AS

FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON APRIL 29, 2022

REGISTRATION

NO. 333-__________________

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

THE

MARYGOLD COMPANIES, INC.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of

incorporation or organization)

90-1133909

I.R.S. Employer Identification Number

120

Calle Iglesia, Unit B

San Clemente, CA, 92672

Phone: (949)-429-5370

(Address, including zip code, and telephone number, including area code of registrant’s

principal executive offices)

Nicholas Gerber

Chief Executive Officer

120

Calle Iglesia, Unit B

San Clemente, CA, 92672

Phone: (949)-429-5370

(Name, address, including zip code, and telephone number, including area code, of agent for

service)

Copies to:

Peter J. Gennuso,

Esq.

McCarter & English, LLP

825 Eighth, 31st Floor

New York, New York 10019

Phone: 212-609-6862

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only

securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box: o

If any of the

securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities

Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plants, check the following box:

x

If this Form

is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form

is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form

is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon

filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. o

If this Form

is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by

check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer |

o |

Accelerated

filer |

o |

|

| Non-accelerated

filer |

x |

Smaller

reporting company |

x |

|

| Emerging

growth company |

o |

|

|

|

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. o

The

registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

relating to these securities that has been filed with the Securities and Exchange Commission is effective. This prospectus is not an

offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not

permitted.

SUBJECT

TO COMPLETION, DATED APRIL 29, 2022

PROSPECTUS

THE MARYGOLD COMPANIES, INC.

$100,000,000

Common

Stock

Preferred

Stock

Warrants

Units

We

may from time to time, in one or more offerings at prices and on terms that we will determine at the time of each offering, sell common

stock, preferred stock, warrants, or a combination of these securities, or units, for an aggregate initial offering price of up to $100,000,000.

This prospectus describes the general manner in which our securities may be offered using this prospectus. Each time we offer and sell

securities, we will provide you with a prospectus supplement that will contain specific information about the terms of that offering.

Any prospectus supplement may also add, update, or change information contained in this prospectus. You should carefully read this prospectus

and the applicable prospectus supplement as well as the documents incorporated or deemed to be incorporated by reference in this prospectus

before you purchase any of the securities offered hereby.

This

prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement.

Our

common stock is currently traded on the NYSE American under the symbol “MGLD.” On April 27, 2022, the last reported

sales price for our common stock was $1.35 per share. The applicable prospectus supplement will contain information, where

applicable, as to any other listing of the securities on the NYSE American or any other securities market or exchange covered by the

prospectus supplement. Prospective purchasers of our securities are urged to obtain current information as to the market prices of

our securities, where applicable.

We

may offer the securities directly or through agents or to or through underwriters or dealers. If any agents or underwriters are involved

in the sale of the securities their names, and any applicable purchase price, fee, commission or discount arrangement between or among

them, will be set forth, or will be calculable from the information set forth, in an accompanying prospectus supplement. We can sell

the securities through agents, underwriters or dealers only with delivery of a prospectus supplement describing the method and terms

of the offering of such securities. See “Plan of Distribution.”

The

aggregate market value of our outstanding common stock held by non-affiliates was approximately $11,384,403 which was calculated based

on 8,432,891 shares of outstanding common stock held by non-affiliates as of April 27, 2022, and a price per share of $1.35, the closing

price of our common stock on April 27, 2022.

The

securities offered by this prospectus involve a high degree of risk. See “Risk Factors” beginning on page 4, in addition

to Risk Factors contained in the applicable prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This

prospectus is dated , 2022

Table

of Contents

You

should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not

authorized anyone to provide you with information different from that contained or incorporated by reference into this prospectus. If

any person does provide you with information that differs from what is contained or incorporated by reference in this prospectus, you

should not rely on it. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained

in this prospectus. You should assume that the information contained in this prospectus or any prospectus supplement is accurate only

as of the date on the front of the document and that any information contained in any document we have incorporated by reference is accurate

only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any prospectus

supplement or any sale of a security. These documents are not an offer to sell or a solicitation of an offer to buy these securities

in any circumstances under which the offer or solicitation is unlawful.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a “shelf’

registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus

in one of more offerings up to a total dollar amount of proceeds of $100,000,000. This prospectus describes the general manner in which

our securities may be offered by this prospectus. Each time we sell securities, we will provide a prospectus supplement that will contain

specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained

in this prospectus or in documents incorporated by reference in this prospectus. The prospectus supplement that contains specific information

about the terms of the securities being offered may also include a discussion of certain U.S. Federal income tax consequences and any

risk factors or other special considerations applicable to those securities. To the extent that any statement that we make in a prospectus

supplement is inconsistent with statements made in this prospectus or in documents incorporated by reference in this prospectus, you

should rely on the information in the prospectus supplement. You should carefully read both this prospectus and any prospectus supplement

together with the additional information described under “Where You Can Find More Information” before buying any securities

in this offering.

On

March 10, 2022, Concierge Technologies, Inc. changed its name to “The Marygold Companies, Inc.” in connection with its uplist

to the NYSE American LLC and public offering of common stock. The terms “The Marygold Companies,” the “Company,”

“MGLD,” “we,” “our,” or “us” or “Marygold” in this prospectus refer to The

Marygold Companies, Inc. and its wholly-owned subsidiaries, unless the context suggests otherwise. Additionally, on April 20, 2022, the

Company’s wholly-owned subsidiary, Wainwright Holdings, Inc. changed its name to “USCF Investments, Inc.”.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus includes forward-looking statements, which involve risks and uncertainties. These forward-looking statements can be identified

by the use of forward-looking terminology, including the terms “believe,” “estimate,” “project,”

“anticipate,” “expect,” “seek,” “predict,” “continue,” “possible,”

“intend,” “may,” “might,” “will,” “could,” would” or “should”

or, in each case, their negative, or other variations or comparable terminology. These forward-looking statements include all matters

that are not historical facts. They appear in a number of places throughout this prospectus and include statements regarding our intentions,

beliefs or current expectations concerning, among other things, the use of proceeds from this offering, our product candidates, research

and development, commercialization objectives, prospects, strategies, the industry in which we operate and potential acquisitions or

collaborations.

