanation of risksdescribed under "Risk Factors" in Bank of Montreal's pricing supplement for thesesecurities. Capitalized terms used but not dened herein have the meanings set forth insuch pricing supplement.

6/7/23, 11:15 AMJETU | MAX? Airlines 3X Leveraged ETNs | MAX ETNs You may lose some or all of your principal - The +3X ETNs do not guarantee any returnon your initial investment. The +3X ETNs are leveraged notes, which means they areexposed to three times the risk of any decrease in the Index Level, compounded daily.Due to leverage, the +3X ETNs are very sensitive to changes in the Index Level and thepath of such changes. Because the Daily Investor Fee and the Daily Financing Chargereduce your nal payment, the Index Level, measured as a component of the closingIndicative Note Value during the Final Measurement Period or Call Measurement Period,or on a Redemption Measurement Date, will need to increase by an amount at leastequal to the percentage of the principal amount represented by the Daily Investor Fee,the Daily Financing Charge and any Redemption Fee Amount in order for you to receivean aggregate amount at maturity, upon a call or redemption, or if you sell your +3X ETNs,that is equal to at least the principal amount. You may lose some or all of yourinvestment at maturity or call, or upon early redemption.Credit of issuer - The +3X ETNs are senior unsecured debt obligations of the issuer, Bankof Montreal, and are not, either directly or indirectly, an obligation of any third party. Anypayment to be made on the +3X ETNs, including any payment at maturity, call or uponearly redemption, depends on the ability of Bank of Montreal to satisfy its obligations asthey come due. As a result, the actual and perceived creditworthiness of Bank ofMontreal will aect the market value, if any, of the +3X ETNs prior to maturity, call orearly redemption. In addition, in the event Bank of Montreal defaults on its obligations,you may not receive any amounts owed to you under the terms of the +3X ETNs.Correlation and compounding risk - A number of factors may aect the +3X ETNs'ability to achieve a high degree of correlation with the performance of the Index, and the+3X ETNs are not expected to achieve a high degree of correlation with the performanceof the Index over periods longer than one day. The leverage is reset daily, the return onthe +3X ETNs is path dependent and you will be exposed to compounding of dailyreturns. As a result, the performance of the +3X ETNs for periods greater than one IndexBusiness Day may be either greater than or less than three times the Index performance,before accounting for the Daily Investor Fee, the Daily Financing Charge and anyRedemption Fee Amount.Path dependence - The return on the +3X ETNs will be highly path dependent.Accordingly, even if the Index Level increases or decreases over the term of the +3X ETNs,or over the term which you hold the +3X ETNs, the value of the +3X ETNs will increase or

6/7/23, 11:15 AMJETU | MAX? Airlines 3X Leveraged ETNs | MAX ETNs decrease not only based on any change in the Index Level over a given time period, butalso based on the volatility of the Index over that time period. The value of the +3X ETNswill depend not only upon the Index Level at maturity, upon call or upon earlyredemption, but also on the performance of the Index over each day that you hold the+3X ETNs. It is possible that you will suer signicant losses in the +3X ETNs, even if thelong-term performance of the Index is positive. Accordingly, the returns on the +3X ETNsmay not correlate with returns on the Index over periods of longer than one day.Long holding period risk - The +3X ETNs are intended to be daily trading tools forsophisticated investors and are designed to reect a leveraged long exposure to theperformance of the Index on a daily basis; however, their returns over dierent periodsof time can, and most likely will, dier signicantly from three times the return on adirect long investment in the Index. The +3X ETNs are very sensitive to changes in theIndex Level, and returns on the +3X ETNs may be negatively aected in complex ways byvolatility of the Index on a daily or intraday basis. Accordingly, the +3X ETNs should bepurchased only by knowledgeable investors who understand the potential consequencesof investing in the Index and of seeking daily compounding leveraged long investmentresults. Investors should actively and frequently monitor their investments in the +3XETNs, even intra-day. It is possible that you will suer signicant losses in the +3X ETNseven if the long-term performance of the Index is positive (before taking into account thenegative eect of the Daily Investor Fee and the Daily Financing Charge, and theRedemption Fee Amount, if applicable).Potential total loss of value - If the closing Indicative Note Value of the +3X ETNs isequal to or less than $0 on any Exchange Business Day, then the Indicative Note Value onall future Exchange Business Days will be $0. If the Intraday Indicative Value of the +3XETNs is equal to or less than $0 at any time on any Index Business Day, then both theIntraday Indicative Value of the +3X ETNs and the closing Indicative Note Value on thatExchange Business Day, and on all future Exchange Business Days, will be $0. If theIndicative Note Value is $0, the Cash Settlement Amount will be $0.Leverage risk - The +3X ETNs are three times leveraged and, as a result, the +3X ETNswill benet from three times any positive, but will decline based on three times anynegative, daily performance of the Index. However, the leverage of the +3X ETNs may begreater or less than 3.0 during any given Index Business Day. Volatility of the Index levelmay have a signicant negative eect on the value of the +3X ETNs.

