Elections have taken center stage in Indonesia. Southeast Asia’s

largest economy is due for its parliamentary election in April and

its presidential election in July. This has sent the Jakarta stock

market higher since the start of the year. The likelihood of an

influx of campaign spending bolstered the companies having more

domestic exposure especially which hail from food, consumer staples

and media businesses, as per Bloomberg.

A few of the leading investment managers of Indonesia appeared

optimistic about the country’s stock market performance this year.

Historically, the Jakarta stock index added massive returns in the

prior two election years – 87% in 2009 and 45% in 2004. Investors

have every reason to believe that 2014 will be no exception (read:

Is it time to buy Indonesia ETFs?).

If this was not enough, Indonesia's main opposition party, PDI-P,

declared on Friday that the popular Jakarta governor Joko

Widodo will be its presidential candidate. This spread

another round of positive vibes in the investing world and the

Indonesian market climbed about 3% on the news.

Its currency, the rupiah, also jumped to its highest level against

the dollar in five months. The top two pure-play ETFs on Indonesia

–

iShares MSCI Indonesia Investable Market Index

Fund (

EIDO) and

Market Vectors

Indonesia ETF (

IDX) – gained as much as,

respectively, 6.5% and 6.0% on Friday’s session.

Investors by and large seem confident about a seamless voting

process in July with the extremely popular (especially among the

poor and middle classes) Jakarta governor’s candidature. The

investing community expects him to run the world's third largest

democracy post election. Within one year of his service as the

governor of the Indonesian capital Jakarta, Joko Widodo – a

furniture manufacturer – has gained quite a following among the

masses.

A Jokowi presidency is being viewed as a trend reversal in

Indonesian politics which has been so far regulated by the members

of the military and influential political figures. Also, the world

market now expects a radical change in the policy making of the

nation which was underperforming heavily thanks to weak leadership,

slowing growth, widening current account deficit and a tumbling

currency.

How to Tap This Opportunity?

Investors should note that Indonesia has been Asia's best performer

this year, advancing more than 20% even amid the Ukrainian crisis

and its geopolitical impact on the global markets (read: How Did

Indonesia Avoid the Emerging Market ETF Slump?).

Three Indonesian ETFs,

EIDO, IDX and

Market Vectors Indonesia Small-Cap ETF

(

IDXJ), have returned 24.8%, 20.1% and 27.2%,

respectively, while the broader emerging market fund,

iShares MSCI Emerging Markets ETF

(

EEM), lost more than 7% year-to-date. We have

highlighted below the three Indonesia ETFs in detail:

EIDO in Focus

The most popular ETF tracking the Indonesian market is EIDO, a

product that looks to follow the MSCI Indonesia Investable Market

Index. The fund invests $440.2 million in about 108 stocks,

charging investors 62 basis points a year in fees for the exposure

(see Southeast Asia ETF Investing 101).

EIDO is a bit concentrated in financials as it accounts for roughly

30% of assets, followed by consumer sectors which, if joined both

cyclical and non-cyclical, make up a similar amount of assets. The

product is also highly concentrated in the top 10 holdings with

about three-fifths of exposure. It has a significant focus on large

cap stocks (about 80%).

IDX in Focus

This is the oldest Indonesia ETF on the market, as it made its

debut in January 2009. The product tracks the Market Vectors

Indonesia Index and charges 59 basis points in fees which make it a

slightly cheaper choice. IDX allocates its $213.5 million of assets

to roughly 53 companies at time of writing. Large caps account for

more than 85% of the fund.

Financials make for the top sector with about 27%, followed by

consumer staples (16%) and consumer discretionary (15%). However,

the product has a diversified geographical approach with Indonesia

accounting for about 60% of the portfolio. This is the reason why

IDX’s year-to-date return is a little less than that of its

Indonesian cousins.

IDXJ in Focus

This relatively new product from Market Vectors might entice

investors willing to tap the smallest publically traded companies

in Indonesia. The ETF tracks an index of small and micro cap

securities that are heavily exposed to Indonesia, holding roughly

36 stocks in total. The fund charges 61 bps in fees.

The portfolio tilt is a little different in this case. Industrials

take up the top spot with a 32% focus followed by a 23% exposure in

real estate. Energy occupies the third position of the fund.

Still, the portfolio is relatively well-spread out from an

individual holding perspective, as barring the top three

allocations, no single company makes up for more than 6.28% of the

total.

Bottom Line

Among the trio, the return from IDXJ remains the best thanks to its

single-minded focus on the domestic economy. IDXJ is made up of

small-cap stocks which tend to offer exposure in the regional field

and are less ruffled by broad global concerns. While IDXJ should be

a clear winner in the recent rally, the other two funds should also

benefit from Joko Widodo’s (if he wins the election) pro-growth

approach.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-EMG MKT (EEM): ETF Research Reports

ISHARS-MS INDON (EIDO): ETF Research Reports

MKT VEC-INDONES (IDX): ETF Research Reports

MKT VEC-INDO SC (IDXJ): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

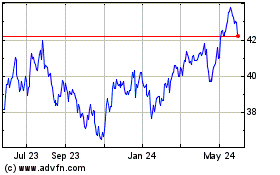

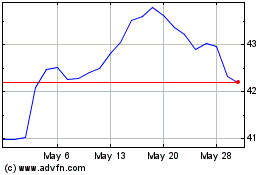

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Jun 2024 to Jul 2024

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Jul 2023 to Jul 2024