We

derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions.

While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and,

of course, it is impossible for us to anticipate all factors that could affect our actual results. Forward-looking statements should

not be read as a guarantee of future performance or results and may not be accurate indications of when such performance or results will

be achieved. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this prospectus may

not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. In addition,

even if our results of operations, financial condition, business and prospects are consistent with the forward-looking statements contained

in this prospectus, those results may not be indicative of results in subsequent periods.

You

should also consider carefully the statements under “Risk Factors” and other sections of this prospectus, which address additional

facts that could cause our actual results to differ from those set forth in the forward-looking statements. We caution investors not

to place significant reliance on the forward-looking statements contained in this prospectus.

Our

business is subject to numerous risks and uncertainties, including those in the section entitled “Risk Factors” and elsewhere

in this prospectus. These risks include, but are not limited to, the following:

| · | The

Company’s business and operation could be negatively affected by any material litigation

involving the Company or its subsidiaries. |

| · | The

emergence of a novel coronavirus on a global scale, known as COVID-19, and related geopolitical

events could continue to lead to increased market volatility, disruption to U.S. and world

economies and markets has and may continue to have significant adverse effects on the Company

and its wholly-owned subsidiaries. |

| · | We

are a holding company and its only material assets are its cash in hand, equity interests

in its operating subsidiaries and its other investments. As a result, the Company’s

principal source of cash flow is distributions from its subsidiaries and its subsidiaries

may be limited by law and by contract in making distributions to Marygold. |

| · | We

are dependent on certain key personnel, the loss of which may adversely affect our financial

condition or results of operations. |

| · | We

need qualified personnel to manage and operate our subsidiaries. |

| · | Unauthorized

computer infiltration, denial-of-service attacks, phishing efforts, unauthorized access,

malicious software codes, computer viruses or other such harmful computer campaigns may negatively

impact our business causing significant disruptions to our business operations. |

| · | Future

acquisitions or business opportunities could involve unknown risks that could harm our business

and adversely affect our financial condition and results of operations. |

| · | There

is no guarantee that we will comply with the NYSE American’s continued listing standards. |

| · | If

we fail to establish and maintain an effective system of internal control, we may not be

able to report our financial results accurately or to prevent fraud. Any inability to report

and file our financial results accurately and timely could harm our reputation and adversely

impact the trading price of our common stock. |

| · | The

Company’s business and operation could be negatively affected by any material litigation

involving the Company or its subsidiaries. |

| · | The

Company’s business and operation could be negatively affected by the SEC Order and

CFTC Order. |

| · | Risks

related to commodity prices could materially and adversely affect USCF’s business. |

| · | We

derive a substantial portion of our revenues from our USCF Investments subsidiary (f/k/a

Wainwright Holdings), as a result, our operating results are particularly exposed to investor

sentiment toward investing in the ETPs and ETFs sponsored by USCF and USCF Advisers. |

| · | We

could be subject to a cybersecurity attack. |

| · | We

could consume resources in researching acquisitions, business opportunities or financings

and capital market transactions that are not consummated, which could materially adversely

affect subsequent attempts to locate and acquire or invest in another business. |

Forward-looking

statements speak only as of the date of this prospectus. You should not put undue reliance on any forward-looking statements. Except

as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason, even if new information

becomes available or other events occur in the future. If we update one or more forward-looking statements, no inference should be drawn

that we will make additional updates with respect to those or other forward-looking statements.

All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified

in their entirety by the cautionary statements contained above and throughout this prospectus.

You

should read this prospectus and the documents that we reference in this prospectus and have filed with the Securities and Exchange Commission,

or SEC, as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual future results,

levels of activity, performance and events and circumstances may be materially different from what we expect. In addition to the risk

factors set forth above, the factors set forth below under “Risk Factors” and other cautionary statements made in this prospectus

should be read and understood as being applicable to all related forward-looking statements wherever they appear in this prospectus.

ABOUT

THE MARYGOLD COMPANIES, INC.

Company

Overview

The

Marygold Companies, Inc., (the “Company” or “Marygold”), a Nevada corporation, operates through its wholly-owned

subsidiaries who are engaged in varied business activities. The operations of the Company’s wholly-owned subsidiaries are more

particularly described herein but are summarized as follows:

| · | USCF

Investments, Inc. (“USCF Investments”) (f/k/a Wainwright Holdings, Inc.), a U.S.

based company, is the sole member of two investment services limited liability company subsidiaries,

United States Commodity Funds LLC (“USCF”), and USCF Advisers LLC (“USCF

Advisers”), each of which manages, operates or is an investment advisor to exchange

traded funds organized as limited partnerships or investment trusts that issue shares which

trade on the NYSE Arca stock exchange. |

| · | Gourmet

Foods, Ltd., a New Zealand based company, manufactures and distributes New Zealand meat pies

on a commercial scale and its wholly- owned New Zealand subsidiary company, Printstock Products

Limited (“Printstock”), prints specialty wrappers for the food industry in New

Zealand and Australia (collectively “Gourmet Foods”). |

| · | Brigadier

Security Systems (2000) Ltd. (“Brigadier”), a Canadian based company, sells and

installs commercial and residential alarm monitoring systems under the names Brigadier Security

Systems and Elite Security in the province of Saskatchewan. |

| · | Kahnalytics,

Inc. dba/Original Sprout (“Original Sprout”), a U.S. based company, is engaged

in the wholesale distribution of hair and skin care products under the brand name Original