6/7/23, 11:15 AMJETU | MAX? Airlines 3X Leveraged ETNs | MAX ETNs The Index has a limited actual performance history - The Index was launched inDecember 2022. Because the Index is of recent origin and limited actual historicalperformance data exists with respect to it, your investment in the +3X ETNs may involve agreater risk than investing in securities linked to one or more indices with a moreestablished record of performance.The Index lacks diversication and is concentrated in one sector, and has a limitednumber of Index component - All of the stocks included in the Index are issued bycompanies in the airline industry, including airlines and aircraft and aircraft partsmanufacturers, and companies engaged in the businesses of air freight and logistics,aircraft leasing and airline and airport operations. As a result, the +3X ETNs will notbenet from the diversication that could result from an investment linked to an index ofcompanies that operate in multiple sectors. Any decrease in the market price of any ofthose stocks is likely to have a substantial negative impact on the Closing Index Level anda substantial adverse impact on the value of the +3X ETNs. Giving eect to leverage,negative changes in the performance of one Index component will be magnied andhave a material adverse eect on the value of the +3X ETNs.We may replace the Index with a dierent index - We may substitute a dierent indexfor the Index. The performance of any new index to which the ETNs are linked mayperform dierently than the Index over the remaining term of the ETNs. Any suchreplacement index may have risks that are dierent from, or additional to, the Index.Accordingly, if we exercise this right, the payments on the ETNs may be adverselyaected.A trading market for the +3X ETNs may not develop - The +3X ETNs are listed on theNYSE Arca under the symbol "JETU." However, a trading market for the +3X ETNs may notdevelop. We are not required to maintain any listing of the +3X ETNs on the NYSE Arca orany other exchange.The Intraday Indicative Value is not the same as the trading price of the +3X ETNsin the secondary market - The Intraday Indicative Value of the +3X ETNs will becalculated and published every 15 seconds on each Exchange Business Day duringnormal trading hours on Bloomberg under the ticker symbol JETUIV so long as no MarketDisruption Event has occurred or is continuing. The trading price of the +3X ETNs at anytime is the price at which you may be able to sell your +3X ETNs in the secondary market