Sprout on a global scale. |

| · | Marygold

& Co., a newly formed U.S. based company, together with its wholly owned limited liability

company, Marygold & Co. Advisory Services, LLC, (collectively “Marygold US”)

was established by the Company to explore opportunities in the financial technology (“Fintech”)

space, is still in the development stage, and is estimated to launch commercial services

in the current fiscal year. To date, expenditures have been limited to developing the business

model and the associated application development. |

| · | Marygold

& Co. (UK) Limited, a newly formed UK company (“Marygold UK”), was established

to act as a holding company for acquisitions to be made in the U.K. To date, there have been

no acquisitions completed and no operations. The expenses of Marygold UK have been included

with those of the Company. |

Marygold

manages its operating businesses on a decentralized basis. There are no centralized or integrated operational functions such as marketing,

sales, legal or other professional services and there is little involvement by Marygold’s management in the day-to-day business

affairs of its operating subsidiary businesses apart from oversight. Marygold’s corporate management is responsible for capital

allocation decisions, investment activities and selection and retention of the Chief Executive to head each of the operating subsidiaries.

Marygold’s corporate management is also responsible for corporate governance practices, monitoring regulatory affairs, including

those of its operating businesses and involvement in governance-related issues of its subsidiaries as needed. Across Marygold and its

subsidiaries the Company employs 114 people.

Listing

on the NYSE American

Until

March 10, 2022, our common stock was quoted on the OTC Pink, operated by OTC Markets Group, where it was quoted under the symbol “CNCG.”

Our common stock is currently traded on the NYSE American under the symbol “MGLD.” On April 27, 2022, the last reported sales

price for our common stock was $1.35 per share.

Corporate

Information

Our

principal offices are located at 120 Calle Iglesia, Unit B, San Clemente, California, 92672. Our main telephone number is (949) 429-5370.

Our website address is https://themarygoldcompanies.com/.

We have not incorporated by reference into this prospectus what can be accessed through our

website and you should not consider it to be part of this prospectus.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should consider carefully the risks, uncertainties

and other factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly reports

on Form 10-Q and current reports on Form 8-K that we have filed or will file with the SEC, which are incorporated by reference into this

prospectus. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently

known to us or that we currently deem immaterial may also affect our operations. Past financial performance may not be a reliable indicator

of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks

actually occurs, our business, business prospects, financial condition or results of operations could be seriously harmed. This could

cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully

the section herein entitled “Special Note Regarding Forward-Looking Statements.”

Our

business, affairs, prospects, assets, financial condition, results of operations and cash flows could be materially and adversely affected

by these risks. For more information about our SEC filings, please see “Where You Can Find More Information”.

USE

OF PROCEEDS

We cannot assure you

that we will receive any proceeds in connection with securities which may be offered pursuant to this prospectus. Unless otherwise indicated

in the applicable prospectus supplement, we intend to use any net proceeds from the sale of securities under this prospectus for the

Marygold product launch, USCF Investments’ fund development, working capital and general corporate purposes, including potential

acquisitions and operating expenses.

We have not determined

the amounts we plan to spend on any of the areas listed above or the timing of these expenditures. We may set forth additional information

on the use of net proceeds from the sale of the securities we offer under this prospectus in a prospectus supplement related to a specific

offering.

Investors are cautioned,

however, that expenditures may vary substantially from these uses. Investors will be relying on the judgment of our management, who will

have broad discretion to allocate the net proceeds, if any, received in connection with securities offered pursuant to this prospectus

for any purpose. The amounts and timing of our actual expenditures will depend upon numerous factors, including the amount of cash generated

by our operations, the amount of competition and other operational factors. We may find it necessary or advisable to use portions of

the proceeds from this offering for other purposes.

DESCRIPTION

OF CAPITAL STOCK

General

The

following description of our capital stock, together with any additional information we include in any applicable prospectus supplement

or any related free writing prospectus, summarizes the material terms and provisions of our common stock and the preferred stock that

we may offer under this prospectus. While the terms we have summarized below will apply generally to any future common stock or preferred

stock that we may offer, we will describe the particular terms of any class or series of these securities in more detail in the applicable

prospectus supplement. For the complete terms of our common stock and preferred stock, please refer to our articles of incorporation

and our bylaws that are incorporated by reference into the registration statement of which this prospectus is a part. The summary below

and that contained in any applicable prospectus supplement or any related free writing prospectus are qualified in their entirety by

reference to our articles of incorporation and our bylaws.

Capital

Stock

Our

authorized capital stock consists of 900,000,000 shares of common stock, $0.001 par value per share, and 50,000,000 shares of preferred

stock, $0.001 par value per share. As of April 27, 2022, there were 39,383,459 shares of common stock and 49,360 shares of Series B Convertible,

Voting, Preferred Stock (“Series B Preferred Stock”) outstanding.

This

description is intended as a summary, and is qualified in its entirety by reference to our amended and restated articles of incorporation

and amended and restated by-laws, which are filed as exhibits to the registration statement of which this prospectus forms a part.

Common

Stock

Holders

of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of the stockholders, and

do not have cumulative voting rights. Subject to preferences that may be applicable to any outstanding shares of preferred stock, holders

of common stock are entitled to receive ratably such dividends, if any, as may be declared from time to time by our Board of Directors

out of funds legally available for dividend payments. All outstanding, shares of common stock are fully paid and nonassessable, and the

shares of common stock to be issued upon completion of this offering will be fully paid and nonassessable. The holders of common stock

have no preferences or rights of cumulative voting, conversion, or pre-emptive or other subscription rights. There are no redemption

or sinking fund provisions applicable to the common stock. In the event of any liquidation, dissolution or winding-up of our affairs,

holders of common stock will be entitled to share ratably in any of our assets remaining after payment or provision for payment of all

of our debts and obligations and after liquidation payments to holders of outstanding shares of preferred stock, if any.