6/7/23, 11:15 AMJETU | MAX? Airlines 3X Leveraged ETNs | MAX ETNs at such time, if one exists. The trading price of the +3X ETNs at any time may varysignicantly from the Intraday Indicative Value of the +3X ETNs at such time.Paying a premium purchase price over the Intraday Indicative Value of the +3XETNs could lead to signicant losses in the event one sells such +3X ETNs at a timewhen such premium is no longer present in the marketplace or the +3X ETNs arecalled - Paying a premium purchase price over the Intraday Indicative Value of the +3XETNs could lead to signicant losses in the event one sells the +3X ETNs at a time whensuch premium is no longer present in the marketplace or if the +3X ETNs are called, inwhich case investors will receive a cash payment in an amount based on the arithmeticmean of the closing Indicative Note Value of the +3X ETNs during the Call MeasurementPeriod. Before trading in the secondary market, you should compare the IntradayIndicative Value with the then-prevailing trading price of the +3X ETNs.Call right - We may elect to redeem all or a portion of the outstanding +3X ETNs at anytime. If we exercise our Call Right, the Call Settlement Amount may be less than theprincipal amount of your +3X ETNs. Any exercise by us of our Call Right could present aconict between your interest in the +3X ETNs and our interests in determining whetherto call the +3X ETNs.Minimum redemption amount - You must elect to redeem at least 25,000 +3X ETNs forus to repurchase your +3X ETNs, unless we determine otherwise or your broker or othernancial intermediary bundles your +3X ETNs for redemption with those of otherinvestors to reach this minimum requirement, and there can be no assurance that theycan or will do so. Therefore, your ability to elect redemption of the +3X ETNs may belimited.Your redemption election is irrevocable - You will not be able to rescind your electionto redeem your +3X ETNs after your redemption notice is received by us. Accordingly, youwill be exposed to market risk if the Index Level decreases after we receive your oer andthe Redemption Amount is determined on the Redemption Measurement Date. You willnot know the Redemption Amount at the time that you submit your irrevocableredemption notice.No interest payments or ownership rights - The +3X ETNs do not pay any interest. Youwill not have any ownership rights in the Index components, nor will you have any rightto receive dividends or other distributions paid to holders of the Index components,except as reected in the Index Level.

6/7/23, 11:15 AMJETU | MAX? Airlines 3X Leveraged ETNs | MAX ETNs Potential conicts - We and our aliates play a variety of roles in connection with theissuance of the +3X ETNs, including acting as an agent of the issuer for the oering of the+3X ETNs, making certain calculations and determinations that may aect the value ofthe +3X ETNs and hedging our obligations under the +3X ETNs. Any prot in connectionwith such hedging activities will be in addition to any other compensation that we andour aliates receive for the sale of the +3X ETNs, which creates an additional incentive tosell the +3X ETNs to you. In performing these activities, our economic interests and thoseof our aliates are potentially adverse to your interests as an investor in the +3X ETNs.Uncertain tax treatment - Signicant aspects of the tax treatment of the +3X ETNs areuncertain. You should consult your own tax advisor about your own tax situation.- Bank of Montreal and its aliates do not provide tax advice, and nothing containedherein should be construed as tax advice. Please be advised that any discussion of U.S.tax matters contained herein (including any attachments): (i) is not intended or written tobe used, and cannot be used, by you for the purposes of avoiding U.S. tax-relatedpenalties, and (ii) was written to support the promotion of marketing of the transactionsor other matters addressed herein. Accordingly, you should seek advice based on yourparticular circumstances from your independent tax advisor.More ProductsRead less

6/7/23, 11:05 AMJETD | MAX? Airlines -3X Inverse Leveraged ETNs | MAX ETNs The return on the MAX Airlines-3X Inverse Leveraged ETNs islinked to a 3X times inverseleveraged participation in thedaily performance of the PrimeAirlines Index, minus theapplicable fees. The ETNs arenot "buy and hold" investmentsand should not be expected toprovide a 3X times inverseleveraged return of theunderlying index's cumulativereturn for periods greater than aday.SectorTickerJETDIntraday Indicative Value TickerJETDIVProduct DetailsAirlinesMAX? Airlines -3X Inverse Leveraged ETNsJETD

Index TickerPJETSNTRCUSIPIssue DateMaturity DateClosing Indicative Value$Market CapitalizationETNs OutstandingFact SheetProspectusDELTA AIR LINES9.42 %UNITED AIRLINES HOLDINGS INC9.14 %Daily Market DataDocumentsView PDFView PDFIndex ConstituentsWeights 063679484 June 20, 2023 May 28, 2043