Holders

As

of April 27, 2022, we had approximately 359 shareholders of record of our common stock. The number of stockholders of record does not

include certain beneficial owners of our common stock, whose shares are held in the names of various dealers, clearing agencies, banks,

brokers and other fiduciaries.

Preferred

Stock

The

current amended and restated certificate authorizes the Company to issue 50,000,000 shares of Preferred Stock.

(a) The Corporation has designated a series of its Preferred Stock named Series A Convertible, Voting, Preferred Stock consisting

of 5,000,000 shares, each of which shares shall be convertible into 5 shares of the Corporation’s Common Stock and, until converted,

shall have 5 votes on all matters brought before the stockholders for a vote. A holder of shares of this series may not exercise his

conversion rights until after 270 days after the date of issuance of the shares and, if exercised, must be exercised with regard to all

shares of this series held by such holder; and, provided further, that no conversion of the shares shall take place until the Corporation

shall have amended its Articles of Incorporation to provide an increase in the number of its authorized shares of Common Stock at lease

sufficient to allow all shares of this series to be converted into Common Stock. As of the date of December 31, 2021 all shares of Series

A Convertible, Voting, Preferred Stock have been converted to shares of Common Stock; and

(b) The Corporation has designated a series of its Preferred Stock named Series B Convertible, Voting, Preferred Stock consisting

of 45,000,000 shares, each of which shares shall be convertible into 20 shares of the Corporation’s Common Stock and, until converted,

shall have 20 votes on all matters brought before the stockholders for a vote. A holder of this series may not exercise his conversion

rights until after 270 days after the date of issuance of the shares and, if exercised, must be exercised with regard to all shares of

this series held by such holder; and, provided further, that no conversion of the shares shall take place until the Corporation shall

have amended its Articles of Incorporation to provide an increase in the number of its authorized shares of Common Stock at least sufficient

to allow all shares of this series to be converted into Common Stock. As of the date of December 31, 2021, there were 49,360 shares of

Series B Convertible, Voting, Preferred Stock outstanding, which upon conversion would result in the issuance of 987,200 shares of common

stock.

Our

Board of Directors, within the limitations and restrictions of our Certificate of Incorporation, has the authority to issue from time

to time shares of preferred stock in one or more series and to fix the terms, limitations, relative rights and preferences and variations

of each series. Although we have no present plans to issue additional shares of preferred stock, the issuance of shares of preferred

stock, or the issuance of rights to purchase such shares, could decrease the amount of earnings and assets available for distribution

to the holders of common stock, could adversely affect the rights and powers, including voting rights, of the common stock, and could

have the effect of delaying, deterring or preventing a change of control of us or an unsolicited acquisition proposal. Preferred stock

is available for possible future financings or acquisitions and for general corporate purposes without further authorization of stockholders

unless such authorization is required by applicable law, the rules of the NYSE American or other securities exchange or market on which

our stock is then listed or admitted to trading.

Our

Board of Directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting

power or other rights of the holders of common stock. The issuance of preferred stock, while providing flexibility in connection with

possible acquisitions and other corporate purposes could, under some circumstances, have the effect of delaying, deferring or preventing

a change-in-control of the Company.

A

prospectus supplement relating to any series of preferred stock being offered will include specific terms relating to the offering. Such

prospectus supplement will include:

| · | the

title and stated or par value of the preferred stock; |

| · | the

number of shares of the preferred stock offered, the liquidation preference per share and

the offering price of the preferred stock; |

| · | the

dividend rate(s), period(s) and/or payment date(s) or method(s) of calculation thereof applicable

to the preferred stock; |

| · | whether

dividends shall be cumulative or non-cumulative and, if cumulative, the date from which dividends

on the preferred stock shall accumulate; |

| · | the

provisions for a sinking fund, if any, for the preferred stock; |

| · | any

voting rights of the preferred stock; |

| · | the

provisions for redemption, if applicable, of the preferred stock; |

| · | any

listing of the preferred stock on any securities exchange; |

| · | the

terms and conditions, if applicable, upon which the preferred stock will be convertible into

our common stock, including the conversion price or the manner of calculating the conversion

price and conversion period; |

| · | if

appropriate, a discussion of Federal income tax consequences applicable to the preferred

stock; and |

| · | any

other specific terms, preferences, rights, limitations or restrictions of the preferred stock. |

The

terms, if any, on which the preferred stock may be convertible into or exchangeable for our common stock will also be stated in the preferred

stock prospectus supplement. The terms will include provisions as to whether conversion or exchange is mandatory, at the option of the

holder or at our option, and may include provisions pursuant to which the number of shares of our common stock to be received by the

holders of preferred stock would be subject to adjustment.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is Issuer Direct, 500 Perimeter Park Drive, Morrisville, North Carolina 27560, Phone:

(877) 481-4014.

Listing

Our

common stock is listed on the NYSE American under the symbols “MGLD”.

DESCRIPTION

OF WARRANTS

We

may issue warrants for the purchase of preferred stock or common stock. Warrants may be issued independently or together with any preferred

stock or common stock, and may be attached to or separate from any offered securities. Each series of warrants will be issued under a

separate warrant agreement to be entered into between a warrant agent specified in the agreement and us. The warrant agent will act solely

as our agent in connection with the warrants of that series and will not assume any obligation or relationship of agency or trust for

or with any holders or beneficial owners of warrants. This summary of some provisions of the securities warrants is not complete. You

should refer to the securities warrant agreement, including the forms of securities warrant certificate representing the securities warrants,

relating to the specific securities warrants being offered for the complete terms of the securities warrant agreement and the securities

warrants. The securities warrant agreement, together with the terms of the securities warrant certificate and securities warrants, will

be filed with the SEC in connection with the offering of the specific warrants.

The

applicable prospectus supplement will describe the following terms, where applicable, of the warrants in respect of which this prospectus

is being delivered:

| · | the

title of the warrants; |

| · | the

aggregate number of the warrants; |

| · | the

price or prices at which the warrants will be issued; |

| · | the

designation, amount and terms of the offered securities purchasable upon exercise of the

warrants; |

| · | if

applicable, the date on and after which the warrants and the offered securities purchasable

upon exercise of the warrants will be separately transferable; |

| · | the

terms of the securities purchasable upon exercise of such warrants and the procedures and

conditions relating to the exercise of such warrants; |

| · | any

provisions for adjustment of the number or amount of securities receivable upon exercise

of the warrants or the exercise price of the warrants; |

| · | the

price or prices at which and currency or currencies in which the offered securities purchasable

upon exercise of the warrants may be purchased; |

| · | the

date on which the right to exercise the warrants shall commence and the date on which the

right shall expire; |

| · | the

minimum or maximum amount of the warrants that may be exercised at any one time; |

| · | information

with respect to book-entry procedures, if any; |

| · | if

appropriate, a discussion of Federal income tax consequences; and |

| · | any

other material terms of the warrants, including terms, procedures and limitations relating

to the exchange and exercise of the warrants. |

Warrants

for the purchase of common stock or preferred stock will be offered and exercisable for U.S. dollars only. Warrants will be issued in

registered form only.

Upon

receipt of payment and the warrant certificate properly completed and duly executed at the corporate trust office of the warrant agent

or any other office indicated in the applicable prospectus supplement, we will, as soon as practicable, forward the purchased securities.

If less than all of the warrants represented by the warrant certificate are exercised, a new warrant certificate will be issued for the

remaining warrants.

Prior

to the exercise of any securities warrants to purchase preferred stock or common stock, holders of the warrants will not have any of

the rights of holders of the common stock or preferred stock purchasable upon exercise, including in the case of securities warrants

for the purchase of common stock or preferred stock, the right to vote or to receive any payments of dividends on the preferred stock

or common stock purchasable upon exercise.

DESCRIPTION

OF UNITS

As

specified in the applicable prospectus supplement, we may issue units consisting of shares of common stock, shares of preferred stock

or warrants or any combination of such securities.

The

applicable prospectus supplement will specify the following terms of any units in respect of which this prospectus is being delivered:

| · | the

terms of the units and of any of the common stock, preferred stock and warrants comprising

the units, including whether and under what circumstances the securities comprising the units

may be traded separately; |

| · | a

description of the terms of any unit agreement governing the units; and |

| · | a

description of the provisions for the payment, settlement, transfer or exchange of the units. |

PLAN

OF DISTRIBUTION

We

may sell the securities offered through this prospectus (i) to or through underwriters or dealers, (ii) directly to purchasers, including

our affiliates, (iii) through agents, or (iv) through a combination of any these methods. The securities may be distributed at a fixed

price or prices, which may be changed, market prices prevailing at the time of sale, prices related to the prevailing market prices,

or negotiated prices. The prospectus supplement will include the following information:

| · | the

terms of the offering; |

| · | the

names of any underwriters or agents; |

| · | the

name or names of any managing underwriter or underwriters; |

| · | the

purchase price of the securities; |

| · | any

over-allotment options under which underwriters may purchase additional securities from us; |

| · | the

net proceeds from the sale of the securities |

| · | any

delayed delivery arrangements |

| · | any

underwriting discounts, commissions and other items constituting underwriters’ compensation; |

| · | any

initial public offering price; |

| · | any

discounts or concessions allowed or reallowed or paid to dealers; |

| · | any

commissions paid to agents; and |

| · | any

securities exchange or market on which the securities may be listed. |

Sale

Through Underwriters or Dealers

Only

underwriters named in the prospectus supplement are underwriters of the securities offered by the prospectus supplement.

If

underwriters are used in the sale, the underwriters will acquire the securities for their own account, including through underwriting,

purchase, security lending or repurchase agreements with us. The underwriters may resell the securities from time to time in one or more

transactions, including negotiated transactions. Underwriters may sell the securities in order to facilitate transactions in any of our

other securities (described in this prospectus or otherwise), including other public or private transactions and short sales. Underwriters

may offer securities to the public either through underwriting syndicates represented by one or more managing underwriters or directly

by one or more firms acting as underwriters. Unless otherwise indicated in the prospectus supplement, the obligations of the underwriters

to purchase the securities will be subject to certain conditions, and the underwriters will be obligated to purchase all the offered

securities if they purchase any of them. The underwriters may change from time to time any initial public offering price and any discounts

or concessions allowed or reallowed or paid to dealers.

If

dealers are used in the sale of securities offered through this prospectus, we will sell the securities to them as principals. They may

then resell those securities to the public at varying prices determined by the dealers at the time of resale. The prospectus supplement

will include the names of the dealers and the terms of the transaction.

Direct

Sales and Sales Through Agents

We

may sell the securities offered through this prospectus directly. In this case, no underwriters or agents would be involved. Such securities

may also be sold through agents designated from time to time. The prospectus supplement will name any agent involved in the offer or

sale of the offered securities and will describe any commissions payable to the agent. Unless otherwise indicated in the prospectus supplement,

any agent will agree to use its reasonable best efforts to solicit purchases for the period of its appointment.

We

may sell the securities directly to institutional investors or others who may be deemed to be underwriters within the meaning of the

Securities Act with respect to any sale of those securities. The terms of any such sales will be described in the prospectus supplement.

Delayed

Delivery Contracts

If

the prospectus supplement indicates, we may authorize agents, underwriters or dealers to solicit offers from certain types of institutions

to purchase securities at the public offering price under delayed delivery contracts. These contracts would provide for payment and delivery

on a specified date in the future. The contracts would be subject only to those conditions described in the prospectus supplement. The

applicable prospectus supplement will describe the commission payable for solicitation of those contracts.