6/7/23, 11:05 AMJETD | MAX? Airlines -3X Inverse Leveraged ETNs | MAX ETNs RAYTHEON TECHNOLOGIES CORP9.03 %GENERAL ELECTRIC CO9.01 %BOEING CO/THE8.98 %AMERICAN AIRLINES GROUP INC8.91 %HONEYWELL INTERNATIONAL INC8.86 %UNITED PARCEL SERVICE-CL B8.73 %FEDEX CORP8.53 %GENERAL DYNAMICS6.99 %SOUTHWEST AIRLINES CO5.92 %ALASKA AIR GROUP2.03 %JETBLUE AIRWAYS CORP1.71 %COPA HOLDINGS SA0.96 %SPIRIT AIRLINES INC0.77 %ALLEGIANT TRAVEL CO0.56 %SKYWEST INC0.46 %as of Jun 7, 2023Risk ConsiderationsKey RisksAn investment in the MAX Airlines -3X Inverse Leveraged ETNs (-3X ETNs) involves risks.Key risks are summarized here, but we urge you to read the more detailed explanation of

6/7/23, 11:05 AMJETD | MAX? Airlines -3X Inverse Leveraged ETNs | MAX ETNs risks described under "Risk Factors" in Bank of Montreal's pricing supplement for thesesecurities. Capitalized terms used but not dened herein have the meanings set forth insuch pricing supplement.The -3X ETNs are linked to the inverse performance of the Index - An investment inthe -3X ETNs is linked to the inverse, or "short," performance of the Index. Therefore,notwithstanding the gains resulting from the daily interest, if any, and the cumulativenegative eect of the daily investor fee, your -3X ETNs will generally appreciate as theIndex Level decreases and will decrease in value as the Index Level increases. You maylose some or all of your investment if the Index Level increases over the term of your -3XETNs.You may lose some or all of your principal - The -3X ETNs do not guarantee any returnon your initial investment. The -3X ETNs are leveraged inverse notes, which means theyare exposed to three times the risk of any increase in the Index Level, compounded daily.Due to leverage, the -3X ETNs are very sensitive to changes in the Index Level and thepath of such changes. Because the Daily Investor Fee and any negative Daily Interestreduce your nal payment, the Index Level, measured as a component of the closingIndicative Note Value during the Final Measurement Period or Call Measurement Period,or on a Redemption Measurement Date, will need to decrease by an amount at leastequal to the percentage of the principal amount represented by the Daily Investor Fee,any negative Daily Interest and any Redemption Fee Amount in order for you to receivean aggregate amount at maturity, upon a call or redemption, or if you sell your -3X ETNs,that is equal to at least the principal amount. You may lose some or all of yourinvestment at maturity or call, or upon early redemption.Credit of issuer - The -3X ETNs are senior unsecured debt obligations of the issuer, Bankof Montreal, and are not, either directly or indirectly, an obligation of any third party. Anypayment to be made on the -3X ETNs, including any payment at maturity, call or uponearly redemption, depends on the ability of Bank of Montreal to satisfy its obligations asthey come due. As a result, the actual and perceived creditworthiness of Bank ofMontreal will aect the market value, if any, of the -3X ETNs prior to maturity, call or earlyredemption. In addition, in the event Bank of Montreal defaults on its obligations, youmay not receive any amounts owed to you under the terms of the -3X ETNs.The Daily Interest may be negative - Although the Daily Interest will be added to theDeposit Amount, the Daily Interest will be negative on any Exchange Business Day on