Delayed

Delivery Contracts

If

the prospectus supplement indicates, we may authorize agents, underwriters or dealers to solicit offers from certain types of institutions

to purchase securities at the public offering price under delayed delivery contracts. These contracts would provide for payment and delivery

on a specified date in the future. The contracts would be subject only to those conditions described in the prospectus supplement. The

applicable prospectus supplement will describe the commission payable for solicitation of those contracts.

Continuous

Offering Program

Without

limiting the generality of the foregoing, we may enter into a continuous offering program equity distribution agreement with a broker-dealer,

under which we may offer and sell shares of our common stock from time to time through a broker-dealer as our sales agent. If we enter

into such a program, sales of the shares of common stock, if any, will be made by means of ordinary brokers’ transactions on the

NYSE American at market prices, block transactions and such other transactions as agreed upon by us and the broker-dealer. Under the

terms of such a program, we also may sell shares of common stock to the broker-dealer, as principal for its own account at a price agreed

upon at the time of sale. If we sell shares of common stock to such broker-dealer as principal, we will enter into a separate terms agreement

with such broker-dealer, and we will describe this agreement in a separate prospectus supplement or pricing supplement.

Market

Making, Stabilization and Other Transactions

Unless

the applicable prospectus supplement states otherwise, other than our common stock all securities we offer under this prospectus will

be a new issue and will have no established trading market. We may elect to list offered securities on an exchange or in the over-the-counter

market. Any underwriters that we use in the sale of offered securities may make a market in such securities, but may discontinue such

market making at any time without notice. Therefore, we cannot assure you that the securities will have a liquid trading market.

Any

underwriter may also engage in stabilizing transactions, syndicate covering transactions and penalty bids in accordance with Rule 104

under the Securities Exchange Act. Stabilizing transactions involve bids to purchase the underlying security in the open market for the

purpose of pegging, fixing or maintaining the price of the securities. Syndicate covering transactions involve purchases of the securities

in the open market after the distribution has been completed in order to cover syndicate short positions.

Penalty

bids permit the underwriters to reclaim a selling concession from a syndicate member when the securities originally sold by the syndicate

member are purchased in a syndicate covering transaction to cover syndicate short positions. Stabilizing transactions, syndicate covering

transactions and penalty bids may cause the price of the securities to be higher than it would be in the absence of the transactions.

The underwriters may, if they commence these transactions, discontinue them at any time.

General

Information

Agents,

underwriters, and dealers may be entitled, under agreements entered into with us, to indemnification by us against certain liabilities,

including liabilities under the Securities Act. Our agents, underwriters, and dealers, or their affiliates, may be customers of, engage

in transactions with or perform services for us, in the ordinary course of business.

LEGAL

MATTERS

The

validity of the securities offered by this prospectus will be passed upon for us by McCarter & English, LLP, New York, New York.

EXPERTS

The

audited consolidated financial statements of The Marygold Companies, Inc. and subsidiaries as of June 30, 2021 and 2020, and for each

of the two years in the period ended June 30, 2021, incorporated by reference in this Prospectus have been audited by BPM LLP, an independent

registered public accounting firm, as stated in their report also incorporated by reference herein. Such financial statements have been

so incorporated by reference in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

No

expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon

the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common

stock was employed on a contingency basis, or had, or is to receive, any interest, directly or indirectly, in our Company or any of our

parents or subsidiaries, nor was any such person connected with us or any of our parents or subsidiaries, if any, as a promoter, managing

or principal underwriter, voting trustee, director, officer, or employee.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and special reports, along with other information with the SEC. Our SEC filings are available to the public over

the Internet at the SEC’s website at http://www.sec.gov.

You may also read and copy any document we file at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549.

Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room.

This

prospectus is part of a registration statement on Form S-3 that we filed with the SEC to register the securities offered hereby under

the Securities Act of 1933, as amended. This prospectus does not contain all of the information included in the registration statement,

including certain exhibits and schedules. You may obtain the registration statement and exhibits to the registration statement from the

SEC at the address listed above or from the SEC’s internet site.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

This

prospectus is part of a registration statement filed with the SEC. The SEC allows us to “incorporate by reference” into this

prospectus the information that we file with them, which means that we can disclose important information to you by referring you to

those documents. The information incorporated by reference is considered to be part of this prospectus, and information that we file

later with the SEC will automatically update and supersede this information. The following documents are incorporated by reference and

made a part of this prospectus:

| · | our

Annual Report on Form 10-K for the year ended June 30, 2021 filed with the SEC on September

22, 2021; |

| · | our

Quarterly Report filed on Form 10-Q for the quarter ended on December 31, 2021 filed on February

14, 2022; |

| · | our

Quarterly Report filed on Form 10-Q for the quarter ended on September 30, 2021 filed on

November 15, 2021; |

| · | the

description of our common stock contained in our Registration Statement on Form 8-A/A (Amendment

No. 1) filed with the SEC on March 8, 2022, including any amendment or report filed for the

purpose of updating such description; and |

| · | all

reports and other documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14

and 15(d) of the Exchange Act after the date of this prospectus and prior to the termination

of this offering. |

We

also incorporate by reference any future filings (other than information furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits

furnished on such form that are related to such items unless such Form 8-K expressly provides to the contrary) made with the SEC pursuant

to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration

statement of which this prospectus is a part and prior to effectiveness of such registration statement, until we file a post-effective

amendment that indicates the termination of the offering of the common stock made by this prospectus and will become a part of this prospectus

from the date that such documents are filed with the SEC. Information in such future filings updates and supplements the information

provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information

in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent

that statements in the later filed document modify or replace such earlier statements.

Notwithstanding

the foregoing, information furnished under Items 2.02 and 7.01 of any Current Report on Form 8-K, including the related exhibits, is

not incorporated by reference in this prospectus.

The

information about us contained in this prospectus should be read together with the information in the documents incorporated by reference.