6/7/23, 11:05 AMJETD | MAX? Airlines -3X Inverse Leveraged ETNs | MAX ETNs which the Daily Interest Rate is negative. On those Exchange Business Days, the DailyInterest will be subtracted from the Deposit Amount, which, in turn, will reduce theIndicative Note Value and the amount that you will receive for your -3X ETNs at maturity,call or redemption.Correlation and compounding risk - A number of factors may aect the -3X ETNs'ability to achieve a high degree of correlation with the performance of the Index, and the-3X ETNs are not expected to achieve a high degree of correlation with the performanceof the Index over periods longer than one day. The leverage is reset daily, the return onthe -3X ETNs is path dependent and you will be exposed to compounding of daily returns.As a result, the performance of the -3X ETNs for periods greater than one Index BusinessDay may be either greater than or less than three times the inverse of the Indexperformance, before accounting for the Daily Investor Fee, any negative Daily Interestand any Redemption Fee Amount.Path dependence - The return on the -3X ETNs will be highly path dependent.Accordingly, even if the Index Level decreases or increases over the term of the -3X ETNs,or over the term which you hold the -3X ETNs, the value of the -3X ETNs will increase ordecrease not only based on any change in the Index Level over a given time period butalso based on the volatility of the Index over that time period. The value of the -3X ETNswill depend not only upon the Index Level at maturity, upon call or upon earlyredemption, but also on the performance of the Index over each day that you hold the-3X ETNs. It is possible that you will suer signicant losses in the -3X ETNs, even if thelong-term performance of the Index is negative. Accordingly, the returns on the -3X ETNsmay not correlate with returns on the Index over periods of longer than one day.Long holding period risk - The -3X ETNs are intended to be daily trading tools forsophisticated investors and are designed to reect a leveraged inverse exposure to theperformance of the Index on a daily basis; however, their returns over dierent periodsof time can, and most likely will, dier signicantly from three times the return on adirect inverse investment in the Index. The -3X ETNs are very sensitive to changes in theIndex Level, and returns on the -3X ETNs may be negatively aected in complex ways byvolatility of the Index on a daily or intraday basis. Accordingly, the -3X ETNs should bepurchased only by knowledgeable investors who understand the potential consequencesof investing in the Index and of seeking daily compounding leveraged inverse investmentresults. Investors should actively and frequently monitor their investments in the -3XETNs, even intra-day. It is possible that you will suer signicant losses in the -3X ETNs

6/7/23, 11:05 AMJETD | MAX? Airlines -3X Inverse Leveraged ETNs | MAX ETNs even if the long-term performance of the Index is negative (before taking into accountthe negative eect of the Daily Investor Fee and the Daily Interest, and the RedemptionFee Amount, if applicable).Potential total loss of value - If the closing Indicative Note Value of the -3X ETNs isequal to or less than $0 on any Exchange Business Day, then the Indicative Note Value onall future Exchange Business Days will be $0. If the Intraday Indicative Value of the -3XETNs is equal to or less than $0 at any time on any Index Business Day, then both theIntraday Indicative Value of the -3X ETNs and the closing Indicative Note Value on thatExchange Business Day, and on all future Exchange Business Days, will be $0. If theIndicative Note Value is $0, the Cash Settlement Amount will be $0.Leverage risk - The -3X ETNs are three times leveraged and, as a result, the -3X ETNs willbenet from three times any negative, but will decline based on three times any positive,daily performance of the Index. However, the leverage of the -3X ETNs may be greater orless than -3.0 during any given Index Business Day. Volatility of the Index level may havea signicant negative eect on the value of the -3X ETNs.The Index has a limited actual performance history - The Index was launched inDecember 2022. Because the Index is of recent origin and limited actual historicalperformance data exists with respect to it, your investment in the -3X ETNs may involve agreater risk than investing in securities linked to one or more indices with a moreestablished record of performance.The Index lacks diversication and is concentrated in one sector, and has a limitednumber of Index components - All of the stocks included in the Index are issued bycompanies in the airline industry, including airlines and aircraft and aircraft partsmanufacturers, and companies engaged in the businesses of air freight and logistics,aircraft leasing and airline and airport operations. As a result, the -3X ETNs will notbenet from the diversication that could result from an investment linked to an index ofcompanies that operate in multiple sectors. Any increase in the market price of any ofthose stocks is likely to have a substantial positive impact on the Closing Index Level anda substantial adverse impact on the value of the -3X ETNs. Giving eect to leverage,positive changes in the performance of one Index component will be magnied and havea material adverse eect on the value of the -3X ETNs.We may replace the Index with a dierent index - We may substitute a dierent indexfor the Index. The performance of any new index to which the ETNs are linked may

6/7/23, 11:05 AMJETD | MAX? Airlines -3X Inverse Leveraged ETNs | MAX ETNs perform dierently than the Index over the remaining term of the ETNs. Any suchreplacement index may have risks that are dierent from, or additional to, the Index.Accordingly, if we exercise this right, the payments on the ETNs may be adverselyaected.A trading market for the -3X ETNs may not develop - The -3X ETNs are listed on theNYSE Arca under the symbol "JETD." However, a trading market for the -3X ETNs may notdevelop. We are not required to maintain any listing of the -3X ETNs on the NYSE Arca orany other exchange.The Intraday Indicative Value is not the same as the trading price of the -3X ETNs inthe secondary market - The Intraday Indicative Value of the -3X ETNs will be calculatedand published every 15 seconds on each Exchange Business Day during normal tradinghours on Bloomberg under the ticker symbol JETDIV so long as no Market DisruptionEvent has occurred or is continuing. The trading price of the -3X ETNs at any time is theprice at which you may be able to sell your -3X ETNs in the secondary market at suchtime, if one exists. The trading price of the -3X ETNs at any time may vary signicantlyfrom the Intraday Indicative Value of the -3X ETNs at such time.Paying a premium purchase price over the Intraday Indicative Value of the -3XETNs could lead to signicant losses in the event one sells such -3X ETNs at a timewhen such premium is no longer present in the marketplace or the -3X ETNs arecalled - Paying a premium purchase price over the Intraday Indicative Value of the -3XETNs could lead to signicant losses in the event one sells the -3X ETNs at a time whensuch premium is no longer present in the marketplace or if the -3X ETNs are called, inwhich case investors will receive a cash payment in an amount based on the arithmeticmean of the closing Indicative Note Value of the -3X ETNs during the Call MeasurementPeriod. Before trading in the secondary market, you should compare the IntradayIndicative Value with the then-prevailing trading price of the -3X ETNs.Call right - We may elect to redeem all or a portion of the outstanding -3X ETNs at anytime. If we exercise our Call Right, the Call Settlement Amount may be less than theprincipal amount of your -3X ETNs. Any exercise by us of our Call Right could present aconict between your interest in the -3X ETNs and our interests in determining whetherto call the -3X ETNs.Minimum redemption amount - You must elect to redeem at least 25,000 -3X ETNs forus to repurchase your -3X ETNs, unless we determine otherwise or your broker or other

6/7/23, 11:05 AMJETD | MAX? Airlines -3X Inverse Leveraged ETNs | MAX ETNs nancial intermediary bundles your -3X ETNs for redemption with those of otherinvestors to reach this minimum requirement, and there can be no assurance that theycan or will do so. Therefore, your ability to elect redemption of the -3X ETNs may belimited.Your redemption election is irrevocable - You will not be able to rescind your electionto redeem your -3X ETNs after your redemption notice is received by us. Accordingly, youwill be exposed to market risk if the Index Level decreases after we receive your oer andthe Redemption Amount is determined on the Redemption Measurement Date. You willnot know the Redemption Amount at the time that you submit your irrevocableredemption notice.No interest payments or ownership rights - The -3X ETNs do not pay any interest. Youwill not have any ownership rights in the Index components, nor will you have any rightto receive dividends or other distributions paid to holders of the Index components,except as reected in the Index Level.Potential conicts - We and our aliates play a variety of roles in connection with theissuance of the -3X ETNs, including acting as an agent of the issuer for the oering of the-3X ETNs, making certain calculations and determinations that may aect the value of the-3X ETNs and hedging our obligations under the -3X ETNs. Any prot in connection withsuch hedging activities will be in addition to any other compensation that we and ouraliates receive for the sale of the -3X ETNs, which creates an additional incentive to sellthe -3X ETNs to you. In performing these activities, our economic interests and those ofour aliates are potentially adverse to your interests as an investor in the -3X ETNs.Uncertain tax treatment - Signicant aspects of the tax treatment of the -3X ETNs areuncertain. You should consult your own tax advisor about your own tax situation.- Bank of Montreal and its aliates do not provide tax advice, and nothing containedherein should be construed as tax advice. Please be advised that any discussion of U.S.tax matters contained herein (including any attachments): (i) is not intended or written tobe used, and cannot be used, by you for the purposes of avoiding U.S. tax-relatedpenalties, and (ii) was written to support the promotion of marketing of the transactionsor other matters addressed herein. Accordingly, you should seek advice based on yourparticular circumstances from your independent tax advisor.Read less