You may request a copy of any or all of these filings, at no cost, by writing or telephoning us at: The Marygold Companies, Inc., David

Neibert, C.O.O. 120 Calle Iglesia, Unit B, San Clemente, California, 92672; Telephone number (949)-429-5370.

$100,000,000

Common Stock

Preferred Stock

Warrants

Units

THE MARYGOLD

COMPANIES, INC.

Prospectus

, 2022

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

14. Other Expenses of Issuance and Distribution.

The

following table sets forth the costs and expenses payable by the Registrant in connection with this offering, other than underwriting

commissions and discounts, all of which are estimated except for the SEC registration fee.

| Item | |

Amount | |

| SEC registration fee | |

$ | 9,270 | |

| Accounting fees and expenses | |

| * | |

| Legal fees and expenses | |

| * | |

| Printing and engraving expenses | |

| * | |

| Transfer agent and registrar fees | |

| * | |

| Miscellaneous | |

| * | |

| Total | |

| * | |

| · | These

fees are calculated based on the securities offered and the number of issuances and accordingly

cannot be estimated at this time. The applicable prospectus supplement will set forth the

estimated amount of expenses of any offering of securities. |

Item

15. Indemnification of Directors and Officers.

As

authorized by Section 78.751 of the Nevada Revised Statutes, we may indemnify our officers and directors against expenses incurred by

such persons in connection with any threatened, pending or completed action, suit or proceedings, whether civil, criminal, administrative

or investigative, involving such persons in their capacities as officers and directors, so long as such persons acted in good faith and

in a manner which they reasonably believed to be in our best interests. If the legal proceeding, however, is by or in our right, the

director or officer may not be indemnified in respect of any claim, issue or matter as to which he is adjudged to be liable for negligence

or misconduct in the performance of his duty to us unless a court determines otherwise.

Under

Nevada law, corporations may also purchase and maintain insurance or make other financial arrangements on behalf of any person who is

or was a director or officer (or is serving at our request as a director or officer of another corporation) for any liability asserted

against such person and any expenses incurred by him in his capacity as a director or officer. These financial arrangements may include

trust funds, self-insurance programs, guarantees and insurance policies.

Additionally,

our Bylaws (“Bylaws”), provide that we shall, to the maximum extent and in the manner permitted by the Nevada Revised Statutes,

indemnify each of our directors and officers against expenses (including attorneys’ fees), judgments, fines, settlements and other

amounts actually and reasonably incurred in connection with any proceeding, arising by reason of the fact that such person is or was

an agent of the Company. Every director, officer, or employee of the Company is required to be indemnified by the Company against all

expenses and liabilities, including counsel fees, reasonably incurred by or imposed upon him/her in connection with any proceeding to

which he/she may be made a party, or in which he/she may become involved, by reason of being or having been a director, officer, employee

or agent of the Company (collectively, “Company Agents”) or is or was serving at the request of the Company as a Company

Agent, or any settlement thereof, whether or not he/she is a Company Agent at the time such expenses are incurred, except in such cases

wherein the person is adjudged guilty of willful misfeasance or malfeasance in the performance of his/her duties; provided that such

indemnification only applies when the Board of Directors approves such settlement and reimbursement as being in the best interests of

the Company.

The

Bylaws also allow us to pay in advance of the final disposition of such action or proceeding, such amounts, upon receipt of an undertaking

by or on behalf of the indemnified party to repay such amount if it shall ultimately be determined by final judicial decision from which

there is no further right to appeal that the indemnified party is not entitled to be indemnified as authorized in the Bylaws.

Neither

our Bylaws nor our Amended and Restated Articles of Incorporation include any specific indemnification provisions for our officers or

directors against liability under the Securities Act. Additionally, insofar as indemnification for liabilities arising under the Securities

Act may be permitted to directors, officers and controlling persons of the Company pursuant to the foregoing provisions, or otherwise,

the Company has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy

as expressed in the Securities Act and is, therefore, unenforceable.

Item

16. Exhibits.

|

Exhibit

Number |

|

Description of Document |

| 1.1 |

|

Form of Underwriting Agreement.* |

| 2.1 |

|

Agreement for Sale and Purchase of a Business, dated May 29, 2015, by and between Gourmet Foods Ltd. and Concierge Technologies, Inc. (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on June 2, 2015). |

| 2.2 |

|

Stock Purchase Agreement, dated May 27, 2016, by and among Concierge Technologies, Inc., Brigadier Security Systems (2000) Ltd., and the shareholders of Brigadier Security Systems (2000) Ltd. (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on June 8, 2016). |

| 2.3 |

|

Stock Purchase Agreement, dated September 19, 2016 by and among Concierge Technologies, Inc., Wainwright Holdings, Inc. and each of the individuals and entities executing signature pages attached thereto (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on September 20, 2016). |

| 2.4 |

|

Asset Purchase Agreement, dated June 24, 2019, by and between Concierge Technologies, Inc., through its wholly-owned subsidiary Gourmet Foods Ltd. and RG & MK Wilson Limited. (incorporated by reference to the Company’s Current Report on Form 8-K filed on June 27, 2019). |

| 2.5 |

|

Termination of Asset Purchase Agreement, dated June 24, 2019, by and between Concierge Technologies, Inc., through its wholly-owned subsidiary Gourmet Foods Ltd. and RG & MK Wilson Limited (incorporated by reference to the Company’s Current Report on Form 8-K filed on August 2, 2019). |

| 3.1 |

|

Amended Articles of Incorporation of Concierge Technologies, Inc. (incorporated by reference to Exhibit A to the Definitive Proxy Materials on Schedule 14A filed on February 28, 2017). |

| 3.2 |

|

Amended Bylaws of Concierge Technologies, Inc. (incorporated by reference to Exhibit B to the Definitive Proxy Materials on Schedule 14A filed on February 28, 2017). |