6/7/23, 11:05 AMJETD | MAX? Airlines -3X Inverse Leveraged ETNs | MAX ETNs JETUCARDMore ProductsMAX? Airlines3X LeveragedETNsView productMAX? AutoIndustry -3XInverseLeveraged ETNsView product

6/7/23, 11:05 AMJETD | MAX? Airlines -3X Inverse Leveraged ETNs | MAX ETNs DisclosureBank of Montreal, the issuer of the ETNs, has filed a registration statement (including a pricingsupplement, product supplement, prospectus supplement and prospectus) with the SEC for theofferings to which this website relates. Before you invest, you should read those documents andthe other documents that Bank of Montreal has filed with the SEC for more complete informationabout Bank of Montreal and these offerings. These documents may be obtained without cost byvisiting EDGAR on the SEC website at www.sec.gov. Alternatively, Bank of Montreal, any agent orany dealer participating in these offerings will arrange to send the applicable pricing supplement,the product supplement, the prospectus supplement and the prospectus if so requested bycalling toll-free at 1-877-369-5412.BMO Capital Markets Corp., an affiliate of the issuer, acts as the underwriter for the offerings ofthe ETNs.HomeProductsResourcesAboutContact Us

6/2/23, 2:24 PMContact Us | MAX ETNs To invest in MAX ETNs, please instruct your broker, advisor, orcustodian to reach out to us.Call usEmail usinfo@maxetns.com1-877-369-5412Contact Us

6/2/23, 2:24 PMContact Us | MAX ETNs DisclosureBank of Montreal, the issuer of the ETNs, has filed a registration statement (including a pricingsupplement, product supplement, prospectus supplement and prospectus) with the SEC for theofferings to which this website relates. Before you invest, you should read those documents andthe other documents that Bank of Montreal has filed with the SEC for more complete informationabout Bank of Montreal and these offerings. These documents may be obtained without cost byvisiting EDGAR on the SEC website at www.sec.gov. Alternatively, Bank of Montreal, any agent orany dealer participating in these offerings will arrange to send the applicable pricing supplement,the product supplement, the prospectus supplement and the prospectus if so requested bycalling toll-free at 1-877-369-5412.BMO Capital Markets Corp., an affiliate of the issuer, acts as the underwriter for the offerings ofthe ETNs.HomeProductsResourcesAboutContact Us

MicroSectors FANG Index ... (AMEX:FNGU)

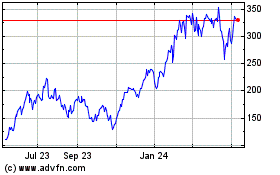

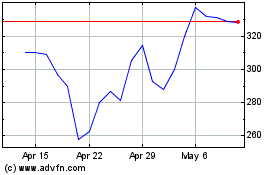

Historical Stock Chart

From Jun 2024 to Jul 2024

MicroSectors FANG Index ... (AMEX:FNGU)

Historical Stock Chart

From Jul 2023 to Jul 2024