| 3.3 |

|

Certificate of Designation (Series of Preferred Stock) (incorporated by reference to Exhibit 3.1 to the Company’s Annual Report on Form 10-K filed on October 8, 2010). |

| 3.4 |

|

Amendment to Certificate of Designation filed with the Secretary of State of the State of Nevada on January 31, 2013 (incorporated by reference to Exhibit 3.3 of the Company’s Quarterly Report on Form 10-Q filed on November 15, 2021). |

| 3.5 |

|

Amendment to Certificate of Designation filed with the Secretary of State of the State of Nevada on January 5, 2015 (incorporated by reference to Exhibit 3.4 of the Company’s Quarterly Report on Form 10-Q filed on November 15, 2021). |

| 4.4 |

|

Form of Certificate of Designation* |

| 4.5 |

|

Form of Preferred Stock Certificate* |

| 4.6 |

|

Form of Warrant Certificate* |

| 4.7 |

|

Form of Stock Purchase Agreement* |

* To be filed

by amendment or by a Current Report on Form 8-K and incorporated by reference herein.

Item

17. Undertakings

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To

include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth

in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total

dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated

maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate,

the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in the effective registration statement.

(iii) To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any

material change to such information in the registration statement; provided,

however, Paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the registration statement is on

Form S-3 or Form F-3 and the information required to be included in a post-effective amendment by those paragraphs is contained in reports

filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of

1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule

424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall

be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that

time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold

at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part

of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information

required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of

the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities

in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that

is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities

in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be

the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part

of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement

or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective

date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement

or made in any such document immediately prior to such effective date; or

(5)

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial

distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant

pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to

the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the

undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned

registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any

other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b)

The registrant hereby undertakes that for purposes of determining any liability under the Securities Act of 1933, each filing

of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where

applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of

1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to

the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering

thereof.

(c) Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons

of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities

and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the

event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid

by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question

whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of

such issue.

(d) The

registrant hereby undertakes that:

(1)

For purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed

as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant

pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement

as of the time it was declared effective.

(2) For

the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus shall

be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that

time shall be deemed to be the initial bona fide offering thereof.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for fling on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of San Clemente, State of California on this 29th

day of April, 2022.

| |

|

|

|

| |

THE MARYGOLD COMPANIES, INC. |

| |

|

|

|

| |

By: |

/s/ Nicholas D. Gerber |

|

| |

|

Nicholas D. Gerber |

| |

|

Chief Executive Officer |

| |

|

(Principal Executive Officer) |

| |

|

|

|

| |

By: |

/s/ Stuart Crumbaugh |

|

| |

|

Stuart Crumbaugh |

| |

|

Chief Financial Officer |

| |

|

(Principal Financial and Accounting

Officer) |

Each

person whose signature appears below constitutes and appoints Nicholas D. Gerber and Stuart Crumbaugh and each of them severally, as

his true and lawful attorney in fact and agent, with full powers of substitution and re-substitution, for him and in his name, place

and stead, in any and all capacities, to sign any or all amendments (including post effective amendments) to the Registration Statement,

and to sign any registration statement for the same offering covered by this Registration Statement that is to be effective upon filing

pursuant to Rule 462(b) under the Securities Act of 1933, as amended, and all post effective amendments thereto, and to file the same,

with all exhibits thereto, and all documents in connection therewith, with the Securities and Exchange Commission, granting unto said

attorney-in-fact and agent, each acting alone, full power and authority to do and perform each and every act and thing requisite and

necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby

ratifying and confirming all that said attorney-in-fact and agent, each acting alone, or his or her substitute or substitutes, may lawfully

do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed below by the following persons in the

capacities and on the dates indicated.

| /s/ Nicholas Gerber |

|

Chief Executive Officer, President

and Director |

|

April 29, 2022 |

| Nicholas Gerber |

|

(Principal Executive officer) |

|

|

| |

|

|

|

|

| /s/ Stuart Crumbaugh |

|

Chief Financial officer |

|

April 29, 2022 |

| Stuart Crumbaugh |

|

(Principal Financial Officer and Principal

Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ David W. Neibert |

|

Chief Operating Officer, Secretary and Director |

|

April 29, 2022 |

| David W. Neibert |

|

|

|

|

| |

|

|

|

|

| /s/ Scott Schoenberger |

|

Director |

|

April 29, 2022 |

| Scott Schoenberger |

|

|

|

|

| |

|

|

|

|

| /s/ Matt Gonzalez |

|

Director |

|

April 29, 2022 |

| Matt Gonzalez |

|

|

|

|

| |

|

|

|

|

| /s/ Derek Mullins |

|

Director |

|

April 29, 2022 |

| Derek Mullins |

|

|

|

|

| |

|

|

|

|

| /s/ Kathryn D. Rooney |

|

Director |

|

April 29, 2022 |

| Kathryn D. Rooney |

|

|

|

|

| |

|

|

|

|

| /s/ Erin Grogan |

|

Director |

|

April 29, 2022 |

| Erin Grogan |

|

|

|

|

| |

|

|

|

|

| /s/ Kelly J. Anderson |

|

Director |

|

April 29, 2022 |

| Kelly J. Anderson |

|

|

|

|

| |

|

|

|

|

| /s/ Joya Delgado Harris |

|

Director |

|

April 29, 2022 |

| Joya Delgado Harris |

|

|

|

|

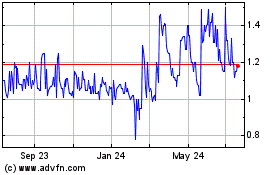

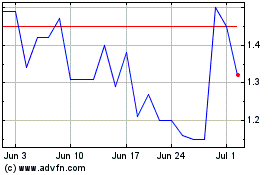

Marygold Companies (AMEX:MGLD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Marygold Companies (AMEX:MGLD)

Historical Stock Chart

From Sep 2023 to Sep 2024